- Knowledge Base

- Free Resume Templates

- Resume Builder

- Resume Examples

- Free Resume Review

Why you need to write a controller resume?

[ Click here to directly go to the complete controller resume sample ]

Being highly skilled in your job alone is not enough to get you a controller job. Writing a resume itself is a skill, and you need to learn it for creating a controller resume for yourself.

First, writing all of your previous experience in the controller resume will not work for the controller job you are applying for. You need to understand how exactly to personalize the resume to maximize the chances of getting an interview.

Secondly, after adding the information, your work is not over. You need to seperate the sections of controller resume to make it more readable and professional.

In this controller resume guide, we will tell you everything you need to know to create an impeccable controller resume.

Here is a small summary of the controller resume blog:

- Highlight your top controller skills in the resume summary if you have over 3 years of experience.

- Create a separate Key Skills section and cite all your skills there.

- Use single-line bullet points to describe your experience in the controller resume.

- If you are an entry-level professional, add additional information in the resume such as internships, volunteer work, certifications, training, etc.

- Use month & year format for writing dates in your controller resume.

In today’s world, the controller job is high in demand. And everyone is trying their best to score an interview. We at Hiration can help you in your quest by helping you with our resume writing service.

From this blog, you will learn, how to create a professional controller resume that brings you closer to your dream job.

Here are the topics we will learn:

- What is a controller resume, and why do you need one?

- How to write the professional experience section in the controller resume?

- How to create key skills in the controller resume?

- How to include your personal information in the controller resume?

- How to write a professional summary in the controller resume?

Meanwhile, if you want, go to Hiration Online Resume Builder tool and create a controller resume by choosing from 25+ professional templates.

Job Description for a Controller

A controller’s job is to manage the accounting and financial operations of a company/ It is a senior-level position that requires as extensive accounting experience.

In a small-scale organization, the controller is the head of financial department, and have to take crucial decision including budgeting, reporting, risk management, etc. But in large organizations, controllers collaborate with chief financial officers to make decisions.

A typical controller job description sample:

- Overseeing, planning, and coordinating the financial operations of a company

- Monitoring and analyzing the financial data to make informed decisions for bolstering growth

- Developing external and internal financial statements

- Coordinating with auditors for ensuring a smooth audit process

- Playing a key role in creating a company budget

- Analyzing financial operations and implementing a new process for improvement

- Monitoring the business performance metrics

- Identifying & introducing new accounting software for improving performance

- Hiring accounting staff and training them by complying with company regulations

Controller Salary

According to the US Buerue of Labor Statistics , the average salary of a controller in the USA is $129,890 per year .

According to salary.com , it’s $221,690 per year .

According to indeed.com , the average salary of a controller in the USA is $96,477 per year .

What Is a Controller Resume?

If you think that your skills as a controller are enough to get a controller job, you are in a big misunderstanding.

Most recruiters don’t have any idea about how the job function. Thus they are incapable of gauging your skills and experience from your resume. However, they are highly knowledgeable on how a well-designed resume should look like. And they are most likely to select candidates who have a well-designed resume.

A tailored financial controller resume has all the essential information that a recruiter considers before shortlisting your resume.

However, you not only have to pass the recruiters. At first, you have to pass the ATS test just to get to the recruiter’s hands.

According to cio.com, 40% of employers uses ATS systems to sort resumes nowadays during their hiring process .

ATS systems sort the resumes based on keywords. If the resume contains specific keywords, the system passes the resume to the hiring manager.

So, when writing a financial controller resume, you also need to think about the ATS requirements as well.

Want to know how to create a professional resume in detail? Read the "Hiration's 2023 Guide on how to write a resume ” for more information.

Have you written a financial controller resume beforehand? Get it professionally reviewed by himation resume experts by going to the Hiration Online Resume Builder tool.

Moreover, if you have already created a leasing consultant resume, get it reviewed by Hiration Resume Experts.

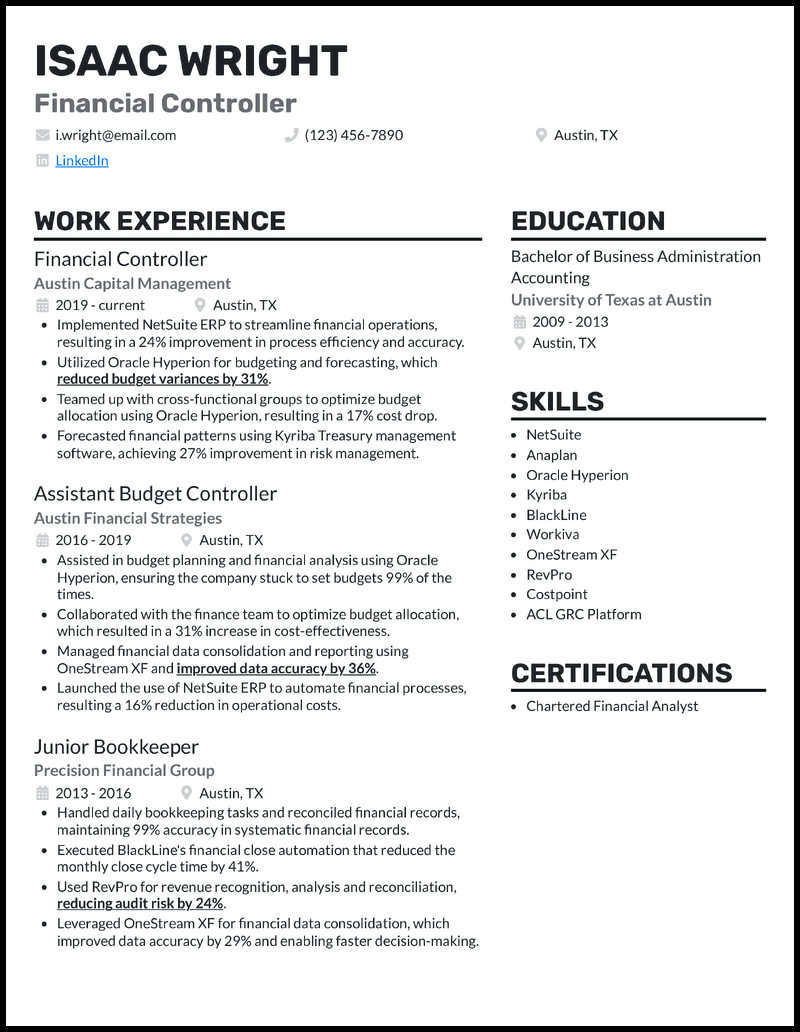

Controller Resume Sample

Given below an ideal accounting controller resume sample showing you how the accounting controller resume must look like.

- Supervised the entire accounting operation for every department and managed USD 200mn.+ turnover

- Oversaw the payroll operation for 500+ employees in compliance with the organizational policy & procedure

- Managed the reconciliation of banking activities for 20 accounts while overseeing the treasury for ensuring accurate information

- Identified and implemented various technologies at 27 branches for ensuring effective cost containment on a regular basis

- Prepared financial reports, balance sheets, budgets, and financial forecasting reports on a quarterly & yearly basis for all branches

- Corresponded with the key stakeholders for financial decisions & implemented new processes for bolstering business growth

- Played a key role in managing financial proposals & contracts for 30+ real-estate lease agreements

- Optimized the guest experience by developing an employee training program in compliance with the Industry Standard

- Corresponded with the banks to get effective lease terms and bank lone rates while saving USD 5mn in bank interest

- Targeted various markets throughout the country and increased revenue by 20% within a span of 2 years

- Prepared an annual budget of USD 1.8mn for renovating the movie theatre, purchasing films, and providing salaries to 150 employees

- Coordinated with the marketing teams to brainstorm 10+ marketing campaigns for increasing guest attendance by 9%

- CGPA : 3.8/4.0

- CGPA : 3.7/4.0 | Dean's list for 4 semesters

- Language: English (native) & Spanish (intermediate)

Controller Resume Sections

After you finish writing the master resume, you need to divide the resume into different sections for improving readability. Here are some of the essential critical areas of the resume.

- Personal Information

- Profile Title

- Summary / Objective

- Technical Skills (if any)

- Professional Experience

- Certifications (if any)

- Awards & Recognition (if any)

- Additional Information (if any)

Want to know more about the key sections of the resume? Read the Hiraiton Resume Key Section guide for more information.

If you want, visit the Hiration Resume Builder and select from 20+ resume controller resume templates to create a professional financial controller resume for yourself.

How to Write a Controller Resume?

If you have been wondering, how exactly to create a good controller resume? Here are the three stages for creating one. These stages are:

- First Stage: Master Controller Resume

- Second Stage : Controller Resume First Draft

- Third Stage : Controller Resume Final Draft

Master Controller Resume

Creating a master controller resume is the best way to store information in one place. We suggest you not think about anything before you jot down all your previous experiences in the master resume.

This helps in two ways:

Resume writing for the present: A master resume will act as the base point for your controller resume. When you actually start creating your controller resume, you will have fewer chances of forgetting any important information in your resume.

Resume writing for the future: If you ever need to update your resume for another job in the future, you will have all your information in one place. And creating different targeted resumes for applying for other jobs will become much easier.

Now, as we understand why creating a master controller resume is so important, let’s look at the second stage of the controller resume.

Controller Resume: First Draft

In this step, we actually start dividing the information into the master data into different sections. These sections comprise of:

- Certification (if any)

Controller Resume: Final Stage

Now it’s time to create the key skills and the summary section.

Key Skills Section : Key skills section consists of all the keywords required to get past the ATS system. It also helps the recruiters quickly gauge the candidate’s experience and skills easily. But it is challenging to create the key skills section without professional experience. That’s why we recommend you to make the key skills section after completing the professional experience section.

Professional Summary : A professional summary is the first thing a potential employer reads in your resume. That means you need to make sure it perfectly hooks the reader to go through the entire resume. That’s why we recommend you create the resume professional summary section at the very last to have a much clearer understanding of the trajectory of your skills and experiences and effectively projects on the professional summary.

Go to the Hiration Resume Builder tool if you wish to create a controller resume by yourself, and select from 20+ professional resume controller resume templates for easy resume creation.

Controller Resume: Header

A resume header makes your resume recognizable from 100 other candidate’s resumes. So you need to ensure that your resume header is professional and unique. Here are some tips for creating a professional resume header for the financial controller resume:

- Do not write “ Resume ” or “ CV ” at the top of your resume.

- Write your own name as the resume header.

- The font size of the resume header must be 16- 20 points.

- Leave a single space between your first and last name. E.g. “Mark Wines”

- If you have a middle name, only add the initial of the middle name in the header. For example, “ Michael Lee Cooper ” should be written in the resume header as “ Michael L. Cooper .”

If you want to create a perfect controller resume, use the Hiration Resume Builder Tool, as all these rules are implemented in the resume builder tool by default.

Example of controller resume header:

Controller Resume: Personal Information

Personal information is one of the most critical pieces of information to put on a resume. This information will help the employer contact you if you get selected for an interview. If you do not use correct personal data on your resume, it might cost you the job.

Here is the information considered as personal information:

- Updated mobile number

- Professional email ID

- Current Location

Here is a format for writing the personal information section of the controller resume.

{Personal Contact number} | {Professional E-mail Address} | {Current Location of Residence}

Updated Mobile Number

If recruiters select your resume for an interview, what way can they contact you?

Via a phone call.

Most recruiters like to get on a call with the potential candidate before a face-to-face interview.

Here are some guidelines to write your contact information in the accounting controller resume:

- Always mention the country ISD code before writing your phone number

- Always add a plus(+) sign before writing the ISD code

- For example: +1 (146) 254 1387

Professional Email Address

Email is the best way to communicate with the recruiters professionally.

But if you are not careful and make typos when writing email id on your resume, it will become a catastrophe.

Apart from that, if your email id is not professional and has a fancy name in it, it may turn off the recruiters and lose the chance to get an interview.

Example of a professional email address:

Example of an unprofessional email address:

The current location you provide will vary based on where you are applying for a job.

- If you are applying for a job within the country, use the City, State code format to describe your location on the resume. For example, Fremont, CA.

- Do not use irrelevant information such as house number, street address, locality, a landmark in your resume.

If you are applying for a job outside your country, then use the city, country code format.

Read the Hiration guide on location in a resume to get a clearer understanding.

Here is an example of the personal information section of the accounting controller resume for you:

Use our Hiration Resume Builder tool if you want to create a professional controller resume for yourself. You can select from 20+ professional designs that you can easily adjust for creating a tailored resume for yourself.

Controller Resume: Profile Title

Each profile title represents the candidate’s professional identity to the recruiters. A recruiter can understand a lot of information from that profile title which helps them gauge the candidates’ skills.

Here are the things a profile title conveys to the hiring manager:

- Current designation

- Functional industry

Here are some tips for you to write your profile title in a professional manner:

- The profile title is the second-largest text in the resume.

- It should be located right under the resume header.

- The typical resume profile title font size is between 14 -16 points.

- The profile title must be specific. For example, if you are an entry-level controller, then write “ Junior Controller ” on the profile title section.

If you land a job where you are not a suitable person, then it might get you into the recruiter’s blacklist and cause you problems in your future job search.

Here is an accounting controller resume profile title example to let you know how to write the profile title correctly.

Controller resume: Professional Experience

The professional experience section is the best place for professionals to showcase their skills and accomplishments.

And effectively communicating your controller resume accomplishments will help you stand out in front of the recruiters and increase your chances of getting shortlisted.

Here are some of the ways you can craft the professional experience section to stand out:

- Frame points

- STAR format

- Bucketing & Bolding

Framing Points

Most recruiters do not have the time to read through a candidate’s resume whole. So, it’s the candidate’s job to highlight your experience in such a way that it hooks the recruiter and makes it impossible for them to ignore your resume.

Here are two financial controller resume examples to show you how it’s done:

Liaised with the stakeholders and implemented innovative solutions for generating $3M in revenue and an additional $1.3M in taxes

Implemented an automated billing system for process improvement & slashed the billing time by 40%

Assisted the software programmers to develop a new payment system for deducing manpower and saving 10+ hours per week

Managed the corporate investment fund while generating a 20% return on investment in a year

Framing Point Analysis

In the second example, the professional experience is nicely written in the one-liner bullet points. It improves the readability and highlights the statistics well.

Recruiters will naturally go towards a resume that is nicely written and easy to read.

Therefore, you need to write the accounting controller resume professional section in single-line bullet points to increase your chances of getting an interview.

Grouping & Highlighting

Another best way to make your professional experience section pop is by using the grouping and highlighting technique. Let us show you how.

Implemented automated billing systems for process improvement & slashed the billing time by 40%

Process Improvement & Revenue Generation

Program Development & Investment Management

Grouping and highlighting: Analysis

If you look closely, you can see that both the example shown above discusses the exact same points. But for example, 2 looks aesthetically more pleasing than example 1 .

Much like you, the recruiter will also find example 2 much more organized and easily readable.

It’s because we have used only the framing point technique in example 1. But we have used the bucketing and bolding method in example 2, making it easier for the recruiter to understand the candidate’s accomplishments.

And by bringing the one-liner points under brackets, it’s easier for the recruiters to get an idea of the candidate’s skills without even reading the whole professional experience section. It makes their job much easier.

STAR Format

If you want to make your resume more effective, you need to create a cause and effect relation in all the one-line bullet points. Here comes the STAR format.

It will help you create a strong relationship between cause and effect and bring more credibility to your professional experience section.

Here is a full form of STAR :

S: Situation where you contributed T: Task you have performed A: Actions you have executed R: Result you have achieved

Here is a perfect example of controller resume professional experience.

Here is a detailed guide on creating the perfect professional experience section in your resume , which will help you create a better professional experience section.

Go to Hiration Online Resume Builder and choose from 25+ professional controller resume templates to create a professional controller resume for yourself.

If you already have a resume, get it reviewed by Hiration Resume experts quickly.

Controller Resume: Education

Providing your education information in the controller resume can be a tricky job. However, as a controller is a senior position, it is necessary to showcase your higher-level education information in the controller resume. It can improve your credibility in front of recruiters and makes you an appealing candidate for the job.

The education section of the controller resume must contain the following elements:

- University Name

- Name of the course

- Location of University

- Enrollment & Graduation Date

Here is the format you can apply to write the education section in the resume:

{School/university Name} | {Name of the degree} | {CGPA} | {Location} & {Dates} (in month & year format)

If you want to learn more about the education section on your resume, read the Hiraiton Education Section 2023 Guide for detailed information.

Here is a controller resume example showcasing an ideal resume education section.

Controller Resume: Certifications

If you have a relevant certification essential for the job you are applying for, do not forget to include it in the resume.

Here are the essential elements that you must add to your accounting controller resume:

- Certificate Name

- Name of the affiliated body

- Institute Location

- Date of certification

We have written a Hiration's 2023 certification guide to help you get more information about resume certification.

Certification format for controller resume: {Name of the Certification} | {Affiliating Institution} | {Location} | {Date} (in month & year format)

Meanwhile, write a controller resume with our guide in the Hiration Resume Builder tool and improve your chance of getting shortlisted for an interview.

Controller Resume: Key Skills Section

Before going to the hands of the recruiters, your resume must pass through the ATS screening process.

And the key skills section is the most keyword-rich part of your resume, which will help you get past the ATS screening test. Here, not only your functional skills but also your technical skills are highlighted.

Are you wondering how to find out the key skills that are perfect for the professional experience section?

- Scan the job description and identify the key skills that are required for the job.

- Go through your own work experience section and pick the key skills relevant to the job.

- Now add those key skills on the resume “key skills” section and arrange them by their relevance.

- Do not stack irrelevant information on the Key Skills section. Ensure to add the skills that are highly relevant to the job you are applying for.

Read the Hiration guide for writing an effective Key Skills section to get more information about how the “Key Skill” section works and how to create an effective Key Skills section for your resume.

Here is an ideal Key Skills section for the controller resume:

Controller Resume Summary/ Objective:

A summary or objective is the first paragraph in your controller resume. So you need to make sure that you write the section more carefully so that recruiters can not skip over your resume.

Controller Resume Summary

A perfect controller resume needs to follow some basic rules:

- Write the resume summary at the end of your resume writing process to avoid leaving out any information at the end.

- Do not write a long resume summary. Focus on writing the resume in just 3-4 lines. Pick the most critical accomplishments from your work experience and include them in the summary section.

- Write the resume summary only if you have work experience which is greater than three years.

Want to learn how to write a resume summary? Here is the Hiration Resume Summary Guide for your reference.

Here is an example of a controller resume summary showcasing how an ideal resume summary should look like:

Hiration resume builder can assist you in writing a professional shortlist-worthy controller resume.

Controller Resume Objective

If you have less than 3 years of experience, you should refrain from writing a resume summary instead of writing a resume objective.

A resume objective is the best choice for the controller resume if:

- If you don’t have any work experience

- If you are a fresher

- If you are an entry-level professional with less than 3 years of experience

The primary objective of a controller resume objective section is to convey what you can contribute to the organization rather than what you want to get from the potential employer.

Here you need to convey your soft skills and project yourself as an individual who is willing to learn and grow in the organization.

Want to learn more about resume objectives: Read the Hiration Resume Objective Guide for more information.

Hiration Resume Review Service

If you want to get your resume professionally reviewed by an expert, here is your chance.

Hiraiton resume experts will review your resume by following the below-mentioned rules:

- Compliance with industry norms

- Content Relevance

- Recruiter Friendly

- Compatible Design

- Conversion Scope

- ATS Compliance

- Compatible Globally

- Assessment of Performance

- Resume Formats

Moreover, with our resume review service, you will get two resumes for free.

Hiration Online Resume Builder

You will find the following features in the online resume builder:

- LIVE resume editor

- Auto bold feature

- LIVE resume score

- 1-click design change

- Full rich-text editor

- 100+ pre-filled resume templates

- 25+ resume designs

- Option to save unlimited resumes

- Intuitive next text suggestion

- JD-resume matcher

- Unlimited PDF downloads

- A sharable link

Use the Online Resume Builder to get all these features NOW!

Key Takeaways

Here are some key points you can takeaway from this blog:

- Always write your own name as the resume header to make it easily recognizable by the hiring manager.

- Double-check your contact details in the resume to make sure you are providing the correct information. Else, all your work will go to waste.

- Create separate sections for each of the important elements of the resume to make it more readable.

- Create the professional experience section in single-line bullet points. Do not use paragraph format in the professional experience section.

- Make sure to include relevant keywords in the resume wherever possible. It will help you get past the ATS systems.

Use all the tips mentioned above to create a perfect controller resume for yourself. We have provided appropriate financial controller resume samples and examples for your reference as well.

Go to Hiration resume builder and create a professional resume for yourself. Additionally, reach out to us at [email protected] and you can get 24/7 professional assistance with all your job & career-related queries.

Share this blog

Subscribe to Free Resume Writing Blog by Hiration

Get the latest posts delivered right to your inbox

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

Is Your Resume ATS Friendly To Get Shortlisted?

Upload your resume for a free expert review.

Build my resume

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- Free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

5 Controller Resume Examples Made for the Job in 2024

Controller Resume

- Controller Resumes by Experience

- Controller Resumes by Role

- Write Your Controller Resume

Financial security is a top concern for every company. You help by enforcing internal controls, conducting audits, and monitoring investments to ensure all financial processes stay on track with company objectives.

But does your resume template make the cut? Can it help create a resume that will secure your next job?

When companies are hiring lead financial pros, they want to ensure they take every measure to find the right candidates for the job. You can use our controller resume examples as a template to help you stand out in that process.

or download as PDF

Why this resume works

- Do you fit such a bill? If yes, prove to what extent you went to achieve success, all while tailoring your controller resume to fit the company’s policies and the job description.

Assistant Controller Resume

- For instance, detail how you went to enhance supplier quality as well as vendor satisfaction.

Quality Controller Resume

- Share these wins in snappy bullet points, taking advantage of those that reflect your success potential for the open role. For example, recount increasing adherence to quality standards or using a tool like Minitab to identify root causes of quality discrepancies. Of course, accomplishments vary from applicant to applicant but make sure to quantify yours when possible.

Inventory Controller Resume

- We’re talking about typos, punctuation mistakes, awkward phrasing, and excessive usage of passive tenses, mistakes tools like Grammarly could unearth and help rectify. However, the human touch brought by a second pair of eyes from a friend or family member is invaluable.

Financial Controller Resume

- The secret here is using your financial controller resume to prove to what extent you applied smart budget tools, skills, and knowledge to achieve goals.

Related resume examples

- Finance Manager

- Financial Analyst

Tailor Your Controller Resume to the Job Description

Every company handles its financial processes a bit differently. For instance, some companies may conduct audits internally, whereas others may want to get an outside opinion through external audits.

Those differences are why you must customize each resume you submit based on the job description . That way, whether the job requires managing cash flows or performing reconciliations, you can ensure each resume will stand out based on the company’s specific needs.

Need some ideas?

15 popular controller skills

- Payroll Processing

- Risk Management

- Financial Forecasting

- Adaptive Insights

- Reconciliations

- General Ledgers

- Statement of Cash Flows

- Oracle Hyperion

- Human Resources

Your controller work experience bullet points

The next part of the equation will be writing some solid examples of previous work achievements in the financial field. You know that metrics are the backbone of analyzing financial performance, so this section should be a breeze for you.

You’ll want to think of examples like how you boosted spending efficiency or helped reduce risks on new investments.

Here are some great metrics for controllers to use.

- Reporting time: Whether the company is preparing for tax season or wrapping up an audit, reducing the time it takes to report the numbers will be very beneficial.

- Statement accuracy: A big part of compliance measures is ensuring financial statements are accurate, making this a significant performance measurement.

- Budget variances: Accurately estimating and sticking to a budget is crucial to company success over the long term.

- Operational costs: Whenever you can reduce operating costs, it’ll greatly benefit the company’s bottom line.

See what we mean?

- Streamlined financial reporting processes by implementing SAP ERP, which resulted in a 31% reduction in reporting time.

- Implemented QuickBooks for enhanced financial tracking, leading to a 34% improvement in the accuracy of financial statements.

- Introduced Concur for expense management, reducing expense report processing time by 16% and ensuring compliance with corporate policies.

- Utilized Oracle Hyperion for budgeting and forecasting, which reduced budget variances by 31%.

9 active verbs to start your controller work experience bullet points

- Streamlined

3 Tips for Writing a Controller Resume with Minimal Experience

- Even if you haven’t led financial control processes, you’ve likely worked in the financial field for some time as an accounts receivable clerk or in other related positions. You should use examples that show high amounts of technical skill, like how you performed a risk management analysis that helped identify and fix four compliance errors.

- Your skills have likely evolved as you’ve worked your way up in the financial field. Therefore, listing your most recent experiences first will help you showcase your most relevant financial analysis and risk management skills to show you have what it takes for this lead role.

- If you’re struggling to fill an entire page, lean on educational experiences showing you have the necessary abilities. For instance, you could cite knowledge you gained while becoming a certified internal auditor, CPA, or obtaining any other relevant certifications.

3 Tips to Write an Impactful Controller Resume for Experienced Applicants

- A resume summary will benefit controllers with ten or more years of work experience . For instance, you could explain how you performed quarterly audits for accounts valued at over $9.7 million, achieving 99% adherence to SEC regulations over your 11-year career.

- If you’ve been in the financial industry for some time, you don’t need to list every job you’ve worked at. Stick to three or four that are the most recent and use the most relevant skills like payroll processing or internal audit management.

- You also don’t need to list all the education you’ve completed—for instance, your high school diploma if you have a bachelor’s degree in accounting. You may also be able to eliminate some financial certifications that aren’t relevant. For example, listing a WMS certificate wouldn’t be needed if you’re now a CFP.

A one-page resume is the optimal length for controllers. You want to keep it concise, like reporting findings from an internal audit to ensure the most important information stands out. If you’re trying to narrow it down, focus on key skills the company is seeking, like external audit management or analyzing cash flows.

Remember, you can always explain details further for writing an effective cover letter .

You should always customize your resume for each job. Consider, for instance, one company uses QuickBooks, and another uses Xero for managing their financial data. If you just use one resume with QuickBooks listed as a skill, you would only stand out to one of these companies.

An active voice is where the subject of a sentence performs an action. It works great for controller resumes since you’ll include actionable examples of financial achievements. The best way to do so is by using action words like “managed” or “audited” within your examples. For instance, you could say you “audited 37 accounts to ensure 99% compliance in reporting.”

1 Controller Resume Example for Your 2024 Job Search

Controllers are responsible for ensuring the accuracy of financial records and managing financial risk. As a controller, your resume should be just like your financial statements: accurate, reliable, and up-to-date. In this guide, we'll review X controller resume examples to help you get the job you want in 2023.

Resume Examples

Resume guidance.

- High Level Resume Tips

- Must-Have Information

- Why Resume Headlines & Titles are Important

- Writing an Exceptional Resume Summary

- How to Impress with Your Work Experience

- Top Skills & Keywords

- Go Above & Beyond with a Cover Letter

- Resume FAQs

- Related Resumes

Common Responsibilities Listed on Controller Resumes:

- Develop and implement financial policies, procedures, and internal controls

- Prepare and analyze financial statements, including balance sheets, income statements, and cash flow statements

- Manage the budgeting and forecasting process

- Monitor and analyze financial performance

- Oversee accounts payable and accounts receivable

- Manage the payroll process and ensure compliance with applicable laws

- Prepare and file tax returns

- Develop and maintain financial models

- Monitor and analyze cash flow

- Develop and maintain financial reporting systems

- Liaise with external auditors and other financial professionals

- Identify areas for cost savings and process improvements

You can use the examples above as a starting point to help you brainstorm tasks, accomplishments for your work experience section.

Controller Resume Example:

- Developed and implemented financial policies and procedures that resulted in a 20% reduction in accounting errors and a 15% increase in financial reporting accuracy.

- Managed the budgeting and forecasting process, resulting in a 10% decrease in expenses and a 5% increase in revenue over a one-year period.

- Identified areas for cost savings and process improvements, resulting in a 25% reduction in operating expenses and a 10% increase in profit margins.

- Prepared and analyzed financial statements, including balance sheets, income statements, and cash flow statements, resulting in a 15% increase in financial transparency and accuracy.

- Managed the payroll process and ensured compliance with applicable laws, resulting in a 100% accuracy rate and zero legal penalties.

- Liaised with external auditors and other financial professionals, resulting in a successful audit and a 95% satisfaction rate from external stakeholders.

- Monitored and analyzed cash flow, resulting in a 20% increase in cash reserves and a 10% decrease in outstanding debts.

- Developed and maintained financial models, resulting in a 15% increase in forecasting accuracy and a 10% decrease in financial risk.

- Prepared and filed tax returns, resulting in a 100% compliance rate and zero legal penalties.

- Financial analysis and reporting

- Budgeting and forecasting

- Cost reduction and process improvement

- Financial statement preparation

- Payroll management and compliance

- External audit coordination

- Cash flow management

- Financial modeling

- Tax preparation and compliance

- Risk management

- Internal controls and policies

- Regulatory compliance

- Financial software proficiency

- Team leadership and management

- Communication and collaboration

Assistant Controller Resume Example:

- Implemented financial analysis tools and techniques to analyze business operations, resulting in a 10% reduction in costs and a 5% increase in revenues.

- Collaborated with cross-functional teams to develop and implement internal financial controls, ensuring compliance with regulatory requirements and reducing the risk of financial fraud by 20%.

- Provided strategic financial advice and guidance to management, leading to the successful implementation of cost-saving initiatives and a 15% improvement in overall financial performance.

- Managed the preparation of financial statements, reports, and other financial information, ensuring accuracy and timeliness in compliance with accounting standards.

- Developed and implemented accounting policies and procedures, resulting in improved efficiency and accuracy in financial reporting and a 10% reduction in audit findings.

- Played a key role in the preparation of budgets and forecasts, providing accurate financial projections that supported strategic decision-making and contributed to a 5% increase in profitability.

- Analyzed financial data and prepared financial reports to summarize and forecast financial position, providing valuable insights that supported executive decision-making and contributed to a 10% increase in shareholder value.

- Assisted in the management of financial systems and policies, streamlining processes and improving data accuracy, resulting in a 15% reduction in financial reporting errors.

- Assisted in the development and implementation of financial strategies and plans, contributing to the successful achievement of organizational goals and a 10% increase in market share.

- Financial analysis and forecasting

- Financial reporting and compliance

- Budget preparation and management

- Strategic financial planning

- Cross-functional collaboration

- Internal financial controls

- Accounting policies and procedures

- Financial systems management

- Data analysis and interpretation

- Strategic decision-making support

- Cost reduction strategies

- Revenue growth strategies

- Financial auditing

- Proficiency in financial software

- Excellent communication skills

- Attention to detail

- Problem-solving abilities.

Document Controller Resume Example:

- Implemented a new document numbering system, resulting in a 30% reduction in document retrieval time and improved overall efficiency of document control processes.

- Collaborated with project teams to ensure compliance with industry regulations, resulting in a 100% success rate in passing document control audits.

- Developed and delivered document control training sessions to staff, resulting in a 20% increase in staff competency and adherence to document control procedures.

- Managed the creation and maintenance of a centralized document control database, resulting in a 50% reduction in document retrieval time and improved accessibility for stakeholders.

- Implemented a document revision tracking system, reducing errors and ensuring that all documents were up to date and compliant with regulations.

- Conducted regular document control audits, identifying and resolving discrepancies, resulting in a 95% accuracy rate and improved data integrity.

- Developed and implemented an electronic filing system, resulting in a 40% reduction in document storage costs and improved accessibility for stakeholders.

- Streamlined document control processes, resulting in a 25% increase in efficiency and reduced document retrieval time.

- Collaborated with project teams to distribute documents to relevant stakeholders, ensuring timely access to critical information and improving project coordination.

- Document control and management

- Database management

- Document numbering system implementation

- Compliance with industry regulations

- Document control training development and delivery

- Document revision tracking

- Audit conduction and discrepancy resolution

- Electronic filing system development and implementation

- Process streamlining

- Document distribution

- Project coordination

- Data integrity maintenance

- Efficiency improvement

- Stakeholder communication

- Knowledge of document control software

- Problem-solving skills

- Time management skills

- Organizational skills

- Ability to work under pressure

- Adaptability to new technologies

- Confidentiality and discretion

- Knowledge of regulatory standards and compliance requirements.

Financial Controller Resume Example:

- Developed and implemented financial policies and procedures, resulting in improved accuracy and efficiency in financial reporting.

- Analyzed financial statements and reports to identify areas for cost reduction and revenue enhancement, leading to a 10% increase in profitability.

- Managed the budgeting and forecasting process, achieving a 95% accuracy rate and ensuring alignment with organizational goals.

- Oversaw the accounts payable and accounts receivable functions, implementing process improvements that reduced payment processing time by 20% and decreased outstanding receivables by 15%.

- Managed cash flow and liquidity, optimizing working capital management and reducing borrowing costs by 10%.

- Ensured compliance with applicable laws and regulations, resulting in zero penalties or fines during regulatory audits.

- Coordinated and prepared tax returns, minimizing tax liabilities and maximizing tax savings by implementing tax planning strategies.

- Developed and implemented internal controls, reducing the risk of fraud and ensuring the accuracy and integrity of financial data.

- Analyzed financial performance and provided recommendations for improvement, resulting in a 5% increase in profit margin and a 10% reduction in operating expenses.

- Financial reporting and analysis

- Financial policy and procedure development

- Cost reduction and revenue enhancement strategies

- Accounts payable and receivable management

- Cash flow and liquidity management

- Tax planning and preparation

- Internal controls development and implementation

- Fraud prevention

- Financial performance analysis

- Working capital optimization

- Strong communication skills

- Leadership and team management

- Decision-making abilities

- Knowledge of current financial regulations and standards

- Time management and organization skills

- Ability to work under pressure and meet deadlines

- Negotiation skills

- Critical thinking skills

- Business acumen

- Ethical conduct

- Advanced Excel skills

- Knowledge of ERP systems

- Project management skills

- Adaptability to changing financial environments.

Project Controller Resume Example:

- Developed and maintained project plans, schedules, and budgets for a complex construction project, resulting in a 10% reduction in project timeline and a 5% decrease in overall project costs.

- Analyzed project risks and developed mitigation plans, successfully minimizing potential delays and cost overruns by 20%.

- Provided project support to stakeholders by effectively communicating project updates and addressing any concerns, resulting in a 15% increase in stakeholder satisfaction.

- Managed and tracked project progress and performance for a large-scale IT implementation, ensuring on-time delivery and meeting all project milestones with a 100% success rate.

- Monitored project costs and expenditures, implementing cost-saving measures that resulted in a 10% reduction in project expenses.

- Prepared and submitted project status reports to senior management, providing accurate and timely information to support decision-making and ensuring project transparency.

- Coordinated project resources and activities for a global marketing campaign, resulting in a 20% increase in brand awareness and a 15% growth in customer acquisition.

- Identified and resolved project issues and conflicts, fostering collaboration and maintaining strong relationships with cross-functional teams, resulting in a 10% improvement in team productivity.

- Ensured project compliance with applicable regulations by conducting regular audits and implementing necessary corrective actions, resulting in a 100% compliance rate and avoiding any legal penalties.

- Project planning and scheduling

- Budget management

- Risk analysis and mitigation

- Project performance tracking

- Cost control and reduction

- Report preparation and presentation

- Resource coordination

- Issue resolution and conflict management

- Cross-functional team collaboration

- Compliance management and auditing

- Strategic planning

- Financial forecasting

- Quality assurance

- Contract negotiation

- Change management

- Knowledge of project management software

- Time management

- Decision-making

- Leadership skills

- Analytical thinking

- Proficiency in Microsoft Office Suite

- Knowledge of industry-specific regulations

- Understanding of IT project management

- Familiarity with construction project management

- Knowledge of marketing project management

- Ability to work in a global, multicultural environment.

Corporate Controller Resume Example:

- Developed and implemented streamlined accounting principles and procedures, resulting in a 20% reduction in financial reporting errors and improved accuracy of financial statements.

- Led the coordination and completion of annual audits, achieving a 100% compliance rate with audit requirements and receiving positive feedback from auditors for the accuracy and completeness of financial records.

- Provided financial analysis and advice to management, resulting in cost-saving recommendations that led to a 10% reduction in operating expenses.

- Managed the production of the annual budget and forecasts, achieving a 95% accuracy rate and ensuring alignment with organizational goals and objectives.

- Oversaw the accounting operations of subsidiary corporations, implementing control systems and policies that reduced financial risks and improved overall financial performance.

- Analyzed financial information and summarized financial status, providing key insights to senior management that supported strategic decision-making and resulted in a 5% increase in profitability.

- Implemented GAAP principles and ensured compliance with local, state, and federal budgetary reporting requirements, resulting in zero penalties or fines for non-compliance.

- Reviewed and recommended modifications to accounting systems and procedures, leading to a 15% increase in efficiency and accuracy of financial processes.

- Prepared financial reports and statements, presenting them to stakeholders and executives, and receiving positive feedback for clear and concise communication of financial information.

- Proficiency in Generally Accepted Accounting Principles (GAAP)

- Strong financial analysis skills

- Expertise in financial reporting and forecasting

- Knowledge of local, state, and federal budgetary reporting requirements

- Ability to develop and implement accounting principles and procedures

- Experience in managing annual audits

- Ability to provide financial advice to management

- Proficiency in managing the accounting operations of subsidiary corporations

- Ability to implement control systems and policies

- Strong strategic decision-making skills

- Experience in preparing and presenting financial reports and statements

- Ability to review and recommend modifications to accounting systems and procedures

- Proficiency in budgeting and forecasting

- Strong leadership skills

- Ability to align financial strategies with organizational goals

- Risk management skills

- Ability to work with stakeholders and executives

- Strong attention to detail

- Proficiency in using financial software and tools

- Strong problem-solving skills

- Excellent organizational skills

- High ethical standards and professionalism, with a commitment to confidentiality.

Accounting Controller Resume Example:

- Implemented a new accounting software system, resulting in a 30% increase in efficiency and accuracy of financial reporting.

- Developed and implemented cost-saving measures, resulting in a 10% reduction in overall expenses.

- Streamlined the month-end closing process, reducing the time required by 20% and ensuring timely and accurate financial statements.

- Managed the implementation of a new budgeting and forecasting system, resulting in a 15% improvement in accuracy and efficiency.

- Developed and implemented internal controls, reducing the risk of fraud and ensuring compliance with regulatory requirements.

- Improved cash flow management by implementing a cash flow projection system, resulting in a 20% reduction in cash flow gaps.

- Managed the external audit process, resulting in a clean audit opinion for three consecutive years.

- Developed and implemented a comprehensive accounts receivable and accounts payable process, reducing outstanding balances by 25% and improving cash flow.

- Implemented a new payroll system, resulting in a 15% reduction in payroll processing time and improved accuracy in employee compensation.

- Proficiency in accounting software

- Cost management

- Financial reporting

- Internal controls implementation

- Audit management

- Accounts receivable and payable management

- Payroll system management

- Process improvement

- Financial analysis

- Problem-solving

- Communication skills

- Data analysis

- Project management

- Ethical standards and professionalism

- Knowledge of GAAP (Generally Accepted Accounting Principles)

High Level Resume Tips for Controllers:

Must-have information for a controller resume:.

Here are the essential sections that should exist in an Controller resume:

- Contact Information

- Resume Headline

- Resume Summary or Objective

- Work Experience & Achievements

- Skills & Competencies

Additionally, if you're eager to make an impression and gain an edge over other Controller candidates, you may want to consider adding in these sections:

- Certifications/Training

Let's start with resume headlines.

Why Resume Headlines & Titles are Important for Controllers:

Controller resume headline examples:, strong headlines.

- Strategic Controller with a track record of implementing cost-saving measures and driving financial growth for Fortune 500 companies

- Experienced Controller with expertise in financial analysis, forecasting, and budgeting, resulting in increased profitability for mid-sized businesses

- Detail-oriented Controller with a focus on compliance and risk management, ensuring regulatory requirements are met and mitigating financial risks for small businesses

Why these are strong: These resume headlines are strong for Controllers as they highlight key skills and achievements that are relevant to their roles. The first headline emphasizes the candidate's ability to drive financial growth and implement cost-saving measures, which are crucial factors that hiring managers look for in Controllers. The second headline showcases the candidate's expertise in financial analysis, forecasting, and budgeting, which are essential skills for Controllers to have. Finally, the third headline emphasizes the candidate's attention to detail and focus on compliance and risk management, which are important qualities for Controllers to possess in order to mitigate financial risks.

Weak Headlines

- Experienced Controller with Strong Financial Background

- Skilled Controller with Knowledge of Accounting Principles

- Controller with Expertise in Financial Reporting and Analysis

Why these are weak: These headlines need improvement as they lack specificity and do not highlight the unique value or accomplishments that the candidates bring to the table. The first headline does not mention the years of experience or the industries the candidate has worked in. The second headline highlights skills but does not provide any context or results, such as percentage improvements or cost savings. The third headline mentions expertise in financial reporting and analysis, but fails to showcase any measurable achievements or certifications that could strengthen the candidate's profile.

Writing an Exceptional Controller Resume Summary:

Resume summaries are crucial for Controllers as they provide a concise yet powerful way to showcase their skills, experience, and unique value proposition. A well-crafted summary can immediately capture the attention of hiring managers, setting the tone for the rest of the resume and positioning the candidate as an ideal fit for the role.

For Controllers specifically, an effective resume summary is one that highlights their ability to strategically manage financial operations and deliver accurate and timely financial reporting.

Key points that Controllers should convey in a resume summary include:

Relevant Experience: Clearly mention the number of years of experience you have in financial management, highlighting any notable achievements or career highlights. If you have experience with different types of financial operations or industries that are particularly relevant to the job, mention that too.

Technical and Domain Expertise: Showcase your knowledge of financial management methodologies (GAAP, IFRS, etc.), as well as any industry-specific knowledge that would be beneficial to the role (e.g., manufacturing, healthcare, etc.).

Leadership and Teamwork: In any financial management role, leadership and collaboration are going to be core components. Emphasize your ability to lead cross-functional teams, collaborate with stakeholders, and create a shared vision for financial operations, as these are key attributes that every hiring manager will want to see in a Controller.

Accuracy and Attention to Detail: Highlight your ability to ensure the accuracy and completeness of financial reporting, as well as your attention to detail in managing financial operations.

Analytical and Problem-Solving Skills: Show that you can analyze financial data, identify trends, and make informed decisions to optimize financial performance and drive growth.

To nail the resume summary, use your best judgment to choose the right combination of these that align closest with the individual role you’re applying for. Remember, your resume summary will be one of the first things that a potential employer will see about you and your financial management career.

Here are some key writing tips to help you make the most of it:

Tailor the Summary: Customize your summary for each job application, ensuring that it aligns with the specific requirements and expectations of the hiring company.

Be Concise: Keep your summary brief and to-the-point, ideally within 3-4 sentences. Avoid using buzzwords or jargon, and focus on concrete skills and accomplishments.

Use Metrics and Tangible Outcomes: Whenever possible, include quantitative data to back up your claims, such as cost savings, revenue growth, or financial reporting accuracy rates.

Begin with a Strong Statement: Start your summary with a compelling statement that captures your unique value proposition as a Controller, and then build on that foundation with your key attributes and experiences.

Controller Resume Summary Examples:

Strong summaries.

- Accomplished Controller with 10 years of experience managing financial operations for Fortune 500 companies. Skilled in financial analysis, budgeting, and forecasting, with a proven track record of increasing profitability and reducing costs. Adept at leading cross-functional teams and implementing process improvements to drive operational efficiency.

- Strategic Controller with expertise in financial planning and analysis, risk management, and compliance. Possessing 8 years of experience in the healthcare industry, successfully managed the financial operations of multiple hospitals and clinics, resulting in a 15% increase in revenue. Skilled in developing and implementing financial strategies to support business objectives and drive growth.

- Detail-oriented Controller with a strong background in accounting and auditing. Proficient in GAAP and SOX compliance, with 5 years of experience in public accounting and 3 years in private industry. Adept at managing financial reporting and analysis, ensuring accuracy and completeness of financial statements, and identifying areas for process improvement.

Why these are strong: These resume summaries are strong for Controllers as they highlight the candidates' key strengths, accomplishments, and industry-specific experience. The first summary emphasizes the candidate's financial expertise and ability to drive operational efficiency. The second summary showcases the candidate's strategic thinking and quantifiable impact on revenue growth in the healthcare industry. Lastly, the third summary demonstrates the candidate's attention to detail and experience in accounting and auditing, making them highly appealing to potential employers.

Weak Summaries

- Controller with experience in financial reporting and analysis, seeking a challenging role in a reputable organization to utilize my skills and knowledge.

- Experienced Controller with expertise in budgeting and forecasting, looking for a new opportunity to contribute to financial planning and analysis in a dynamic company.

- Controller with a focus on process improvement and cost reduction, committed to optimizing financial operations and driving profitability for the organization.

Why these are weak: These resume summaries need improvement for Controllers as they lack specific achievements, metrics, or examples of how the candidate has added value to their previous employers. The first summary provides only a general overview of the candidate's experience, without mentioning any specific accomplishments or industries. The second summary mentions budgeting and forecasting but doesn't provide any quantifiable results or details on the candidate's successes in implementing these approaches, which would make their profile more compelling to potential employers. The third summary mentions process improvement and cost reduction, but again, doesn't provide any specific examples of how the candidate has achieved these goals or how they have impacted the organization's bottom line.

Resume Objective Examples for Controllers:

Strong objectives.

- Detail-oriented and results-driven aspiring Controller seeking an entry-level position to utilize my strong analytical skills and knowledge of financial reporting to ensure accurate and timely financial statements and contribute to the growth of a dynamic organization.

- Recent accounting graduate with a background in auditing and financial analysis, eager to apply my knowledge of GAAP and internal controls to support the Controller in maintaining accurate financial records and providing insightful analysis to drive business decisions.

- Experienced accountant with a proven track record of managing financial operations and leading cross-functional teams, seeking a Controller position to leverage my expertise in budgeting, forecasting, and financial analysis to drive profitability and growth for a forward-thinking company.

Why these are strong: These resume objectives are strong for up and coming Controllers because they showcase the candidates' relevant skills, education, and experience, while also highlighting their eagerness to learn and contribute to the success of the organization. The first objective emphasizes the candidate's attention to detail and analytical skills, which are important attributes for a Controller. The second objective showcases the candidate's educational background and knowledge of GAAP and internal controls, demonstrating a strong foundation for success in the role. Lastly, the third objective highlights the candidate's experience in financial operations and leadership, making them a promising fit for a Controller position where they can further develop their skills and contribute to the company's growth.

Weak Objectives

- Seeking a Controller position where I can utilize my skills and experience to contribute to the success of the company.

- Recent accounting graduate with an interest in pursuing a career as a Controller.

- Aspiring Controller with some experience in financial analysis, seeking to develop my career in the accounting industry.

Why these are weak: These resume objectives need improvement for up and coming Controllers because they lack specificity and don't effectively showcase the unique value or skills the candidates possess. The first objective is generic and doesn't provide any information about the candidate's background, passion, or relevant experience. The second objective only mentions the candidate's interest in pursuing a career as a Controller, but doesn't provide any information about their skills or qualifications. The third objective hints at some experience in financial analysis, but it doesn't mention any specific achievements, education, or industries the candidate is interested in.

Generate Your Resume Summary with AI

Speed up your resume creation process with the ai resume builder . generate tailored resume summaries in seconds., how to impress with your controller work experience:, best practices for your work experience section:.

- Highlight your experience in managing financial operations, including budgeting, forecasting, and financial reporting.

- Showcase your ability to analyze financial data and provide insights and recommendations to senior management.

- Emphasize your experience in managing accounting functions, including accounts payable, accounts receivable, and general ledger.

- Demonstrate your knowledge of regulatory compliance and financial controls, including SOX and GAAP.

- Highlight your experience in managing audits and working with external auditors.

- Call out any experience in implementing financial systems or process improvements that resulted in cost savings or increased efficiency.

- Mention any experience in managing a team of financial professionals and developing their skills.

- Lastly, ensure that the language you use is the same language HR, recruiters, and hiring managers are familiar with - not just industry jargon.

Example Work Experiences for Controllers:

Strong experiences.

Developed and implemented financial controls and procedures, resulting in a 20% reduction in accounting errors and a 15% increase in overall financial accuracy.

Led the preparation and analysis of monthly financial statements, providing key insights to senior management and enabling informed decision-making.

Collaborated with cross-functional teams to develop and implement cost-saving initiatives, resulting in a 10% reduction in operating expenses.

Oversaw the annual budgeting process, resulting in a 5% increase in revenue and a 10% reduction in expenses.

Managed the company's cash flow, ensuring timely payments to vendors and reducing outstanding accounts payable by 25%.

Implemented a new financial reporting system, improving the accuracy and efficiency of financial reporting by 30%.

Why these are strong:

- These work experiences are strong because they demonstrate the candidate's ability to effectively manage financial operations and implement controls that result in improved accuracy and cost savings. The use of specific metrics and outcomes showcases the candidate's ability to deliver tangible results, while the collaboration with cross-functional teams highlights their leadership and communication skills.

Weak Experiences

Assisted in the preparation of financial statements and reports, ensuring accuracy and compliance with accounting standards.

Conducted routine audits of financial records and transactions, identifying discrepancies and proposing corrective actions.

Collaborated with other departments to gather financial data and provide analysis for budgeting and forecasting purposes.

Managed accounts payable and receivable processes, ensuring timely and accurate processing of invoices and payments.

Prepared and reviewed monthly financial statements, analyzing variances and providing recommendations for improvement.

Assisted in the development and implementation of internal controls and procedures to mitigate financial risks.

Why these are weak:

- These work experiences are weak because they lack specificity and quantifiable results. They provide generic descriptions of tasks performed without showcasing the impact of the individual's work or the benefits brought to the company. To improve these bullet points, the candidate should focus on incorporating metrics to highlight their achievements, using more powerful action verbs, and providing clear context that demonstrates their leadership qualities and direct contributions to successful outcomes.

Top Skills & Keywords for Controller Resumes:

Top hard & soft skills for controllers, hard skills.

- Financial Reporting and Analysis

- Budgeting and Forecasting

- Cost Accounting

- Internal Controls and Compliance

- Tax Planning and Compliance

- Financial Modeling

- Cash Flow Management

- ERP Systems (e.g. SAP, Oracle)

- GAAP and IFRS Knowledge

- Audit Preparation and Management

- Variance Analysis

- Financial Statement Preparation

Soft Skills

- Leadership and Team Management

- Communication and Presentation Skills

- Collaboration and Cross-Functional Coordination

- Problem Solving and Critical Thinking

- Adaptability and Flexibility

- Time Management and Prioritization

- Attention to Detail and Accuracy

- Analytical and Financial Analysis Skills

- Decision Making and Strategic Planning

- Conflict Resolution and Negotiation

- Process Improvement and Optimization

- Ethical and Professional Conduct

Go Above & Beyond with a Controller Cover Letter

Controller cover letter example: (based on resume).

As a Controller, you know the importance of attention to detail and accuracy in financial reporting. You also understand the value of going above and beyond to ensure the success of your organization. Pairing your resume with a tailored cover letter can give you a crucial edge over the competition and significantly increase your chances of landing an interview. A cover letter is an extension of your resume, an opportunity to delve deeper into your relevant experience and showcase your passion for the role. Contrary to common belief, crafting a compelling cover letter doesn't have to be an arduous task, and the benefits far outweigh the effort required.

Here are some compelling reasons for submitting a cover letter as a Controller:

- Personalize your application and showcase your genuine interest in the company and role

- Illustrate your unique value proposition and how your skills align with the specific job requirements for a Controller

- Communicate your understanding of the company's financial needs and how you plan to address them

- Share success stories and achievements in financial management that couldn't be accommodated in your resume

- Demonstrate your writing and communication skills, which are essential for Controllers

- Highlight your ability to manage and lead a team, and how you plan to apply those skills in the new role

- Differentiate yourself from other applicants who might have opted not to submit a cover letter

By submitting a cover letter along with your resume, you can showcase your expertise and passion for financial management, and demonstrate why you are the best candidate for the job. Don't miss out on this opportunity to make a lasting impression and secure your dream job as a Controller.

Resume FAQs for Controllers:

How long should i make my controller resume.

A Controller resume should ideally be one to two pages long, with a focus on highlighting the most relevant and significant experiences and achievements. It is important to keep in mind that Controllers are typically responsible for managing financial operations and ensuring compliance with regulations, so the resume should emphasize skills and experiences related to these areas. Additionally, including quantifiable achievements and metrics can help demonstrate the impact of the Controller's work. Ultimately, the length of the resume should be determined by the amount of relevant experience and achievements the Controller has to showcase.

What is the best way to format a Controller resume?

The best way to format a Controller resume is to start with a clear and concise summary statement that highlights your experience and skills in financial management, accounting, and budgeting. Use bullet points to list your key achievements and responsibilities in previous roles, and be sure to include any relevant certifications or licenses. In terms of layout, use a clean and simple design with easy-to-read fonts and consistent formatting throughout. Avoid using too many colors or graphics, as this can be distracting and take away from the content of your resume. It's also important to tailor your resume to the specific job you are applying for. Highlight the skills and experiences that are most relevant to the position, and use keywords from the job description to help your resume stand out to hiring managers. Overall, a well-formatted Controller resume should showcase your financial expertise and demonstrate your ability to manage budgets, analyze data, and make strategic decisions that drive

Which Controller skills are most important to highlight in a resume?

The following Controller skills are important to highlight in a resume: 1. Financial Analysis: Controllers should have strong financial analysis skills to be able to analyze financial data, identify trends, and make informed decisions. 2. Budgeting and Forecasting: Controllers should be able to develop and manage budgets and forecasts to ensure that the organization's financial goals are met. 3. Accounting and Reporting: Controllers should have a solid understanding of accounting principles and be able to prepare accurate financial statements and reports. 4. Risk Management: Controllers should be able to identify and manage financial risks to ensure the organization's financial stability. 5. Leadership and Management: Controllers should have strong leadership and management skills to lead and manage a team of accounting professionals. 6. Communication: Controllers should be able to communicate financial information effectively to stakeholders, including executives, board members, and investors. 7. Technology: Controllers should have a good understanding of financial software and technology to streamline financial processes and improve efficiency. In summary, highlighting these skills on a resume can help Controllers stand out to potential employers and demonstrate their ability to effectively manage an organization's financial operations.

How should you write a resume if you have no experience as a Controller?

If you have no experience as a Controller, it is important to focus on highlighting your relevant skills and experiences that can transfer to the role. Here are some tips for writing a resume: 1. Start with a strong objective statement that highlights your interest in becoming a Controller and your relevant skills and experiences. 2. Emphasize your education and any relevant coursework, such as accounting or finance. 3. Highlight any experience you have in financial analysis, budgeting, or other related areas. This could include internships, volunteer work, or part-time jobs. 4. Showcase your skills in areas such as data analysis, problem-solving, and communication. 5. Consider obtaining a certification, such as a Certified Public Accountant (CPA) or Certified Management Accountant (CMA), to demonstrate your commitment to the field. 6. Tailor your resume to the specific job you are applying for, highlighting the skills and experiences that are most relevant to the position. Remember, even if you don't have

Compare Your Controller Resume to a Job Description:

- Identify opportunities to further tailor your resume to the Controller job

- Improve your keyword usage to align your experience and skills with the position

- Uncover and address potential gaps in your resume that may be important to the hiring manager

Related Resumes for Controllers:

Controller resume example, more resume guidance:.

7 Controller Resume Examples & Writing Guide

Learn how to create an impactful controller resume with these 7 real-world examples and proven writing tips. Discover what it takes to highlight your accounting expertise, leadership skills and key accomplishments to impress employers. Follow our step-by-step guide to build a resume that opens doors to exciting controller career opportunities.

A good resume is very important if you want to get interviews for Controller jobs. Your resume is often the first thing hiring managers see, so it needs to make a strong impression and show that you're a great fit for the role.

In this article, you'll find a step-by-step guide on how to write an impressive Controller resume that gets you noticed. We'll cover what information to include, how to structure it, and tips for making your accomplishments and skills stand out.

You'll also see 7 real-world examples of Controller resumes that worked. These samples come from Controllers who successfully landed jobs, so you can see what an effective resume looks like in practice.

Whether you're an experienced Controller or seeking your first role, this article will give you the information and inspiration you need to create a resume that opens doors. Let's dive in and learn how to take your Controller resume to the next level!

Common Responsibilities Listed on Controller Resumes

- Managing and directing day-to-day accounting operations and processes

- Overseeing the preparation of financial statements, including balance sheets, income statements, and cash flow statements

- Ensuring compliance with financial regulations and accounting standards

- Coordinating and managing the annual audit process with external auditors

- Developing and implementing accounting policies, procedures, and internal control systems

- Analyzing and interpreting financial data to identify trends and opportunities for improvement

- Supervising and managing the accounting staff, providing guidance and training as needed

- Preparing and reviewing budgets, forecasts, and financial reports for management and stakeholders

- Monitoring and managing cash flow, accounts receivable, and accounts payable

- Implementing and maintaining accounting software and systems

- Collaborating with other departments, such as finance and operations, to ensure accurate financial reporting

- Performing variance analysis and identifying cost-saving opportunities

- Ensuring compliance with tax regulations and overseeing tax filings and payments

- Participating in strategic planning and decision-making processes related to financial matters

How to write a Resume Summary

Understanding the importance of summary/objective section in a controller resume.

A controller resume is a unique professional document. Just like a company's financial health, it needs a fine balance of detail and brevity, precision and persuasiveness. Balancing all this becomes critical especially in the very first part of your resume - the summary or objective section.