- Service Tax in Tally Prime

What is Services Tax

Service tax is a tax levied by the government on service providers on certain service transactions, but is actually borne by the customers. It is categorized under Indirect Tax and came into existence under the Finance Act, 1994. ... This tax is not applicable in the state of Jammu & Kashmir.

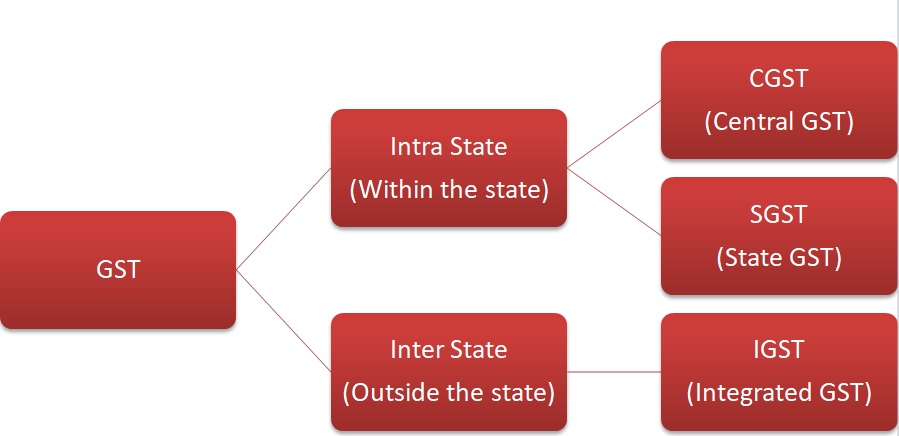

- Intra-State supply of goods or services is when the location of the supplier and the place of supply i.e., location of the buyer are in the same state. In Intra-State transactions, a seller has to collect both CGST and SGST from the buyer. The CGST gets deposited with Central Government and SGST gets deposited with State Government.

- Inter-State supply of goods or services is when the location of the supplier and the place of supply are in different states. Also, in cases of export or import of goods or services or when the supply of goods or services is made to or by a SEZ unit, the transaction is assumed to be Inter-State. In an Inter-State transaction, a seller has to collect IGST from the buyer.

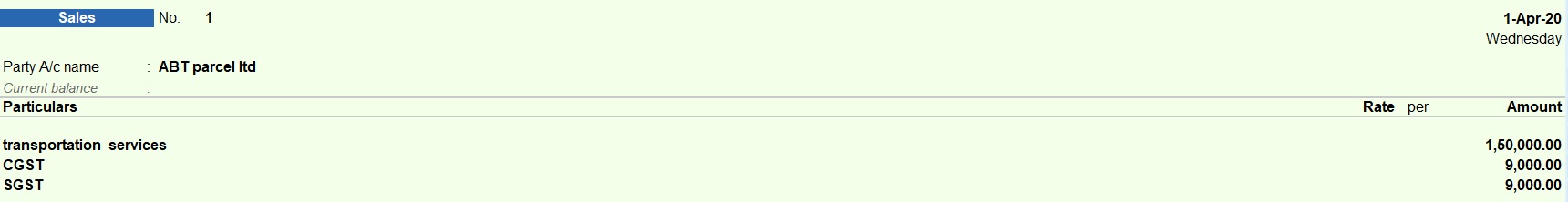

Sales voucher

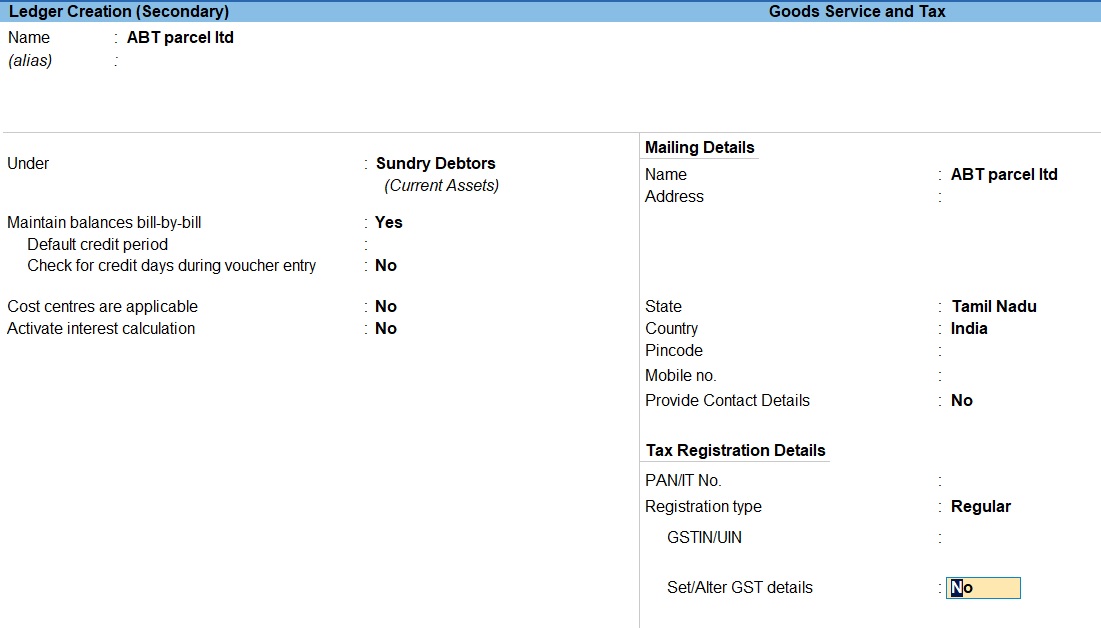

1. Go to Gateway of Tally prime > masters > Ledgers > Create . 2. Enter the ledger Name . 3.Select sundry debtors as the group name in the field Under . 4.Select Service Tax as the Type of duty/tax . 5.The Ledger Creation screen appears as shown below:

6. press Enter to save.

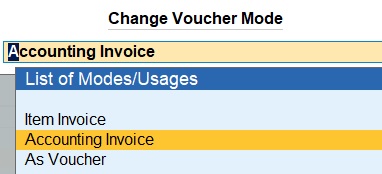

1. Select Change mode > Accounting Invoice > Enter

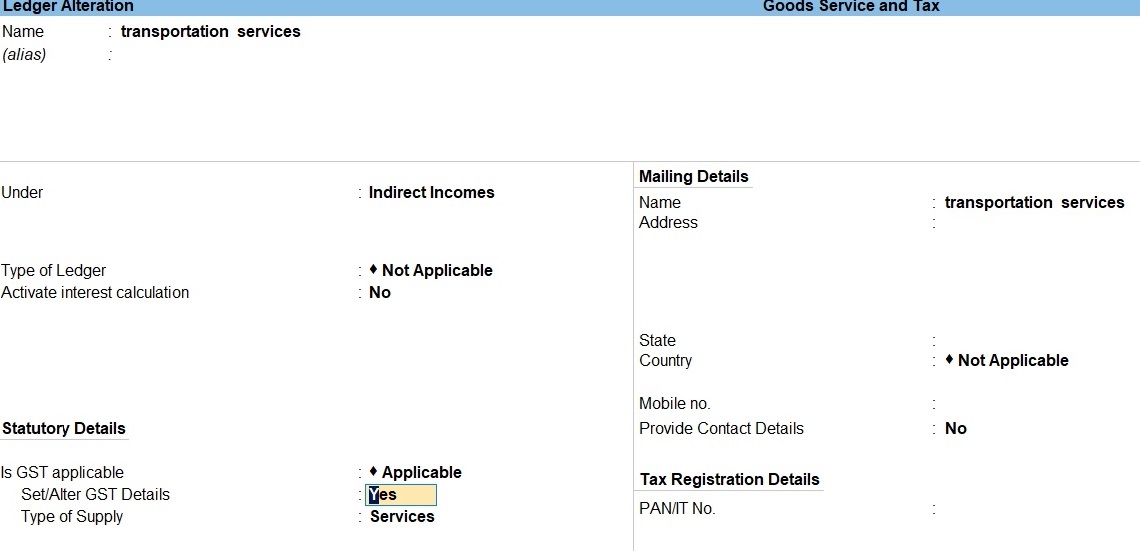

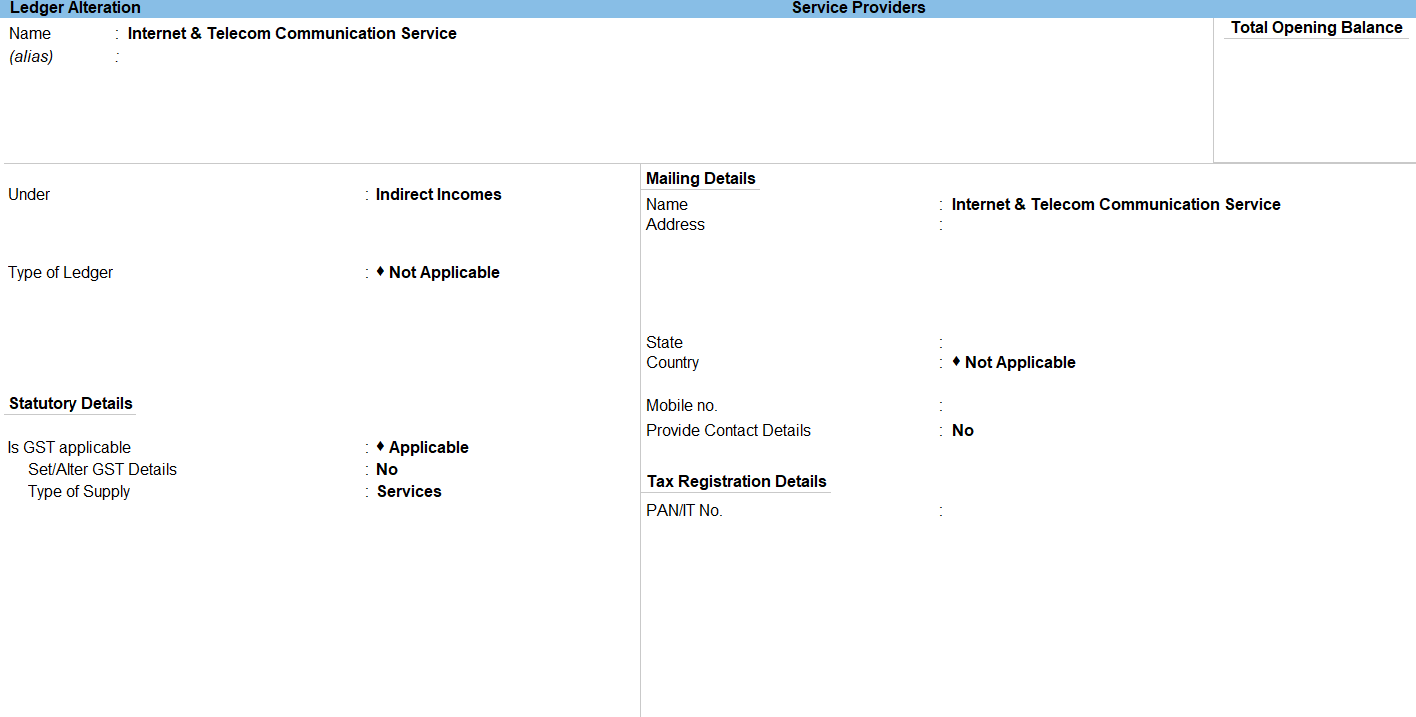

2. Go to Gateway of Tally prime > voucher sales >Alt+ C > Create . 3. Enter the ledger Name . 4. Select indirect incomes as the group name in the field Under .

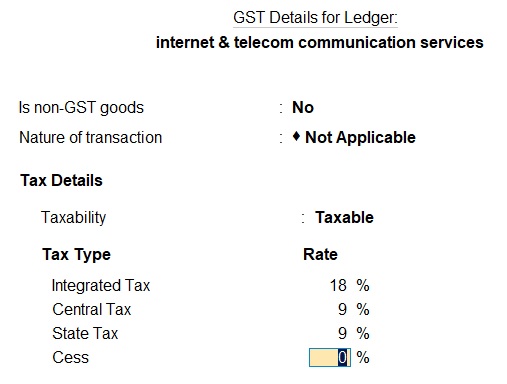

5. Select Set/alter GST details Enter YES.

6. Select Service Tax as the Type of duty/tax 7. The Ledger Creation screen appears as shown below: 8. press Enter to save.

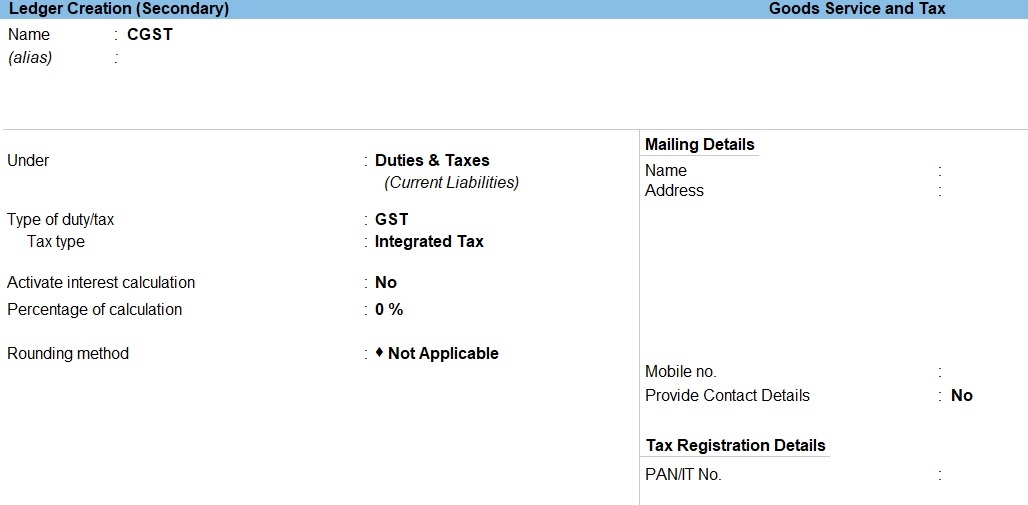

Common tax ledger creation

1. Go to Gateway of Tally > voucher sales >Alt+ C > Create . 2. Enter the ledger Name . 3. Select Duties & Taxes as the group name in the field Under . 4. Select Integrated tax as the Type of duty/tax . 5. The Ledger Creation screen appears as shown below:

6. Press Enter to save.

voucher purchase

1. Go to Gateway of Tally prime > voucher purchase >Alt+ C > Create . 2. Enter the ledger Name . 3. Select Indirect Income as the group name in the field Under .

4. Select Set/alter GST details Enter YES.

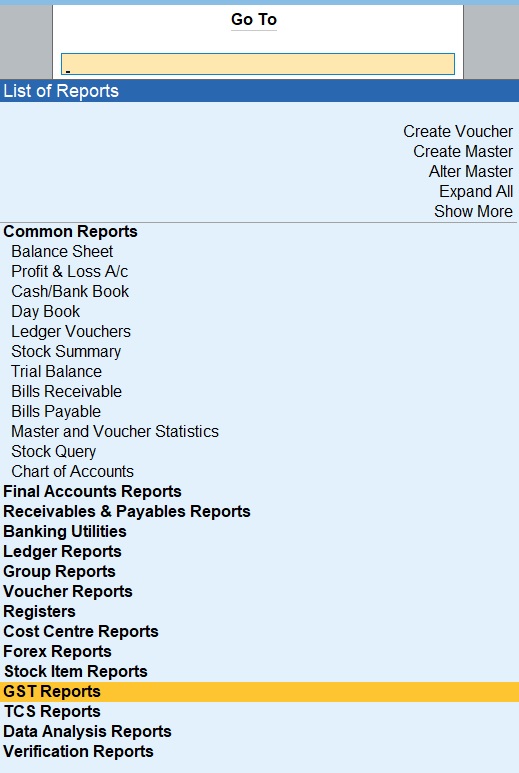

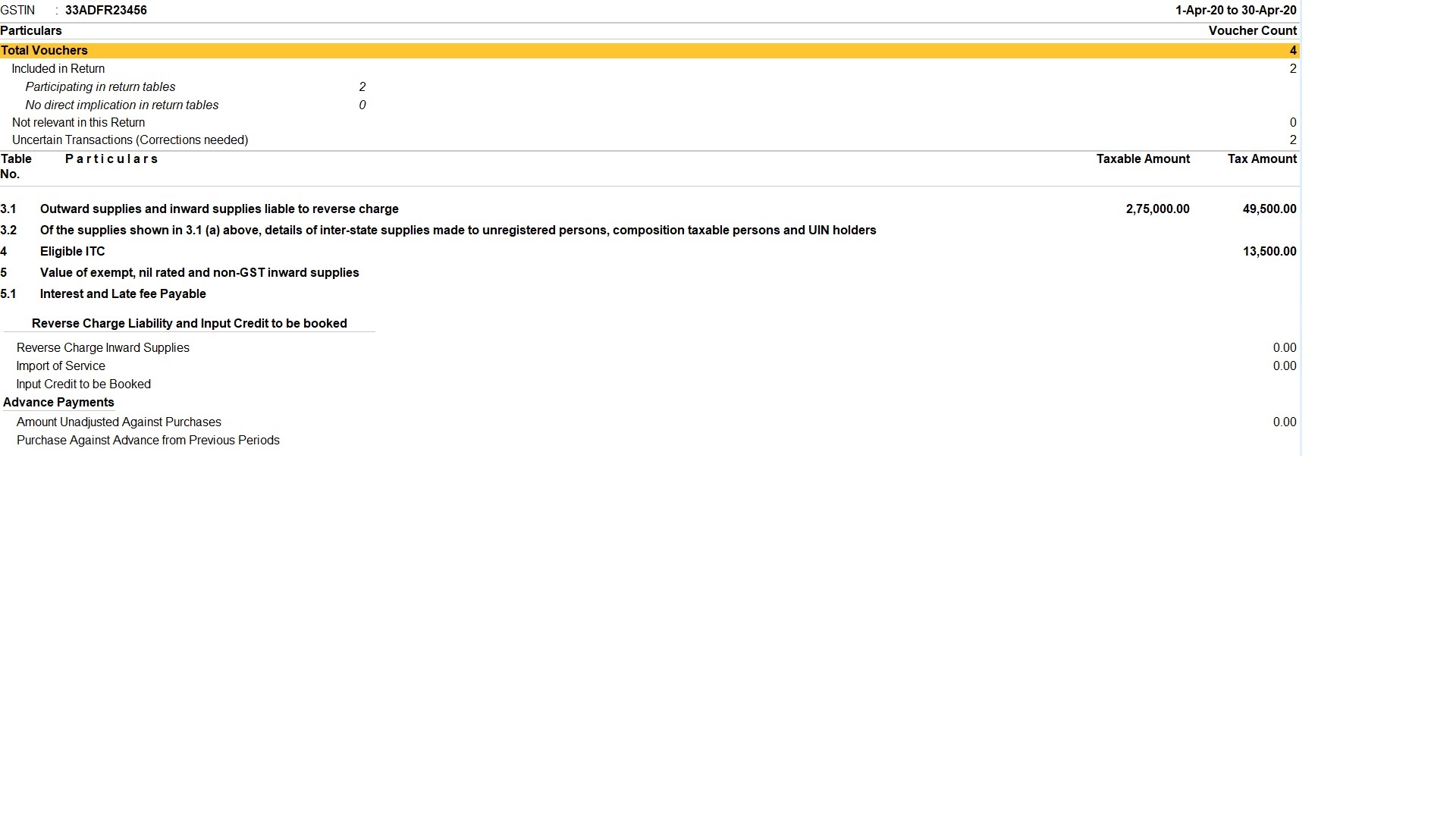

1. Go to Gateway of Tally prime > GO To > GST Reports>Enter.

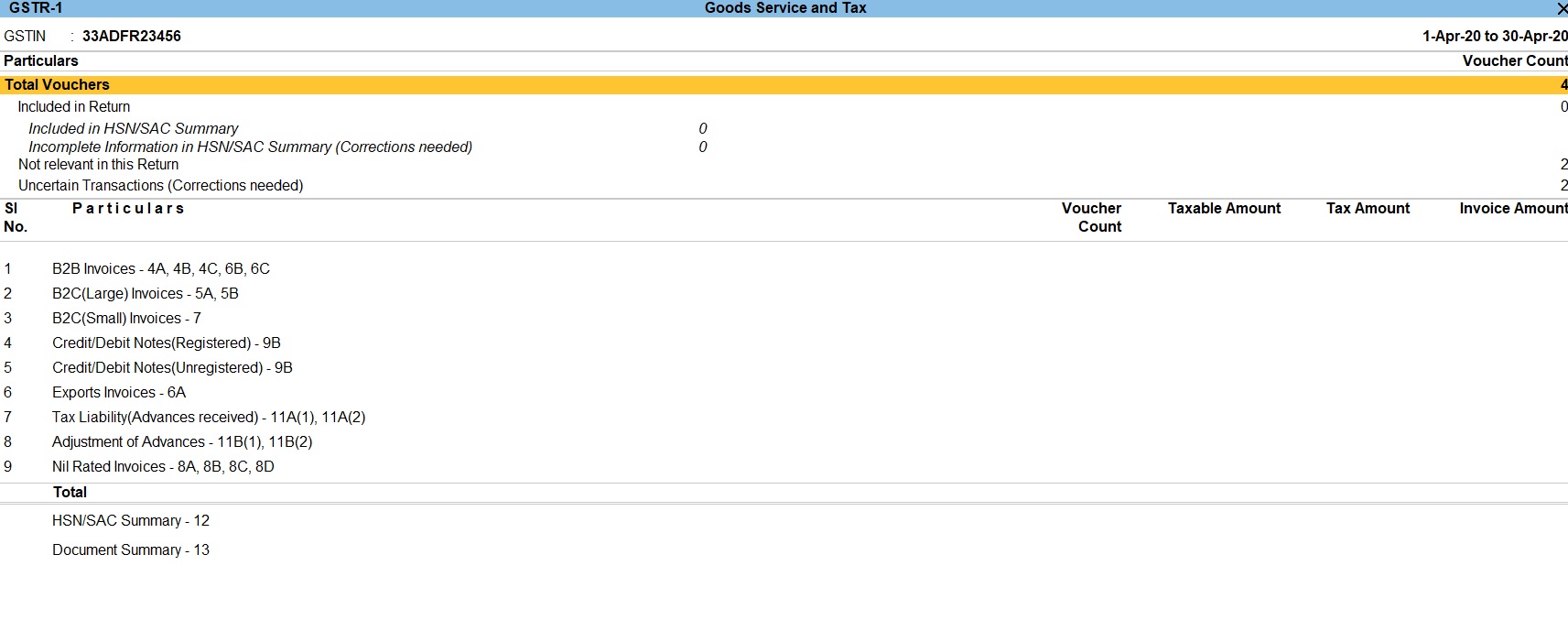

2.Go to Gateway of Tally prime > GO To > GST Reports > GSTR-1> Enter.

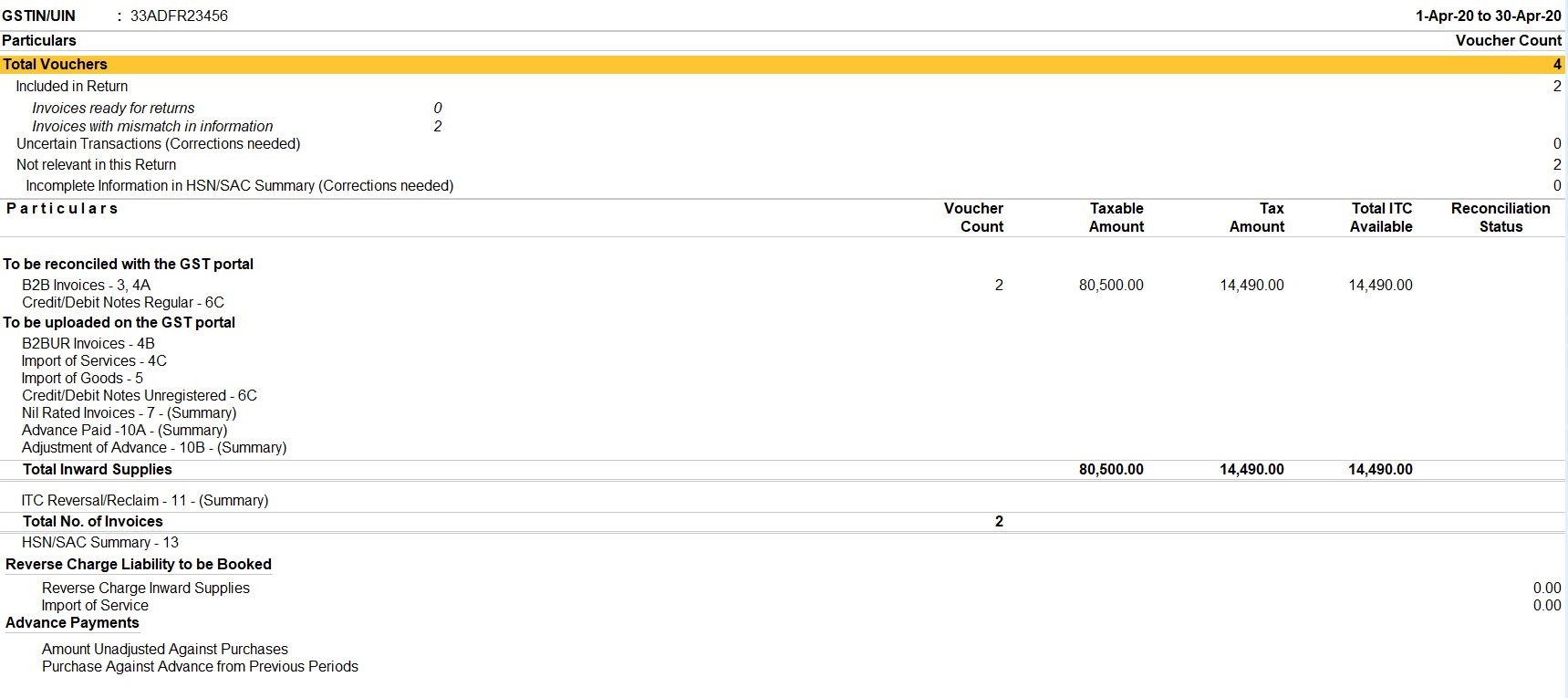

3.Go to Gateway of Tally prime >Display more Reports> Statutory Reports> GST Reports> GSTR-2> Enter.

4.Go to Gateway of Tally prime > Display more Reports > Statutory Reports > GST Reports > GSTR -3B > Enter.

Service Tax Sum

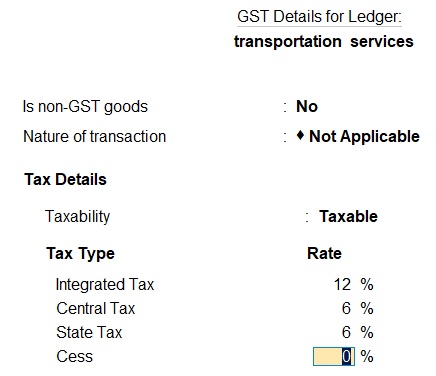

1. Providing transportation based services to ABT parcel ltd Chennai,tamilnadu worth rs.150000. Additionally GST 12% is charged on the invoice with reference number SR101.

2. Providing internet & telecom communication based services to info tech ltd Bangalore, Karnataka worth rs.275000. Additionally GST 18% is charged on the invoice with reference number SR105.

3. Receiving a hotel accommodation services from holiday inn hotel Salem, tamilnadu worth rs.5500. Additionally 18% GST charged on the invoice with reference number HI123.

4. Receiving professional services from terabyte ltd Gujarat worth rs.75000. Additionally 18% GST charged on the invoice with reference number HI124.

Tally Prime

Introduction.

- Introduction of Tally Prime

- History of Tally

- Company Creation in Tally Prime

- Group and Ledger in Tally Prime

- Overview of Masters in Tally Prime

- Trial Balance in Tally Prime

Accounts Only

- Accounting Voucher

- Accounting Voucher Entry in Tally Prime

- Cost Center in Tally Prime

- Budget in Tally Prime

- Payroll in Tally Prime

- Bank Reconciliation Statement in Tally Prime

- Inventory Management

- Inventory in Tally Prime

- Order Processing in Tally Prime

- Godowns in Tally Prime

- Manufacturing Date and Expiry Date in Tally Prime

- Interest Calculation in Tally Prime

- Price List in Tally Prime

- Tax Deducted at Source in Tally Prime

- Goods And Service Tax in Tally Prime

- Data Management

- Point Of Sales in Tally Prime

- Tally Short cuts in Tally Prime

- Multi Currency in Tally Prime

Example Sums

- Opening Balance

- Inventory Voucher Entry in Tally Prime

- Godown Voucher Entry in Tally Prime

- Cost Center Voucher Entry in Tally Prime

- Goods Service Tax in Tally Prime

- Tax Collected at Sources in Tally Prime

Tally Prime 4.0

Accounting terms in tally.

- Company Creation

- Multiple Company Creation

- Groups and Ledger

- Opening Balance Calculation

- Opening Balance Manual Calculation

- Creating Multiple Ledger

- Credit and Debit Rules

- Accounting Only

- Voucher Manual Calculation

- Creating Voucher Entry

- Cost Center

Banking Management

- Bank Reconciliation Statement

- Auto Bank Reconciliation

- Streamlining Bank Cheque Management

- Print Cash and cheque deposit slips

- Post Dated Cheque

- Accounts Receivable and Payable

- Set Party's Credit Limit

- Stock categories

- Manufacturing Stock (Stock Merge)

- Stock Valuation Methods

- Godown Maintenance

- Damage Goods Maintenance

- Various Interest Calculation

- MFG Date & Expiry Date

Order Processing

- Purchase Order Processing

- Sales Order Processing

- Order Cancellation

- Reorder Level

- Product Price Level Management

- MIS Reports

- Ageing Analysis

- what is Tax Deducted at Source

- Tax Deducted at Source Practical Work

- TDS Reports

GST - Goods Tax

- What is GST

- GST - Intrastate Supply

- GST - Interstate Supply

- GST - Return of Goods

- GST - Supplies Inclusive of Tax

- GST - Tax Rates at Master and Transaction Levels

- Input Tax Credit Adjustment

- GST - Tax Payment

- GST - with various dealers

- GST - Exports,Imports,Exempted Goods and SEZ Sales

- Advance Receipt and Payment Entries in GST

GST - Service Tax

- GST service Tax

- GST - Intrastate service

- GST - Interstate service

- GST - Cancellation of Services

- Multi Service and Exempted Service

- GST Reports - Amended Transactions

- TCS - Introduction

- TCS Normal Rated Transactions

- TCS Lower rate and Higher Rated Transactions

- TCS Transfer of any rights transactions

- TCS advance receipt and adjusting towards bill

- TCS tax Payment

- Job Costing

Data Maintenance

- Invoice Printing Management

- Multi Currency

- Changing Company Financial Year

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions

- e-Learning Centers

- Call Us: +91-9214493851

- Login | Register

- Online Test Series - TOPPERSEXAM.COM

Service Tax In Tally ERP 9 Notes

Tally notes, tally.net feature in tally.erp 9, new tally notes, tally erp 9 shortcut keys, tally erp 9 tutorials, tally.erp 9 notes (audit working paper), tally.erp 9 release notes for release 4.92, tally.erp 9 notes in hindi, tally erp 9 notes : tds ( tax deducted at sources ).

Tally ERP 9 Notes - Service Tax

Define Service Tax at the Company Level

Go to Gateway of Tally --> F11: Features --> F3: Statutory.

· Set Enable Service Tax to Yes.

· Enable Set/Alter Service Tax Details to Yes to display the Service Tax Details screen.

· Select the required details.

· Enable Set/alter service tax details to Yes.

· Enter the Name.

· Enter the rate for Service Tax.

· Enter the rate for Education cess.

· Enter the rate for Secondary education cess.

· Press Enter.

· Press Enter to save the details.

·

To Create the Service Tax Ledger

· Go to Gateway of Tally --> Accounts Info.-- > Ledgers-- > Create.

· Select Duties and Taxes as the group name in the Under field.

· Select Service Tax as the Type of Duty/Tax.

· Select Service Tax as the Tax Head, from the List of Tax Heads.

· Select the rounding method.

· Press Ctrl + A to save the details.

Record the Sale of Services

· Go to Gateway of Tally-- > Accounting Vouchers-- > F8: Sales-- > Accounting Invoice.

· Select the party’s name in the Party's A/c Name field.

· Select the sales ledger under Particulars.

· Enter the amount in the Amount field.

· Select the ledger grouped under duties and taxes ledger. The service tax rate will get calculated automatically, using the details defined at the company level.

· Enter the bill-wise details, as required.

· Enter Narration, if required.

Service Tax on Advance Payment

To record an advanced payment

· Go to Gateway of Tally-- > Accounting Vouchers-- > F5: Payment.

· Click S: Stat Payment.

· Select Service Tax as the Tax Type.

· Enter the date in the Period from field and in the To field.

· Select Advance in the Type of Payment.

· Select bank ledger in the Account field.

· Select the expense ledger for arrears under Particulars.

· Enter the Amount.

· Enter the Bank Allocation details, as applicable.

· Press Ctrl + A to save the invoice.

Reverse Charge - To record a reverse charge transaction

· Go to Gateway of Tally-- > Accounting Vouchers-- > F9: Purchase- > Accounting Invoice.

· Enter the Supplier Invoice No.

· Enter the Date.

· Select the party's name in the Party's A/c Name field.

· Select the purchase ledger under Particulars.

· Enter the amount.

· Select duties and taxes ledger. The service tax rate will get calculated automatically, using the details defined at the ledger level.

· Press Enter to save the invoice.

Support/Help

- Enqiury Form

- Self Learning

- Live Training + Downloads

- Education/Test DVD's

- Address: Tally Academy http://www.tallyonlinetraining.com/

- Mobile: +91-9214493851

- E-mail: [email protected]

Bank Details

- M/S SOFTCOM COMPUTER INSTITUTE

- SUBZI MANDI,KOTA-(RAJ.)-324005

- AC.NO.: 688305023877

- RTGS/NEFT/IFSC CODE: ICIC0006883

- Branch: Subji Mandi Kota(Raj) India

- OR IN THE CASE OF D.D. IS IN FAVOUR OF "SOFTCOM COMPUTER INSTITUTE" PAYABLE AT - KOTA (RAJ.)

Have any Questions

If you have any questions, feel free to call us

Contact No: +91-9214493851

10AM-7PM (Working Days)

- Layout 1 Full Width

- Layout 1 Boxed

- Layout 2 Full Width

- Layout 2 Boxed

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Implementation of Service Tax in Tally.ERP 9

Loading Preview

Sorry, preview is currently unavailable. You can download the paper by clicking the button above.

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

dVIDYA : e-learning | CA/CS/CMA Foundation | CBSE/ISCE/Boards- Class 11-12 | Competitive Exams

Practical Assignments : GST Accounts–Tally

The Practical Assignments-Tax Accounts- covers Basic tasks of Maintaining GST Accounts, from set up, Data Entry to GST Reports, in Tally Prime Rel 3.x.

This assignment is in continuation to Practical Assignments of Basic Financial Accounting & Basic Invoicing & Inventory Accounts. Maintain GST Accounts in the same Company in which Basic Financial Accounts and Basic Invoicing & Inventory Accounts Practical Assignments data were entered.

Perform the operations for each Assignment as explained. Capture the screenshots (Prtscr) and paste it in MS Word file in 1×1 cell. Write the number and Name of screen shot as indicated. Explain the options and operational step.

This way, capture the screenshots and place in MS Word file, in sequence. Don’t repeat same screenshot.

After completing all assignments, take Back up of the data files. Now email to [email protected], attaching the Data Back Up file and screenshot zip file.

GST Accounting – Practical Assignments

Continue in same Company after previous assignments

01-1 Company GST Features

[At Company >Click F11. At Company Features , under section Taxation , set Yes at Enable Goods & Services Tax (GST) . Next, At GST Details screen , under GST Registration Details section, enter the relevant details.]

Capture Screenshot 1-1A : Company Features . 1-1B : Company GST Details set up

For more details, visit

https://dvidya.com/goods-service-tax-gst/ https://dvidya.com/goods-services-tax-gst-set-up-composition-dealers-tally/ https://dvidya.com/goods-services-tax-gst-set-up-regular-dealers-tally/ https://youtu.be/STv3wbduT8A https://youtu.be/RwJJIYC6msE https://youtu.be/VSS48c_LZXY https://youtu.be/OjSvFYUJ_bI https://youtu.be/mLrLyOeDX78 https://youtu.be/7wlTsturfks

02 GST Masters

02-1 Create SGST Ledger Account Master

[Select GoT>Create> Ledger. At Ledger Account creation , at Name , enter SGST; at Under , select Duties & Taxes ; at Tax Type , select SGST/UTGST ; At Inventory Values are affected , set No .

Capture Screenshot 1-2 : SGST Ledger Account Creation.

https://dvidya.com/gst-set-up-accounts-inventory-masters-tally/ https://youtu.be/x8VZLjVEeug https://youtu.be/XVZbi0-ufDY https://youtu.be/Uzsise4yZXg

02-2 Create CGST Ledger Account Master

[Select GoT>Create> Ledger. At Ledger Account creation , at Name , enter CGST; at Under , select Duties & Taxes ; at Tax Type. At Inventory Values are affected , set No . Capture Screenshot 2-2 : CGST Ledger Account Creation.

02-3 Create IGST Ledger Account Master

[Select GoT>Create> Ledger. At Ledger Account creation , at Name , enter IGST; at Under , select Duties & Taxes ; at Tax Type select I GST ; At Inventory Values are affected , set No .

Capture Screenshot 2-3 : CGST Ledger Account Creation.

https://youtu.be/XVZbi0-ufDY

02-4 UQC set up in UoM Master

Set UQC in UoM – Kilograms [Select GoT>Alter> Unit. Select Kilogram. At Unit Alteration , at Unit Quantity Code (UQC) , select KGS-Kilograms from the UQC list. Press Ctrl+A to save].

Capture Screenshot 2-4 : UoM-UQC set up.

https://youtu.be/KAKto78n9fQ

02-5 GST details set up in Stock Item Master

Set GST details in Stock Item Wheat, Select GoT>Alter> Item. Select Wheat, At Stock Item Alteration, Under HSN/SAC & Related Details, at HSN/SAC Details , select Specify Details Here. At HSN Description – Food grains, HSN Code- 1234, At Description of Goods, select Specify Details Here , Under GST Rate and related Details, At GST Rate details, select Specify Details Here . At Taxability Type, select Taxable . At GST Rate, enter the GST Rate applicable for the Item. At Type of Supply, select Goods .

2-5 : Capture Screenshot UoM-UQC set up.

https://youtu.be/U7fuonC9dkI https://youtu.be/LK-df_Oh6Vk

02-6 Set GST details in Supplier Master

At Supplier Ledger Account, enter Tax related details [Select GoT>Alter>Ledger, select ABC & Co. At Ledger Alteration, click F12:Configure. At Ledger Master Configuration screen, under Party Tax Registration details , set Yes at Provide GST Registration details . At Tax Registration details of Ledger Account Master, Enter Registration Type- Regular, GSTIN 19AAAC1234K1ZV. At Set Alter Additional Details, set Yes and then Place of Supply, select the State of the Party.

Capture Screenshot : 2-6A: Ledger Account Master, 2-6B: Ledger Master Configuration screen,

https://youtu.be/1_jlZD8mXkI https://youtu.be/B6jEPMw26Tg

03 GST Invoicing

3-1 Create GST Sales Invoice .

Create Sales Invoice for 10 kg of Wheat @25 per kg sold to ABC & Co on 1-5-21. [Select GoT>Vouchers. Click F8:Sales (or press F8). Select Sales Voucher type from List. Click Ctrl+H and select Item Invoice . Enter Voucher Date 1-5-21 . At Party A/c Name , select ABC & Co . At Sales Ledger, select Sales . At Name of Item , select Wheat , At Quantity , enter 10 kg. at Rate , enter 25/kg. The amount 250 would be shown. In next line, select End of List . Next select SGST, the SGST amount (15.00) would be auto calculated. Next select CGST. the CGST amount (15.00) would be auto calculated. The total Invoice amount (250.00+15.00+15.00 = 280.00) is displayed. Press Ctrl+A to save the Voucher].

Capture Screenshot : 3-1 GST Sales Invoice Entry ,

https://youtu.be/L57aR4Zb7GM https://youtu.be/S0y56oS7r1U

3-2 Print the Sales Voucher

Voucher dated 1-5-23 on ABC Co [Select GoT>Day Book . At Day Book display, press F2 and Date 1-5-23. Select the Sales Voucher from the list to get the Voucher Alteration. Press Ctrl+P to get the Print screen. Click I:Preview to View the Print form of the Invoice on screen]

Capture Screenshot : 3-2 GST Sales Invoice in Print ,

https://youtu.be/L57aR4Zb7GM https://youtu.be/S0y56oS7r1U

03-03 GST Reports

- Display GSTR-1 for 1-4-23 to 31-7-23

[Select GoT>Display more reports>GST Reports>GSTR-1. Click F2:Period (or press F2) and enter Period from 1-4-23 to 31-7-23 to display GSTR-1 Report

Capture Screenshot : 3-3 GSTR-1 Display, https://dvidya.com/gsrt-1-return-filing-tally/

Ask Question, Get Answer

This will close in 0 seconds

209 Tally Rd, Wappapello, MO 63966

What's special.

Vinyl sided 2 or 3 bedroom cottage with Metal roof with 20' x 30' detached workshop with partial finished room with sink on 3 acres a short drive down to the Boat Ramp. Show more

Likely to sell faster than 88 % nearby

Travel times

Facts & features, bedrooms & bathrooms.

- Bedrooms : 3

- Bathrooms : 1

- Full bathrooms : 1

- Main level bathrooms : 1

- Main level bedrooms : 3

- Space Heater, Gas

- Basement : None

- Has fireplace : No

Interior area

- Total structure area : 792

- Total interior livable area : 792 sqft

- Finished area above ground : 792

- Parking features : Off Street

- Levels : One

- Size : 3 Acres

- Parcel number : 1082152200000000312

- Special conditions : Standard

Construction

Type & style.

- Home type : SingleFamily

- Architectural style : Bungalow / Cottage

- Property subtype : Single Family Residence

- Year built : 1970

Utilities & green energy

- Water : Community

Community & HOA

- Subdivision : No

- Region : Wappapello

Financial & listing details

- Price per square foot : $56/sqft

- Tax assessed value : $22,000

- Annual tax amount : $175

- Date on market : 12/12/2023

- Ownership : Private

- Wayne County

- 209 Tally Rd

Nearby cities

- Greenville Real estate

- Lowndes Real estate

- McGee Real estate

- Mill Spring Real estate

- Patterson Real estate

- Piedmont Real estate

- Shook Real estate

- Silva Real estate

- Wappapello Real estate

- Williamsville Real estate

Tally Practical Assignment with Solutions PDF

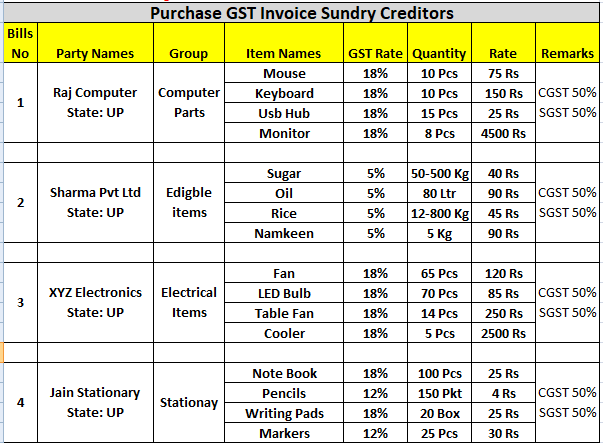

Tally Practical Assignment including GST with Solutions PDF for free download. Super Success Institute Tally computer training coaching classes day by day task. Notes is very useful for learn and practice the tally ERP 9 with GST. We found that student face problem to find the practice assignment of Tally. The Training Faculty of Super Success Institute compiled the practice task in this PDF for self study of students.

Our Tally Coaching Class Assignment / task includes following:-

Purchase Invoice Bills Sundry Creditors Sales Invoice Bills Sundry Debtors Purchase Invoice Bills Batch Wise Details

Brief of GST Business For Purchase & Sales Of Goods Business for Service providing Who are Compulsory For GST Registration Document Required For GST Registration GST What is GSTIN Number Types of GST Rates GST Rates How GST Apply in Tally How GST Apply in Invoice SGST (State Tax) & CGST (Central Tax) IGST (Interstate Tax) – Purchase GST Invoice Sundry Creditors Sale GST Invoice Sundry Debtors

Purchase Entry

Purchase Invoice with GST (Sundry Creditors)

Sales Invoice with GST Sundry Debtors

| Bills No | Party Names | Item Names | GST Rate | Quantity | Rate |

| 1 | Raghu Raj State: UP | Mouse | 18% | 8 Pcs | 85 Rs |

| Keyboard | 18% | 10 Pcs | 190 Rs | ||

| Usb Hub | 18% | 12 Pcs | 30 Rs | ||

| Monitor | 18% | 7 Pcs | 5000 Rs |

Entry of 25 Sundry Debater bills are given in the PDF

Download Tally Practice Assignment PDF

Document Name : Tally Practice Assignment with solution

Publisher : S uper Success Institute Muzaffarnagar and https://onlinestudytest.com Author : Super Computer Muzaffarnagar Number of Pdf Pages : 28 Quality Very good

Note : The Tally Practical Assignment with Solutions notes PDF are property of Super Success Institute Muzaffarnagar. We are sharing the google drive download link with due consent of Computer Coaching Institute.

Tally Prime Notes

- Fundamental of Accounting and Tally Prime Notes

- Introduction of Tally Prime Notes

- Groups and Ledgers in Tally Prime Notes

- Voucher Entry in Tally Prime Notes

- Create Stock Item in Tally Prime Notes for Practice

- Bill wise entry in Tally Prime

- Batch wise Details in Tally Prime Notes

- Cost Center in Tally Prime Notes

- Export Import Ledger in Tally Prime

More Tally PDF may be found – Tally Notes PDF Archives – SSC STUDY

Tally Prime Book PDF Free Download – SSC STUDY

Tally ERP9 Question Paper in Hindi – Online Study Test

Related Posts

O level computer course book pdf download, tally computer course notes pdf download, computer book pdf for competitive exams in hindi, computer questions pdf for competitive exams.

- TallyPrime Server

- Developer Reference

- Tally.ERP 9

Service Sales Ledger (Service Tax)

You can create a ledger for accounting the services rendered, under Sales Accounts group.

- Gateway of Tally > Vouchers > press F8 (Sales). Alternatively, press Alt + G (Go To) > Create Voucher > press F8 (Sales). Press Ctrl + H (Change Mode) to select the required voucher mode ( Accounting Invoice , in this case)

- Enter the ledger Name.

- Select Sales Accounts as the group name in the field Under.

- Set Inventory values are affected? to No.

- Set the Rounding Method, if required.

- Set the option Is Service Tax Applicable? to Applicable.

- Enter a Name of the service category, if required.

- Enter the rate of Service tax.

- Enter rate of Education cess, if required

- Enter rate of Secondary education cess, if required.

- Enter the rate of Swachh Bharat cess.

- Enter the rate of Krishi Kalyan cess.

- Press Ctrl+A to save. The Ledger Creation screen appears as shown below:

8.Press Enter to save.

Related Topics

- How to Configure Specified Person Higher Tax Rate u/s 206AB

- How to Configure Specified Person Higher Tax Rate u/s 206CCA

- How to View Income Tax Computation Report (Finance…

- New Tax Regime Under Section 115BAC

- How to Record Sales Receipts and Sales with…

Forgot ID/Password?

Reset password.

IMAGES

VIDEO

COMMENTS

1.Press F11 (Features) > set Enable Service Tax to Yes. 3.Press F12 (Configure) in the Service Tax Details screen, and set the option Enable SEZ unit to Yes as shown below: 4.Press Ctrl+A to accept and return to Service Tax Details screen. 5.Set the option Is company in SEZ? to Yes.

Service Tax entries In Tally PrimeIn this video, we'll discuss the Service Tax entries in Tally Prime. We'll cover questions like what is a Service Tax, wha...

Voucher Class for Sales - Accounting Invoice. Specifying Rate as Inclusive of Service Tax. Recipient Liability. Service Received from Non-taxable Territory. Import of Services. Reverse Charge. Configure Reverse Charge for Service Tax. Tax Liability with Reverse Charge. Modifying Tax Details in Transactions.

Service tax integrated in Tally.ERP 9 takes care of your service tax transactions. It eliminates error-prone information, incorrect remittance, penalties, interests, compliance issues, etc. Service Tax in Tally.ERP 9 needs a one-time configuration for service tax features to be activated. Tally.ERP 9 tracks bill-wise (bill-by-bill) detail and ...

To get started with service tax using TallyPrime, you have to enable the service tax options and enter your company's service tax registration details. To enable service tax. Press F11 (Features) > set Enable Service Tax to Yes. If you do not see this option:. Set Show more configurations to Yes.. Set Show all configurations to Yes. Enter ...

Service Tax shall be paid to the government account through any designated branches of the authorised banks, along with G.A.R.-7 Challans. Returns & Time lines The Service Tax returns are to be filed half yearly in the prescribed Form ST-3 or Form ST - 3A 1. Form ST-3 - For all the registered assessee, including Input Service Distributors,

Create the company Crystal Services (P) Ltd in Tally.ERP 9 and specify it is located in India. 2. Go to F11: Features > Statutory & Taxation > Select Service Tax. 3. In the Service Tax Configuration screen, select the applicable date to enable Service Tax functionality.

1. Go to Gateway of Tally prime > masters > Ledgers > Create . 2. Enter the ledger Name . 3.Select sundry debtors as the group name in the field Under . 4.Select Service Tax as the Type of duty/tax . 6. press Enter to save. 1. Select Change mode > Accounting Invoice > Enter.

On 24-11-2010, ABC Company made payment of Rs. 4,41,200 to Raman Creations towards the service purchases. On 29-11-2010 after export of goods, ABC Company claimed the refund of service tax Rs. 41,200 paid on the input services purchased as on 15-11-2010 from Raman Creations, which are used for providing services exported.

To Create the Service Tax Ledger. · Go to Gateway of Tally --> Accounts Info.-- > Ledgers-- > Create. · Enter the Name. · Select Duties and Taxes as the group name in the Under field. · Select Service Tax as the Type of Duty/Tax. · Select Service Tax as the Tax Head, from the List of Tax Heads. · Select the rounding method.

Setting up GST Service Ledgers in Tally Prime ensures accurate tax calculations and reporting for services your business provides. Here's a detailed guide: 1. Accessing the Ledger Creation Menu: 2. Specifying Ledger Type: 3. Choosing the Ledger Name: 4. Entering Ledger Details: 5. Setting GST Details: 6. Configure Taxability: 7. Additional Options: 8. Saving and […]

Step 1: Create a Payment Voucher Go to Gateway of Tally > Accounting Vouchers > F5: Payment 1. Press F2 and change date to 05/07/2008 2. In Debit field select Service Tax @ 12.36% from the List of Ledger Accounts and press enter to view Service Tax Bill Details screen. 3.

For the accurate calculation of Service Tax and TDS follow the given steps. 1. Book the Expenses and Service Tax through Purchase Voucher as shown. 2. Deduct TDS in a separate Journal Voucher using of Alt + S: TDS Deduction. 3. Make the Payment to party. 4. Check the Service-Tax Input credit Form -report displays the realised value & total ...

Gateway of Tally > Display More Reports > Service Tax Reports > Form ST3. Alternatively, press Alt+G (Go To) > type or select Service Tax Reports > Form ST3 > and press Enter. 2.Select the row Service Tax Credit Availed and press Enter. 3.Select Service Credit Received in the Service Tax Credit Availed screen and press Enter.

>> Accounting for Opening Service Tax Credit in TallyERP9 >> Payment of Service Tax ... 17 Chapters in TallyPrime Book + 45 Practical Assignment with GST in TallyPrime & All features are described with Practical Problems with Solutions. ... the web site of Tally Solutions Pvt. Ltd. for resolving their doubts or for clarifications Trademark ...

Tally Prime with GST Course Notes with Example. Step by Step Guide for GST implementation, create CGST, SGST, IGST ledgers, Sample Purchase and Sales entry with GST. Computer Training Institute Notes with practice assignment PDF is very useful for learners. GST (Goods and Service Tax) CGST - Centre Goods and Service Tax

The Practical Assignments-Tax Accounts- covers Basic tasks of Maintaining GST Accounts, from set up, Data Entry to GST Reports, in Tally Prime Rel 3.x. This assignment is in continuation to Practical Assignments of Basic Financial Accounting & Basic Invoicing & Inventory Accounts. Maintain GST Accounts in the same Company in which Basic ...

Service Tax is a tax levied by the central government of India on service providers on certain Service transactions. To get started with service tax using Tally.ERP 9, you have to enable the service tax options and enter your company's service tax registration details. To enable service tax 1. Go to ...

Select GST as the Type of duty/tax. [6-Sales Process in TallyPrime-3 & Higher] Select State Tax as the Tax type. Note : Percentage of Calculation should be 0% ( Don't Change ) due to multiple Tax Rate. Similarly, you can create ledgers CGST & IGST by selecting the relevant Tax type under GST. For CGST Ledger :

Zillow has 16 photos of this $44,500 3 beds, 1 bath, 792 Square Feet single family home located at 209 Tally Rd, Wappapello, MO 63966 built in 1970. MLS #23073301.

We found that student face problem to find the practice assignment of Tally. The Training Faculty of Super Success Institute compiled the practice task in this PDF for self study of students. Our Tally Coaching Class Assignment / task includes following:-. Purchase Invoice Bills Sundry Creditors. Sales Invoice Bills Sundry Debtors.

Date of Registration - Enter the Date of Registration of Service Tax for your service. Type of Organisation - In this field select the type of your organisation from the List of Organisations menu. Enable Service Tax Round Off: By default this option will be set to Yes. If this option is Yes, Service Tax will get rounded off to nearest ...

To record the transaction. 1. Gateway of Tally > Vouchers > press F9 (Purchase). Alternatively, press Alt + G (Go To) > Create Voucher > press F9 (Purchase). Press Ctrl + H (Change Mode) to select the required voucher mode ( Accounting Invoice, in this case) 2.Enter AZ/04/025 in the field Supplier Invoice No. 3.Enter 01-06-2016 in the field Date.

Reagan's 1981 tax cut and Obama's 2012 tax cut extension were 3.5% and 1.7% of GDP, respectively. Trump's 2017 tax cut, by contrast, was estimated to be about 1% of GDP.

Service Sales Ledger (Service Tax) You can create a ledger for accounting the services rendered, under Sales Accounts group. Gateway of Tally > Vouchers > press F8 (Sales). Alternatively, press Alt+G (Go To) > Create Voucher > press F8 (Sales). Press Ctrl+H (Change Mode) to select the required voucher mode (Accounting Invoice, in this case); Enter the ledger Name.