How To Write a Successful Investment Bank Business Plan (+ Template)

Creating a business plan is essential for any business, but it can be especially helpful for investment bank s that want to improve their strategy or raise funding.

A well-crafted business plan not only outlines the vision for your company but also documents a step-by-step roadmap of how you will accomplish it. To create an effective business plan, you must first understand the components essential to its success.

This article provides an overview of the key elements that every investment bank business owner should include in their business plan.

Download the Ultimate Business Plan Template

What is an Investment Bank Business Plan?

An investment bank business plan is a formal written document describing your company’s business strategy and feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write an Investment Bank Business Plan?

An investment bank business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Investment Bank Business Plan

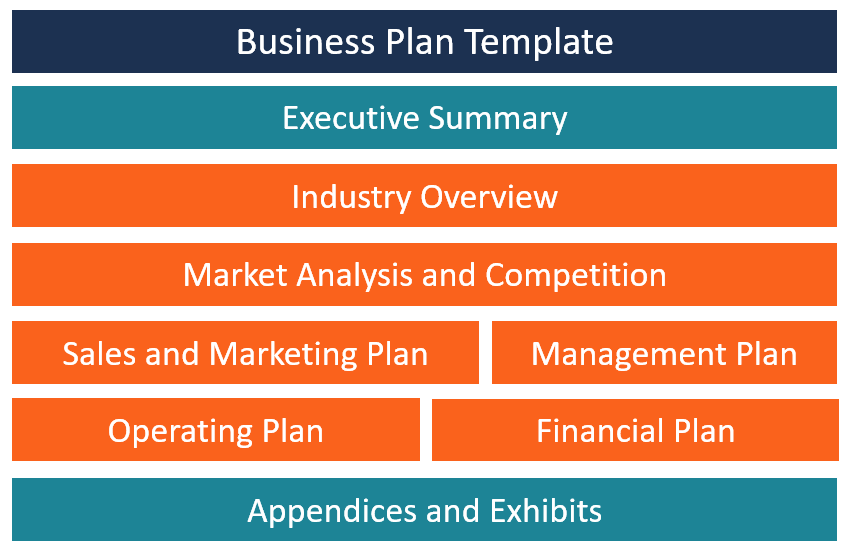

The following are the key components of a successful investment bank business plan:

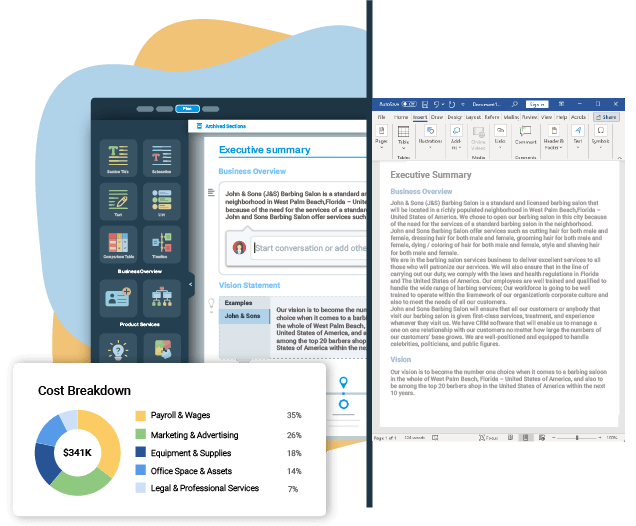

Executive Summary

The executive summary of an investment bank business plan is a one to two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your investment bank company

- Provide a summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast, among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started and provide a timeline of milestones your company has achieved.

You may not have a long company history if you are just starting your investment bank business. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company or been involved in an entrepreneurial venture before starting your investment bank firm, mention this.

You will also include information about your chosen investment bank business model and how, if applicable, it differs from other companies in your industry.

Industry Analysis

The industry or market analysis is a crucial component of an investment bank business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the investment bank industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support your company’s success)?

You should also include sources for your information, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, an investment bank’s customers may include small businesses, middle market companies, and large corporations.

You can include information about how your customers decide to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or investment bank services with the right marketing.

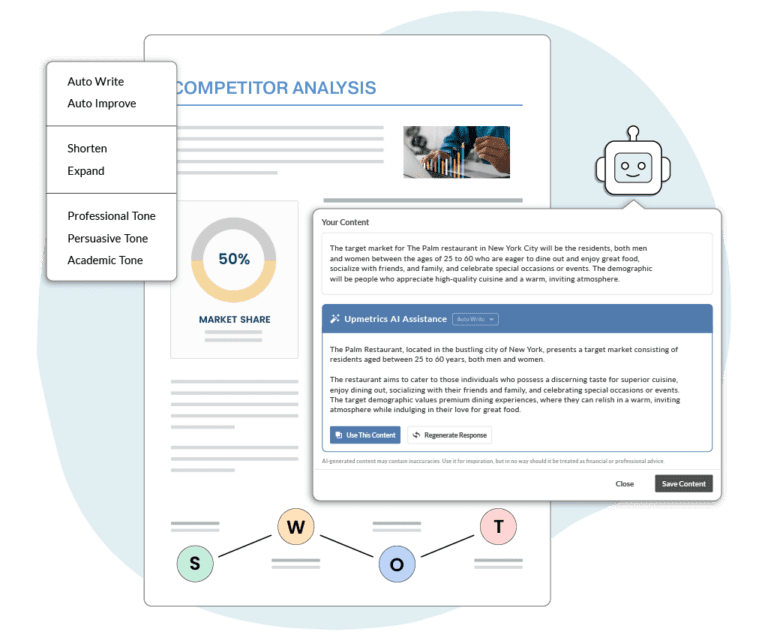

Competitive Analysis

The competitive analysis helps you determine how your product or service will differ from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive advantage; that is, in what ways are you different from and ideally better than your competitors.

Below are sample competitive advantages your investment bank business may have:

- In-depth industry knowledge

- Strong relationships with key players

- Focus on long-term investments

- Innovative products and services

- Personalized customer service

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, or launch a direct mail campaign. Or you may promote your investment bank business via a PR or influencer marketing campaign.

Operations Plan

This part of your investment bank business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing to the overall brand image you are trying to present.

Finally, and most importantly, in your Operations Plan, you will lay out the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters and then each year for the following four years. Examples of milestones for an investment bank business include reaching $X in sales. Other examples include expanding to new markets, launching a new product or service line, and hiring key personnel.

Management Team

List your team members here, including their names and titles, as well as their expertise and experience relevant to your specific investment bank industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

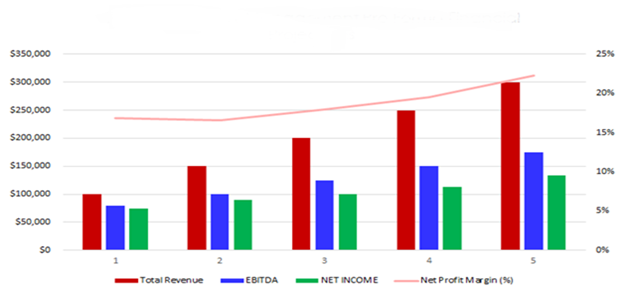

Financial Plan

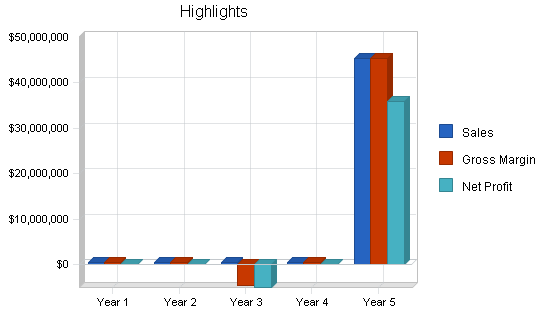

Here you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Investment Bank Firm

| Revenues | $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 |

| $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 | |

| Direct Cost | |||||

| Direct Costs | $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 |

| $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 | |

| $ 268,880 | $ 360,750 | $ 484,000 | $ 649,390 | $ 871,280 | |

| Salaries | $ 96,000 | $ 99,840 | $ 105,371 | $ 110,639 | $ 116,171 |

| Marketing Expenses | $ 61,200 | $ 64,400 | $ 67,600 | $ 71,000 | $ 74,600 |

| Rent/Utility Expenses | $ 36,400 | $ 37,500 | $ 38,700 | $ 39,800 | $ 41,000 |

| Other Expenses | $ 9,200 | $ 9,200 | $ 9,200 | $ 9,400 | $ 9,500 |

| $ 202,800 | $ 210,940 | $ 220,871 | $ 230,839 | $ 241,271 | |

| EBITDA | $ 66,080 | $ 149,810 | $ 263,129 | $ 418,551 | $ 630,009 |

| Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| EBIT | $ 60,880 | $ 144,610 | $ 257,929 | $ 413,351 | $ 625,809 |

| Interest Expense | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 |

| $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 | |

| Taxable Income | $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 |

| Income Tax Expense | $ 18,700 | $ 47,900 | $ 87,600 | $ 142,000 | $ 216,400 |

| $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 | |

| 10% | 20% | 27% | 32% | 37% | |

Balance Sheet

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Investment Bank Firm

| Cash | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

| Other Current Assets | $ 41,600 | $ 55,800 | $ 74,800 | $ 90,200 | $ 121,000 |

| Total Current Assets | $ 146,942 | $ 244,052 | $ 415,681 | $ 687,631 | $ 990,278 |

| Fixed Assets | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 |

| Accum Depreciation | $ 5,200 | $ 10,400 | $ 15,600 | $ 20,800 | $ 25,000 |

| Net fixed assets | $ 19,800 | $ 14,600 | $ 9,400 | $ 4,200 | $ 0 |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

| Current Liabilities | $ 23,300 | $ 26,100 | $ 29,800 | $ 32,800 | $ 38,300 |

| Debt outstanding | $ 108,862 | $ 108,862 | $ 108,862 | $ 108,862 | $ 0 |

| $ 132,162 | $ 134,962 | $ 138,662 | $ 141,662 | $ 38,300 | |

| Share Capital | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Retained earnings | $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 |

| $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 | |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

Cash Flow Statement

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include cash flow from:

- Investments

Below is a sample of a projected cash flow statement for a startup investment bank business.

Sample Cash Flow Statement for a Startup Investment Bank Firm

| Net Income (Loss) | $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 |

| Change in Working Capital | $ (18,300) | $ (11,400) | $ (15,300) | $ (12,400) | $ (25,300) |

| Plus Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| Net Cash Flow from Operations | $ 21,480 | $ 82,910 | $ 152,629 | $ 256,551 | $ 380,709 |

| Fixed Assets | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Net Cash Flow from Investments | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Equity | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Debt financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow from Financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow | $ 105,342 | $ 82,910 | $ 152,629 | $ 256,551 | $ 271,847 |

| Cash at Beginning of Period | $ 0 | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 |

| Cash at End of Period | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and grow your investment bank company. It not only outlines your business vision but also provides a step-by-step process of how you are going to accomplish it.

Now that you know how to write a business plan for your investment bank, you can get started on putting together your own.

Finish Your Business Plan in 1 Day!

Wish there was a faster, easier way to finish your business plan?

With our Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

How to Start Your Own Investment Bank: A Comprehensive Guide

To start your own investment bank, you need to follow these steps: (120 words) First, obtain the necessary licenses and certifications from regulatory authorities in your jurisdiction. This is crucial for legal compliance and gaining the trust of potential clients.

Next, develop a comprehensive business plan that outlines your target market, services offered, and growth strategy. Secure adequate capital to meet regulatory requirements and fund your operations. Establish strategic partnerships with key stakeholders such as institutional investors, government entities, and other financial institutions.

Finally, invest in robust technology systems and skilled professionals to deliver efficient and trustworthy services to your clients. By following these steps, you can successfully start your own investment bank and position yourself in the financial market.

Understanding The Opportunities And Challenges

Starting your own investment bank can be a lucrative venture, but it also comes with its fair share of challenges. Understanding the opportunities and challenges is crucial to navigate this complex industry.

Exploring the potential benefits and risks is the first step. Investment banking services offer a wide range of opportunities for revenue generation, such as mergers and acquisitions, underwriting securities, and providing financial advisory services. However, it is important to carefully evaluate the market demand for these services to ensure sustainability.

Assessing regulatory requirements and compliance is another critical aspect. Investment banks operate in a heavily regulated environment. Understanding and meeting the necessary regulatory standards is paramount to avoid legal and financial penalties.

By thoroughly understanding the opportunities and challenges, evaluating market demand, and complying with regulatory requirements, aspiring investment bankers can take the necessary steps to start their own successful investment bank.

Defining Your Investment Banking Business Model

Defining your investment banking business model is crucial when starting your own investment bank. This involves identifying your target market and niche. Conduct market research to determine the most profitable areas to focus on. Consider factors such as industry trends, competition, and potential client needs. Once you have identified your target market, choose the appropriate legal structure for your investment bank. Consult with legal professionals to understand the various options available and select the one that best suits your needs. Establishing strategic partnerships and alliances is also important. Look for opportunities to collaborate with other financial institutions, technology providers, or industry associations. This can help you leverage resources, expand your network, and gain credibility in the market. By carefully defining your investment banking business model, you can set yourself up for success in the highly competitive financial industry.

Building A Strong Team

In order to build a strong team for your investment bank, it is important to hire experienced professionals in the field of investment. Look for candidates who have a proven track record and extensive knowledge in the industry. Additionally, assembling a competent support staff is crucial for the smooth operation of your bank. Your support staff should be reliable and efficient in handling administrative tasks and providing excellent customer service.

Furthermore, developing a robust training and development program is essential for the growth and success of your team. Invest in continuous learning opportunities for your employees, including workshops, seminars, and online courses. This will help them stay updated with the latest trends and developments in the investment banking industry, and enhance their skills and expertise.

A well-structured training and development program not only improves the knowledge and capabilities of your team members, but also boosts their morale and job satisfaction. It demonstrates your commitment to their professional growth and helps in retaining top talent.

Obtaining The Necessary Licenses And Registrations

Starting your own investment bank can be a complex process that requires obtaining the necessary licenses and registrations from regulatory authorities. Researching the regulatory landscape is the first step in this process. It is important to thoroughly understand the rules and regulations that govern the establishment and operation of investment banks in your jurisdiction.

Once you have researched the regulatory landscape, you can begin the process of applying for relevant licenses and registrations. This typically involves submitting detailed applications, providing supporting documentation, and paying the required fees. It is important to carefully follow the application process and ensure that all the necessary information is provided.

After obtaining the licenses and registrations, it is crucial to comply with ongoing reporting requirements. Investment banks are typically required to submit regular reports to regulatory authorities, detailing their financial activities and ensuring compliance with applicable laws and regulations. Keeping track of these reporting requirements and fulfilling them in a timely manner is essential to maintain the necessary licenses and registrations for your investment bank.

Establishing Compliance And Risk Management Systems

To establish a successful investment bank, it is crucial to have effective compliance and risk management systems in place. Designing a comprehensive compliance program is the first step towards ensuring regulatory adherence. This program should include establishing relevant policies and procedures, conducting regular training sessions for employees, and implementing a robust reporting mechanism. Compliance officers need to stay updated with the latest regulatory changes to ensure constant compliance.

Implementing robust risk management controls is equally important. This involves identifying potential risks, assessing their impact, and developing mitigation strategies. Risk management controls should cover various areas like credit, market, operational, and liquidity risks. Additionally, it is essential to conduct regular internal audits and reviews to evaluate the efficiency of these controls and make any necessary adjustments. This helps in identifying any potential weaknesses and taking corrective actions.

Leveraging Technology And It Infrastructure

To start your own investment bank, it is crucial to leverage technology and IT infrastructure effectively. Selecting the right technology platforms and systems is key to ensuring seamless operations. It is essential to choose software and hardware solutions that cater to the specific needs of your investment bank while keeping scalability in mind.

In addition to technology platforms, establishing secure data storage and backup protocols is imperative. Protecting sensitive client information and ensuring data integrity are essential for building trust and maintaining regulatory compliance. Implementing robust backup systems and disaster recovery plans will help safeguard your data.

Efficient network and communication solutions are also vital for operating a successful investment bank. A reliable and high-speed network is necessary for seamless collaboration and quick access to critical information. Implementing secure communication solutions, such as encrypted emails and virtual private networks, will ensure confidentiality when communicating with clients and partners.

Setting Up Operational Processes And Procedures

Setting up operational processes and procedures is crucial when starting your own investment bank. Developing effective workflows and procedures will ensure that your bank operates smoothly and efficiently.

One of the key aspects of setting up operational processes is streamlining back-office functions. This includes tasks such as account opening, settlement, and reconciliation. By creating standardized processes and defining roles and responsibilities, you can minimize errors and reduce operational risks.

Another important step is implementing performance measurement and reporting systems. These systems allow you to track and measure the performance of different departments and individuals within your bank. They provide valuable insights that can help you identify areas for improvement and make data-driven decisions.

Building Trust And Credibility

Building Trust and Credibility is crucial when starting your own investment bank.

To establish a reputable brand identity, focus on consistent branding and a clear value proposition . Build a strong online presence through an appealing website, engaging social media platforms, and targeted digital marketing strategies. Highlight your expertise and industry knowledge to position yourself as a trustworthy authority.

Engaging in thought leadership activities helps build credibility. Write insightful blog posts , contribute to industry publications, and participate in relevant conferences and webinars. This will showcase your expertise and attract potential clients.

Fostering strong relationships with industry stakeholders is essential. Network with key players and maintain open lines of communication. Collaborate with industry associations and join relevant professional organizations.

By following these steps, you can build trust, establish a reputable brand identity, engage in thought leadership activities, and foster relationships with industry stakeholders to start your own investment bank successfully.

Attracting And Retaining Clients

When it comes to attracting and retaining clients for your investment bank, developing tailored investment solutions is key. Clients are looking for investment banks that can provide them with personalized services and solutions based on their unique financial goals and risk appetite. One way to do this is by leveraging marketing and advertising strategies to showcase the advantages of your investment bank and the value you can provide to clients.

Moreover, providing exceptional client service and support is crucial in building long-term relationships with clients. This includes being responsive to their needs, providing timely and accurate information, and offering ongoing support to address any concerns or questions they may have. By focusing on these aspects, your investment bank can stand out in a competitive market and attract and retain a loyal client base.

Creating A Robust Financial Plan

Creating a Robust Financial Plan

One of the key steps in starting your own investment bank is to develop a detailed and comprehensive financial plan . This involves conducting detailed financial projections and analyses to assess the potential viability of your venture. By carefully examining various financial indicators and market trends, you can gain a better understanding of the opportunities and challenges that lie ahead.

Identifying potential revenue streams is another crucial aspect of your financial plan. You need to determine the various ways in which your investment bank can generate income, such as through advisory fees, underwriting fees, and asset management fees. This will help you establish realistic short-term and long-term targets for revenue generation and ensure the sustainability of your business.

Managing Costs And Optimizing Efficiency

In order to start your own investment bank, it is crucial to effectively manage costs and optimize efficiency. This can be achieved through implementing cost control measures, streamlining operational processes, and embracing technological innovations and automation.

Implementing cost control measures is essential to ensure that expenses are kept in check and resources are utilized efficiently. This can include conducting regular audits to identify areas of overspending and implementing strategies to reduce costs.

Streamlining operational processes is another key aspect of managing costs and optimizing efficiency. By analyzing and re-evaluating existing processes, banks can identify bottlenecks and inefficiencies, and implement improvements to streamline workflows and enhance productivity.

Embracing technological innovations and automation is crucial in today’s digital age. Investing in advanced technologies can help automate repetitive tasks, improve accuracy, and reduce human error. This can lead to cost savings and increased efficiency.

In summary, starting your own investment bank requires a strategic approach towards managing costs and optimizing efficiency. By implementing cost control measures, streamlining operational processes, and embracing technological advancements, aspiring entrepreneurs can set a solid foundation for success.

Frequently Asked Questions For How To Start Your Own Investment Bank

Can anyone start their own investment bank.

Yes, anyone with the right qualifications, resources, and regulatory compliance can start their own investment bank. However, starting an investment bank requires extensive knowledge, experience, and capital, and it is recommended to have a team of experts and professionals to navigate the complex regulatory landscape.

What Is The Process Of Starting An Investment Bank?

Starting an investment bank involves several steps, including obtaining the necessary licenses and permits, establishing a business plan and financial structure, hiring qualified personnel, setting up operational infrastructure, and complying with regulatory requirements. It is crucial to have a thorough understanding of the market, industry, and compliance regulations before embarking on this endeavor.

What Are The Key Challenges In Starting An Investment Bank?

Starting an investment bank comes with its own set of challenges, including obtaining regulatory approvals, attracting top talent, building a reputable brand, securing adequate funding, and navigating the complex regulatory landscape. Additionally, staying competitive in a saturated market and adapting to changing market conditions pose ongoing challenges for investment banks.

Starting your own investment bank is a complex task that requires careful planning and extensive knowledge of the financial industry. By following the steps outlined in this blog post, such as obtaining the necessary licenses, building a qualified team, and developing a comprehensive business plan, you can lay a strong foundation for success.

Remember to conduct thorough market research and seek advice from industry experts to ensure that your investment bank is positioned for growth. Good luck on your entrepreneurial journey!

Monica M. Watkins stands as a prominent authority in the realm of investment, recognized for her expertise as a “how-to” invest expert. With a robust background in finance and a keen understanding of market dynamics, Monica M. Watkins has become a trusted source for practical insights on investment strategies. Her career is characterized by a commitment to demystifying the complexities of financial markets and offering actionable guidance to both novice and seasoned investors. Whether unraveling the intricacies of stock market trends, providing tips on portfolio diversification, or offering guidance on risk management, Monica M. Watkins’s expertise spans a wide spectrum of investment-related topics. As a “how-to” invest expert, she empowers individuals with the knowledge and tools needed to navigate the ever-changing landscape of investments, translating complex financial concepts into accessible and actionable advice. Monica M. Watkins continues to be a guiding force for those seeking to make informed and strategic investment decisions, contributing significantly to the broader discourse on wealth-building and financial success.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Investment Bank Business Plan [Sample Template]

By: Author Tony Martins Ajaero

Home » Business ideas » Financial Service Industry » Bank

Are you about starting an investment bank? If YES, here is a complete sample investment bank business plan template & feasibility report you can use for FREE .

Okay, so we have considered all the requirements for starting an investment bank . We also took it further by analyzing and drafting a sample investment bank marketing plan template backed up by actionable guerrilla marketing ideas for investment banks. So let’s proceed to the business planning section.

If you have enough cash to invest and also friends and partners who can raise you cash plus people who are interested in investing their cash with the aim of getting returns without bothering themselves with running a business, then you should think towards starting an investment bank.

Suggested for You

- Bank Business Plan [Sample Template]

- Microfinance Bank Business Plan [Sample Template]

- Private Banking Business Plan [Sample Template]

- Financial Coaching Business Plan [Sample Template]

- Fintech Startup Business Plan [Sample Template]

Investment banking has to do with starting a financial institution that helps individuals, corporations, and even governments raise capital by acting as the client’s agent in the issuance of securities. This kind of venture needs the effort of more than one person and it is also a very lucrative business.

You will need a large financial base if you truly want to successfully run your investment bank and you will also need investment experts to be part of your team.

The truth is that there are loads of stuffs you need to learn if you intend making a success from this business. So, in order to get started, take out time to read up all you can on investment banks and investment vehicles and also you can under study a successful investment bank to know how they operate and make their money.

Business plan is yet another very important business document that you should not take for granted when launching your investment bank. Below is a sample investment bank business plan template that can help you to successfully write your own with little or no hassles.

A Sample Investment Bank Business Plan Template

1. industry overview.

Businesses that operate in the Investment Banking and Securities Dealing industry comprises of businesses that provide a wide range of securities services, which include investment banking and broker-dealer trading services.

They also offer banking and wealth management services and engage in proprietary trading (trading their own capital for a profit) in varying degrees. Investment banking services include securities underwriting and corporate financial services while trading services include market making and broker-dealer services.

In the face of fee growth from the Investment Banking and Securities Dealing industry’s traditional underwriting and advisory services, both cyclical and structural influences on trading activity have ultimately affected revenue generation for operators in the industry in recent years. The revenue generated by players in this industry is expected to decline.

Most of the troubles experienced in the industry in recent time emanates from fixed income, commodities and currencies (FICC) trading operations. Expensive capital requirements and the trend of transitioning derivative trading to central clearinghouses are anticipated to structurally diminish the industry’s fixed income, commodities and currencies (FICC) revenue.

The Investment Banking and Securities Dealing industry will continue to experience growth in all parts of the world especially in developed countries such as united states of America, Canada, United Kingdom , Germany, Australia, South Korea, Japan and China et al.

Statistics has it that in the United States of America alone, there are about 8,691 licensed and registered Investment Banking and Securities Dealing Companies scattered all across the length and breadth of the country and they are responsible for employing about 100,472 employees.

The industry rakes in a whooping sum of $105 billion annually with an annual growth rate projected at -13.0 percent within 2011 and 2016. The organizations that are leaders in the industry are; Bank of America, Citigroup Inc., JP Morgan Chase & Co, Morgan Stanley and The Goldman Sachs Group Inc.

A report recently published by IBISWorld shows that while the number of industry activities has not deviated dramatically over the five-year period, the share of revenue that each activity accounts for has undergone substantial volatility.

The report also started that products and services in the Investment Banking and Securities Dealing industry vary considerably on a company-by-company basis, largely depending on operator size. The report further stated that small- and medium-size investment banks target niche industries and small companies and rely more heavily on traditional investment banking activities such as underwriting and financial advisory. Alternatively, major industry players earn a substantial share of revenue from trading activities.

One factor that encourages entrepreneurs to start their own investment banking business could be that despite the fact the business in capital intensive and the risks are high, it is indeed a thriving and profitable business venture for high end entrepreneurs.

Starting an investment bank requires professionalism and good grasp of how investment works on a global platform. Besides, you would need to get the required certifications and license and also meet the standard capitalization for such business before you can be allowed to start an investment bank in the United States.

2. Executive Summary

Platform™ Investment Bank, Inc. is a registered, licensed and accredited investment bank that will be based in Westchester County – New York.

We are in business to engage in a wide range of securities services which include investment banking and broker-dealer trading services. Of course we will also offer banking and wealth management services and engage in proprietary trading.

Platform™ Investment Bank, Inc. is a client – focused and result driven investment bank that plays by the rules and also provides broad – based services. We will offer trusted and profitable services to all our clients at local, state, national, and international levels. We will ensure that we work hard to meet and surpass our clients’ expectations whenever we take control of any company.

At Platform™ Investment Bank, Inc., our client’s best interest would always come first, and everything will be guided by our values and professional ethics. We will ensure that we hire professionals who are experienced in the stock exchange and other investment portfolios with good track record of return on investments.

Platform™ Investment Bank, Inc. will at all times demonstrate her commitment to sustainability by actively participating in our communities and integrating sustainable business practices wherever possible. We will ensure that we hold ourselves accountable to the highest standards by meeting our client’s needs precisely and completely.

Our plan is to position the business to become one of the leading brands in the investment and business management line in the whole of Westchester County, and also to be amongst the top 25 investment banks in the United States of America within the first 15 years of operation.

This might look too tall a dream but we are optimistic that this will surely be realized because we have done our research and feasibility studies and we are confident that New York is the right place to launch our investment bank.

Platform™ Investment Bank, Inc. is founded by Shannon Stevens and other business partners. Shannon Stevens has a B.Sc. in Business Administration from the University of Nebraska-Lincoln and MBA in Economics from Columbia Business School.

Investing is a family trait Shannon inherited from his father, a stockbroker and U.S. congressman, in his hometown of Omaha, Nebraska. At the age of 11, Shannon made his first investment, and by the age of 13 he was selling homemade cookies and cupcakes and operating a paper delivery service. Shannon is a Certified Investment Banking IT Professional (CIBIT) and Certified Investment Banker –CIB.

3. Our Products and Services

Platform™ Investment Bank, Inc. is established with the aim of maximizing profits in the Investment Banking and Securities Dealing industry. We want to compete favorably with the leading wealth management firms in the United States which is why we have but in place a competent team that will ensure that we meet and even surpass our customers’ expectations.

We are in the Investment Banking and Securities Dealing industry to make profits and we will ensure that we do all that is permitted by the law in the United States of America to achieve our aims and ambitions of setting up the business Our services and products are listed below;

- Underwriting services (debt)

- Trading and related services

- Underwriting services (equity)

- Corporate finance services

- Other financial advisory and consultancy services

4. Our Mission and Vision Statement

- Our vision is to build an investment bank that will become one of the top choices for investors in the whole of Westchester County – New York.

- Our mission is to position the business to become one of the leading brands in the investment banking line of business in the whole of Westchester County, and also to be among the top 25 investment banks in the United States of America within the first 15 years of operation.

Our Business Structure

As part of our plans to build a standard investment bank in Westchester County – New York, we have perfected plans to get it right from the beginning which is why we are going the extra mile to ensure that we want qualified, competent, honest and hardworking employees to occupy all the available positions in our firm. Below is the business structure that we will build Platform™ Investment Bank, Inc.;

- Chief Executive Officer

Investment Banking Officer

Admin and HR Manager

Risk Manager

- Marketing and Sales Executive

- Chief Financial Officer (CFO) / Chief Accounting Officer (CAO).

- Customer Care Executive / Front Desk Officer

5. Job Roles and Responsibilities

Chief Executive Office:

- Increases management’s effectiveness by recruiting, selecting, orienting, training, coaching, counseling, and disciplining managers; communicating values, strategies, and objectives; assigning accountabilities; planning, monitoring, appraising job results and developing incentives

- Responsible for fixing prices and signing business deals

- Responsible for providing direction for the business

- Creates, communicates, and implements the organization’s vision, mission, and overall direction – i.e. leading the development and implementation of the overall organization’s strategy.

- Responsible for signing checks and documents on behalf of the company

- Evaluates the success of the organization

Chief Financial Officer (CFO)/Chief Accounting Officer (CAO)

- Accountable for preparing financial reports, budgets, and financial statements for the organization

- Prepares the income statement and balance sheet using the trial balance and ledgers prepared by the bookkeeper.

- Provides managements with financial analyses, development budgets, and accounting reports; analyzes financial feasibility for the most complex proposed projects; conducts market research to forecast trends and business conditions.

- Responsible for financial forecasting and risks analysis.

- Performs cash management, general ledger accounting, and financial reporting for one or more properties.

- Accountable for developing and managing financial systems and policies

- Responsible for administering payrolls

- Ensures compliance with taxation legislation

- Handles all financial transactions for the company

- Serves as internal auditor for the company

- Carries out underwriting services (debt), trading and related services, underwriting services (equity), corporate finance services and other financial advisory and consultancy services

- Creates research and review platforms for new, existing and potential investment products

- Works closely with analysts and traders to ensure trading strategy is carried out correctly

- Constructs and review performance reports to show to investors

- Performs due diligence visits and assessing investment management firms and quantitatively analyzing investment pools

- Has extensive knowledge of industry policies and regulations set in place by the SEC

- Focusing on capital introductions and networking to sign up new investors

- Plans, designs and implements an overall risk management process for the organization;

- Risks assessment, which involves analyzing risks as well as identifying, describing and estimating the risks affecting the business;

- Risks evaluation, which involves comparing estimated risks with criteria established by the organization such as costs, legal requirements and environmental factors, and evaluating the organization’s previous handling of risks;

- Establishes and quantifies the organization’s ‘risk appetite’, i.e. the level of risk they are prepared to accept;

- Risks reporting in an appropriate way for different audiences, for example, to the board of directors so they understand the most significant risks, to business heads to ensure they are aware of risks relevant to their parts of the business and to individuals to understand their accountability for individual risks;

- Corporates governance involving external risk reporting to stakeholders;

- Conducts audits of policy and compliance to standards, including liaison with internal and external auditors;

- Responsible for overseeing the smooth running of HR and administrative tasks for the organization

- Designs job descriptions with KPI to drive performance management for clients

- Regularly hold meetings with key stakeholders to review the effectiveness of HR Policies, Procedures and Processes

- Maintains office supplies by checking stocks; placing and expediting orders; evaluating new products.

- Ensures operation of equipment by completing preventive maintenance requirements; calling for repairs.

- Defines job positions for recruitment and managing interviewing process

- Carries out induction for new team members

- Responsible for training, evaluation and assessment of employees

- Responsible for arranging travel, meetings and appointments

- Oversees the smooth running of the daily office activities.

Marketing/Investors Relations Officer

- Identifies, prioritizes, and reaches out to new partners, and business opportunities

- Identifies development opportunities; follows up on development leads and contacts;

- Writes winning proposal documents, negotiate fees and rates in line with company policy

- Responsible for handling business research, marker surveys and feasibility studies

- Documents all customer contact and information

- Represents the company in strategic meetings

- Helps to increase sales and growth for the company

Client Service Executive/Front Desk Officer

- Welcomes guests and clients by greeting them in person or on the telephone; answering or directing inquiries.

- Ensures that all contacts with clients (e-mail, walk-In center, SMS or phone) provides the client with a personalized customer service experience of the highest level

- Through interaction with clients on the phone, uses every opportunity to build client’s interest in the company’s services

- Manages administrative duties assigned by the manager in an effective and timely manner

- Consistently stays abreast of any new information on the company’s products, promotional campaigns etc. to ensure accurate and helpful information is supplied to clients

- Receives parcels/documents for the company

- Distribute mails in the organization

6. SWOT Analysis

Platform™ Investment Bank, Inc. engaged the services of professionals in the area of business structuring to assist our organization in building a well – structured investment bank that can favorably compete in the highly competitive Investment Banking and Securities Dealing industry.

Here is a summary from the result of the SWOT analysis that was conducted on behalf of Platform™ Investment Bank, Inc.;

Top on the list when it comes to the strength of the team is our workforce. We have a team that can give our clients good returns on their investment, and also increase our annual returns; a team that are trained and equipped to pay attention to details and to deliver excellent jobs. We are well positioned and we know we will attract loads of accredited investors from the first day we open our doors for business.

As a new investment bank, it might take some time for our organization to break into the market and gain acceptance especially from big – time investors, that is perhaps our major weakness. So also, we may not have the required cash to give our business the kind of publicity we would have loved to.

- Opportunities:

The opportunities in the Investment Banking and Securities Dealing industry is massive considering the number of companies and individuals who would need to invest their money. As a standard and accredited investment bank, we are ready to take advantage of any opportunity that comes our way.

Investment banks and their operations involves large amount of cash and it is known to be a very high – risk venture hence, whoever chooses to manage it must not just have solid investment background, but must also know how to handle risks and discover potential thriving businesses and opportunities.

The truth is that if you are not grounded in risk management, you may likely mismanage peoples’ monies and investment. Just as in any other business and investment vehicles, economic downturn, unstable financial market and unfavorable government economic policies can hamper the growth and profitability of investment banks.

7. MARKET ANALYSIS

- Market Trends

A close watch of the Investment Banking and Securities Dealing industry shows that in the dawn of recessionary declines, the industry is expected to continue on a path to growth, but not without a few more ups and downs. As a result of this trend, the Investment Banking and Securities Dealing industry revenue is expected to grow over the five-year period at an annualized rate of 9.1 percent to $42.9 billion in 2016.

The revenue growth for the industry was restrained in the early part of the period as the industry was reluctant to bounce back from the financial crisis and subsequent recession of the prior period that caused stock markets and business activity to dramatically contract in the United States and of course in the global market.

On the average, it is trendy to find investment banks employ strategies that can help them reduce market risk specifically by shorting equities or through the use of derivatives.

8. Our Target Market

Our responsibility is not just to raise capital but also to look for companies where the capital can be invested (buying over a good percentage of their shares) and that can generate good returns over a period of time. The truth is that it takes a core professional to be able to identify a company that has the potential to grow and become profitable if funds are pumped into it.

As a standard, accredited and licensed investment bank, Platform™ Investment Bank, Inc. offers a wide range of investment portfolio management services hence we are well trained and equipped to manage and provide oversight functions for established companies.

Our target market cuts across businesses and investors that have the required capital to invest in companies and other investment portfolios. We are coming into the industry with a business concept that will enable us produce good returns on investment for ourselves and our clients. Below is a list of individuals and organizations that we have specifically designed and services for;

- Accredited Investors

- Investment Clubs

- Top corporate executives

- Corporate Organizations / Blue Chip Companies

- Celebrities

- Business man and women

- Small and medium scales businesses

Our competitive advantage

Despite the fact that investment banks give huge returns on investment, it is indeed a risky venture. For you to survive as an investment bank, you should be able to come up with workable investment and business management strategies; strategies that will help you attract the required capital and above all you should be a good risk manager and one that can spot a good business from afar.

We are quite aware that to be highly competitive in the Investment Banking and Securities Dealing industry means that we should be able to give good returns on investments to our clients, turn around the fortunes of a dying company , spot potential successful business ideas and invest in them, deliver consistent quality service, our clients should be satisfied with our investment strategies and we should be able to meet the expectations of clients.

Platform™ Investment Bank, Inc. might be a new entrant into the industry in the United States of America, but our management and staff are considered gurus. They are licensed and highly trained portfolio management experts in the United States. These are part of what will count as a competitive advantage for us.

Lastly, our employees will be well taken care of, and their welfare package will be among the best within our category in the industry meaning that they will be more than willing to build the business with us and help deliver our set goals and achieve all our aims and objectives.

9. SALES AND MARKETING STRATEGY

- Sources of Income

Platform™ Investment Bank, Inc. is established with the aim of maximizing profits in the Investment Banking and Securities Dealing industry and we are going to ensure that we do all it takes to attract clients on a regular basis. Platform™ Investment Bank, Inc. will generate income by offering the following investment related services;

10. Sales Forecast

One thing is certain, there would always be accredited investors who would need the services of tested and trusted investment banks.

We are well positioned to take on the available market in Westchester County and other key cities in the United States of America and we are quite optimistic that we will meet our set target of generating enough income from the first six months of operation and grow the business and our clientele base beyond Westchester County.

We have been able to examine the Investment Banking and Securities Dealing industry, we have analyzed our chances in the industry and we have been able to come up with the following sales forecast.

Below is the sales projection for Platform™ Investment Bank, Inc., it is based on the location of our business and the wide range of investment management services that we will be offering;

- First Fiscal Year: $1 Million

- Second Fiscal Year: $ 2.5 Million

- Third Fiscal Year: $5 Million

N.B : This projection was done based on what is obtainable in the industry and with the assumption that there won’t be any major economic meltdown and there won’t be any major competitor offering same services as we do within same location. Please note that the above projection might be lower and at the same time it might be higher.

- Marketing Strategy and Sales Strategy

We are mindful of the fact that there are stiff competitions amongst investment banks and other related financial investment vehicles in the United States of America, hence we have been able to hire some of the best business developers to handle our sales and marketing.

Our sales and marketing team will be recruited based on their vast experience in the industry and they will be trained on a regular basis so as to be equipped to meet the overall goal of the organization. We will also ensure that our return on investment and excellent job deliveries speaks for us in the market place.

Our goal is to grow our investment bank to become one of the top 25 investment banks in the United States of America which is why we have mapped out strategies that will help us take advantage of the available market and grow to become a major force to reckon with not only in the Westchester County but also in other cities in the United States.

Platform™ Investment Bank, Inc. is set to make use of the following marketing and sales strategies to attract clients;

- Introduce our business by sending introductory letters alongside our brochure to corporate organizations, startups, accredited investors, entrepreneurs and key stake holders in Westchester County and other cities in the United States

- Advertise our business in relevant financial and business-related magazines, newspapers, TV and radio stations

- List our business on yellow pages’ ads (local directories)

- Attend relevant international and local finance and business expos, seminars, and business fairs

- Create different packages for different category of clients (startups and established corporate organizations) in order to work with their budgets and still deliver good returns on investment

- Leverage on the internet to promote our business

- Engage direct marketing approach

- Encourage word of mouth marketing from loyal and satisfied clients

11. Publicity and Advertising Strategy

The uniqueness of the Investment Banking and Securities Dealing industry is such that it is the results they produce that helps boost their brand awareness. Investment banks are strategic when it comes to inviting investors to invest in a project or when it comes to acquiring a struggling company.

It will be out of place to boost your investment bank brand if you have not proven your worth in the industry. If you have successfully proven that you have what it takes to operate a successful investment bank, then you next port of call is to strategically engage the media to help you promote your brand and create a positive corporate identity.

Below are the platforms we intend to leverage on to promote and advertise Platform™ Investment Bank, Inc.;

- Place adverts on both print (community based newspapers and magazines) and electronic media platforms

- Sponsor relevant community based events/programs

- Leverage on the internet and social media platforms to promote our brand

- Install our billboards in strategic locations all around Westchester County.

- Ensure that all our workers wear our branded shirts and all our vehicles are well branded with our company’s logo.

12. Our Pricing Strategy

Investment banks are known to generate income from returns on their investment in companies and other investment portfolios hence there are no pricing models for this type of business . But on the other hand, they tend to negotiate with their financial partners on percentage whenever they invest their money in an investment vehicle handled by a venture capitalist firm.

At Platform™ Investment Bank, Inc. we will ensure that we give good returns on investment (ROI) and always maximize profits.

- Payment Options

The payment policy adopted by Platform™ Investment Bank, Inc. is all inclusive because we are quite aware that different customers prefer different payment options as it suits them but at the same time, we will ensure that we abide by the financial rules and regulation of the United States of America. Here are the payment options that Platform™ Investment Bank, Inc. will make available to her clients;

- Payment via bank transfer

- Payment via online bank transfer

- Payment via check

- Payment via bank draft

In view of the above, we have chosen banking platforms that will enable our client make payment for investment without any stress on their part.

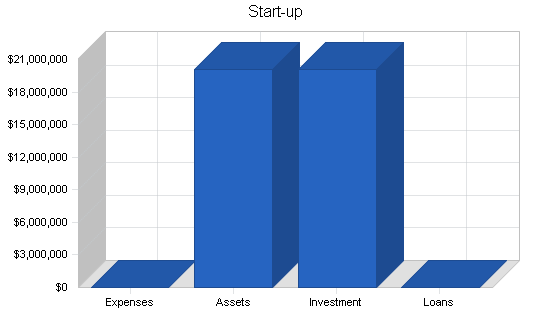

13. Startup Expenditure (Budget)

The cost of starting an investment bank is in the two – folds; the cost of setting up the office structure and the capital meant for investment. The amount required to invest in this line of business could range from 1 Million to even multiple Millions of Dollars. So, you must employ aggressive strategies to pool such cash together.

As regards the cost of setting up the office structure, your concern should be to secure a good office facility in a busy business district; it can be expensive though, but that is one of the factors that will help you position your firm to attract the kind of investors you would need. This is the financial projection and costing for Platform™ Investment Bank, Inc.;

- The total fee for incorporating the business in the United States of America – $750.

- The budget for basic insurance policy covers, permits and business license – $2,500

- The amount needed to acquire a suitable Office facility in a business district 6 month (Re – Construction of the facility inclusive) – $40,000.

- The cost for equipping the office (computers, software applications, printers, fax machines, furniture, telephones, filing cabins, safety gadgets and electronics et al) – $5,000

- The cost of the required software applications (CRM software, Accounting and Bookkeeping software and Payroll software et al) – $10,500

- The cost of Launching your official Website – $600

- Budget for paying at least three employees for 3 months plus utility bills – $10,000

- Additional expenditure (Business cards, Signage, Adverts and Promotions et al) – $2,500

- Investment fund – 1 Million Dollars

- Miscellaneous: $1,000

Going by the report from the market research and feasibility studies conducted, we will need $150,000 excluding $1M investment capital to successfully set up a medium scale but standard investment bank in the United States of America.

Generating Startup Capital for Platform™ Investment Bank, Inc.

Platform™ Investment Bank, Inc. will be owned and managed by Shannon Stevens and other partners. They are the financier of the firm, but may likely welcome other partners later which is why they decided to restrict the sourcing of the startup capital for the business to just three major sources.

- Generate part of the startup capital from personal savings

- Source for soft loans from family members and other investors

N.B: We have been able to generate about $150,000 ( Personal savings $100,000 and soft loan from family members $50,000 ). Please note that we have perfected plans to generate $1 million dollars from accredited investors whose names can’t be mentioned for obvious reasons.

14. Sustainability and Expansion Strategy

The future of a business lies in the number of loyal customers that they have, the capacity and competence of their employees, their investment strategy and the business structure. If all of these factors are missing from a business, then it won’t be too long before the business closes shop.

One of our major goals of starting Platform™ Investment Bank, Inc. is to build a business that will survive off its own cash flow without injecting finance from external sources once the business is officially running. We know that one of the ways of gaining approval and winning customers over is to give investors under our business good returns on their investment.

We will make sure that the right foundation, structures and processes are put in place to ensure that our staff welfare are well taken of. Our company’s corporate culture is designed to drive our business to greater heights and training and retraining of our workforce is at the top burner of our business strategy.

As a matter of fact, profit-sharing arrangement will be made available to all our management staff and it will be based on their performance for a period of three years or more as determined by the board of the organization. We know that if that is put in place, we will be able to successfully hire and retain the best hands we can get in the industry; they will be more committed to help us build the business of our dreams.

Check List/Milestone

- Business Name Availability Check : Completed

- Business Incorporation: Completed

- Opening of Corporate Bank Accounts: Completed

- Opening Online Payment Platforms: Completed

- Application and Obtaining Tax Payer’s ID: In Progress

- Application for business license and permit: Completed

- Purchase of Insurance for the Business: Completed

- Securing a standard office facility in Westchester County: Completed

- Conducting Feasibility Studies: Completed

- Generating part of the startup capital from the founder: Completed

- Applications for Loan from our Bankers: In Progress

- Writing of Business Plan: Completed

- Drafting of Employee’s Handbook: Completed

- Drafting of Contract Documents: In Progress

- Design of The Company’s Logo: Completed

- Printing of Promotional Materials: Completed

- Recruitment of employees: In Progress

- Purchase of the needed software applications, furniture, office equipment, electronic appliances and facility facelift: In progress

- Creating Official Website for the Company: In Progress

- Creating Awareness for the business (Business PR): In Progress

- Health and Safety and Fire Safety Arrangement: In Progress

- Establishing business relationship with key players in the industry: In Progress

Essential Guide: Writing a Business Plan for Investment Banking Success

By alex ryzhkov, get full bundle.

| $169$99 | $59$39 | $39$29 | $15$9 | $25$15 | $15$9 | $15$9 | $15$9 | $19 |

Are you looking to start your own investment bank? It's an exciting venture that requires careful planning and strategic decision-making. In this blog post, we will guide you through the process of writing a business plan for an investment bank in 9 essential steps . But first, let's take a look at the latest statistics and growth trends in this industry.

Related Blogs

- 7 Mistakes to Avoid When Starting a Investment Bank in the US?

- What Are The Top 9 Business Benefits Of Starting A Investment Bank Business?

- What Are The Nine Best Ways To Boost A Investment Bank Business?

- Investment Bank Business Idea Description in 5 W’s and 1 H Format

- Master the Art of Acquiring Investment Bank Business: Your Checklist

- Investment Bank Owner Earnings: A Comprehensive Guide

- How to Open an Investment Bank: The Essential Checklist

- Critical KPIs for Investment Banks: A Guide

- How to Manage High Operating Costs in Investment Banking

- What Are The Top Nine Pain Points Of Running A Investment Bank Business?

- Unleash Your Business Potential Today! Perfect Your Pitch Deck Now!

- How Innovative Strategies Can Enhance Investment Bank Profitability

- The Complete Guide To Investment Bank Business Financing And Raising Capital

- Strategies To Increase Your Investment Bank Sales & Profitability

- How To Sell Investment Bank Business in 9 Steps: Checklist

- How Much Does It Cost To Set Up An Investment Banking Firm?

- Valuing an Investment Bank: How?

The investment banking industry has been experiencing steady growth over the past few years. According to market research , the global investment banking market size was valued at $78.3 billion in 2020 and is projected to reach $108 billion by 2027. This indicates a compound annual growth rate (CAGR) of 4.6% from 2021 to 2027. The growing demand for financial services and the rise of corporate restructuring activities are major factors contributing to this growth.

Now that we have a glimpse of the industry's potential, let's dive into the step-by-step process of writing a business plan for your investment bank. These steps will help you lay a solid foundation and position your bank for success in a competitive market.

- Conduct market research: Understand the current market landscape and identify potential opportunities for your investment bank.

- Identify target market and potential clients: Determine the specific audience you want to cater to and define your ideal client profile.

- Assess competition and industry trends: Analyze your competitors and stay updated on the latest trends in investment banking to stay ahead of the game.

- Determine and define services and product offerings: Clearly define the range of services and products your investment bank will offer to meet the needs of your clients.

- Develop a strategic business model: Create a roadmap for your investment bank's operations, including revenue streams, cost structure, and value proposition.

- Establish a legal structure and obtain necessary licenses: Ensure compliance with all legal and regulatory requirements by choosing the appropriate legal structure and obtaining the necessary licenses and permits.

- Determine staffing and recruitment strategy: Plan your staffing needs and define your recruitment strategy to build a talented and dedicated team.

- Create a comprehensive financial projection: Develop a detailed financial projection that includes revenue forecasts, expense estimates, and cash flow analysis.

- Define marketing and sales strategy: Outline your marketing and sales approach to attract clients and promote your investment bank's services effectively.

By following these steps, you will be well-prepared to write a comprehensive business plan for your investment bank. Stay tuned for the detailed guide on each of these steps in our upcoming blog posts.

Conduct Market Research

Market research is a crucial step in the process of writing a business plan for an investment bank. It provides valuable insights into the current market conditions, industry trends, and customer preferences. By conducting thorough market research, you can gather essential information that will help you make informed decisions and develop a successful business strategy.

Here are some important aspects to consider when conducting market research:

- Industry Analysis: Analyze the investment banking industry to understand its overall structure, key players, and market trends. Identify any emerging opportunities or challenges that may impact your business.

- Target Market: Identify your target market based on specific criteria such as company size, industry sector, geographical location, and financial needs. Determine the market demand for investment banking services within your target market.

- Customer Preferences: Understand the preferences and requirements of your potential clients. Conduct surveys, interviews, or focus groups to gather valuable insights about their expectations from an investment bank.

- Competitor Analysis: Assess the strengths and weaknesses of your competitors in the investment banking industry. Identify their unique selling points and areas where you can differentiate your services and gain a competitive advantage.

- Market Size and Growth: Determine the overall market size for investment banking services and analyze the potential growth rate. This information will help you estimate your market share and develop realistic financial projections.

Tips for Conducting Market Research:

- Utilize both primary and secondary research methods to gather relevant data.

- Use online resources, industry reports, and financial publications for secondary research.

- Engage with potential clients and industry experts to gain insights into market trends and demands.

- Consider hiring a professional market research firm if your budget allows.

- Analyze the results of your market research and incorporate them into your business plan.

| Investment Bank Financial Model Get Template |

Identify Target Market And Potential Clients

Identifying the target market and potential clients is a crucial step in developing a successful business plan for an investment bank. This step allows you to understand who your services will cater to and how you can effectively reach them.

1. Conduct market research: Start by conducting thorough market research to gain insights into the financial industry and the specific needs of your target market. Look at industry reports, market trends, and customer preferences to identify potential gaps or opportunities.

2. Define your niche: Determine the specific niche or area of expertise within the financial services industry that your investment bank will focus on. This could be a particular industry sector, geographical location, or specialized financial products.

3. Segment your target market: Divide the market into specific segments based on demographic, geographic, psychographic, and behavioral characteristics. This segmentation will help you define customer profiles and tailor your services to their unique needs.

4. Determine ideal clients: Identify the characteristics of your ideal clients within each market segment. Consider factors such as their financial goals, investment preferences, company size, and potential for long-term business relationships.

5. Evaluate competition: Research and analyze your competitors to understand their target markets and the services they offer. This analysis will help you identify gaps in the market that your investment bank can fill and differentiate your services from the competition.

- Consider conducting surveys or focus groups to gather feedback from potential clients and understand their needs and expectations.

- Utilize market segmentation tools and techniques to identify untapped customer groups and tailor your marketing efforts accordingly.

- Stay updated with industry news and trends to identify emerging opportunities and potential shifts in customer preferences.

By identifying your target market and potential clients, you can develop a business plan that aligns with their needs and positions your investment bank as the preferred choice in the market. This step lays the foundation for the next stages of your business plan, such as defining your services, creating a marketing strategy, and projecting financials.

Assess Competition And Industry Trends

Assessing the competition and industry trends is a crucial step in developing a business plan for an investment bank. By conducting a thorough analysis of the competitive landscape, you can gain valuable insights into the market dynamics and identify potential opportunities and challenges.

To assess the competition, start by identifying the key players in the investment banking industry. Look at both local and global banks that offer similar services and target a similar client base. Analyze their strengths, weaknesses, and market positioning. This will help you understand what sets your bank apart and how you can differentiate yourself.

Industry trends play a significant role in shaping the future of investment banking. Stay up-to-date with the latest developments, regulatory changes, and emerging technologies that are impacting the industry. This will help you anticipate shifts in customer preferences and adapt your business strategy accordingly.

- Tip 1: Use online resources, industry publications, and analyst reports to gather information on market trends and competitor analysis.

- Tip 2: Attend conferences and networking events to connect with industry experts and gain firsthand insights into the latest trends and innovations.

- Tip 3: Leverage social media platforms and online communities to engage with industry professionals and stay informed about industry discussions and news.

Determine And Define Services And Product Offerings

When writing a business plan for an investment bank, it is crucial to determine and define the services and product offerings that your bank will provide. This step is essential in order to clearly communicate to potential investors and clients what your bank brings to the table and how it differentiates itself from competitors.

To start, conduct a thorough analysis of the market to identify the specific financial services that are in demand and that align with your bank's expertise and target market. This analysis will help you identify the unique value proposition that your bank can offer.

Once you have identified the services that your bank will provide, define them in detail in your business plan. Outline the specific features and benefits of each service and how they can meet the needs of your target market. Additionally, explain how these services will be delivered and any unique approaches or methodologies that your bank will employ.

It is important to consider that as an investment bank, your services and product offerings should be comprehensive and tailored to the specific needs of your clients. This may include capital raising services, securities trading, financial advisory, corporate finance, and asset management. The ability to offer a full range of financial solutions is often a key differentiator for investment banks.

Tips for determining and defining services and product offerings:

- Conduct market research to identify the specific financial services that are in demand.

- Clearly outline the features and benefits of each service in detail.

- Tailor your services to meet the specific needs of your target market.

- Consider offering a comprehensive range of financial solutions to differentiate your bank.

By determining and defining your services and product offerings, you can effectively position your investment bank in the market and attract clients who are in need of the specialized financial solutions that your bank provides.

Develop A Strategic Business Model

In order to build a successful investment bank, it is essential to develop a strategic business model that outlines how the bank will operate and achieve its goals. This model will serve as the foundation for the bank's operations and will guide decision-making processes.

1. Define your value proposition: Start by identifying the unique value that your investment bank will bring to the market. Determine what sets your bank apart from competitors and how you will differentiate yourself in terms of the services and products you offer. This will help you attract clients and build a strong customer base.

2. Assess the market demand: Analyze the market to understand the demand for the services your bank aims to provide. Identify potential clients and target markets, and determine how your bank can meet their specific financial needs. This will help you narrow down your focus and tailor your services accordingly.

3. Identify revenue streams: Determine how your bank will generate revenue. Explore different revenue streams, such as fees for financial advisory services, commissions from securities trading, or management fees for asset management. Understand the profitability of each revenue stream and prioritize them based on their potential impact on your business.

4. Build partnerships: Consider forming strategic partnerships with other financial institutions or service providers. Collaborating with established players in the industry can give your bank access to valuable resources, expertise, and a wider network of potential clients. Look for opportunities to create mutually beneficial partnerships that can enhance your bank's offerings.

- Regularly review and update your strategic business model to adapt to changing market conditions and evolving client needs.

- Consider conducting surveys or focus groups to gather feedback from potential clients and validate your business model.

- Keep a close eye on industry trends and technological advancements that may impact your business model, and be proactive in embracing innovation.

By developing a strategic business model, you will have a clear roadmap for your investment bank's success. It will help you make informed decisions, allocate resources effectively, and position your bank as a trusted and reliable financial partner in the market.

Establish A Legal Structure And Obtain Necessary Licenses

Once you have conducted market research, identified your target market, and defined your services and product offerings, it is crucial to establish a strong legal structure for your investment bank. This will not only ensure compliance with regulatory requirements, but also safeguard your business and its stakeholders. Here are the key steps to follow: