WTO / Applications / 20 Best Loan Application Letter Samples (Guide and Format)

20 Best Loan Application Letter Samples (Guide and Format)

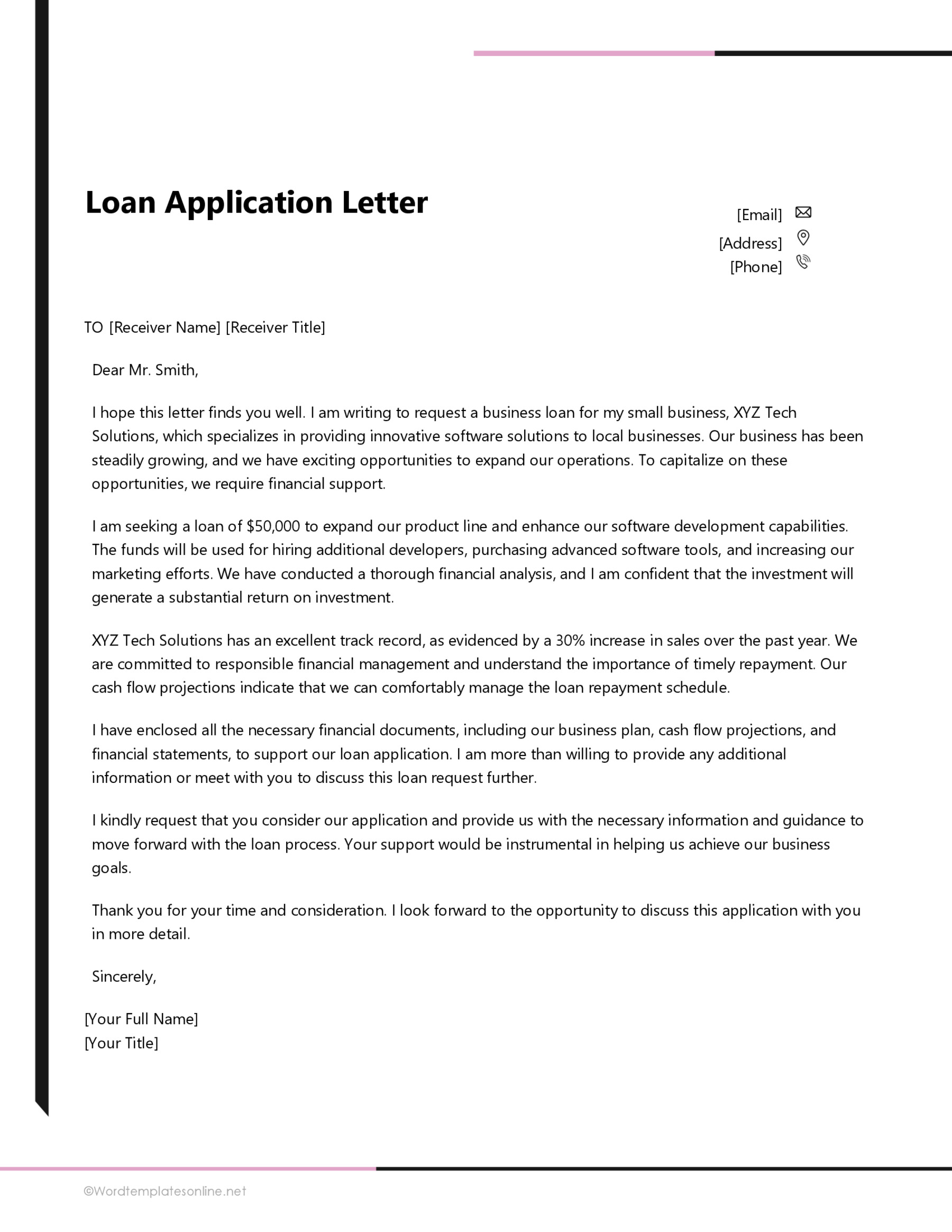

An application letter for a loan is a formal letter written to a financial institution by a borrower requesting a loan, payable in a specified amount of time.

The letter helps lenders get acquainted with the borrowers better to determine if they qualify for the loan based on the information provided or not. Writing it is important because it helps convince lending institutions to lend you a specific amount of money. It is their first impression of you, which is why it should be written with great care. In this article, we will guide you on how to write it, the type of information you should provide, and some pointers that will help you highlight your strengths in the letter.

Brief Overview- What to Include

There are no strict rules for writing an application for a loan. It depends on the borrower to decide what information to include, but the following items are typically included in it:

- Contact information

- Explanation of why money is needed

- Amount of money being requested

- Purpose of the money

- Details about employment history

- Personal references

- Company information

- A list of supporting documents

When to Write?

Two main situations warrant this letter. The first instance is when you are seeking a loan from a conventional bank lender. Conventional bank lenders are financial institutions that do not offer loans but make them available to the general public. Conventional banks usually require applicants to submit this application to prove their creditworthiness.

The second situation that warrants its use is when applying for an SBA-guaranteed loan. An SBA-guaranteed loan involves the federal government; applicants must undergo additional screening before they are approved for funding. Applicants can improve their chances of getting an SBA guarantee by submitting a personalized, formal loan application with supporting documentation.

There are situations when you do not necessarily need to write this letter, such as when you are borrowing from friends and family, from an alternative lender who may only require your bank statements or pay slips, when seeking equipment financing, and lastly when you are requesting a business line of credit.

Free Templates

Pre-writing Considerations

Applying for a loan involves being prepared for anything, so it is important to have the things you need before writing. Do some research on your lender, and write down notes about why they are suitable for you and what you would like them to know about your project. Write those questions that may arise during the process of applying for your loan. Check your credit score and know your rights as a borrower when you apply for a loan.

After you have done all of the above, review everything and ensure that what you’ve written is easy to understand by someone who has not read your notes or audited your finances. When applying for a loan in a major financial institution or applying for an SBA loan, you will almost always be required to write an application letter for a loan. It is important to note that unless it is supported by a sound credit situation or proper financial planning, it may not be enough to help you secure the loan.

Fortunately, there are two things that you can do to increase your loan limit and increase your chances of getting a loan. You can first check your business and personal credit scores from accredited credit reporting bureaus such as TransUnion, Equifax, and Experian and take the necessary steps to improve them.

The second thing that you can do is to prepare your business financial statements, i.e., your profit and loss statement , cash-flow statement , balance statement, etc., for the past six months and attach them to your letter. These documents are essential when applying for a loan as they help the financial institution assess your creditworthiness and increase your chances of securing a loan.

How to Write a Loan Application?

Writing it can seem daunting, but it can be a simple process if you follow the proper format and include all the required information.

The following is a summary of the information you must provide in your letter:

The header is an integral part of the standard business letter format . It should include:

- Your name and contact information : Make sure to include your full name, address, and contact information. This should include a mailing address with a zip code, a business email address, and your cell phone number where you can be reached.

- The date : Include the month, day, and year of the letter. You must ensure that you write the date on which the letter was created.

- The name of the recipient : This will be a bank representative in many cases, but it can also be an SBA representative or another financial institution to whom the borrower is addressing the letter.

Subject line

When writing it, make sure to include a clear subject line that will help the recipient understand the purpose of the letter. Make sure to include whether the loan is for personal or professional use in the subject line.

“Loan Request Application Letter.”

Address your letter correctly. If you do not know who will be reading it, write “ To Whom It May Concern . ” If you are trying to get a business loan, address it to the company’s representative issuing the loan. If you are applying for a personal loan , address it to the bank or whoever provides it.

Introduction

It should begin with a brief statement of the goal and amount you are requesting. It should also state your qualifications for the loan and any other pertinent information that can be used for your evaluation as a borrower such as your financial status , your work history, the length of time you have been in business, etc.

The body is the main part of the letter, and it should contain all the information the recipient will need to decide whether to grant the loan or deny the request.

Some of the information that must be covered in the body includes:

- Basic business information : If you are writing it, the first item to include in the body of the letter is details about your business. This information will help the lender understand who you are and will serve as the foundation for your loan application. Some of the information that you should cover in this section includes your business’s registered name, business type (i.e., partnership , sole proprietorship, LLC , etc.), nature of your business (i.e., what you do), main services and products, your business model, the number of employees that you have, and your annual generated revenue.

- The purpose of the loan : You must explain why you need the loan and the purpose for which it is being requested. This can be to purchase or expand a business, for a personal reason, or to pay some debt.

- Present yourself as being trustworthy : To get a loan, you need to establish trust with the lender. This can be achieved by explaining what you do for a living, providing some identity documents, and demonstrating why you deserve to be trusted.

- Explain how you intend to pay back : Explain briefly how you plan on repaying the loan. This should include a timeline for repayment and be supported by evidence such as a business plan, personal financial statement, or credit report .

- Proof of financial solvency : In some cases, you will be asked to provide evidence that the funds requested are not your only source of income. Documents like bank statements or tax returns can help you prove that you have other sources of funding, which will increase the likelihood that your request will be granted.

In the conclusion, you must thank the lender for considering your request. Briefly mention all the attached financial documents. Remember that each lender has their own set of loan application requirements and may request different information or documentation from borrowers, so make sure to double-check the specific instructions provided by the lender.

Once you have finished writing the letter, be sure to sign it at the bottom. You may include phrases such as:

“Respectfully yours” or “Sincerely yours”.

Place your name and contact information directly above the signature line.

SBA Loan Application Letter Template

[Your Name]

[Your Address]

[City, State ZIP Code]

[Your Phone Number]

[Your Email Address]

[Loan Officer’s Name]

[Bank Name]

[Bank Address]

Dear [Loan Officer’s Name],

I am writing to apply for a Small Business Administration (SBA) loan to help fund my [business name]. I am excited to have the opportunity to present my business plan to you and explain why I believe my business is a great candidate for an SBA loan.

[Provide an introduction to your business, including its history, products or services offered, and unique selling proposition. Explain why you started the business and what sets it apart from competitors. This should be no more than two paragraphs.]

I am seeking an SBA loan in the amount of [$ amount], which will be used to [briefly explain how the funds will be used]. My business has experienced steady growth in recent years, but we need additional capital to take advantage of new opportunities and expand our reach.

[Provide a detailed explanation of how you plan to use the funds, including any expected return on investment. Be specific about the amount of money you need, how long you will need it for, and how it will be used.]

As part of my loan application, I have included the following documents for your review:

- Business plan

- Financial statements for the past three years

- Tax returns for the past three years

- Cash flow projections

- Articles of incorporation

- Personal financial statements for all owners

A list of collateral that will be used to secure the loan, if applicable

[Provide a comprehensive list of all the documents you have included with your application. Make sure you have included everything the bank has asked for, and any additional documents that may be relevant.]

I am confident in the future success of my business and believe that an SBA loan is the right choice for us. I understand that the loan application process can be lengthy, and I am committed to providing any additional information or documentation that may be required to support my application.

Thank you for considering my loan application. I look forward to hearing from you soon.

Loan Application Letter Sample

Make your small business loan application more polished with our simple sample letters. They’re crafted to help you convey your needs professionally and improve the impact of your request.

Sample letter 1

Dear Sir/Madam,

I am writing to apply for a Small Business Administration loan to support my growing business, GreenTech Innovations. Established in 2018, we specialize in eco-friendly technology solutions. Our recent market analysis indicates significant growth potential in sustainable energy products.

To capitalize on this opportunity, we require additional funding for research and development, marketing, and expanding our team. An SBA loan would enable us to invest in these critical areas, fostering innovation and job creation. Our business plan, attached to this application, outlines our strategy for a sustainable and profitable future.

GreenTech Innovations has a strong financial track record, with consistent revenue growth over the past three years. We have maintained a healthy cash flow and have a solid plan for loan repayment, as detailed in our financial projections. Our commitment to financial responsibility and strategic growth makes us an ideal candidate for an SBA loan.

Thank you for considering our application. We are committed to contributing positively to the economy and the environment. Your support would be instrumental in helping us achieve our goals.

Jordan Smith

Owner, GreenTech Innovations

Sample letter 2

Dear Business Loan Officer,

I am reaching out to request a business loan for my company, Bella’s Boutique, a unique clothing and accessories store located in downtown Springfield. Since our opening in 2019, we have become a beloved part of the local community, known for our exclusive designs and personalized customer service.

This loan is sought to enhance our inventory, upgrade our in-store technology, and expand our online presence. These improvements are essential for keeping pace with the evolving retail landscape and meeting the growing demands of our customers. Our detailed business plan is attached for your review.

Financially, Bella’s Boutique has demonstrated resilience and growth, even amid challenging economic times. Our sales figures have shown a steady increase, and we have a clear plan for managing the loan and ensuring its repayment. We believe these factors make us a strong candidate for a loan.

Your consideration of our loan application is greatly appreciated. This funding will not only help Bella’s Boutique thrive but will also support the local economy by providing more employment opportunities and enhanced retail experiences.

Thank you for your time and consideration.

Warm regards,

Isabella Martinez

Founder, Bella’s Boutique

The effectiveness of these sample letters as a guide for someone seeking to write a loan application lies in several key aspects. Firstly, they demonstrate the importance of a clear and concise introduction, where the purpose of the letter is immediately stated, ensuring the reader understands the intent from the outset. This is crucial in any formal business communication. Both samples skillfully describe the nature and background of the respective businesses, providing just enough detail to give the reader a sense of the company’s identity and market position without overwhelming them with unnecessary information. This balance is vital in maintaining the reader’s interest and establishing the context of the request.

Moreover, the letters excel in explicitly stating the purpose of the loan, which is a critical component of any loan application. They outline how the funds will be utilized to grow and improve the business, demonstrating not only a clear vision but also a strategic approach to business development. This helps in building a sense of trust and reliability with the lender. Furthermore, the inclusion of financial health indicators, such as past revenue growth, cash flow management, and a repayment plan, adds to this trust by showing financial responsibility and foresight.

The writers also incorporate attachments like business plans and financial projections, which provide additional depth and substantiation to their claims. This shows thorough preparation and professionalism, which are highly regarded in the business world. Finally, the tone of the letters is appropriately formal yet approachable, and they conclude with a note of gratitude, reflecting good business etiquette. This combination of clarity, conciseness, relevance, and professionalism makes these letters exemplary guides for anyone looking to draft an effective and persuasive business loan application.

Tips for Writing

Following are some tips for writing this letter:

Be specific

Be sure to include specific details in it to keep the reader’s attention. Ensure that you include information about the purpose of the loan, how much money you need, and the reason why you are a good candidate for a loan.

Brevity is essential when writing this letter. Stick to the essential points and avoid extraneous details. This will help to ensure that your letter is easy to read and that the reader is not distracted by irrelevant information.

Address the appropriate person

Ensure that you address your letter to the most relevant party for your particular situation.

Consider contacting the bank to find out to whom it should be addressed. This is how you can be sure that it will get to the right person.

Use a proper format and layout

As with all letters, you should use clear, concise paragraphs and avoid unnecessary jargon. Make sure to use the appropriate format for formal letter writing and use a professional, polished layout.

Include business financial statements

The financial statements for your company must be attached to your letter if you are a business owner. In this way, the reader will better understand your overall financial situation and help demonstrate that you are a good candidate for a loan.

The following are some of the purposes for which you may request a small business administration loan: to start a new business, to buy new equipment or inventory for your company, to upgrade or expand an existing business, to cover unanticipated expenditures, to pay off high-interest debt, to fund marketing campaigns, to move your office to a new location, to buy insurance for your business, to purchase stock, to buy out shareholders, and for any other lawful reason authorized by the lender.

Key Takeaways

Here are the key takeaways from this article:

- When writing an application for a loan, be sure to provide specific details about the purpose of the loan, how much money you need, and why you are a good candidate for a loan.

- Use the standard business letter format and use clear, concise paragraphs.

- Brevity is vital when writing such a document, so mention only the essential points and avoid extraneous details.

- Address your letter to the most relevant party for your situation, and be sure to include your company’s financial statements.

About This Article

Was this helpful?

Great! Tell us more about your experience

Not up to par help us fix it, keep reading.

Applications

10 Good Examples of Sports Sponsorship Proposal

Applications , Employment , Forms , Human Resource

22 free job application forms (templates) – word, pdf.

Applications , Forms

55 blank rental application forms – templates – editable, thank you for your feedback.

Your Voice, Our Progress. Your feedback matters a lot to us.

Personal Loan Request Letter (Format & Sample)

A personal loan request letter is a letter written by a loan applicant and addressed to a financial institution, introducing the applicant, and supporting their loan application. Anyone wanting to take out a personal loan should write a personal loan request letter to introduce themselves to their target banking institution. The purpose of the letter is to request a loan formally and to demonstrate that they can repay the loan amount requested.

In short, the applicant needs to use this letter to demonstrate to the bank that they are a reasonable financial risk.

How to Write a Personal Loan Request Letter

This is a professional document, so write professionally and use a formal format for your letter. Write clearly and concisely, and send supporting financial documents. These documents might include tax returns, paycheck stubs, and bank account balances. You might want to include collateral information you can use to obtain the loan, such as a car, a boat, or a house.

Tip: Your personal loan request letter is the first document the lender will see when applying for a loan. Address it to a person, not a title. Addressing the loan administrator by name can positively influence their first impression of you as a borrower. You can ask for this information at the bank, or you can look for the information on the bank’s website.

What a Lender Needs to Know

Lenders are primarily concerned with your ability to repay the amount you are requesting as a loan. However, a lender must have some other information about your loan request before they can judge your ability to repay the loan. Here is what to include in a personal loan application letter:

- The amount of the loan you are requesting

- Your name and contact information

- Your status as a borrower, such as bank accounts and income information

- Any property you might have as collateral for the loan

- The intended use of the loan funds

- The expected benefit of the use of funds

- A detailed list of enclosed documents, including your loan application

This might sound overwhelming, but it is really quite simple. For example, if you have a home in need of a renovation, you might ask for a loan of the amount needed to perform the renovation. In writing your letter, you would state the renovation as the intended use of the funds and the return on investment (ROI) you anticipate as the expected benefit the renovation will provide.

Personal Loan Request Letter Format

{your name}

{your address}

{recipient name}

{recipient title}

{financial institution name}

{financial institution address}

RE: Personal loan request for {amount}

Dear {recipient}:

The purpose of this letter is to request a personal loan in the amount of {amount}. I intend to use the funds to {intended use}. {Use this space to briefly discuss the use of the funds and the expected benefit from this use.}

Attached, please find my loan application. I have also enclosed my most recent tax return, current bank account statements, proof of my income, and a list of my current assets. These financial documents and my credit score of {number} combine to make me a strong credit risk for {financial institution name}.

I would greatly appreciate the opportunity to discuss my personal loan application with you. I can be reached at {your phone number} or {your email address}.

Thank you for your time and your consideration of my loan application.

{your signature}

Sample Personal Loan Request Letter

2004 South Perkins Street

Bowen, TX 89556

August 22, 2022

Mr. Jacob Harrison

Personal Loan Administrator

Bank of Texas

4886 West 93 Street

Bowen, TX 89558

RE: Personal loan request for $6,000

Dear Mr. Harrison:

The purpose of this letter is to request a personal loan in the amount of $6,000. I intend to use the funds to renovate my home’s outdated bathroom. I have attached the best estimate for the renovation and an estimate of the return on investment for this renovation. As you can see, the ROI expected increases my home’s value by an amount greater than the cost of the renovation.

Attached, please find my loan application. I have also enclosed my most recent tax return, current bank account statements, proof of my income, and a list of my current assets. These financial documents and my credit score of 724 combine to make me a strong credit risk for Bank of Texas.

I would greatly appreciate the opportunity to discuss my personal loan application with you. I can be reached at 987-234-5889 or [email protected] .

Personal Loan Request Letter (Word Template)

The purpose of a personal loan request letter is to support your loan application positively. Be clear about your financial circumstances and the benefits the loan can provide. This supporting information, written clearly and concisely, can assist you in getting the loan you need to accomplish your goals.

How did our templates helped you today?

Opps what went wrong, related posts.

Timeshare Cancellation Letter Samples and Templates

Block Letter Format: Rules (with Examples)

Statement of Purpose Examples

Restaurant Apology Letter to Customers

Proof of Residency (Tennessee)

California Proof of Residency (CA)

Proof of Residency Texas

Proof of Residency Ohio

Thank you for your feedback.

How to Write a Loan Application Letter

Table of Contents

Sometimes, taking out a loan can become inevitable. Whether dealing with piled-up medical bills or a financial emergency, it’s common to turn to fast and convenient borrowing options. According to statistics, advances and loans accounted for more than 60% of bank assets in the European Union in 2021.

If you wish to take out a loan, you’ll have to fill out a loan application or request letter that details what you need the money for and how you’ll use it. The best way to appeal to a lender is by using a convincing tone and showcasing a clear plan for the money. Keep reading as we look at ways you can achieve this and ensure that your loan is granted successfully.

What is a Loan Application Letter?

A loan application letter is a typed or handwritten letter provided to your lender, helping them decide whether to approve your loan request. This letter is written when the borrower is seeking financial assistance from a lender to pay off some bills or other expenses.

When Do You Need One?

You might require a loan application letter in the following financing situations:

- When you wish to borrow money from the SBA (Small Business Administration) since it recommends and encourages applicants to start their loan proposals with an executive summary or a loan application letter

- When a borrower opts for a loan from a conventional bank lender and has to demonstrate that their business is financially viable and experiencing growth

In some situations, you aren’t required to write a loan application letter. These include scenarios like when a borrower is seeking equipment financing and said equipment serves as collateral, when someone requests a business line of credit with business bank statements or financial statements, and when a borrower seeks a term loan online using alternative lenders who want to go over your recent bank statements.

Essential Loan Application Elements

There are specific guidelines you need to follow when writing a loan application:

1. Header and Greeting

Whether you’re filling out a loan application letter for a personal or business loan, it’s crucial that you start with a header and greeting. Include several sentences that outline the necessary, accurate details of your loan request in the header. If you’re opting for a business loan, then you need to include the following details:

- Company name

- Company phone number

- Company address

- Loan agent or lender’s name and title

- Loan agent or lender’s contact details

- A subject line stating the desired loan amount

Follow this by incorporating a greeting right below the header so that you introduce your application with a friendly tone.

2. Loan Request Summary

You will have to provide your lender or loan agent with an overview of your loan request in this section. Ensure this section is concise, detailing only crucial information that’ll enable the lender to reach the letter’s body quickly. Entrepreneurs applying for a business loan should state why they are trustworthy borrowers, basic business details, the ideal loan amount, and the use of the loan.

3. Basic Business Details

It would be best if you started by making a clear loan request which includes the amount you wish to borrow. When you write a few sentences about the workings of your business, they should include the following information:

- The legal business name

- Any DBA used by the organization

- The amount of time the business has been operating

- The business structure

- Number of employees

- An overview of what the company does

- Profits and annual revenue, if applicable

Once this is done, you can move on to the next step, which is explaining why you need a loan. Don’t also forget to outline how you plan to repay the owed amount if the lender grants the loan.

4. Loan Usage

Every lender’s goal is to minimize risk as much as possible, so don’t be surprised if they carefully scrutinize your application before deciding whether to accept or disapprove it. They will assess whether you can pay back the loan entirely on time. Make a solid outline of how you intend to use the loan and why granting you the funds is a wise investment. It’s essential to inform the lender that you have clear goals you will accomplish if the loan application is approved.

5. Proof of How You’ll Pay Back the Loan

In order to show your company’s financial health, you’ll need to use figures from the latest balance sheet or income statement. These records are essential because they demonstrate that you can repay the loan.

Additionally, you must include any additional business finances to prove you’re a low-risk investment. State down any existing debt and a schedule detailing how you’ll pay it back if you owe someone else money. Perhaps, you’re a new business, but profits are stable. In that case, ensure you mention this, as it proves your ability to repay the loan.

Once you achieve this, you can add a particular cash flow prediction to give the lender an idea of your payback plan, including the principal and interest amount.

6. Give Accurate Information

There’s no doubt that lending money is a risky investment. You can make your lender’s life easier by providing factual and correct details to ensure both parties agree with the terms of the deal. For example, include your accurate credit history. If you are dishonest during the loan application process, you will be considered a fraud, and there will be repercussions for your actions.

Tips for Writing a Loan Application Letter

- Before sending a loan letter request, check your business and personal credit scores and whether you need to take specific steps to improve them

- Provide transparent, genuine, and concise explanations

- Ensure all information is factual and relevant

- Keep all your financial statements ready, such as business balance sheets, cash flow statements, PSL statements, etc

- Submit every relevant credential with your loan application request letter

- Include the date, time, method, and manner you’ll use to make your payment

- Avoid writing a letter that is unnecessarily wordy and long

- Follow the rules available online on writing formal letters, so you don’t use an informal tone while assembling your loan application letter

- Whether including your business’s current assets, liabilities, or financial health, don’t jot down false information that can get you into legal trouble.

Loan Terms and Penalties

If you fail to pay your loan on time, cancellation fees or penalties may apply that depend on the number of days you’re overdue on the payment. For example, if you’ve looked into how to get a title loan with a lien , you know that your car will be used as collateral. In case you default on payment or provide false information, you are likely to lose ownership of the vehicle.

You should go through the loan terms and conditions as this will enable you to determine how many days your payments can be delayed, how much penalties are for late payments, and the amount you’ll be charged if you cancel your loan. Choosing a loan provider that offers the lowest and most amenable terms is recommended.

Whatever reason you have for acquiring a loan, writing a solid loan application letter will improve your chances of obtaining the financial help you need. This application letter should be composed in a polite, convincing tone and include accurate information. You can do thorough research to pick a lender whose provided options align with your requirements. Consider beforehand how much money you need and apply for the relevant loan.

Join the thousands who have sharpened their business writing skills with our award winning courses.

Copyright © 2024 Businesswritingblog.com.

Sample Letters

Writing a Loan Application Letter That Works

In this guide, I’ll share my personal tips, real-life examples, and three unique templates to help you write a loan application letter that works.

Key Takeaways

- Purpose of a Loan Application Letter : Explain why you need the loan and how you plan to use the funds.

- Essential Elements : Include your contact information, a formal greeting, a clear purpose, a detailed financial plan, and a professional closing.

- Tone and Language : Maintain a polite, respectful, and professional tone.

- Personal Experience Tips : Highlight your financial stability, previous successful loans, and your commitment to repayment.

- Templates : Three unique and customizable templates to suit different needs.

Understanding the Purpose

The primary purpose of a loan application letter is to provide the lender with a clear understanding of why you need the loan and how you plan to use it. It should also demonstrate your ability to repay the loan. From my experience, being transparent about your financial situation and future plans significantly increases your chances of approval.

Elements of a Successful Loan Application Letter

| Element | Description |

|---|---|

| Include your name, address, phone number, and email. | |

| Address the letter to a specific person if possible. | |

| Clearly state the purpose of the loan. | |

| Provide detailed financial information and a repayment plan. | |

| End with a professional closing and your signature. |

Tips from Personal Experience

- Be Specific : Clearly outline the purpose of the loan. For instance, if you need a loan for home renovation, specify the projects you plan to undertake.

- Provide Evidence : Include any relevant documents that support your application, such as business plans, invoices, or contracts.

- Show Stability : Highlight your financial stability by mentioning your employment status, income, and any assets you have.

- Repayment Plan : Detail your plan for repaying the loan, including timelines and amounts.

Real-Life Example

When I applied for a loan to expand my small business, I included a detailed business plan showing projected revenue and expenses. I also attached contracts from new clients that demonstrated the demand for my services. This thorough approach impressed the lender and led to a successful loan approval.

Template 1: Personal Loan Application

[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date]

Trending Now 🔥 {"title":"Trending Now \ud83d\udd25","limit":"3","offset":0,"range":"all","time_quantity":24,"time_unit":"hour","freshness":false,"order_by":"views","post_type":"post, page","pid":"","cat":"42","taxonomy":"category","term_id":"","author":"","shorten_title":{"active":false,"length":0,"words":false},"post-excerpt":{"active":true,"length":"15","keep_format":false,"words":true},"thumbnail":{"active":false,"build":"manual","width":0,"height":0},"rating":false,"stats_tag":{"comment_count":false,"views":"1","author":false,"date":{"active":false,"format":"F j, Y"},"category":false,"taxonomy":{"active":false,"name":"category"}},"markup":{"custom_html":true,"wpp-start":" ","wpp-end":" ","title-start":" ","title-end":" ","post-html":" {title} "},"theme":{"name":""}}

[Loan Officer’s Name] [Bank’s Name] [Bank’s Address] [City, State, ZIP Code]

Dear [Loan Officer’s Name],

I am writing to formally request a personal loan of $[amount] to [state purpose, e.g., consolidate my debt]. I have been a loyal customer of [Bank’s Name] for [number] years, and I am confident in my ability to repay this loan in a timely manner.

My current financial situation is stable, as I am employed at [Your Employer] with a monthly income of $[amount]. Attached are my recent pay stubs and a detailed budget outlining my expenses and repayment plan.

I appreciate your consideration and look forward to your positive response.

Sincerely, [Your Name]

Template 2: Business Loan Application

[Your Name] [Your Business Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date]

I am writing to request a business loan of $[amount] to [state purpose, e.g., expand my business operations]. My business, [Your Business Name], has been operating successfully for [number] years, and this loan will enable us to [specific plans, e.g., open a new branch, purchase new equipment].

Enclosed are our financial statements, business plan, and contracts from new clients, which demonstrate our growth potential and ability to repay the loan.

Thank you for your time and consideration.

Template 3: Home Renovation Loan Application

I am seeking a home renovation loan of $[amount] to improve my residence at [your address]. The planned renovations include [specific projects, e.g., kitchen remodeling, roof replacement], which will enhance the value and functionality of my home.

Attached are estimates from contractors, my recent bank statements, and a detailed plan of the renovations. I am committed to repaying the loan over [repayment period], as outlined in the attached budget.

I look forward to your favorable response.

Final Thoughts

Writing a compelling loan application letter requires attention to detail and a clear presentation of your financial situation and plans. By following this guide and using the provided templates, you can increase your chances of securing the loan you need. Remember, honesty and clarity are your best allies in this process.

Word & Excel Templates

Printable word and excel templates.

Loan Application Letter

Applying for the loan requires you to provide a lot of documentation. Some organizations ask you to fill out the loan application form, while in some cases, you have to write a loan application letter to the institute to apply for the loan.

The loan application letter allows you to add all the details that you are required to provide. The letter is written to the loan manager of the company, and he then decides whether he should accept the application or not. The letter should include the personal information of the applicant, and since it is a formal letter, it should be written to the point by avoiding unnecessary details. The lender should follow a standard format while writing the loan application letter. The loan manager should be told about the intended use of the money.

The first paragraph of the letter should state the reason for lending the money. It should be assured in the letter that you will not use this money for any illegal purpose. The date on which the applicant will return the borrowed money should be mentioned in the letter.

You should also include information about you in the letter that can make the reader feel that you are a trustworthy person. Here is a sample letter that can help you learn about the structure and format of the letter.

Loan application letter:

Dear [Recipient’s Name],

It is stated that I am writing this letter to request a loan from the finance office of your company because of some of my very peculiar and essential needs. My mother is seriously ill, and I must get her treated at the hospital, for which I need money. Please accept my loan application and sanction me $2000. I assure you that I will return you the loan from the deductions of my gross salary.

I will be highly grateful for this favor of yours.

I am looking forward to your reply.

[Your Name]

Preview and Details of Template

File: Word ( .doc ) 2003 + and iPad Size: 31 KB

More options

I am writing this letter to get a loan from your bank branch situated in New Jersey. Currently, I am working as a sales executive for ABC Organization and need a $10,000 loan. I am in utmost need of this amount as I have to meet the surgery expenses of my father. I have gone through all the requirements related to the loan process and have enclosed the necessary documents along with this email. Please let me know what other documents I need to send you, and you can call me at any time for further queries. I hope you will give a positive response to my request.

This application is a request to ask for a loan from your organization. I am Christiana Roseland, and I am currently running a bakery in New Jersey. I am planning to open a new branch according to the rising demand of people. For this purpose, I need $70,000/- and I will return the amount in installments. I have thoroughly read the rules and policies for the loan process and hopefully, I will return the entire amount within the given time period and the financial pronouncement has been affixed with this application. Waiting to get positive feedback from you.

This letter is a request for a loan application to construct a house. I am the managing director at ABC Company, and my monthly salary is not adequate to meet the construction expenses. I will return the due amount according to the company’s rules and policies and will not let you be disappointed. I contacted the admin office to find out the details, and Mr. Jackson has provided me with all the information. If you need additional information, you can ask me at any time. Thank you for taking my request into account.

Dear Madam, I, Darcy Louis, work in the security office of your company. I live in Valley Stream and travel two hours daily to come to the office. I do not have a personal vehicle, and sometimes it creates a lot of difficulties, and I often arrive late to the workplace. I want to apply for a loan because I have to buy a motorcycle. I need $10,000 in this regard. I have chosen a six-month installment plan, and 20% of my salary will be deducted each month. I request that you accept my loan application. I will be grateful to you. Thanking in anticipation.

Dear Sir, I am Dorothy John, and I live in Toronto. I am running a branch of ABC School. The strength of students is increasing with each session, and it is becoming difficult to adjust to the large number of students in a limited space. Therefore, I need to open a new branch adjacent to the current school and construct a new building, but I do not have enough money. I learned about your loan policy and want to apply for it. I have attached the needed documents along with the application. I am hoping to hear a quick response from you.

I am Julia Hughes, and I am writing this message to ask for a loan from your bank. I have an account in your Brooklyn branch, and my account number is [#]. I have a small business marketing in Brooklyn, and I intend to open a new branch in the Netherlands. Hence, it can be a source of ease for hundreds of people. The savings I have and the loan I am asking for will be of great help in expanding my business. Kindly send me an email detailing all the formalities for the loan process. I would like to ask you to send me a confirmation message so I may visit your branch on an immediate basis.

- Holiday Closing Messages

- Letter Requesting Transfer to another Department

- Letter Requesting Promotion Consideration

- Umrah Leave Request Letter to Boss

- Ramadan Office Schedule Announcement Letters/Emails

- Letter to Friend Expressing Support

- Letter to Employer Requesting Mental Health Accommodation

- Letter Requesting Reference Check Information

- Letter Requesting Salary Certificate

- Letter Requesting Recommendation from Previous Employer

- One Hour Off Permission Letter to HR

- Payroll Apology Letter to Employee

- Advice Letter to Subordinate on Effective Communication

- Advice Letter to Subordinate on Time Management

- Letter to Patient for Feedback/Responding Survey/Online Form

Letters.org

The Number 1 Letter Writing Website in the world

Sample Loan Application Letter

Last Updated On December 25, 2019 By Letter Writing Leave a Comment

Loan application is written when the applicant wants to seek monetary assistance in the form of loan mostly on a mortgage of property. Since it is a request, the letter should be written in a polite tone.

Use the following tips and samples to write an effective loan application letter to a bank manager or a company.

Sample Loan Application Letter Writing Tips:

- As loan application letter is formal, the phrases and words should be chosen carefully.

- The language used should be simple and easy to understand

- The content of the letter should be short and straightforward.

Sample Loan Application Letter Template

__________ (Branch Manager’s name) __________ (Branch address) __________ __________

______________ (Your name) ______________ (Your address) __________________

Date __________ (date of writing letter)

Dear Mr. /Ms_____________ (name of the concerned person),

I have a savings account in your bank with account no._________ for the past …………… years. I want to apply for a ……………..(type of loan) loan for ………………….(state purpose) .

If you can inform me about the details and formalities required for seeking the loan, I shall make all the arrangements and meet you at the earliest.

Looking forward to meeting you,

Thanking you,

Yours Sincerely,

___________ (Your name)

Sample Loan Application Letter Sample, Email and Example/Format

Pavan Kumar 3214 Breeze apts Worli Hyderabad

The Branch Manager, Axis Bank, Station Road Branch, Hyderabad

30th September 2013

Subject: Loan application letter

Dear Sir/Madam,

I have a savings account in your bank for the last five years. I want to avail a home loan from your bank. I would like to know the details to seek a home loan from your bank.

I am a salaried employee, and I work for a central government organisation as a research scientist. You can verify my salary certificate and other details.

As the home loan interest rates have down, I would like to utilise this opportunity to buy a house. I have already booked a flat in Banjara Hills Hyderabad, and I need about Rs 35 lakhs as the loan amount. With my pay scale, I think I am eligible to seek a loan for this amount.

If you can send your representative to my place, we can discuss and finalise the loan. I shall keep all the documents ready so that there will not be a delay in processing the loan.

Looking forward to hearing from you,

_____________

Pavan Kumar

Email Format

A loan application letter is written to ask for financial credit service on some secured mortgage basis. As it is our requirement, the words should be so humble and sincere that the banker or the lender acquires total trust on the applicant. Loan application letter helps the loan applier to appeal for the various types of loans whichever he wishes to depend upon certain conditions.

I have sent this letter to you to explain my reasons behind requesting a loan modification on my mortgage. I wish to purchase a Mercedes Benz 300 Limousine costing Rs 56 lakhs. I am seeking an interest reduction down to 6.25% from my current 8.80%. I feel it is a fair percentage for you, and it is just within my means.

Without a reduction on the interest, I will not be able to afford the monthly payments. I have to choose between a loan modification and a foreclosure. I would far prefer the former, and you probably would as well. 6.25% is the most I will be able to manage, even if I cut all of my expenses out of the picture. Please consider my application seriously, and I hope to hear more from you on the matter.

Yours Faithfully,

____________

Jimmie Verna Melendez.

Related Letters:

- Sample Application Letter

- Sample Job Application Cover Letter

- Sample College Application Letter

- Sample Application Cover Letter

- Sample Scholarship Application Letter

- Job Application Letter

- Transfer Application

- Application Letter by Fresher

- Application Letter for Referral

- Business Application Letter

- College Application Letter

- Credit Application Letter

- General Application Letter

- Good Application Letter

- Grant Application Letter

- Letter Of Intend Application

- Job Application E-Mail Template

- Job Application Letter Format

- Job Application Letter Template

- Receptionist Application Letter

- Solicited Application Letter

- Summer Job Application Letter

- Work Application Letter

- Unsolicited Application Letter

- Corporation Application Letter

Leave a Reply Cancel reply

You must be logged in to post a comment.

How to Write an Effective Letter Asking for a Loan (with Templates and Examples)

A business loan application process often requires numerous documents, one of which is a request letter. This letter is a significant part of your application as it is written to request financial assistance from the financial institution.

In most loan application cases, the success of your application process hinges on your ability to craft a convincing and professional business loan request letter. However, to do this, you need to know what the letter entails, the necessary information to include, and, of course, how to write one.

To help you with your application process, below we have compiled everything you need to know about writing a request letter for a business loan.

Seeking a loan can be daunting but a well-crafted letter can make all the difference in getting approved. This comprehensive guide will teach you how to write a persuasive letter asking for a loan, whether for personal or business needs.

What is a Letter Asking for a Loan?

A letter asking for a loan is a formal written request addressed to a bank or financial institution. It aims to convince the lender that you are creditworthy and will repay the loan

The letter should provide key details:

- The loan amount required

- Purpose of the funds

- Your ability to repay

This document acts as an introduction and summary of your loan application. It allows you to make a strong first impression before the lender reviews your application in depth.

Why Write a Letter Asking for a Loan?

While the application form contains your details, a letterpersonalizes your request. Here are key reasons to write one:

Demonstrates your communication skills – Well-written letters reflect positively on you.

Allows you to make a case for yourself – The letter lets you explain your situation and need for financing in your own words.

Provides a snapshot of your request – It summarizes critical details for quick review.

Creates a good first impression – Many lenders consider the letter an indicator of how you’ll interact as a client.

In short, a compelling letter can boost your chances of getting approved.

Essential Elements of a Letter Asking for a Loan

To write an effective letter, include these key details:

The header should contain:

- Your full name and contact details

- Lender’s name and address

2. Greeting

Begin with a formal greeting like “Dear Mr./Ms. [name]”.

Briefly introduce yourself and state the loan amount you need.

Example: I am writing this letter to request a personal loan of $15,000 from your institution.

4. Loan Purpose

Explain what you need the loan for and why it is necessary.

Example: I need to take this loan to pay for my son’s college education.

5. Ability to Repay

Show you have the means to repay by highlighting:

- Your income sources

- Credit score and history

- Any existing debts

Example: I have been employed with my company for 5 years and have a stable source of income to repay this loan.

6. Supporting Documents

List any accompanying documents like bank statements, tax returns, etc. that support your request.

Example: Please find enclosed my last 3 months’ pay stubs, bank statements, and tax returns for your review.

7. Appreciation

Thank the lender for considering your application.

Example: I appreciate you taking the time to review my application. I look forward to your favorable response.

End with “Yours sincerely” followed by your signature and printed name.

Dos and Don’ts

Follow these guidelines when writing your letter:

- Stick to a formal tone using clear, concise language

- Keep the letter to 1 page

- Be honest and accurate with all information

- Proofread thoroughly before sending

DON’T:

- Use casual language or slang

- Make spelling/grammatical errors

- Exaggerate or provide misleading facts

- Forget to sign the letter

Sample Letter Asking for Personal Loan

Here is a sample personal loan request letter using the above guidelines:

Dear Mr. Buckley,

I am writing this letter to request a personal loan of $15,000 from First National Bank. I need to take this loan to pay for my son’s college education.

As an account holder with your bank for 7 years, I have a good credit history. My current credit score is 720, and I have no history of defaulting on loans. I have been employed with XYZ Corp. for the last 5 years and earn an annual income of $45,000. I also have $10,000 in savings that can act as collateral for this loan.

Please find enclosed my last 3 months’ pay stubs, bank account statements, and tax returns for the previous 2 years for your review. These demonstrate my financial status and ability to repay the requested loan amount. I plan to repay this loan within a 2 year period with monthly installments of $700.

I sincerely appreciate you taking the time to review my application. I look forward to your favorable response regarding my personal loan request. Please feel free to contact me if you need any other information.

Yours sincerely, [Signature] Jane Smith [Contact details]

Sample Letter Asking for Business Loan

Here is a sample business loan request letter:

Dear Ms. Matthews,

I am writing to request a business loan of $50,000 on behalf of ABC Company. This loan will be used to expand our marketing efforts and hire 2 new sales executives.

ABC Company is a profitable retail business operating since 2015. We have grown from 3 to 15 employees and saw 25% revenue growth last year.

Our 2019 financial statements demonstrate annual sales of $550,000 and a net profit of $125,000. I have also enclosed our business plan, ownership details, and a schedule of our business debts.

With an excellent personal credit score of 780 and no history of late repayments, I am confident in my ability to repay the requested loan. Our company possesses assets worth $100,000 that can additionally act as collateral if required.

I appreciate your time and consideration of this loan request. Please contact me at [phone] or [email] if you need any further information. I look forward to starting a long-term financing relationship with your institution.

Sincerely, [Signature] John Davis CEO ABC Company [Contact Details]

Helpful Loan Request Letter Templates

- Personal loan request letter template

- Business loan request letter template

- Mortgage loan request letter template

- Student loan request letter template

- Car loan request letter template

Key Takeaways

- Letters asking for loans summarize and personalize your request.

- Include details on the amount needed, purpose, ability to repay, and supporting documents.

- Maintain a formal tone and provide accurate information.

- Review loan request letter templates to write an effective letter quickly.

- A compelling letter can boost your chances of loan approval significantly.

With these tips and samples, you can now craft a polished letter asking for a loan to convince lenders of your creditworthiness. Just be sure to customize your letter to reflect your unique situation and financial needs.

Basic Business Information

Money lenders and financial institutions do not give out loans to businesses or individuals who walk up their doorsteps. They do not accept and disburse loans without knowing who the borrower is. A detailed business loan request letter should begin with a proper introduction that communicates the borrower’s basic personal and business details.

It is a great way to not only break the ice but also get the lender to be familiar with you and know you’re genuine. The basic business information should include the following:

- Your address

- Your business name

- Your business address

- Name of the money lender or loan agent

- Contact information of the loan agent

- Requested loan amount

- Current business project

- Current annual revenue

- Turnover of the previous financial year

- Current number of employees

These details tell the institution all they need to know about you, your financial needs, and your business. Needless to say, all information given should be legal and up-to-date.

Heading And Greeting

When writing a letter, it is a formality to have the heading and greeting first. The loan request letter is not left out. At the top of your business loan application letter, you are expected to leave a formal greeting and belief introduction of yourself. This is where the basic business information comes into play.

- Begin by writing your name and contact information

- Date the letter correctly (when the letter was written)

- Include the name, title, and other important contact information of your loan agent

- Include a subject line that states you are applying for a loan and the amount of loan you are applying for

- Include a formal greeting.

Below is an example of a format for the heading and greeting section of your letter:

At a glance, the heading and creating part of your letter will tell the lender what they need to know about your business and the type of loan you need.

Loan Request Application To Your Company As An Employee | How To Write Application For Loan Request

How to write a letter to ask for a loan?

How do you ask for a loan professionally?

How to write a letter requesting a loan from your boss?

How should I write a loan request letter?

Begin your loan request letter by introducing yourself with your full name, address, and contact information. This not only establishes your identity but also ensures the lender can easily reach you: “My name is John Doe, residing at 123 Main Street, Anytown, USA. I can be reached at (555) 555-5555.

What is a personal loan request letter?

A personal loan request letter is a letter written by a loan applicant and addressed to a financial institution introducing the applicant and supporting their loan application. It is a document that introduces the applicant to their target banking institution when applying for a personal loan.

What is the purpose of a loan request letter?

The purpose of a loan request letter is to formally request a loan and demonstrate that the applicant can repay the loan amount requested. In short, the applicant needs to use this letter to demonstrate to the bank that they are a reasonable financial risk. This is a professional document, so write professionally and use a formal format for your letter.

What do banks look for in a loan request letter?

A bank loan request letter is your opportunity to present a compelling case to the lender, showcasing your financial responsibility, business acumen, and planning skills. Real-Life Examples: Learn from actual experiences and examples to better understand what banks look for in a loan request letter.

Related posts:

- How Do Property Tax Loans Work? A Complete Guide

- How to Get an Equity Loan With No Credit Check

- How to Get a Home Equity Loan With No Income

- Thinking of Changing Home Loan Lenders? Here’s What You Need to Know

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Connecting small business owners with financing solutions

Grow efficiently with low-interest SBA loans - tailored for small businesses.

Secure stable funding for growth - flexible terms, fixed rates.

- Line of Credit

Flexible funds on hand to manage your cash flow seamlessly.

Small Business Stories

Hear from small businesses, like yours, that have accessed funding to drive success.

Learn how we make the complex clear and the process seamless

- Loan Process

Our streamlined loan process blends innovative technology with personalized service.

- SBA Loan Calculator

Review potential payments and navigate the SBA 7(a) loan confidently with our SBA loan calculator.

Learn more about SmartBiz and small business financing. Explore our frequently asked questions.

- Small Business Blog

Unlock invaluable insights and tips for small business success.

We’re your dedicated small business financial partner

- Our Company

Discover our story and our commitment to supporting small businesses.

Join a dynamic team dedicated to driving innovation and growth.

Stay informed with our latest announcements and industry updates.

Customer Reviews

Hear from our customers - real stories of success and satisfaction.

- 7 Tips on How to Write a Business Loan Request Letter

- Learning Center

- Small Business Loans

One of the toughest aspects of applying for a traditional bank or small business loan is the numerous hoops borrowers generally must jump through to qualify. From gathering all the proper documentation to ensuring your business has the necessary prerequisites to qualify, applying for a loan can be an arduous process.

The primary purpose of the lengthy application is to help the lender determine whether you’ll actually be able to repay the loan. While all the information you provide helps make your case, a well-written loan request may mean the difference between qualification and rejection. Below detailed tips on how to write a business loan request letter that presents your company in the best light possible.

What is a business loan request letter?

A business loan request letter is a written document that you provide with your loan application to help improve your chances of getting approved. Small business owners use it to report the amount of money they’d like to borrow. They also use it to detail how they’ll use the funds for their business and how they’ll repay the loan over time. All that information arrives alongside an explanation of why the bank should fund the business.

How to write a small business loan request letter

Your loan request letter is often the first thing your lender will look at after receiving your small business loan application. It’s how the lender will judge whether you’re eligible for a loan, so writing it correctly is highly important.

While there are many factors to consider when writing a business loan request letter, one thing to keep in mind is its length. Lenders typically use your letter to make snap judgments on whether to continue the review process. That generally means a longer letter may be one reason as to why your application might be rejected . The ideal loan request is usually a page long but packed with all the necessary details, as listed below.

1. Start with a header and a greeting

The top of your letter is reserved for basic identifying information and a subject line that includes your requested loan amount. Most loan request headers include personal details such as:

- Your first and last name

- The name of your business

- Your business’s address

- Your business’s phone number

- The name of the lender or loan officer presiding over your case

- That lender or loan officer’s contact information

- A subject line that states you’re writing to request a loan and the amount you’re trying to borrow

Keeping a cordial tone throughout the letter can help leave a good impression on the lender. So beneath all the necessary information in the header, you should write a kind but formal greeting.

2. Write a brief summary

Start the body of your letter with a brief summary of why you’re writing it and the amount of money you’d like to borrow. Doing so typically means expanding on the information you provide in the header. Accordingly, you’ll want to include only a basic overview of your business while reiterating the amount you’d like to borrow and why.

While there’s more information here than in the header, you should still try and include only the most essential details. The summary section is meant to convince the loan agent to keep evaluating your application, so brevity is key.

3. Provide a basic overview of your business

There’s specific information that you should include as a part of the overview of your business, such as the following.

- Your business’s legal name and any fictitious names for which you have a DBA

- How your business is structured: Is it an S corporation or a partnership , or is it something else?

- A description of the products or services your business provides

- How long your business has been operating

- Your current number of employees

- Your business’s annual revenue (and profits, if applicable)

As with the sections above, keep this information concise so you don’t accidentally dissuade the loan agent from continuing to read. Additionally, make sure to cover the most unique aspects of your business so you can stand out among other applicants in your industry.

4. Add info on any partners, if applicable

It’s not just your business’s success that’s being evaluated. Lenders also put your personal finances and leadership abilities under the microscope to determine the likelihood of your business succeeding in the long term. So if you’re just one of many people who own your business, then it stands to reason that lenders will assess any co-owners as well. Add their info to the header alongside yours and include their finances in any revenue or debt calculations .

hbspt.cta._relativeUrls=true;hbspt.cta.load(21458256, '7cc0e43b-a4ce-4dc3-a21a-b721421c096c', {"useNewLoader":"true","region":"na1"});

5. explain how you plan to use your business loan funds.

While you may have briefly mentioned why you want the loan in previous sections, it’s here that you’ll go into detail. Explain how you’ll use the funds in as much detail as possible while remaining clear and concise. This section should demonstrate that you know what your business needs to increase its profitability. And that you have a plan in place to get there.

Remember that the lender's main goal during this process is to ascertain whether you’ll actually repay the loan. It doesn’t necessarily matter how you use the money as long as you back up your actions with a solid business plan.

To that end, try to be specific when stating the purpose of your new funds. A financial institution won’t approve a loan that simply lists wanting more working capital as the reason for their loan request. Some more acceptable examples of reasons for wanting additional funds include, but aren’t limited to, the below.

- Purchasing additional commercial property

- Funding more expansive marketing campaigns

- Buying out shareholders

- Hiring more experienced employees

- Purchasing newer equipment

- Moving your business operations to a new location

Note that this isn’t an exhaustive list of acceptable reasons to seek a small business loan. If you adequately explain any way that the funds will help your business grow over time, your application generally has a better chance of qualifying .

6. Demonstrate that you can repay the loan

Staying in line with the lender's desire to minimize financial risk, you must demonstrate your business’ ability to repay the loan. Essentially, this means proving that your company is financially healthy enough to make long-term monthly payments on the principal loan amount plus interest.

The financial information you provide to fill out the rest of the loan application will go a long way here, but further detail is typically necessary. For example, you could include a cash flow statement to show that your business is profitable. Or you could highlight your credit history to show that you’ve reliably paid current and past debts.

7. Add your concluding elements

Make sure to keep a cordial tone once you’ve reached the end of the business loan request letter as you include the following information.

- A reference to your attached financial statements (usually about a paragraph long)

- A final paragraph that formally requests that the lender review your application. You should also indicate that you look forward to speaking with them in the near future.

- A signature

- A list of all the documents you’ve included to complete your loan application

Examples of a small business loan request letter

Below are two examples of a small business loan request letter that you may use as templates.

Example small business loan request letter #1

Your First and Last Name [And the name of any company co-owners] Your Business’s address City, State, Zip Code

Name of the Loan Agent Loan Agent’s Title Name of the Agent’s Financial Institution Financial Institution’s address City, State, Zip Code

Subject: Small business loan request for [Amount]

Dear [Lender/Loan Agent’s Name],

I am writing this letter to request a small business loan of [Amount] to [Purpose of the loan]. My business, [Name of Business], is part of the [Type] industry and has proven to be a successful venture within its market.

Opening its doors in [Date] with [Number] of employees, [Business Name] has shown reliable, remarkable financial growth over the past [Number] of years. Structured as a [Legal structure of your business], [Business name] now employs [Number] individuals, with our annual sales revenue reaching [Number] last year. In addition, we’ve reached net profits of [Number, Include if your business is profitable], maintaining strong economic growth in the [Number] years since opening.

[Use this section to explain the reason for your loan request, for example]: We’ve observed an increasing number of customers coming into our storefront coupled with increased demand for [Your business’s product or service]. We wish to further capitalize on our success by expanding our current floor space, allowing more customers to purchase our [Product or service] at once. As a result, we request funding to afford [Name what you need] and continue growing our business with [Summary of your business plan].

The potential financial growth of our business is immediate, allowing us to fit repayments plus interest into our monthly budget easily. But we cannot currently produce a lump sum large enough to afford [Name what you need] in a reasonable timeframe. A loan in the amount of [Number] enables us to purchase [Name what you need] to capitalize on this growth opportunity and begin generating new revenue as quickly as possible.

We feel that [Business name] is of minimal financial risk to your bank due to our strong credit score of [Number] and positive finances. Attached to this application are our annual profit and loss statement and our most recent cash flow statement to help corroborate our excellent economic position.

Please take a moment to review this request letter and the accompanying financial documents. If you feel our company is a good match for your bank, we would love to hear from you.

Your Signature Your Printed Name

List of Enclosures: Business plan, cash flow statement, and P&L statement [plus any other documents that are part of the loan application]

Example small business loan request letter #2

Name of the Loan Agent Name of the Agent’s Financial Institution Financial Institution’s address City, State, Zip Code

Dear [Lender/Loan Agent’s name],

This letter is meant to request a loan of [Amount] for the express purpose of growing my business, [Business name]. It’s a [Type of business] venture that’s proven itself a successful provider of [Main product or service] since we opened our doors in [Date]. As an established name within our industry, and with a continually growing customer base, we would like additional funding to capitalize on our success by expanding our operation over the next [Time frame].

[Business name] is a [State your type of business entity ] catering towards [Type of clientele]. When we first opened our doors, we employed [Number] people, and in the [Number of years] since, that number has swelled to [Current number of employees]. Furthermore, our management team comprises [Describe each partner and co-owner] who ably [Detail each company leader's responsibilities] while managing employees.

With our current business strategies and team makeup, we’ve reached an annual sales revenue of [Number] and a net profit of [Number – only include if your business is profitable]. We plan to capitalize on our successes with new product initiatives that capture a wider range of clientele within our target market and any overlapping industries.

According to our business plan, any funding we receive would go towards [Explain what your company will use the money for along with any secondary goals]. We believe that our business will present minimal financial risk to your bank, with our credit history demonstrating our penchant for repaying debts on time. Additionally, after carefully assembling [Business name]’s most recent cash flow statement, we believe that our current revenue can easily cover an extra monthly fee plus interest.

In addition, our overhead is very flexible due to the operation of our business accommodating contract and freelance employees, lessening financial strain. This allows us to reliably remain on top of our debts even during tough economic times or if the funding provides fewer profits than anticipated.

We would like to take advantage of this growth opportunity as soon as possible and would appreciate it if you could take the time to review our request letter. Enclosed with the application are several financial documents that help corroborate [Business name]’s continued economic health. We’re more than happy to provide any other information you might need to decide on our loan.

When do you need a business loan request letter?

Generally, business loan request letters are only necessary when you apply for the below two types of loans.

- Conventional bank term loans. Applying for a bank term loan requires you to meet that lender's particular requirements for eligibility. A loan letter is often one of those requirements. Banks are notoriously risk-averse, and your letter may help to show them that your business is financially stable enough to repay the loan.

- SBA loans. Applying for an SBA loan requires you to meet prerequisites that are just as strict as for conventional bank loans, if not more so. Most SBA loan guidelines recommend including a loan request or similar cover letter-like document to support the financial information in your application.

While the above loans tend to require a loan request letter, other business financing options typically don’t. Such options include:

- Loans from an alternative lender. These loans’ qualification criteria are often less strict than with traditional financial institutions. Some alternative lenders may only request your bank statements when you apply.

- Equipment financing. Typically, with equipment financing, there’s less of a need to prove that your business is profitable. That’s because the equipment you purchase serves as collateral for the loan. If you can’t repay the loan, the lender may easily recoup their losses.

- Business lines of credit. While the eligibility criteria for a business line of credit are similar to traditional banks in some respects, it doesn’t require as much documentation. Generally, getting one will only require your most recent bank or financial statement, not a business loan request letter.

Let SmartBiz® make the loan application process easier

While business loan request letters aren’t always required, they can be time-consuming when they are necessary. And if you’re applying for many loans, you might not have the time to write a loan request for every one. While writing from a template could work, knowing whether you qualify for a loan before you enter the bank may save you even more time. That’s where SmartBiz comes in handy. SmartBiz displays lenders in your area and compares their loan plans with your finances. Check now which loans you prequalify for * before you’ve even picked up an application.

Have 5 minutes? Apply online

- Follow SmartBiz

Access to the right loan for right now

- Business Credit

- Business Finances

- Business Marketing

- Business Owners

- Business Stories

- Business Technologies

- Emergency Resources

- Employee Management

- SmartBiz University

- More SBA Articles

Related Posts

Getting ready to qualify for an sba loan, social media guide for small businesses: strategies, tools, and trends, sba loans vs. credit cards: which financing is right for your business, smart growth is smart business.

See if you pre-qualify, without impacting your credit score. 1

*We conduct a soft credit pull that will not affect your credit score. However, in processing your loan application, the lenders with whom we work will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and happens after your application is in the funding process and matched with a lender who is likely to fund your loan.

The SmartBiz® Small Business Blog and other related communications from SmartBiz Loans® are intended to provide general information on relevant topics for managing small businesses. Be aware that this is not a comprehensive analysis of the subject matter covered and is not intended to provide specific recommendations to you or your business with respect to the matters addressed. Please consult legal and financial processionals for further information.

Find the best business loan rates (2024)

How to Write a Loan Request Letter to Get Your Small Business Funded

TABLE OF CONTENTS

If you want to get business financing from your bank or the Small Business Administration (SBA), you’ll need to know how to write a loan request letter.