Accounting Business Plan Template

Written by Dave Lavinsky

Accounting Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their accounting firms.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write an accounting business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is an Accounting Business Plan?

A business plan provides a snapshot of your accounting business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for Your Accounting Firm

If you’re looking to start an accounting firm or grow your existing accounting business, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your accounting business to improve your chances of success. Your accounting business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Accounting Firms

With regards to funding, the main sources of funding for an accounting firm are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for accounting firms.

Finish Your Business Plan Today!

How to write a business plan for an accounting firm.

If you want to start an accounting business or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your accounting business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of accounting business you are running and the status. For example, are you a startup, do you have an accounting business that you would like to grow, or are you operating an established accounting business you would like to sell?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overv iew of the accounting industry.

- Discuss the type of accounting business you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of accounting business you are operating.

For example, you might specialize in one of the following types of accounting firms:

- Full Service Accounting Firm: Offers a wide range of accounting services.

- Bookkeeping Firm: Typically serves small business clients by maintaining their company finances.

- Tax Firm: Offers tax accounting services for businesses and individuals.

- Audit Firm: Offers auditing services for companies, organizations, and individuals.

In addition to explaining the type of accounting business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, or the amount of revenue earned.

- Your legal business structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the accounting industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the accounting industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your accounting business plan:

- How big is the accounting industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your accounting business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your accounting business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, organizations, government entities, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of accounting business you operate. Clearly, individuals would respond to different marketing promotions than corporations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are othe r accounting firms.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes CPAs, other accounting service providers, or bookkeeping firms. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of accounting business are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide options for multiple customer segments?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a accounting business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type o f accounting company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide auditing services, tax accounting, bookkeeping, or risk accounting services?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of yo ur plan, yo u are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your accounting company. Document where your company is situated and mention how the site will impact your success. For example, is your accounting business located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your accounting marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your accounting business, including answering calls, scheduling meetings with clients, billing and collecting payments, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to book your Xth client, or when you hope to reach $X in revenue. It could also be when you expect to expand your accounting business to a new city.

Management Team

To demonstrate your accounting business’ potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing accounting businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing an accounting business or bookkeeping firm.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance s heet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you see 5 clients per day, and/or offer discounts for referrals ? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your accounting business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a accounting business:

- Cost of equipment and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or a list of your most prominent clients. Summary Writing a business plan for your accounting business is a worthwhile endeavor. If you follow the accounting business plan example above, by the time you are done, you will truly be an expert. You will understand the accounting industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful accounting business.

Accounting Business Plan Template FAQs

What is the easiest way to complete my accounting business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your accounting business plan.

How Do You Start an Accounting Business?

Starting an accounting business is easy with these 14 steps:

- Choose the Name for Your Accounting Business

- Create Your Accounting Business Plan

- Choose the Legal Structure for Your Accounting Business

- Secure Startup Funding for Your Accounting Business (If Needed)

- Secure a Location for Your Business

- Register Your Accounting Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Accounting Business

- Buy or Lease the Right Accounting Business Equipment

- Develop Your Accounting Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Accounting Business

- Open for Business

Don’t you wish there was a faster, easier way to finish your Accounting business plan?

OR, Let Us Develop Your Plan For You Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how a Growthink business plan writer can create your business plan for you. Other Helpful Business Plan Articles & Templates

Create a Winning Accounting Firm Business Plan: A Step-by-Step Guide

Starting your own accounting accounting firm is an exciting yet challenging endeavour. It's certainly hard work and there are a lot of aspects to consider before taking the plunge. Before launching any business, you need to devise a solid business plan to guide you on your journey. Business plans clarify what you're doing, what you hope to achieve, and how you'll get there.

There are a lot of components that make up a business plan. Bringing everything together into a logical and cohesive document is not always an easy thing to do.

Key Takeaways from this Post

For this reason, I've created this step-by-step guide to composing a winning accounting firm business plan. It includes all the sections that you'll need to cover in your plan, what they mean for your business, and how to craft them.

What is an Accounting Firm Business Plan?

An accounting firm business plan is a document that details a plan of action for starting and running accounting firms. It will articulate your objectives and strategies for reaching your goals. A business plan will also detail your budget, along with the services you'll provide.

A business plan is often used as a way of obtaining funding for a business venture. A finance provider will look at your business plan and use it, along with other information, to decide whether or not to offer you a business loan or to invest in your firm.

Business plans should be updated annually and used as a guide for understanding whether your business is on track. Adjust your business plan as needed to help you grow your business further, get more funding, and gain more clients through your marketing efforts. Your plan must also specify the best business structure for your firm.

Why do You Need an Accounting Firm Business Plan?

An accounting firm business plan has the following advantages:

- Articulate your vision: Having an idea is great but you need to hone in on it and articulate the exact steps to bring your vision to life.

- Viability: A business plan will help you learn whether or not your business strategy or idea is actually viable, both financially and practically.

- Secure investments: As touched upon earlier, a business plan can help you bring investors onboard and secure the funding you need to take off.

- Identify and address risks: Creating a business plan should force you to look at your business idea from all angles, while asking yourself important questions that'll help you identify and address potential risks.

- Create a marketing strategy: A marketing strategy is a big part of your business plan. It'll make you think about who you'll market to and precisely how you'll do it.

- Reach your goals: A business plan can clarify your goals, both long-term and short-term, and give you something to focus on to reach them.

How to Create Your Accounting Firm Business Plan

There is no definitive rule for what components to include in a business plan. Here is a potential structure for your accounting firm business plan:

- Executive Summary

- Company Description

- SWOT Analysis

- Market Analysis

- Marketing and Sales Strategy

- Financial Operations, Projections, and Plan

1. Executive Summary

Your Executive Summary summarises your business. It begins with a short text that includes key elements of your business and services, like what you'll do, how you'll do it, and what you'll require to do it. For example:

[Name of firm] provides eCommerce accounting , tax management, and bookkeeping services to small eCommerce businesses within the UK. Currently a one-person accounting firm owned and run by [your name], the business will hire an administrative assistant and invest in marketing solutions to bring in new clients. This business plan outlines the business objectives and strategies for growth over the next one year, three years, and five years.

Products and Services

After your initial statement, detail the products and services your firm does/will provide. List your services and then any subgroups within the services. For example:

Tax services

- Tax planning

- Tax return preparation

- Tax return filing

- Audit representation

Underneath each section, write a paragraph discussing the services in more detail, including the charge to clients and any potential cost to yourself. Although it might be difficult at this early stage, you can specify how many hours per week you are able to dedicate to each service.

Your vision is basically your objectives; that is, your business goals. These could be goals for different interims, such as one year, three years, and five years. And, they can include goals for growth, such as gaining X amount of clients and generating X amount of revenue. You could also include goals to hire more staff to achieve these overall goals and enable you to offer more services.

You mission is more focused on your current situation and what you're doing to achieve your goals. For example, your mission could be to offer the best value for money, provide clients with valuable insights that'll help their businesses to grow, or to ensure tax compliance regardless of jurisdiction. And of course, you can specify multiple areas of your mission.

Keys to Achieving Vision

Note a few different ways you can achieve your vision and enhance your overall success. This could be, for example, prioritising excellent client communication, investing in further training, and developing trust with clients to build long-term relationships.

2. Company Description

Begin with a short summary of your company. Who owns it, when it was/will be founded, and what you do. If you've already launched your business, you'll want to include historical details, such as annual revenues and start up investments. You must also detail your business structure.

It would be useful to include a clear graph or table detailing past sales, and gross and net profits, showing side-by-side yearly comparisons. If you haven't yet launched, you'll want to include your specific plans for the company.

Roles and Responsibilities

In this section, discuss concisely the roles that will be filled that'll help your business achieve its visions. And, what the responsibilities are for those fulfilling the roles. Roles could include:

- Admin assistant

- Receptionist

If you're a lone ranger, still complete this section and detail your responsibilities within the firm and how these contribute to your overall goals.

3. SWOT Analysis

Next up you'll complete your SWOT analysis. This is a method for critically analysing your business, skills, and the resources available to you. The well-known planning tool forces you to consider all angles and potential outcomes of your business, both good and bad.

Here are the components that make up a SWOT analysis:

Your strengths are the things that your company does, or will do, well. They are the areas that you currently excel at and the qualities that set you above, and give you an advantage over, your competitors.

Ask yourself questions like:

- What skills do I have?

- What is the business's USP?

- What does my business do particularly well?

Some examples of strengths include:

- Your extensive experience and years of training.

- Your expertise in a particular area.

- Offering a personable service.

- Strong capital for starting up.

- High marketing budget.

On the flip side, you have your weaknesses. These are things that go against you and your business, particularly when compared with competitors. They are the things that put you behind other firms. Understanding your weaknesses can help you to improve on them or find workarounds.

- What areas of accounting do I lack skills in?

- What do competitors have that I don't?

- What are my limitations when it comes to capital and resources?

Some examples of weaknesses include:

- A small start up and marketing budget.

- Not as well known as competitors.

- Not able to offer the same services as competitors.

- Not enough staff to accommodate many clients.

Opportunities

Here, you'll identify opportunities within your business to improve, grow, learn, and develop. They are opportunities within your niche and industry, as well as within the business itself.

Ask yourself the following questions to identify opportunities:

- Are there any gaps in the market that competitors aren't taking advantage of?

- Are there any ways to secure more funding for my business?

- What technology could help my business?

- Do competitors have any weaknesses that would benefit my business?

- Are there any opportunities for business expansion, either geographically or by expanding my services.

Here are some examples of opportunities:

- Connect with potential clients on social media.

- Technology that allows you to offer more services and saves you time, such as sales tax software for accountants .

- A growing need for eCommerce accounting.

- Not much local competition for eCommerce accounting.

The 'T' in SWOT stands for Threats. These are the things that could potentially harm your business and impact it in a negative way. By identifying these possibilities early, you can take mitigating steps to eliminate or minimise the damage threats could do to your business.

These are some questions that'll help you identify possible threats:

- In what ways do our weaknesses harm our business?

- Are there any economic, social, or political factors that could negatively impact my accounting firm?

- Is our target market expanding or shrinking?

- In what ways could my competitors harm my business in the future?

- Could technology be used against me or have a negative impact on my business?

And here are some potential threats to your business:

- eCommerce accounting could become a more widely-adopted service, leading to higher competition.

- Technology that you rely on might crash or not work as intended.

- Technology might allow businesses to do their own accounting.

4. Market Analysis

A market analysis defines and articulates the current state of your market. It looks at things like the value of the market, market trends, customer segmentation, and your competitive market.

Begin this section with a market summary. This is a paragraph explaining the market, such as who you're targeting and why they'd hire or outsource an accountant that offers the same key services as you. This shows potential investors that you understand the industry and its potential.

Market Trends

There are loads of different aspects of market trends, like social media trends, historical trends, demographic trends, and seasonal trends.

- Begin this section by defining what market trends you'll be looking into. Once you know this, you can go ahead and define your goal for analysing market trends. For instance, you might want to identify purchasing patterns or gather data to help project revenue. Whatever your goal is, write it down.

- Write a plan as to how you'll carry out your market trend analysis. This needs to be done over a period of time so you can identify patterns within the market. You should also do this regularly so you can keep up with changing trends.

- Now you can choose your tools. Different software can reveal critical insights into market trends, patterns, and opportunities. Prioritise tools that offer a user-friendly dashboard that clearly shows your data in the form of easy-to-understand graphs.

- Play around with different filters, asking the right questions, and analysing the right data. Record your findings in this section of your business plan, along with how you found them and why it matters.

Target Market

You must now define and segment your target market. So for example, you might target small businesses and new businesses within a specific geographical area, such as the UK.

During your research for your business plans, you identify that there are currently X amount of businesses that meet that specific criteria. Write a short paragraph defining each segment. For example, you could classify a new business as one that's less than a year old.

This is your target market.

You can break your figures down further by specifying the percentage of each segment. For example, small businesses might make up 65% of your potential customers. New businesses might make up 30%, while 5% could be classified as 'Other businesses'.

Write how and why you'll accommodate each segment.

Competitive Analysis

Next up you must analyse your competitors and the competitive landscape. Separate your direct competitors from your indirect ones. Your direct competitors are other accounting firms. Indirect competitors are the other options that businesses have, such as subscribing to a SaaS or a bookkeeping firm.

Once you've identified your direct competitors, detail things like pricing, types of customers, services they offer, and their strengths and weaknesses. Now articulate what you'll do to set your accounting firm apart from competitors and give you a competitive advantage. For example, offering a different service or better prices.

Side note: We touched on this competitive landscape analysis earlier during our SWOT analysis. The Swot analysis should be short, scannable bullet points while this section dives in deeper into the analysis.

5. Marketing and Sales Strategy

Developing marketing and sales strategies is a critical part of your business planning efforts. They define your long term and short term plans for promoting your business and selling your accountancy services, in addition to a sales forecast.

Your marketing plan clarifies your long-term marketing goals, along with the methods and channels you'll use for marketing. Marketing focuses on promoting your services and getting your key points out there for potential clients to see.

List each of your marketing methods, and include some details and context about each. For example:

- Monthly advertisements of specific or general services in local publications. Track the ads' performance over time to determine ROI.

- Optimise website for search engines by investing significantly in SEO. Work with a specialised service that'll ensure our site is at the top of search engines.

- Implement social media marketing by creating engaging content for our target audience. Reply to comments, ask for reviews, and maintain an open dialogue.

- Apply to be in accountant directories, such as Xero or QuickBooks. (Link My Books also has an accountant directory where customers can find an expert accountant that meets their specific needs.)

Your sales strategy is more focused on how you'll convert potential clients into actual paying clients. So for example, you might communicate directly with leads, offer special discounts, or run a referral scheme that directly gets you more sales. Specify your sales tactics in this section, similar to how you did it with marketing.

Sales Forecast

Begin this section by creating your pricing strategy. Now detail your sales forecast of each service and how much you expect to earn on each. Create a table and possibly graphs displaying your projections.

Take into account how your marketing efforts are likely to impact your sales. Also outline what your sales forecast shows and what the circumstances are for each particular forecast. For instance, costs associated with travelling to meet clients, the number of hours you'll dedicate, and how many members of staff you'll have.

6. Financial Operations, Projections, and Plan

A financial plan is the final component of your business planning document. It is an important and detailed inclusion that could help you secure funding for your new business venture. The financial projections are essential and must be as detailed as possible.

Your financial plan will consist of the following:

- Costs: Specify your assumed costs such as rent, marketing, paying staff, necessary equipment, and technology. If this is set to change, for example, you might spend more on marketing during the first year before word of mouth kicks in, include this in your costs outline too.

- Capital requirements: In this section, write down how much capital you need and break down what it's for. Detail what the funds will be spent on, such as marketing, salaries, etc. Write your plan on how you'll gain funding for your new business.

- Key assumptions: Summarise your expenses based on key assumptions like how many clients you'll have per year (increasing year on year) and how much rent you'll need to pay.

- Cash flow statement: Use the key assumptions, along with your sales forecast above, to create a cash flow statement, income statement, and balance sheet for a five year period. Include how much revenue you'll generate for each service.

How Link My Books Can Help

.webp)

Link My Books is an automated bookkeeping software that let's you put your clients' bookkeeping on autopilot. Designed for eCommerce businesses and accountants, our specialised software automatically transfers sales data to accounting software, like Xero or QuickBooks.

Link My Books will save you around six hours per month on every one of your clients. This affords you considerably more time to take on more clients, and offer a more comprehensive and complete service.

These are some of the core features that make Link My Books an essential tool for accountants:

Profit and Loss Summary Statements

Link My Books produces accurate profit and loss summary statements for each of your clients' sales channels. It breaks down data, clearly showing revenue and expenses, like sales, refunds, fees, advertising costs. You can manually transfer these to your eCommerce accounting software , view them in your Link My Books dashboard, or set it to autopilot so it transfers them automatically.

Tax Management

Link My Books calculates taxes on every product your clients sell. When you sign up, you'll complete the Guided Tax Wizard (or opt for a free onboarding session), where you'll input information that'll ensure the correct tax rates are applied to each sale.

The calculations are accurate, regardless of where in the world your clients operate. This information is also sent to accounting software, simplifying the preparation and sending of tax returns

Analytics and Reporting

.webp)

Link My Books has some powerful analytical tools that'll help you with your business planning efforts, including market analysis. One tool is called Benchmarking and this gives you a percentile ranking of how your client's business is performing compared to others in their industry. It looks at data like sales growth percentage and refund ratio, to name a couple.

Another tool is called P & L by Channel. This tool allows you to compare performance across different sales channels. You can do side-by-side comparisons of data like sales, fees, shipping costs, and refunds. You can also apply date filters.

Integrations

Link My Books facilitates thorough eCommerce accountancy services by having plenty of available integrations. Connect with sales channels like Amazon, Shopify, TikTok Shop, and eBay, among others. And, connect as many as you and your clients need.

Link My Books integrates with both Xero and QuickBooks (two of the best accounting software), along with all payment processors, including PayPal and Klarna.

Start Your Business Planning Efforts With a Solid Accounting Firm Business Plan

.webp)

While business planning is not an easy thing to do, it doesn't have to be as complicated as you might think either. Following business plan templates like the one above can keep you on the right track and ensure you include everything you need to.

Successful businesses almost always begin with solid business plans. These plans should detail your business structure, legal structure, accountancy services, and financial projections, to name a few aspects. They're also essential for clarifying your goals and pinpointing any challenges you might face.

Part of your business planning endeavours also involves choosing what technology to use. Accounting firms around the world trust Link My Books to save them hours every month on every client. It does this by taking bookkeeping off your hands and putting it on autopilot.

Start as you mean to go on. Sign up for your free Link My Books trial and make sure you have the time to dedicate to your clients and your business growth.

Keep reading

Creating an accounting firm business plan is an essential step to take before you launch your business. Not sure how? Follow this step-by-step guide.

The Ultimate Guide: How to Automate Accounting for Efficiency

Every business wants an efficient accounting system. Automation can help ensure you spend as little time as possible on accounting tasks. This guide reveals all

.webp)

Why Outsource Accounting: Top 6 Compelling Reasons to Take the Leap

Should you outsource accounting services or hire an accounting team internally within your business? This post looks at why outsourcing is often preferred.

.webp)

eBay Accounting: Principles, Tools, and Compliance (Explained)

Get your eBay business finances in order with our comprehensive guide to eBay accounting. Perfect for businesses of any size, ensuring accurate bookkeeping.

%20Full%20Comparison.webp)

Webgility vs. ShipBob (vs. Link My Books): Full Comparison

Explore the differences between Webgility and ShipBob. Uncover the pros, cons, and features of each to determine the best solution for your e-commerce business.

![accountant business plan writer How to Use an Amazon FBA Calculator [Step-by-Step Process]](https://cdn.prod.website-files.com/60af32ce0a63dc4f22cc85a1/66683148f9e741959817b783_How%20to%20Use%20an%20Amazon%20FBA%20Calculator%20%5BStep-by-Step%20Process%5D.webp)

How to Use an Amazon FBA Calculator [Step-by-Step Process]

Uncover the secrets of using the Amazon FBA calculator. Perfect for sellers wanting to assess costs, fees, and boost their revenue efficiently.

Accurate Ecommerce Accounting

On autopilot.

Whether you’re an e-commerce business or accountant, our software helps get rid of your bookkeeping headache and allows you to focus on growth. Made in the UK by ex e-commerce sellers and accountants.

.png)

Accounting Business Plan Template

Written by Dave Lavinsky

Accounting Business Plan

You’ve come to the right place to create your Accounting business plan.

We have helped over 5,000 entrepreneurs and business owners create business accounting plans and many have used them to start or grow their accounting firms.

Below is a template to help you create each section of your Accounting business plan.

Executive Summary

Business overview.

DeSanta & Co is a new accounting firm located in Indianapolis, Indiana. We provide a full suite of accounting services to local businesses, including bookkeeping, accounting, and tax services. Our combined decades of expertise and client-focused service ensures that we will become the #1 accounting firm in the next five years.

DeSanta & Co is run by Michael DeSanta. Michael has decades of accounting experience and has gained a loyal clientbase from providing his services through competing firms. His expertise, reputation, and loyal clientbase will ensure that our firm is successful.

Product Offering

DeSanta & Co will offer its clients a full suite of accounting services. These services include bookkeeping, accounting, tax services, and auditing. The company will employ a large and diverse staff of professional accountants to ensure we can offer as many services as possible.

Customer Focus

DeSanta & Co will serve small and medium-sized businesses located in the Indianapolis, Indiana area. Most of these businesses will have less than 1000 employees and earn a revenue less than $10 million per year. We will also offer limited services to individuals, such as tax prep and help.

Management Team

DeSanta & Co’s most valuable asset is the expertise and experience of its founder, Michael DeSanta. Michael has been a certified public accountant (CPA) for the past 20 years. Throughout his career, he has developed a loyal client base, and many clients have stated that they will switch to DeSanta & Co once the company is established and running. Michael’s combination of skills, accounting knowledge, and loyal following will ensure that DeSanta & Co is a successful firm.

Success Factors

DeSanta & Co will be able to achieve success by offering the following competitive advantages:

- Michael DeSanta will initially help the clientbase that he has built carefully over the past twenty years.

- The company will emphasize providing client-focused service so that our clients feel valued.

- The company will provide our accounting services at an affordable rate.

Financial Highlights

DeSanta & Co is currently seeking $400,000 to launch. The funding will be dedicated to the office build out, purchase of initial equipment, working capital, marketing costs, and startup overhead expenses. The breakout of the funding is below:

- Office design/build: $100,000

- Office equipment, supplies, and materials: $50,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $50,000

- Working capital: $50,000

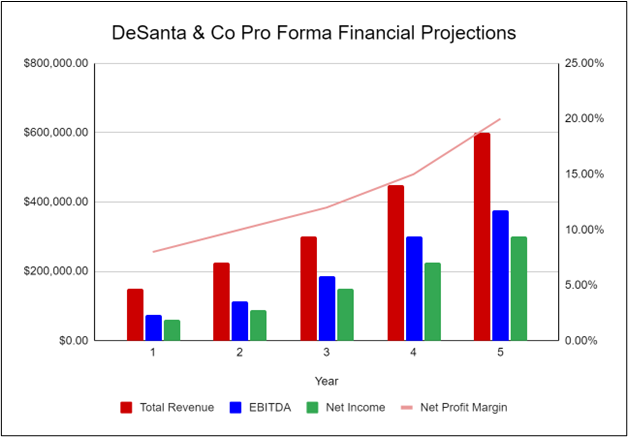

The following graph below outlines the pro forma financial projections for DeSanta & Co.

Company Overview

Who is desanta & co.

DeSanta & Co is a new accounting firm located in Indianapolis, Indiana that provides local businesses with a full suite of accounting services. We are a small firm but have considerable experience, so we can offer better quality of services than our competition. We expect that our most popular services will include bookkeeping, accounting, and tax services. Our combined decades of expertise and client-focused service ensures that we will become the #1 accounting firm in the next five years.

DeSanta & Co is run by Michael DeSanta. Michael has decades of accounting experience and has gained a loyal clientbase from providing his services through competing firms. After working for several accounting firms around town, he surveyed his clientbase to see if they would be willing to switch to his new company once launched. Most of his clients responded positively, which motivated Michael to finally launch his business.

DeSanta & Co History

Upon surveying his clientbase and finding a potential office, Michael DeSanta incorporated DeSanta & Co as an S-Corporation in April 2023.

The business is currently being run out of Michael’s home office, but once the lease on DeSanta & Co’s office location is finalized, all operations will be run from there.

Since incorporation, DeSanta & Co has achieved the following milestones:

- Found an office space and signed Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Hired an interior designer for the decor and furniture layout

- Determined equipment and fixture requirements

- Began recruiting key employees

DeSanta & Co Services

DeSanta & Co will provide the following services to its clients:

- Bookkeeping

- Tax services

- Advisory services

- Investment services

- Management consulting

- Valuation and planning

Industry Analysis

The accounting industry is essential to the success of other businesses and industries. Accountants record and track financial transactions, which helps businesses ensure they are making a profit. As such, accounting services are always in demand and the industry often sees great growth.

There are several essential services that accounting firms can provide to businesses and individuals. The most popular services include bookkeeping, tax services, advisory services, and valuation and planning. Though most businesses employ their own accountants, many businesses are switching to hiring accounting firms to save on costs.

The accounting industry is expected to grow over the next several years. According to The Business Research Company, the accounting industry is expected to grow at a CAGR of 4.2% from now until 2027. This growth is due to the increasing demand for accountants worldwide. This increase in demand and industry growth ensures that DeSanta & Co will achieve success.

Customer Analysis

Demographic profile of target market, customer segmentation.

DeSanta & Co will primarily target the following customer profiles:

- Local small businesses

- Medium-sized businesses

- Individuals

Competitive Analysis

Direct and indirect competitors.

DeSanta & Co will face competition from other companies with similar business profiles. A description of each competitor company is below.

Perkins & Smith

Perkins & Smith is a small accounting firm that has intentionally remained small so that they can have stronger relationships with their clients. Since they opened in 1960, Perkins & Smith has been one of the leading accounting firms in the Four State Region. They offer a wide range of services including accounting, bookkeeping, payroll services, tax prep and planning, and advisory services. They have built up a loyal clientele and maintained a strong, positive reputation since their opening decades ago.

Premiere Accounting

Premiere Accounting is a large accounting firm that specializes in helping large businesses with accounting, taxes, and similar services. Since opening in 1995, they have acquired a loyal client base, including several multi-billion dollar companies. They employ over a hundred professionals who all have diverse backgrounds. This helps serve their diverse clientele and ensures they are meeting the specific needs of every business that works with them.

Jackson Brothers Accounting

Jackson Brothers Accounting is a privately held accountant practice that has been popular in the area since 1985. They offer a wide variety of services including, tax planning and preparation, payroll processing, financial planning, and small business accounting. Though they are open to helping nearly all businesses and sectors, they primarily focus on local small businesses and startups.

Competitive Advantage

DeSanta & Co will be able to offer the following advantages over the competition:

- Client-oriented service : DeSanta & Co will put a focus on customer service and maintaining long-term relationships. We aim to be the best accounting firm in the area by catering to our customer’s needs and developing a strong connection with them.

- Management : Michael has been extremely successful working in the accounting sector and will be able to use his previous experience to help his clients better than the competition.

- Relationships : Having lived in the community for 25 years, Michael DeSanta knows many of the local leaders, newspapers and other influences.

Marketing Plan

Brand & value proposition.

DeSanta & Co will offer a unique value proposition to its clientele:

- Client-focused financial services, where the company’s interests are aligned with the customer

- Service built on long-term relationships

- Big-firm expertise in a small-firm environment

Promotions Strategy

The promotions strategy for DeSanta & Co is as follows:

Targeted Cold Calls

DeSanta & Co will initially invest significant time and energy into contacting potential clients via telephone. In order to improve the effectiveness of this phase of the marketing strategy, a highly-focused call list will be used, targeting individuals in areas and occupations that are most likely to need accounting services. As this is a very time-consuming process, it will primarily be used during the startup phase to build an initial client base.

DeSanta & Co understands that the best promotion comes from satisfied customers. The Company will encourage its clients to refer other businesses by providing economic or financial incentives for every new client produced. This strategy will increase in effectiveness after the business has already been established.

Social Media

DeSanta & Co will invest heavily in a social media advertising campaign. The company will create social media accounts and invest in ads on all social media platforms. It will use targeted marketing to appeal to the target demographics.

Website/SEO

DeSanta & Co will invest heavily in developing a professional website that displays all of the company’s services. It will also invest heavily in SEO so that the firm’s website will appear at the top of search engine results.

The fees and hourly pricing of DeSanta & Co will be moderate and competitive so clients feel they are receiving great value when utilizing our accounting services.

Operations Plan

The following will be the operations plan for DeSanta & Co. Operation Functions:

- Michael DeSanta will be the Owner of DeSanta & Co. In addition to providing accounting services, he will also manage the general operations of the business.

- Michael DeSanta is joined by a full-time administrative assistant, Jessica Baker, who will take charge of the administrative tasks for the company. She will also be available to answer client questions and will be the primary employee in charge of client communications.

- As the company builds its client base, Michael will hire more accounting professionals to provide the company’s services, attract more clients, and grow our business further.

Milestones:

DeSanta & Co will have the following milestones completed in the next six months.

- 6/2023 Finalize lease agreement

- 7/2023 Design and build out DeSanta & Co

- 8/2023 Hire and train initial staff

- 9/2023 Kickoff of promotional campaign

- 10/2023 Launch DeSanta & Co

- 11/2023 Reach break-even

Though he has never run his own business, Michael DeSanta has worked as an accountant long enough to gain an in-depth knowledge of the operations (e.g., running day-to-day operations) and the business (e.g., staffing, marketing, etc.) sides of the industry. He also already has a starting client base that he served while working for other accounting firms. He will hire several other employees who can help him run the aspects of the business that he is unfamiliar with.

Financial Plan

Key revenue & costs.

DeSanta & Co’s revenues will primarily come from charging clients for the accounting services we provide. We will charge our clients an hourly rate that will vary depending on the services they need.

The notable cost drivers for the company will include labor expenses, overhead, and marketing expenses.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and pay off the startup business loan.

- Number of clients:

- Year 4: 100

- Year 5: 125

- Annual Rent: $100,000

Financial Projections

Income statement.

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Total Revenues | $360,000 | $793,728 | $875,006 | $964,606 | $1,063,382 | |

| Expenses & Costs | ||||||

| Cost of goods sold | $64,800 | $142,871 | $157,501 | $173,629 | $191,409 | |

| Lease | $50,000 | $51,250 | $52,531 | $53,845 | $55,191 | |

| Marketing | $10,000 | $8,000 | $8,000 | $8,000 | $8,000 | |

| Salaries | $157,015 | $214,030 | $235,968 | $247,766 | $260,155 | |

| Initial expenditure | $10,000 | $0 | $0 | $0 | $0 | |

| Total Expenses & Costs | $291,815 | $416,151 | $454,000 | $483,240 | $514,754 | |

| EBITDA | $68,185 | $377,577 | $421,005 | $481,366 | $548,628 | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| EBIT | $41,025 | $350,417 | $393,845 | $454,206 | $521,468 | |

| Interest | $23,462 | $20,529 | $17,596 | $14,664 | $11,731 | |

| PRETAX INCOME | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Use of Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Taxable Income | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Income Tax Expense | $6,147 | $115,461 | $131,687 | $153,840 | $178,408 | |

| NET INCOME | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 |

Balance Sheet

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| ASSETS | ||||||

| Cash | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 | |

| Accounts receivable | $0 | $0 | $0 | $0 | $0 | |

| Inventory | $30,000 | $33,072 | $36,459 | $40,192 | $44,308 | |

| Total Current Assets | $184,257 | $381,832 | $609,654 | $878,742 | $1,193,594 | |

| Fixed assets | $180,950 | $180,950 | $180,950 | $180,950 | $180,950 | |

| Depreciation | $27,160 | $54,320 | $81,480 | $108,640 | $135,800 | |

| Net fixed assets | $153,790 | $126,630 | $99,470 | $72,310 | $45,150 | |

| TOTAL ASSETS | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 | |

| LIABILITIES & EQUITY | ||||||

| Debt | $315,831 | $270,713 | $225,594 | $180,475 | $135,356 | |

| Accounts payable | $10,800 | $11,906 | $13,125 | $14,469 | $15,951 | |

| Total Liability | $326,631 | $282,618 | $238,719 | $194,944 | $151,307 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| Total Equity | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| TOTAL LIABILITIES & EQUITY | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 |

Cash Flow Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| CASH FLOW FROM OPERATIONS | ||||||

| Net Income (Loss) | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 | |

| Change in working capital | ($19,200) | ($1,966) | ($2,167) | ($2,389) | ($2,634) | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| Net Cash Flow from Operations | $19,376 | $239,621 | $269,554 | $310,473 | $355,855 | |

| CASH FLOW FROM INVESTMENTS | ||||||

| Investment | ($180,950) | $0 | $0 | $0 | $0 | |

| Net Cash Flow from Investments | ($180,950) | $0 | $0 | $0 | $0 | |

| CASH FLOW FROM FINANCING | ||||||

| Cash from equity | $0 | $0 | $0 | $0 | $0 | |

| Cash from debt | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow from Financing | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow | $154,257 | $194,502 | $224,436 | $265,355 | $310,736 | |

| Cash at Beginning of Period | $0 | $154,257 | $348,760 | $573,195 | $838,550 | |

| Cash at End of Period | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 |

Accounting Business Plan FAQs

What is an accounting business plan.

An accounting business plan is a plan to start and/or grow your accounting business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Accounting business plan using our Accounting Business Plan Template here .

What are the Main Types of Accounting Businesses?

There are a number of different kinds of accounting businesses , some examples include: Full Service Accounting Firm, Bookkeeping Firm, Tax Firm, and Audit Firm.

How Do You Get Funding for Your Accounting Business Plan?

Accounting businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start an Accounting Business?

Starting an accounting business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop An Accounting Business Plan - The first step in starting a business is to create a detailed accounting business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your accounting business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your accounting business is in compliance with local laws.

3. Register Your Accounting Business - Once you have chosen a legal structure, the next step is to register your accounting business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your accounting business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Accounting Equipment & Supplies - In order to start your accounting business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your accounting business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful accounting business:

- How to Start an Accounting Business

All articles

How to create an effective business plan for an accounting firm, filter by category.

Thinking of starting your own accounting firm? That's great! Getting success in the high-demand finance industry needs persistence, hard work, and proper planning.

Yes, a detailed accounting firm business plan! Whether you are preparing to raise funding, applying for loans, or want to expand the company—a business plan is the key to all.

But do you know how to write one? Worry not, you are at the right place. This guide on writing an accounting business plan effectively will help you get started.

Why do you need a business plan for your accounting firm?

If you're planning to launch a new accounting firm or thinking of expanding the existing one, a well-crafted business plan is essential. It does not only act as a roadmap for your firm's growth, but it also improves your chances of securing funding if required.

It also outlines the goals and strategies of the company, allowing you to make strong decisions that align with its long-term goals.

How to write an accounting firm business plan?

Writing an effective business plan is critical for the success of your accounting firm. It acts as a roadmap for your business. But writing it includes many steps—if you need help you can use any business planning software for support. Various steps to include in the plan are:

1. Executive summary

An executive summary is a brief overview of the entire business plan. It acts as a hook to engage readers, motivating them to further explore your business plan.

This section should include important details such as mission, goals, services briefs, marketing & sales strategies, and financial goals.

The executive summary should be concise yet comprehensive, giving readers a clear understanding of your firm's potential and value proposition.

2. Company description

Now, this is the section where you give a detailed description of your accounting firm.

Start the section by mentioning the legal structure of your accounting firm, whether it's a sole proprietorship, partnership, limited liability company (LLC) , or corporation.

Also, highlight your firm's mission, values, long-term vision of the firm, location of your business, and business history (if any). You should also mention the owners of the business along with their experience and educational qualifications.

3. Market analysis

Before you start writing your business plan, conduct market research . Identify the size and scope of the market, including the number of accounting firms.

First, define your target market based on your research. Understand all their pain points and accounting needs, so you can customize your services accordingly.

After that, do the competitive analysis. Identify your direct and indirect competitors, and conduct a SWOT analysis to understand your unique selling propositions.

Mention any industry trends. You can adapt your strategies by staying informed about all the trends.

Finally, add the legal regulations you need to follow to run the accounting business in a particular location. Mention about all the licenses or permits your business needs.

4. Accounting services

This is the section, where you highlight all the services and mention how you are the best in providing them.

Give a detailed description of each service you provide. It can be about tax preparation, auditing, bookkeeping, or consulting. You can also mention the specialized services if you provide any such as business valuation, acquisition support, or anything else.

Mention if you use any special software or technology to provide such services. For example, any accounting software, client portal software , communication tools, etc.

5. Marketing and sales strategies

After mentioning your services, you need to highlight sales and marketing strategies to show how will you reach the customers.

Here, you need to identify the types of customers you are going to serve. For example, individuals, firms, small businesses, startups, or NPOs. Once you know the target audience, describe your strategies to attract them. Not only attract them but also retain the existing customers.

Some strategies your accounting firm can use are networking events, social media marketing, SEO, content marketing, email marketing, etc.

6. Operational plan

The main essence of an operational plan is to showcase how you work daily. Here explain the procedure of the services you provide.

For example, a client needs to register first, then schedule a meeting with the accountant, and then that particular accountant will be in the touch with client throughout.

With the procedure, you need to mention the timeline too, in which you will provide the services. Along with all these, mention in detail all the technologies or software you plan to purchase like project management tool , bookkeeping & accounting software, file sharing software , or some other.

7. Management team

Introduce your accounting firm's key members along with their roles, experience, and educational qualifications. This will build trust for your audience about who is behind the firm and how reliable they are.

Include brief biographies or resumes of each key team member to show their expertise. You also need to give details about the CEO or the owners of the firm.

Additionally, showcase the organizational structure of your team members and who will report to whom. Do not forget to include any advisory board or third-party consultants, if you have hired any.

8. Financial plan

Here, you have to show the financial health of your accounting firm. You need to present the financial forecasts of the firm for at least three to five years.

The financial forecasts should include profit & loss statements, cash flow statements, balance sheets, and cash flow tools .

With one view of the financial plan, your audience should get to know how much profit your business will make in the future. They should also get to know about the break-even point of the business.

9. Funding request

In the funding request section, mention the financial ask you need for your business. For that, you need to calculate the startup costs first and be clear about your requirements from investors or bankers.

Provide a breakdown of the funding required for various purposes, such as office rent, staff salaries, marketing, technology, and equipment.

Highlight the potential return on investment for investors, including projected revenue growth and profitability. If you are not writing the accounting firm's business plan for funding then you can skip this section.

10. Appendix

An appendix is kind of your supporting section, which has all the documents that support the main content of the whole business plan.

This might include resumes of the team members, detailed financial projections, customer feedback, legal documents, or any other additional information that you feel like to be added.

Including all this additional information can help provide a wider view of your accounting firm and support your business plan.

How Clinked Can Help You

Starting the adventure of managing an accounting firm can be significantly smoother with the right technological partners. Clinked is here to supercharge your firm’s operational capabilities and client interactions.

Here’s how Clinked can be a game-changer for your business:

- Secure Client Portal: Imagine a world where your clients have continuous access to a secure, branded client portal for your accounting firm . Here, they can view their financial documents, share necessary files, and communicate effortlessly with your team. This transparency not only boosts client satisfaction but also enhances client retention.

- Effortless Real-Time Collaboration: With Clinked, gone are the days of back-and-forth emails and disconnected workflows. Your team can now edit documents simultaneously, streamline processes, and ensure that every financial statement or tax filing is perfect the first time around.

- Streamlined Task Management: Keep your projects on track with Clinked’s intuitive task management tools. Assign tasks, set deadlines, and monitor progress in a way that ensures your team is always productive and no client query goes unanswered.

- Uncompromised Security and Compliance: In the realm of accounting, securing sensitive information is paramount. Clinked fortifies your client data with state-of-the-art security measures and ensures compliance with the latest financial regulations, thereby nurturing trust and maintaining your firm’s esteemed reputation.

- Mobile Accessibility: In today’s fast-paced world, access to information on the go is not just a luxury—it’s a necessity. With Clinked’s mobile app, your team and clients can remain connected and operational from anywhere, at any time, facilitating unparalleled flexibility and responsiveness.

By integrating Clinked into your daily operations, you not only streamline complex processes but also enhance your firm’s overall productivity and client service capabilities. With Clinked, you’re not just surviving in the competitive accounting industry; you’re thriving.

So that's it! That is how you write an effective accounting firm business plan. If you are still confused about how to write one, then in this AI phase, you can use an AI business plan generator to write your plan or free business plan template.

Using an AI business plan generator can save you time and effort, allowing you to focus on other aspects of your business. Therefore, using these tools can be beneficial for business owners, entrepreneurs, and individuals.

Alongside AI tools, integrating platforms like Clinked can further enhance your business operations and client interactions. Clinked offers a secure, customizable client portal, real-time collaboration tools, and mobile access to manage your business effectively from anywhere. These features ensure that your accounting firm not only meets but exceeds client expectations, setting you apart in a competitive industry. Embrace these technological solutions, and propel your firm towards a successful future.

- How To Start An Accounting Firm

- 8 Best Project Management Software for Accounting Firms

- Virtual Accounting Firm: How To Make It A Success

- 8 Best Accounting Practice Management Software in 2024

Let Us Know What You Thought about this Post.

Put your Comment Below.

Related articles

Find out how Clinked can help you achieve your goal

- Client Portal

- Partner Portal

- Secure File Sharing

- Collaboration Software

- Communication Software

- Intranet Software

- Project Management Software

- Virtual Data Room

- White Label Software

- SharePoint Alternative

- Accounting Client Portal

- Financial Services Client Portal

- Legal Services Client Portal

- Help & Learning Center

- Clinked Blog

- Case Studies

- About Clinked

- Career Hiring!

- Partner with Clinked

- Security and Compliance

- Service Status

- Submit a Ticket

Subscribe to our newsletter

The latest Clinked news, articles, and resources, sent straight to your inbox every month.

- Terms of use

- Privacy Policy

- Clinked EU Data Processing Agreement

- Sample Business Plans

Accounting Firm Business Plan

If you are planning to start a new accounting firm, the first thing you will need is a business plan. Use our sample accounting firm business plan created using Upmetrics business plan software to start writing your business plan in no time.

Before you start writing your business plan for your new accounting firm, spend as much time as you can reading through some examples of service-related business plans .

Reading sample business plans will give you a good idea of your aim. It will also show you the different sections that different entrepreneurs include and the language they use to write about themselves and their business plans.

We have created this sample accounting firm business plan for you to get a good idea about how a perfect business plan should look and what details you will need to include in your stunning business plan.

Accounting Firm Business Plan Outline

This is the standard accounting firm business plan outline which will cover all important sections that you should include in your business plan.

- Product and Services

- Vision Statement

- Mission Statement

- Business Structure

- Chief Executive Officer

- Accounting and Tax Consultants

- Admin and HR Manager

- Marketing and Sales Executive

- Client Service Executive / Front Desk Officer

- SWOT Analysis

- Market Trends

- Target Market

- Competitive Advantage

- Sources of Income

- No. of Clients v/s Revenue Chart

- Payment Options

- Publicity and Advertising Strategy

- Financial Projections and Costing

- Generating Funds/Startup Capital

- Sustainability and Expansion Strategy

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

After getting started with upmetrics , you can copy this sample business plan into your business plan and modify the required information and download your accounting firm business plan pdf and doc file. It’s the fastest and easiest way to start writing your business plan.

Download a sample accounting firm business plan

Need help writing your business plan from scratch? Here you go; download our free accounting firm business plan pdf to start.

It’s a modern business plan template specifically designed for your accounting firm business. Use the example business plan as a guide for writing your own.

Related Posts

Bookkeeping Business Plan

Counseling Private Practice Business Plan

Presenting your Business Plan

Top Business Planning Tools

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

Free Download

Accounting & Bookkeeping Business Plan Template

Download this free accounting & bookkeeping business plan template, with pre-filled examples, to create your own plan..

Or plan with professional support in LivePlan. Save 50% today

Available formats:

What you get with this template

A complete business plan.

Text and financials are already filled out and ready for you to update.

- SBA-lender approved format

Your plan is formatted the way lenders and investors expect.

Edit to your needs

Download as a Word document and edit your business plan right away.

- Detailed instructions

Features clear and simple instructions from expert business plan writers.

All 100% free. We're here to help you succeed in business, no strings attached.

Get the most out of your business plan example

Follow these tips to quickly develop a working business plan from this sample.

1. Don't worry about finding an exact match

We have over 550 sample business plan templates . So, make sure the plan is a close match, but don't get hung up on the details.

Your business is unique and will differ from any example or template you come across. So, use this example as a starting point and customize it to your needs.

2. Remember it's just an example

Our sample business plans are examples of what one business owner did. That doesn't make them perfect or require you to cram your business idea to fit the plan structure.

Use the information, financials, and formatting for inspiration. It will speed up and guide the plan writing process.

3. Know why you're writing a business plan

To create a plan that fits your needs , you need to know what you intend to do with it.

Are you planning to use your plan to apply for a loan or pitch to investors? Then it's worth following the format from your chosen sample plan to ensure you cover all necessary information.

But, if you don't plan to share your plan with anyone outside of your business—you likely don't need everything.

More business planning resources

Industry Business Planning Guides

Simple Business Plan Outline

Business Plan Template

How to Write a Business Plan for Investors

How to Create a Business Plan Presentation

How to Start a Business With No Money

10 Qualities of a Good Business Plan

How to Write a Business Plan

Download your template now

Need to validate your idea, secure funding, or grow your business this template is for you..

- Fill-in-the-blank simplicity

- Expert tips & tricks

We care about your privacy. See our privacy policy .

Not ready to download right now? We'll email you the link so you can download it whenever you're ready.

Download as Docx

Download as PDF

Finish your business plan with confidence

Step-by-step guidance and world-class support from the #1 business planning software

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Accounting Company Business Plan [Sample Template]

By: Author Tony Martins Ajaero

Home » Business ideas » Financial Service Industry » Accounting, Bookkeeping and Tax Preparation

Are you about starting an accounting firm? If YES, here is a complete sample accounting firm business plan template & feasibility report you can use for FREE .

Okay, so we have considered all the requirements for starting an accounting firm. We also took it further by analyzing and drafting a sample accounting firm marketing plan template backed up by actionable guerrilla marketing ideas for accounting firms. So let’s proceed to the business planning section.

Have you ever dreamt of becoming your own boss? Did you by chance study Accountancy and are finding it difficult to get your ideal job? You don’t need to worry because your dream of becoming your own boss and still work as an accountant can be fulfilled with little or no start-up capital.

In case you didn’t know, there are loads of small businesses, mom and pop businesses, amongst a few without the faintest idea of any accounting skills. These businesses struggle with their books and accounting concerns a lot.

Research shows that one of the reasons why many small businesses remain small and sometimes close shop is not because they don’t have clients or capital to run the business but because they fail to keep their books properly. If you are an accountant, then you can leverage on this read to start your own accounting services firm.

You can be rest assured that your services would always be in demand not only by small businesses that can’t afford to hire a full-time accountant but also medium scale and big corporation especially for auditing purpose and other accounting consulting services.