What is Integrated Business Planning?

The origins of integrated business planning, how integrated business planning differs from traditional business planning methods.

- How Integrated Business Planning Aligns FP&A with Overall Business Strategy

- Strategic Role of FP&A

Enhanced Decision Making

- Benefits of IBP for FP&A Teams

1. Better Budget Processes

2. improved forecast accuracy, 3. agility and responsiveness, 4. cross-functional collaboration, 5. resource optimization.

- Key Elements of Effective Integrated Business Planning for FP&A Teams

Accurate Demand Forecasts

Scenario planning and sensitivity analysis, performance management, technology and data integration, cross-functional communication.

- How IBP Connects FP&A and Extended Planning & Analysis (xP&A)

IBP as a Bridge

Collaboration across functions.

- Future of FP&A with IBP and xP&A

- Embracing Integrated Business Planning in FP&A

Additional Resources

Integrated business planning (ibp) in fp&a.

Integrated Business Planning (IBP) enhances financial planning, forecasting, decision-making, and strategic alignment between finance and other business functions

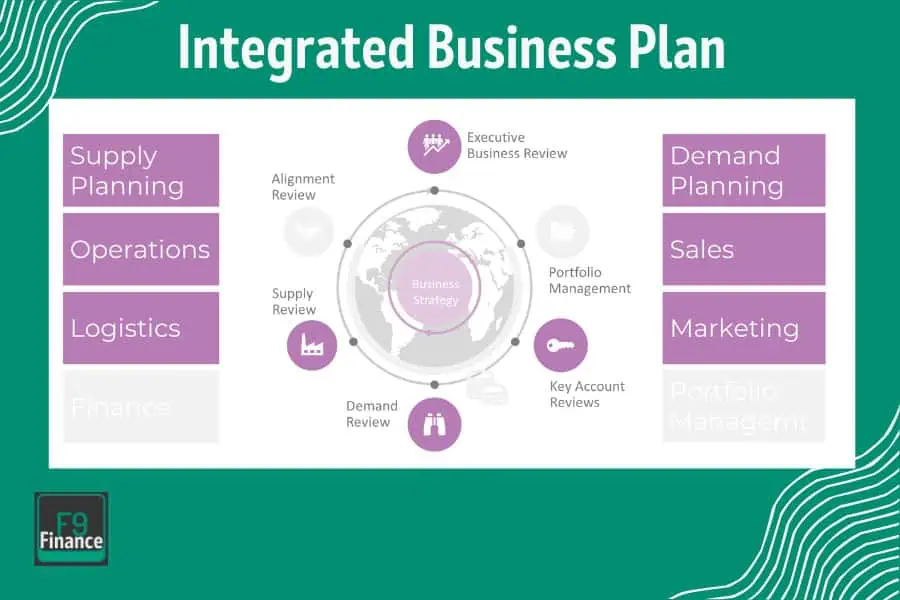

Integrated Business Planning (IBP) is a strategic approach that aligns various functions within a company — such as finance, operations, supply chain, and sales — into a unified planning process. It’s designed to ensure that all business units work together towards common goals, improving decision making, resource allocation, and overall business performance.

Within Financial Planning and Analysis (FP&A) , IBP is a potential game-changer. IBP allows FP&A professionals to forecast more accurately, make data-driven decisions, and ensure alignment between financial strategy and the company’s broader strategic objectives. This alignment helps businesses achieve financial targets and drive sustainable long-term performance.

As businesses increasingly rely on Integrated Business Planning, FP&A professionals who can adopt this approach can make significant contributions and create strategic value for their organizations.

Key Highlights

- Integrated Business Planning (IBP) breaks down silos, unifies various business functions, and ensures alignment between FP&A and overall business strategy.

- IBP supports improved forecasting accuracy and scenario analysis so FP&A teams can better anticipate outcomes, optimize resource allocation, and deliver realistic and strategically aligned financial plans.

- Extended Planning & Analysis (xP&A) and IBP expand the scope of traditional FP&A to integrate cross-functional business insights, positioning FP&A professionals as significant contributors to driving strategic value.

Integrated Business Planning has its roots in Sales and Operations Planning (S&OP), a process that emerged in the 1980s. S&OP was initially developed to align production and sales, ensuring that supply met demand efficiently. The process focused primarily on balancing supply-chain management with market demand.

As businesses grew more complex, the limitations of S&OP became apparent. Organizations needed a more comprehensive approach that included financial and business strategies in addition to sales and operations planning. IBP emerged as an extension of S&OP, combining financial planning, strategic planning, sales, and operations planning into a unified process.

IBP stands apart from traditional business planning by breaking down silos, maintaining a dynamic and responsive approach, and ensuring that planning efforts are strategically aligned with the company’s long-term goals. This makes IBP a far more effective approach to modern business planning, particularly for organizations seeking to remain competitive in today’s fast-paced market.

| Linear and siloed. Each business unit creates its own plan, often in isolation from other functions. | Breaks down silos. Unifies business units into one planning process, enhancing collaboration and strategic alignment. | |

| Static, with fixed annual or quarterly plans, which makes companies slower to adapt to changes in the business environment. | Dynamic and continuous, allowing for regular updates and adjustments. More adaptable and responsive to evolving business conditions. | |

| Emphasizes departmental goals. Business unit plans can lack alignment with each other or with overall business strategy. | Ensures cross-functional collaboration across an entire business. All planning activities align with the overall business strategy and objectives. |

How Integrated Business Planning Aligns FP&A with Overall Business Strategy

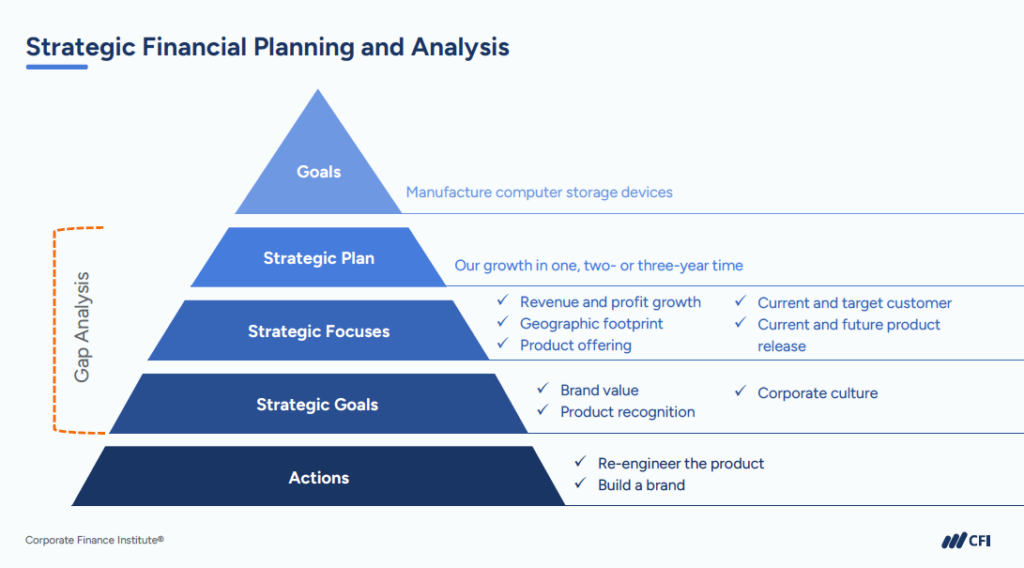

Strategic role of fp&a.

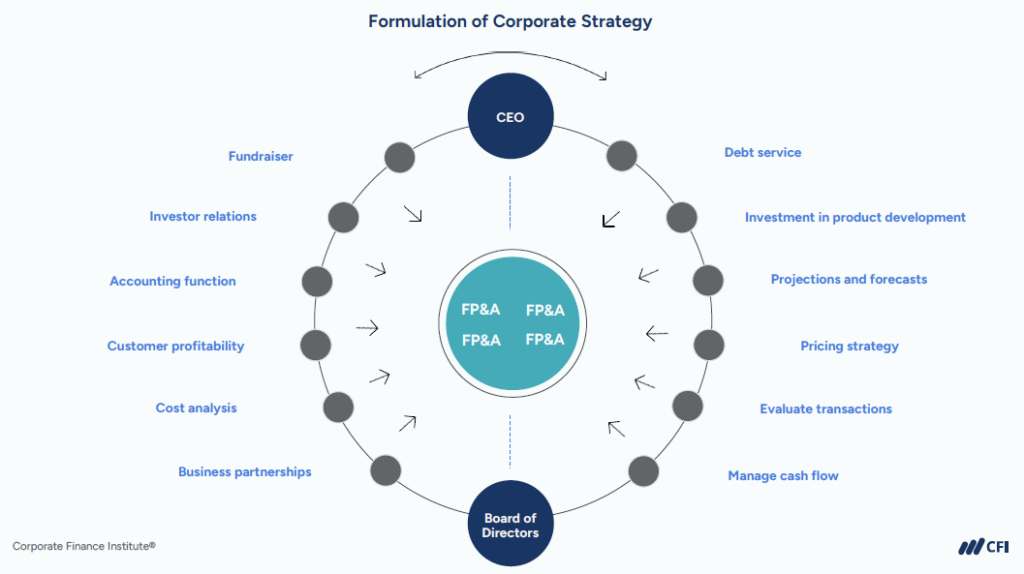

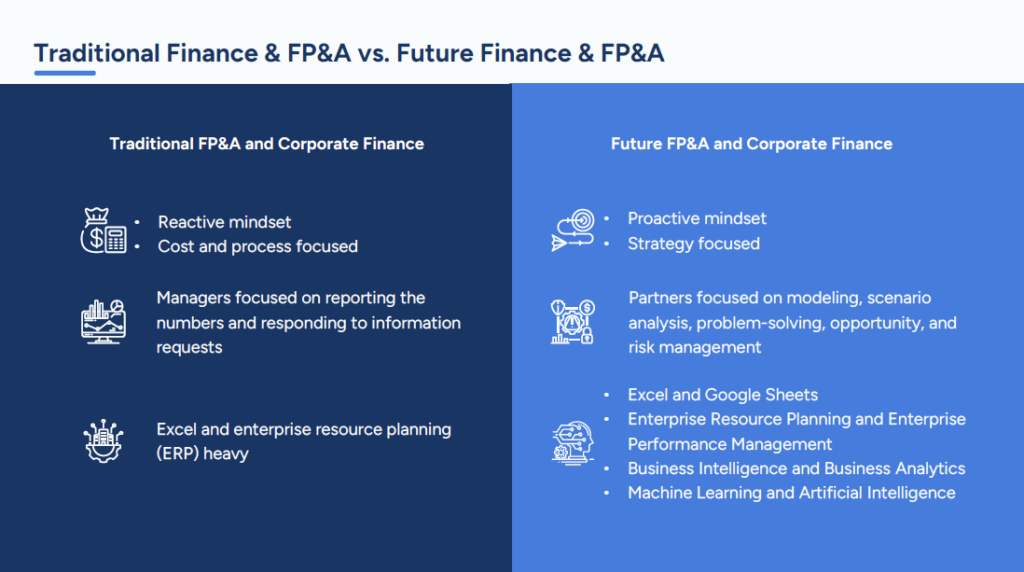

FP&A has evolved from a purely financial function to a critical player in shaping and supporting business strategy. FP&A teams are expected to go well beyond budgets and forecasts to driving strategic decisions that impact the company’s long-term success.

IBP as a Strategic Tool

Integrated Business Planning (IBP) empowers FP&A to connect financial goals with the company’s broader business objectives. By integrating financial planning with operational and strategic plans, IBP ensures that FP&A’s budgets and forecasts are aligned with the company’s overall strategy. This alignment helps the organization allocate resources more effectively, prioritize investments, and achieve strategic goals.

With IBP, FP&A teams can use cross-functional data and insights to provide more accurate and actionable recommendations. This data-driven approach enhances decision making across the entire organization, enabling leaders to make informed strategic choices based on comprehensive, integrated financial and operational information.

Benefits of IBP for FP&A Teams

IBP ties operational plans to financial outcomes, enabling FP&A teams to develop budgets that are aligned with the company’s strategic goals. This budgeting process ensures that financial plans are realistic and achievable, based on integrated data from various business functions. Creating budgets that are aligned with strategic objectives, managing financial resources, and setting financial targets that drive business performance.

IBP enhances the accuracy of financial forecasts by integrating data from various business functions. This comprehensive view allows FP&A teams to create more precise and reliable forecasts that reflect the current state of the business. By using up-to-date information, FP&A can anticipate financial outcomes more effectively, reducing the likelihood of surprises and improving overall financial planning.

The dynamic nature of IBP enables FP&A teams to quickly adapt to changes in the business environment. Whether it’s a sudden market shift, a new competitor entering the space, or an unexpected supply chain disruption, IBP allows FP&A to adjust financial plans in real time. This agility helps the organization stay resilient and responsive, making informed decisions that keep the company on track to meet its goals despite changing circumstances.

IBP fosters collaboration between FP&A and other departments, with key benefits in breaking down silos and ensuring that all parts of the organization are aligned. By working closely with teams across the company, FP&A can develop more cohesive and actionable financial plans. An understanding of financial implications by all departments leads to more effective execution of business strategies with teams working towards the same objectives.

Resource planning ensures the company has the necessary financial and operational resources to execute its strategy. For FP&A, this collaborative planning also involves aligning financial resources with capacity requirements to optimize resource allocation and manage cash flow effectively. Ensuring that financial plans account for resource constraints and capacity needs, thereby supporting efficient and cost-effective operations.

Key Elements of Effective Integrated Business Planning for FP&A Teams

Certain elements are especially critical to effectively implement and leverage IBP in FP&A. Key components include demand planning and forecasting, supply-chain planning, scenario planning, performance management, technology and data integration, and cross-functional communication. These are crucial for FP&A teams to effectively implement and leverage Integrated Business Planning within their organizations.

Integrating accurate demand forecasts into financial planning can directly affect revenue projections, budget planning, and resource allocation. IBP allows FP&A professionals to create more reliable financial forecasts that reflect real customer demand and market conditions, ensuring that financial plans are based on actual business conditions. This integration helps in aligning supply chain, production, inventory management, and sales efforts with financial goals, reducing the risk of over- or underestimating future demand and financial projections.

Example: You work in FP&A at a company planning to expand into a new market.

- As an FP&A professional, you collaborate with sales, marketing, and operations on demand planning to gain insights into customer demand in this market.

- By integrating these insights into your financial forecasts, you can develop an expansion plan that accurately reflects future demand.

- This holistic approach reduces risks and increases the likelihood of greater customer satisfaction and achieving the company’s financial objectives for market expansion.

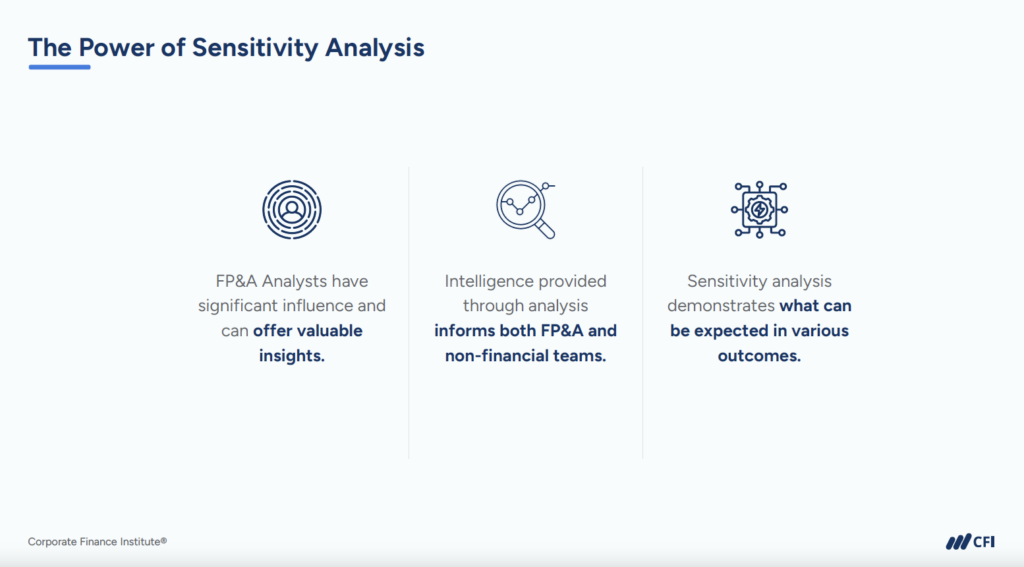

Scenario planning within IBP enables FP&A professionals to prepare for various business conditions by evaluating potential outcomes based on different “what-if” analyses. By modeling various scenarios and sensitivities — such as changes in market trends, pricing fluctuations, or supply chain disruptions — FP&A can assess the financial impact of each scenario and develop contingency plans. This proactive approach ensures that the company is better prepared to handle uncertainties and make informed strategic decisions.

Example: You work in FP&A for a company that is evaluating whether to launch a new product line.

- Using IBP, you can perform scenario analysis and sensitivity analysis by integrating data from various departments, such as sales, marketing, and operations planning.

- You might create multiple scenarios — such as different market adoption rates or varying production costs — and assess how each scenario impacts the company’s financials, from revenue forecasts to cash flow and profitability.

- Additionally, sensitivity analysis can be used to identify which variables (e.g., cost of materials, pricing strategy) have the most significant impact on the outcomes.

- This comprehensive analysis allows leadership to fully understand the potential risks and rewards under different conditions and make decisions accordingly.

IBP plays a vital role in tracking and reporting financial performance against strategic goals. This component enables continuous monitoring of key performance indicators (KPIs) , variance analysis, and reporting, helping to keep the organization on track to achieve its financial objectives.

By continuously monitoring key performance indicators (KPIs) that are aligned with the company’s strategic objectives, FP&A teams can provide management team with timely insights into how well the business is performing. This ongoing performance management allows for quick adjustments to strategies and plans, ensuring that the organization stays on course to achieve its long-term goals.

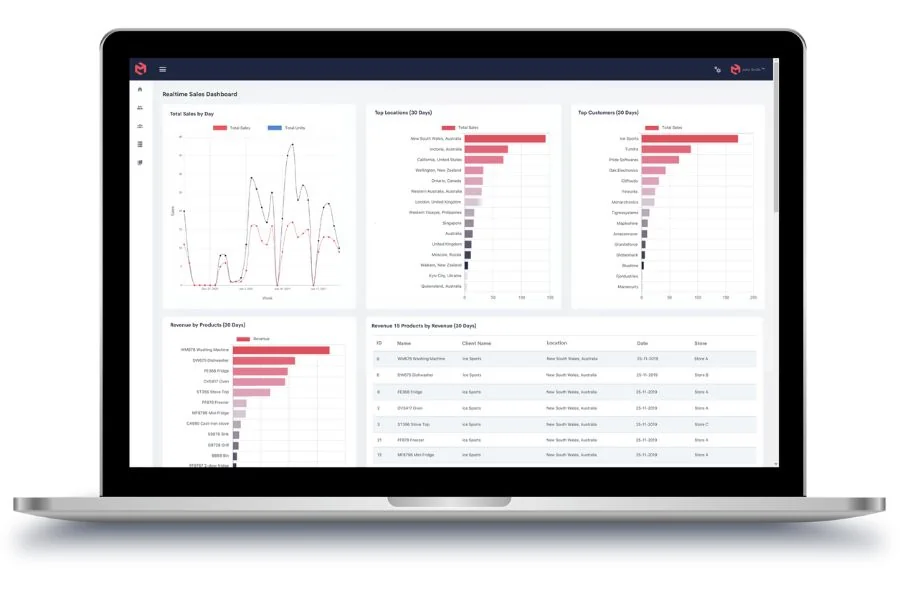

Effective IBP relies heavily on the use of technology, advanced analytics, and integrated data systems. Advanced software tools that can aggregate and analyze data from across the organization are essential for FP&A teams to develop accurate demand forecasts, conduct scenario analyses, and monitor performance. Advanced analytics, combined with integrated data, ensures that all departments are working with the same information, reducing discrepancies and enhancing the accuracy of financial planning.

Encouraging collaboration and communication across departments is key to the successful implementation of IBP. When finance, operations, sales, and other departments regularly share information and insights, FP&A teams can ensure that financial plans are cohesive and aligned with the company’s overall strategy. This cross-functional communication improves planning accuracy and helps build a unified approach to achieving business objectives.

How IBP Connects FP&A and Extended Planning & Analysis (xP&A)

Extended Planning & Analysis (xP&A) expands traditional FP&A beyond finance, incorporating other business functions like operations, HR, sales, and marketing. xP&A creates a holistic approach to planning, aligning all parts of the organization with strategic objectives.

As companies increasingly value integrated planning, xP&A is becoming essential in modern finance. IBP is essential for connecting FP&A with xP&A, fostering integration, and advancing a more strategic approach to the business planning process.

IBP unifies financial, sales, and supply-chain operations and planning, enabling a seamless transition to xP&A. This integration ensures that all planning activities support the company’s overall goals, resulting in a cohesive approach to business planning.

By breaking down silos, IBP enables FP&A to work closely with other teams, leading to more integrated planning and decision making. This collaboration ensures that financial insights are incorporated into operational decisions and vice versa, enhancing overall operational efficiency and effectiveness.

Future of FP&A with IBP and xP&A

Embrace IBP and xP&A practices as your career in finance evolves. Position yourself to lead in a more connected, strategically aligned FP&A environment by developing skills in:

- Communication and cross-functional collaboration.

- Advanced analytics

- Strategic planning processes

Embracing Integrated Business Planning in FP&A

Integrated Business Planning (IBP) aligns financial planning with broader business processes and strategies, breaking down silos and enabling more dynamic and accurate decision making. By integrating demand forecasting, scenario planning, and performance management, IBP enhances FP&A’s effectiveness and serves as a bridge to xP&A, expanding FP&A’s influence across the organization.

As finance evolves, FP&A’s role will become increasingly strategic. Embracing IBP and xP&A is essential for staying ahead. Integrating financial insights with operational data, leveraging advanced analytics, and fostering cross-functional collaboration will position FP&A teams as key drivers of business success. Early career finance professionals who adopt these practices will be well-prepared to lead in this new era of integrated planning.

Thank you for reading CFI’s guide to Integrated Business Planning for FP&A. To keep learning and advancing your career, check out the following resources:

- Extended Planning and Analysis (xP&A)

- FP&A Modeling Best Practices

- FP&A Manager: Skills and Responsibilities

- See all FP&A resources

- See CFI’s FP&A Specialization

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

- United States

Integrated planning: The key to agile enterprise performance management

Facebook Twitter Linked In E-mail this page

Table of contents

What is integrated planning, change as a given: the truth about plans, planning across the organization, the ultimate integrated planning solution.

- Need for real-time insights

- Integrated planning

- Agile and ready organizations

- Integrated planning drives better results

Integration is key to streamlined planning, budgeting, and forecasting. In order to adapt to today's quickly changing business conditions, you need an enterprise performance management solution that creates a single source of truth and delivers speed and agility to your planning process.

Did you know that 33 percent of critical information is delivered late?

The delay of critical information can cause a ripple effect that drives poor decision making and poor results. Today’s business simply cannot afford this type of cost in our customer-centric environment, where data is one of our most valuable assets. To stay ahead of the competition, businesses rely on a solution that can deliver acceleration, agility, and collaboration in every part of the organization.

Integrated planning ensures all parts of the organization are connected and planning is streamlined.

A must in the culture of “now.”

In virtually all industries, work has become more interactive and collaborative. More sharing is required, and more data is available than ever before. Success means integrating information across strategic and operational perspectives, as well as different functional and external sources.

Integrated planning mirrors the modern way we do business — it elevates the critical value of collaboration and cuts through data silos, driving more access to information and faster insights. Leaders use highly collaborative approaches to plan, budget, and forecast. Business planning requires accurate and complete data and buy-in across the entire organization, both from the top down and the bottom up. It sounds simple, but organizational silos are some of the biggest obstacles to accomplishing good work because they hinder critical decisions that strategically steer the business. And at the modern enterprise, silos are everywhere.

Integrated planning starts with a sophisticated planning platform that everyone in the organization can use, creating one source of truth. Data from diverse data sources such as ERPs, CRMs, and HRMs is unified, so users can access the information they need when they need it. Integrated planning helps ensure that plans, budgets, and forecasts are created with a holistic approach. Trends are easier to spot and quickly act on with more accurate and reliable plans. According to analysts at the Aberdeen Group , those organizations that champion data accessibility and collaboration between stakeholders promote organizational accountability and decrease time-to-decisions while increasing revenue. 1

The fact of the matter is that without effective communication, coordination, and collaboration between stakeholders, there is no way to improve organizational performance. 1

Bringing together people, data, and technology leaves organizations well-poised for optimal performance. Most importantly, integrated planning enables employees to be agile in responding to changing circumstances and able make the best decisions possible — all at the speed of modern business.

According to an Aberdeen study, 1 leaders who adopt enterprise performance management tools show a keen understanding of the importance of collaboration. They recognize that to make data driven decisions, they need to make all information accessible by integrating data and breaking down silos. Figure 1 shows steps taken by leaders to democratize data and drive more accurate forecasts.

Leaders put a high value on data integration and accessibility. They see the value of providing real-time data to decision makers and taking the guesswork out of forecasting. These strategies create comprehensive, actionable visibility into overall company performance and drive better results.

Gartner Predicts by 2020, at least 25 percent of large organizations will increase planning accuracy by integrating key operational planning processes with financial planning and analysis. 2

Do you have an integrated view of your data?

I do not feel confident in where to find comprehensive data, even for just my department

I have a good handle on my own departmental data (but only mine)

I have access to my data and that of other departments that impact my planning

IBM Planning Analytics helps Deutsche Bahn unite its global enterprise

Deutsche Bahn AG is a German railway company, and one of the largest IBM Planning Analytics customers with over 6,000 users worldwide. Deutsche Bahn uses IBM Planning Analytics to unite their wide-ranging operations across the globe, ensuring that the most accurate data is being used to create critical plans and forecasts that drive their business forward.

The truth about plans is that they always change. The goal of a dynamic, integrated planning approach is not to create a perfect, fixed plan. It’s to use all the resources available to create the most accurate, flexible and transparent plan possible, using a solution that does more than just plan — it analyzes data, reveals trends, and allows for real-time iteration.

Better, quicker access to data means faster and more informed decisions, laying the foundation for an organization to be agile and ready to pivot when changing business conditions demand.

If you’re reading this and thinking, “great, the finance team integrates all our plans, so we are off the hook,” think again. While we’d like to think that finance is the well-informed master of plans, miraculously weaving them together in perfect harmony and balance, that’s not always the case. In fact, it rarely is. Many, many finance teams rely on the manual collection of data into spreadsheets, which are often disconnected. Remember that much of an organization’s critical planning starts outside of finance and never gets communicated back up the chain or across the organization. There are simply too many top-down and bottom-up communication problems. Spreadsheets only complicate smooth communications. When a finance person is collecting and analyzing budget spreadsheets from across the organization, there is high risk for error in the process of combining and editing, causing confusion at the highest levels. Contradictory data can inhibit a clear picture of what is actually going on and identifying business drivers or detractors. Spreadsheets have proven over and over to be a highly imperfect yet highly common business practice.

With real-time access to data, companies take the guesswork out of planning, decreasing time involved in forecasting and increasing forecast accuracy. 3

Bye bye, silos. Hello, cross-functional planning.

A centralized, automated solution for performance data and planning allows coordination between different parts of the business and enables more streamlined, accurate plans. Leadership needs to understand what is truly driving the business — what causes increases and decreases in revenue or demand. At every level, access to a full range of data is critical to understanding how change (both internal and external) impacts the business. Though planning often starts with finance, other areas of the business can benefit from a dynamic planning solution as well. Let’s dive into a few use cases.

Supply chain planning

The term “operations” covers an enormous range of business activities. But one that’s almost universal is supply chain management. Supply chain planners are under constant pressure to reduce costs, increase efficiency and improve margins. Unfortunately, too many of them lack visibility into data and are misaligned with other teams. One centralized tool can help connect operational tactics with financial plans to allocate resources more effectively in response to market opportunities or competitive threats. This helps planners avoid mismatched data across multiple spreadsheets and enables them to pivot in the case of supply chain disruptions.

“ Our managers all have quick, easy access to the latest operational data via detailed reports that help them make better-informed decisions to improve the efficiency of the entire supply chain. ”

- Homarjun Agrahari, Director, Advanced Analytics, FleetPride

Learn more about supply chain planning

Infographic Webinar Learn more

Workforce planning

A company is only as good its people. That’s why it’s so important to hire and retain the right talent. Alignment between HR, finance and operations is crucial to ensure that the right people are in the right roles at the right time in order to meet organizational demands. This is rarely a simple task and too often it involves manual spreadsheet-based processes. Ensuring that departmental staffing targets are in sync with broader organizational objectives requires high levels of planning integration.

“ Our business is based on people. IBM Analytics is helping us manage that critical asset much more efficiently and effectively than ever before. ”

- Nadia Bertoncini, Coordinator of Governance, Projects and HR Analytics for Latin America, Natura Cosméticos

Learn more about workforce planning

Infographic Aberdeen report Learn more

Sales planning

Misalignment between finance, marketing and sales could lead to investment in the wrong initiatives, missed opportunities and inaccurate revenue forecasts that can severely hinder sales growth. And in a fast-moving market, manual processes and siloed systems are detrimental to agility. Decisions that are based on outdated information can lead to misguided sales strategies and thus lost sales and lost revenue. It’s critical to unite data under one roof for one single view to boost sales and effectively manage sales people.

“ The sheer level of detail that IBM Planning Analytics provides is very impressive … We can calculate our sales and gross margins for each SKU in IBM Planning Analytics and generate insightful reports at the click of a button. As a result, senior managers can rapidly access the comprehensive information they need to make effective strategic decisions. ”

- Vince Mertens, Group Accounting and Consolidation Manager, Continental Foods

Learn more about sales planning

Marketing planning

Constantly changing customer preferences and rising customer expectations require marketers to interpret high volumes of data and respond appropriately. But siloed data systems give only a partial picture and hinder smart decision-making. In addition, marketing teams can be fragmented and often disconnected from sales. Siloed planning causes misalignment with overall marketing goals, driving misallocated spend on the wrong elements of the marketing mix. Manual, siloed processes reduce visibility into how marketing activities affect one another, how marketing and sales touches move a lead through the funnel and how marketing helps achieve overall financial and business goals.

“ We first needed a better handle on our sales data. With so many lines of business, channels, and franchisees, collecting and consolidating this information was something that we knew we could do better. ”

- Donald Neumann, Demand Manager, Grupo Boticário

Learn more about marketing planning

Ventana report Learn more Infographic

IT planning

With IT, you need a business case for every dollar spent. But balancing the IT needs of an entire organization with digital transformation objectives and constant technology innovation is no simple task, and often requires additional resources. That’s why it’s so important leverage a planning solution that keeps IT focused on the projects that matter, automates planning tasks, gives a clear view into resources available and helps measure ROI. It’s also critical to coordinate with both finance and human resources to ensure the right resources are provided for IT initiatives and projects.

“ A few years ago, my team probably spent around half their time just keeping everything running — now it’s around 10 percent. With the move to IBM Analytics in the IBM Cloud, we have 40 percent more time to focus on working with the business to add value. Instead of asking ‘how do I make it work?’ we ask ourselves ‘how do I make it better?’ It’s a quantum shift in mindset. ”

- Vimal Dev, Vice President – IT, Global Enterprise Applications Leader, Genpact

Learn more about IT planning

Learn more IBV report

Operations, sales, marketing, human resources and other departments and disciplines all have a need for fast, flexible planning and analysis. And all of them can use the same tools to provide insight and manage performance. When people in one part of the organization see how their decisions affect other parts of the organization, all of the activities will be better coordinated and drive better results. In fact, according to Aberdeen, leading organizations are those who align planning across departments at double the rate of laggards in areas like sales, marketing and finance.

Become a leader

With IBM Planning Analytics , you can break down silos and generate an integrated view of your departmental or organizational performance. The solution enables you to create more accurate forecasts, identify potential performance gaps before they occur and make resource allocation decisions quickly and intelligently. Using multidimensional modeling and scenario analysis, IBM Planning Analytics lets you drill down into your data to examine the ripple effects of alternative courses of action and understand how your decision will affect related areas of the organization and ultimately impact the bottom line.

Using what-if scenario analysis to make smarter decisions

With IBM Planning Analytics, you can build multidimensional models and perform “what-if” analysis to explore scenarios or test business assumptions. Creating and maintaining sophisticated models with advanced sandboxing capabilities is simple. Easily test business assumptions and model scenarios to immediately see the impact of alternative courses of action on before deciding to implement changes.

IBM Planning Analytics offers all areas of your business — finance, operations, HR, sales, marketing, operations, IT and more — the ability to solve problems today and respond to new challenges with agility tomorrow.

Click on any quadrant for more information.

Headcount and staffing planning

Salary and compensation planning

Successions planning

Corporate planning and, budgeting and forecasting

Strategy planning

Operational planning

Capital planning

Expense planning

Profitability analysis

Demand planning

Sales and operations planning

IT project planning

IT budgeting

IT portfolio management

Sales territory planning and quota planning

Sales forecasting

Sales capacity planning

Resource allocation

Marketing revenue planning and forecasting

Campaign optimization

Dive deeper into the solution

Find out if IBM Planning Analytics is right for you.

Download the white paper

Download and save the PDF version of this SmarterPaper.

Try the interactive demo

Experience an interactive demo to get a real taste of functionality.

Shortfall: CFOs worry that their teams aren’t ready to weather the disruption

Here are four issues that are holding back many finance organizations and possible solutions.

Integrated Business Planning

Succession planning

Corporate planning, budgeting and forecasting

Strategic planning

Captial planning

By Whitney Gillespie April 16, 2024

Complete guide to integrated business planning (ibp).

Integrated Business Planning, or IBP for short, is a strategic management process that connects various organizational departments to align business operations with financial goals. How? By integrating business functions – such as Sales, Marketing, Finance, Supply Chain and Operations – to create a holistic view of the company's performance and future direction. This blog post offers a comprehensive guide to discuss what precisely IBP entails and how Finance can drive business results and collaboration within the organization via a robust and comprehensive IBP process.

What Is Integrated Business Planning?

While the business world and Finance have always had shared language and acronyms, some new (and reimagined) acronyms may now be flooding your feed. One such topic you may be hearing a lot about lately is Integrated Business Planning (IBP). Yet the concept of IBP isn't new. In fact, it's related to Sales & Operations Planning (S&OP) , a concept that's been around awhile.

Still, IBP may seem overwhelming in the context of all the different acronyms related to financial and operational planning floating around lately. For example, IBP, S&OP, eXtended Planning and Analysis (xP&A) and others are just a few acronyms muddying the waters. But this comprehensive guide to all things IBP aims to help demystify the process.

So what, exactly, is IBP?

IBP ultimately aims to unify business strategy with planning, budgeting and forecasting activity for all business lines and functions – providing one version of the numbers. In turn, a trusted, common view of the numbers provides a robust baseline for agile decision-making. That common view also keeps all teams collectively trying to achieve the same corporate objectives while staying focused on specific KPIs. In other words, the different teams maintain their independence while working in unison to achieve corporate success by leveraging the same trusted and governed data.

The bottom line? IBP is about aligning strategy intent, unifying planning processes and bringing the organization together.

How Integrated Business Planning Works

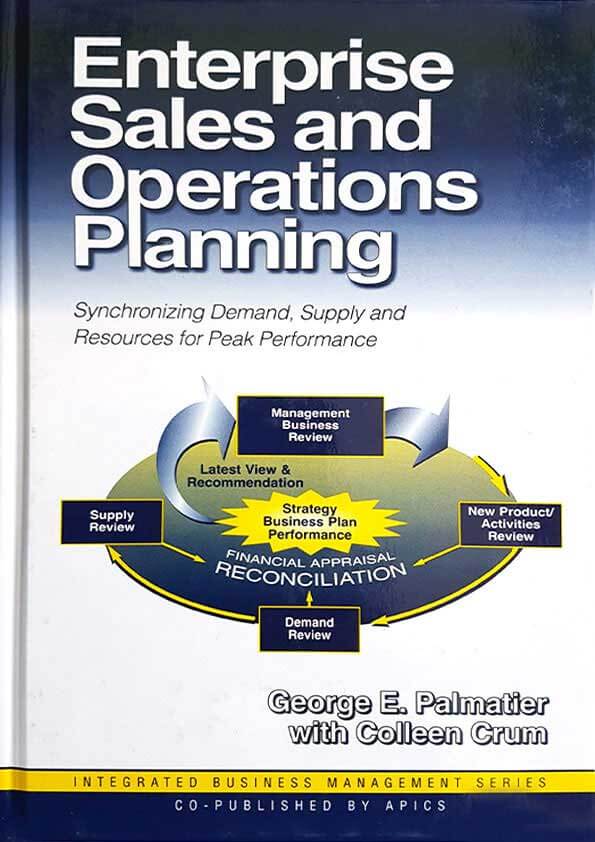

The IBP process is a framework to address the C-suite needs and help implement the business strategy and manage uncertainty to improve decision-making. So what's the secret sauce of IBP to make all of that happen? A collaboration between the different teams under a single view of the numbers that must unequivocally be tied to financial performance. That's how the C-suite gets value from IBP. Consequently, Finance plays a central role in the IBP process.

IBP typically focuses on horizons of 24-60 months, as opposed to the short term. That focus equates to Integrated Tactical Planning or Sales and Operations Planning and Execution. Since the process must be fully integrated, it removes the departmental silos. Plus, the IBP process must adapt to the organizational construct of every business (IBP isn't a one-size-fits-all type of process).

A typical IBP process involves several stages:

- Data Collection and Analysis : Gathering relevant data (e.g., sales forecasts, production capacities, inventory levels and financial projections) from different departments.

- Demand Planning: Predicting future demand based on historical data, market trends, customer feedback and sales forecasts.

- Supply Planning: Determining the resources and capabilities (e.g., materials, production capacity and distribution channels) needed to meet the forecasted demand.

- Financial Planning : Developing financial plans and budgets aligned with the demand and supply forecasts, considering factors such as revenue targets, cost structures and investment requirements.

- Scenario Planning: Creating alternative scenarios to assess how different strategies, market conditions or external factors impact business outcomes.

- Management Business Review : Collaborating across departments to make informed decisions on resource allocation, investments, pricing strategies and operational adjustments.

- Execution and Monitoring : Implementing the plans, tracking performance against targets, and continuously monitoring key metrics to identify deviations and take corrective actions.

The most efficient way to foster this collaboration is through a unified solution and data model that caters to the needs of the various agents involved on each review. In fact, Figure 1 shows how one solution gathering all the capabilities in the greyed area under a unified data model is the most efficient approach to IBP.

Figure 1: A Unified Data Model for IBP

Core Elements and Stages of the Integrated Business Planning Process

The IBP process includes the following core elements:

- Governance Structure : Establishing a cross-functional team with representatives from key departments to oversee the IBP process, define roles and responsibilities, and ensure alignment with organizational goals.

- Data Integration : Integrating data from different systems and sources to create a single source of truth for decision-making, using technologies such as enterprise resource planning (ERP) systems, Corporate Performance Management (CPM) tools, business intelligence (BI) tools and data analytics platforms.

- Collaborative Planning : Encouraging collaboration and communication between departments to share insights, align objectives and develop consensus-based plans that support overall business objectives.

- Continuous Improvement : Implementing feedback loops, performance reviews and process refinements to enhance the effectiveness and agility of the IBP process over time.

Key Performance Indicators (KPIs) for Integrated Business Planning

Some key KPIs to measure the effectiveness of an IBP process include:

- Forecast Accuracy : Comparing actual sales or demand with forecasted figures to assess the accuracy and reliability of forecasting models.

- Inventory Turnover : Calculating how often inventory is sold and replaced within a specific period indicates efficiency in inventory management.

- Customer Service Levels : Monitoring metrics like on-time delivery, order fulfillment rates, and customer satisfaction scores to measure service performance.

- Financial Metrics : Evaluating financial KPIs such as revenue growth, gross margin, operating profit, and return on investment (ROI) to gauge overall business performance.

- Supply Chain Performance : Assessing metrics like lead times, supplier performance, inventory levels, and supply chain costs to optimize supply chain operations.

Technological Enablers for Integrated Business Planning

Several technological enablers support a robust IBP process:

- ERP Systems : Integrated ERP systems consolidate data from different departments, automate processes, and provide real-time visibility into business operations.

- BI and Analytics Tools : Business intelligence tools and analytics platforms enable data visualization, trend analysis, scenario modeling, and predictive analytics for informed decision-making.

- Collaboration Platforms : Cloud-based collaboration tools facilitate communication, document sharing, and workflow management among cross-functional teams involved in IBP.

- Advanced Planning Software : Specialized IBP software solutions offer capabilities for demand planning, supply chain optimization, financial modeling , scenario planning, and performance monitoring.

- AI and Machine Learning : AI-driven algorithms and machine learning techniques can enhance forecasting accuracy, identify patterns, optimize resource allocation, and automate repetitive tasks in IBP processes.

By leveraging these technological enablers, finance professionals can streamline the IBP process, improve decision-making, and drive business growth.

In conclusion, Integrated Business Planning (IBP) is a strategic approach that aligns business functions, integrates data-driven insights and fosters collaboration to achieve operational excellence, financial stability, and competitive advantage. By implementing a robust IBP process supported by technology and focused on continuous improvement, finance professionals can effectively drive sustainable growth, mitigate risks, and adapt to evolving market dynamics.

Want to learn how you can maximize the benefits of your IBP process and get leadership on board with the plan? Check out our eBook Unifying Integrated Business Planning Across Finance and Supply Chain . You'll learn how to unify IBP across Finance and Supply Chain teams and read about use cases as proof points. Plus, you'll gain an understanding of the unique capabilities OneStream's Intelligent Finance Platform brings to unify Finance and Supply Chain planning activities.

Related Resources

Integrated Business Planning: A Detailed Exploration of Strategy and Execution

✅ All InspiredEconomist articles and guides have been fact-checked and reviewed for accuracy. Please refer to our editorial policy for additional information.

Integrated Business Planning Definition

Integrated business planning is a management process that synergizes sales, marketing, finance, operations, and logistics to drive an aligned operational plan and business strategy, balancing demand and supply while also considering financial objectives and the allocation of critical resources. It embraces short, medium, and long-term business planning and assists in decision-making, reducing risks, and increasing profitability.

Importance of Integrated Business Planning

The crucial role of integrated business planning.

Today’s businesses exist in a world that is, to say the least, complex and full of rapid changes. In these circumstances, integrated business planning plays a pivotal role in navigating through the turbulent times by bridging the gap between the company’s strategic ambitions and their operational constraints.

As a unifying framework, the process provides a link between the top-level strategic planning and day-to-day operational activities. It eliminates silos between departments providing a holistic, transparent and real-time view of the business. By mapping all operations to strategic goals, it ensures that all decisions and actions are pulling in the same direction toward the fulfillment of those goals.

Aligning Strategic, Operational, and Financial Planning

With integrated business planning, synchronization becomes achievable at an elevated level. It enables businesses to align their strategic objectives with operations and finances, thus ensuring a smooth flow of processes. When strategy, operations, and finance harmoniously work together, it eliminates any disconnects, resulting in effective and efficient decision-making.

From a strategic perspective, the approach aids in prioritizing goals and developing responsive and realistic plans to achieve them. On the operations front, it identifies bottlenecks, assesses risk, and ensures that all operations are in line with strategic objectives. Lastly, the integration with financial planning leads to accurate financial forecasts, effective cash management, and robust financial control.

To put it another way, this integrated view of business planning is akin to a well-conducted orchestra. Each section of the orchestra, be it strategic, operational, or financial, knows its role, its tasks, and how it contributes to the overall performance of the melody; which in this case, becomes the successful completion of strategic goals.

The Outcome: A Resilient Business Model

In the face of evolving markets and shifting customer demands, integrated business planning empowers businesses to quickly identify, adapt, and respond to changes efficiently. The approach supports timely and informed decision-making, improves communication and collaboration, and nurtures a proactive business culture focused on future growth.

The process also provides a robust system that facilitates scenario planning and risk mitigation. It promotes informed and rational decision-making, thus creating a resilient business model capable of withstanding market uncertainties and disruptions.

In summary, integrated business planning offers a comprehensive, more intelligent approach to business management—one that aligns strategy, operations, and finance towards a common goal while driving performance and sustainable growth.

Core Components of Integrated Business Planning

At the epicenter of integrated business planning is demand. Understanding current customer needs and predicting future ones is key to running a profitable operation. This involves market research, analysis of historical data and forecasting. By getting an accurate approximation of demand, businesses can take proactive measures to efficiently meet those needs.

Supply Management

It’s not just enough to understand the demand. A business must have a competent supply management system that can meet the anticipated demand. This is achieved by coordinating all elements of procurement, production, and logistics to effectively fulfill customer needs. A successful supply chain management strategy incorporates everything from sourcing raw materials, managing inventory, production planning, to eventual delivery.

Product Management

Product management is a very significant part of integrated business planning. It’s the process by which a business decides what products to offer and how to position them in the market. Product managers work cross-functionally with other teams like marketing, sales, and engineering, to ensure that the product aligns with company goals and customer requirements. They also analyze market trends, competitive landscape, and customer feedback to inform product features and enhancements.

Financial Planning

Lastly, financial planning provides the fiscal framework for integrated business planning. It involves budgeting, revenue projection, expense tracking, and monitoring financial performance against these predictions. A detailed financial plan enables a business to execute its strategies within available resources, capitalize on opportunities and respond timely to market changes. Financial planning is indispensable for a sustainable long-term business growth.

Each of these components works seamlessly with the others in integrated business planning. While demand, product, and supply chain management ensures that the business retains a competitive edge in the market, financial planning provides the necessary oversight to ensure the business remains profitable while doing so. This alignment across all the key functional areas is what makes integrated business planning so critical to the success of a business.

The Role of Integrated Business Planning in Corporate Decision Making

In a dynamic business environment, integrated business planning helps corporations quickly adapt and respond. It operates as a navigational tool, guiding decision-making processes at various levels of an organization, from operational to strategic.

Operational Decision Making

At the operational level, integrated business planning aids in managing immediate and short-term decisions. It provides a detailed view of the current business operations- from sales forecasts, customer demands, supply chain management to available resources.

For instance, consider a rise in demand for a product. An operational decision might involve assessing the production capacity and inventory levels, which integrated business planning can readily provide by unifying data from multiple business functions. This allows the organization to react swiftly and efficiently to unexpected changes.

Tactical Decision Making

Tactical decisions contributing towards achieving short-term goals also benefit from integrated business planning. It aids in providing a firm ground that aligns operational decisions with corporate strategy.

Key functions like marketing campaigns, collaborations, or prodigious investments often hinge on the insights captured through integrated business planning. It not only allows companies to seize up-to-the-minute market opportunities but also helps in mitigating potential risks.

Strategic Decision Making

At a strategic level – where decisions have long-term implications and contribute directly to the achievement of an organization’s mission – integrated business planning is instrumental. It provides organizations with forward-thinking views, predicting future scenarios, and laying out a roadmap to achieve the desired goals.

For instance, making decisions about entering new markets, launching new product lines, or obsoleting older ones are all powered by the insights from integrated business planning.

Thus, integrated business planning is central to decision-making processes, underpinning them with a clear, synchronized view of business functions. It enables corporations to respond effectively and swiftly to business environment changes, maintaining their competitive edge.

Integrated Business Planning and Risk Management

Integrated business planning (IBP) plays a crucial role in managing business risks. It enables organizations to align strategic, operational, and financial plans to achieve overall corporate objectives.

Assessing and Managing Risks with IBP

With IBP, an organization can continually assess potential risks and adjust its plans based on a comprehensive and timely understanding of possible implications. This process reduces the likelihood of sudden impact from unanticipated events and enhances the resilience of the business.

For instance, IBP can help in foreseeing economic downturns and prepare for them by diversifying income streams or increasing savings. Similarly, if a company anticipates a shortage of raw materials, it may use IBP to develop contingency plans such as seeking alternate supply sources, redesigning products, or adjusting manufacturing schedules.

Identifying Opportunities

On the flip side, integrated business planning also plays an essential role in identifying opportunities. This comprehensive approach can uncover potential synergies, efficiencies, and strategic initiatives that would otherwise go unnoticed. Leveraging integrated data, businesses can identify market trends early, allowing them to deploy new solutions or services ahead of their competitors.

Consider an organization that notices an increase in the use of sustainable materials via integrated data analysis. With IBP, the company can assess the possible financial and operational implications of shifting to eco-friendly materials, then devise strategies to capitalize on this trend.

Holistic View of Business Landscape

Furthermore, the holistic view provided by integrated business planning assists businesses with identifying both threats and opportunities. By providing viably comprehensive, cross-functional views of the business landscape, IBP allows companies to anticipate changes, react effectively, and seize the opportunities these changes bring.

In conclusion, integrated business planning’s role in risk management is immense. It promotes resilience by enabling organizations to anticipate potential risks and build strategies to navigate them. It also encourages innovation by highlighting emerging opportunities, leading to improved competitiveness and sustainability.

Tailoring Integrated Business Planning to Different Business Models

Applying integrated business planning (ibp) to service-based businesses.

The successful application of Integrated Business Planning (IBP) in service-based businesses can prove to be unique due to the nature of service delivery and customer expectations. Unlike in a product-oriented business where the primary goal is to manage the supply chain, service-based businesses encounter market variability and require a flexible planning process.

IBP helps these businesses by providing a platform to align their operational plans with strategic goals. For instance, the nature of the service can dictate the planning horizon and the frequency of revising plans. A healthcare provider may need a more immediate planning horizon compared to a consultancy firm due to the unpredictable nature of medical emergencies. Hence, IBP can be tailored to accommodate these different planning horizons.

Adapting IBP for Product-Oriented Businesses

Product-oriented businesses, on the other hand, often have tangible inventory and a visibly structured supply chain. Here, IBP comes in handy to integrate various components like sales, operations, and finance to ensure the business stays on track to achieve its strategic goals.

By synchronizing all critical business units, the company can ensure demand forecast accuracy, reduce stockouts and overstocks, and optimize cash flow. For instance, in a manufacturing business, the use of IBP can be pivotal in decisions ranging from raw material procurement to production planning to order fulfillment.

Implementing IBP in Hybrid Business Models

A hybrid business model, a mix of service and product-oriented business, calls for even more flexible application of IBP. Hybrid businesses need to balance the complexities of both models, and this can be achieved by integrating decisions about service delivery and product supply.

The outcome is a more harmonized strategic plan that accommodatively factors in both the intangible and tangible aspects of the business. For instance, a software company that offers both software products (product-oriented) and software services (service-oriented) may use IBP to synchronize the timeline for product development and service delivery.

In conclusion, while the fundamental elements of IBP remain the same, its implementation can and should be tailored to the unique needs of specific business models. The flexibility of IBP lies in its ability to adapt and accommodate the diverse patterns of businesses, ensuring alignment of strategic goals with operational plans. This is what makes IBP not just an effective planning tool, but an innovative business methodology.

The Relationship between Integrated Business Planning and Corporate Social Responsibility

In the application of integrated business planning, it’s important to consider its impact on a corporation’s social responsibility (CSR) practices. Integrated business planning has direct implications, as it can form a strategic platform for organizations to proactively manage their social and environmental responsibilities, in addition to driving financial performance.

When considering a business’s social and environmental responsibilities, it’s clear that these elements can significantly influence planning processes. This is because businesses, especially those operating in sensitive sectors such as mining or manufacturing, must account for the potential social and environmental impacts of their operations.

Effect on Planning Process

Understanding this, the planning process under an integrated business planning model needs to not only focus on traditional economic factors, but integrate CSR into the heart of their business strategies in a structured and systematic way. This might involve predicting potential social and environmental risks and planning appropriate mitigation strategies, or identifying socio-environmental initiatives and integrating them into the business’s operating model.

Asset Utilization and ESG Compliance

Moreover, integrated business planning can allow businesses to better utilize their assets in the service of both financial objectives and CSR. For instance, a manufacturing facility might plan to use more energy-efficient technologies, demonstrating commitment to environmental sustainability, while also potentially reducing operational cost.

Furthermore, a solid integrated business planning can enhance a company’s efforts in Environmental, Social, and Governance (ESG) compliance. It allows the business to consistently align its operational activities and financial planning with its CSR policies and governance standards. This, in return, may improve the public image, customer trust, and overall market reputation of the company.

Aligning Business Goals with Societal Values

Ultimately, a key aim of integrating CSR into the business planning process is to ensure that an organization’s business goals are well-aligned with societal values and environmental sustainability. Doing so not only helps businesses to fulfill their moral and civic duties, but is also increasingly recognized as a powerful driver of long-term financial performance.

Software Tools for Integrated Business Planning

In order to successfully implement integrated business planning (IBP), businesses need to make use of a variety of software tools. These tools not only make the complex process more manageable, but they also increase accuracy, improve collaborative efforts and provide meaningful insights for better decision-making.

Popular Software Tools

One popular tool is SAP Integrated Business Planning (SAP IBP) . This tool is lauded for its real-time supply chain management features. SAP IBP offers features for demand planning, supply and inventory planning, sales and operations planning, and response and supply control.

Another widely adopted software is Anaplan . Anaplan’s platform helps businesses model and visualize their data, and is known for its capability to handle extremely large data sets, making it ideal for large organizations.

Oracle Demand Management Cloud is also worth mentioning. It provides predictive analytics to understand and manage demand, and it integrates well with other Oracle applications, making it an attractive choice for businesses already using the Oracle ecosystem.

Kinaxis RapidResponse stands out for its scenario planning features, allowing businesses to simulate and compare various situations and their outcomes.

Role of Technology in IBP

Technology plays a pivotal role in IBP, simplifying and enhancing the process. With the vast amount of data businesses deal with today, manually managing such processes would be time-consuming and prone to human errors. Software tools automate most of these tasks, ensuring accuracy and efficiency.

Moreover, these tools often provide data visualization features, converting complex data into easy-to-understand charts and graphs. This not only makes data more accessible to all stakeholders, but also aids in quicker decision-making.

One significant advantage of using these tools is the ability to collaborate in real-time. Multiple users can work together on the same data sets, breaking down silos within the organization. With everyone on the same page, the alignment between different business functions improves, boosts the overall business performance.

Lastly, with features like predictive analytics and scenario planning, businesses can better anticipate future scenarios and prepare accordingly, reducing the risk associated with unforeseen changes in the market or supply chain.

Thus, with the help of software tools, integrated business planning becomes a more streamlined, accurate, and collaborative process.

Implementing Integrated Business Planning

Essential considerations for successful implementation.

To ensure a successful transition to using integrated business planning, several key aspects must be considered.

Employee Training

A central aspect of this change-over is the training of employees. Your employees need to understand the principles of integrated business planning and how they can apply these principles in their day-to-day activities. This training could be delivered through workshops, seminars, or e-courses, depending on what’s most effective for your employees.

Ongoing mentorship and support are also beneficial, helping employees adjust to the new system over time. By providing continuous learning opportunities, you keep your employees engaged and motivated, thus enhancing the adoption of integrated business planning.

Technological Requirements

The transition to integrated business planning is not only about changing mindset, but also about updating your technology stack, as this approach often relies on advanced software solutions. The exact technology needed may vary depending on the scale of your business and the nature of your operations, but a comprehensive business planning software suite is usually a baseline requirement.

Additionally, you would need to evaluate your current IT infrastructure to check if it can support the new systems. It might be necessary to upgrade certain components to ensure seamless operation. Remember, your new software should be user-friendly to promote ease of use among your employees.

Embracing Cultural Change

Implementing integrated business planning can bring about a significant shift in your company culture. As an approach that emphasizes collaboration and transparency, it requires a shift away from organizational silos. Employees at all levels need to get used to sharing information and making collective decisions.

Promoting this cultural shift can be challenging. Clear, effective communication will be crucial. Explain the advantages of the new system, engage employees in the planning process, and make sure everyone understands their responsibilities. Celebrating small victories can also help to promote positive feelings towards the change.

By paying attention to these critical aspects – employee training, technology, and culture change – you can lay the foundation for a smooth transition to integrated business planning.

Share this article with a friend:

About the author.

Inspired Economist

Related posts.

Accounting Close Explained: A Comprehensive Guide to the Process

Accounts Payable Essentials: From Invoice Processing to Payment

Operating Profit Margin: Understanding Corporate Earnings Power

Capital Rationing: How Companies Manage Limited Resources

Licensing Revenue Model: An In-Depth Look at Profit Generation

Operating Income: Understanding its Significance in Business Finance

Cash Flow Statement: Breaking Down Its Importance and Analysis in Finance

Human Capital Management: Understanding the Value of Your Workforce

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Start typing and press enter to search

A better way to drive your business

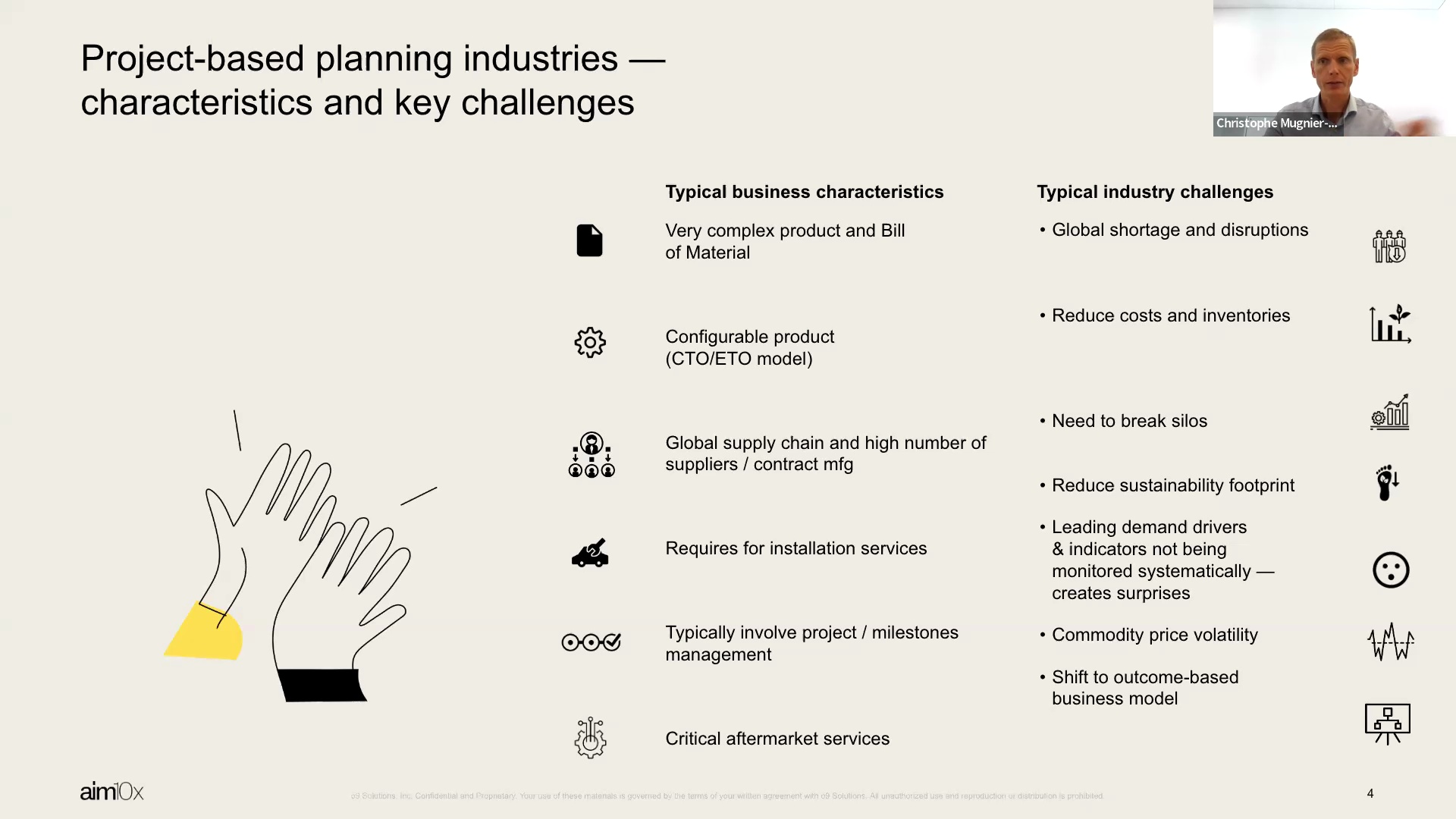

Managing the availability of supply to meet volatile demand has never been easy. Even before the unprecedented challenges created by the COVID-19 pandemic and the war in Ukraine, synchronizing supply and demand was a perennial struggle for most businesses. In a survey of 54 senior executives, only about one in four believed that the processes of their companies balanced cross-functional trade-offs effectively or facilitated decision making to help the P&L of the full business.

That’s not because of a lack of effort. Most companies have made strides to strengthen their planning capabilities in recent years. Many have replaced their processes for sales and operations planning (S&OP) with the more sophisticated approach of integrated business planning (IBP), which shows great promise, a conclusion based on an in-depth view of the processes used by many leading companies around the world (see sidebar “Understanding IBP”). Assessments of more than 170 companies, collected over five years, provide insights into the value created by IBP implementations that work well—and the reasons many IBP implementations don’t.

Understanding IBP

Integrated business planning is a powerful process that could become central to how a company runs its business. It is one generation beyond sales and operations planning. Three essential differentiators add up to a unique business-steering capability:

- Full business scope. Beyond balancing sales and operations planning, integrated business planning (IBP) synchronizes all of a company’s mid- and long-term plans, including the management of revenues, product pipelines and portfolios, strategic projects and capital investments, inventory policies and deployment, procurement strategies, and joint capacity plans with external partners. It does this in all relevant parts of the organization, from the site level through regions and business units and often up to a corporate-level plan for the full business.

- Risk management, alongside strategy and performance reviews. Best-practice IBP uses scenario planning to drive decisions. In every stage of the process, there are varying degrees of confidence about how the future will play out—how much revenue is reasonably certain as a result of consistent consumption patterns, how much additional demand might emerge if certain events happen, and how much unusual or extreme occurrences might affect that additional demand. These layers are assessed against business targets, and options for mitigating actions and potential gap closures are evaluated and chosen.

- Real-time financials. To ensure consistency between volume-based planning and financial projections (that is, value-based planning), IBP promotes strong links between operational and financial planning. This helps to eliminate surprises that may otherwise become apparent only in quarterly or year-end reviews.

An effective IBP process consists of five essential building blocks: a business-backed design; high-quality process management, including inputs and outputs; accountability and performance management; the effective use of data, analytics, and technology; and specialized organizational roles and capabilities (Exhibit 1). Our research finds that mature IBP processes can significantly improve coordination and reduce the number of surprises. Compared with companies that lack a well-functioning IBP process, the average mature IBP practitioner realizes one or two additional percentage points in EBIT. Service levels are five to 20 percentage points higher. Freight costs and capital intensity are 10 to 15 percent lower—and customer delivery penalties and missed sales are 40 to 50 percent lower. IBP technology and process discipline can also make planners 10 to 20 percent more productive.

When IBP processes are set up correctly, they help companies to make and execute plans and to monitor, simulate, and adapt their strategic assumptions and choices to succeed in their markets. However, leaders must treat IBP not just as a planning-process upgrade but also as a company-wide business initiative (see sidebar “IBP in action” for a best-in-class example).

IBP in action

One global manufacturer set up its integrated business planning (IBP) system as the sole way it ran its entire business, creating a standardized, integrated process for strategic, tactical, and operational planning. Although the company had previously had a sales and operations planning (S&OP) process, it had been owned and led solely by the supply chain function. Beyond S&OP, the sales function forecast demand in aggregate dollar value at the category level and over short time horizons. Finance did its own projections of the quarterly P&L, and data from day-by-day execution fed back into S&OP only at the start of a new monthly cycle.

The CEO endorsed a new way of running regional P&Ls and rolling up plans to the global level. The company designed its IBP process so that all regional general managers owned the regional IBP by sponsoring the integrated decision cycles (following a global design) and by ensuring functional ownership of the decision meetings. At the global level, the COO served as tiebreaker whenever decisions—such as procurement strategies for global commodities, investments in new facilities for global product launches, or the reconfiguration of a product’s supply chain—cut across regional interests.

To enable IBP to deliver its impact, the company conducted a structured process assessment to evaluate the maturity of all inputs into IBP. It then set out to redesign, in detail, its processes for planning demand and supply, inventory strategies, parametrization, and target setting, so that IBP would work with best-practice inputs. To encourage collaboration, leaders also started to redefine the performance management system so that it included clear accountability for not only the metrics that each function controlled but also shared metrics. Finally, digital dashboards were developed to track and monitor the realization of benefits for individual functions, regional leaders, and the global IBP team.

A critical component of the IBP rollout was creating a company-wide awareness of its benefits and the leaders’ expectations for the quality of managers’ contributions and decision-making discipline. To educate and show commitment from the CEO down, this information was rolled out in a campaign of town halls and media communications to all employees. The company also set up a formal capability-building program for the leaders and participants in the IBP decision cycle.

Rolled out in every region, the new training helps people learn how to run an effective IBP cycle, to recognize the signs of good process management, and to internalize decision authority, thresholds, and escalation paths. Within a few months, the new process, led by a confident and motivated leadership team, enabled closer company-wide collaboration during tumultuous market conditions. That offset price inflation for materials (which adversely affected peers) and maintained the company’s EBITDA performance.

Our research shows that these high-maturity IBP examples are in the minority. In practice, few companies use the IBP process to support effective decision making (Exhibit 2). For two-thirds of the organizations in our data set, IBP meetings are periodic business reviews rather than an integral part of the continuous cycle of decisions and adjustments needed to keep organizations aligned with their strategic and tactical goals. Some companies delegate IBP to junior staff. The frequency of meetings averages one a month. That can make these processes especially ineffective—lacking either the senior-level participation for making consequential strategic decisions or the frequency for timely operational reactions.

Finally, most companies struggle to turn their plans into effective actions: critical metrics and responsibilities are not aligned across functions, so it’s hard to steer the business in a collaborative way. Who is responsible for the accuracy of forecasts? What steps will be taken to improve it? How about adherence to the plan? Are functions incentivized to hold excess inventory? Less than 10 percent of all companies have a performance management system that encourages the right behavior across the organization.

By contrast, at the most effective organizations, IBP meetings are all about decisions and their impact on the P&L—an impact enabled by focused metrics and incentives for collaboration. Relevant inputs (data, insights, and decision scenarios) are diligently prepared and syndicated before meetings to help decision makers make the right choices quickly and effectively. These companies support IBP by managing their short-term planning decisions prescriptively, specifying thresholds to distinguish changes immediately integrated into existing plans from day-to-day noise. Within such boundaries, real-time daily decisions are made in accordance with the objectives of the entire business, not siloed frontline functions. This responsive execution is tightly linked with the IBP process, so that the fact base is always up-to-date for the next planning iteration.

A better plan for IBP

In our experience, integrated business planning can help a business succeed in a sustainable way if three conditions are met. First, the process must be designed for the P&L owner, not individual functions in the business. Second, processes are built for purpose, not from generic best-practice templates. Finally, the people involved in the process have the authority, skills, and confidence to make relevant, consequential decisions.

Design for the P&L owner

IBP gives leaders a systematic opportunity to unlock P&L performance by coordinating strategies and tactics across traditional business functions. This doesn’t mean that IBP won’t function as a business review process, but it is more effective when focused on decisions in the interest of the whole business. An IBP process designed to help P&L owners make effective decisions as they run the company creates requirements different from those of a process owned by individual functions, such as supply chain or manufacturing.

One fundamental requirement is senior-level participation from all stakeholder functions and business areas, so that decisions can be made in every meeting. The design of the IBP cycle, including preparatory work preceding decision-making meetings, should help leaders make general decisions or resolve minor issues outside of formal milestone meetings. It should also focus the attention of P&L leaders on the most important and pressing issues. These goals can be achieved with disciplined approaches to evaluating the impact of decisions and with financial thresholds that determine what is brought to the attention of the P&L leader.

The aggregated output of the IBP process would be a full, risk-evaluated business plan covering a midterm planning horizon. This plan then becomes the only accepted and executed plan across the organization. The objective isn’t a single hard number. It is an accepted, unified view of which new products will come online and when, and how they will affect the performance of the overall portfolio. The plan will also take into account the variabilities and uncertainties of the business: demand expectations, how the company will respond to supply constraints, and so on. Layered risks and opportunities and aligned actions across stakeholders indicate how to execute the plan.

Would you like to learn more about our Operations Practice ?

Trade-offs arising from risks and opportunities in realizing revenues, margins, or cost objectives are determined by the P&L owner at the level where those trade-offs arise—local for local, global for global. To make this possible, data visible in real time and support for decision making in meetings are essential. This approach works best in companies with strong data governance processes and tools, which increase confidence in the objectivity of the IBP process and support for implementing the resulting decisions. In addition, senior leaders can demonstrate their commitment to the value and the standards of IBP by participating in the process, sponsoring capability-building efforts for the teams that contribute inputs to the IBP, and owning decisions and outcomes.

Fit-for-purpose process design and frequency

To make IBP a value-adding capability, the business will probably need to redesign its planning processes from a clean sheet.

First, clean sheeting IBP means that it should be considered and designed from the decision maker’s perspective. What information does a P&L owner need to make a decision on a given topic? What possible scenarios should that leader consider, and what would be their monetary and nonmonetary impact? The IBP process can standardize this information—for example, by summarizing it in templates so that the responsible parties know, up front, which data, analytics, and impact information to provide.

Second, essential inputs into IBP determine its quality. These inputs include consistency in the way planners use data, methods, and systems to make accurate forecasts, manage constraints, simulate scenarios, and close the loop from planning to the production shopfloor by optimizing schedules, monitoring adherence, and using incentives to manufacture according to plan.

Determining the frequency of the IBP cycle, and its timely integration with tactical execution processes, would also be part of this redesign. Big items—such as capacity investments and divestments, new-product introductions, and line extensions—should be reviewed regularly. Monthly reviews are typical, but a quarterly cadence may also be appropriate in situations with less frequent changes. Weekly iterations then optimize the plan in response to confirmed orders, short-term capacity constraints, or other unpredictable events. The bidirectional link between planning and execution must be strong, and investments in technology may be required to better connect them, so that they use the same data repository and have continuous-feedback loops.

Authorize consequential decision making

Finally, every IBP process step needs autonomous decision making for the problems in its scope, as well as a clear path to escalate, if necessary. The design of the process must therefore include decision-type authority, decision thresholds, and escalation paths. Capability-building interventions should support teams to ensure disciplined and effective decision making—and that means enforcing participation discipline, as well. The failure of a few key stakeholders to prioritize participation can undermine the whole process.

Decision-making autonomy is also relevant for short-term planning and execution. Success in tactical execution depends on how early a problem is identified and how quickly and effectively it is resolved. A good execution framework includes, for example, a classification of possible events, along with resolution guidelines based on root cause methodology. It should also specify the thresholds, in scope and scale of impact, for operational decision making and the escalation path if those thresholds are met.

Transforming supply chains: Do you have the skills to accelerate your capabilities?

In addition to guidelines for decision making, the cross-functional team in charge of executing the plan needs autonomy to decide on a course of action for events outside the original plan, as well as the authority to see those actions implemented. Clear integration points between tactical execution and the IBP process protect the latter’s focus on midterm decision making and help tactical teams execute in response to immediate market needs.

An opportunity, but no ‘silver bullet’