Item added to your cart

Here is a free business plan sample for a mortgage brokerage firm.

Embarking on a journey as a mortgage broker can be both exciting and daunting, especially if you're unsure about the first steps to take.

In the content that follows, we will present you with a comprehensive business plan tailored specifically for mortgage brokers.

As an aspiring entrepreneur in the financial sector, you're likely aware that a meticulously formulated business plan is crucial for laying the foundation of a successful practice. It serves as a roadmap, guiding you through the intricacies of the industry while setting clear objectives and strategies.

To streamline your planning process and get started on the right foot, feel free to utilize our mortgage broker business plan template. Our team of professionals is also on standby to provide a free review and fine-tuning of your plan.

How to draft a great business plan for your mortgage brokerage firm?

A good business plan for a mortgage broker must be tailored to the nuances of the mortgage industry.

To start, it's crucial to provide a comprehensive overview of the mortgage market. This includes up-to-date statistics and an analysis of emerging trends in the industry, similar to what we've included in our mortgage broker business plan template .

Your business plan should articulate your vision clearly. Define your target market (such as first-time homebuyers, property investors, or those refinancing) and your unique value proposition (expertise in specific loan types, personalized service, etc.).

Market analysis is a key component. You need to understand the competitive landscape, regulatory environment, and the needs and behaviors of potential clients.

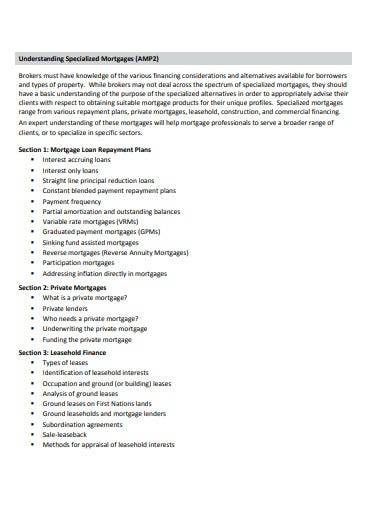

For a mortgage broker, it's important to outline the range of mortgage products and services you plan to offer. Describe how these will cater to the diverse needs of your clientele, such as fixed-rate mortgages, adjustable-rate mortgages, government-backed loans, and refinancing options.

The operational plan should detail your brokerage's structure, including your office location, the technology you will use for loan processing, your network of lenders, and your approach to client consultations and application processing.

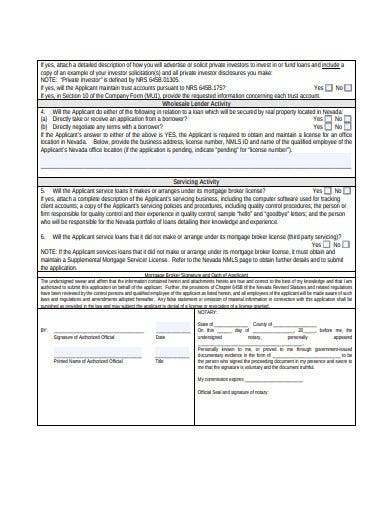

Compliance with financial regulations and maintaining a high standard of ethical practices should be emphasized in your plan.

Discuss your marketing and client acquisition strategies. How will you build trust and establish a reputation in the market? Consider your approach to networking, partnerships, online marketing, and customer service excellence.

Incorporating digital strategies, such as a professional website, online application tools, and a social media presence, is vital in the modern marketplace.

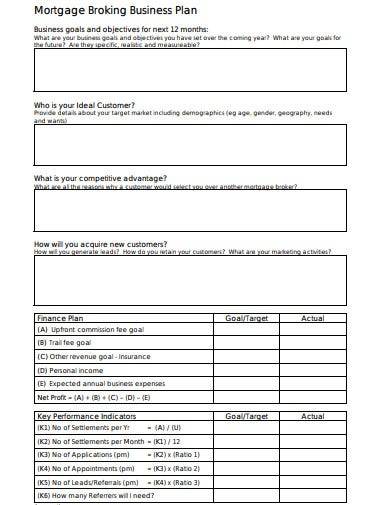

The financial section is critical. It should include your startup costs, revenue projections, operating expenses, and the point at which you expect to become profitable.

As a mortgage broker, understanding your commission structures and potential volume bonuses is essential for accurate financial forecasting. For assistance, you can refer to our financial forecast for a mortgage brokerage .

Compared to other business plans, a mortgage broker's plan must pay special attention to industry-specific regulations, the importance of building strong relationships with lenders, and strategies for maintaining a steady flow of clients.

A well-crafted business plan will not only help you clarify your strategies and goals but also serve as a tool to attract investors or secure lines of credit.

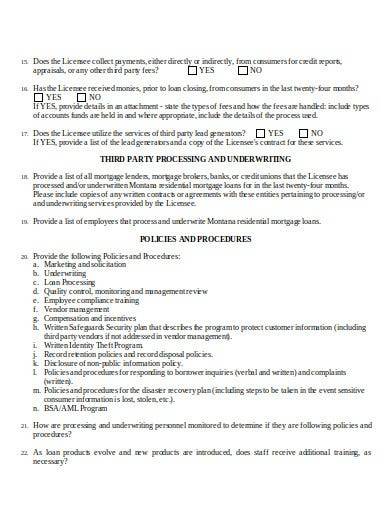

Lenders and investors will look for a thorough market analysis, realistic financial projections, and a clear plan for client engagement and compliance.

By presenting a detailed and substantiated business plan, you showcase your professionalism and dedication to the success of your brokerage.

To achieve these goals efficiently, you can fill out our mortgage broker business plan template .

A free example of business plan for a mortgage brokerage firm

Here, we will provide a concise and illustrative example of a business plan for a specific project.

This example aims to provide an overview of the essential components of a business plan. It is important to note that this version is only a summary. As it stands, this business plan is not sufficiently developed to support a profitability strategy or convince a bank to provide financing.

To be effective, the business plan should be significantly more detailed, including up-to-date market data, more persuasive arguments, a thorough market study, a three-year action plan, as well as detailed financial tables such as a projected income statement, projected balance sheet, cash flow budget, and break-even analysis.

All these elements have been thoroughly included by our experts in the business plan template they have designed for a mortgage broker .

Here, we will follow the same structure as in our business plan template.

Market Opportunity

Market data and figures.

The mortgage brokerage industry is a vital component of the real estate sector, facilitating a significant volume of home loans every year.

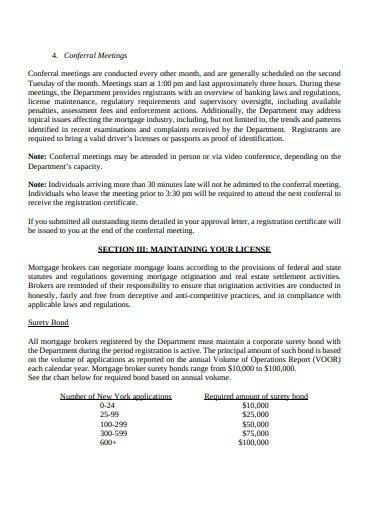

Recent data indicates that the mortgage brokerage market in the United States is robust, with mortgage brokers originating approximately 15% of all residential mortgages. This translates to billions of dollars in home loans, showcasing the critical role mortgage brokers play in the housing market.

With a growing population and a steady demand for housing, the mortgage brokerage industry is poised for continued growth, emphasizing the need for professional and reliable brokerage services.

The mortgage industry is experiencing several key trends that are shaping the future of home financing.

Technology is playing an increasingly important role, with the rise of online mortgage platforms and digital loan processing. This shift towards digital services is streamlining the application process and improving the customer experience.

There is also a growing demand for more flexible and tailored mortgage products, as consumers seek options that fit their unique financial situations.

Regulatory changes continue to influence the industry, with brokers needing to stay informed and compliant with the latest laws and guidelines to protect consumers.

Sustainability is becoming a consideration for borrowers, with green mortgages and incentives for energy-efficient homes gaining traction.

Lastly, the importance of financial education is being recognized, as brokers increasingly provide valuable advice and guidance to help clients make informed decisions.

Success Factors

Several factors contribute to the success of a mortgage brokerage.

Trustworthiness and transparency are paramount in building long-term relationships with clients. A broker who consistently acts in the best interest of their clients is more likely to secure repeat business and referrals.

Expertise in the mortgage industry is essential. A broker with a deep understanding of various loan products, regulations, and market conditions can provide superior service and advice.

Networking and partnerships with lenders and real estate professionals can greatly enhance a broker's ability to offer competitive rates and diverse loan options.

Customer service is also a critical component. Prompt and clear communication, personalized attention, and a commitment to guiding clients through the entire loan process can set a brokerage apart.

Finally, effective marketing strategies and a strong online presence are important for attracting new clients in a digital age where many consumers begin their search for mortgage information online.

The Project

Project presentation.

Our mortgage brokerage project is designed to address the needs of a diverse clientele seeking reliable and personalized mortgage solutions. Strategically located in an area with a booming real estate market, our brokerage will offer a comprehensive range of mortgage services, including first-time homebuyer loans, refinancing options, and investment property financing. We will work with a variety of lenders to ensure competitive rates and terms tailored to each client's unique financial situation.

The emphasis will be on transparency, trust, and tailored advice to ensure clients make informed decisions about their mortgage options.

This mortgage brokerage aims to become a trusted advisor in the community, guiding clients through the complexities of the mortgage process and helping them achieve their property ownership or investment goals.

Value Proposition

The value proposition of our mortgage brokerage project is centered on providing expert, unbiased mortgage advice and facilitating access to a wide range of financing options. Our commitment to personalized service ensures that each client receives a mortgage plan that aligns with their financial objectives and lifestyle.

We are dedicated to simplifying the mortgage process, offering clarity and support at every step, and building long-term relationships with our clients based on trust and integrity.

Our brokerage aspires to empower clients with the knowledge and resources they need to make confident mortgage decisions, contributing to their financial stability and peace of mind.

Project Owner

The project owner is a seasoned mortgage broker with a comprehensive understanding of the real estate and finance industries.

With a track record of successful client relationships and a deep knowledge of mortgage products, the owner is committed to establishing a brokerage that stands out for its dedication to client success, ethical practices, and market expertise.

Driven by a vision of financial empowerment and education, the owner is determined to offer tailored mortgage solutions that support the community's homeownership dreams and investment strategies.

His commitment to professionalism and his passion for helping others navigate the mortgage landscape make him the driving force behind this project, aiming to enhance the financial well-being of clients and contribute to the growth of the local economy.

The Market Study

Market segments.

The market segments for a mortgage brokerage are diverse and can be categorized as follows:

Firstly, there are first-time homebuyers who are navigating the complex process of purchasing their initial property and require guidance and financing options.

Next, existing homeowners looking to refinance their mortgages to take advantage of lower interest rates or to consolidate debt form another significant segment.

Investors who are interested in purchasing properties for rental or resale purposes also represent a key market segment for mortgage brokers.

Lastly, real estate agents and financial advisors can be influential by referring clients who are in need of mortgage financing expertise.

SWOT Analysis

A SWOT analysis of the mortgage brokerage business reveals several key points:

Strengths include a deep understanding of the mortgage industry, strong relationships with various lenders, and the ability to offer a wide range of mortgage products to clients.

Weaknesses might involve the highly competitive nature of the mortgage industry and the sensitivity to interest rate fluctuations and economic cycles.

Opportunities can be found in the growing housing market, the potential to leverage technology for improved customer service, and the ability to specialize in niche markets such as eco-friendly or sustainable housing loans.

Threats include regulatory changes that could affect lending practices, the entry of new fintech competitors in the mortgage space, and the potential for economic downturns which can impact the housing market.

Competitor Analysis

Competitor analysis in the mortgage brokerage industry indicates a crowded and competitive landscape.

Direct competitors include other local and national mortgage brokers, banks, credit unions, and online lending platforms.

These entities compete on interest rates, customer service, speed of processing, and the diversity of their loan products.

Key competitive advantages may include personalized customer service, a wide network of lender relationships, expertise in specific types of loans, and advanced technology for efficient processing.

Understanding the strengths and weaknesses of competitors is crucial for carving out a unique value proposition and for client acquisition and retention strategies.

Competitive Advantages

Our mortgage brokerage's competitive advantages lie in our personalized approach to client service and our commitment to finding the best financial solutions for our clients.

We offer a comprehensive suite of mortgage products, including conventional loans, government-backed loans, and innovative financing options for unique property types.

Our expertise in navigating complex financial situations and our dedication to educating our clients on their mortgage options set us apart in the industry.

We also pride ourselves on our agility in adapting to market changes and our use of cutting-edge technology to streamline the mortgage application and approval process, enhancing the overall customer experience.

You can also read our articles about: - how to become a mortgage broker: a complete guide - the customer segments of a mortgage brokerage firm - the competition study for a mortgage brokerage firm

The Strategy

Development plan.

Our three-year development plan for the mortgage brokerage firm is designed to establish us as a trusted leader in the industry.

In the first year, we will concentrate on building a strong client base by offering personalized mortgage solutions and exceptional customer service.

The second year will focus on expanding our services to include refinancing options, debt consolidation, and financial advisory services to provide comprehensive financial solutions to our clients.

In the third year, we aim to form strategic alliances with real estate agencies and financial institutions to broaden our service offerings and enhance our market reach.

Throughout this period, we will remain dedicated to maintaining the highest standards of integrity, transparency, and professionalism to meet the evolving needs of our clients and secure a dominant position in the market.

Business Model Canvas

The Business Model Canvas for our mortgage brokerage firm targets individuals and families looking to purchase or refinance their homes, as well as real estate investors.

Our value proposition is centered on providing expert mortgage advice, competitive rates, and a seamless application process.

We offer our services through our office, online platforms, and mobile consultations, utilizing key resources such as our industry knowledge and network of lending partners.

Key activities include client consultations, loan application processing, and market analysis.

Our revenue streams are generated from commissions on successful mortgage placements, consultation fees, and potential partnerships with financial institutions.

Find a complete and editable real Business Model Canvas in our business plan template .

Marketing Strategy

Our marketing strategy is built on trust and expertise.

We aim to educate potential clients on the mortgage process and the benefits of working with a broker. Our strategy includes online educational content, mortgage calculators, and workshops on home buying and financing.

We will also establish referral programs with real estate agents and previous clients to expand our network.

Additionally, we plan to leverage social media, search engine optimization, and targeted advertising to reach a wider audience and showcase our success stories and client testimonials.

Risk Policy

The risk policy of our mortgage brokerage firm is to minimize financial and operational risks.

We adhere to strict compliance with industry regulations and ethical standards, ensuring all loan options presented to clients are in their best interest.

We conduct thorough risk assessments on loan products and maintain a diversified portfolio to mitigate market volatility.

Prudent financial management and a contingency plan are in place to safeguard against economic downturns.

Additionally, we carry professional indemnity insurance to protect against potential legal claims. Our priority is to provide secure and reliable mortgage brokerage services while ensuring client satisfaction.

Why Our Project is Viable

We are committed to establishing a mortgage brokerage firm that addresses the needs of homebuyers and investors in a changing financial landscape.

With our focus on customer-centric services, market expertise, and strategic partnerships, we are poised for success in the competitive mortgage industry.

We are enthusiastic about empowering our clients to make informed financial decisions and are prepared to adapt to market changes to achieve our objectives.

We look forward to the promising future of our mortgage brokerage firm and the opportunity to serve our community.

You can also read our articles about: - the Business Model Canvas of a mortgage brokerage firm - the marketing strategy for a mortgage brokerage firm

The Financial Plan

Of course, the text presented below is far from sufficient to serve as a solid and credible financial analysis for a bank or potential investor. They expect specific numbers, financial statements, and charts demonstrating the profitability of your project.

All these elements are available in our business plan template for a mortgage broker and our financial plan for a mortgage broker .

Initial expenses for our mortgage brokerage include securing a professional office space, obtaining the necessary licenses and certifications, investing in industry-specific software for loan processing and customer relationship management, as well as costs related to brand creation and launching targeted marketing campaigns to reach potential homebuyers and those looking to refinance.

Our revenue assumptions are based on a thorough analysis of the local housing market, interest rate trends, and the demand for mortgage advisory services, considering the growing need for personalized mortgage solutions.

We anticipate progressively increasing client acquisition, starting modestly and growing as the reputation of our mortgage brokerage develops.

The projected income statement indicates expected revenues from our service fees, commission from lenders, and potential consulting services, minus the operating expenses (office rent, marketing, salaries, etc.), and the cost of maintaining our professional credentials.

This results in a forecasted net profit crucial for evaluating the profitability of our business over time.

The projected balance sheet reflects assets specific to our business, such as office equipment, software, and liabilities including debts and anticipated operating expenses.

It shows the overall financial health of our mortgage brokerage at the end of each period.

Our projected cash flow budget details incoming and outgoing cash flows, allowing us to anticipate our cash needs at any given time. This will help us effectively manage our finances and avoid cash flow problems.

The projected financing plan lists the specific financing sources we plan to use to cover our startup expenses, such as business loans or investor capital.

The working capital requirement for our mortgage brokerage will be closely monitored to ensure we have the necessary liquidity to finance our daily operations, including office expenses, marketing initiatives, and salary payments.

The break-even point specific to our project is the level of transactions needed to cover all our costs, including startup expenses, and start making a profit.

It will indicate when our business will be financially sustainable.

Performance indicators we will track include the conversion rate of leads to closed loans, the average commission per transaction, the liquidity ratio to assess our ability to cover financial obligations, and the return on investment to measure the effectiveness of our capital invested in the project.

These indicators will help us evaluate the financial health and overall success of our mortgage brokerage.

If you want to know more about the financial analysis of this type of activity, please read our article about the financial plan for a mortgage brokerage firm .

- Choosing a selection results in a full page refresh.

- Opens in a new window.

Mortgage Broker Business Plan Template

Written by Dave Lavinsky

Mortgage Broker Business Plan

You’ve come to the right place to create your Mortgage Broker business plan.

We have helped over 10,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Mortgage Broker companies.

Below is a template to help you create each section of your Mortgage Broker business plan.

Executive Summary

Business overview.

Davidson Mortgage, located in Tucson, Arizona, is a new mortgage brokerage specializing in residential mortgages. The company will operate in a professional setting, conveniently located next to several banks in the center of the shopping district. We offer a wide range of services to help our clients get a mortgage, including finding loan options, applying for the loans on the clients’ behalf, and completing all the paperwork. We strive to serve our clients with the utmost empathy to ensure they get the best mortgage for their situation.

Davidson Mortgage is headed by Harold Davidson. He is an MBA graduate from Arizona State University with 20 years of experience working in the finance industry. His passion is to help his clients qualify for their dream homes and provide them with a smooth process from start to finish.

Davidson Mortgage will focus on providing superior service to all of its clients to ensure they get the best mortgage possible. Our services include finding loan options, applying for loans on behalf of customers, and completing closing paperwork. Since customer service is our top priority, we will keep in touch with our clients after they have closed on the mortgage. Furthermore, Harold will create webinars, online courses, and other content to educate his clients and the local community on the mortgage lending process.

Customer Focus

Davidson Mortgage will primarily serve homebuyers interested in properties located in the Tucson, Arizona area. Tucson is a growing city with thousands of residents eager to purchase a new home. We expect our clientele to be equal parts first-time home buyers and existing homeowners.

Management Team

Davidson Mortgage is run by Harold Davidson. Harold has been a licensed mortgage broker for the past 20 years, working for several large firms. However, throughout his career, he desired to have a closer connection with his clients as well as have more flexibility to help them get their dream homes. He started this company in order to achieve those goals. In addition to his valuable experience, Harold also holds an MBA from Arizona State University.

Harold is joined by Bethany Peterson. She will serve as the company’s full-time assistant, who, among other things, will manage the company website, coordinate scheduling, and answer basic client questions. Bethany has experience working with C-level executives and has spent significant time as an administrator.

Success Factors

Davidson Mortgage is uniquely qualified to succeed due to the following reasons:

- Davidson Mortgage will fill a specific market niche in the growing community we are entering. In addition, we have surveyed local realtors and homebuyers and received extremely positive feedback saying that they would consider making use of our services when launched.

- Our location is in an economically vibrant area where new home sales are on the rise, and turnover in homes and rentals occurs often due to the upward mobility of residents.

- The management team has a track record of success in the mortgage brokerage business.

- The local area is currently underserved and has few independent mortgage brokers offering high customer service to homebuyers.

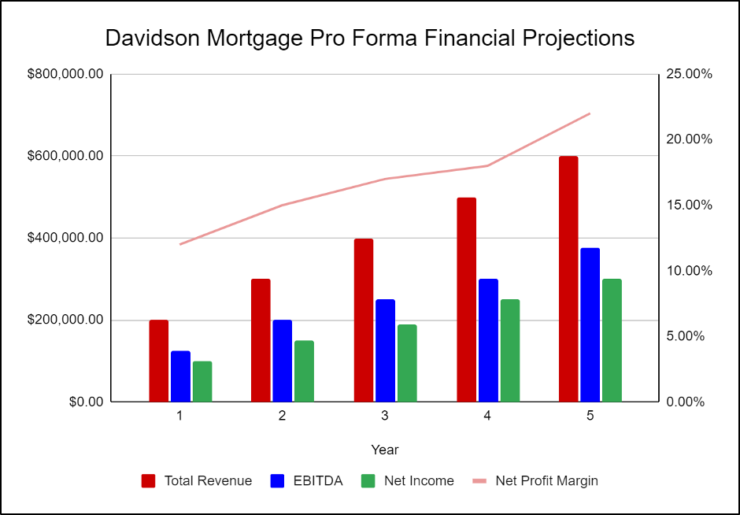

Financial Highlights

Davidson Mortgage is seeking a total funding of $250,000 of debt capital to open its office. The capital will be used for funding capital expenditures and location build-out, hiring initial employees, marketing expenses, and working capital.

Specifically, these funds will be used as follows:

- Office design/build: $50,000

- Three months of overhead expenses (payroll, rent, utilities): $100,00

- Marketing expenses: $50,000

- Working capital: $50,000

Company Overview

Who is davidson mortgage, davidson mortgage history.

After surveying the local customer base and finding a potential office, Harold Davidson incorporated Davidson Mortgage as an S-Corporation on 1/1/2023.

The business is currently being run out of Harold’s home office, but once the lease on Davidson Mortgage’s office location is finalized, all operations will be run from there.

Since incorporation, Davidson Mortgage has achieved the following milestones:

- Found office space and signed Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Hired an interior designer for the decor and furniture layout

- Determined equipment and fixture requirements

Davidson Mortgage Services

Industry analysis.

Despite the pandemic hurting several industries, the mortgage brokers industry still performed strong and is projected to continue to do so. Last year, U.S. mortgage brokerages brought in revenues of $11.7 billion and employed 47,000 people. There were just over 12,000 businesses in this market.

However, the mortgage broker industry is highly fragmented, with the top two companies accounting for just over 11% of industry revenue. Furthermore, mortgage interest rates are on the rise, as well as housing prices, preventing many people from buying houses and applying for mortgages. These two factors significantly stunt the industry at present.

Despite these challenges, the industry is still projected to increase moderately throughout the rest of the decade. Though larger firms may dominate revenue and clientele, studies and surveys show that clients don’t necessarily favor working with large firms. Providing excellent service and personal touches throughout the process can help small firms succeed in the industry.

Customer Analysis

Demographic profile of target market.

Davidson Mortgage will primarily serve the residents of Tucson, Arizona. The area we serve has a significant population of people who are searching for their first home, as well as families and individuals who need a new home.

The precise demographics for Tucson, Arizona are:

Customer Segmentation

Davidson Mortgage will primarily target the following customer segments:

- Existing homeowners

- First-time home buyers

Competitive Analysis

Direct and indirect competitors.

Davidson Mortgage will face competition from other companies with similar business profiles. A description of each competitor company is below.

The Loan Store

Established in 2010, The Loan Store originates, finances, and sells mortgage and non-mortgage lending products throughout the United States. It offers a range of consumer credit products, such as home loan products, home equity loans, and unsecured personal loans, as well as home and personal loan servicing. The company claims to be one of the largest private, independent retail mortgage lenders in the U.S. Its current business channels include direct lending, affinity, branch retail, and servicing.

However, agents working with The Loan Store experience high turnover, resulting in little concern for maintaining ongoing relationships with clients. Also, the agents themselves are mixed in quality, ranging from part-time brokers with little experience or sales records to full-time brokers with long-term experience. There is no systematic company method for passing on knowledge from experienced to inexperienced brokers as all are competing with each other, to a certain extent, for commissions.

Direct Loan Connection

Founded in 2006, Direct Loan Connection (DLC) employs licensed mortgage professionals who have access to multiple lending institutions, including banks, credit unions, and trust companies. This access enables the company to offer a vast array of available mortgage products – ranging from first-time homebuyer programs to financing for the self-employed to financing for those with credit blemishes. In addition, to help homebuyers and homeowners, DLC offers commercial mortgages.

Though they are a local leader in the premium end of the market, they refuse to negotiate their broker’s fees and sometimes lose potential clients because of this. Davidson Mortgage’s fees will be far more reasonable.

Supreme Mortgage

Supreme Mortgage specializes in mortgage brokering and is committed to helping homebuyers, and homeowners get the best mortgage with the lowest interest rate. The brokerage works with more than 40 lenders who compete to provide mortgages and who pay Supreme Mortgage’s fee so that clients receive the service free of charge.

Some reviews of Supreme Mortgage point out the low-quality service offered by brokers, who have little training in customer service. Furthermore, Supreme Mortgage does not attempt to maintain long-term relationships with customers who will eventually purchase another home.

Competitive Advantage

Davidson Mortgage enjoys several advantages over its competitors. These advantages include:

- Location: Davidson Mortgage’s location is near the center of town, in the shopping district of the city. It is visible from the street, where many residents shop for both day-to-day and luxury items.

- Client-oriented service: Davidson Mortgage will have a full-time assistant to keep in contact with clients and answer their everyday questions. Harold Davidson realizes the importance of accessibility to his clients and will further keep in touch with his clients through monthly seminars on topics of interest.

- Management: Harold Davidson has been extremely successful working in the mortgage brokerage sector and will be able to use his previous experience to grant his clients detailed insight into the world of home loans. His unique qualifications will serve customers in a much more sophisticated manner than many of Davidson Mortgage’s competitors.

- Relationships: Having lived in the community for 25 years, Harold Davidson knows many of the local leaders, newspapers, and other influencers.

Marketing Plan

Davidson Mortgage will use several strategies to promote its name and develop its brand. By using an integrated marketing strategy, Davidson Mortgage will win clients and develop consistent revenue streams.

Brand & Value Proposition

The Davidson Mortgage brand will focus on the company’s unique value proposition:

- Client-focused residential mortgage brokerage services, where the company’s interests are aligned with the customer

- Service built on long-term relationships and personal attention

- Big-firm expertise in a small-firm environment

Promotions Strategy

The promotions strategy for Davidson Mortgage is as follows:

Website/SEO

Davidson Mortgage will invest heavily in developing a professional website that displays all of the features and benefits of working with the mortgage broker. It will also invest heavily in SEO so the brand’s website will appear at the top of search engine results.

Social Media

Davidson Mortgage will invest heavily in a social media advertising campaign. Harold and Bethany will create the company’s social media accounts and invest in ads on all social media platforms. It will use targeted marketing to appeal to the target demographics.

Davidson Mortgage understands that the best promotion comes from satisfied customers. The company will work to partner with local realtors by providing economic or financial incentives for every new client produced. This strategy will increase in effectiveness after the business has already been established.

By offering webinars and courses on topics of interest in the office or other locations, Harold Davidson will encourage residents in the community to become comfortable with the expertise and character of Davidson Mortgage. These webinars will generally be offered free of charge as general promotion and for direct networking.

Davidson Mortgage’s pricing will rely on the standard industry rates in order to be perceived as neither a luxury nor a discount broker. The standard rate for brokering a mortgage is 1-2% of the loan amount. By seeking quality clients and maintaining long-term relationships with them, Davidson Mortgage will fend off pressure to discount their rates, even in down markets.

Operations Plan

The following will be the operations plan for Davidson Mortgage.

Operation Functions:

- Harold Davidson is the founder and will operate as the President of the company. He will be in charge of all the general operations and executive functions within the company. Furthermore, until he hires additional staff, he will personally help all clients who agree to utilize the company’s services.

- Harold is assisted by his long-term assistant Bethany Peterson. She will serve as the company’s full-time assistant and will manage the company website, coordinate scheduling, and answer basic client questions. Bethany has experience working with C-level executives and has spent significant time as an administrator.

- As the business grows and Harold takes on more clients, he will hire other mortgage brokers to assist him.

Milestones:

The following are a series of steps that will lead to the company’s long-term success. Davidson Mortgage expects to achieve the following milestones in the next six months:

3/202X Finalize lease agreement

4/202X Design and build out Davidson Mortgage office

5/202X Hire and train initial staff

6/202X Kickoff of promotional campaign

7/202X Reach break-even

8/202X Reach 25 ongoing clients

Financial Plan

Key revenue & costs.

Davidson Mortgage’s revenues will come primarily from the commissions earned from residential mortgage sales.

The major cost drivers for the company will include employee salaries, lease payments, and marketing expenses.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required to achieve the revenue and cost numbers in the financials and to pay off the startup business loan.

- Annual lease: $30,000

Financial Projections

Income statement.

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Total Revenues | $360,000 | $793,728 | $875,006 | $964,606 | $1,063,382 | |

| Expenses & Costs | ||||||

| Cost of goods sold | $64,800 | $142,871 | $157,501 | $173,629 | $191,409 | |

| Lease | $50,000 | $51,250 | $52,531 | $53,845 | $55,191 | |

| Marketing | $10,000 | $8,000 | $8,000 | $8,000 | $8,000 | |

| Salaries | $157,015 | $214,030 | $235,968 | $247,766 | $260,155 | |

| Initial expenditure | $10,000 | $0 | $0 | $0 | $0 | |

| Total Expenses & Costs | $291,815 | $416,151 | $454,000 | $483,240 | $514,754 | |

| EBITDA | $68,185 | $377,577 | $421,005 | $481,366 | $548,628 | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| EBIT | $41,025 | $350,417 | $393,845 | $454,206 | $521,468 | |

| Interest | $23,462 | $20,529 | $17,596 | $14,664 | $11,731 | |

| PRETAX INCOME | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Use of Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Taxable Income | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Income Tax Expense | $6,147 | $115,461 | $131,687 | $153,840 | $178,408 | |

| NET INCOME | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 |

Balance Sheet

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| ASSETS | ||||||

| Cash | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 | |

| Accounts receivable | $0 | $0 | $0 | $0 | $0 | |

| Inventory | $30,000 | $33,072 | $36,459 | $40,192 | $44,308 | |

| Total Current Assets | $184,257 | $381,832 | $609,654 | $878,742 | $1,193,594 | |

| Fixed assets | $180,950 | $180,950 | $180,950 | $180,950 | $180,950 | |

| Depreciation | $27,160 | $54,320 | $81,480 | $108,640 | $135,800 | |

| Net fixed assets | $153,790 | $126,630 | $99,470 | $72,310 | $45,150 | |

| TOTAL ASSETS | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 | |

| LIABILITIES & EQUITY | ||||||

| Debt | $315,831 | $270,713 | $225,594 | $180,475 | $135,356 | |

| Accounts payable | $10,800 | $11,906 | $13,125 | $14,469 | $15,951 | |

| Total Liability | $326,631 | $282,618 | $238,719 | $194,944 | $151,307 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| Total Equity | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| TOTAL LIABILITIES & EQUITY | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 |

Cash Flow Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| CASH FLOW FROM OPERATIONS | ||||||

| Net Income (Loss) | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 | |

| Change in working capital | ($19,200) | ($1,966) | ($2,167) | ($2,389) | ($2,634) | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| Net Cash Flow from Operations | $19,376 | $239,621 | $269,554 | $310,473 | $355,855 | |

| CASH FLOW FROM INVESTMENTS | ||||||

| Investment | ($180,950) | $0 | $0 | $0 | $0 | |

| Net Cash Flow from Investments | ($180,950) | $0 | $0 | $0 | $0 | |

| CASH FLOW FROM FINANCING | ||||||

| Cash from equity | $0 | $0 | $0 | $0 | $0 | |

| Cash from debt | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow from Financing | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow | $154,257 | $194,502 | $224,436 | $265,355 | $310,736 | |

| Cash at Beginning of Period | $0 | $154,257 | $348,760 | $573,195 | $838,550 | |

| Cash at End of Period | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 |

Mortgage Broker Business Plan FAQs

What is a mortgage broker business plan.

A mortgage broker business plan is a plan to start and/or grow your mortgage broker business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Mortgage Broker business plan using our Mortgage Broker Business Plan Template here .

What are the Main Types of Mortgage Broker Businesses?

There are a number of different kinds of mortgage broker businesses , some examples include: Retail Mortgage Broker, Business/Corporate Mortgage Broker, or Private Mortgage Brokers.

How Do You Get Funding for Your Mortgage Broker Business Plan?

Mortgage Broker businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Mortgage Broker Business?

Starting a mortgage broker business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Mortgage Broker Business Plan - The first step in starting a business is to create a detailed mortgage broker business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your mortgage broker business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your mortgage broker business is in compliance with local laws.

3. Register Your Mortgage Broker Business - Once you have chosen a legal structure, the next step is to register your mortgage broker business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your mortgage broker business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Mortgage Broker Equipment & Supplies - In order to start your mortgage broker business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your mortgage broker business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful mortgage broker business:

- How to Start a Mortgage Broker Business

- Sample Business Plans

- Real Estate & Rentals

Mortgage Broker Business Plan

A mortgage broker firm can be profitable. Mortgage brokers frequently receive compensation from the loans they assist their clients in obtaining. A mortgage broker can establish a successful firm and earn a sizable income with the correct tactics and abilities.

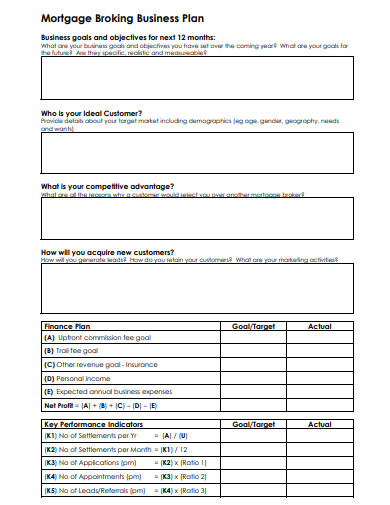

So, planning to start or grow your mortgage broker firm? You will need precise planning too with good knowledge.

Need help writing a business plan for your mortgage broker business? You’re at the right place. Our mortgage broker business plan template will help you get started.

Free Business Plan Template

Download our free mortgage broker business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write a mortgage broker Business Plan?

Writing a mortgage broker business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

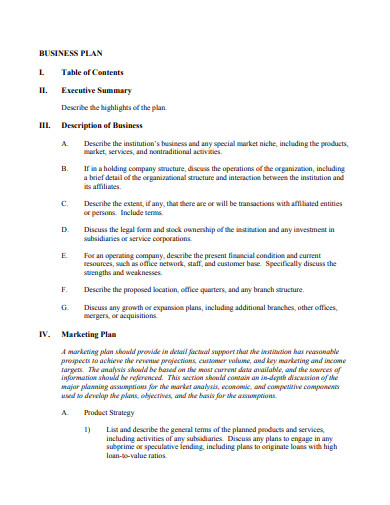

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

- Introduce your business: Start your executive summary by briefly introducing your business to your readers.

- This section may include the name of your mortgage broker business, its location, when it was founded, the type of mortgage broker business (E.g., traditional mortgage firm, online mortgage firm.), etc.

- Market opportunity: Summarize your market research, including market size, growth potential, and marketing trends. Highlight the opportunities in the market and how your business will fit in to fill the gap.

- Mortgage services: Highlight the mortgage broker services you offer your clients. The USPs and differentiators you offer are always a plus.

- For instance, you may include loan orientation, loan processing, and real-estate consultancy as some of your services.

- Marketing & sales strategies: Outline your sales and marketing strategies—what marketing platforms you use, how you plan on acquiring customers, etc.

- Financial highlights: Briefly summarize your financial projections for the initial years of business operations. Include any capital or investment requirements, associated startup costs, projected revenues, and profit forecasts.

- Call to action: Summarize your executive summary section with a clear CTA, for example, inviting angel investors to discuss the potential business investment.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your company. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

- Business description: Describe your business in this section by providing all the basic information:

- Traditional mortgage broker: They work with a variety of lenders and offer the best to their clients.

- Niche mortgage broker: These firms specialize in a certain type of mortgage or market segment

- Wholesale mortgage broker: They frequently have access to a variety of loan lenders and can assist brokers in locating the most affordable rates and conditions.

- Mortgage lender-brokerage firm: These companies are mortgage loan originators and brokers. They have loan officers that work with clients to acquire loans, but if they don’t have an appropriate product or rate for the client, they may also broker loans to other lenders.

- Describe the legal structure of your mortgage broker company, whether it is a sole proprietorship, LLC, partnership, or others.

- Mission statement: Summarize your business’ objective, core principles, and values in your mission statement. This statement needs to be memorable, clear, and brief.

- Business history: If you’re an established mortgage broker service provider, briefly describe your business history, like—when it was founded, how it evolved over time, etc.

- Additionally, If you have received any awards or recognition for excellent work, describe them.

- Future goal: It’s crucial to convey your aspirations and vision. Mention your short-term and long-term goals; they can be specific targets for revenue, market share, or expanding your services.

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

- Target market: Start this section by describing your target market. Define your ideal customer and explain what types of services they prefer. Creating a buyer persona will help you easily define your target market to your readers.

- For instance, first-time homebuyers, real estate investors, and self-employed borrowers can be your target market.

- Market size and growth potential: Describe your market size and growth potential and whether you will target a niche or a much broader market.

- Competitive analysis: Identify and analyze your direct and indirect competitors. Identify their strengths and weaknesses, and describe what differentiates your mortgage broker services from them. Point out how you have a competitive edge in the market.

- Market trends: Analyse emerging trends in the industry, such as technology disruptions, changes in customer behavior or preferences, etc. Explain how your business will cope with all the trends.

- For instance, the use of online portals to collect client information, using digital signatures to sign documents and usage of online tools is increasing, so how do you plan on coping with the trends?

- Regulatory environment: List regulations and licensing requirements that may affect your mortgage broker company, such as business registration, licensing, fiduciary duty, etc.

Here are a few tips for writing the market analysis section of your mortgage business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products And Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

- Mortgage services: Mention the mortgage broker services your business will offer. This list may include services like,

- Fixed-rate mortgages

- Adjustable rates mortgages

- Government-backed loans

- Describe each service: Next, give a more thorough explanation of the particular services your company will offer. It can include support with pre-qualification and pre-approval, rate comparisons for mortgages, and aid with filling out loan applications.

In short, this section of your mortgage broker plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

- Unique selling proposition (USP): Define your business’s USPs depending on the market you serve, the equipment you use, and the unique services you provide. Identifying USPs will help you plan your marketing strategies.

- For example, it can include any particular services you provide, such as personalized support during the mortgage application process or access to niche lending programs.

- Pricing strategy: Describe your pricing strategy—how you plan to price your services and stay competitive in the local market. You can mention any discounts you plan on offering to attract new customers.

- Marketing strategies: Discuss your marketing strategies to market your services. You may include some of these marketing strategies in your business plan—social media marketing, Google ads, brochures, and print marketing.

- Sales strategies: Outline the strategies you’ll implement to maximize your sales. Your sales strategies may include direct sales calls, partnering with other businesses, offering referral programs, etc.

- Customer retention: Describe your customer retention strategies and how you plan to execute them. For instance, introducing loyalty programs, personalized service, etc.

Overall, this section of your mortgage broker business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your mortgage broker business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

- Staffing & training: Mention your business’s staffing requirements, including the number of employees, licensed loan officers, underwriters, processors, and administrative staff to support the day-to-day operations of your business. Include their qualifications, the training required, and the duties they will perform.

- Operational process: Outline how your company will collaborate with customers to obtain a mortgage. It can contain information on how you will gather client data, compare mortgage rates, and assist clients in selecting the best mortgage choice for their requirements.

- Equipment & software: Include the list of equipment and machinery required for a mortgage broker, such as software, computer & office equipment, office supplies, etc.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your mortgage broker business’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

- Founder/CEO: Mention the founders and CEO of your mortgage broker company, and describe their roles and responsibilities in successfully running the business.

- Key managers: Introduce your management and key members of your team, and explain their roles and responsibilities.

- It should include, key executives(e.g. COO, CMO.), senior management, and other department managers (e.g. operations manager, sales manager.) involved in the mortgage broker business operations, including their education, professional background, and any relevant experience in the industry.

- Organizational structure: Explain the organizational structure of your management team. Include the reporting line and decision-making hierarchy.

- Compensation plan: Describe your compensation plan for the management and staff. Include their salaries, incentives, and other benefits.

- Advisors/consultants: Mentioning advisors or consultants in your business plans adds credibility to your business idea.

- So, if you have any advisors or consultants, include them with their names and brief information consisting of roles and years of experience.

This section should describe the key personnel for your mortgage broker services, highlighting how you have the perfect team to succeed.

8. Financial Plan

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

- Profit & loss statement: Describe details such as projected revenue, operational costs, and service costs in your projected profit and loss statement. Make sure to include your business’s expected net profit or loss.

- Cash flow statement: The cash flow for the first few years of your operation should be estimated and described in this section. This may include billing invoices, payment receipts, loan payments, and any other cash flow statements.

- Balance sheet: Create a projected balance sheet documenting your mortgage broker business’s assets, liabilities, and equity.

- Break-even point: Determine and mention your business’s break-even point—the point at which your business costs and revenue will be equal.

- This exercise will help you understand how much revenue you need to generate to sustain or be profitable.

- Financing needs: Calculate costs associated with starting a mortgage broker business, and estimate your financing needs and how much capital you need to raise to operate your business. Be specific about your short-term and long-term financing requirements, such as investment capital or loans.

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more. These statements must be the latest and offer financial projections for at least the first three or five years of business operations.

- Provide data derived from market research, including stats about the industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your mortgage company business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample mortgage broker business plan will provide an idea for writing a successful mortgage broker plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our mortgage broker business plan pdf .

Related Posts

Real Estate Business Plan

Real Estate Investment Business Plan

How to make a Business Plan for a Startup

Best Sample Business Plans

Real Estate Agent Business Plan

Best Business Planning Softwares

Frequently Asked Questions

Why do you need a mortgage broker business plan.

A business plan is an essential tool for anyone looking to start or run a successful mortgage broker business. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your mortgage broker company.

How to get funding for your mortgage broker business?

There are several ways to get funding for your mortgage broker business, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

Small Business Administration (SBA) loan

Crowdfunding, angel investors.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your mortgage broker business?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your mortgage broker business plan and outline your vision as you have in your mind.

What is the easiest way to write your mortgage broker business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any mortgage broker business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Turn your business idea into a solid business plan

Explore Plan Builder

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

Don't bother with copy and paste.

Get this complete sample business plan as a free text document.

Mortgage Broker Business Plan

Start your own mortgage broker business plan

Claremont Funding

Executive summary executive summary is a brief introduction to your business plan. it describes your business, the problem that it solves, your target market, and financial highlights.">.

Claremont Funding is an outstanding mortgage brokerage firm serving the lending needs of real estate professionals, builders and individual home buyers. We have access to a full range of mortgage sources and are dedicated to finding the right loan–with the best rates, terms and costs–to meet our clients’ unique needs.

This firm is capitalized by two principal investors, Joan Billings and Maureen Shoe. Both are licensed brokers with a combined experience of over 30 years in the industry.

1.1 Objectives

Claremont Funding aims to offer comprehensive mortgage broker services. Claremont Funding will focus on providing personal and specialized services to meet each client’s specific needs. The primary objectives of our firm are:

- Become profitable serving the real estate investment opportunities becoming available in the rapidly growing old town section of the city.

- Develop a solid, corporate identity in our specified target market area.

- Become one of the top brokerage firms in the area by our third year of operation, or before.

- Realize a positive return on investment within the first 12 months.

1.2 Mission

Claremont Funding offers high-quality mortgage brokerage services to residential and business customers. Our aim is to provide our customers with fair mortgage rates at reasonable prices, while keeping our clients informed and educated throughout the process. We will become friends and mentors to our customers as well as quality service providers. Claremont is an excellent place to work, a professional environment that is challenging, rewarding, creative, and respectful of ideas and individuals. Claremont ultimately provides excellent value to its customers and fair reward to its owners and employees.

Company Summary company overview ) is an overview of the most important points about your company—your history, management team, location, mission statement and legal structure.">

Claremont Funding is a new company that provides a high level of expertise. We will provide superior personal service to buyers. We take pride in knowing that 70% of our business comes from repeat clients and their referrals.

Our responsibility as mortgage professionals is to determine what a customer’s financial goals are, not just quote a rate. We have access to hundreds of loan programs, allowing us to arrange the most beneficial solution… whatever the buyer’s needs may be.

2.1 Company Ownership

The owners and brokers of Claremont Funding are Joan Billings and Maureen Shoe.

2.2 Start-up Summary

Our start-up costs are outlined in the following table. Start-up costs derive from website design, office equipment, main computer station complete with all mortgage information for broker usage, stationery, legal costs, furnishings, office advertising and services, and expenses associated with opening our office. The start-up costs are to be financed by direct owner investment and credit. Lease office space averages $1.10 – 1.60 per square foot to an approximate of $1,500 per month, plus utilities, for efficient leased office space. Commercial lease will be for a three to five year agreement with the first month and a security deposit equal to the monthly lease rate payable at the time of lease start date.

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $900 |

| Stationery etc. | $2,000 |

| Brochures | $1,000 |

| Advertising | $2,500 |

| Insurance | $200 |

| Rent | $3,000 |

| Answering Service | $200 |

| Utilities Start Up | $250 |

| Office Furnishings | $4,000 |

| Expensed Equipment | $3,000 |

| Business Software | $2,000 |

| Office Supplies | $1,000 |

| Total Start-up Expenses | $20,050 |

| Start-up Assets | |

| Cash Required | $39,950 |

| Other Current Assets | $20,000 |

| Long-term Assets | $0 |

| Total Assets | $59,950 |

| Total Requirements | $80,000 |

| Start-up Funding | |

| Start-up Expenses to Fund | $20,050 |

| Start-up Assets to Fund | $59,950 |

| Total Funding Required | $80,000 |

| Assets | |

| Non-cash Assets from Start-up | $20,000 |

| Cash Requirements from Start-up | $39,950 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $39,950 |

| Total Assets | $59,950 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $30,000 |

| Accounts Payable (Outstanding Bills) | $10,000 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $40,000 |

| Capital | |

| Planned Investment | |

| Investor 1 | $20,000 |

| Investor 2 | $20,000 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $40,000 |

| Loss at Start-up (Start-up Expenses) | ($20,050) |

| Total Capital | $19,950 |

| Total Capital and Liabilities | $59,950 |

| Total Funding | $80,000 |

Our personal goal is to break through the barriers that impede homeownership for those who wish to realize the American Dream. We provide potential and current homeowners the opportunity to find the best mortgage loan for their needs.

We match buyers to loan programs. We have an extensive questionnaire for our buyers to list their wants and needs. We then take this questionnaire and put the supplied information to match buyers to the loan packages matching their criteria.

Market Analysis Summary how to do a market analysis for your business plan.">

Due to the strengthening of the area’s economy and lower interest rates, more home buyers today are looking to purchase homes. These changes in attitudes of home buyers are a tremendous boost to real estate firms. Residential construction is booming in the city’s Old Town section. We are poised to take advantage of these changes, and expect to become a recognized name and profitable entity in the city’s real estate market. We chose to locate our office in the area of most revenue potential and where we have close connection to dominant real estate firms. Our targeted market area, the Old Town area, shows stability and growth. We have a beautiful office, centered in the Old Town area.

The first quarter home values were up 12.5 percent from the same period in 2001, the Office of Federal Housing Enterprise Oversight reported. The gain reflects an increase from the previous quarter, when residential real estate values saw growth of 12.1 percent.

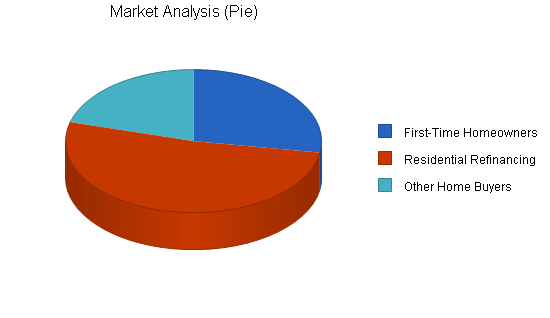

4.1 Market Segmentation

The home buyers that Claremont Funding will be serving can be divided into two groups:

- First-time homeowners: A bulk of the new construction in the Old Town section of the city is directed toward first-time homeowners.

- Residential refinancing: Whether it is for purchasing, construction, remodeling, debt consolidation, investment properties or refinancing–we have programs available to service those with good and bad credit.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| First-Time Homeowners | 15% | 80,000 | 92,000 | 105,800 | 121,670 | 139,921 | 15.00% |

| Residential Refinancing | 10% | 150,000 | 165,000 | 181,500 | 199,650 | 219,615 | 10.00% |

| Other Home Buyers | 7% | 60,000 | 64,200 | 68,694 | 73,503 | 78,648 | 7.00% |

| Total | 10.87% | 290,000 | 321,200 | 355,994 | 394,823 | 438,184 | 10.87% |

4.2 Target Market Segment Strategy

We cannot survive waiting for the customer to come to us. Instead, we must get better at focusing on the specific market segments whose needs match our offerings. Focusing on targeted segments is the key to our future. Therefore, we need to focus our marketing message and our services offered. We need to develop our message, communicate it, and make good on it.

Strategy and Implementation Summary

Claremont Funding will focus on the mortgage broker needs in the Old Town section of the city and the surrounding areas. Our target customer will be first-time home buyers and existing homeowners who are interested in refinancing.

5.1 Sales Forecast

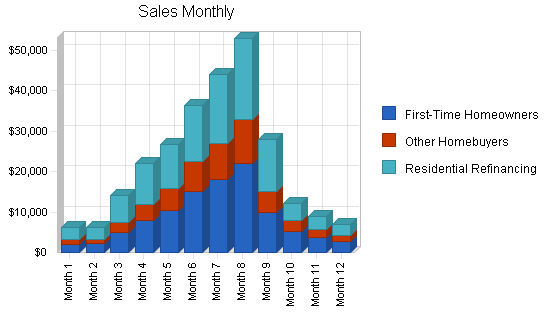

The following table and chart give a run-down on forecasted sales. We expect sales to build between January through March with the most growth during the months of March through August. We expect sales to drop off from September till the end of the year.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| First-Time Homeowners | $104,672 | $150,000 | $180,000 |

| Other Homebuyers | $52,336 | $75,000 | $90,000 |

| Residential Refinancing | $107,839 | $140,000 | $175,000 |

| Total Sales | $264,847 | $365,000 | $445,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| First-Time Homeowners | $0 | $0 | $0 |

| Other Homebuyers | $0 | $0 | $0 |

| Residential Refinancing | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $0 | $0 | $0 |

5.2 Milestones

The accompanying table lists important program milestones, with dates and managers in charge, and budgets for each. The milestone schedule indicates our emphasis on planning for implementation.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Lease Office Space | 12/15/2001 | 12/28/2001 | $3,000 | Maureen | Marketing |

| Purchase Office Equipment/Computer, etc. | 12/1/2001 | 12/15/2001 | $3,000 | Maureen | Marketing |

| Office Utilities | 12/20/2001 | 12/21/2001 | $250 | Joan | Web |

| Answering Service | 12/13/2001 | 12/23/2001 | $200 | Joan | Web |

| Stationary | 12/1/2001 | 12/10/2001 | $2,000 | Joan | Admin |

| Business Software | 12/15/2001 | 12/28/2001 | $2,000 | Joan | Admin |

| Advertising | 12/1/2001 | 12/30/2001 | $2,500 | Maureen | Marketing |

| Totals | $12,950 | ||||

5.3 Competitive Edge

Claremont Funding’s competitive edge is that both Joan and Maureen are the most visible lecturers to new home owners in the city. Joan has a weekly column in the city’s daily newspaper and Maureen lectures weekly to the city’s numerous neighborhood councils and civic groups. Together, they represent the most recognizable faces in the city on the subject of home ownership and refinancing a home.

Between them, they have a base of 6,000 satisfied customers who continue to make referrals to the brokers.

The city has been growing by 15% annually for the past 10 years. With the population now at 1.3 million, the new construction in the Old Town section of the city is valued at two billion dollars in home sales next year alone. Claremont Funding is positioned well to grab a large share of the mortgage services demanded by the city’s growth in Old Town.

Management Summary management summary will include information about who's on your team and why they're the right people for the job, as well as your future hiring plans.">

Claremont Funding is a two member mortgage brokerage firm. Both brokers are equal partners in the firm.

6.1 Personnel Plan

The following table shows the personnel plan for Claremont Funding.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Joan Billings | $60,000 | $80,000 | $90,000 |

| Maureen Shoe | $60,000 | $80,000 | $90,000 |

| Admin Assistants | $46,000 | $60,000 | $80,000 |

| Total People | 3 | 4 | 4 |

| Total Payroll | $166,000 | $220,000 | $260,000 |

Financial Plan investor-ready personnel plan .">

- We want to finance growth mainly through cash flow.

- The most important factor for Claremont Funding is the closing sales days. These dates will be determined ultimately by the Seller and the Buyer and a move out/move in schedule will be complied with.

7.1 Important Assumptions

The financial plan depends on important assumptions, most of which are shown in the following table as annual assumptions. The monthly assumptions are included in the appendix. From the beginning, we recognize that collection days are critical, but not a factor we can influence easily. At least we are planning on the problem, and dealing with it. Interest rates, tax rates, and personnel burden are based on conservative assumptions. Some of the more important underlying assumptions are:

- We assume a strong economy, without major recession.

- We assume, of course, that there are no unforeseen changes in the economy that would change our estimations.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

7.2 Break-even Analysis

The following table and chart will summarize our break-even analysis.

| Break-even Analysis | |

| Monthly Revenue Break-even | $19,975 |

| Assumptions: | |

| Average Percent Variable Cost | 0% |

| Estimated Monthly Fixed Cost | $19,975 |

7.3 Projected Profit and Loss

Our projected profit and loss is shown on the following table.

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $264,847 | $365,000 | $445,000 |

| Direct Cost of Sales | $0 | $0 | $0 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $0 | $0 | $0 |

| Gross Margin | $264,847 | $365,000 | $445,000 |

| Gross Margin % | 100.00% | 100.00% | 100.00% |

| Expenses | |||

| Payroll | $166,000 | $220,000 | $260,000 |

| Sales and Marketing and Other Expenses | $7,800 | $13,000 | $19,000 |

| Depreciation | $0 | $0 | $0 |

| Leased Equipment | $200 | $0 | $0 |

| Utilities | $2,400 | $2,400 | $2,400 |

| Insurance | $2,400 | $2,400 | $2,400 |

| Rent | $36,000 | $36,000 | $36,000 |

| Payroll Taxes | $24,900 | $33,000 | $39,000 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $239,700 | $306,800 | $358,800 |

| Profit Before Interest and Taxes | $25,147 | $58,200 | $86,200 |

| EBITDA | $25,147 | $58,200 | $86,200 |

| Interest Expense | $2,950 | $2,550 | $2,250 |

| Taxes Incurred | $6,659 | $16,695 | $25,185 |

| Net Profit | $15,538 | $38,955 | $58,765 |

| Net Profit/Sales | 5.87% | 10.67% | 13.21% |

7.4 Projected Cash Flow

Cash flow projections are critical to our success. The annual cash flow figures are included here and the more important detailed monthly numbers are included in the appendix.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $66,212 | $91,250 | $111,250 |

| Cash from Receivables | $187,004 | $269,352 | $330,237 |

| Subtotal Cash from Operations | $253,216 | $360,602 | $441,487 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $4,500 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $12,000 | $0 | $0 |

| Subtotal Cash Received | $269,716 | $360,602 | $441,487 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $166,000 | $220,000 | $260,000 |

| Bill Payments | $90,879 | $99,759 | $124,576 |

| Subtotal Spent on Operations | $256,879 | $319,759 | $384,576 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $4,500 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $3,000 | $3,000 | $3,000 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $264,379 | $322,759 | $387,576 |

| Net Cash Flow | $5,337 | $37,842 | $53,911 |

| Cash Balance | $45,287 | $83,129 | $137,040 |

7.5 Projected Balance Sheet

The balance sheet in the following table shows managed but sufficient growth of net worth, and a sufficiently healthy financial position. The monthly estimates are included in the appendix.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $45,287 | $83,129 | $137,040 |

| Accounts Receivable | $11,631 | $16,030 | $19,543 |

| Other Current Assets | $20,000 | $20,000 | $20,000 |

| Total Current Assets | $76,918 | $119,159 | $176,583 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $0 |