Insurance Cover Letter: Sample & Guide [Entry Level + Senior Jobs]

Create a standout insurance cover letter with our online platform. browse professional templates for all levels and specialties. land your dream role today.

Writing a cover letter for an insurance job can be intimidating. With this guide, you'll understand how to write a competitive and professional cover letter that will give you the best chance of landing the job. We'll walk you through crafting your cover letter, from understanding the basics of insurance cover letters to actionable tips for creating an impressive and unique document.

We will cover:

- How to write a cover letter, no matter your industry or job title.

- What to put on a cover letter to stand out.

- The top skills employers from every industry want to see.

- How to build a cover letter fast with our professional Cover Letter Builder .

- What a cover letter template is, and why you should use it.

Related Cover Letter Examples

- Community Health Nurse Cover Letter Sample

- Clinical Nurse Educator Cover Letter Sample

- Clinical Research Associate Cover Letter Sample

- Infusion Nurse Cover Letter Sample

- Hospital Pharmacist Cover Letter Sample

- Dental Lab Technician Cover Letter Sample

- General Practitioner Cover Letter Sample

- Athletic Trainer Cover Letter Sample

- Nursing Attendant Cover Letter Sample

- Assistant Director Of Nursing Cover Letter Sample

- Staff Pharmacist Cover Letter Sample

- ER Nurse Cover Letter Sample

- Orthodontist Cover Letter Sample

- Staff Nurse Cover Letter Sample

- Pediatric Nurse Cover Letter Sample

- Pharmacy Assistant Cover Letter Sample

- Care Manager Cover Letter Sample

- Experienced Psychiatrist Cover Letter Sample

- Director Of Nursing Cover Letter Sample

- Nursing Assistant Cover Letter Sample

Insurance Cover Letter Sample

Dear Hiring Manager,

I am submitting my application for the position of Insurance with your organization. With over 10 years of experience in the insurance industry, I have the knowledge and expertise to be an effective member of your team.

I am currently working as an Insurance Agent with ABC Insurance Company, where I am responsible for providing customers with a variety of insurance products and services. I specialize in life and health insurance, and have been successful in helping customers develop comprehensive insurance plans tailored to their needs. My experience also includes providing customers with quotes, explaining policy coverage options, and negotiating premium rates.

In addition to my technical knowledge of the insurance industry, I possess strong customer service skills. I have had success in building relationships with customers and helping them to understand their policy coverage. I am also skilled in resolving customer complaints and handling difficult conversations with professionalism and empathy.

I am confident that my experience and qualifications make me an ideal candidate for the position. I am excited at the prospect of joining your team and contributing to the growth of your organization.

Thank you for your time and consideration. I look forward to hearing from you.

Sincerely, John Doe

Why Do you Need a Insurance Cover Letter?

- A insurance cover letter is a great way to make sure that you are adequately covered for any eventuality.

- It can help to protect you from financial losses and provide peace of mind in the event of an accident or other unexpected event.

- Insurance cover letters provide an assurance that any losses you suffer will be covered by the insurance company.

- Having an insurance cover letter also helps to ensure that you are not left with a large financial burden if something unexpected happens.

- Having a insurance cover letter is also important if you have any assets such as a house or a car that you would like to be protected.

- In the event of an accident, the insurance cover letter will provide you with the financial assistance that you need in order to recover any losses.

- Having an insurance cover letter also helps to ensure that your medical costs are covered in the event of an illness or injury.

A Few Important Rules To Keep In Mind

- Start with a professional greeting. Address your letter to the hiring manager by name if you know it.

- Outline your most relevant qualifications and experience in your opening paragraph.

- Include specific details that relate to the position and demonstrate why you are the ideal candidate.

- Explain why you are interested in the position and why you are the best candidate for the job.

- Keep your letter brief and to the point. Avoid using flowery language and excessive detail.

- Provide examples that demonstrate your experience and qualifications.

- Close with a thank you and a call to action.

- Proofread your letter carefully to ensure that there are no spelling or grammar errors.

What's The Best Structure For Insurance Cover Letters?

After creating an impressive Insurance resume , the next step is crafting a compelling cover letter to accompany your job applications. It's essential to remember that your cover letter should maintain a formal tone and follow a recommended structure. But what exactly does this structure entail, and what key elements should be included in a Insurance cover letter? Let's explore the guidelines and components that will make your cover letter stand out.

Key Components For Insurance Cover Letters:

- Your contact information, including the date of writing

- The recipient's details, such as the company's name and the name of the addressee

- A professional greeting or salutation, like "Dear Mr. Levi,"

- An attention-grabbing opening statement to captivate the reader's interest

- A concise paragraph explaining why you are an excellent fit for the role

- Another paragraph highlighting why the position aligns with your career goals and aspirations

- A closing statement that reinforces your enthusiasm and suitability for the role

- A complimentary closing, such as "Regards" or "Sincerely," followed by your name

- An optional postscript (P.S.) to add a brief, impactful note or mention any additional relevant information.

Cover Letter Header

A header in a cover letter should typically include the following information:

- Your Full Name: Begin with your first and last name, written in a clear and legible format.

- Contact Information: Include your phone number, email address, and optionally, your mailing address. Providing multiple methods of contact ensures that the hiring manager can reach you easily.

- Date: Add the date on which you are writing the cover letter. This helps establish the timeline of your application.

It's important to place the header at the top of the cover letter, aligning it to the left or center of the page. This ensures that the reader can quickly identify your contact details and know when the cover letter was written.

Cover Letter Greeting / Salutation

A greeting in a cover letter should contain the following elements:

- Personalized Salutation: Address the hiring manager or the specific recipient of the cover letter by their name. If the name is not mentioned in the job posting or you are unsure about the recipient's name, it's acceptable to use a general salutation such as "Dear Hiring Manager" or "Dear [Company Name] Recruiting Team."

- Professional Tone: Maintain a formal and respectful tone throughout the greeting. Avoid using overly casual language or informal expressions.

- Correct Spelling and Title: Double-check the spelling of the recipient's name and ensure that you use the appropriate title (e.g., Mr., Ms., Dr., or Professor) if applicable. This shows attention to detail and professionalism.

For example, a suitable greeting could be "Dear Ms. Johnson," or "Dear Hiring Manager," depending on the information available. It's important to tailor the greeting to the specific recipient to create a personalized and professional tone for your cover letter.

Cover Letter Introduction

An introduction for a cover letter should capture the reader's attention and provide a brief overview of your background and interest in the position. Here's how an effective introduction should look:

- Opening Statement: Start with a strong opening sentence that immediately grabs the reader's attention. Consider mentioning your enthusiasm for the job opportunity or any specific aspect of the company or organization that sparked your interest.

- Brief Introduction: Provide a concise introduction of yourself and mention the specific position you are applying for. Include any relevant background information, such as your current role, educational background, or notable achievements that are directly related to the position.

- Connection to the Company: Demonstrate your knowledge of the company or organization and establish a connection between your skills and experiences with their mission, values, or industry. Showcasing your understanding and alignment with their goals helps to emphasize your fit for the role.

- Engaging Hook: Consider including a compelling sentence or two that highlights your unique selling points or key qualifications that make you stand out from other candidates. This can be a specific accomplishment, a relevant skill, or an experience that demonstrates your value as a potential employee.

- Transition to the Body: Conclude the introduction by smoothly transitioning to the main body of the cover letter, where you will provide more detailed information about your qualifications, experiences, and how they align with the requirements of the position.

By following these guidelines, your cover letter introduction will make a strong first impression and set the stage for the rest of your application.

Cover Letter Body

A Insurance Cover Letter Body Should Typically Include:

- A brief introduction that states the position you are applying for and why you are a good fit for the role.

- A description of your relevant experience and skills, including any industry-specific knowledge.

- Examples of how you have demonstrated the required skills in past positions (if applicable).

- A statement of your enthusiasm for the job and the company.

- A closing paragraph that summarizes your qualifications and expresses your interest in the position.

When writing a cover letter for an insurance job, it is important to focus on the specific skills that you possess that make you a qualified candidate. It is important to demonstrate your knowledge of the insurance industry and your interest in the position. Your cover letter should also focus on the benefits that you can bring to the organization.

When highlighting my relevant experience, I focus on the skills and knowledge I have acquired through my past positions. For example, I have years of experience in the insurance industry, so I am well versed in the industry's regulations and procedures. I am also knowledgeable about the various types of insurance policies available and the various coverage levels. Additionally, I possess excellent customer service and communication skills, which I have utilized in my past roles.

In my previous positions, I have demonstrated my ability to handle customer inquiries and complaints in a timely and professional manner. I am also highly organized and have experience in processing and filing paperwork. My strong attention to detail ensures that all documents are accurate and up to date. I have the ability to work independently and as part of a team, and I am comfortable taking on additional tasks when needed.

I am excited about the opportunity to join your organization and am confident that I can make a positive contribution. I am eager to use my knowledge and experience to help your organization succeed. Please do not hesitate to contact me if you have any questions. I look forward to hearing from you.

Complimentary Close

The conclusion and signature of a cover letter provide a final opportunity to leave a positive impression and invite further action. Here's how the conclusion and signature of a cover letter should look:

- Summary of Interest: In the conclusion paragraph, summarize your interest in the position and reiterate your enthusiasm for the opportunity to contribute to the organization or school. Emphasize the value you can bring to the role and briefly mention your key qualifications or unique selling points.

- Appreciation and Gratitude: Express appreciation for the reader's time and consideration in reviewing your application. Thank them for the opportunity to be considered for the position and acknowledge any additional materials or documents you have included, such as references or a portfolio.

- Call to Action: Conclude the cover letter with a clear call to action. Indicate your availability for an interview or express your interest in discussing the opportunity further. Encourage the reader to contact you to schedule a meeting or provide any additional information they may require.

- Complimentary Closing: Choose a professional and appropriate complimentary closing to end your cover letter, such as "Sincerely," "Best Regards," or "Thank you." Ensure the closing reflects the overall tone and formality of the letter.

- Signature: Below the complimentary closing, leave space for your handwritten signature. Sign your name in ink using a legible and professional style. If you are submitting a digital or typed cover letter, you can simply type your full name.

- Typed Name: Beneath your signature, type your full name in a clear and readable font. This allows for easy identification and ensures clarity in case the handwritten signature is not clear.

Common Mistakes to Avoid When Writing an Insurance Cover Letter

When crafting a cover letter, it's essential to present yourself in the best possible light to potential employers. However, there are common mistakes that can hinder your chances of making a strong impression. By being aware of these pitfalls and avoiding them, you can ensure that your cover letter effectively highlights your qualifications and stands out from the competition. In this article, we will explore some of the most common mistakes to avoid when writing a cover letter, providing you with valuable insights and practical tips to help you create a compelling and impactful introduction that captures the attention of hiring managers. Whether you're a seasoned professional or just starting your career journey, understanding these mistakes will greatly enhance your chances of success in the job application process. So, let's dive in and discover how to steer clear of these common missteps and create a standout cover letter that gets you noticed by potential employers.

- Failing to customize the cover letter for the specific position and company.

- Including irrelevant personal information.

- Using a generic greeting such as "To whom it may concern" or "Dear Sir or Madam".

- Using too much technical jargon.

- Making spelling and grammar mistakes.

- Using overly flowery or fancy language.

- Including information that has already been included in the resume.

- Not mentioning any of the skills or qualifications the employer is looking for.

- Failing to provide contact information.

Key Takeaways For an Insurance Cover Letter

- Highlight relevant skills and qualifications that are relevant to the insurance industry.

- Express a clear understanding of the job role and how your skills will help the company.

- Explain the value you can bring to the company in terms of experience and qualifications.

- Outline the unique benefits of the insurance product and explain how it can help the customer.

- Communicate your enthusiasm and commitment to the insurance company and the customer.

- Provide examples of how you have successfully solved customer problems in the past.

- Convey a deep understanding of the customer’s needs and explain how the insurance product can meet them.

- Be professional and courteous in your correspondence.

- Ensure that all relevant information is included in the letter.

1 Insurance Agent Cover Letter Example

Insurance Agents excel at assessing risk, tailoring policies to individual needs, and providing peace of mind in uncertain situations. Similarly, your cover letter is your opportunity to assess and present your own professional 'risks' and 'policies' - your skills, experiences, and unique value - in a way that provides recruiters with confidence in your potential. In this guide, we'll navigate through top-notch Insurance Agent cover letter examples, ensuring your application stands out in the competitive insurance industry.

Cover Letter Examples

Cover letter guidelines, insurance agent cover letter example, how to format a insurance agent cover letter, cover letter header, what to focus on with your cover letter header:, cover letter header examples for insurance agent, cover letter greeting, get your cover letter greeting right:, cover letter greeting examples for insurance agent, cover letter introduction, what to focus on with your cover letter intro:, cover letter intro examples for insurance agent, cover letter body, what to focus on with your cover letter body:, cover letter body examples for insurance agent, cover letter closing, what to focus on with your cover letter closing:, cover letter closing paragraph examples for insurance agent, pair your cover letter with a foundational resume, cover letter writing tips for insurance agents, highlight your expertise in the insurance industry, showcase your sales skills, demonstrate your customer service abilities, emphasize your attention to detail, express your adaptability, cover letter mistakes to avoid as a insurance agent, failing to highlight relevant skills, using generic language, not proofreading, being too lengthy, not showing enthusiasm, cover letter faqs for insurance agents.

The best way to start an Insurance Agent cover letter is by addressing the hiring manager directly, if their name is known. Then, introduce yourself and state the position you're applying for. Make sure to include a compelling hook in your opening paragraph that highlights your relevant experience, skills, or achievements. For instance, you could mention how your expertise in risk management strategies led to a significant decrease in claims at your previous company. This not only grabs the reader's attention but also shows that you understand the role and its requirements.

Insurance Agents should end a cover letter by summarizing their key skills and experiences that make them a suitable candidate for the role. They should express enthusiasm for the opportunity and show interest in the company's mission or values. It's also crucial to include a call to action, such as a request for an interview or a meeting. For example: "I am excited about the opportunity to bring my unique blend of skills and experience to your team and am confident that I can contribute to your company's success. I look forward to the possibility of discussing my application with you further. Thank you for considering my application." Remember to end the letter professionally with a closing like "Sincerely" or "Best regards," followed by your full name and contact information.

An Insurance Agent's cover letter should ideally be about one page long. This length is sufficient to introduce yourself, explain why you're interested in the insurance field, highlight your relevant skills and experiences, and express your interest in the specific agency you're applying to. It's important to keep it concise and to the point, as hiring managers often have many applications to review and may not spend a lot of time on each one. A well-written, one-page cover letter can effectively convey your qualifications and enthusiasm for the job without overwhelming the reader with too much information.

Writing a cover letter with no experience as an Insurance Agent can seem challenging, but it's all about showcasing your transferable skills, eagerness to learn, and passion for the industry. Here's a step-by-step guide on how to do it: 1. Start with a Professional Greeting: Address the hiring manager by name if possible. If you can't find the name, use a professional greeting such as "Dear Hiring Manager". 2. Opening Paragraph: Begin by stating the position you're applying for. Express your enthusiasm for the role and the company. If someone referred you, mention their name and connection to the company here. 3. Highlight Transferable Skills: Even if you don't have direct experience as an Insurance Agent, you likely have skills that can be applied to the role. These could include customer service, sales, problem-solving, or analytical skills. Use specific examples from your past work, education, or volunteer experience to demonstrate these skills. For example, if you've worked in retail, you might discuss how you upsold products or handled customer complaints. 4. Show Industry Knowledge: Show that you understand the insurance industry and the role of an Insurance Agent. You could mention relevant coursework, certifications, or self-study. Discuss why you're interested in insurance and how you plan to contribute to the company. 5. Show Enthusiasm and Willingness to Learn: Employers value candidates who are eager to learn and grow. Express your willingness to undergo training and learn the ins and outs of the industry. 6. Closing Paragraph: Reiterate your interest in the role and the company. Thank the hiring manager for considering your application and express your hope for further discussion. 7. Professional Sign-off: Close the letter with a professional sign-off such as "Sincerely" or "Best regards", followed by your full name. Remember to keep your cover letter concise and to the point, and always proofread before sending it. Tailor each cover letter to the specific job and company, showing that you've done your research and are genuinely interested in the role.

Related Cover Letters for Insurance Agents

Insurance agent cover letter, call center cover letter.

Customer Service Manager Cover Letter

Customer Success Manager Cover Letter

Flight Attendant Cover Letter

Personal Trainer Cover Letter

Related Resumes for Insurance Agents

Insurance agent resume example.

Try our AI-Powered Resume Builder

5 Professional Insurance Agent Cover Letter Examples for 2024

Your insurance agent cover letter must immediately highlight your expertise in the industry. Demonstrate your proficiency with various insurance products and markets in the first few lines. Tailor your second paragraph to reflect your exceptional customer service skills. An insurance agent's success is deeply rooted in client trust and satisfaction.

All cover letter examples in this guide

Insurance Account Manager

Insurance Agent

Insurance Product Manager

Insurance Sales

Cover letter guide.

Insurance Agent Cover Letter Sample

Cover Letter Format

Cover Letter Salutation

Cover Letter Introduction

Cover Letter Body

Cover Letter Closing

No Experience Insurance Agent Cover Letter

Key Takeaways

Crafting an insurance agent cover letter can feel like a daunting task as you step into the world of job applications, eager to stand out from the crowd. You've polished your resume to perfection, yet the cover letter remains a hurdle, struggling not to echo what's already listed. Remember, the key is to present a compelling narrative about that shining professional moment without falling into clichés. We'll guide you to keep it succinct, personal, and confined to a single page, ensuring your cover story captivates.

- Writing the essential insurance agent cover letter sections: balancing your professionalism and personality;

- Mixing storytelling, your unique skill set, and your greatest achievement;

- Providing relevant (and interesting) information with your insurance agent cover letter, despite your lack of professional experience;

- Finding the perfect format for your[ insurance agent cover letter, using templates from industry experts.

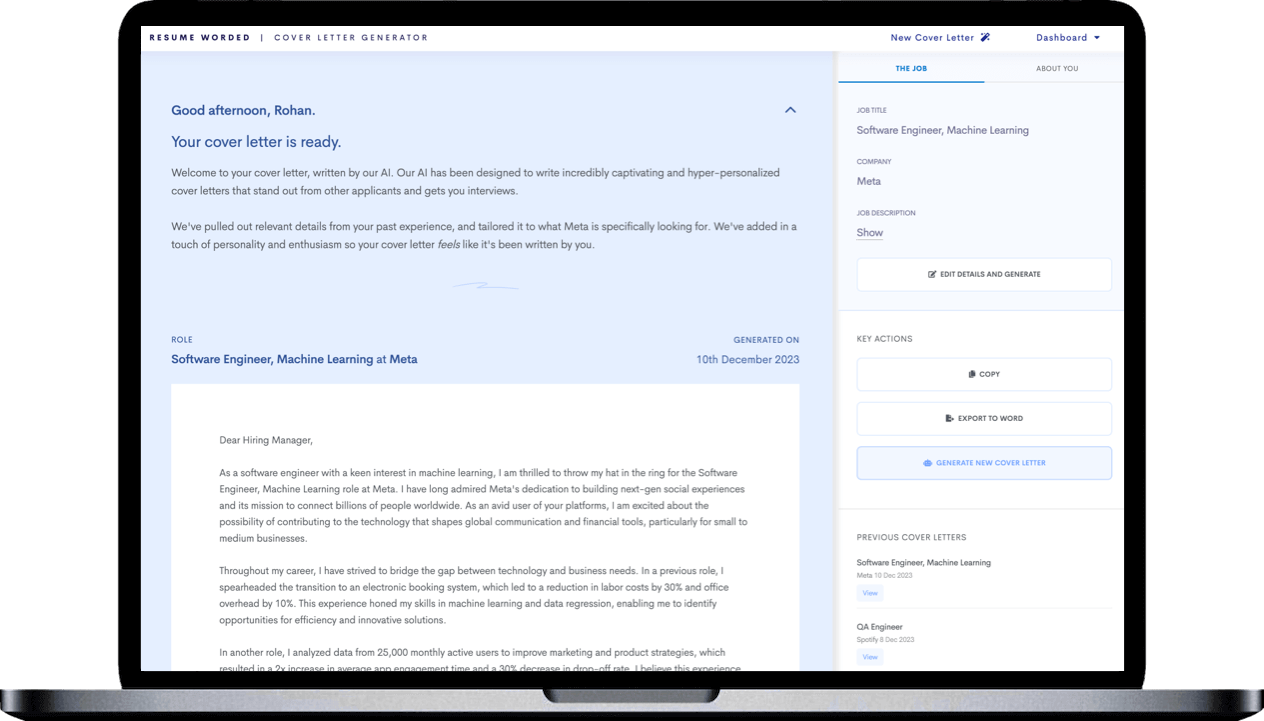

Leverage the power of Enhancv's AI: upload your resume and our platform will map out how your insurance agent cover letter should look, in mere moments.

If the insurance agent isn't exactly the one you're looking for we have a plethora of cover letter examples for jobs like this one:

- Insurance Agent resume guide and example

- Pawn Broker cover letter example

- Account Manager cover letter example

- Customer Account Manager cover letter example

- Grocery Stocker cover letter example

- SaaS Account Executive cover letter example

- Regional Account Manager cover letter example

- Senior Sales Executive cover letter example

- Leasing Manager cover letter example

- Product Specialist cover letter example

- Sales Lead cover letter example

Insurance Agent cover letter example

AMELIA MILLER

San Jose, California

+1-(234)-555-1234

- Emphasizing relevant past achievements, like improving a customer service process, can demonstrate direct experience and potential for impact in the new role.

- Quantifying success, such as reducing call wait times by 30% and achieving a 95% customer satisfaction rating, provides concrete evidence of one's effectiveness and competency.

- Expressing alignment with the company's values reinforces the candidate's fit for both the role and the organizational culture.

- Showing enthusiasm to bring specific expertise, like customer service management and problem-solving, to the new team can make the applicant stand out as a proactive and committed candidate.

Standard formatting for your insurance agent cover letter

Structure your insurance agent cover letter, following industry-leading advice, to include:

- Header - with your name, the role you're applying for, the date, and contact details;

- Greeting - make sure it's personalized to the organization;

- Introduction paragraph - no more than two sentences;

- Body paragraph - answering why you're the best candidate for the role;

- Closing paragraph - ending with a promise or a call to action;

- Signature - now that's optional.

Set up your insurance agent cover letter for success with our templates that are all single-spaced and have a one-inch margin all around.

Use the same font for your insurance agent cover as the one in your resume (remember to select a modern, Applicant Tracker System or ATS favorites, like Raleway, Volkhov, or Chivo instead of the worn-out Times New Roman).

Speaking of the ATS, did you know that it doesn't scan or assess your cover letter? This document is solely for the recruiters.

Our builder allows you to export your insurance agent cover letter in the best format out there: that is, PDF (this format keeps your information intact).

The top sections on a insurance agent cover letter

Header : This should include the applicant's contact information, the date, and the insurance agency's details; it is essential for establishing professionalism and making it easy for the recruiter to reach out for an interview.

Greeting : A personalized greeting to the hiring manager shows attention to detail and a personal touch, which is valuable in a client-focused industry like insurance.

Introduction : This section should grab attention by succinctly stating the applicant’s interest in the role and highlighting relevant experience in sales, customer service, or previous insurance positions to indicate immediate value to the agency.

Body : In one or two paragraphs, the body should detail the candidate’s qualifications, including sales achievements, knowledge of insurance policies, and customer relationship management skills, directly correlating those with the needs of the insurance agency.

Closing : The closing should reiterate the applicant's enthusiasm for the position, include a call to action such as asking for an interview, and express gratitude to the recruiter for considering the application, reflecting the interpersonal skills important for an insurance agent role.

Key qualities recruiters search for in a candidate’s cover letter

- Deep understanding of insurance products: Knowledge of various insurance policies, terms, and concepts is essential to effectively explain coverage options and advise clients.

- Strong sales skills: Ability to persuade and influence decisions is vital for selling insurance policies and meeting sales targets.

- Excellent customer service abilities: An insurance agent must be able to handle client inquiries, claims, and issues with empathy and professionalism.

- Proven track record of meeting and exceeding sales goals: Demonstrates the agent's ability to thrive in a competitive environment and generate business for the agency.

- Effective communication and interpersonal skills: Crucial for building and maintaining relationships with clients, underwriters, and other stakeholders.

- Attention to detail: Accuracy is important when preparing and reviewing policies, applications, and related paperwork to ensure compliance and avoid errors.

Kick off your insurance agent cover letter: the salutation or greeting

When writing your insurance agent cover letter, remember that you're not writing for some complex AI or robot, but for actual human beings.

And recruiters, while on the lookout to understand your experience, would enjoy seeing a cover letter that is tailored to the role and addresses them . Personally.

So, if you haven't done so, invest some time in finding out who's the hiring manager for the role you're applying to. A good place to start would be LinkedIn and the corporate website.

Alternatively, you could also get in touch with the company to find out more information about the role and the name of the recruiter.

If you haven't met the hiring manager, yet, your insurance agent cover letter salutation should be on a last-name basis (e.g. "Dear Mr. Donaldson" or "Dear Ms. Estephan").

A good old, "Dear HR Professional" (or something along those lines) could work as your last resort if you're struggling to find out the recruiter's name.

List of salutations you can use

- Dear Hiring Manager,

- Dear [Company Name] Team,

- Dear [Department Name] Hiring Committee,

- Dear Mr./Ms. [Last Name],

- Dear [First Name] [Last Name],

- Dear Dr. [Last Name],

Your insurance agent cover letter introduction and the value you bring

Moving on from the "Dear Recruiter" to your professional introduction .

Use those first two sentences of your insurance agent cover letter to present the biggest asset you'd bring to the organization.

Don't go into too much detail about your achievement or the skill set, but instead - go straight for the win.

That is - what is your value as a professional?

Would you be able to build stronger, professional relationships in any type of communication? Or, potentially, integrate seamlessly into the team?

What to write in the middle or body of your insurance agent cover letter

Here's where it gets tricky.

Your insurance agent cover letter body should present you in the best light possible and, at the same time, differ from your resume.

Don't be stuck in making up new things or copy-pasting from your resume. Instead, select just one achievement from your experience.

Use it to succinctly tell a story of the job-crucial skills and knowledge this taught you.

Your insurance agent cover letter is the magic card you need to further show how any organization or team would benefit from working with you.

Final words: writing your insurance agent cover letter closing paragraph

The final paragraph of your insurance agent cover letter allows you that one final chance to make a great first impression .

Instead of going straight to the "sincerely yours" ending, you can back up your skills with a promise of:

- how you see yourself growing into the role;

- the unique skills you'd bring to the organization.

Whatever you choose, always be specific (and remember to uphold your promise, once you land the role).

If this option doesn't seem that appealing to you, close off your insurance agent cover letter with a follow-up request.

You could even provide your availability for interviews so that the recruiters would be able to easily arrange your first meeting.

No experience insurance agent cover letter: making the most out of your profile

Candidates who happen to have no professional experience use their insurance agent cover letter to stand out.

Instead of focusing on a professional achievement, aim to quantify all the relevant, transferrable skills from your life experience.

Once again, the best practice to do so would be to select an accomplishment - from your whole career history.

Another option would be to plan out your career goals and objectives: how do you see yourself growing, as a professional, in the next five years, thanks to this opportunity?

Be precise and concise about your dreams, and align them with the company vision.

Key takeaways

Winning recruiters over shouldn't be difficult if you use your insurance agent cover letter to tell a story that:

- Is personalized by greeting your readers and focusing on key job skills greets;

- Isn't spread all over the place, but instead focuses on one key achievement and selling your value as a professional;

- Introduces your enthusiasm for the role, passion for the job, or creativity in communication;

- Is also visually appealing - meeting the best HR practices;

- Ends with a nod to the future and how you envision your growth, as part of the company.

Insurance Agent cover letter examples

Explore additional insurance agent cover letter samples and guides and see what works for your level of experience or role.

Cover letter examples by industry

AI cover letter writer, powered by ChatGPT

Enhancv harnesses the capabilities of ChatGPT to provide a streamlined interface designed specifically focused on composing a compelling cover letter without the hassle of thinking about formatting and wording.

- Content tailored to the job posting you're applying for

- ChatGPT model specifically trained by Enhancv

- Lightning-fast responses

When Should You Include Your High School on Your Resume?

Resume for 10 years of experience, how to create a combination resume (+6 unique hybrid resume examples), how i got an internship at tesla, what is an unsolicited resume, why is my resume getting rejected.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Examples

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

- Resume Builder

- Resume Templates

- Resume Formats

- Resume Examples

- Cover Letter Builder

- Cover Letter Templates

- Cover Letter Formats

- Cover Letter Examples

- Career Advice

- Interview Questions

- Resume Skills

- Resume Objectives

- Job Description

- Job Responsibilities

- FAQ’s

Insurance Cover Letter Examples

Writing a cover letter for an insurance position can be challenging. Knowing how to present yourself in the best possible light to increase your chances of getting the job is key. To help you get started, we have compiled some examples of successful insurance cover letters, along with a guide on how to write an effective cover letter. With these helpful tips and examples, you can create an engaging, informative cover letter that will make a great impression.

- Insurance Agent

- Insurance Broker

- Underwriter

- Claims Adjuster

- Claims Examiner

- Claims Investigator

- Risk Manager

- Insurance Sales Agent

- Customer Service Representative

- Insurance Appraiser

- Insurance Auto Damage Appraiser

- Insurance Fraud Investigator

- Insurance Account Manager

- Insurance Compliance Officer

- Insurance Analyst/Underwriting Analyst

- Insurance Product Manager

- Reinsurance Underwriter

- Insurance Medical Examiner

- Insurance Risk Surveyor

- Insurance Operations Manager

- Insurance Marketing Manager

- Insurance IT Analyst

- Insurance Actuarial Analyst

- Insurance Accountant

- Insurance Auditor

- Insurance Claims Manager

- Insurance Underwriting Manager

- Insurance Sales Manager

- Insurance Operations Analyst

- Insurance Compliance Analyst

- Insurance Data Analyst

- Insurance Marketing Coordinator

- Insurance Portfolio Manager

- Insurance Project Manager

- Insurance Business Analyst

- Insurance Credit Analyst

- Insurance Loss Control Specialist

- Insurance Benefits Administrator

- Insurance Policy Administrator

- Insurance Fraud Prevention Analyst

- Insurance Legal Counsel

- Insurance Human Resources Manager

- Insurance Training and Development Specialist

Why a Insurance profession needs a cover letter

When applying for an insurance policy, it is essential to include a cover letter. A cover letter provides additional information about the policy itself, as well as the applicant’s motivations for requesting the policy. It is a way for applicants to express their needs and goals in a concise and effective way.

A cover letter is also a way for applicants to demonstrate their qualifications and credentials. Insurance companies often request policy applications to be accompanied by a cover letter, as it allows them to get a better understanding of why the applicant needs the policy. This includes the applicants’ financial and lifestyle needs, their asset protection goals, and any other motivations they may have for applying for the policy. The cover letter also provides an opportunity for applicants to make a strong case for themselves and why they are deserving of the insurance policy.

In addition to providing additional information, a cover letter also helps to ensure that the insurance company is aware of all the necessary details for the policy. Cover letters should include relevant information such as the applicant’s name, contact information, and the type of insurance being applied for. The letter should also include any relevant documents, such as evidence of income and financial statements. This information is necessary for insurance companies to make an informed decision about the policy.

A well- crafted cover letter can make all the difference when applying for an insurance policy. It is a valuable tool that allows applicants to share their motivations and qualifications, as well as provide necessary information that insurance companies require. A cover letter is an essential part of the insurance application process and should not be overlooked.

Writing the Perfect Insurance Cover Letter

Crafting a great insurance cover letter requires more than just inserting a generic template into your word processor. Your cover letter is your chance to make a strong first impression and show hiring managers why you’re the right fit for the insurance job.

The first step to writing an effective cover letter is to understand the job requirements. Research the company’s website and social media channels to get a better understanding of the company’s culture, the insurance job market, and the specific job you’re applying for. This will help you tailor your cover letter to the job and explain how you’re a great fit.

When writing your cover letter, use a professional tone and make sure your grammar, punctuation, and spelling are all correct. Include relevant details about your qualifications and career successes, such as any awards you’ve won or certifications you’ve earned.

Talk about the skills and experiences that make you an ideal candidate for the job. Make sure your cover letter is personal and conveys your enthusiasm for the role. Show that you’ve put in the effort to research the company, and explain why you’d be a great addition to the team.

Finally, be sure to thank the hiring manager for their time, and provide contact information in case they have any questions. Proofread your letter and make sure it’s error- free before sending it off.

By following these tips, you’ll be sure to write an effective insurance cover letter that will help you stand out from the competition and land your dream job!

What should be included in a Insurance cover letter

A cover letter is an important part of any insurance application, as it provides a snapshot of your qualifications and experience to the insurance company. It is essential that you include the relevant information needed to give the insurance provider an impression of who you are and why you are the best candidate for their policy.

A successful insurance cover letter should include the following:

- A brief introduction outlining your background and the reason for your application.

- A detailed explanation of your qualifications and experience, such as any relevant certifications, licenses, or any other qualifications related to the insurance field you are applying for.

- A statement of why you are the best candidate for the position.

- A summary of your achievements and successes in the past.

- Information about the type of policy and coverage you are seeking and why you feel it is best suited to your needs.

- Any additional information you believe will help you stand out from the other applicants.

- Contact information, including your name, address, phone number, and email address.

Conclusion :

Your insurance cover letter should also include a conclusion, thanking the provider for their time and consideration and reiterating your interest in the policy. By including all of the above elements in your cover letter, you will give the insurance provider the best possible impression of yourself and your qualifications.

How to format a Insurance cover letter

A well- formatted insurance cover letter should:

- Introduce yourself: Begin your letter by introducing yourself and why you are writing. Explain why you are a good fit for the position.

- Describe your experience: Provide a brief summary of your experience in the insurance field and highlight any accomplishments.

- Demonstrate your knowledge: Explain your knowledge of the industry, the specific company, and the position you’re applying for.

- Show your enthusiasm: Demonstrate your enthusiasm for the position and explain why you’re the best fit for the job.

- Express thanks: Conclude your letter by thanking the reader for their time and expressing interest in discussing the position further.

- Provide contact information: Include your contact information so that the hiring manager can easily reach you.

- Keep it concise: Aim for a one- page letter that is concise and to the point. Avoid using overly- technical language and focus on the essential points.

Common mistakes to avoid when creating a Insurance cover letter

- Not researching the company – Before creating a cover letter for any potential insurance employer, it is important to research the company and the job for which you are applying. This will help you to tailor your letter to the specific employer and position.

- Using a generic template – Use a customized cover letter that speaks to the specific employer and position. A generic template may not stand out to the employer and could make you seem like you are not taking the job seriously.

- Not addressing the employer directly – Address the cover letter to a specific person who will be reviewing it. If you are unable to find the exact name of the person, use a job title and department. This shows the employer that you took the time to personalize the letter.

- Focusing too much on yourself – Use your cover letter to highlight any relevant experience and skills you have, but keep it focused on how you will benefit the employer. Make sure to also include what you know about the company and the value you can add to the organization.

- Making spelling and grammar mistakes – Review your cover letter multiple times before sending it to the employer. Poorly written letters with spelling and grammar mistakes can make you look unprofessional, so double- check all of the content.

- Not proofreading – Before submitting your letter, have a friend or colleague review it. They may be able to spot mistakes and typos that you have missed.

- Not tailoring it to the job – Your cover letter should be tailored to the specific job you are applying for. Include any relevant experience and skills that are specifically required for the job.

- Not including contact information – To make it easier for employers to reach you, make sure to include your contact information such as your phone number, email address, and LinkedIn profile.

Benefits of submitting a Insurance cover letter

A cover letter is an important document when applying for insurance. It provides a unique opportunity for the potential policyholder to personalize their application and make it stand out. Here are some of the key benefits of submitting an insurance cover letter:

- Demonstrate a Professional Image: A well- crafted cover letter shows that the applicant is knowledgeable about the insurance industry and has taken the time to carefully craft an impressive document. It projects an image of professionalism and attention to detail that can help the applicant stand out from the competition.

- Explain Insurance Needs: A cover letter provides the policyholder with an opportunity to explain their insurance needs and how the policy they are applying for will meet those needs. This can help the insurance provider better understand the applicant’s needs and tailor their coverage to better suit them.

- Highlight Unique Qualifications: A cover letter can also be used to highlight any unique qualifications or experiences the applicant may possess that would make them an ideal policyholder. This could include anything from previous insurance experience to special certifications or training.

- Showcase Personality: An insurance cover letter is also a chance to showcase the applicant’s personality and demonstrate that they are a good fit for the policy. This can help to create mutual trust and understanding between the policyholder and the insurance provider.

- Strengthen Negotiations: A strong cover letter can also strengthen the applicant’s negotiations with the insurance provider. By clearly outlining their needs, qualifications, and personality, the applicant is better equipped to negotiate for a policy that is tailored to fit their unique needs.

When writing your insurance cover letter, it is important to keep in mind the purpose of the letter and tailor it to the specific job and company you are applying for. This guide has shown you how to write an effective cover letter for an insurance job and provided you with examples of cover letter templates to help you get started. By following the tips and advice provided here, you will be well on your way to writing a professional cover letter that will make you stand out from the competition. Best of luck in your job search!

Insurance Agent Cover Letter Example

Written by Mark DeGrasso

May 16, 2023.

Applying for a new job can be a daunting task, especially when it comes to crafting the perfect cover letter. As an insurance agent, your cover letter can make or break your chances of landing the job you desire. In this article, we will walk you through everything you need to know about writing an effective insurance agent cover letter. From the essential components to common mistakes to avoid, we’ve got you covered. Let’s dive in.

When it comes to highlighting your understanding of the insurance industry, it’s important to use specific examples and industry-specific language. For example, if you’re applying for a position in property and casualty insurance , you might mention your experience with underwriting policies for homeowners and auto insurance. If you’re applying for a position in health insurance, you might discuss your experience with navigating the Affordable Care Act and helping clients choose the right health plan for their needs.Another important aspect of a standout insurance agent cover letter is showcasing your relevant experience and skills. This could include experience working in a similar role, as well as any relevant certifications or licenses you hold. You might also highlight any sales or customer service experience you have, as these skills are essential for success in the insurance industry.In addition to demonstrating your knowledge and experience, a great insurance agent cover letter should also showcase your passion for helping clients. This could include discussing your approach to building relationships with clients and providing personalized service, as well as your commitment to staying up-to-date on industry trends and changes.Finally, attention to detail and strong communication skills are essential for any insurance agent. Make sure your cover letter is well-written, free of errors, and tailored specifically to the job description and company you’re applying to. This will show employers that you’re serious about the position and have taken the time to research and understand their needs.Overall, a standout insurance agent cover letter should demonstrate your knowledge, experience, passion, and communication skills, while also showcasing your attention to detail and commitment to providing exceptional service to clients. With these elements in place, you’ll be well on your way to landing your dream job in the insurance industry.

Essential Components of a Insurance Agent Cover Letter

When crafting your insurance agent cover letter, there are a few key components you should always include:

First and foremost, your cover letter should be personalized and tailored to the specific job you are applying for. This means researching the company and the position, and highlighting how your skills and experience align with their needs.

An attention-grabbing opening statement is crucial in making a strong first impression. Consider starting with a personal anecdote or a statistic that showcases your passion for the insurance industry. For example, you could mention how you have always been interested in helping people protect their assets and plan for their future.

After your opening statement, provide a brief overview of your relevant experience and qualifications. This should include your education, any relevant certifications or licenses, and any previous insurance industry experience you have.

Next, provide a more detailed account of your skills that are directly related to the specific job requirements. For example, if the job posting emphasizes the importance of strong communication skills, provide specific examples of how you have excelled in this area in previous roles.

It is also important to provide examples of your past successes and achievements in the insurance industry. This could include increasing sales figures, improving customer retention rates, or receiving awards or recognition for your work.

Finally, close your cover letter with a statement that reiterates your interest in the position and thanks the employer for considering your application. Consider including a call to action, such as requesting an interview or offering to provide additional information.

Overall, a strong insurance agent cover letter should showcase your passion for the industry, highlight your relevant skills and experience, and demonstrate your potential value to the employer.

Common Mistakes To Avoid When Writing a Insurance Agent Cover Letter

As an insurance agent, you know the importance of attention to detail. It’s crucial to apply that same level of detail to your cover letter. Here are some common mistakes to avoid:

- Using a generic cover letter: Employers can spot a generic cover letter from a mile away. Take the time to customize your letter to the specific job requirements and company culture.

- Focusing too much on personal achievements: While it’s important to highlight your accomplishments, make sure to tie them back to how they can benefit the company. Employers want to know how you can add value to their team.

- Submitting a letter with errors: Grammatical and spelling errors can be a deal-breaker for employers. Take the time to proofread your letter multiple times and consider having someone else review it as well.

- Overusing buzzwords and industry jargon: While it’s important to demonstrate your knowledge of the industry, be careful not to overdo it with buzzwords and jargon. This can come across as confusing or even pretentious to the employer.

- Not tailoring the cover letter: Just as you wouldn’t sell car insurance to someone who needs homeowners insurance, you shouldn’t submit a generic cover letter to an employer in a specific insurance niche. Take the time to research the company and industry and tailor your letter accordingly.

By avoiding these common mistakes, you can ensure that your insurance agent cover letter stands out from the crowd and showcases your qualifications and value as a potential employee.

Final Steps On Writing Your Insurance Agent Cover Letter

Congratulations on completing your insurance agent cover letter! You’ve taken a crucial step towards landing your dream job. However, before you hit “send,” there are a few final steps you should take to ensure that your cover letter is polished and professional.

First and foremost, proofread your cover letter thoroughly. Check for typos, grammatical errors, and spelling mistakes. These small errors can be a red flag to potential employers and may harm your chances of getting hired. Take the time to read through your cover letter carefully, or even consider using a proofreading tool or service to help you catch any mistakes.

It’s also a good idea to have a trusted friend or mentor read your letter and offer feedback. They may be able to spot areas where you can improve your writing, or offer suggestions for making your cover letter more compelling. Additionally, they can provide an outside perspective on your letter and help you identify any areas that may be unclear or confusing.

Finally, ensure that your formatting is consistent and easy to read. Use a professional font and font size, and make sure that your paragraphs are well-organized and easy to follow. Use bullet points or numbered lists where appropriate to help break up the text and make your letter more visually appealing.

By taking these final steps, you can ensure that your insurance agent cover letter is the best it can be. Good luck with your job search!

Example Insurance Agent Cover Letter

Dear [Employer’s Name],

I am writing to express my interest in the [Position Title] at [Company Name]. As an experienced insurance agent with [Number of Years] of experience, I am confident in my ability to excel in this role and make a valuable contribution to your company.

Throughout my career, I have demonstrated a strong commitment to excellent customer service and achieving sales targets. In my most recent role at [Previous Company Name], I consistently exceeded sales goals and maintained a high level of customer satisfaction. I was also responsible for managing a team of agents and training them on effective sales techniques.

One of my proudest achievements was creating and implementing a successful marketing campaign that increased brand awareness and drove sales. I collaborated with the marketing team to develop targeted messaging and utilized social media platforms to reach a wider audience. This resulted in a 25% increase in sales over a six-month period.

I am particularly drawn to [Company Name]’s reputation for innovation and customer-centric approach to insurance. I believe that my strong communication skills and attention to detail make me a perfect fit for this position. I am also excited about the opportunity to work with a team of professionals who are passionate about delivering exceptional service to clients.

Outside of work, I am an active member of the community and have volunteered with various organizations, including Habitat for Humanity and the American Red Cross. I believe in giving back and making a positive impact in the lives of others.

Thank you for considering my application. I look forward to the opportunity to discuss my qualifications in further detail.

[Your Name]

Insurance Agent Cover Letter FAQ

Are you seeking a career as an insurance agent? If so, you’ll need a strong cover letter to accompany your resume. Here are some frequently asked questions about insurance agent cover letters, along with some helpful tips to make your cover letter stand out:

Q: How long should my insurance agent cover letter be?

A: Generally, a cover letter should be no longer than one page. This ensures that your letter is concise and to the point, while still providing enough information to entice the employer to read your resume.

Q: Should I include a salary requirement in my insurance agent cover letter?

A: It’s typically not necessary to include a salary requirement in your initial cover letter. If the employer requires this information, they will likely ask for it separately. Instead, focus on highlighting your skills and qualifications that make you the best fit for the job.

Q: How do I address my cover letter if I don’t know the employer’s name?

A: If you don’t know the employer’s name, you can address your letter to “Dear Hiring Manager” or “Dear Human Resources.” However, it’s always best to do a little research to find out the name of the person who will be reviewing your application. This shows that you’ve taken the time to personalize your letter and are truly interested in the position.

Q: Do I need to submit a cover letter if the job posting doesn’t require one?

A: Even if a cover letter isn’t required, it’s always a good idea to submit one as it can help set you apart from other applicants and demonstrate your enthusiasm for the position. Use your cover letter to showcase your skills and experience, and explain why you’re the best candidate for the job.

As an insurance agent, you’ll be responsible for helping clients navigate the often confusing world of insurance. This requires not only a strong knowledge of insurance policies and regulations, but also excellent communication skills and the ability to build trust with clients. In your cover letter, be sure to highlight any experience you have in these areas, as well as any relevant certifications or licenses you hold.

Additionally, it’s important to show that you’re familiar with the company and its mission. Do some research on the company’s website and social media channels to get a better sense of its values and goals. Then, use this information to tailor your cover letter to the specific company and position you’re applying for.

In conclusion, writing an effective insurance agent cover letter requires careful attention to detail, a strong understanding of the insurance industry, and excellent communication skills. By following the tips outlined in this article, you’ll be well on your way to crafting a standout cover letter that will impress potential employers.

Table of Contents

Insurance Cover Letter Examples

A great insurance cover letter can help you stand out from the competition when applying for a job. Be sure to tailor your letter to the specific requirements listed in the job description, and highlight your most relevant or exceptional qualifications. The following insurance cover letter example can give you some ideas on how to write your own letter.

or download as PDF

Cover Letter Example (Text)

Hallie Glant

(793) 597-4266

Dear Aubrynn Faden,

I am writing to express my interest in the insurance position available at Allstate Corporation, as advertised. With a solid foundation of five years of experience in the insurance industry, gained through my tenure at AXA SA, I am excited about the opportunity to contribute to your esteemed company and further hone my skills in a new environment.

During my time at AXA SA, I was fortunate to have honed a comprehensive skill set that I believe aligns well with the expectations for the role at Allstate Corporation. My experience has equipped me with a deep understanding of insurance policies, underwriting, risk assessment, and customer service excellence. I have consistently demonstrated my ability to manage and grow client portfolios while maintaining a high standard of compliance and due diligence.

I take pride in my ability to build and maintain strong relationships with clients, offering them tailored solutions that meet their unique needs. My analytical skills, coupled with my attention to detail, have enabled me to identify potential risks and make informed decisions that benefit both the company and our clients. Furthermore, I have actively contributed to team success through collaboration, sharing best practices, and innovative thinking.

I am particularly drawn to the prospect of working for Allstate Corporation because of your commitment to customer satisfaction and your innovative approach to insurance products and services. I am eager to bring my background in insurance and customer service to your team, where I am confident that my proactive approach and dedication to excellence will lead to successful outcomes.

Thank you for considering my application. I am looking forward to the opportunity to discuss how my experience and skills will be beneficial to Allstate Corporation. I am enthusiastic about the possibility of joining your team and contributing to your company’s continued success.

Warm regards,

Related Cover Letter Examples

- Insurance Sales Agent

- Insurance Account Executive

- Insurance Billing Specialist

- Insurance Sales Manager

- Insurance Sales Representative

- Insurance Verification Specialist

Insurance Agent Cover Letter - Examples and Guidelines

An insurance career is innovative and dynamic, attracting people from all walks of life. You have the opportunity to make a difference in the community, have access to many jobs and get to work in a stable industry.

All cover letter examples in this guide

Insurance Agent Cover Letter Example

Junior Brown 4184 McDonald Avenue Apopka, FL 32703 [email protected] linkedin.com/in/juniorbrown 2/12/2018

Mr. Steven Hicks Hiring Manager Jubilee Insurance Company 833 American Drive Pennsauken, NJ 08110

Dear Steven,

I'm excited to learn that there is an opening for an Insurance sales agent position at Jubilee Insurance. I have nine years of experience in the Insurance industry and would love an opportunity to work at Jubilee, an innovator in the industry. I believe that my knowledge, talent, and skills are perfect for the said position, and this will also be an excellent opportunity for growth.

In my previous role as an insurance agent, I was tasked with managing a portfolio with 25 clients. I increased the company's revenue by 20% by upselling our existing insurance products and getting more clients on board. My experience has also allowed me to grow my communication, customer service, and negotiation skills.

I recently took up a Certified Insurance Counselors certification and increased my knowledge in personal line insurance, helping me serve my clients better. I believe that this knowledge will be vital for this position.

Please let me know if you have any further questions regarding my qualifications. Thank you for taking the time to check my application. I look forward to hearing from you.

Kind regards, Ivy.

However, you need a strong job application consisting of a resume and an outstanding insurance agent cover letter to beat your competition. Writing a cover letter may be challenging as you determine what to add to it.

Here is a detailed guide that will give you tips to help you create a professional cover letter that gets you your dream job. Some of the topics we'll cover include:

- The layout and structure you should consider for your cover letter.

- How to write an introduction that gets the recruiter's attention.

- The dos and don'ts of writing a farewell as you finish your cover letter.

- The right way to add your call to action.

How to Write a Cover Letter for Insurance Agents

Cover letters make a difference in your application by giving more details about your qualifications. You get to showcase your personality as you write about your skills and experience.

Once in a while, you'll encounter a hiring manager who doesn't require a cover letter, but this is also rare. Your application will be incomplete without a cover letter , so always complement your resume with one unless specifically stated otherwise.

If you don't have much experience, highlight your educational qualifications and show the recruiter how specific courses have prepared you for the position. A cover letter also allows you to express your interest in the job.

The structure of your insurance agent cover letter should have the following information:

- A header section

- A formal greeting

- An introduction of your cover letter

- The body of the cover letter(consists of relevant experience, skills, and other accomplishments)

- A conclusion

- The call to action

- A farewell to close the letter.

Start With The Header

The header section of your cover letter will have your personal details and those of the addressee. Your details include your full name, street address, professional email address, and a link to your LinkedIn profile(This is optional).

The addressee's details include their name, job title, company name, and street address.

The recruiter will use these details to contact you, so ensure they are accurate.

Introduce Yourself As You Begin Your Cover Letter

As you write your resume, use these tips to help you write a strong introduction.

- Start this section with a professional greeting and add the recipient's name. If you have done your research and still couldn't find the recipient's name, you can use 'Dear Sir/Madam,' but this is not always recommended.

- Express your interest in the position in this section and tell the recruiter how you found out about the job opportunity. Keep it short and brief as you add your introduction.

- Mention the good things you've heard about the company and add your experience level as an insurance agent.

Correct example

I'm excited about the open insurance agent position at Allstate Insurance advertised on the company website. I have worked in the insurance field for six years and specialized in property and liability insurance.

In my previous role at Chubb insurance, I won the employee of the year award after closing one of the biggest deals for the company. I also surpassed all my sales targets by 15% by focusing on a niche market that was tough to penetrate initially but eventually paid off. Though I achieved great success in my previous job, I believe it's time for a new challenge.

The introduction above starts with the correct greeting and proceeds to describe the candidate's experience that has prepared them for the position. It also expresses the candidate's interest in the position.

Incorrect example

I recently saw an open insurance agent position at Allstate Insurance and would like to apply for the same. I believe that my experience will allow me to perform my duties diligently and serve your customers well.

The example above starts with a lazy greeting not directed to any specific person. It also fails to give details that show the recruiter what makes you a unique candidate.

Explain Why You're the Best for the Job

The second part of your cover letter is the body. This is where you'll add your job duties/responsibilities at your previous job . As you add them, use figures and facts to quantify the achievements and show the hiring manager the value you could bring to the company. This section of your cover letter can have two to three paragraphs.

The first paragraph of this section focuses on your previous role and the job duties. As you add the duties/responsibilities, incorporate the right keywords and action verbs from the job description. These optimize your cover letter and ensure that it gets past the ATS systems that hiring managers use to filter out resumes and cover letters that don't have the right requirements.

The second paragraph in this section describes how your previous experience and skills have prepared you for the job. This is where you'll add an achievement that sets you apart from everyone else if you have one.

Some of my tasks in my previous role included overseeing a portfolio of 10 clients, identifying new customers and closing deals that increased sales by 20%, and arranging for and maintaining all types of personal insurance policies within the company.

My position allowed me to improve my communication and negotiation skills. I'm also a great team player who collaborates well with people to ensure the company achieves its targets. I believe that my valuable experience and skills will allow me to perform an excellent job.

The example above describes the candidate's responsibilities and shows the recruiter how their experience and skills has prepared them for the new job.

Some of my duties included contacting new clients, upselling customer products and services, and reaching out to old clients to find out their needs. I believe that my experience will allow me to do a good job.

The example above highlights the candidate's duties but fails to give details of their achievements that make them stand out.

Finish Your Cover Letter With a Call to Action (CTA)

A call to action is vital as you conclude the cover letter. It encourages the recruiter to respond to you once they receive your application . Failure to add one may cause you not to hear from the recruiter. As you add your call to action, take some time to thank the recruiter for reviewing your application and ask them for the next steps.

You can reach me anytime on the email or phone number provided.

This gives the recruiter options to contact you when they need to provide information about the job.

Let me know if there are any updates.

This encourages the recruiter to update you on the hiring process, which is great, especially if you're waiting for feedback for more than one opportunity.

I'd love to set up a meeting and discuss my qualifications further.

This might inspire the recruiter to give you a callback and plan an in-person meeting.

I'd like to discuss my background further at your earliest convenience.

This call to action implies that there are more details about you that the recruiter should be intrigued about.

I hope to hear from you soon.

This implies that you're already positive that you'll hear from the recruiter and may encourage them to reach out.

The Farewell: Finish With a Professional Sign-off

If you write an exceptional cover letter but fail to add the correct sign-off, you'll probably miss out on the opportunity. This is the last section of the cover letter . Here are some examples to help you out.

- Sincerely yours

- Best regards

- Yours truly

- Most sincerely

- Respectfully yours

- Kind regards

- Respectfully

- Best wishes

- Affectionately

Accompany Your Cover Letter with a Powerful Resume

While a cover letter is an essential document that boosts your application, you still need an outstanding resume to make your application complete. The resume highlights your experience, skills, and top accomplishments . Check out our resume examples that will help you create the perfect resume. Also, use our resume templates or resume builder to structure the cover letter.

Key Takeaways

- Start with an interesting introduction that gets the recruiter's attention.

- Check the contact information you've provided to ensure that it's correct.

- Personalize the greeting at the beginning of the cover letter by adding the addressee's name.

- The cover letter must always have a call to action.

- Check out our cover letter examples to help you write yours.

- Always end the cover letter with a professional sign-off.

Frequently Asked Questions

Which companies are hiring insurance agents.

According to Glassdoor , the companies hiring insurance agents include:

- Liberty Mutual Insurance

- American Income Life

- Progressive Insurance

What should a cover letter for insurance include?

- An introduction

- Body of the cover letter

- A call to action

- A professional sign-off

Tasuta allalaetav kaaskirja mall

Motivatsioonikiri, millele on enamikul juhtudel lisatud CV, on iga töötaotluse põhielement. Seda tüüpi kiri peab lühidalt kirjeldama oskusi, võimeid ja teadmisi, mis teil on ja mis on teatud huviga seoses otsitava ametikohaga. Selles mõttes peab kaaskiri lihtsalt sisaldama sellele ametikohale kandideerimise motivatsiooni ja põhjendusi. See peab äratama värbajas huvi ja panema ta pidama teid selle töö jaoks parimaks võimaluseks.

Kuidas koostada lihtsat kaaskirja

- 1 Valige oma valitud CV mall.

- 2 Austab ühtset struktuuri. Näiteks kasutage kaaskirja struktuuriga "Sina-Mina-Meie".

- 3 Lisage järgmised osad, apellatsioonivorm, lühitutvustus, kirja sisu ja järeldus

- 4 Ärge unustage viimast viisakusvalemit. Vaadake kaaskirja viisakusvalemite näiteid.

- 5 Isiklikuma ja formaalsema ilme lisamiseks lisage lehe allossa oma allkiri

- 6 Kui soovite saata selle meili teel, eksportige oma kaaskiri PDF-vormingus.

Teised kaaskirjade näidised

Kaaskirja struktureerimise nõuanded.

Kaaskirja kirjutamise hõlbustamiseks pidage meeles, et koguge eelnevalt kogu vajalik teave. Näidake toimetaja loovust, järgides samal ajal tüpograafiliste reeglite õiget kasutamist ja jälgides, et ei tekiks kirjavigu. Sest hea kaaskiri peegeldab teie kuvandit inimese ja professionaalina. Olge oma kirjutamisel loominguline ja originaalne, jäädes samas lihtsaks, kokkuvõtlikuks ja täpseks. Näidake läbitud punktide ohutust, enesekindlust ja meisterlikkust. Rõhutage, mida saate ettevõttesse tuua ja mainige oma erialast kogemust vastavas valdkonnas. Märkige ka kõik põhipunktid, mis panevad teid end uute ideedega täitva transformeeriva agendina ilmuma. Täpsustage oma võimet saavutada kavandatud eesmärgid ja kohaneda uute suundumustega.

Näita ennast positiivselt. Ärge langege sellesse viga, et kasutate sama kaaskirja mitme ettevõtte jaoks. Koostage kaaskiri iga taotletava töö kohta. Seda tüüpi kiri võimaldab tööandjal kujundada teie isiksuse kohta arvamust, sest see annab teile võimaluse täpsustada oma motivatsioone, mida lihtsas CV-s tegelikult ei kirjeldata.

Lihtsa ja tõhusa kaaskirja kirjutamise soovitused

- Laiendage Intro Pidage meeles, et pärast kõne valemit peate välja töötama sissejuhatuse, kus tutvustate end ametlikult ja isiklikult. Ärge unustage märkida peamist eesmärki, mis ajendas teid seda kirja kirjutama.

- Struktureerige oma kirja sisu Laske end juhinduda järgmistest küsimustest: – Miks?, Mis eesmärgil?, Kuidas?, Miks soovite selles ettevõttes töötada? → selles osas peate kirjeldama, mida saate ettevõttele tuua. – Rõhutage, kuidas teie teadmised võivad oluliselt mõjutada ettevõtte funktsioonide arengut ja majandussektorit, kus ta tegutseb. - Kuidas te seda teeksite tee seda? → lihtsalt rõhutab teie teadmisi ja võimeid professionaalina – Rõhutage oma õnnestumisi, varasemaid kogemusi, diplomeid, saadud tunnustusi või auhindu.

- Olge oma järeldustes otsekohene Andke teada, et olete vestluseks saadaval, esitades kontaktteabe, näiteks oma e-posti aadressi, telefoninumbri ja postiaadressi. Kui need kontaktandmed muutuvad, ärge unustage uuendada oma CV-d ja kaaskirja ning saata need uuesti ettevõtetele, kes on need juba saanud.

- Hoolitse paigutuse eest Teie kaaskiri peab olema kooskõlas teie CV-ga. Värbaja peab esmapilgul nägema, et need 2 dokumenti moodustavad ühe taotluse. Kasutage oma kaaskirjas samu värve, fonti, ikoone jne, mis oma CV-s. See väike näpunäide aitab teil luua tõhusa ja professionaalse rakenduse.

Create your resume with the best templates

Domande frequenti sulle lettere di accompagnamento

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh et justo cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.

What’s a Rich Text element?

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

Static and dynamic content editing