- How we work

- Let’s talk →

How to conduct mobile app market research? Full expert guide

So, you’ve decided to build a mobile app.

You’ve got a brilliant idea and you’re dying to get down to work.

But, did you conduct market research first? Building a mobile app without doing proper market research is like building a house without laying out the foundations first.

In-depth market research is essential for the success of your app.

In this article we’ll show you why and walk you through all the steps to successful market research.

Let’s dive in!

Table of Contents

What is mobile app market research?

Mobile app market research is the process of gathering and analyzing information about a market you want to target with your app.

Market research is a key part of product discovery and will help you find opportunities in your target market.

Need help with your project? Let’s talk →

You’ll be talking with our technology experts.

Most importantly, it will help you identify your target audience , i.e. the people who are likely to buy and use your mobile app.

This will help you validate your idea , position your product, and get to a product-market fit.

And once you’re done with market research, you’ll know:

- The size and growth dynamics of your target market

- How your competitors position their products

- Which features you should prioritize

- How you can position your product

And that’s exactly what you need to know to build a successful app.

Types of market research

Next, we’ll cover the different types of mobile app market research.

Primary and secondary market research

Mobile app market research can be broadly categorized into 2 main categories – primary and secondary market research.

Here’s a quick explainer of their differences:

source: Qualtrics

Primary market research is research you do yourself and involves collecting original data directly from your potential users.

It includes methods like:

- User interviews

- Focus groups

- Questionnaires

- Observation-based research

Secondary market research, on the other hand, is when you use and analyze data collected by other sources .

This includes:

- Company reports

- Industry reports

- Whitepapers

- Government-collected data

Using both types is essential for successful mobile app market research.

Primary research gives you firsthand, specific information about your target audience and their needs.

And secondary research helps you understand (and take advantage of!) industry trends and dynamics in your target market.

Qualitative and quantitative market research

Other than primary and secondary research, you can also differentiate between qualitative and quantitative market research.

So, what’s the difference between the two?

In the simplest terms, qualitative research deals with non-numerical data while quantitative deals with numbers and statistics.

Of course, there’s a lot more to it than that – here’s a detailed overview of the differences between the two:

Qualitative market research is all about understanding your target users’ behavior and preferences.

And it gives you detailed insights into their motivations and pain points, which will help you find ways your app can solve them.

It includes research methods like:

- Observational studies

On the other hand, quantitative market research is about collecting and analyzing numerical data to identify patterns in user behavior .

It gives you measurable statistical data you can use to make data-driven decisions about your app.

Some top qualitative methods you should use are:

- Review scores

You need to use both types if you want a comprehensive understanding of your target audience and target market.

And that’s the only way to build an app that can succeed in the market.

Why is app market research so important?

First of all, the app industry is huge.

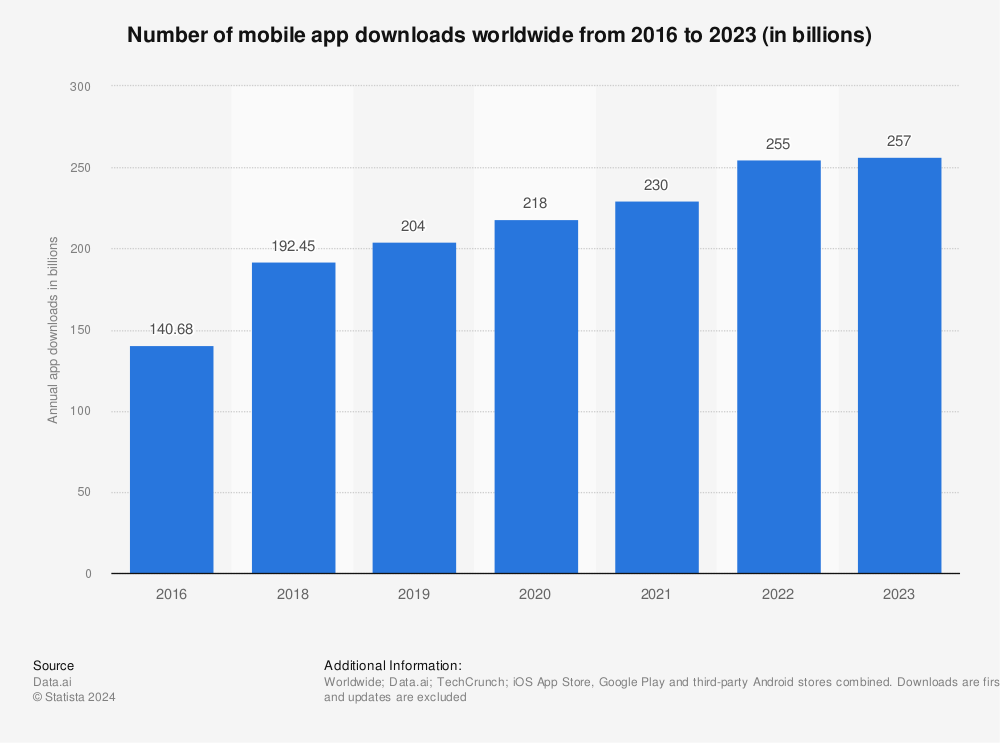

In 2023 alone, users downloaded more than 257 billion apps and games.

And, on average, a 1000 new apps are added every day to both the App Store and Google Play .

source: Statista

You don’t want to rush in there without a plan or strategy, right?

This happened to the taxi app Hailo .

Hyped up from their success in the United Kingdom, they tried to break in to the U.S. market.

However, they made a fatal mistake – they didn’t properly research the characteristics of the U.S. market.

source: Apptunix

You shouldn’t make the same mistake – that’s where market research comes in.

Market research will give you valuable inputs, like:

- Your audience’s pain points

- Industry trends

- The psychology of your potential users

- Your competitors’ strengths and weaknesses

Next, we’ll show you exactly how to do market research for your mobile app.

4 key steps to conduct mobile app market research

Here, we’ll guide you through the 4 key steps you need to follow for successful market research.

1. Prepare for your market research

Good preparation is half the battle won. Grab a piece of paper (or open a Google doc) and write down these questions:

- Who is your target audience?

- Is it a wide customer base or a more niche one?

- What is the goal of your app?

- Which user problems does your app solve?

Also, try to imagine the day-to-day issues your users come across.

Make sure you always have your users’ pain points on your mind and how your app can solve them.

This is especially important if you’re building fintech or health apps because the user’s well-being depends on them.

Next, you need to sketch out your app’s business model:

- Will your app be free or will you go with a “try before they buy” approach?

- Do you want to monetize it with in-app advertising or in-app purchases?

- Do you want to go with a paid model?

As you can see, you have plenty of business models to choose from. It may feel overwhelming, but when you’re done with the research, you’ll be able to successfully monetize your app.

Also, you should do a SWOT analysis of your app – SWOT stands for S trengths, W eaknesses, O pportunities and T hreats.

It’s a popular technique that’ll give you a bird’s eye view of your app and will serve as a good roadmap.

Finally, you should write all this down and later compare it with findings from your research.

2. Conduct the research using these methods

Next, let’s dive headlong into research – we’ve selected a few top research methods you should use during market research.

One of the primary market research methods you should use are surveys.

Here, you give a series of questions to a predefined group of people to gain valuable information.

Surveys are a highly effective and easy way to step into your potential users’ shoes.

Give users open-ended questions at the beginning and narrow them as you go.

But, don’t go too narrow. Those questions aren’t useful because they won’t give you conclusive answers.

Your surveys should be tailored to your target audience and you need to make sure you send them out to the right people.

So, don’t rely on feedback from friends or coworkers – they’ll be very biased and skew your research results.

You can easily create surveys with tools like:

- SurveyMonkey

- Google Forms

But, make sure they’re not too long – the sweet spot is 7-10 questions and 10-14 minutes to complete it.

Also, you should give users an incentive to complete the survey.

This can be exclusive access to your app, a discount or something else with added value.

Social media listening

Nowadays, people live on social media – 62% of the global population uses some form of social media.

So, it should be no surprise that social media is a treasure trove for market research – which is where social media listening comes in.

Monitoring relevant social media content is essential in conducting market research.

Get exclusive founder insights delivered monthly

It will help you gain insight into how users communicate with your competitors and their pain points.

So, if you’re developing a gaming app, check out relevant Discord servers or if you’re working on a fitness app, check out fitness groups on Facebook.

You should also use social listening tools like:

- Sprout Social

Social media listening isn’t just perfect for analyzing your target audience, but your competitors, too – we’ll touch on that later.

Collecting relevant data

Market research is pointless without relevant data.

That’s why your sources should have trustworthy, fresh and relevant data.

Luckily, collecting that data is much easier with online tools like:

- Sensor Tower

- Business of Apps

- Google Trends

Sensor Tower is a digital intelligence and analytics tool with a treasure trove of data about a wide variety of markets.

Statista is a platform with a lot of up-to-date data and statistics about various industries and countries.

Business of Apps is an excellent source of not only app data but also news, podcasts and insights related to the app industry.

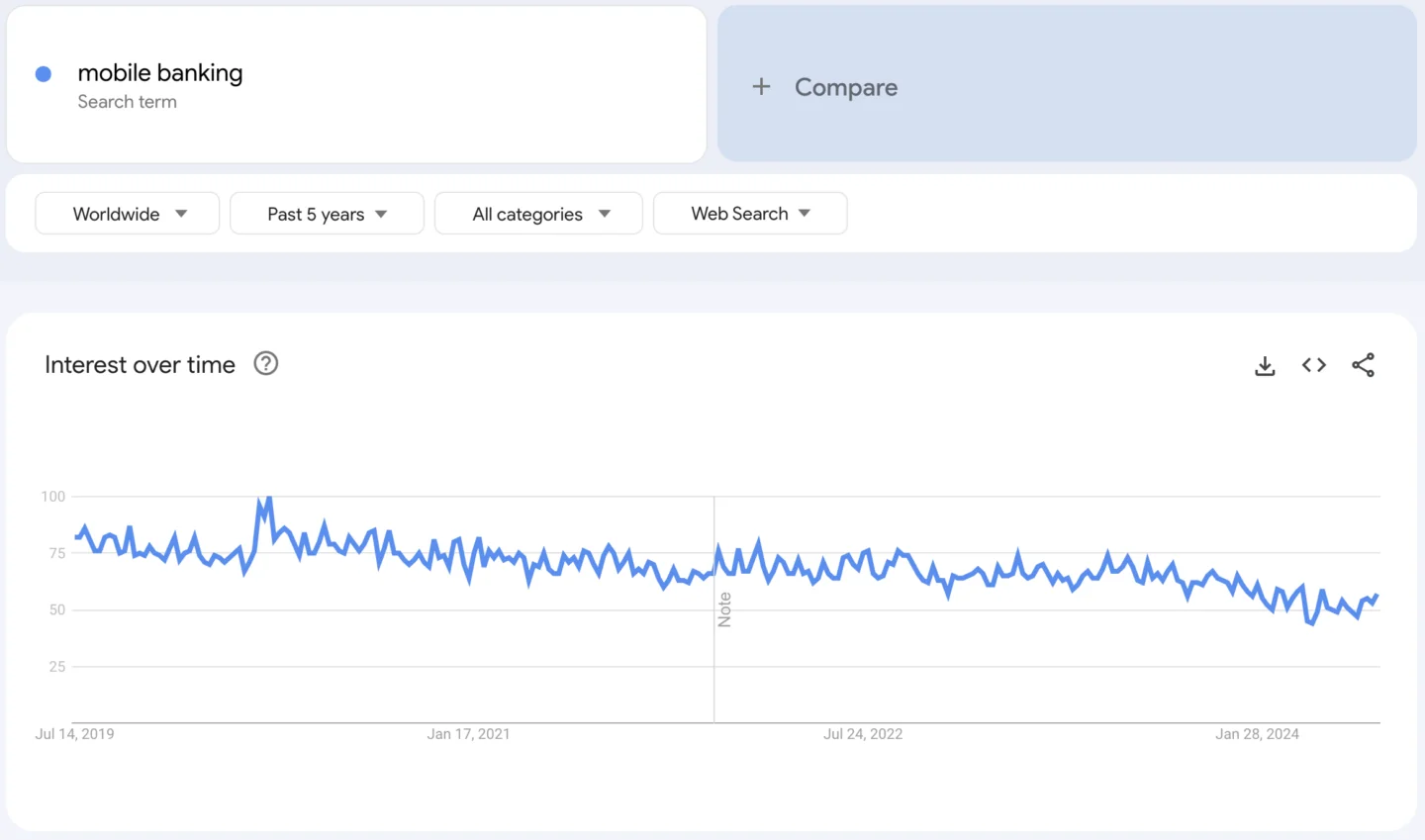

Finally, even a simple and free tool like Google Trends can be helpful during market research.

source: Google Trends

It’s a great tool for comparing search trends all around the world.

So, if you’re wondering which countries are the best user base for your app, you can find that out with just a few clicks.

And if you don’t have time to browse around, you can subscribe and get data about trending topics and searches.

3. Analyze your competitors

We’ve all heard the saying “keep your friends close and your enemies closer”.

And the same goes for market research – this is where competitive analysis comes in.

It will help you get a clear picture of industry trends and consumer behavior.

First, you need to determine who your competitors are – since they’re already operating in your niche so it shouldn’t be difficult to find them.

Then, you need to gather as much information as you can and find answers to these questions:

- Are they privately or publicly owned?

- What’s their business model?

- Who are their users?

- What problems does their app solve for users?

- What are their app’s features?

- How much revenue and profit did they make last year?

- What’s their marketing strategy?

Tools like Apptopia or Determ will make collecting this data much easier.

Then, you need to analyze your findings, identify any gaps in their business model, and find out how your app can be better than theirs.

Also, it’s useful to do a SWOT analysis of your competitors.

This way, the differences between your app and your competitors’ product will be crystal clear.

Also, don’t focus just on direct competitors , or ones similar or the same as you.

Widen your horizons and do an analysis of various companies – big and small.

You’ll gain lots of valuable insights from their approach to business, users or competitors.

4. Apply the results to your mobile app

Wait, there’s still work to do.

Take all your findings, compare them with your notes and incorporate them into your app.

If something doesn’t add up, or you realize you’ll have to make some changes, don’t feel bad – it’s a normal part of the app development process.

And it’s better to find mistakes in the initial stages of development than later on.

So, what should you do next?

Group your findings in a spreadsheet and make sure you include:

- Your buyer persona

- Competitive analysis

- Industry trends and general overview

- Your price model

Along with your findings, make sure to include all the relevant data you’ve collected from outside sources.

Then, compare them to the notes you took before the beginning of your research.

You can compare the findings on your customers with your own description of the ideal user and ask:

- Are there any gaps?

- Do their preferences align with your business plan?

- Does your app solve their pain points?

For example, if you’ve found that your potential users only download free apps, you won’t decide on a paid model.

And if you’re satisfied with the results, congratulations! You’ve completed your market research.

How to conduct market research for your mobile app: summary

Effective market research is the key to building a successful mobile app – it gives you the information you need to make informed decisions about your app’s development.

With that in mind, here’s a summary of the key steps you need to follow to conduct mobile app market research:

- Prepare for your market research

- Conduct the research using these methods: surveys, social media listening, collecting relevant data

- Analyze your competitors

- Apply the results to your mobile app

So, there you have it – now you’ve got everything you need to successfully do market research for your mobile app.

Important tips for conducting mobile app market research

We asked our product manager, Boris Plavljanic, to share his most important tips for mobile app market research.

And here’s what he had to say:

1. Identify your target audience

Identify your app’s intended users and understand their demographic details, behaviors, preferences, and the challenges they face. This will allow you to tailor the app’s features and your marketing efforts and effectively address their needs. Boris Plavljanic, Product manager at DECODE

Getting this one right is key if you want to build an app that can actually meet your users’ needs – and it’s key for its long-term success.

2. Analyze your competitors

Check out the top apps in your niche. Look at their strengths, weaknesses, the feedback they get, and their unique features. Doing this can reveal market gaps and highlight opportunities for you to stand out. Boris Plavljanic, Product manager at DECODE

Standing out from your competition is the best way to establish yourself in your target market. And you can’t do that without analyzing your competitors first.

3. Get direct feedback from potential users

Use surveys and questionnaires to get direct feedback from potential users and ask them about their preferences, challenges, and the features they want. Also, you should talk to small groups of potential users or do individual interviews to get deeper insights. Boris Plavljanic, Product manager at DECODE

Getting direct feedback from your target audience is the only way to build a truly user-friendly app and succeed in a crowded market.

Mobile app market research: FAQs

Most importantly, it will help you identify your target audience, i.e. the people who are likely to buy and use your mobile app.

Why is mobile app market research important?

Mobile app market research is important because it will help you:

- Identify your target market and target audience

- Position your product

- Get your app to a product-market fit

- Identify gaps in the market

Which types of market research should I use?

You should use:

- Primary market research – research you do yourself by collecting original data

- Secondary market research – using and analyzing data collected by other sources

- Qualitative market research – non-numerical data, used to understand users’ behavior and pain points

- Quantitative market research – numerical and statistical data, used to identify patterns and make data-driven decisions

Need market research for your app?

So, you have a great app idea but don’t have the time for in-depth market research and product discovery?

Luckily, you’re in the right place.

We can help you do in-depth market research for your app, validate your idea, and then build your app from scratch.

If you want to learn more, check out our product discovery process and feel free to reach out – we’ll set up a quick call to discuss your needs in more detail.

Ivan Kardum

Lead product manager.

Ivan is truly passionate about what he does. In his role as Lead Product Manager, his strength is shaping products that not only meet market needs but also wow their users. And with over a decade of experience at software companies and startups, he knows all the ins and outs of building successful products. In his spare time, he enjoys staying active, whether it's hitting the gym, playing sports, or hiking. His dream office? A terrace in Komiža on the island of Vis, taking in the warm Adriatic sun.

Related articles

Here, we'll show you how to build the best mobile app development team - we'll discuss key roles, the team structure and how to hire the team.

Wondering what kind of app you should make? Here are 90+ mobile app ideas to help you out!

Here, we'll give you 7 top tips for choosing a mobile app development company - finding the right one is key for your app's success.

Need high-end mobile app development from true experts? — Let’s talk →

Ready to level up your insights?

Get ready to streamline, scale and supercharge your research. Fill out this form to request a demo of the InsightHub platform and discover the difference insights empowerment can make. A member of our team will reach out within two working days.

Cost effective insights that scale

Quality insight doesn't need to cost the earth. Our flexible approach helps you make the most of research budgets and build an agile solution that works for you. Fill out this form to request a call back from our team to explore our pricing options.

- What is InsightHub?

- Data Collection

- Data Analysis

- Data Activation

- Research Templates

- Information Security

- Our Expert Services

- Support & Education

- Consultative Services

- Insight Delivery

- Research Methods

- Sectors We Work With

- Meet the team

- Advisory Board

- Press & Media

- Book a Demo

- Request Pricing

Embark on a new adventure. Join Camp InsightHub, our free demo platform, to discover the future of research.

Read a brief overview of the agile research platform enabling brands to inform decisions at speed in this PDF.

InsightHub on the Blog

- Surveys, Video and the Changing Face of Agile Research

- Building a Research Technology Stack for Better Insights

- The Importance of Delegation in Managing Insight Activities

- Common Insight Platform Pitfalls (and How to Avoid Them)

- Support and Education

- Insight Delivery Services

Our services drive operational and strategic success in challenging environments. Find out how.

Close Connections bring stakeholders and customers together for candid, human conversations.

Services on the Blog

- Closing the Client-Agency Divide in Market Research

- How to Speed Up Fieldwork Without Compromising Quality

- Practical Ways to Support Real-Time Decision Making

- Developing a Question Oriented, Not Answer Oriented Culture

- Meet the Team

The FlexMR credentials deck provides a brief introduction to the team, our approach to research and previous work.

We are the insights empowerment company. Our framework addresses the major pressures insight teams face.

Latest News

- Insight as Art Shortlisted for AURA Innovation Award

- FlexMR Launch Video Close Connection Programme

- VideoMR Analysis Tool Added to InsightHub

- FlexMR Makes Shortlist for Quirks Research Supplier Award

- Latest Posts

- Strategic Thinking

- Technology & Trends

- Practical Application

- Insights Empowerment

- View Full Blog Archives

Discover how to build close customer connections to better support real-time decision making.

What is a market research and insights playbook, plus discover why should your team consider building one.

Featured Posts

- Five Strategies for Turning Insight into Action

- How to Design Surveys that Ask the Right Questions

- Scaling Creative Qual for Rich Customer Insight

- How to Measure Brand Awareness: The Complete Guide

- All Resources

- Client Stories

- Whitepapers

- Events & Webinars

- The Open Ideas Panel

- InsightHub Help Centre

- FlexMR Client Network

The insights empowerment readiness calculator measures your progress in building an insight-led culture.

The MRX Lab podcast explores new and novel ideas from the insights industry in 10 minutes or less.

Featured Stories

- Specsavers Informs Key Marketing Decisions with InsightHub

- The Coventry Panel Helps Maintain Award Winning CX

- Isagenix Customer Community Steers New Product Launch

- Curo Engage Residents with InsightHub Community

- Tech & Trends /

How to Write a Market Research Plan (+ Free Template)

Chris martin, infographic: artificial intelligence in market res....

In today’s data-driven landscape, insight and business professionals are often looking for more effi...

Sophie Grieve-Williams

- Insights Empowerment (31)

- Practical Application (174)

- Research Methods (283)

- Strategic Thinking (200)

- Survey Templates (7)

- Tech & Trends (387)

A market research plan, similar to a brief, is a vital document that details important information about your market research project. Though it is often an overlooked step of the market research process , an effective plan is often a critical factor in determining whether or not your market research efforts are successful.

Why? Because a well-thought through plan, more so than objectives alone, can be a vital instrument in focusing your investment. It ensures you know, ahead of the commencement date, the timeline, budget and desired outcomes from the project. It can even be used as a tool for receiving quicker sign-off from management when embarking on a new venture.

But it’s also important to remember that the research plan is not just for your team. To make full use of this document, it should be written in a way that can be distributed to agency partners as well – ensuring that your insight team and specialist partners are all working towards the same goal.

Tips for Crafting a Successful Plan

The first rule of writing a successful market research plan is to keep it short. The perfect length is between 1-2 pages, but as an absolute maximum try to ensure that it never exceeds 3. This will give you enough space to explain the background, scope and practicalities of the project while ensuring it is concise enough to be read in full. Throughout these few short pages, the tone of your plan should be informative. Remember that you are outlining information that you already know.

Write in a way that holistically encompasses all aspects of the project. Throughout the duration of your scripting, data collection, analysis and reporting stages of your project you should always be referring back to this document in order to remain focused. As any researcher knows, one of the biggest challenges in any research project is staying true to your original objectives.

With both exploratory and confirmatory research alike, new information is likely to arise which may spark other ideas or bring light to previously unknown issues. Remember these, but set them aside for further investigation at a later date. Travelling too far down the rabbit hole is the quickest way to overspend and under deliver on your original goal.

The 10 Elements of the Best Research Plans

First, let me preface this with a reminder: every project is different. A long term co-creation community will have different needs and requirements to a customer feedback survey or ad testing project. However, despite this – it is important to give equal consideration to all projects, and plan each with the same high degree of meticulous care. With this in mind, these are the 10 key aspects we recommend that all research plans should include:

1. Overview

Use this first section to outline the background to the problem that you are attempting to solve. Include background information on the business to provide context, as well as the circumstances that have led to the need for research. Overviews should be limited to 200 words at most, with most of the word count dedicated to the business circumstances & challenges surrounding the research.

2. Objectives

Arguably the most important aspect of the entire document, objectives should be in bullet point format. List 3-5 of the decisions or initiatives that the research will inform – this will become the remit of the project. Below are a few examples of both well and poorly written objectives:

Well written research objectives:

- Understand the channels in which our customers are most comfortable shopping, in order to decide which should be prioritised in the 2017 Q1 budget

- Develop an active co-creation community that contributes 2 user-generated product improvements for testing to the R & D team per month

- Learn what is leading to an increase in customer churn so that a new retention strategy can be put in place within 12 weeks

Poorly written research objectives:

- Survey 1,000 potential customers to find out how our products can be improved

- Develop a panel of employees that are able to provide answers to research questions on an ad-hoc basis

- Learn how our company is perceived in comparison to competitors and how we can stand out in the marketplace

3. Deliverable outcomes

This section acts as a list what you expect to be produced at the end of the project. This can include, but is not limited to: a target number of responses you expect to receive, descriptions of how the data should be presented and the extent to which the data will be used to inform future decisions. In long term projects such as panels or communities, this may include a target for the amount of decisions that research is expected to inform and/or a pipeline for new ideas in exploratory studies.

4. Target audience

Different to sample, your target audience describes the population that you wish to research. This can be defined by a number of factors depending on the nature of your project. Some of the most common include: demographics, psychographics, life stages and company/ product interaction.

5. Sample plan

The sample plan should be used to indicate the amount of participants you wish to research, as well as a breakdown of each group. This will be affected by the choice to use qualitative, quantitative or multi-method approaches, as well as the estimated size of the target population.

6. Research Methods

List the different research methods that you plan to use in your project. This will be used by your team and agency partners to ensure that the insight you need comes from the most appropriate tools. Be sure to include any non-traditional methods you plan to use as well – it’s important that your team are aware of how data will be captured, even if it is being gathered by an experimental technique.

7. Timeline

These usually take the form of a Gantt chart, but can vary depending on the scope and length of your project. Try to break down tasks as much as possible but be wary of dependencies within your chart. Be sure to schedule enough time in case some research tasks over-run or response rates are lower than expected.

Perhaps the most dreaded aspect of any research plan, budgeting is never easy. But by providing a breakdown of costs and outlining which elements of the project require most investment, a well-planned budget can be a benefit rather than a hurdle.

9 & 10. Ethical and Further considerations

Finally, you should outline any ethical/ other considerations or issues that may arise throughout the course of your project. Whether these are as simple as a conflict of interest or a concern about supplier relationships – this is your chance to address any problems that may arise before they do.

Free Market Research Plan Template

Use this link to download our free market research plan template . The template comes complete with each of the sections outlined above, with instructions on usage and tips on how to make the most out of it. Currently available in .docx format, please email [email protected] if you have any problems with the download.

What do you believe should be included in a successful market research plan? Share your advice with us in the comments below and join the conversation.

About FlexMR

We are The Insights Empowerment Company. We help research, product and marketing teams drive informed decisions with efficient, scalable & impactful insight.

About Chris Martin

Chris is an experienced executive and marketing strategist in the insight and technology sectors. He also hosts our MRX Lab podcast.

Stay up to date

You might also like....

Market Research Room 101: Round 2

On Thursday 9th May 2024, Team Russell and Team Hudson duelled in a panel debate modelled off the popular TV show Room 101. This mock-gameshow-style panel, hosted by Keen as Mustard Marketing's Lucy D...

Delivering AI Powered Qual at Scale...

It’s safe to say artificial intelligence, and more specifically generative AI, has had a transformative impact on the market research sector. From the contentious emergence of synthetic participants t...

How to Use Digital Ethnography and ...

In one way or another, we’ve all encountered social media spaces. Whether you’ve had a Facebook account since it first landed on the internet, created different accounts to keep up with relatives duri...

Mobile Marketing: 12 Powerful Strategies & the Ultimate Guide [2024]

Mobile marketing is a powerful component of digital marketing and businesses of all sizes, across all industries, can benefit from a great mobile marketing strategy!

Mobile devices are everywhere – more than 90% of the global population uses mobile phones, and more than 83.72% of the global population owns a smartphone . When it comes to internet access, more than 70% of users access the internet on a mobile device, increasing to over 90% in some regions.

Marketing campaigns that are optimized specifically for mobile devices offer unique advantages. They’re cost-effective, easy to execute, and can fit seamlessly into your existing marketing efforts.

Mobile marketing strategies like text message marketing also boast incredibly high open and click-through rates, and location-based mobile marketing provides a level of contextual relevance that few other marketing channels can match.

So, what are the best mobile marketing strategies to use and how do you create a successful mobile marketing plan for your business?

Today, we’re going to cover what mobile marketing means, what the advantages and disadvantages are, and then show you some of the best mobile marketing strategies, examples, and expert tips to create a successful mobile marketing plan for your business!

Let’s jump right in!

Skip to What You Need

What is Mobile Marketing?

Mobile marketing is a digital marketing strategy that uses multiple channels to engage consumers on smartphones, tablets, and other mobile devices. The channels used in mobile marketing include SMS, MMS, email, social media, content marketing , mobile responsive websites, apps and push notifications.

Mobile marketing is one of the most effective methods to use. It offers unique advantages in that messaging is immediate, precisely timed and targeted, and can be location-specific and highly personalized.

In terms of reach, there are more than 6.5 million smartphone users globally, and by 2025 three quarters ( 72.6%) of all internet users will be accessing the internet via smartphone . In the USA, 85% of consumers own a smartphone , which they check more than 50 times a day!

TLDR – MOBILE MARKETING IS:

Mobile marketing is a form of multi-channel digital marketing aimed at connecting with consumers via their mobile devices, like smartphones and tablets. Main channels include SMS, MMS, email, social media, content marketing, mobile responsive websites, apps, and push notifications.

Mobile Marketing Channels

Any channel that a consumer can access from their phone or tablet can be used for mobile marketing, however, the main channels used specifically in mobile marketing are:

SMS or Text Messages

SMS or text message marketing is a quick and easy way for consumers to receive notifications, updates, personalized promotional offers, and time-sensitive deals.

Text/SMS marketing reaches consumers wherever they are, no matter what they’re doing, and the open rates are incredibly high – close to 100% within the first 20 minutes!

Push Notifications and In-app Messaging

For businesses with an app, when users opt-in to receive notifications you can send them offers, suggestions, notifications, and reminders to their home/lock screen, whether they’re currently using the app or not. Done right, push notifications can be a powerful mobile marketing strategy!

In-app messages do not require an opt-in from users, so messaging can reach your entire user base. This makes in-app messaging great for gathering information, establishing preferences, and letting users know about additional offers available to them.

If your app has an inbox, you can use it like you would use email marketing for longer and more in-depth communication. App inboxes provide a wealth of analytics data while allowing you to control the content in messages even after they land in the inbox. That means you can further personalize offers and improve the user experience.

- Mobile Optimized Email Marketing

Email marketing is not mobile-specific, but as the majority of smartphone users access their email from their phones, it’s essential that your email marketing is optimized for mobile. Content created with mobile in mind, mobile responsive website design, and branded mobile apps make it super easy for email recipients to go directly to your site and take the desired action!

TLDR: 3 MAIN MOBILE MARKETING CHANNELS

Most digital marketing channels can be optimized for mobile but the main mobile-specific channels are:

- Text Messages or SMS Marketing

- Push Notifications and In-app Messaging

Mobile Marketing: Advantages and Disadvantages

Advantages of mobile marketing.

Mobile marketing offers some unique advantages that make it a highly effective component of digital marketing:

1. Easily Accessible to a Large Audience

Reaching your audience via their phones is an immediate, real-time form of contact, which reaches the majority of all internet users, instantly.

As of 2022, globally there are more than 6.5 million smartphone users, which is projected to rise to over 7.6 million by 2027 . In terms of mobile access to the internet, 72.6 % of all internet access will via smartphone by 2025 – that is three-quarters of all internet users!

And that is just smartphones. It does not include those using tablets and other mobile devices.

In terms of SMS or text marketing, a uniquely mobile marketing channel, the open rates are as high as 98% , which is another reason mobile marketing is such an effective marketing method.

2. Highly Cost-effective Marketing

Mobile marketing is one of the most diverse and cost-effective ways to reach your audience. This comes down to several factors:

- Your existing content and messaging can easily be re-purposed and optimized for mobile

- Screen sizes are smaller, which means the new content you create for mobile is inherently smaller and simpler, which takes less time and costs less money

- Precise targeting and location-based marketing allow you to focus your marketing efforts on the right segments of your audience, reducing wasted ad spend

- Mobile-only channels like push notifications, in-app ads, and SMS or text marketing are some of the cheapest channels available

The bottom line is that mobile marketing is both effective and cost-effective compared to other marketing techniques in terms of ROI.

3. Mobile Marketing Allows You to Make the Most of Location and Personalization

People carry their phones with them all the time, wherever they go. One of the biggest benefits of mobile marketing is that you can reach your audience with relevant communication, no matter where they are.

Location-based marketing lets you gather a great deal of information about your audience, including their habits, preferences, purchase history, and current location.

This information is hugely valuable for precise targeting, and highly personalized marketing. You can then reach the right segments of your audience, with the right offers, at the right time and in the right place!

4. Mobile Marketing is Immediate and Allows for Instant, Impulse Transactions

People use their phones when they’re bored or killing time, which presents a great opportunity for sellers. In the same way that items on the side of the check-out line at the grocery store catch your attention while you wait, mobile marketing can reach people when they’re looking for something of interest and have nothing else on their minds.

In a sense, it capitalizes on boredom and entices people to make impulse purchases almost as a form of entertainment. Aside from maybe social media marketing, there are precious few marketing channels that let you do this!

5. Sharing, Referrals, and the Potential for Viral Campaigns

Everyone loves to share things with their contacts, especially if they’re interesting/entertaining or offer something of value.

Mobile marketing makes everything highly shareable, which increases the odds of informal referrals between customers.

It also creates the potential for your content to go viral, gaining attention and spreading brand awareness at zero cost to you.

IN SHORT, THE UNIQUE ADVANTAGES OF MOBILE MARKETING ARE:

- It is easy to reach a very large number of people because almost everyone uses a mobile phone, smartphone, or tablet.

- Many mobile marketing channels are free or low-cost and easy to deploy.

- It is ideal for leveraging location-based marketing techniques to their full advantage.

- Mobile marketing allows for fine-grained targeting and a high level of personalization.

- Communication is immediate so it can be precisely timed.

- Mobile marketing reaches people on the go, in situations where they’re looking for entertainment or something of interest, which drives impulse purchasing.

- Content viewed on mobile devices is highly shareable, which increases the chances of referrals and customer advocacy, as well as the odds of your campaign going viral.

Disadvantages of Mobile Marketing

While mobile marketing offers great advantages, there are also some pitfalls to be aware of when you’re planning your mobile marketing campaigns:

1. Immediacy Means There is No Wiggle Room to Fix Errors

Mobile marketing is by nature an immediate/real-time method of communication. If you make a mistake in your message, there is no time to fix it before the recipients see it, and sending out an error followed by a correction notice is hardly the first impression you want to make!

2. Easy Sharing and Viral Potential Can Backfire

The potential for your content to be shared far and wide very quickly is great in the right context. In the wrong context, however, it can be a huge liability. If your content is being shared and circulated for reasons that reflect poorly on your brand, it can do a lot of damage to your brand reputation, which is difficult and expensive to remedy. Make sure all your content is carefully thought through and will land as intended before you send it to anyone’s mobile phone!

3. Costs to the User

While some mobile marketing channels, like email and SMS marketing, can be some of the most cost-effective marketing for you, they might be costing your audience in terms of data or text message charges. This is something to keep in mind when you formulate your mobile marketing plan and choose the strategies you will use to reach different segments of your target market.

4. Limited Accessibility for Non-Smartphone Mobile Users

The majority of your target audience will be using smartphones but there will still be a segment that is not using smartphones and won’t be reached via mobile marketing channels that require internet or data usage. In the USA, it is estimated that 80% of mobile phone users have a smartphone, while 20% do not. Remember to factor this into your strategy and focus on SMS/text marketing for those without smartphones.

IN SHORT, THE UNIQUE DISADVANTAGES OF MOBILE MARKETING ARE:

- Instant messaging means there is no wiggle room to fix mistakes so every piece of content and every message needs to be on point, every time.

- Easy sharing and viral potential can backfire if your audience is sharing your content for reasons that reflect badly on your business.

- Unlike most other digital marketing methods, mobile marketing can carry a cost for your audience in the form of mobile data or text message charges.

- Not everyone who owns a mobile phone owns a smartphone so some mobile marketing channels will not reach those users, even if they’re in your target audience.

Right, now that you have an idea of the unique opportunities mobile marketing offers, and the potential pitfalls to look out for, let’s take a look at some of the best mobile marketing strategies to consider:

12 Mobile Marketing Strategies & Examples in 2024

1. responsive website design that is optimized for mobile.

Your website, marketing content, and ads all need to be optimized for mobile. That is a step further than just ‘mobile friendly’ and it means having a highly responsive website, that is designed with mobile use in mind.

A mobile-optimized website ensures a great customer experience for those browsing on their phones and any other mobile device. It also increases conversion rates and lowers bounce rates.

There are several ways to optimize your website, such as using mobile-specific platforms, using HTML5, and ensuring that the site is adaptive and responsive. Your content also needs to be created with mobile in mind and made to be easily digested, as well as scale easily and load quickly.

Take a look at this short video by HostGator for a quick breakdown of what it means to optimize your website for mobile:

While this can be a little too much on the technical side for many, some great mobile marketing agencies offer everything you need, including web development and design for mobile, and creative content production .

2. Mobile-friendly Content and Copy

As we noted above, mobile optimization is not limited to your website infrastructure. Using content that is mobile-friendly is important too!

Here are some tips to ensure that your content is mobile-friendly:

- Use high-quality images, videos, and GIFs. Mobile content needs to be visually engaging and interesting.

- Copy needs to be short, concise, and to the point. Use short sentences, break up paragraphs with headings and sub-headings, and use ordered and unordered lists for any content that can be skimmed.

- Use large fonts (size 14px or bigger), as small font sizes are hard to read on a small screen.

- Add alt text, image names, and captions to all media so that viewers can see what it is if it’s taking a while to download on a slow data connection, or if their browser does not automatically load media.

- Most people watch videos on mute, so adding subtitles is essential to get your message across even with the sound off!

3. Opt-In (and Opt-Out) Forms

In digital marketing, especially email marketing, it is best practice to get permission from recipients and make sure that they have a way to opt out too. Mobile marketing is no different!

Opt-in forms on your website, emails, and any other form of communication you use will grant you permission to contact people AND help you grow your email and SMS lists.

You can use a simple pop-up or you can use something more complex, like a lead-magnet offer with a free resource download in exchange for an email address or phone number.

Similarly, having an opt-out option is critical. If someone knows they can opt-out, they’re more likely to give you their contact info. They’re also more likely to remove themselves from your email or SMS lists, which saves you doing it for them when they’re no longer responsive.

Regularly purged contact lists have higher open rates and CTR, which improves things like email reputation and deliverability.

4. SMS/Text Message Marketing

When it comes to mobile marketing campaigns, SMS marketing, and text blasts are really effective. They’re highly cost-effective, and SMS has close to a 100% open rate!

Text messages are great for time-sensitive offers and leveraging a sense of urgency. According to Tatango, 90% of marketing text messages are opened within just 3 minutes , and 99% are opened within the first 20 minutes.

To make the most of your text/SMS marketing, include opt-ins and opt-outs and use coupons – digital coupons, like a discount code or a link to an exclusive offer, are used more than coupons from any other marketing channel.

5. Paid Social Media Ads

Social media marketing has become a leading marketing channel and it’s great for mobile marketing, with 76% of users accessing social media using a mobile device .

Include social media ads in your social media and mobile marketing plans, and do some A/B tests to determine which platforms perform the best for your brand.

Ads are simple way to target specific segments of your audience with highly relevant offers. They’re also effective for spreading awareness of your brand and gain followers for your social media profiles.

6. GIFs and Video Content

Mobile marketing strategies work best when they’re coupled with interactive visual content like GIFs and videos. People expect mobile content to be easy to digest and entertaining. No one wants to read pages and pages of text on a small screen!

Video marketing has become a cornerstone of almost all forms of digital marketing, especially on social media.

Video is especially useful for reviews and educational content on products and services. Almost 75% of people prefer watching a video over reading a guide when learning about a new product.

Incorporating video and GIFs into your mobile marketing plan and social media strategy increases engagement, holds attention for longer and makes your content more memorable. It also makes it easier to digest and more entertaining for your audience.

7. Location-based Marketing Techniques

Location-based marketing techniques, such as mobile targeting, geofencing, and geotargeting , are invaluable mobile marketing strategies.

Check out this short video by John Arnott for more on the basics of geofencing and other location-based marketing techniques:

Leveraging real-time location data provides insights into customer behavior and preferences that you can use to fine-tune your targeting and provide highly personalized offers.

For brick-and-mortar businesses and businesses with apps, location-specific search results help you reach people close by and make the most of the convenience factor.

For mobile marketing in e-commerce, brands that provide location-based offers, like free delivery within a specific area or products that need to be delivered quickly like food, will benefit from location-based marketing.

8. Voice Search Optimization

In addition to voice searches on mobile phones, as of 2022, it is projected that more than 50% of homes use a voice smart speaker , and the trend is increasing rapidly.

This is important for marketing because, according to Invoca , 43% of the people who own a voice-enabled device use it to shop. Of those, 51% use voice search to research products, 22% make purchases directly through the voice search and 17% use it to reorder items.

People also use voice search for location-specific recommendations, like local restaurants , store locations, and services. Most voice searches lead to a phone call to the business they found, website visits, and in-store visits, which makes voice search an important driver of actual sales, not just traffic.

9. In-app Support to Improve Customer Experience

Customer experience is everything. Providing great customer service, support, and an effortless experience doing business with you will improve customer retention, drive repeat purchases, and increase customer lifetime value.

It will also increase the chances of customers referring their friends and family to you, advocating for you online, and sharing their positive experiences with your brand on social media.

A lot goes into providing a great customer experience but when it comes to mobile marketing strategies, you can use in-app messaging and support to make each customer’s experience that much better.

In-app support through live chat on your website or in your business’s mobile app is a convenient and immediate way to communicate with your customers. The easier it is for them to contact you and get a quick answer and an easy solution to their problems, the better!

10. Push Notifications

For businesses with a mobile app, push notifications are a great way to send notifications, and time-sensitive offers and keep users updated on your latest promotions. When users opt-in to push notifications, those notifications will appear on their home screen and not only when they’re in the app itself.

Push notifications are also useful for cart abandonment and re-engagement messaging. To make the most of your push notifications, use quick and easy elements like buttons and quick links, and keep messaging short, fun, and engaging with emojis and other visual elements.

11. In-App Messaging

Unlike push notifications, users do not need to opt-in to receiving messages to your app’s message inbox. This means every user will automatically get these messages and you can use them for automated communications like onboarding, setting preferences, marketing promotions, and upselling additional products or features.

12. Personalized Mobile Marketing Campaigns

Personalization is key in digital marketing, especially in email and mobile marketing. In fact, 75% of consumers are more likely to buy from a retailer that uses their name and makes recommendations based on their purchase history.

One of the best things about mobile marketing is just how personalized and precisely targeted your marketing can be!

Mobile user data can help you to create highly personalized offers, using location data, interaction/purchase history, and some basic demographic information that is easy enough to gather when people opt-in to your mobile marketing channels.

Mobile Marketing Plan: 3 Steps to Get it Right

While the mobile marketing strategies we listed above are all highly effective, not every strategy will be appropriate or practical for your specific business.

That is where your mobile marketing plan comes in. A good mobile marketing plan sets out the roadmap and overall strategy for your mobile marketing, including the channels and strategies you will use, and how you will tie mobile-specific marketing into your overall marketing mix.

When you’re putting your mobile marketing plan together, these three steps will set you up for success:

1. Select and Prioritize the best Mobile Marketing Strategies to Use

Choosing the right combination of strategies to use comes down to your business model, and where and when you want to reach your audience.

Consider your marketing goals and objectives and how mobile marketing can help you reach them.

Look at the marketing channels you’re already using and see where you can use mobile marketing to strengthen different channels, like social media, or fill gaps, like location-based marketing, to round out your overall marketing efforts.

Create robust customer personas and identify where and when they’re using mobile devices, and how best you can meet their needs. Are they bored and scrolling on social media? Are they looking for the nearest solution to an urgent need? Are they driving or are they at home?

From there, you can determine which strategies will be the most effective and which ones will be the easiest to implement. Start with those, and you can add on more (and cut back on any that do not show results!) as you progress.

2. Consider Your Budget and Make the Most of Free or Low-cost Mobile Marketing Strategies

One of mobile marketing’s biggest advantages is how cost-effective it is! Make the most of that by choosing free strategies, like claiming your location on Google and other location-specific listings, or low-cost strategies like text message marketing.

You should also leverage all the information available to you to hone in on personalization and precise targeting to reduce any wasted ad-spend and increase your ROI.

Factoring the costs, and potential savings, into your mobile marketing plan will help you develop a plan that is sustainable and makes the most of whatever budget you have available.

3. Optimize Your Current Marketing Channels for Mobile

Take all your existing marketing channels and optimize them for mobile – especially your website, search ads, email, and social media marketing.

You can leverage the benefits of mobile marketing simply by making what you’re doing already mobile-friendly. This is the simplest, easiest way to get going with mobile marketing, even if you do not have the resources to start new campaigns specifically for mobile.

In addition to making your website responsive and mobile-optimized, look at your content and messaging and finesse them to work for mobile and small screens.

Starting small and building up slowly also allows you to gather information and populate lists before you branch out into new mobile marketing strategies.

Even simple things like adding an opt-in for an SMS list to your marketing emails and on your website can get the ball rolling.

TLDR – 3 KEY STEPS TO TAKE IN A GREAT MOBILE MARKETING PLAN:

- Step 1: Choose the best mobile marketing strategies to use and prioritize them

- Step 2: Focus on free and low-cost mobile marketing strategies to begin with

- Step 3: Optimize all your existing marketing channels for mobile

Final Thoughts on Mobile Marketing Strategies

Mobile marketing is a powerful component of digital marketing, which cannot be overlooked. It is inexpensive, can easily be incorporated into your overall marketing strategy, and is highly effective.

When you use the right combination of mobile marketing strategies and formulate a good mobile marketing plan, you can reach your target audience, anywhere, at any time, with highly relevant, contextual, and personalized marketing content.

Today, we have covered some of the best mobile marketing strategies and examples, as well as three essential steps to take when you’re creating your mobile marketing plan.

Which strategies will you use first?

Frequently Asked Questions

What is a mobile marketing strategy.

Mobile marketing strategy refers to multi-channel methods used in digital marketing to engage consumers on their smartphones, tablets and other mobile devices. Mobile marketing channels include websites and ecommerce stores, email, SMS/text marketing, MMS, social media, and mobile apps. Check out the full guide for more on the best mobile marketing strategies to use in your mobile marketing plan.

How do I start a mobile marketing strategy?

Start by developing a comprehensive mobile marketing plan, which includes the most relevant and accessible mobile marketing strategies for your business. Start by optimizing all your existing marketing channels for mobile, and then branch out into free and low-cost strategies like location-based marketing and SMS or text marketing. Read the full guide to learn more about mobile marketing strategies and where to begin.

What is a mobile marketing plan?

A mobile marketing plan is the roadmap and overall strategy you will use to guide your various mobile marketing campaigns. It sets out the different strategies or techniques you will use, the order in which to deploy them and how they tie into your overall marketing plan. A good mobile marketing plan emphasizes targeting, personalization and location-based information. Read the full guide for tips on how to develop a successful mobile marketing plan.

Act.On: 5 Ways Mobile Marketing is Affecting Social Media

Bankmycell: 2024 Mobile User Statistics

Crazy Egg: How Mobile Optimization Affects your Conversions

CNBC: Nearly Three-Quarters of the World Will Use Just Their Smartphones to Access the Internet By 2025

G2 Learn Hub: 46 SMS Marketing Statistics Your Customers Wish You Knew

Invoca Blog: 34 Voice Search Stats Marketers Need to Know

Marketo: Mobile Marketing Strategy Pdf

Plexure: The Power of Location-Based Marketing

Statista: Number of Smartphone Subscriptions Worldwide 2016 – 2027

Tatango: SMS Marketing Statistics

Techjury: 67+ Revealing Smartphone Statistics for 2024

Suggested Articles

Email, Mobile & SMS Marketing Marketing Agencies

12 Best App Marketing Agencies in 2024 [Updated Review]

There are currently 4 million apps available, up from 500 in 2008 when the iOS app store debuted. Th...

Email, Mobile & SMS Marketing Marketing Guides

15 B2B Cold Email Templates: Achieve Results in 2024 with Our Top Picks [Based on Real Cold Email Analysis]

Cold email campaigns are tricky at the best of times, and most cold emails hardly make a dent. Wi...

Cold Email Open Rates: Stats & How to Supercharge Your Performance in 2024

The challenge many email marketers face for successful cold email marketing campaigns is optimizing ...

- Building Referral Program

- Building Employee Advocacy Program

- Building Ambassador Program

- Building Loyalty Program

- Building Affiliate Program

- Choosing Digital Marketing Agency

Solutions Review

- Affiliate Management

- Brand Ambassador Management

- Customer Loyalty

- Cold Emailing

- Referral Marketing

- Influencer Marketing

Harness the Power of AI for Your Influencer Marketing Campaigns

Enroll in our free 5-lesson email course today! Free for limited time only.

We created P2P to provide free resources to brands that believe in the power of peers to promote their service or products.

- Affiliate Disclaimer

- Privacy Policy

- Affiliate Program

- Ambassador Program

- Customer Loyalty Program

- Employee Advocacy Program

- Referral Program

© 2019 P2P Marketing All Rights Reserved.

- Starting a Business

Our Top Picks

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our In-Depth Reviews

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Explore More

- Business Solutions

- Entrepreneurship

- Franchising

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

- Financial Solutions

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

- HR Solutions

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

- Business Intelligence

- Marketing Solutions

- Marketing Strategy

- Public Relations

- Social Media

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

- Technology Solutions

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

- FreshBooks vs. QuickBooks Comparison

- Salesforce CRM vs. Zoho CRM

- RingCentral vs. Zoom Comparison

- 10 Ways to Generate More Sales Leads

Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here .

How to Create a Market Research Plan

Before starting a business, you want to fully research your idea. A market research plan will help you understand your competition, the marketplace and more.

Table of Contents

While having a great idea is an important part of establishing a business, you’ll only get so far without laying the proper groundwork. To help your business take off, not only do you need to size up the competition, but you also need to identify who will buy your product, how much it will cost, the best approach to selling it and how many people will demand it.

To get answers to these questions, you’ll need a market research plan, which you can create yourself or pay a specialist to create for you. Market research plans define an existing problem and/or outline an opportunity. From there, the marketing strategy is broken down task by task. Your plan should include objectives and the methods that you’ll use to achieve those objectives, along with a time frame for completing the work.

What should a market research plan include?

A market research plan should provide a thorough examination of how your product or service will fare in a defined area. It should include:

- An examination of the current marketplace and an analysis of the need for your product or service: To know where you fit in the market, it’s important to have a broad understanding of your industry — covering everything from its annual revenue to the industry standards to the total number of businesses operating within it. Start by gathering statistical data from sources like the U.S. Bureau of Labor Statistics and BMI Research and consider the industry’s market size, potential customer base and how external factors such as laws, technology, world events and socioeconomic changes impact it.

- An assessment of the competition: By analyzing your competitors, you can discover strategies to fill market gaps. This involves identifying well-known competitors and noting trends they employ successfully, scrutinizing customer feedback about businesses in your sector, such as through online reviews, and understanding competitors’ product or service offerings. This knowledge can then guide the refinement of your own products or services to differentiate them from others in the market.

- Data about customers: Identify which segment of potential customers in your industry you can effectively target, considering their demographics — such as age, ethnicity, income and location and psychographics, including beliefs, values and lifestyle. Learn about the challenges your customers face in their daily lives and determine how the features and benefits of your offerings address their needs.

- The direction for your marketing in the upcoming year: Your plan should provide a clear roadmap for your marketing strategies for the next year, focusing on approaches to distinguish your brand from competitors. Develop marketing messages that resonate with and display empathy toward your target market and find ways to address customers’ needs and demonstrate value.

- Goals to be met: Outline goals your business would like to achieve and make these goals clear to all employees on your team. Create goals that are realistic and attainable while also making a meaningful impact on the business’s growth. Consider factors including your target number of products or services, the expected number of units to sell based on market size, target market behavior, pricing for each item and the cost of production and advertising.

How to create your market research plan

Doing business without having a marketing plan is like driving without directions. You may eventually reach your destination, but there will be many costly and time-consuming mistakes made along the way.

Many entrepreneurs mistakenly believe there is a big demand for their service or product but, in reality, there may not be, your prices may be too high or too low or you may be going into a business with so many restrictions that it’s almost impossible to be successful. A market research plan will help you uncover significant issues or roadblocks.

Step 1. Conduct a comprehensive situation analysis.

One of the first steps in constructing your marketing plan is to create a strengths, weaknesses, opportunities and threats (SWOT) analysis , which is used to identify your competition, to know how they operate and then to understand their strengths and weaknesses.

Step 2: Develop clear marketing objectives.

In this section, describe the desired outcome for your marketing plan with realistic and attainable objectives, the targets and a clear and concise time frame. The most common way to approach this is with marketing objectives, which may include the total number of customers and the retention rate, the average volume of purchases, total market share and the proportion of your potential market that makes purchases.

Step 3: Make a financial plan.

A financial plan is essentia l for creating a solid marketing plan. The financial plan answers a range of questions that are critical components of your business, such as how much you intend to sell, what will you charge, how much will it cost to deliver your services or produce your products, how much will it cost for your basic operating expenses and how much financing will you need to operate your business.

In your business plan, be sure to describe who you are, what your business will be about, your business goals and what your inspiration was to buy, begin or grow your business.

Step 4: Determine your target audience.

Once you know what makes you stand out from your competitors and how you’ll market yourself, you should decide who to target with all this information. That’s why your market research plan should delineate your target audience. What are their demographics and how will these qualities affect your plan? How do your company’s current products and services affect which consumers you can realistically make customers? Will that change in the future? All of these questions should be answered in your plan.

Step 5: List your research methods.

Rarely does one research avenue make for a comprehensive market research plan. Instead, your plan should indicate several methods that will be used to determine the market share you can realistically obtain. This way, you get as much information as possible from as many sources as possible. The result is a more robust path toward establishing the exact footprint you desire for your company.

Step 6: Establish a timeline.

With your plan in place, you’ll need to figure out how long your market research process will take. Project management charts are often helpful in this regard as they divide tasks and personnel over a timeframe that you have set. No matter which type of project management chart you use, try to build some flexibility into your timeframe. A two-week buffer toward the home stretch comes in handy when a process scheduled for one week takes two — that buffer will keep you on deadline.

Step 7: Acknowledge ethical concerns.

Market research always presents opportunities for ethical missteps. After all, you’ll need to obtain competitor information and sensitive financial data that may not always be readily available. Your market research plan should thus encourage your team to not take any dicey steps to obtain this information. It may be better to state, “we could not obtain this competitor information,” than to spy on the competitor or pressure their current employees for knowledge. Plus, there’s nothing wrong with simply feeling better about the final state of your plan and how you got it there.

Using a market research firm

If the thought of trying to create your own market research plan seems daunting or too time-consuming, there are plenty of other people willing to do the work for you.

Pros of using a market research firm

As an objective third party, businesses can benefit from a market research firm’s impartial perspective and guidance, helping to shape impactful brand strategies and marketing campaigns. These firms, which can help businesses with everything from their marketing campaigns to brand launches, deliver precise results, drawing on their expertise and experience to provide in-depth insights and solutions tailored specifically to your company’s needs.

Even more, working with a market research firm can elevate a brand above the competition, as they provide credible and unique research that is highly valued by the media, enhancing brand credibility and potentially increasing website traffic, social media shares and online visibility.

Cons of using a market research firm

Although hiring a firm can provide businesses with tremendous results, certain downsides can lead a business toward the do-it-yourself route. Most notably, market research firms can be a costly expense that some businesses can’t afford. However, businesses that can allocate the funds will likely see a positive return on investment, as they are paying for the expertise and proficiency of seasoned professionals in the field.

Additionally, finding the right market research firm for your business’s needs can take some time — and even longer, ranging from weeks to months, for a market research firm to complete a plan. This lack of immediate results can be detrimental for businesses that don’t have the time to wait.

Market research firms can charge into the thousands of dollars for a market research plan, but there are ways to get help more affordably, including:

- Outline your plans carefully and spell out objectives.

- Examine as many sources as possible.

- Before paying for any information, check with librarians, small business development centers or market research professors to see if they can help you access market research data for free.

- You may think you’ll need to spend a hefty sum to create a market research plan, but there are plenty of free and low-cost sources available, especially through university business schools that will guide you through the process.

Miranda Fraraccio contributed to this article.

Get Weekly 5-Minute Business Advice

B. newsletter is your digest of bite-sized news, thought & brand leadership, and entertainment. All in one email.

Our mission is to help you take your team, your business and your career to the next level. Whether you're here for product recommendations, research or career advice, we're happy you're here!

- User Acquisition

- App Store Optimization

- App Engagement

- App Revenue

- App Leaders

- AI Marketing

- Apple Search Ads

- Growth Marketing

- Mobile Marketing

- Mobile Game Marketing

- Performance Marketing

- Customer Engagement

- Marketing Automation

- In-app Messaging

- iOS Push Notifications

- Android Push Notifications

- SMS Marketing

- Mobile Attribution

- Mobile Measurement Partners

- Crash Reporting

- App Monitoring

- A/B Testing

- Mobile Game Monetization

- Subscription Platforms

- Paywall Platforms

- App Investors

- Social Media Marketing

- TikTok Marketing

- Mobile Ad Networks

- Ad Networks

- CTV Advertising

- In-game Advertising

- Ad Exchanges

- Ad Fraud Tools

- Mobile Ad Analytics

- Mobile DSPs

- Retargeting

- App Installs

- Content Lock

- Incentivized Ads

- Interstitial

- Offer Walls

- Rewarded Video

- Pay Per Call

- Programmatic

- Real Time Bidding

- Self Service

- Augmented Reality

- Virtual Reality

- Los Angeles

- San Francisco

- Entertainment

- Real Estate

- App Builders

- Mobile Games

- Lead Generation

- Sweepstakes

- App Benchmarks

- App Reports

- App Sectors

- App Rankings

- App Growth Awards

- marketplace

- Mobile Marketing Strategies

Mobile Marketing Strategies (2023)

Artem Dogtiev | July 13, 2023

Today, about 7 billion people in the world carry a mobile phone in their pocket. From a modest debut with several hundred apps back in 2008 to about 2 million in 2023 – Apple’s App Store has gone a long way and the Google Play store by Google tops this number with its staggering 2.9 million. The mobile landscape isn’t limited to apps – the bulk of websites have a mobile version and when it comes to online search, for any search query Google search’s algorithm is tuned to return a set of links for mobile-friendly web pages.

We live in a mobile world. Businesses always follow their customers and hence the world economy-wide shift to mobile as the prime channel to reach existing and potential customers. As a new channel, mobile has brought huge advantages and challenges to brands. On one hand – mobile devices are deeply personal and always inches away from being used, on the other hand – the screen size is smaller than a desktop one and the inception of social media launched the ultimate competition for people’s attention. All this goes to underscore the fact that a mobile marketing strategy is a staple of any brand’s success.

Elevate Your Mobile App Today!

Join Moburst, your partner in success! We’re a vibrant full-service mobile agency, crafting leaders and powering giants like Google, Reddit, and Uber.

In this article, we want to highlight the most robust mobile marketing strategies for businesses to adopt and build their success with. The first up is the website optimization for mobile.

Mobile-friendly websites

Today mobile apps are ubiquitous, with several million apps between Apple’s App Store and Google Play from Google, they’ve become a must-have channel to connect with consumers. Yet, given how many commercial websites are online, it’s not feasible to actually develop an app for all those websites.

When people are looking for a product or service to buy and see your website in the search results, you need to make sure that by clicking on your site they get the best experience of interacting with your brand on a website optimized for mobile devices. The whole website should be built on the principle of a responsive design , so the site visitors can navigate around with ease and get out of your mobile-friendly website as much as they would get from a mobile app built for your brand. Strictly speaking, a native mobile app always provides a better experience than its mobile-friendly web equivalent but it is possible to keep both experiences close enough to satisfy your customers.

Source: iStockphoto

Once you develop a mobile-friendly version of your website, you need to make sure all content available on your site is also optimized for mobile devices.

Featured Mobile Marketing Companies

Finally, from your brand’s visibility perspective, you need to consider that websites optimized for mobile devices are ranked higher by the Google algorithm. If your website isn’t mobile-friendly, you’re losing to your competitors no matter how good your product or service is, you just don’t get as much visibility as they get.

From websites optimized for mobile to mobile apps that deliver the best mobile experience to your existing and potential customers.

Mobile apps

Along with a mobile-friendly version of your website, your brand needs a mobile app designed either for both iOS and Android mobile operating systems or, if you experience financial constraints, a cross-platform app that it’s cheaper to develop but it isn’t capable to take advantage of all features available to native apps.

With billions of smartphones in use and millions of mobile apps developed for a wide range of functions, people expect to be able to communicate with brands via mobile apps. With the right strategy, a mobile app can be your best tool to build and elevate your brand.

A well-designed and built mobile app can function as a shopping cart for your product and services, a source of information about your brand, a communication channel, and a means for educating your customers about your products or services.