- Fri. May 31st, 2024

Constructing Ideas, Developing Possibilities.

Property Development Case Studies: Lessons from Successful Projects

By build-wire.com

Property development case studies provide valuable insights and lessons from successful projects in the real estate industry. By analyzing these case studies, professionals and aspiring developers can gain knowledge about the key factors contributing to success, challenges faced, and the lessons learned. These case studies serve as a valuable resource to understand the intricacies of property development and implement effective strategies in future projects.

In this article, we will explore three case studies: Project A, Project B, and Project C. Each case study will provide an overview of the project, discuss the key factors that contributed to its success, highlight the challenges faced during the development process and how they were overcome, and finally, delve into the lessons learned from each project.

By examining these case studies, readers will gain a comprehensive understanding of the property development process and the critical elements that drive successful outcomes. Whether you are an experienced developer or new to the field, these lessons can be applied to future projects to optimize success and minimize potential setbacks.

Join us as we delve into these case studies and uncover the valuable lessons that can be gleaned from successful property development projects.

Table of Contents

Case Study 1: Project A

Embark on a captivating journey as we dive into Case Study 1: Project A. Discover the ins and outs of this remarkable property development venture. From the overview of Project A to the key factors that propelled its success, we’ll explore the challenges faced and the ingenious solutions that were implemented. Prepare to uncover the valuable lessons learned from Project A that are bound to leave you inspired and enlightened.

Overview of Project A

Incorporating the provided keywords:

In City X , we embarked on Project A , an endeavor that involved a mixed-use development spanning 100,000 square feet. With a construction cost of $10 million, our goal was to complete the project within 18 months.

One of the key features of Project A was its mixed-use nature, combining residential and commercial areas. This allowed residents to live, work, and engage in leisure activities within the same vicinity. Our design carefully catered to the community’s needs, providing a blend of residential and commercial spaces.

However, Project A also faced challenges due to a limited budget and zoning restrictions. To overcome these obstacles, we adopted value engineering techniques to optimize costs without compromising the project’s quality. Additionally, we embraced creative design approaches that align with zoning regulations, maximizing the potential of the space.

Throughout the project, we learned valuable lessons. We recognized the importance of flexibility in design to adapt to unforeseen circumstances and changing market demands. Thorough market research played a crucial role in identifying the needs and preferences of our target audience.

This is an overview of Project A .

Key Factors Contributing to Success

The key factors contributing to the success of property development projects are meticulous planning, effective project management, financial stability, and proactive problem-solving. These elements play a vital role in ensuring the achievement of successful outcomes in property development.

- Meticulous planning: Thorough research, feasibility studies, and comprehensive project designs are crucial in ensuring the success of a property development project. These activities involve detailed market analysis, understanding of target demographics, and careful consideration of location and amenities. By incorporating meticulous planning , developers can optimize their project’s potential for success.

- Effective project management: Strong project management skills are essential to oversee all aspects of the development process. This includes coordinating various stakeholders, monitoring progress, and ensuring timely completion of tasks. Clear communication and efficient decision-making are critical in navigating any challenges that arise. Effective project management practices have been identified as a key factor in achieving successful property development outcomes, according to a study by the Urban Land Institute.

- Financial stability: Adequate financial resources and a well-structured financial plan are vital for successful property development projects. This involves securing sufficient funding, managing costs effectively, and maintaining a healthy cash flow throughout the project. By ensuring financial stability , developers can mitigate potential risks and optimize the chances of project success.

- Proactive problem-solving: The ability to anticipate and address potential issues and obstacles is crucial in ensuring project success. Developers must be proactive in identifying challenges and finding solutions promptly. This may involve adapting to changing market conditions, resolving construction delays, or mitigating unforeseen risks. By implementing proactive problem-solving strategies, developers can overcome obstacles and increase the likelihood of successful property development outcomes.

Fact: According to a study by the Urban Land Institute, strong project management practices have been identified as a key factor in achieving successful property development outcomes.

Challenges Faced and How They Were Overcome

Challenges faced in property development projects are common, but with effective strategies, they can be overcome. In Project A, one of the challenges faced was securing financing for the construction phase. To overcome this, the development team approached multiple lenders and presented a comprehensive business plan, highlighting the project’s potential return on investment. Eventually, they secured financing from a reputable bank, enabling them to proceed with the project.

In Project B, the challenge was unexpected delays in obtaining permits and approvals from the local authorities. To overcome this, the development team engaged in regular communication and collaboration with the authorities, addressing any concerns promptly and providing all necessary documentation. This proactive approach helped to expedite the approval process and minimize delays.

Project C encountered challenges related to unexpected cost overruns during the construction phase. To overcome this, the development team implemented thorough cost control measures, closely monitoring the progress and expenses on a regular basis. They also renegotiated contracts with suppliers and contractors, seeking cost-saving opportunities without compromising quality.

By effectively tackling these challenges, the projects achieved success and valuable lessons were learned. The key takeaway is that proactive and strategic problem-solving, effective communication, and diligent cost management are essential in overcoming challenges faced in property development projects.

In future property development projects, it is crucial to anticipate potential challenges, develop contingency plans, and maintain open lines of communication with stakeholders. This proactive approach will help mitigate risks and ensure successful project outcomes.

Lessons Learned from Project A

- Effective project planning: Project A taught us invaluable lessons about the importance of meticulous planning. By thoroughly analyzing the market, creating a detailed timeline, and setting clear objectives, we were able to stay on track and avoid unnecessary delays.

- Adaptability and flexibility: Throughout Project A, we encountered unexpected challenges. However, by remaining flexible and open to new ideas, we were able to adapt our strategies and find innovative solutions to overcome these obstacles. These adaptability skills were key lessons learned from Project A.

- Strong communication and collaboration: Effective communication played a crucial role in the success of Project A. Regular team meetings, clear communication channels, and open dialogue with stakeholders ensured that everyone was on the same page and working towards a common goal. Project A taught us the importance of strong communication and collaboration.

- Risk management: We learned the importance of identifying and mitigating potential risks early on in Project A. By conducting thorough risk assessments and having contingency plans in place, we were able to minimize the impact of unforeseen issues on the project. Project A provided valuable lessons in risk management.

- Continuous evaluation and learning: Project A taught us the value of continuously evaluating our processes and outcomes. Regular assessment of the project’s progress allowed us to identify areas for improvement and implement necessary changes, ultimately enhancing the overall efficiency and success of the project. This focus on continuous evaluation and learning was a crucial lesson from Project A.

In a similar vein, a notable historical example of learning from mistakes is the construction of the Eiffel Tower in the late 19th century. Engineer Gustave Eiffel faced numerous challenges during the construction process, including public criticism and technical difficulties. However, by embracing innovative engineering techniques and maintaining open communication with his team, Eiffel was able to overcome these obstacles and complete the iconic structure. The lessons learned from the construction of the Eiffel Tower, such as the importance of perseverance and creativity in problem-solving, continue to inspire and guide construction projects to this day.

Case Study 2: Project B

In our exploration of successful property development case studies, let’s dive into Case Study 2: Project B . This intriguing project offers valuable insights into the key factors that contributed to its success, the challenges faced and how they were overcome, and the lessons learned along the way. Get ready to uncover the secrets behind Project B’s triumph and gain actionable knowledge from this remarkable endeavor. Hold on tight as we navigate through the highs and lows of this captivating case study.

Overview of Project B

Project B is a property development project located in [Actual Location] . It has a [Actual Timeline] timeline and requires an investment of [Actual Investment Amount] . The project encompasses a total area of [Actual Size] and aims to [Actual Objective] . Key stakeholders involved in the project include [Actual Stakeholders] .

Fun fact: The completion of Project B boosted the local economy by [Actual Percentage] , creating [Actual Number] of jobs in the community.

The key factors contributing to success in property development projects are detailed below:

- Thorough market research: Conducting comprehensive market research to identify viable investment opportunities and understand the demand and trends in the target market.

- Strategic location: Choosing a location that offers convenience, accessibility, and growth potential, considering factors such as proximity to amenities, transportation, and future development plans.

- Effective project management: Implementing strong project management principles to ensure efficient planning, organizing, and controlling of all project activities, timelines, and resources.

- Financial feasibility: Conducting thorough financial analysis to evaluate the viability and profitability of the project, including accurate cost estimations, realistic revenue projections, and careful budget management.

- Strong partnerships: Collaborating with reliable and experienced professionals, such as architects, contractors, and property agents, to ensure the successful execution of the project and tap into their expertise.

- Effective marketing and sales: Implementing a well-developed marketing strategy and sales campaign to effectively promote the project, attract prospective buyers or tenants, and achieve optimal occupancy or sales targets.

These key factors contribute to the success of property development projects by enhancing their market competitiveness, attracting investors, ensuring efficient project execution, and maximizing returns on investment.

A true story of success in property development involves a developer who followed these key factors diligently. The developer conducted extensive market research and identified a strategically located piece of land near a rapidly developing area. With effective project management and financial feasibility analysis, the developer successfully designed and built a residential complex that met the demands of the target market. Through strong partnerships, the developer collaborated with reputable architects and contractors to ensure the delivery of high-quality construction. By implementing an effective marketing and sales strategy, the developer achieved full occupancy and exceeded revenue projections. This success story highlights the importance of considering these key factors for a prosperous property development venture.

Challenges are an inherent part of property development projects, and learning how to overcome them is crucial for success. In the case studies, various challenges were encountered, but they were effectively tackled through strategic approaches.

Firstly, in Project A , one of the challenges faced was a tight deadline. To overcome this, the project team implemented a rigorous schedule, prioritized tasks, and increased manpower. This allowed them to meet the deadline and ensure project completion on time.

In Project B , a major challenge arose due to unexpected construction delays. The team took proactive measures by engaging in regular communication with contractors and suppliers, as well as implementing contingency plans. This helped to mitigate delays and ensure that the project stayed on track.

Project C faced a challenge related to zoning regulations. The team navigated this obstacle by conducting thorough research, collaborating with local authorities, and adjusting the project plans accordingly to comply with regulations. This ensured a smooth approval process and prevented any significant setbacks.

Suggestions for addressing challenges in property development projects include conducting comprehensive risk assessments at the outset, maintaining open lines of communication with all stakeholders, continuously monitoring and evaluating project progress, and being prepared to modify plans as needed. By adopting these strategies, developers can effectively anticipate and address challenges, leading to increased project success and profitability.

Lessons Learned from Project B

Throughout history, successful property development projects have provided valuable lessons for future endeavors. Project B serves as a prime example of the importance of market research, collaboration, adaptability, and contingency planning. By applying the lessons learned from Project B, we can cultivate proficiency in property development and enhance our chances of success in future projects. The importance of thorough market research is evident in Project B. It taught us the significance of conducting comprehensive market research before embarking on any property development project . By understanding the demand, competition, and trends in the market, we were able to make informed decisions and strategically position our project for success.

Additionally, Project B emphasized the value of collaboration and teamwork. We encountered several challenges that required collaborative problem-solving . It highlighted the importance of effective communication among project stakeholders and fostered a collaborative environment. Through teamwork, we were able to overcome obstacles and achieve our goals.

Furthermore, Project B taught us the significance of adaptability in the property development industry. We faced unexpected changes in regulations, market conditions, and construction logistics. By being adaptable and open to change, we successfully navigated these challenges and adjusted our plans accordingly.

Moreover, Project B highlighted the need for contingency planning . Despite thorough research and planning, unexpected circumstances can arise during property development. Therefore, having a well-developed contingency plan is crucial. By having contingency plans in place, we can mitigate risks and respond effectively to unforeseen events.

Case Study 3: Project C

In this fascinating case study, we delve into Project C , where we uncover the secrets to its success , the hurdles faced and conquered, and the invaluable lessons it taught us. From gaining an overview of Project C to understanding the key factors that contributed to its triumph , this sub-section brings you insights that can reshape your own property development ventures. Get ready to be inspired , informed , and equipped with the wisdom gleaned from Project C ‘s journey of triumph and growth.

Overview of Project C

The overview of Project C showcases its key details and scope.

Project C involves the development of a commercial building in a prime location. The building will have a total area of 10,000 square feet, with 5 floors dedicated to office spaces and 2 floors allocated for retail stores. The project aims to cater to the growing demand for office spaces and retail establishments in the area.

One of the key factors contributing to the success of Project C is the careful selection of the location. Extensive market research was conducted to identify an area with high footfall and a strong potential for business growth. The chosen location meets these criteria, ensuring the project’s viability and profitability.

Despite the careful planning, Project C did face some challenges along the way. The primary challenge was the tight construction schedule, as the client had a strict deadline for the completion of the building. To overcome this, the project team implemented an efficient construction plan and allocated sufficient resources to meet the timeline without compromising quality.

Throughout the course of Project C , several valuable lessons were learned. One important lesson is the significance of effective communication and collaboration among the project team and stakeholders. Open and transparent communication facilitated problem-solving and ensured the smooth progress of the project.

- A clear and well-defined project vision and goals are key factors contributing to success . Without a clear vision, it becomes difficult to align the team and make informed decisions.

- An experienced and competent project management team is crucial for success . This team should have expertise in the specific area of property development and be able to effectively manage resources, timelines, and risks.

- Thorough market research and analysis play a vital role in success . Understanding the current market trends, demand, and competition allows for informed decision-making and the identification of profitable opportunities.

- Effective communication and collaboration among all stakeholders , including investors, contractors, and suppliers, are essential. Transparent and regular communication ensures that everyone is aligned, and issues can be addressed promptly.

- Proper financial planning and management are critical. This includes realistic budgeting, cost control, and ensuring sufficient funds are available throughout the project to avoid delays or compromises in quality.

- Adherence to relevant regulations and compliance is vital to avoid legal issues and penalties. This includes obtaining necessary permits and approvals, complying with building codes, and addressing environmental concerns.

- Quality control and attention to detail are key factors contributing to success . Regular inspections, monitoring, and adherence to high-quality standards ensure the delivery of a superior finished product.

- Effective risk management and contingency planning are essential. Identifying potential risks, developing mitigation strategies, and having backup plans in place can prevent costly disruptions and delays.

- Flexibility and adaptability to changing conditions and unforeseen challenges are critical. The ability to adjust plans, make quick decisions, and find innovative solutions can help overcome obstacles and maintain project momentum.

- Customer satisfaction and meeting their needs and preferences are paramount. Understanding the target market and delivering on their expectations ensures a successful outcome and positive reputation.

The challenges faced during property development projects can be significant, but with careful planning and strategizing, they can be overcome. Here, we will discuss some common challenges and how they were successfully dealt with:

- Financial constraints: Limited funding can pose a challenge, but project teams can overcome this by seeking out alternative financing options such as partnerships, loans, or crowdfunding.

- Permitting and regulatory hurdles: Navigating the complex landscape of permits and regulations requires expertise. Developers can ensure compliance and negotiate any obstacles that arise by engaging experienced professionals and consultants.

- Construction delays: Delays in construction can occur due to various factors, including weather conditions or unforeseen issues on the site. By having contingency plans in place, allowing for flexibility in project timelines, and maintaining open communication with contractors, delays can be minimized.

- Community opposition: Local communities may sometimes resist development projects. Developers can gain community support and mitigate opposition by proactively engaging with the community, addressing concerns, and demonstrating the potential benefits of the project.

- Environmental considerations: Environmental regulations and sustainability goals are increasingly important in property development. Developers can overcome environmental challenges and contribute to a greener future by adopting eco-friendly practices, incorporating renewable energy sources, and adhering to sustainable design principles.

Pro-tip: Successful property development projects require proactive problem-solving and adaptability. By anticipating challenges, seeking expert advice, and maintaining effective communication, developers can overcome obstacles and ensure project success.

Lessons Learned from Project C

During Project C, the team gained valuable lessons that significantly impacted the project’s success. Thorough market research emerged as a crucial lesson, as it allowed the team to identify market gaps and develop a unique selling proposition for their property. This approach attracted buyers and tenants, leading to high occupancy rates.

Furthermore, effective project management proved to be essential. The team learned the importance of closely monitoring timelines and budgets, while implementing strategies to mitigate risks and challenges. This resulted in smooth execution, minimizing delays and cost overruns.

Communication played a vital role in Project C’s success. The team recognized the significance of clear and consistent communication with stakeholders such as investors, contractors, and tenants. Regular updates and ongoing dialogue ensured everyone was aligned and working towards shared goals.

Sustainability was also a key lesson learned. By incorporating green building practices and leveraging energy-efficient technologies, Project C reduced its environmental impact and operating costs. This attracted environmentally-conscious buyers and tenants, enhancing the project’s reputation and marketability.

Lastly, Project C highlighted the importance of adaptability and flexibility. The team faced unexpected challenges throughout the development process but demonstrated the ability to pivot and find innovative solutions. This emphasized the need to remain open-minded and adaptable in an ever-changing market.

Key Lessons from Successful Property Development Projects

Key lessons from successful property development projects can be summarized as follows:

- Thorough Market Research: Conducting comprehensive market research is vital before embarking on any property development project. This helps identify demand, potential competition, and target demographics.

- Effective Planning and Budgeting: Developing a solid plan and budget is crucial to ensure efficient use of resources and minimize cost overruns.

- Strong Project Management: Successful projects require effective project management to ensure timely completion, coordination between teams, and adherence to quality standards.

- Attention to Location: Choosing the right location is essential for the success of a property development project. Factors such as accessibility, amenities, and future growth potential should be considered.

- Good Relationships with Stakeholders: Establishing positive relationships with stakeholders, including investors, contractors, and local authorities, can enhance project success and facilitate smooth operations.

- Focus on Sustainability: Incorporating sustainable practices, such as energy efficiency and environmentally friendly design, not only benefits the environment but also attracts environmentally conscious buyers or tenants.

- Adaptability to Market Changes: The ability to adapt to changing market conditions, trends, and preferences is crucial for long-term success in the property development industry.

Frequently Asked Questions

Question 1: how can i maximize returns on a property development project.

Answer: To maximize returns on a property development project, it is important to carefully plan and execute each stage of the project. This includes conducting thorough market research, selecting the right location, managing costs effectively, and ensuring timely completion. Additionally, considering factors such as value capture and infrastructure dynamics can further enhance returns.

Question 2: What are some successful small scale development projects?

Answer: Some successful small scale development projects include ECO Modern Flats in Fayetteville, Arkansas, Oslo in Washington, D.C., The Rose in Minneapolis, Minnesota, AF Bornot Dye Works in Philadelphia, Pennsylvania, Sofia Lofts in San Diego, California, 21c Museum Hotel Cincinnati in Cincinnati, Ohio, Bullitt Center in Seattle, Washington, and Trinity Groves in Dallas, Texas.

Question 3: How are infrastructure investment and real estate development linked?

Answer: Infrastructure investment and real estate development are closely linked, with infrastructure initiatives often benefiting real estate development. The completion of infrastructure projects like the Second Avenue Subway can lead to an increase in the value of residential real estate along the corridor. Infrastructure developments can also spur economic development, create new diversification opportunities, and impact real estate values in port areas and surrounding regions.

Question 4: What challenges are faced in property development projects?

Answer: Property development projects can face various challenges, such as obtaining planning approvals, dealing with unfavourable market conditions, managing construction costs, and ensuring timely completion. Stakeholder outreach and engagement are also important challenges to address in infrastructure and real estate projects. However, with solid systems, residential development processes, and hard work, it is possible to overcome these challenges and achieve a great result.

Question 5: How can value capture be utilized in infrastructure and real estate projects?

Answer: Value capture is a concept where infrastructure developments are financed through taxing the increased value of properties near transit stops. By capturing a portion of the increased property value resulting from infrastructure improvements, funds can be generated to finance the infrastructure project itself. This approach helps to align the costs and benefits of infrastructure development and can contribute to the overall success of the project.

Question 6: Who is Dean Schwanke and what is his expertise in real estate development?

Answer: Dean Schwanke is the Senior Vice President, Case Studies and Publications at the Urban Land Institute. With over 30 years of experience in the field, he has authored or coauthored numerous books on real estate development. He holds a BA degree from the University of Wisconsin–Madison and a master of planning degree from the University of Virginia. As an expert in real estate development, he provides valuable insights into successful projects and the key factors that contribute to their success.

Related Post

Hilti 22-volt hex cordless sid 4-a22 impact driver tool body review, diy guide: building custom shelving for your home, how to create a kid-friendly playroom, industrial workshop construction costs: budgeting and planning, from blueprint to reality: steps in industrial workshop construction, innovations in construction techniques for shopping centers, designing for safety: industrial workshop best practices.

Case studies

We are extremely proud of the work we do and the lasting legacies our work has on the communities and environments we work within.

Square Gardens

Broadcasting Tower

Downing Plaza

The Port of Liverpool

29 May 2024

Downing Prepares For Record Breaking Year

22 April 2024

Square Gardens Reveals First Look At Extensive Social And Amenity Spaces

9 April 2024

Downing Reaches New Heights At Square Gardens

20 March 2024

Princes Primary School receives new Sunshine Coach thanks to Downing

- Privacy Overview

- Strictly Necessary Cookies

- Cookie notice

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie are enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages.

Keeping this cookie enabled will helps us to track which sections users find most useful, and improve our website.

Please enable Strictly Necessary Cookies first so that we can save your preferences!

Click here to read our cookie notice .

Deal Profile: Shea's Seneca

Deal profile: sun crest heights, deal profile: arthaus.

View all case studies

Sign in with your uli account to get started.

Don’t have an account? Sign up for a ULI guest account.

Case Studies

Case study 1 – developing without money.

Everyone says they can’t be a property developer because they don’t have any money. Well, here’s an example of how you can develop without having much money at all.

This project was worth tens of millions of dollars and the developer didn’t have to pay for the land or the construction of the building; all they had to do was “cut the deal”.

Developers are entrepreneurs. All you need to do is learn.

Case Study 2 – Problems Post Completion

When the builder finishes construction and settlements start occurring everything is just perfect. Well not so on this project. The problems on this project started to happen after the building was complete and after people started moving into their apartments.

A project isn’t finished until everything is resolved. Sometimes these types of things happen and you must be prepared for them.

As Heard On

- Property Owners

- Businesses / Owner Occupants

- Best Use - Best Results

- Strategic Property Planning

- Contemporary Development

- Purpose Driven Portfolio

- Intelligent Brokerage

- Site Selection

- Real Estate Due Diligence

- Land Entitlement

- Real Estate Development Project Management

- Development

- Joint Ventures (JV's) / Partnerships

- Small Business Development Consulting Solutions

- The Landowner Experience

- The Real Estate Development Process

- Types of Commercial Real Estate Transactions

- Resources & Downloads

- Multifamily

- Residential

- Industrial & Logistics

- Life Sciences

- Greater Raleigh Market

- Call Now: 919.913.8788

- Acquisition Opportunities

The Guide to a Real Estate Development Feasibility Study

Successful real estate development is about leaving a lasting impact on future generations – creating unique spaces where people enjoy living, showing up to work, or spending their free time.

But even the most creative spaces never become a reality if the project is not also profitable – developers need to make money too. So, before a project is greenlit, it would be wise to conduct a feasibility study to evaluate its viability.

But here's the thing about the phrase "feasibility study." It's a term that has lost much of its meaning over the years – corporate middle managers have co-opted it as a means of sounding productive by throwing around buzzwords and jargon.

Can’t you picture Michael Scott asking for a feasibility study before stepping back into his office for another 4-hour block of “creative time?”

So, in this article, we will focus on defining a real estate development feasibility study, breaking it down into its parts, and covering what you need to know to assess the viability of your development.

What is a real estate development feasibility study?

Think SWOT analysis, but instead of vapid management consulting corporate speak, a quality development feasibility study dives into the strengths of weaknesses of a project within a specific market.

Before you outlay a bunch of capital pursuing a project, you'll want to ensure that it provides a certain profit level or exceeds certain financial feasibility thresholds.

A real estate development feasibility study is typically conducted as part of the project's initial due diligence.

It seeks to offer a roadmap for a potential project by assessing all site investigation, research, and preliminary due diligence items against potential problems and their financial implications.

The main purpose of a feasibility study is to provide a predictive analysis of the success of the overall project and the probability of various outcomes.

A feasibility study will also weigh competitor data, municipal-specific requirements, demographic trends, and macroeconomic implications - developers will have much more insight into a project's potential snafus.

The cost of mistakes during a development project

Mistakes during the real estate development process come in different shapes and sizes.

Some are avoidable – lack of experience and expertise or mismanagement and poor research can result in dealing with potentially foreseeable issues.

Other mistakes may be less apparent – political risk can be a huge question mark during a project, even for experienced developers.

In the early stages of a development project, enthusiasm is typically high, and that’s when a real estate developer is more prone to making silly mistakes.

Commonly, developers will overpay for land or buy the wrong type of property entirely – that could result from underestimating overall costs or just buying a property that doesn't meet the needs of a proposed project. Site selection mistakes frequently lead to project failure.

It’s also not uncommon to see developers overextend themselves during due diligence. If you fail to identify critical feasibility items early and fail to sequence your real estate due diligence activities properly, you leave yourself financially exposed.

Or even worse, what if you enter the wrong market entirely? Some developers build for personal taste – that rarely ever works out. Others fail to consider the market's needs or get swept into the craze over fads and flashy headlines.

The reality is that mistakes made during a development project can range from thousands of dollars to upwards of 7-figures.

But there is good news.

Conducting a feasibility study significantly mitigates project risks. It forces the developer to understand their target market, assess relevant political, land entitlement, and development unknowns, and ultimately determine the profitability of a project.

Components of a real estate development feasibility study

Market analysis.

An in-depth market analysis is the core of any development feasibility study.

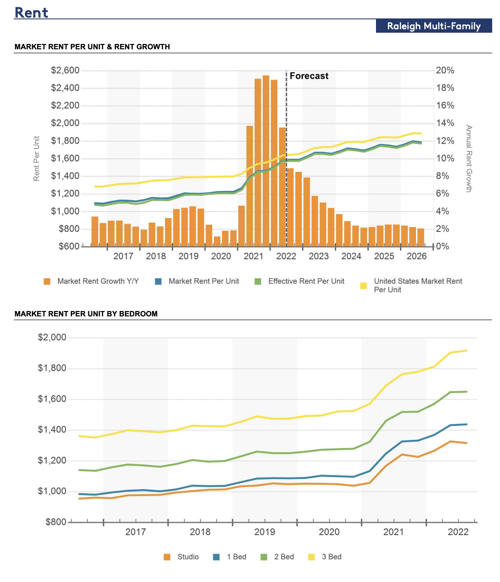

First and foremost, you’ll want to begin by charting historical data on the given market and submarket you're proposing to enter. Consider collecting data on the following critical rental metrics:

- Lease rates by property type and bedroom count (if you’re proposing a residential or multifamily project)

- Historical vacancy rates

- Average time to re-let space upon vacancy

- Property absorption statistics

- Local housing market activity

That data will give you a much better insight into the type of real estate development strategy that makes sense for your given market. Additionally, it's critical also to consider market-specific living and employment metrics like:

- Data on population in-migration growth

- Job growth and nearby employment centers

- Major employers and proposed future corporate relocations

- Workforce education levels

- Data on the number of nearby households and income levels

- Nearby amenities and access to major highways

- Walkability and quality of public transportation

Once you’ve identified and analyzed the key metrics for your given market, it's important to chart that data and extrapolate for future market trends. Historical data is an essential tool but only tells you part of the equation. A successful development project hinges on a market's continued growth and vibrancy for years to come.

But, you also need to ask yourself how these market forces impact your development strategy.

Based on the data you collected, what types of land development projects will most likely be successful? For example, if a given market has a robust entry-level employment feeder system, possibly by being colocated near a university, a well-positioned multifamily property may make sense. This is especially true if the area is already lacking in the supply of affordable starter homes.

Another factor to investigate is political risk. For example, if your proposed project isn't allowed "by-right" on a property or similar projects have faced resistance from the local planning department or city council, it’s worth considering.

And while political risk may not be quantifiable in terms of dollars and cents, it can lead to additional expenses for attorneys and more complex land entitlement procedures.

If there is a serious question about the possibility of a project not being approved, assigning a probability to that outcome is wise. Then you'll be able to develop several different profitable courses of action, during initial due diligence, in the event you need a contingency plan.

Competitive analysis

Think SWOT analysis from business 101 - a competitive analysis overviews the existing competitors and opportunities in a given market.

There is something to be said about having a first mover advantage. An innovative company may deliver a product or service and create a market for something we didn't even know we needed.

But that’s a risky process. And companies that move too early are frequently left flapping in the breeze.

You don't have to be an innovator to make money. Some of the most successful projects and companies are the ones that don't try to reinvent the wheel – they do something folks are already doing and do it a bit better.

So, a competitive analysis aims to understand what competitors have already developed property in your target market and evaluate their strategies to determine strengths and weaknesses relative to your own business.

Additionally, it is essential to consider where there may be supply or quality gaps in the marketplace – what consumer needs aren't being met?

After a development feasibility study competitive analysis, you should have insight into:

- The position of your competitors in a market

- An understanding of what is working and what isn’t for market competitors

- Any gaps in the market that need to be filled

- A concept for brand positioning as you enter the market

Ultimately, even a thorough competitive analysis won't ensure that your project will be successful. It will, however, highlight what has worked in the past and offer a framework from which you can make informed market entrance and development product placement decisions.

Real estate development model & financial analysis

The single most crucial feasibility metric for a new real estate development project is whether it's profitable or not.

Even the most selfless, mission-driven real estate developers are beholden to lenders' and outside equity partners' financing and underwriting standards. So, unless you're self-financing a deal, if the project isn’t profitable, you probably won’t be able to receive development financing .

The financial analysis determines a project's expected return on investment and the timing of cash flows over the project's life.

And one of the significant challenges to consider is that most developments don't see revenue until several years after a project begins. This is because, before lease-up and property stabilization, a large amount of capital is required for real estate due diligence and feasibility work, land entitlement , permitting, and construction.

So, you have cash out the door without the prospect of cash inflows for several years – that makes cash flow timing and financial projections even more critical to successfully analyzing a project.

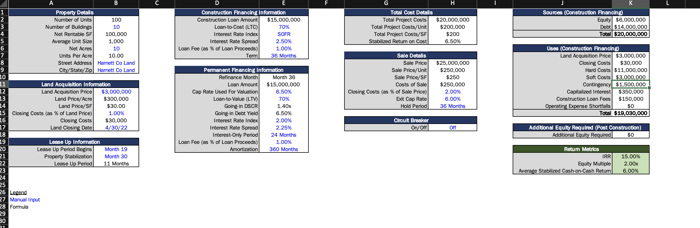

There are several critical components of a real estate development model you need to consider:

Land & site development costs

The term ‘development costs’ is frequently used as a catchall to describe all the costs associated with developing a site. But that can be misleading and often leads to poor assumptions.

For the sake of our development models, land and site development costs generally include: the cost of the land and an estimate of all sitework and land development costs , which consists of all earthwork, utilities, off-site improvements , etc.

Construction costs

Construction costs are generally broken down by hard costs vs. soft costs , which differentiate between whether or not the expenses are related to the physical construction of the building. From a cost control and a budgeting standpoint, it's important to distinguish between hard and soft construction costs as a part of your financial analysis.

Depending on the type of real estate development model you build, it's worth considering using an s-curve to forecast your construction and site development costs. An s-curve better matches the timing of construction cash outflows against the forecasted percentage of work completed at various stages throughout the process.

It's also important to incorporate a hard and soft cost contingency to guard against unexpected price fluctuations.

Revenue & sales assumptions

Depending on the type of project exit, a developer will either sell the project after construction or retain the project through lease-up and a predetermined hold period.

If the plan is to sell a property following completion, it will be important to incorporate comparable sales data into the model to anticipate revenue for selling the property after commissions.

If instead, the plan is to lease up and manage the property, you'll need to incorporate relevant rental statistics specific to the type of property you're bringing to market.

Critical to both exit scenarios are realistic and conservative property absorption and lease-up rates. For instance, how quickly do comparable properties sit vacant on the market? Or how long does it take to sell similar projects in the submarket?

These assumptions will ultimately offer insight into the anticipated carrying costs associated with the project and how long it will take a project to break even.

Expense assumptions

We've already discussed costs associated with the actual development and construction of the property. But if your plan is to hold the project, what about expenses related to the actual property management?

It’s critical to account for the property's operating expenses as part of your financial analysis. Consider expenses like:

- Repairs and maintenance

- Contract services

- CAPEX budget

- Property management

Additionally, you’ll want to associate an annual expense growth rate with these costs to account for inflation and other macroeconomic factors.

Financing assumptions

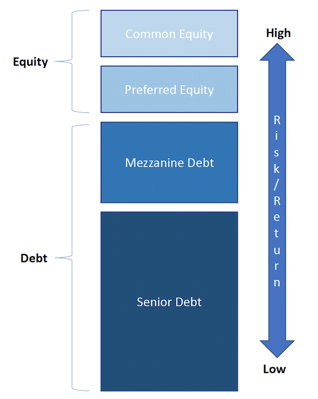

Modeling your financing package to fund a project can be a significant challenge. There are a variety of different ways to finance a development project .

The capital stack can be comprised of different debt and equity financing types. Each financing source comes with an associated cost of capital that will impact the project's overall profitability.

First, you must address several critical assumptions as part of your financing package. For example, if incorporating some form of senior debt, you'll need to account for a loan-to-cost percentage and an interest rate assumption. If you're financing the project through some portion of limited partner equity, you'll need to account for the timing and size of any preferred returns and partner distributions.

These assumptions and any underlying financing costs and interest accrued during development and construction must be accounted for in your development model.

Tying everything together for your financial analysis

Once you’ve compiled all the data and assumptions into your development analysis, you’re ready to model your financial projections.

Most models rely on a discounted cash flow (DCF) analysis to determine critical financial metrics. Therefore, you'll first need to calculate the project's free cash flows.

A project’s free cash flows represent the project’s underlying cash flows after all revenue, expense, and financing assumptions have been accounted for.

Once you've quantified free cash flows for the project hold period, you can calculate critical financial metrics like net present value (NPV), internal rate of return (IRR), payback period, equity multiple, and cash-on-cash return.

Your real estate development model should also include a sensitivity analysis to account for fluctuations in critical assumptions like:

- Debt interest rate

- Revenue and expense assumptions

- Anticipated project exit capitalization (cap) rate

- Loan-to-cost ratio

This “what if” exercise will illuminate how sensitive your project’s profitability margin is to the worst- and best-case scenario.

Why are real estate development feasibility studies important?

Remember those costly mistakes we talked about earlier? You’ll want to avoid those. And a real estate development feasibility study is the most critical thing you can do to ensure you’ve done quality market research, accounted for potential obstacles, and set your project up for success.

Developing a property is much different than traditional buy-and-hold real estate strategies. Projects are more complex, the stakes are more significant, and the potential downside is often much greater.

All business endeavors pose some level of risk. But a feasibility study examines and quantifies that risk to determine if it’s worth taking and how profitable the project will be.

Feasibility studies are also used to pitch potential investors and lenders on the viability of a project.

Ultimately, projects backed by informed research and data have a much higher likelihood of success.

A real estate consultant can help craft your development feasibility study

Are you thinking about pursuing a development project? Consider leveraging the expertise of a real estate development consultant as you investigate feasibility before it’s too late.

A feasibility study is a fundamental step in the due diligence process. Not only to serve as a business plan of sorts for you but also as a tool to help onboard potential capital partners.

To equate it with risk management – a real estate consultant can direct your efforts in investigating all critical feasibility items and codifying those findings into a roadmap to guide your project - even if you're unsure where to start.

And Marsh & Partners can help - ultimately delivering you maximum project value and reducing project risk.

You can learn more about our real estate consulting services here for more information on how we can add value to your next project.

- Investing (63)

- Development (58)

- Small Businesses (51)

- Due Diligence (46)

- Industry Trends (37)

- Underwriting & Valuation (19)

- Financing (15)

- Consulting (12)

- Landowners (11)

- Leadership (8)

- Syndication (7)

- Interviews (2)

Real Estate Due Diligence For Land Investing, Site Selection, & Land Development (Includes Checklist)

CRE Development Mistakes - Structuring Real Estate Development Land Contracts

Assembling Your Real Estate Development Team: Hiring for Your Project

Real Estate Finance and Development

This course teaches the fundamentals of real estate finance and development. Lectures and case studies introduce students to the full range of financial analysis skills and analytical processes for evaluating private and public development and investment in real estate. All major property types and land uses are covered as well as all stages of the development process, including site selection, market analysis, financial feasibility, design and legal considerations, construction, lease-up, operations, and sale of the final product. The cases are designed to place students in a number of decision-making situations commonly faced by real estate professionals. Prior or supplementary study of microeconomics is useful, but not required. Students studying business, law, and government, as well as selected undergraduates will be admitted, space permitting.

Please note this course will meet online through 9/15.

Site Analysis for Real Estate Developments + Case Study

by Naiyer Jawaid | Jun 12, 2020 | Development , Market Research , Real Estate | 0 comments

In this post we will be exploring how to do site analysis of a vacant land for the feasibility study and development analysis, however; the concepts remain same for any real asset acquisition and development. Site analysis is a preliminary phase in real-estate development that encompasses study of the climatic, topographical, legal, and infrastructural characteristics of a specific site.

A well-conducted site analysis allows real-estate developers to improve a project, by ensuring that they purchase the land at the right price and the resources are effectively utilized.

When doing a site analysis for real estate developments, below are the various factors which should be explored, and answered:

Zoning Regulations

Perhaps, the first and most important factor in doing a site analysis is making ourselves sure of the the zoning regulations. Zoning regulations specify what type of real estate development could be done on the said site - residential, commercial, or industrial. Zoning regulations also dedicates the limit of the size and bulk of structures that can be developed on a piece of land. Building height, setbacks, easement, density, and other development parameters are usually controlled by the zoning regulation.

Zoning is controlled by the local government bodies, and the base idea is to separate residential real estate from other property uses, like industrial. A simple way of getting the zoning regulations for a piece of real estate is to simply check the zoning map of the district.

Usually, development parameters are provided with the land title but should be always checked with the local authorities. Basic zoning information could also be found online, like for Toronto, you can check this zoning by-law map , while in Vancouver, you can check this zoning by-law map.

Have a look at below zoning map for the city of Vancouver.

Accessibility and Visibility

The value of a land is primarily driven by what could be built on that site, which is mostly governed by the zoning regulations. However, there are other factors which are also equally important.

The accessibility and visibility of a site is another major factor to consider when doing a site analysis for real estate development. It becomes rather important for commercial real estate developments. Accessibility refers to how convenient it is to get to the site, while visibility refers to how easy it is to be seen from a major highway or other landmark structures.

Sometimes for mega mixed-use real estate developments, accessibility and visibility might not be as important. However, for stand-alone real estate developments, choosing a suitable location with easy access and visibility makes a huge difference.

If a site is accessible though more than one major highway, it becomes more valuable.

Context and Characteristics

The context and characteristics of a site are another important factor to be considered while doing site analysis for real estate development.

The context and characteristics of a site refer to its properties, relative to its urban and natural environment - the topography of the area. Certain physical factors might affect the desired end products in real-estate development. Runoffs and flooding hazards are examples of a poorly conducted site context analysis.

Factors like the climate of an area, available natural resources, proximity to the city center, and soil conditions are just a few of the external factors to consider when conducting a site context analysis.

In real estate development, the intended purpose of a piece of land might change solely based on the context of the site. A factor like poor soil condition, could see an intended site developed into something else, or devalue the land due to increased construction cost (various forms of ground improvements could be required).

The context and characteristics of a site also include proximity to natural resources or views. The proximity of Toronto and Vancouver to the sea is one of the factors that have influenced the surge in real estate development in both cities. Tourist attractions like the Toronto Islands and Stanley Park respectively, have consequently led to immigrants settling and acquiring real estate.

Surrounding Land Use and Competition

Another factor to consider while doing a site analysis is to study the surrounding land use, and to understand the competition for the land and for a particular type of real estate asset in the vicinity. Land use refers to the modification of the natural environment into built environments, while land competition is said to occur when multiple real estate companies compete to acquire a land.

Land competition could occur for countless reasons, but most of the time, it is greatly influenced by the natural resources found in the land, location, and surrounding land use. The surrounding environment of a real estate greatly affects it. A piece of land with multiple uses and geographical advantage tends to come at a very steep price. Carrying out an analysis of the surrounding land use will better help understand the value of the land and its development potential.

If the said site is surrounded by lands which are zoned for multi-family housing, it does not make much sense to acquire such land for same use. Whereas a land zoned for multi-family development located at a mixed-use development would be highly desirable.

Proximity to Demand Generators

Demand generators in real estate are locations or buildings strategically located to draw consumer's attention towards their service. A well-placed office building in the proximity of a residential site or a hotel/school could greatly increase the value of a site in due time.

Similarly, a residential zoned land near a commercial district would also be highly valued. A land zoned for retail development in a residential area with high disposable income would be similarly expensive.

SWOT Analysis

The final step in doing site analysis for real estate development is the SWOT analysis. SWOT, a quite common acronym stands for strengths, weaknesses, opportunities, and threats.

SWOT analysis encompasses the intangibles in acquiring a real estate, and it is required to clearly itemize the weaknesses and the strengths of a land, accounting for factors not previously considered, and also for detecting the threats and opportunities of it.

When conducting the SWOT analysis, the weaknesses and strengths are regarded as the internal factors and characteristics, while the threats and opportunities are the external factors.

We will investigate the SWOT analysis into more detail in some future post.

As a case study, we will be doing a site analysis for a land parcel which has been listed for sale. The site is located at located at 799 Gorman Park/Sheppard Ave W 128, Toronto, Ontario.

Before we start the site analysis, just to put things in perspective, we must note that according to Livingin-Canada.com , in the last 10 years, the average price of owning a house in Canada has seen an increase of over 60%, with Vancouver and Toronto seeing the most surge in recent years. Precondo.com estimates the cost of owning a house in Toronto surged from $430,000 in 2010 to $940,000 in 2020, an increase of over 100%.

Zoning Regulations:

Checking the Toronto zoning by-law map we observe that the real estate is designated residential-detached zone (RD) and according to the section 10.20 of the Toronto zonal by-laws, this piece of land can be used for any form of residential development, like a detached house, or low rise condo building; however, with certain conditions it can also be used for commercial real estate development. The listing also says that the land is made up of 6 properties (all detach bungalows) with a total land area of 0.924 acres. Property is recently re-zoned for a 9-story mixed-use building.

The current zoning must be confirmed with the local authorities.

Accessibility and Visibility:

The site is in Clanton Park neighborhood of Toronto with a good road connectivity and is about 15km from the Downtown Toronto. Site is located at the corner of a T-junction and accessible from the Allen Road (1.25km) and the Wilson Height Boulevard (500m). Now defunct Downsview Airport is 8m drive (4.1km). There are school, parks and sport facility within walkable reach.

The site has good accessibility and visibility, for a residential development.

Context and Characteristics:

The site is made up of 6 existing properties, all detached bungalows on a land totaling 3,740 square meters in area. The land is relatively flat and has no extreme topographical disadvantage. Toronto is relatively prone to storms and floods but with about 13km to the nearest shoreline, it is relatively safe. Existing structures needs to be demolished and cleared.

Surrounding Land Use & Competition:

The land is in a residential zone, making it relatively serene and peaceful. There is no existing conflict with regards to the site, and competition is mild, mainly due to its location at a corner. However, the site does not offer much differentiation as compared to the surrounding land use.

Proximity to Demand Generators:

The site is in Clanton Park and is surrounded by two public schools, one private school, and a college. Also, three shopping malls, fifteen entertainment/sport facilities, twenty restaurants, four hotels and two art galleries are also located in the vicinity. However, there is no commercial development in the area.

SWOT analysis:

The below table summarizes the SOWT analysis for the site:

Buying a residential land in a residential neighborhood does not offer much differential; however, it should also be noted that the Covid-19 pandemic has severely impacted the real estate in Canada , and it appears that residential real estate would be the first to recover. The site presents an opportunity for residential real estate development at a right land price.

Site analysis for real estate development is a must for feasibility study , development analysis and valuation . A site analysis covers the study of the climatic, topographical, legal, and infrastructural characteristics of a specific site.

Case study provides an insight into how site analysis can be done for real estate developments.

Are you someone involved with real estate feasibility?

We are excited to launch the next generation of real estate feasibility software to help you manage your development projects with ease.

Register now for a free trail license!

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Follow Us On

Latest Posts

Looking for Feasibility Study Samples?

60+ real-life feasibility study samples for FREE!

Property Development Case Study: 37 Mount Street Altona

Feb 20, 2020 by Peter Kelly | All , Case Studies , Dual Occupancy

Without a doubt, the two questions we at Little Fish get asked the most are around cost and time. So in this article, I’m going to share a property development case study where I lift up the on a dual occupancy development project that we completed for a client at the end of 2019.

I’m going to share all the projects timing and costs. Including the eventual result as far as profit and the clients return on investment.

Let’s get into it.

Now before we rip the hood open on this property development case study and sink our teeth into the project particulars, I think it’s important to note that our client purchased the property at the extreme top of the Melbourne property market and ended up selling the new dwellings at the very bottom.

Which you will see on the timeline when we get to that part of the article.

The reason I wanted to mention that now, is because I want to make it clear that you can and should be able to make money no matter where you are in the market cycle .

Let’s breakdown 37 Mount Street, Altona .

Get your 'Townhouse Development Blueprint' Now!

Grab a copy of my exclusive step-by-step blueprint for mastering townhouse development.

Project Particulars

It’s was a side by side dual occupancy design , with an east-west site orientation. It was approximately 780 square meters of land with a 15.5m frontage and 50.3m in depth.

I also want to point out that the south neighbour was set off the boundary which helped our client’s ability to maximise the site as there were no shadowing issues.

Ultimately, we were able to build two 30 square monsters with 4 bedrooms, 3 bathrooms and lockup garages.

Project Timeline

Before we get into the numbers let’s look at the project’s timeline.

To give the project some perspective. When the clients purchased the property, their initial plan was to rent it out with a thought that they may develop it one day. Which kind of happened but just much sooner than they thought.

They stumbled across our website one evening and the rest is history.

It’s also important to note that around the time we trying to secure their construction finance the banking royal commission was in full swing. As a direct result, they ran into so trouble.

In the end we looped them in with our broker who eventually helped them secure the finance. By default of the situation, it cost some time.

I also wanted to touch on the importance that all subdivision requirements are met timely throughout the construction process. It’s so that the new title registrations are done either prior to construction completion or at the very latest in parallel.

Thanks to the hard work of our team here at Little Fish all the subdivision requirements were met in plenty of time.

It guaranteed that settlement with the buyers was achieved within 14 days of project completion meaning they got their capital back and saw their profits sooner ready for them to roll into their next project.

Now you’ve got some perspective around the timing let’s get into the numbers.

The Numbers

Let’s start with the costs.

For the purpose of this exercise I’ve broken down the costs into seven categories:

- The purchase

- Early development

- Middle development

- Construction

- Holding (bank interest)

Purchase Costs

These costs include the purchase contract price, stamp duty and the relevant adjustments including the conveyancing.

Early Development Costs

These were the costs incurred from the point in which we took the project on (or in most other cases from the purchase date) right through until town planning approval.

So essentially, in this case, all of the costs for the first 8 months.

These costs included the deposit for our project management services , the land surveying so the re-establishment and features and levels survey’s and the drafting and planning costs.

Middle Development Costs

These were all the costs incurred from the planning permit approval right up until construction.

They include the demolition, construction documentation, the interior design package, the plan of subdivision application. It also includes the new power pit that was required and all the service connections such as NBN, telecommunications and the water.

Our stage 2 PM invoice for achieving town planning approval was also paid at this point.

Construction Costs

All of our construction contracts fixed price and are full turnkey so it included everything you can think of from the landscaping to the letterboxes, clotheslines and everything in between.

It also included some additional funds for earthworks after we hit some rock. Nothing too crazy or unexpected but there were some costs incurred.

Our stage 3 PM invoice for construction commencement was also paid at this point after we had run the full tender process, engaged the builder and they had started on site.

Marketing Costs

These were some minor costs for marketing assets to support the sales campaign. It included some 3D renders, the hoarding and marketing banner and the custom brochure design and printing.

Bank Interest (holding costs)

For this project the client was able to have the bank interest capitalised. This essentially meant the interest was accrued over the duration of the project. It was then paid in full from the proceeds of the sales when they were settled at the end. So when the loan was closed out.

Completion Costs

Which included the agent’s sale commissions and portal listings which were also paid at settlement of the two sales.

There were some minor settlement costs. And the final payment for the project was our stage 4 PM invoice that was due upon project completion.

As shown on the timeline earlier in the video both properties were sold off the plan and the new titles were registered timely. So, the properties were able to be settled with the buyers 14 days after the builder issued the certificate of occupancy.

If your goal is to maximise your financial return. Then this is exactly how you want the end of your project to go.

The key is to settle with your buyers as soon as possible so you get your money sooner, pay down your debt and roll into your next project.

This case study proves you can make money in good and bad markets. As long as you make good decisions and you don’t over capitalise.

This Mount Street project wasn’t without complications either which is why we choose to do a case study on it.

Not only was it purchased at the top of the market and sold at the bottom but there were issues with getting the required finance. The royal commission was happening at the time and the banks had tightened lending.

So there were legitimate and significant time and cost implications the negatively affected the bottom line.

BUT through old fashioned hard work, the power of knowledge, highly refined systems, processes and efficiencies it still ended up a super successful and profitable project.

The buyers were happy, the clients were happy, and we couldn’t have been happier.

The key to becoming a successful property developer is all about patience and discipline. Your goal isn’t to retire on your first development. Something I have tried to reiterate multiple times in this property development case study.

You want to get in the game at a level that you aren’t overexposed financially so you can begin to grow your capital with as minimal risk as possible. It’s no secret that money makes money. So get on the developing merry-go-round and start growing your capital one project at a time.

Worry less about market cycles and focus more on learning, relationships, networks and efficiencies. Because if you do, you’ll look back on your journey in ten-year time and you’ll be able to appreciate how good it’s been to you.

I hope you enjoyed this property development case study. We plan on releasing more over the coming months so be sure to keep checking back at our ever-growing property development blog .

Hopefully, you got some value from this dual occupancy case study – I’ve have shared another dual occ one here and a side by side development one here . Thinking of doing three dwellings on your block? Check out this three dwelling.

Filled under: All Case Studies Dual Occupancy

To put it mildly, Peter Kelly is enthusiastic about real estate. When he’s not looking at properties, or visiting potential sites, Peter can be found online at realestate. com. For him, it’s more than a job – it’s an obsession. Peter is a co-founder here at Little Fish Property developments.

Follow Peter Kelly

Related Posts

Real Estate Development Case Study: 11 Milford Street Newport

April 13, 2020 by Peter Kelly

Two questions we at Little Fish get asked on a daily basis are around cost and time. So, in this real estate development case study, I’m going to share everything cost and time-related for a three-townhouse site we completed for a client at the end of 2019. I’ll break down every facet of the project Continue Reading

Dual Occ Advisors: 6 Benefits of Dual Occupancy

January 20, 2020 by Peter Kelly

Have you ever wondered if doing a dual occ project was a good idea and why? Well, keep reading because I’m going to put my dual occ advisors hat on and share 6 reasons why kicking off your first dual occ is absolutely an awesome idea. By the end, it will become glaringly obvious and Continue Reading

drop us a line

We’d love to discuss your goals. click below to speak with an expert..

Discover how we expertly manage development projects to minimise risk and maximise returns.

Get Your 'Townhouse Development Blueprint' Now!

Get my exclusive blueprint for mastering townhouse development.

Privacy policy

Get Your 'Townhouse Development Blueprint' Now!"

"I thought the blog was handy, But this blueprint? Even better!" Bryce Barker, director at JBM Group

Talk to an Expert Today!

To read this content please select one of the options below:

Please note you do not have access to teaching notes, the property development process: case studies from grainger town.

Property Management

ISSN : 0263-7472

Article publication date: 1 July 2005

This paper aims to contribute to the theory of property development as a complex process that involves multiple drivers, stakeholders and contributions from many academic disciplines.

Design/methodology/approach

The paper presents a web‐based model of the property development process consisting of seven defined major elements, each of which is subdivided and linked by functional relationships. The model is applied to three linked case studies drawn from Grainger Town in Newcastle upon Tyne, UK, which involve the conversion or redevelopment of listed buildings in the context of urban regeneration.

The case studies examined demonstrate the influential roles of many private sector actors and different arms of government. Site characteristics were found to have a bearing on events, as did long‐term trends. These inputs were often independent of economic or property market forces.

Research limitations/implications

The paper relates primarily to commercial development in the UK. The three case studies inevitably present particular circumstances, though they do represent the reuse of existing urban sites, which is highly complex and increasingly the norm.

Practical implications

The findings of this paper should be of practical benefit to anyone involved in property development and of particular interest to organisations whose core business is not development or to anyone engaged in a public‐private development partnership.

Originality/value

This paper presents an original way of conceiving the property development process using a web‐based model. The model may be used to analyse situations where development is strongly influenced by social, political or environmental factors.

- Property management

- Organizational analysis

- Regeneration

- Partnership

- United Kingdom

Fisher, P. (2005), "The property development process: Case studies from Grainger Town", Property Management , Vol. 23 No. 3, pp. 158-175. https://doi.org/10.1108/02637470510603510

Emerald Group Publishing Limited

Copyright © 2005, Emerald Group Publishing Limited

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

IMAGES

VIDEO

COMMENTS

Property development case studies provide valuable insights and lessons from successful projects in the real estate industry. By analyzing these case studies, professionals and aspiring developers can gain knowledge about the key factors contributing to success, challenges faced, and the lessons learned. ...

The Property Development Process: case studies from 'Grainger Town' Page 2 The outcomes of property development depend on a great many social, political, economic and environmental factors, which are then affected by them. Property development outcomes also result from the involvement of a wide range of public and private actors. However, most

20 March 2024. Princes Primary School receives new Sunshine Coach thanks to Downing. Read more. +44 151 707 2666. [email protected]. Where to find us. About us. What we do. Case studies.

Case Study #11 - Residential Development Business Model: Build And Sell (Case + Solution) This residential development case study explores the strategic planning and execution of Pinkstone Group's latest project, Serene Homes, amidst the backdrop of the COVID-19 pandemic. As remote working becomes the norm and the demand for quality housing ...

In this case study I break down the numbers including the costs and timing in this dual occupancy property development case study.SUBSCRIBE: https://www.yout...

Aug 24, 2023. --. Data-Driven Real Estate Development: A Case Study. In this case study, we explore how data-driven strategies have revolutionized the real estate development process, enabling ...

Below is the timeline for this real estate development case study for Milford Street Newport. Milford Street falls in the Hobson's Bay municipality which is notorious for being slow with their planning approvals. This proved to be true on this project, costing at least a couple of months more than what we would have typically expected.

New York City New York, USA. August 2023. View all case studies. ULI Case Studies provide comprehensive examples of hundreds of real estate projects that are proven financially successful, including access to costs, trade-offs, the challenges faced, and the lessons learned. Learn More.

Indeed, Fisher's (2005) case studies on the property development process in Granger town, in the north-east of England as a deprived regional economy, provides some illustration of collaborations ...

Securing £700,000 Development Exit Finance for Property Developer. £700,000 Property Development Exit Finance - with no interest to repay TL:DR When the Covid crisis hit, one... 7 August 2020. Case Study.

Case Study 1 - Developing Without Money. Everyone says they can't be a property developer because they don't have any money. Well, here's an example of how you can develop without having much money at all. This project was worth tens of millions of dollars and the developer didn't have to pay for the land or the construction of the ...