Puma History Case Study- All You Need To Know About The Brand

- Written by 440 Industries

- Branding , Case Study , Puma

- November 22, 2021

Do you know the story of the iconic brand Puma? Well, most people do not. This brand is a leading sports brand around the globe. It is famous for creating and selling footwear, apparel, and accessories. Puma earned its fame by providing customers with top-quality products, but that’s not all there is to the brand. This is why we’re inquisitive and have decided to look into the brand. This Puma history case study explores all you need to know about the brand. It will touch on how the brand came to be and how it came to become one of the biggest sporting brands in the world. So now that you know what’s coming, let’s dig right in.

Puma History: A Brand Borne Out of Siblings Rivalry

Puma is a famous sportswear brand that started with 14 employees. Today, it is known as a global sports brand, but few know about Puma history. This company started as Drassler, founded in 1919 by Rudolph and Adolf Dassler, who are brothers. The company started in Herzogenaurach, Germany, and back then, the brothers had no way of knowing that they were laying the foundations for a renowned sports shoe brand. The company started in their mother’s laundry company. Five years after the company kicked off, they moved into their first factory in 1924. The company began to experience success in their company when the majority of German athletes in the 1928 summer Olympics wore Dassler shoes. It was at this time that the company experienced a national and global breakthrough.

One thing was clear; each brother had a specific skill that contributed to the company’s growth. Rudolph was in charge of marketing the products, while Adolf handled the creative and production side of the business. Although the company was such a success, it was taken over by the army during the Second World War. Due to that, the company started making shoes for the soldiers instead of the sports shoes they were famous for. At this time, the brothers’ wives weren’t getting along either. Soon, it became clear that both brothers had to go their separate way. In 1948, they closed the family business, but with both brothers determined to keep up a shoemaking business, they each started their own. Adolf started Addas, known as Adidas today, while Rudolf started Ruda, the bedrock of Puma history.

Puma History: The Birth of the Puma Logo

Rudolf chose the name Puma because he wanted his business to embody the qualities of a Puma. He wanted a brand that offers speed, suppleness, strength, and endurance, which an athlete needs. Puma history is also not complete without the mission statement, which is the fastest sports brand globally. Also, the brand wanted to be the most desirable and sustainable sports Lifestyle Company in the world. When Rudolph started, he always had the Puma in his logo. It all started with the puma silhouette jumping through the letter D. A white dot in the logo symbolized the Puma’s eyes.

Further down the years, in 1951, he updated the logo to include Puma at the end. Additionally, there was a hexagon encompassing the image. Again in 1957, he added a black and white contour of the Puma to the hexagon. The following year, three words which are Rudolf Dassler Schuhfabrik was added to each side of the hexagon. Once again, a new logo was introduced and was used for ten years before Rudolf commissioned a caricaturist to create a new one. The logo featured a football knot with the words Puma Formstrip at the beginning of the image. Rudolf didn’t like it because it didn’t reflect the puma qualities he wanted.

Adding Cougar Body Parts to the Logo

The caricaturist drew a black panther that had the hands and legs of a cougar. The logo’s cat was jumping upward, and the tail was also on the same level. Puma used the logo from 1968 to 1970, and Rudolf offered to pay the caricaturist a cent for every product sold with the logo. However, he declined and opted for being paid 600 marks only, a mistake that cost him a fortune. In 1976, the company ditched the jumping puma and only had Puma in its logo. The p was in lowercase, while the rest of the letters were in uppercase.

However, the jumping cougar image was a crucial part of Puma history. It was so popular that Puma decided to revert to it. They made a few changes to the logo, like the cougar placed at the upper-right side to make it look like it was leaping over the word ‘Puma.’ This logo has remained to date, and the primary colors were always black and white.

Puma History: The Journey to Success

The company enjoyed a successful collaboration with Jesse Owens in 1936. Therefore, the brand decided to continue endorsing sports icons to popularize its products. In 1952, Rudolf created boots with studs you could screw beneath it and named the model ‘super atom.’ Puma created the model with inputs from top personalities like the West Germany football team’s coach. The same year, the gold-winning Olympic medalist wore Puma shoes for his winning run. Throughout 1960, we continually saw Puma’s involvement with top sports personalities. These partnerships help to promote the company’s growth and increase revenues. One such partnership was with Armin Hary, who also won the Puma shoes at the 1968 Olympics for his gold medal-winning run.

In 1986, the company developed an advanced running shoe called the Running System shoe. It was in this same year that Puma became a public limited company. Additionally, the shoe had a couple of devices installed to measure speed, calories, and steps. Every year, Puma history recorded global expansion for the company and higher revenues. The company also gained entry into the far east market by sponsoring an anime show called Hungry hearts. In the show, the characters constantly wore the puma jersey and sportswear.

The Takeover

The Puma history isn’t complete without mentioning the company’s takeover by the French retailer, PPR. PPR bought Puma in a friendly takeover bid. The company started out buying a 27% stake in the company. However, they later announced share buybacks. Puma’s board welcomed the move because they believed it was in the company’s interest. By the end of 2007, the French retailer owned a 60% stock in the company. The company shifted to the European Union trading model in 2011 by becoming a member.

Today, Puma has a 5% state in Borussia Dortmund which is a famous German club. They also sponsor the players’ sports gear regularly. Additionally, they possess contracts with Nascar and Formula One and usually sponsor their racing shoes and suits. This partnership ensured Puma had a vested interest in creating racing sportswear. In addition to the brand’s success, they started making basketball sponsorship deals with the NBA draft players in 2018.

Puma History: Their Marketing Strategy

After exploring Puma history, it is essential to also talk about the marketing strategies implemented by the brand that contributed vastly to the company’s success. Apart from diversifying their products, there are several other marketing strategies known to Puma. Below, we’ll be exploring these marketing strategies in detail.

Puma Three-Segmentation Strategy

If you want to increase profits as a company, you need to find your target market or markets. For example, it would be challenging to sell baby clothing if your advertising only appeals to athletes. Instead, there’s a need for an ad that would appeal to parents. There’s also a need to meet the needs of the target market. For example, if your target audience is a truck company and they’re currently into buying more pickup trucks, the advertising sedans at that moment wouldn’t make much sense. Throughout Puma history, the brand practiced segmentation that helps it achieve interchange between it and the target market. Each segment featured its product and marketing strategy. Puma is known for using three segmentation strategies explored below.

- Demographic Segmentation: This segmentation category requires dividing the population by their age, income, race, gender, nationality, and life stages. Each segmentation helped create a niche group the brand could target.

- Geographic Segmentation: this is easier to understand as it is divided by the target’s audience geography. Therefore, the population split into languages, locations, and ideologies shared by various people worldwide.

- Psychographic Segmentation: This was the last form of segmentation that accounted for the lifestyle, interests, activities, and other psychological aspects of the consumer. It also took into consideration the consumer’s purchasing habits and attitude.

Throughout Puma history, the brand used these three segmentation forms to create its target market. However, segmentation is only the first step, with targeting following closely behind.

Targeting Strategy

With different people buying products in different ways and for various reasons, it’s vital that advertising and the product also evolve. Puma takes note of different trends and patterns and then tailors their advertisement to each group. To simplify this strategy, Puma sells more sportswear to specific segments. Therefore, these segments will see more ads for this sportswear. They also receive updates on related products.

Positioning Strategy

This strategy refers to a brand’s place in the consumer’s mind. When it comes to quality products, Puma has earned a spot in the consumer’s mind. This brand is famous for providing users with quality athletic wear. This positioning was the goal of several other marketing strategies.

Product Diversification

Although Puma history involves only footwear products, Puma has grown over the years. Puma deals in footwear, eyewear, sports accessories, watches, personal care, and sports apparel. By being present in many interrelated segments, the company can increase profits and their number of consumers.

Puma Content Strategy

Although there weren’t social media to utilize in Puma history, it is now one of their top marketing strategies. With everything on social media these days, Puma uses platforms to engage with its audience. In addition, the brand utilizes brand storytelling to explore new marketing opportunities. With people online more, Puma is continually exploring new types of content. They also upload photos of new products, footwear designs, and photos of their influencers.

Puma Campaign Strategy

This is closely tied to their content and social media strategy. Campaigns are great and can help you get closer to your audience. Puma history shows a brand constantly embracing change, showing this feature. Puma embraces change within its consumers and in the environment. The brand has come up with various social media campaigns that allow them to connect and collaborate with its communities. These campaigns are usually not just about promoting new products.

In the Only See Great Campaign, their ambassadors tell of the struggle and meaning of achieving greatness. In ‘She Moves Us,’ the goal is to empower women globally. The campaign shows the style and confidence of a woman while showing how she is a force of nature. This campaign also helped shed light on gender equality while increasing female athletes’ visibility in the sports industry.

Puma Ambassadors and Collaboration Strategy

A brand ambassador represents and advertises the brand in the best way. Puma always chooses ambassadors based on their beliefs and story. Since an ambassador adds a human touch to a brand, finding the right one can be difficult. One of the top ambassadors of Puma is Neymar Jr . They also have one with Rihanna and the collaboration with Fenty , which was one of the most significant collaborations ever. This brand also brought in Selena Gomez, who brought in her artistry skills to the brand. Other top celebrities part of the brand’s collaborative projects are J. Cole, Cara Delevingne, and many more.

Puma History Case Study: Final Thoughts

Puma history shows a brand that slowly rose to become a leading sportswear brand. The brand uses effective marketing techniques, unique designs, and top-selling techniques to position itself. As a result, it has been on a path of continuous growth since its inception and today has thousands of employees in over 40 countries. We hope this article shared insight into how Puma can maintain an equal balance between sales and further growth.

Was This Article Helpful?

You're never to cool to learn new things, here are sources for further research.

Please note: 440 Industries is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Fashion Marketing

Retail marketing, fashion entrepreneurship, fashion finance.

MORE ARTICLES FROM OUR BLOG

Diesel Case Study: Fashion Industry’s Sustainable Revolution

Explore the Diesel Case Study: fashion industry’s sustainable shift through cleaner engines, innovative campaigns, and Smart Rebels focus.

The OTB Group Case Study: Core Values and Growth Strategies

Discover The OTB Group Case Study, highlighting core values, growth strategies, sustainability efforts, and digital innovation in the fashion world.

Jil Sander Case Study: Fashion Legacy & Adaptations

Explore the Jill Sander Case Study, delving into her minimalist fashion legacy and how creative directors Lucie and Luke Meier adapt to market changes.

Marni Case Study: Bold Fashion and Diverse Collaborations

Explore the Marni Case Study, highlighting bold fashion, diverse collaborations, and innovative digital expansion in this captivating analysis.

440 Industries Disclaimer, Credits and acknowledgements. Privacy Policy

Copyright © 440 industries 2024.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

PESTLE Analysis

Insights and resources on business analysis tools

Puma SWOT Analysis: 25 Factors Influencing the Sportswear Giant

Last Updated: May 28, 2024 by Jim Makos Filed Under: Companies , SWOT Analysis

You might have already heard about the notorious cat that has taken over athletic apparel; Puma. Did you know that Puma came into existence at the same time as Adidas did and that too by two brothers!

So the story is that back in 1924, two brothers started a company that went by the name of Gebrüder Dassler Schuhfabrik, which translates to “Dassler Brothers Shoe Factory .” As fate would have it, the two chaps fell off from each other and decided to split the family business into two separate brands, you guessed it, Adidas and Puma.

Headquartered in Herzogenaurach, Bavaria, Germany, Puma was started in 1948 by Rudolf Dassler and sold athletic accessories , clothes, and shoes, amongst other things.

Today, Puma is the third largest company producing sportswear. As of 2023, Puma has managed to generate $8.5 billion in revenue.

Currently, Arne Freundt serves as the CEO of Puma. As per the latest reports from 2023, Puma operates in over 120 countries and employs more than 16,000 people worldwide. Let’s explore the Puma SWOT analysis in more detail to see where it stands in the market these days and how Puma has managed to stay relevant all these years.

SWOT Analysis of Puma

A SWOT analysis is a tool that helps people understand the strengths, weaknesses, opportunities, and threats of a business or project. Here’s what each part means:

- Strengths: These are things that the business is really good at or advantages it has over others. For example, being very popular or having cool designs.

- Weaknesses: These are areas where the business might not be as good or things it struggles with. Maybe it’s not very well-known in some countries.

- Opportunities: These are chances or situations that the business can use to its advantage. Like a new trend in sportswear that they can follow.

- Threats: These are things that could cause problems for the business, like new competitors or changes in fashion.

Puma, like any other big company, needs a SWOT analysis to understand how it can improve and stay competitive. By knowing its strengths, it can build on them. By knowing its weaknesses, it can work to fix them. By spotting opportunities, it can take action to benefit from them. And by being aware of threats, it can prepare and protect itself.

Using both a SWOT and a PESTLE analysis together gives a complete picture of both internal and external factors affecting Puma. This way, Puma can make better decisions to grow and succeed. Feel free to combine today’s SWOT analysis with our PESTLE analysis of Puma !

Puma’s Strengths

- Large Workforce: Employing over 16,000 people worldwide demonstrates Puma’s stability and low employee turnover rate.

- Strong Brand Associations: Puma is associated with many stellar brands around the world, which is vital in highlighting it as a top-notch brand itself. Puma is a key supplier of racing gear for top motorsport teams in Formula One , NASCAR, and other racing series.

- Robust R&D Sector: Puma’s extensive Research & Development department keeps it at the forefront of innovation and the latest trends.

- In 2014, Puma appointed pop superstar Rihanna as their Creative Director. This strategic move was part of Puma’s broader effort to rejuvenate its brand and appeal to a younger, fashion-forward audience. Rihanna’s influence and unique style were instrumental in transforming Puma’s image and expanding its reach beyond traditional sportswear into the lifestyle and fashion segments.

- Puma’s largest marketing investment demonstrates the brand’s financial strength and commitment to enhancing its market position. This significant investment can bolster brand awareness and attract new customers globally

- Strong Brand Name: Puma’s globally recognized brand name is a significant asset, bolstered by a huge following and support from celebrity endorsements. Endorsements from celebrities and athletes enhance Puma’s brand image and attract a broad audience. How many of us think of a feral jungle cat upon hearing the name Puma instead of a pair of kick-ass sneakers?

- In 2019, Puma signed a long-term partnership deal with Manchester City FC , one of the most successful football clubs in the English Premier League. This partnership extends to the City Football Group’s other teams, including Melbourne City FC, Girona FC, and more. This collaboration has been instrumental in increasing Puma’s visibility and popularity across different continents.

This robust set of strengths, coupled with its strategic partnerships and innovative practices, continues to position Puma as a leading brand in the sportswear industry.

If you want to learn more about the strengths any business should consider in their SWOT analysis, check out the full list of strengths we have ! It’s a great way to understand what makes companies successful.

Puma’s Weaknesses

There’s a reason Puma isn’t the number-one brand in the sportswear industry at the moment: it has weaknesses.

- Limited Market Share: Whereas we’ve established that Puma is notorious worldwide, it still doesn’t have as much market share as some of its rivals , such as Nike and Adidas. Ouch, imagine being beaten by the enemy brother!

- Brand Perception: Puma is often seen as a cheaper alternative to high-end brands, affecting its overall brand value and prestige.

- Customer Loyalty Challenges: In the highly competitive sportswear industry, maintaining a loyal customer base is difficult due to numerous better-priced alternatives.

- Intense Competition: Puma faces competition from both higher-priced and lower-priced brands, catering to various customer needs and preferences.

- Production Concerns: A significant portion of Puma’s production is concentrated in Asian markets, which have been criticized for labor exploitation and underpayment issues.

- The initial release of only 500 pairs of Re2.0 sneakers may limit the immediate impact of the product on the market. Puma needs to develop scalable solutions to meet broader demand and achieve significant market penetration.

These weaknesses highlight areas where Puma can improve to strengthen its position in the sportswear industry.

Curious about what weaknesses businesses need to watch out for? Head over here to see the complete list of weaknesses to consider in a SWOT analysis. It’s important to know where improvements can be made!

Puma’s Opportunities

- Puma is set to dress the team of the Arab Republic of Egypt for the Paris 2024 Olympic Games. By partnering with the Egyptian Ministry of Youth and Sports and the Egyptian Olympic Committee, Puma can capitalize on Egypt’s growing economic potential and passion for sports. This can open up new market opportunities and drive sales in the region

- Women’s Attire and Accessories: With a growing interest in sports and fitness among women, Puma can focus on expanding its range of women’s clothing and accessories. More women are interested in sports and fitness as each day passes, they should have as many options to choose from as the men do.

- Growing Sports Industry: The exponential growth of the sports industry provides Puma with the chance to associate itself with new sports events and increase its presence.

- Puma’s collaboration with global superstar Selena Gomez has boosted Puma’s visibility among younger consumers. The partnership has also helped the brand position itself as a fashionable choice beyond the gym. Gomez’s influence has extended Puma’s reach into everyday fashion, making Puma a go-to brand for both athletic and casual wear. The collections launched under this collaboration have included stylish, versatile pieces that blend sports functionality with streetwear aesthetics, appealing to a broad audience who value both comfort and style in their daily lives.

- The A$AP-PUMA collaboration opens doors to new consumer segments, particularly those interested in streetwear and motorsport-inspired fashion. This can expand Puma’s customer base and increase market share.

These opportunities provide Puma with various avenues to grow and enhance its brand presence globally.

Interested in finding out what opportunities businesses can take advantage of? Explore a full set of opportunities for a SWOT analysis. You’ll see how companies can grow and succeed by seizing the right chances.

Puma’s Threats

- Puma reported a significant drop in quarterly earnings in early 2024 . The company’s revenue decreased by 15% compared to the same period in the previous year, primarily due to reduced sales in key markets such as Europe and North America.

- Intense Competition: Puma faces fierce competition from a wide range of brands, including Converse, Bata, Reebok, Nike, and Adidas, which offer both more expensive and cheaper alternatives.

- Counterfeiting: The prevalence of counterfeit Puma products in the market leads to significant potential sales losses and damages the brand’s reputation.

- Market Saturation: The sportswear market is highly saturated, making it challenging for Puma to differentiate itself and capture additional market share.

- Supply Chain Disruptions: Potential disruptions in the supply chain, especially in regions criticized for labor practices, can affect production and delivery schedules.

- The devaluation of the Argentine peso and hyperinflation significantly affected Puma’s financial results in 2023, reducing net income to approximately 305 million euros. This volatility introduces a level of financial instability, making it challenging to maintain consistent profit margins.

These threats highlight the challenges Puma faces in maintaining its market position and financial stability.

Want to learn about the threats that can affect businesses? Check out our detailed list of threats to include in a SWOT analysis. Knowing these can help companies prepare and stay strong!

Recommendations based on Puma’s SWOT Analysis

Puma is easily the brand which is always in the top 5 choices of a sportswear enthusiast’s consideration set. With a global reach and rockhard influence, Puma is a brand that we anticipate to see as a player in the industry for many years to come.

As obvious from this SWOT analysis, Puma’s strengths and opportunities outweigh their weaknesses and threats. However, caution should never be completely disregarded. They do face some serious competition with pre-existing brands as well as recent entrants, so they do need to dive into strategies of growing their presence even further. We’ve known and loved Puma for literally more than 70 years now! Some serious props to Puma for keeping it real for all these years when so many brands vanish in a third of this time. We hope to see great things from the brand in the future.

To gain a deeper understanding of how SWOT analysis can benefit any business, I invite you to explore our comprehensive guide on SWOT analysis . This guide provides detailed insights into identifying strengths, weaknesses, opportunities, and threats, helping businesses leverage their advantages and mitigate potential risks.

Additionally, we have recently conducted SWOT analyses of Puma’s major competitors. Reviewing these analyses will give you a broader perspective on the competitive landscape in the sportswear industry . By comparing Puma’s SWOT analysis with those of its rivals, you can better understand how Puma stacks up in terms of market positioning, brand strength, innovation, and challenges.

- SWOT Analysis of Nike

- SWOT Analysis of Adidas

Puma Marketing Strategy: The Case Study

What is Puma’s marketing strategy? Puma has become a leading sports brand in the world. It carries out the design development as well as the marketing of clothing and footwear. Thanks to its quality, since its foundation in 1948 by Rudolf Dassler , it is one of the companies with the highest performance when it comes to the sporty style. This German company has managed to expand into more than 130 countries, and not only for its products, but its marketing strategy also deserves credit. If you are interested in knowing how marketing influences sports brands like Puma, keep reading this post in order to explore the puma marketing case study.

Table of Contents

What is Puma’s target audience?

While that’s true, Puma in its early days catered to professional athletes who competed nationally and internationally. However, over time it has reinvented itself and has shown its products to a more general target audience . Therefore, it has ceased to be a brand focused on elite sports, to advertise its products to anyone who wants to buy them.

Thus, the brand’s customer base is headed by young people aged 20-35. Puma’s customers belong to the upper class, a group that cares about leading a healthy and hygienic lifestyle.

Consequently, to attract a large number of customers regardless of their segmentation, the brand has taken care of knowing the individual characteristics to make the promotions more attractive to the target audience and the final customer.

Puma Marketing Strategy: Positioning

It’s worth starting with one very important factor. The Puma brand has been using a combination of geographical, demographic, and psychographic segmentation strategies for many years. This way, you can more easily understand the needs of customers which can change day by day in the market.

However, this positioning strategy turns out to be the key to the development of each of its products and categories. The brand has always been an inspiration to those who want to move positively through life. Thus, the positioning of the puma brand has also been achieved by adding value to the company.

Competitive Advantage Of Puma Marketing Strategy

90% of the brand’s products come from Asian markets, as the production and production facilities are located right there. Sourcing is very important to Puma, which is why it maintains stable coordination with over 200 suppliers located in more than 36 countries .

The Wide Product Portfolio

Puma has long been involved in various categories of its products such as personal care, footwear, sports accessories, eyewear, clothing, watches, and much more.

Indeed, being present in segments that include different products helps the brand to have a greater share of the market to increase its portfolio of potential customers.

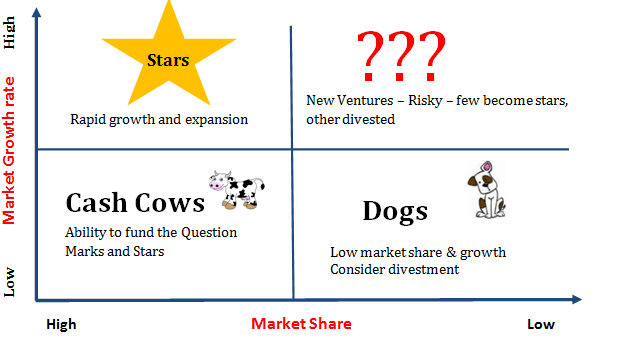

Puma BCG Matrix In Marketing

The BCG Matrix works like a growth matrix which is used with the aim of evaluating the product portfolio within a company. In the case of Puma, it took over Puma & Cobra Golf, which dealt with the same products in the sports market.

If we go back a few years, specifically to the year 2015, we can see that this group generated 45% of net sales. From that date to today, the segmentation of this product has generated a high amount of revenue , unlike other product categories such as clothing and accessories.

Distribution Strategy Of Puma

Considering that Puma too got carried away by a marketing mix , let’s talk a bit about its distribution strategy. This company has distributed its offerings through three exclusive channels, which include the brand’s exclusive retail stores , wholesale sites, and e-commerce sites like Alibaba and Amazon . Typically, the largest percentage of their sales usually comes from the wholesale channel.

Brand Equity Of Puma Marketing Strategy

For those who do not know what Brand Equity means, they are the efforts that are being made with the company’s brand and its products. Puma has had a long time in the footwear industry , and as time goes by, confidence in other of its products, such as sportswear, increases.

Likewise, these product categories have been inspired by their appeal and to match those people who are not afraid to take risks, because they simply prefer to live their life to the fullest.

To make the most of the Brand Equity , the brand has entered into important partnerships with world-renowned sports personalities , such as Tyger Woods.

Analysis of the Puma marketing strategy

Let’s look at the competitive and market analysis of the Puma marketing strategy :

Competitive analysis

As we have already said at the beginning of this post, Puma has operations worldwide. However, the brand has focused on manufacturing the products in the Asian market because the price of labor is cheaper. Likewise, the cost of the raw material has been an advantage for the brand to stay one step ahead of the competition.

Market analysis

Currently, there are many factors that can intervene in the sector so that sports brands can remain on the market: the bargaining power of suppliers, lifestyle changes, population migration, and rising labor costs .

Sports brands also need a marketing mix strategy to outperform the competition. Puma’s marketing strategy has been focused on understanding the needs of its public no matter where in the world it is located, this has generated higher income , considering that its products are produced in a market like Asia, where the hand of work is not as expensive as in other countries.

If you have a sports brand that you want to make known, at Mix With Marketing we have the marketing professionals you need to make a strategy that fits your objectives and your target audience . You just have to contact us and we will gladly assist you.

Do you want to be up to date with topics related to the world of marketing? Subscribe to our monthly newsletter, and we will share the best content with you.

You might also read:

Pepsi Marketing Strategy: The Case Study

McDonald’s marketing strategy: A benchmark in the fast food industry

Nike Marketing Strategy: The Case Study (Just Do It)

Red Bull Marketing Strategy: The Case Study

If You like this information then don’t forget to like, share, subscribe and leave comments. Thank You

- Trackback: Adidas Marketing Strategy The Case Study (Impossible is Nothing) - Mix With Marketing

Leave a comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

You May Also Like

10 Tips to Select the Best Domain Name for Your Website

What is Social Media Promotion?

What is a sales funnel? – Introducing how to create content for attracting customers

Don't miss out on this amazing opportunity - subscribe now and start enjoying all the benefits!!!

No thanks, I’m not interested!

Newsletter Subscribe

Get the Latest Posts & Articles in Your Email

We Promise Not to Send Spam:)

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

PUMA Brand Analysis Report

Related Papers

Whale Dolphin

arpita mukherjee

Hossein Moghaddasi

This article is intended to present an overview around the origins and motivations of the culture and design of sport shoe as contemporary global phenomena by examining the relationship between fashion designers and sportswear companies. The theoretical critique also, unravels some of the intertwining influences that the fashion and sport industries have had on each other by exploring the reciprocal nature of their relationship in the recent years.

Journal of Product & Brand Management

Jana Hawley

This report considers 12 international sports brands — adidas, ASICS, FILA, Kappa, Lotto, Mizuno, New Balance, Nike, Puma, Reebok, Speedo and Umbro — and examines the steps they take to ensure their suppliers in Asia allow workers to organise trade unions and bargain collectively for better wages and conditions. It concludes that all sportswear companies need to take a more serious approach to workers’ right to freedom of association. Some companies — notably Reebok, Puma, adidas, Nike, ASICS and Umbro — are involved in positive initiatives which have led to improved conditions in some factories, but their overall approach to trade union rights has been inconsistent and at times contradictory. FILA, owned by Sports Brands International (SBI), has taken the least action to improve respect for trade union rights in its Asian supplier factories. FILA has failed to adequately address serious labour rights abuses when they have been brought to the company’s attention and since February 2005 has ignored multiple attempts by labour rights groups and trade unions to communicate with the company about labour issues. Asian sportswear workers who want to form unions and bargain collectively frequently face discrimination, harassment, threats of dismissal and, in some cases, violent intimidation. Two of the cases researched for this report — one in Sri Lanka and the other in Indonesia — involved violent assaults on workers who were attempting to form unions in sportswear factories. Women, who make up 80% of the global workforce in the sportswear sector, face particular barriers to participating in trade unions due to gender discrimination within their workplaces, their societies and within workers’ organisations. Transnational corporations (TNCs) in sportswear and other industries cannot, on their own, create the conditions where trade union rights are fully respected. Governments have a responsibility to ensure that labour rights are protected by properly enforced state legislation. However, governments in developing countries are frequently wary of regulating the behaviour of TNCs for fear that they will lose production and investment to other countries. In this context sportswear TNCs can play an important role in ensuring that trade union rights are properly respected in their own supply chains, thereby reducing pressure on governments to erode state protection for these rights.

Evan Allen , Siri Terjesen

theido mokhara

Fariaz Fahad

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

News & Analysis

- Professional Exclusives

- The News in Brief

- Sustainability

- Direct-to-Consumer

- Global Markets

- Fashion Week

- Workplace & Talent

- Entrepreneurship

- Financial Markets

- Newsletters

- Case Studies

- Masterclasses

- Special Editions

- The State of Fashion

- Read Careers Advice

- BoF Professional

- BoF Careers

- BoF Insights

- Our Journalism

- Work With Us

- Read daily fashion news

- Download special reports

- Sign up for essential email briefings

- Follow topics of interest

- Receive event invitations

- Create job alerts

How Puma Became a Rare Wholesale Success Story

- Daniel-Yaw Miller

Key insights

- Puma’s first-quarter earnings beat expectations all around, with overall sales growth of nearly 20 percent.

- The company’s wholesale business grew by 23 percent in the first quarter, benefitting from Nike and Adidas vacating wholesale to focus on their direct channels.

- A decade ago, Puma was struggling. But through pivoting to wholesale and merchandising more performance-forward products, the German brand has seen tremendous growth in the past year.

For much of the last decade, Puma was in limbo, too small to compete with Nike and Adidas, too big to fend off new, niche rivals. Its signature product was a pair of casual suede sneakers — neither fashion-forward nor athletic.

But the German activewear brand may have finally found its place in the market.

In the first quarter of 2022, Puma saw sales increase 19.7 percent to €1.9 billion ($2 billion), the company reported Wednesday, continuing a growth streak that outperformed both Nike and Adidas in their respective fiscal 2021 years.

“This was Puma’s best-ever performing quarter, both in terms of revenue and EBIT [earnings before interest and taxes],” chief executive Bjørn Gulden told analysts on the company’s earnings call.

ADVERTISEMENT

The strategy: rather than compete with Nike and Adidas head-on, Puma went where the sportswear giants didn’t. As Nike and Adidas pulled back from wholesale to focus on their direct channels, Puma swooped in, bulking up its partnerships with multi-brand retailers in North America. It invested in underserved sports like motorsports and cricket, where the category’s giants aren’t as big a presence, partnering with Indian cricketer Virat Kohli and chess world champion Magnus Carlsen to reach new groups of consumers.

Improving Puma’s technical sportswear — also known as performance — offering has been central to its turnaround. Its fastest-growing categories, basketball and running shoes, were reintroduced by the brand in the last four years, and have been key drivers in Puma’s breakthrough in North America, according to Gulden.

“Puma has turned things around since five years ago, when they couldn’t have been described as a performance brand,” said Matt Powell, an analyst and sportswear expert with the NPD Group.

Bucking the DTC Trend

The big opportunity for Puma came in 2020, when Nike began pulling its shoes from wholesale retailers around the world. Nike expects direct-to-consumer sales to account for 60 percent of its total revenue by 2025, up from 39 percent in 2021, according to data analysed by McKinsey & Company.

Suddenly, there were thousands of stores, ranging from mom-and-pop retailers to big chains like DSW and Urban Outfitters that needed a well-known brand to serve their customers, and Puma seized the moment.

In the first quarter of 2022, Puma’s wholesale business increased by 23.3 percent compared to the same period last year, up from €1.2 billion ($1.3 billion) to €1.5 billion, which accounts for roughly 79 percent of total sales.

“Where [Nike and Adidas] are vacating department stores, online retailers and physical retailers, these businesses now have shelf space to fill,” said Deutsche Bank analyst Adam Cochrane. “Puma is taking on these wholesale contracts and filling more of the space.”

Puma’s sales have also benefited from reduced competition at these retailers, and the brand was able to sell more products at full price, with less discounting, according to Deutsche Bank analysis. Puma’s wholesale segment is especially strong in the Americas region, where its first-quarter revenue rose 44 percent compared to the same period in 2021.

A Performance-First Product

A renewed emphasis on technical apparel and footwear designed for specific sports is also key to Puma’s growth. Its successful re-entry into the basketball category in 2018 after a 20-year absence, for instance, has boosted sales in Europe and North America, mitigating challenges such as global supply chain disruptions and declining sales in Asia, according to a Deutsche Bank report on Tuesday.

Gulden, a former professional footballer, began his tenure as Puma’s CEO in 2013 by re-evaluating its product offering. The emphasis shifted toward performance-oriented products that also showcase fashion chops, such as the brand’s foam-soled ‘Nitro’ running shoe line, which resembles a contemporary sneaker collection and is successfully winning over consumers and athletes alike.

“For example, [Puma’s] running products are both technical and trend-right, and the quality of its basketball product has allowed it to grow its market share,” said Powell.

Since its return to basketball, a growing number of NBA and WNBA players, including LaMelo Ball and Breanna Stewart, now wear Puma shoes during games.

Puma is also building its reputation as a performance brand through partnerships with winning athletes in niche sports, including Formula 1, cricket and Nascar racing — fields where Adidas, Nike and Under Armour have little presence. Brand ambassadors include Dutch Formula 1 driver Max Verstappen, the Mercedes AMG team, who won the 2021 competition overall, and Indian cricket legend Virat Kohli — a hugely popular figure in India, with over 240 million followers across Instagram and Twitter. Puma also recently signed world chess champion and internet sensation Magnus Carlsen to a long-term endorsement deal.

All the while, Puma retains big-ticket names in popular sports, such as Usain Bolt, who has been signed to the brand since 2003, Lewis Hamilton and Neymar Jr, the revered Brazilian footballer.

Rebuilding Cultural Clout

Puma’s partnerships across fashion and culture have allowed the brand to stay relevant in the lives of its consumers, according to Cochrane. A sell-out collaboration with Fenty in 2015 proved Puma could stir up some buzz within fashion too.

In March, the German sportswear giant partnered with popular Parisian fashion label Ami to create a range of elevated sportswear, carried by fashion-forward retailers such as End Clothing, and modelled by Romeo Beckham in a high profile campaign.

Puma’s ongoing partnership with British model Cara Delevingne, meanwhile, allows it to reach a younger, more fashion-forward consumer. Last week, the brand announced that Delevingne will be taking part in the company’s RE:SUEDE programme, which will create a biodegradable version of their most iconic shoe. In the music scene, Puma signed Davido, a high profile Nigerian artist, to grow brand visibility among consumers in sub-Saharan Africa.

“Puma is starting to link relevant pop culture to their products, and this has been reinforced by the brand’s sporting credentials,” Cochrane said.

Activewear’s Biggest Disruptors

Breaking into the $384 billion sports apparel market is no easy task, but fast-growing start-ups are stealing market share by creating specialised, fashion-forward products around underserved interests.

How to Win the Pandemic's Activewear Boom

Workout clothes have been a bright spot in the struggling apparel sector this year, but independent brands need to play smart to turn the current bump into long-term success.

Case Study | Inside Nike’s Radical Direct-to-Consumer Strategy

How did Nike’s share price hit an all-time high in the middle of a pandemic? The American sportswear giant’s success is rooted in a radical direct-to-consumer strategy built around content, community and customisation, and conceived for a post-internet world where brand connections are everything.

Daniel-Yaw Miller is Senior Editorial Associate at The Business of Fashion. He is based in London and covers menswear, streetwear and sport.

- Bjorn Gulden

- Under Armour

- New Balance

© 2024 The Business of Fashion. All rights reserved. For more information read our Terms & Conditions

This Week, a Check-In on Gap’s Turnaround Efforts

Gap Inc. will follow up a month of red-carpet highlights with an update on whether its efforts to reignite sales are paying off.

Gildan’s Entire Board Resigns, Handing Victory to Activist Browning West

The company, one of the world’s largest makers of affordable T-shirts and owner of the American Apparel brand, has spent months embroiled in a toxic feud over its direction and who should be in charge.

What Fashion Retail Professionals Need to Know Today

BoF Careers provides essential sector insights for fashion professionals in retail this month, to help you decode fashion’s retail landscape.

How Emerging Travel Trends Are Informing July’s Expansion Strategy

As global travel flows return to pre-pandemic levels, luggage brand July is evolving its offering, placing the needs of new consumers at the centre of its strategy. BoF speaks to co-founder and director Athan Didaskalou to learn more.

Subscribe to the BoF Daily Digest

The essential daily round-up of fashion news, analysis, and breaking news alerts.

Our newsletters may include 3rd-party advertising, by subscribing you agree to the Terms and Conditions & Privacy Policy .

Our Products

- BoF Insights Opens in new window

An Analysis of Puma’s Global Marketing in the COVID-19 Era

- Conference paper

- First Online: 28 June 2023

- Cite this conference paper

- Zichun Pan 7 ,

- Kaiyan Wang 8 ,

- Yuechun Wang 9 &

- Ruonan Zhao 10

Part of the book series: Applied Economics and Policy Studies ((AEPS))

1732 Accesses

Puma is one of the well-known sportswear brands. It’s reasonable and rigorous in product design, as well as long-term clear objectives in market segmentation and distribution channel management. However, in the 1980s and 1990s, Puma was far behind Nike, Reebok, Adidas, and other clothing giants in marketing and sales. The research analyzed the strengths and weaknesses of the Puma brand from the inside, based on SWOT. From the external analysis, the existing threats, competitive situations, and development opportunities in the market are all analyzed. Based on the perspective of 4Ps Marketing Theory, this study analyzed the market for Puma products and studies the strategies for products, pricing, placement, and promotion. Puma’s main market is Asia. Further this paper made a discussion based on the SWOT analysis and give some suggestions on further marketing strategies. The implication as well as contribution were discussed later and limitation and future study were also included.

Z. Pan, K. Wang, Y. Wang, R. Zhao: These authors contributed equally.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Durable hardcover edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Asdi A, Putra AHPK (2020) The effect of marketing mix (4P) on buying decision: empirical study on brand of Samsung smartphone product. Point View Res Manag 1(4):121–130

Google Scholar

Baike. https://baike.baidu.com/item/PUMA/620783 . Last accessed 2022/5/30

Chen Y (1997) Equilibrium product bundling. J Bus 70(1):85

CityAM website. https://www.cityam.com/CORONAVIRUS-OUTBREAK-SPORTSWEAR-GIANTS-PUMA-AND-ADIDAS-WARN-ON-TRADING-IMPACT/ . Last accessed 2022/6/24

Cleverism website. https://www.cleverism.com/place-four-ps-marketing-mix/ . Last accessed 2022/6/17

Coursehero.com website. http://www.coursehero.com/file/p36emkhp/The-promotional-and-advertising-strategy-in-the-Puma-marketing-strategy-is-as/ . Last accessed 2022/5/31

Fang Y, Sun L, Gao Y (2017) Bundle-pricing decision model for multiple products. Procedia Comput Sci 112:2147–2154

Article Google Scholar

Fashionunited.com website. https://fashionunited.com/executive/management/puma-swings-to-loss-as-covid-19-hits-sales-scraps-full-year-outlook/2020072934703 . Last accessed 2022/5/30

IIDE website. https://iide.co/case-studies/marketing-strategy-of-puma/ . Last accessed 2022/5/31

Investopedia website. https://www.investopedia.com/terms/d/distribution-channel.asp . Last accessed 2022/6/17

Investopedia website. https://www.investopedia.com/terms/s/swot.asp . Last accessed 2022/6/24

Ir.uitm.edu.my website. https://ir.uitm.edu.my/id/eprint/50750/ . Last accessed 2022/6/24

Lei L (2020) Research on RX coffee 4P marketing strategy in internet environment

Marketing91 website. http://www.marketing91.com/marketing-strategy-puma/ . Last accessed 2022/5/31

MBA Skool-Study.Learn.Share. website. https://www.mbaskool.com/marketing-mix/products/17274-puma.html . Last accessed 2022/6/24

Mbaskool website. https://www.mbaskool.com/marketing-mix/products/17274-puma.html . Last accessed 2022/5/31

Mehta S, Saxena T, Purohit N (2020) The new consumer behaviour paradigm amid covid-19: permanent or transient? J Health Manag 22(2):291–301

Meissner F, McCarthy E (1960) Basic marketing: a managerial approach. J Mark 42(4):103

Oppewal H, Holyoake B (2004) Bundling and retail agglomeration effects on shopping behavior. J Retail Consum Serv 11(2):61–74

Philip K (1986) Harvard Business Review. In: Philip K (ed) Conference, vol 64, no 2

Puma.com website. https://annual-report.puma.com/2021/downloads/puma-ar-2021_annual-report.pdf . Last accessed 2022/6/18

PUMA SE website. https://about.puma.com/en/this-is-puma/history . Last accessed 2022/5/30

PUMA SE website. https://about.puma.com/en/sustainability/social/covid-19-supply-chain . Last accessed 2022/5/30

PUMA SE website. https://about.puma.com/en/newsroom/corporate-news/2020/2020-03-11-corona . Last accessed 2022/5/30

PUMA SE website. https://about.puma.com/en/newsroom/corporate-news/2021/02-24-2021-q4-results . Last accessed 2022/6/24

PUMA SE website. https://about.puma.com/en/newsroom/corporate-news/2020/2020-03-24-measures . Last accessed 2022/6/24

ResearchGate website. https://www.researchgate.net/publication/336471791_THE_EFFECT_OF_MARKETING_MIX_ON_ORGANIZATIONS_PERFORMANCE . Last accessed 2022/6/17

Scribbr website. https://www.scribbr.com/methodology/qualitative-research/ . Last accessed 2022/6/24

SSAC Advisory & Professionals website. https://ssacltd.com/insight/benefits-of-swot-analysis/ . Last accessed 2022/6/24

Statista website. https://www.statista.com/statistics/268466/footwear-sales-of-puma-worldwide-since-1993/ . Last accessed 2022/5/30

Stremersch S, Tellis GJ (2002) Strategic bundling of products and prices: a new synthesis for marketing. J Mark 66(1):55–72

Textilegoglobal.com website. http://textilegoglobal.com/xwzx/yw/70109.html . Last accessed 2022/5/30

Thabit TH, Raewf MB (2018) The evaluation of marketing mix elements: a case study. Int J Soc Sci Educ Stud 4(4):100–109

The Digital School website. http://iide.co/case-studies/marketing-strategy-of-puma/ . Last accessed 2022/6/24

Thesocialgrabber.com website. https://thesocialgrabber.com/market-segmentation-of-puma/ . Last accessed 2022/6/18

Vittana.org website. https://vittana.org/23-advantages-and-disadvantages-of-qualitative-research . Last accessed 2022/6/24

Wang Y (2020) Analysis on the marketing strategy of H real estate project based on 4P marketing theory

Yu Z (2020) The research on the 4P marketing strategy of Yantai Enbang Company’ marking machine

Zhang L (2019) Research on L’Oreal’s marketing strategy in China

Download references

Author information

Authors and affiliations.

JBJI Economic, Jinan University, Guangzhou, 511486, China

Economics and Management, Zhejiang Sci-Tech University, Hangzhou, 310018, China

Kaiyan Wang

Economics and Management, University of Putra Malaysia, Yunnan, 653100, China

Yuechun Wang

International Business, Xi’an Jiaotong-Liverpool University, Suzhou, 215028, China

Ruonan Zhao

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Ruonan Zhao .

Editor information

Editors and affiliations.

Department of Postal Management, Beijing University of Posts and Telecomm, Beijing, China

Xiaolong Li

School of Economics and Management, Beijing University of Posts and Telecommunications, Beijing, China

Chunhui Yuan

Supply Chain Management, University of Arkansas, Fayetteville, NC, USA

Rights and permissions

Reprints and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper.

Pan, Z., Wang, K., Wang, Y., Zhao, R. (2023). An Analysis of Puma’s Global Marketing in the COVID-19 Era. In: Li, X., Yuan, C., Kent, J. (eds) Proceedings of the 6th International Conference on Economic Management and Green Development. Applied Economics and Policy Studies. Springer, Singapore. https://doi.org/10.1007/978-981-19-7826-5_4

Download citation

DOI : https://doi.org/10.1007/978-981-19-7826-5_4

Published : 28 June 2023

Publisher Name : Springer, Singapore

Print ISBN : 978-981-19-7825-8

Online ISBN : 978-981-19-7826-5

eBook Packages : Economics and Finance Economics and Finance (R0)

Share this paper

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

ROI Revolution

Case Study: PUMA

Drives Increased Conversion Value & ROAS Through Facebook Attribution

Top-of-Funnel Marketing

Attribution Clarity

The Situation

PUMA , an industry-leading sports brand, has been innovating sports apparel, footwear, and accessories since 1948. PUMA invests heavily in awareness across lots of different accounts and builds a strong brand identity through collaborations with numerous renowned labels, brand ambassadors, and celebrity influencers. But with so many avenues to reach customers, there was a lack of conversion-focused accountability on the paid social side of business, muddling the waters of driving and tracking direct sales from Facebook and Instagram.

Opportunity Identified

This lack of conversion clarity is a common theme for brands investing in multiple channels, especially when it comes to cross-device tracking. While PUMA recognized the importance of top-of-funnel brand awareness campaigns, being able to clarify conversions driven by paid social advertising would require different measurement tools. PUMA turned to their partners at ROI Revolution for a solution.

ROI in Action

ROI started by implementing Facebook Attribution to look at first-touch, last-touch, and all the touchpoints in between and gain a deeper understanding of the impact of PUMA’s upper-funnel campaigns.

The team knew a lot could be gained from understanding both cross-device and cross-channel conversions, which are often impossible to track in Google Analytics. The team also ran a Cross-Source Conversion Lift to gain insight into the impact of PUMA’s ads on driving incremental sales and conversions.

Results Achieved

More case studies, how can we help you achieve your goals.

- 919-954-5955

- [email protected]

- 4401 Atlantic Ave, Raleigh, NC 27604

- Advertising for Amazon

- Conversion Rate Optimazition

- Paid Search & Shopping

- Product Feed Optimization

- Programmatic Advertising

- Search Engine Optimization

- Social Media Advertising

- ROI Technology

- Case Studies

- Resource Library

Targets and Strategy

PUMA has continued its brand mission to become the fastest sports brand in the world. Therefore, we continued to focus on the following six strategic priorities: create brand heat, develop product ranges that are right for our consumers, build a comprehensive offer for women, improve the quality of our distribution, increase the speed and efficiency of our organizational infrastructure and strengthen our positioning in the North American market by leveraging our re-entry into basketball. In 2020, we also added an even stronger focus on local relevance and sustainability as additional strategic priorities for PUMA.

For more than 70 years, PUMA has created brand heat by partnering with the most famous and successful athletes: Usain Bolt, Sir Lewis Hamilton, Pelé, Maradona, Tommie Smith, Boris Becker, Linford Christie, Serena Williams, Heike Drechsler and Martina Navratilova, just to name a few. Today, PUMA continues to strengthen its position as a sports brand through partnerships with some of the most famous ambassadors: the Italian national football team, star strikers Antoine Griezmann, Romelu Lukaku, Sergio Agüero and Luis Suarez, top football manager Pep Guardiola, international top clubs Manchester City, Borussia Dortmund, Valencia CF, Olympique Marseille and AC Milan, golf stars Lexi Thompson, Rickie Fowler and Bryson DeChambeau, seven-time Formula 1 world champion Sir Lewis Hamilton, Norwegian hurdler and world champion Karsten Warholm, Canadian sprinter André De Grasse, Swedish pole vault world record holder Mondo Duplantis and the Jamaican and Cuban Olympic Federations. In 2020, we also added Brazilian football star Neymar Jr. to our roster of world-class assets, underlining our continued focus on the football category. Teaming up with the best athletes, teams and federations is key in keeping the credibility of the PUMA brand at the highest levels. To connect with young, trend-setting consumers, PUMA also drives brand heat by working with icons of culture and fashion such as Selena Gomez, Cara Delevingne, Winnie Harlow and Dua Lipa. This has made PUMA one of the hottest sports and fashion brands for young consumers.

PUMA aims to design “cool stuff that works” and in 2020, we significantly improved our product offering across all our business units. In performance footwear, we keep on moving forward with the revolutionary PUMA ULTRA football boot and our running & training shoes based on our proprietary NITRO, HYBRID and XETIC technology platforms.

In Sportstyle, we continued to see strong sell-through of our key footwear product families of RS, RIDER, and CALI. The demand from our consumers for these franchises has been maintained through the launch of strong new models in 2020. The Classics pillar with models such as the iconic SUEDE, the RALPH SAMPSON or the SPEEDCAT also continued to perform strongly throughout the year.

In apparel and accessories, we saw a good development across the portfolio, especially from motorsport and basketball apparel as well as our essentials offering, which includes socks and underwear.

Our COBRA Golf and PUMA Golf business also showed a strong performance in 2020, mainly driven by higher sales of our innovative COBRA Golf clubs. Especially our COBRA Golf SPEEDZONE Drivers enjoyed market share growth globally with the introduction of the innovative CNC Milled Infinity Face leading to maximum ball speed and higher precision - a first in the golf industry.

Creating a leading product offer for women remains a priority for PUMA and we continue our mission to be the most fashion-forward sports brand for the female consumer. In 2020 we evolved our positioning of “PUMA owns the space where the gym meets the runway” as more and more women take up sports worldwide and athletic wear has long made its way into everyday outfits. As we identified a culture shift in our female consumer from “me” to “we” we defined our new “She Moves Us” communications platform, which celebrates women who move together to achieve and connect – through sport, culture and values.

Returning to basketball , with an approach that resonated well on and off the court, was an important step towards increasing our credibility as a sports brand in North America. With the support of JAY-Z, our Creative Director for basketball, we developed a strong product offering across footwear, apparel and accessories that can be worn on and off the court. We also continued to work with highly talented NBA players across several teams and gained great on-court visibility when PUMA athletes Kyle Kuzma and Danny Green won this year’s NBA Championship with the Los Angeles Lakers. Signing a long-term partnership with the top 2020 NBA prospect LaMelo Ball further underlines our commitment to basketball. Our basketball business also continues to grow beyond the key North American market, and we saw continued strength in our performance basketball product portfolio and basketball inspired Sportstyle product families such as the RALPH SAMPSON.

While basketball is especially important for North America, we also focused on ensuring strong local relevance in all our other markets worldwide. As the PUMA brand and products continue to resonate well around the world, we see an increased need to focus on the sports, ambassadors, collaboration partners and communication platforms that are most relevant in the different markets. A good example for this is India, where we have a market-leading position in part due to our strong presence in the nation’s most popular sport of cricket and our long-term partnership with Virat Kohli, the captain of the Indian national cricket team. We also continued to strengthen our position in other locally relevant sports such as handball, netball, rugby or Australian rules football. Over the years, we have also established a strong portfolio of locally relevant brand ambassadors and influencers that complement our roster of top global assets and strengthened our presence on locally relevant communication platforms such as Weibo, Youku or WeChat in China. In order to be closer to the market and to ensure a strong local relevance of our products, we also have Regional Creation Centers in key markets such as North America, Europe, India, China and Japan that work in part on joint product creation projects with local collaboration partners.

PUMA improved the quality of its distribution and expanded its presence in key Sports Performance and Sportstyle accounts around the world. We continued to strengthen the relationships with our retailers by being a flexible and service-oriented business partner, also throughout the COVID-19 crisis. By improving sell-through, we further expanded the shelf space given to us in our partners’ retail stores. In parallel, we also continued to invest in our direct-to-consumer business which includes our owned-and-operated retail stores as well as our e-commerce business. Due to mandatory store closures during the COVID-19 crisis and an accelerated shift towards digital, we saw strong growth in our e-commerce business and invested in our respective front-end and back-end capabilities. We continued to improve the user experience and product offering on our existing e-commerce channels and launched a new e-commerce site in the important Mexican market. We also increased our investments into performance marketing to drive traffic and conversion in all our e-commerce channels. Furthermore, PUMA continued to upgrade its owned-and-operated retail store network and opened selective new doors around the world.

Operationally, we continued to improve infrastructure , processes and systems that are required to support our overall growth ambition. In 2020, a strong focus was put on expanding our logistical network in key markets. Our new, highly automated multi-channel distribution center in Indianapolis, USA successfully went live in the second quarter of 2020 and an additional multi-channel distribution center in Geiselwind, Germany is expected to open in the second quarter of 2021. New state-of-the-art distribution centers like the ones in Geiselwind and Indianapolis are providing us with the required back-end infrastructure to support our future growth in the wholesale and direct-to-consumer channels.

Beyond distribution center expansion, PUMA continued to focus on standardization of ERP systems and enhancements of product development tools. This, combined with improvements of the overall IT infrastructure, enabled faster and better communication and information exchange within PUMA and with our external partners. Due to the travel restrictions during the COVID-19 crisis, we also invested in additional digital capabilities along the whole go-to-market process, from virtual product development to virtual sell-in meetings.

In sourcing, the long-term collaboration with suppliers remains the key component of our sourcing strategy to ensure a stable sourcing base, consistent quality of our products and being well prepared for changes in the trade environment. The strong collaboration with our suppliers, who are mainly based in Far East, has helped us during the COVID-19 crisis and contributed to a very resilient supply chain situation throughout the year.

While social, economic and environmental sustainability has always been a core value for PUMA, we want to place an even higher strategic emphasis on this topic with a special focus on increasing the number of sustainable products in our ranges and stronger consumer-facing communication. In 2020 we officially announced our 10FOR25 targets that outline our ambitious sustainability-related objectives until the year 2025 and which link back to the United Nation’s Sustainable Development Goals. In 2020, we also launched our FOREVER BETTER communication platform that will serve as the overarching umbrella of all our consumer-facing communication on sustainability. Because of our increased focus on developing more sustainable products, we successfully introduced the PUMA x FIRST MILE and PUMA x CENTRAL SAINT MARTINS sustainability collections with strong feedback from our retailers and end consumers. Other product highlights include the Time4Change youth collection made of organic cotton. PUMA also continued its leading role at the Fashion Charter for Climate Action and continued to work with key stakeholders on all levels to promote more sustainable business practices within our industry. In relation to human rights, we took all required actions to safeguard our suppliers and workers during the pandemic by honoring our purchasing commitments and ensuring that all workplace safety and legal standards are met through our long-standing social compliance program.

- My basket Quantity Price

- Your Shopping Basket is empty.

Sign in to Your Account or Register

Password reminder, case study: puma.

In 2001, PUMA was facing a crossroads. The German brand that had been born out of the infamous Dassler family feud in 1948, which launched PUMA and Adidas, was in big need of rejuvenation.

After early successes with its sports footwear products through the sixties, seventies and eighties, the company found it had become less relevant to the urban youth market. The business was wedged between sports giants like Nike and Adidas, and the small, edgy footwear independents, that had spun out of the skateboarding and dance music scenes of the late eighties and nineties.

Ten years on and its rebirth is palpable by every measure. Not only has PUMA increased its brand value steadily in line with the major brands, (according to Brand Finance's annual Global 500 study); the brand has snapped up six D&AD Yellow Pencils to boot. Last summer, PUMA hit EURO 3bn sales for the first time, and with sprinter Usain Bolt as brand champion for Olympics year, 2012 is looking promising.

Register Now to Keep Reading

Once registered you will have access to this article and all other features, access our archive and case studies, be able to submit your work to us and receive our newsletter if opted-in.

Why Am I Being Asked to Register?

We'll ask you to provide a few details about yourself, your current role and what you do. We won't share your information with other parties and won't spam your mailbox.

This site contains over 50 years’ of award winning work, articles, interviews and case studies. Register to gain full access to everything.

Sign In to Your Account

Just one more thing to do.

Join our mailing list to receive awards news, creative case studies, trends, insights and exclusive invitation to events.

Things To Do

D&AD Awards 2024

D&AD Annual 2023: Explore the winning work and insights

New Blood Awards 2024

D&AD Awards Ceremony

How to have good ideas

D&AD Masterclasses

D&ad awards winners 2024.

See the world's best creative advertising, design, craft and culture work of 2024.

D&AD Masterclasses power up careers and future proof businesses by focussing on the creative skills of tomorrow taught by the stars of today.

- Case Studies

- Flexible Products

- Expert Insights

- Research Studies

- Creativity and Culture

- Management and Leadership

- Business Solutions

- Member Spotlight

- Employee Spotlight

How PUMA built an interim headquarters in record time

The iconic sportswear brand tapped wework for a temporary office that would energize current and prospective employees.

Around the world, companies of all sizes find space to succeed at WeWork. Our case studies share their unique stories.

The challenge: finding an interim space that reflects a global brand and attracts talent

An office is more than just where people work. This is especially true for PUMA ’s Boston-based teams, which include marketing and product design. For them, an office space needs to be inspirational for employees thinking up their next big campaign or sneaker design and aspirational for talent interviewing at the multinational sportswear company.

Unfortunately, PUMA didn’t have that at their previous office.

“It was outdated, dark, sparse—it was hard to generate energy,” says Tom Coen, vice president and deputy general counsel at PUMA. “It was not a modern space that employees and candidates expected. And we had the opportunity to fix that.”

That occasion came when the lease expired and the building was marked for demolition. PUMA started designing a Boston headquarters that would get employees excited to come to work every day—an office they would be proud of.

“Boston is a key location in the United States for an athletic footwear and apparel company,” Coen says. “There’s a tremendous amount of talent in this area, so we needed to do everything we could to have a compelling office environment to attract and retain new hires.”

But it would be a full two years between breaking ground on the headquarters and moving in. PUMA’s executive team knew that it was crucial to maintain the employee experience during that time.

They sought an interim office that didn’t feel like a generic swing space. Even though it would be for only two years, PUMA needed a workspace that reflected their dynamic brand. Without it, they’d be at a disadvantage in Boston’s competitive market. In addition, Boston is an international hub for the company, and the space needed to accommodate—and invigorate—visiting teams from around the world.

And true to their slogan, “Forever Faster,” PUMA required a real estate solution quickly.

The solution: an inspired workplace in record time

With WeWork’s agile real estate offering , PUMA now had a partner that could move at the necessary pace. WeWork built out two floors at 33 Arch St in downtown Boston for 250 PUMA employees. The reception desk bears PUMA’s logo, and a large wall is emblazoned with the “Forever Faster” slogan. Custom paintings, inspired by street art, hang in the halls. Large windows look out over downtown Boston.

“For two floors, 60,000 square feet in downtown Boston, the pace felt pretty insane,” says Kate Armanetti, head of human resources at PUMA. In fact, the entire project was delivered to PUMA within eight months. But despite the accelerated time line, WeWork completed the project without compromising quality. “It was done fast—and it was done well,” Armanetti says.

PUMA’s new workspace offers functional spaces customized to their employees’ unique needs—including a conference room that doubles as a sneaker showroom, a photo studio for marketing shoots, and storage spaces to hold the different materials used in product design. In addition, the office has a number of space types , from quiet nooks and phone booths for heads-down work to lounges for collaboration and conference rooms for private meetings.

“What we found impactful was the time that WeWork spent with us learning about our business, and how that translated into a design specific to PUMA,” Coen says. “WeWork understands what our designers need to make footwear and what marketers need to foster creativity.”

The result: an on-brand, agile space solution that energizes current and prospective employees

PUMA’s WeWork space so fully embodies their brand that it’s helping them achieve key business objectives.

“We ended up with a space that feels like a PUMA office, not a WeWork office,” says Adam Petrick, global director of brand and marketing at PUMA. “I’m proud to be able to bring clients, celebrities, and all of our ambassadors into this space.”

As the company continues to see double-digit growth in all product segments, PUMA now has a workplace environment that attracts and retains talent as they push to further innovate .

“We’re seeing more candidates in the door than ever before,” Armanetti says.

What started out as an agile space solution to meet a pressing need has become a valuable business asset.

“We ended up coming out with an office far better than the one we left,” adds Coen. “Our employees reap the benefit of it every single day.”

Key highlights

- Prime downtown Boston location

- Move-in-ready space within eight months

- Design that reflects PUMA’s iconic brand and assists in talent acquisition and retention

- Purpose-built spatial features to meet the needs of marketing and product-design teams

WeWork offers companies of all sizes space solutions that help solve their biggest business challenges.

Related articles

With Transport for London, it’s easy to travel all over the city for the best working environments

Used in both marketing and machine learning, decision trees can help you choose the right course of action

Before you spend a cent on marketing, you first have to understand the market and your customers

Proving sustainability through transparency

Puma, the global active and sportswear brand, has a clear, strong and comprehensive commitment to sustainability..

As well as apparel and accessories, the company recognized that in-store consumables, such as bags and clothes hangers, were an opportunity to progress towards their science-based targets and positive climate change impact.

Brandon collaborates with PUMA to develop in-store materials, showing transparency across the supply chain, to prove the sustainable benefits of our work together.

What was the challenge?

PUMA is committed to achieving their “10FOR25” sustainability targets.

This list of targets includes commitments on topics such as climate, human rights, fair income, products and circularity.

Brandon must contribute towards PUMA achieving these goals through improvements to in-store materials that reduce climate impact. For instance, PUMA set strict limits on the supply of unsustainable products such as plastic bags.

PUMA is vigilant to avoid any perception of greenwashing. All products must be signed off from the company’s in-house sustainability department, who require transparency throughout the supply chain. Products must also be tested and approved by reputable sustainability authorities such as EcoVadis and the Forest Stewardship Council (FSC).

Finally, several challenges stem from the fact PUMA is a highly successful, multi-national company. Brandon had to identify and source from factories that could cope with extremely large order volumes, for example, the 25–30 million sustainable paper bags manufactured each year. And, with 600 stores in more than 120 countries, maintaining brand consistency across the entire PUMA retail network was high on the agenda.

How we contribute to PUMA’s sustainability targets

Brandon redesigned and resourced PUMA’s in-store consumables with recycled materials. The consumables themselves are recyclable too.

How we made sustainability commercially viable

Brandon consolidated production to a limited number of factories to keep costs down.

We made other financial and environmental savings by carefully sourcing paper and automating production. We work closely with our supplier network to make production more efficient. One example was the redesign of bag handles, so a new machine with greater production capacity could be used.

We don’t just claim sustainability – we prove it

PUMA expects transparency throughout their supply chain.