Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Download Free PDF

SAMPLE BUSINESS PLAN FOR COSMETICS BUSINESS.

2020, SAMPLE BUSINESS PLAN BY AKAMPURIRA BRIAN

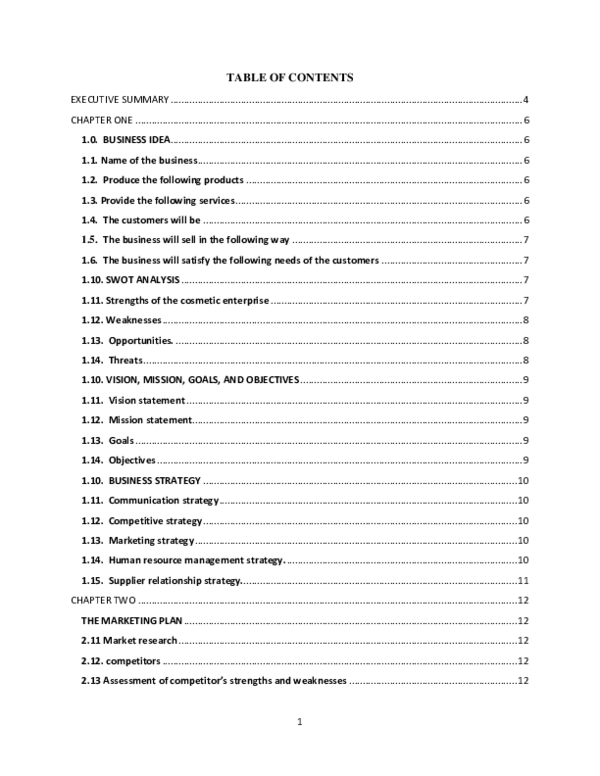

This plan is to set up a cosmetic shop in the name of " Briox Cosmetics Enterprise ", which will be located in Easy View Arcade Garage street Mbarara. The cosmetic shop will be a sole proprietorship owned by Akampurira Brian. I will use startup capital of 52,380,000 Uganda shillings. UGX 34,380,000 will be owners’ equity and the remaining UGX 18,000,000 will be a bank loan which will be secured from centenary bank at 10% interest rate. The key personnel at the cosmetic Enterprise will include Senior manager, buying inputs and overall supervisory work, operations and production staff, sales and marketing staff, skin therapy and hairdressing staff, record keeping and accounting, stock control and direct selling staff The key objective of the cosmetic shop will be to provide fresh quality cosmetics to our clients to enable them improve their general skin beauty, to obtain maximum customer satisfaction through continued quality production, to obtain continuous production and supply of our products to the customers, to create customer loyalty to our products such that they become well pronounced in the customer minds. To achieve our objective, the cosmetic shop will employ strategies such as: Offering quality, body skin lotions, oils and herbal cosmetics that help fight the skin diseases made from fresh fruit and vegetable which are nutritious through adequate research and proper mixture of the lotions, oils and herbal ointments to meet the standard skin contents and characteristics of customers in the market through advertisement by use of sign posts, direct selling and radio stations, offering special incentive to our regular clients, offering our cosmetics at relatively lower prices for market penetration, creating a conducive environment for our clients, employing people who understand the meaning of customer care and meaning of quality by giving them samples for use as a way of expanding our markets especially among the young children, youth and women. All this encompasses our strategies that include, communication strategy, supplier relationship strategy, marketing strategy, competitive strategy and human resource strategy. The vision of the cosmetic shop will be ‘To be the leading suppliers of quality, fresh and health skin booting cosmetics product’ Our mission will be, dedicated at improving the skin health and body look and appearance of our client. "We seek to become the recognized leader in our targeted local and international market for carrying a diverse line of in demand cosmetics including perfumes, makeup, and other accessories that will have a competitive edge towards customer satisfaction and retention at attractive prices. Our major customers will be corporate employees, students, market vendors, tourists and retailers who will be consuming a range of our products including; Perfumes 1st class, Lemon body lotion, Hair relaxer cream, Avocadoes body cream smoother and Hair glow. Our forms/ ways of distribution will include, through Retailers, distributors and wholesalers who will buy and sell in bulk to our final customers which we cannot sell to directly we shall also sell directly to the customers because we have a high customer traffic at our main outlet in Mbarara. We shall as well be using a van that will be leased to distribute to our customers who order in large quantities. In terms of our legal responsibilities, the following taxes apply to our business, sales tax, employees’ income tax, national social security fund and Mbarara Municipal Council Tax and other licenses like trading license, and Uganda National Bureau of Standards license. We shall as well need to the insurance for our business and also carry out other social responsibilities like corporate social responsibility, being environmentally friendly, and ensuring cleanliness of Mbarara town. Our products are costed and priced after comparison with our major competitor’s prices and costing information acquired through market research. We have as well carried out cash flow estimates to ensure that our business does not run out of cash. Our startup capital has been allocated to what we intend to start our business with that is renting building for two months, buying machines for mixing the inputs, Machines, leasing van, buying furniture and fittings, massage equipment, cloths and uniforms and other necessary things to start with including the employee salaries for the first two months. This plan will be effective on 1st January 2018 and that is when my business will begin in Mbarara Easy View Arcade.

Related papers

Academia Letters, 2021

En toda obra de ingeniería civil se debe utilizar los mejores materiales posibles para obtener un buen funcionamiento de las propiedades de resistencia, adherencia y durabilidad de los materiales. El agregado constituye alrededor del 75% en volumen de una mezcla típica de concreto. El termino agregado se refiere a todo lo que comprende las arenas, agravas naturales y piedra triturada utilizada para preparar concretos y morteros. El peso unitario de un agregado (árido) es la relación entre el peso de una determinada cantidad de este material y el volumen ocupado por el mismo, considerado como volumen al que ocupan las partículas del agregado y sus correspondientes espacios inter granulares. Los agregados generalmente se dividen en dos grupos: finos y gruesos. Los agregados finos consisten en arenas naturales o manufacturadas con tamaños de partícula que pueden llegar hasta 10 mm; los agregados gruesos son aquellos cuyas partículas se retienen en la malla No. 16 y pueden variar hasta 152 mm. El tamaño máximo del agregado que se emplea comúnmente es el de 19 mm o el de 25 mm. Los agregados deben consistir en partículas con resistencia adecuada, así como resistencia a condiciones de exposición a la intemperie y no deben contener materiales que pudieran causar deterioro del concreto. Para tener un uso eficiente de la pasta de cemento y agua, es deseable contar con una granulometría continua de tamaños de partículas. La calidad del concreto depende en gran medida de la calidad de la pasta. En un concreto elaborado adecuadamente, cada partícula de agregado está completamente cubierta con pasta, así como también todos los espacios entre partículas de agregado. La pasta está compuesta de cemento Portland, agua y aire atrapado o aire incluido intencionalmente. Existen normas que determinan y cuantifican la calidad de la grava y arena, bajo ciertos efectos físicos y mecánicos. Dentro de estas normas se encuentran las Pruebas Estándar Americanas para Materiales (ASTM por sus siglas en inglés), que son pruebas que se han desarrollado desde los años 80 y que se les realizan a diferentes materiales (no precisamente de construcción) para estandarizar resultados y establecer límites de calidad. El estudio de estos bancos para agregado servirá de consulta a empresas o identidades constructoras que desarrollen proyectos de obras civiles en las zonas donde distribuyen su material, resultando de mucha importancia. En las investigaciones a concretos tanto en sus propiedades y características propias; indirectamente relacionan a los agregados, pero no lo toman como un material que pueda definir la calidad. Donde la calidad final de un concreto es de suma importancia para los constructores interesados en ofertar una obra, por lo que esta tiene que cumplir con los rigores de funcionalidad, durabilidad, seguridad y economía. Allí radica la importancia de conocer el comportamiento de los agregados que formaran parte de la masa de concreto.

EL AGUA DE LA VIDA, 2020

EL IMPERATIVO ANEXO PARA ALCANZAR LA PLENA SALUD

Siti syarofah, 2021

Κρητικά Χρονικά, 2022

Zygon, 2022

Oikos, 1997

Workplace Health & Safety, 2020

Current Science, 2020

Journal of Indian Society of Periodontology, 2016

The EGU General Assembly, 2017

Ultrasound in Obstetrics and Gynecology, 2008

InTech eBooks, 2017

Related topics

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Don't bother with copy and paste.

Get this complete sample business plan as a free text document.

Cosmetics Manufacturing Business Plan

Start your own cosmetics manufacturing business plan

Executive Summary executive summary is a brief introduction to your business plan. It describes your business, the problem that it solves, your target market, and financial highlights.">

Opportunity.

The cosmetics industry is in a state of flux. Traditional brands (Revlon, L’Oreal, Lancôme etc.) are viewed as old. The consumer is looking for more holistic and healing benefits from her skin care products. She is no longer content with just the appearance benefits offered by traditional brands. The Body Shop brought her an awareness of cruelty free and natural products. These initial nudges lead to today’s consumer being more informed and more inquisitive about the benefits of her personal care products. Her skin crème needs to protect her from the suns damaging rays, moisturize her skin and reduce the effects of aging. She is seeking relief from the effects of a hectic 24/7 lifestyle. She has learned the benefits of herbal therapy and aromatherapy. She has either experienced or read about the benefits (both physical and emotional) of a Day Spa.

Bluespa is a multi-channel concept, combining a wholesale distribution network with a retail strategy, e-commerce, and a consumer catalogue. The face of retailing is changing.

Bluespa will occupy a unique market position. No other brand offers a specialty line that includes skin care, cosmetics, fitness apparel and accessories. However, within each category significant brands do exist. Quality and price vary widely within each group. Bluespa will be positioned as a quality brand. The U.S. cosmetics market has seen large annual growth rates over the past decade. Last year alone, the market grew by over $1 billion. Clear divisions between traditional categories are becoming blurred and new lines, such as aromatherapy are also emerging, creating new openings for profit.

In fitness apparel and accessories there is a tremendous opportunity since the female customer has been grossly overlooked. Most major companies do not produce products focused specifically on the female customer. Puma is the only brand that has developed a line of fitness apparel fro women. Early sales for them have been exceptional, further highlighting the potential within this category.

In the skin care and cosmetics category the competition can be divided into three groups: Commercial–i.e. MAC, Origins, Philosophy, Erno Laslo and Shesheido; Clinical–i.e. Kiehl’s, Clinique, Clarins and Dr. Hauscha; Spa–private label brands associated with spas.

Competition

Traditionally the dynamics of the industry have favored large houses because they can fund the major advertising and marketing campaigns associated with this industry. Today an underground (or gorilla) marketing effort can be more effective in gaining credibility with this market segment. In the past the volume of product required to produce a batch, and the cost of producing packaging have favored the larger players. Today, technology has evolved to allow the efficient production of small batches. Packaging resources exist that allow for efficient cost controls and rapid delivery of these components. In brief, the advantages of size that created barriers to entry for new players have been swept aside. The cosmetic giants still hold a dominant position in this industry and they will most likely continue to. But they have realized the need to acquire new brands and to keep their affiliation in the background. LVMH and Lauder have done an excellent job of identifying emerging brands and acquiring them.

In recent years names like MAC, Bloom, Bliss, NARS, Fresh and Kiehl’s have been acquired. This strategy indicates that a few of the traditional big players recognize the benefits, for themselves and the industry, of emerging niche brands. Add to this equation the growth of the day spa industry in the United States over the last 20 years. 20 yrs ago, there were 25 day spas in America. 10 yrs ago, that number had risen to 200. Today there are over 3,000 day spas in the U.S. and 300 in Canada. Americans are beginning to understand the benefits and pleasures of taking care of themselves.

Bluespa represents quality in skin care, fitness apparel and accessories. We will accomplish this using high quality manufacturing and research, a creative marketing program, and a comprehensive distribution network using both brick and mortar retail outlets, internet presence, and a consumer catalogue.

Expectations

In order to launch its unique product line Bluespa requires an initial outlay. Sales at Bluespa retail stores are planned to grow rapidly from Year 1 through Year 5. During this time frame our wholesale revenues are planned to grow enormously. Bluespa will become profitable in our third year of operation. Initial growth will be financed by a combination of equity investment and debt financing. Our ratios are well within prudent limits and our growth plans are challenging, but realistic.

Financial Highlights by Year

Financing needed.

We will be getting $420,000 to start. Ray will be contributing $254,000. Barbara will be contributing $64,000. We have $100,000 of current borrowing.

Problem & Solution

Problem worth solving.

The cosmetics industry is in a state of flux. Traditional brands (Revlon, L’Oreal, Lancôme etc.) are viewed as old. The consumer is looking for more holistic and healing benefits from her skin care products. She is no longer content with just the appearance benefits offered by traditional brands. The Body Shop brought her an awareness of cruelty free and natural products. These initial nudges lead to today’s consumer being more informed and more inquisitive about the benefits of her personal care products. Her skin crème needs to protect her from the suns damaging rays, moisturize her skin and reduce the effects of aging. She is seeking relief from the effects of a hectic 24/7 lifestyle. She has learned the benefits of herbal therapy and aromatherapy. She has either experienced or read about the benefits (both physical and emotional) of a Day Spa.

Our Solution

Bluespa is a company that has created a brand concept consisting of both skin care and athletic apparel utilizing multiple channels of distribution. We are seeking recurring investment to fund the growth of the brand, and position the company for an IPO. The plan that follows explains our market, our value proposition and our market segmentation strategy. The detailed financial plans provide a clear view of our sales and profit forecasts. These plans show how Bluespa will reach profitability in our third year of operation and generate shareholder return on equity within five years.

Target Market

Market size & segments.

Market Segmentation

For the purpose of this analysis we are focusing solely on the female market. Therefore our potential customers base (for the purpose of developing projections) does not include any statistics or provisions for male consumers. We have used the demographic report for spa goers conducted by spa weekly as a basis for our assumptions. Based upon this survey the spa goer is predominantly female (85%), well educated (46% attended college), and crosses income levels (26% earn less than $35,000; 32% earn between $35,000 and $74,999 and 42% earn over $75,000).

4.3 Target Market Segment Strategy

Because Bluespa is a combined retail (direct to end user) and wholesale (to the end user through a reseller) strategy our target customer must be broken into two distinct groups, the end user and the reseller.

Our targeted end user is between the ages of 24 and 65. They are urban professionals with at least some college. This consumer has an active lifestyle. They are concerned about social and environmental issues. Mind and body wellness are important to them. They belong to a health club; take yoga, pilate’s or tai chi lessons. The effects of aging and the maintenance of a youthful appearance are a part of their life. A recent survey conducted by The American Spa Industry revealed the following demographic for day spa goers: 85% are female, 46% have some college and 39% are college graduates, 63% are married, 32% have an annual income between $45,000 and $74,999, 40% have income above $74,999 and 26% have incomes below 45,000, 47% are between 34 and 52 years of age.

They are predominantly female. They are well educated. Between 1993 and 1998 20% more BAs and MBAs were awarded to women than men. Women received 59% of all associate degrees, 55% of bachelor degrees, 53% of masters’ degrees and 40% of doctoral degrees earned in the United States. Today college campuses are over 60% female. The buying power of this segment of the market continues to grow. There are currently over 109 million female consumers. Their buying power is estimated at $4.4 trillion. (In comparison, the junior market is estimated at $100 billion). In 1997 64% of working women earned more than one half of the family income. Today, businesses owned by women generate over $3.6 trillion in annual sales. Of the net increase in the workforce between 1992 and 2005, 62% are projected to be women. In retail the female consumer is the primary decision maker in 85% of households. Women buy or influence the purchase of 80% of consumer goods. Their increasing educational attainment makes young women even more sophisticated and demanding consumers.

Today’s female consumer is living a transactional life with multiple constituencies. Her life is on fast forward. In the last few years the sales of anxiety drugs to this consumer has surpassed the sales of anti-depressants. Her definitions are shifting, blurring the lines between home and office; private and public; professional and casual; even male and female. Age has become irrelevant. Life stages are no longer defined cleanly by age. (A 44-year-old first-time mother has much in common with a 22-year-old first-time mother.) Links between generations and mindsets are becoming very spread out. Today’s female consumer defines herself more by mindset or approach to life than by age. Parents and teens are often on parallel treadmills. The older segment is interested in staying young and the younger segment is acting older.

In addition there has been a democratization of luxury. The upper-class family group is massive. More than eight million households have incomes above $100,000. Luxury spending is growing four times faster than overall spending. Working women of all ages have more money and they are spending it on personal luxuries. This is a reaction to the chaos of 24/7 consumerism. She’ll buy, but she wants more than just another product. She is not seeking empowerment–she is empowered. She is choosing to take better care of herself and others. She is looking for peace, solutions and fulfillment. Purchasing has moved beyond price. The Price:Value ratio has become more meaningful. She is seeking a "value added" experience or product. Our strategy of combined channels of distribution allows us to fit into her schedule while our product philosophy provides her with the benefits she is seeking.

Our target customers (vs. end user) for wholesale distribution will be resellers who recognize the needs of this consumer and who she identifies with. We have used the term resellers because they will not be limited to retailers. We will reach the consumer through four distinct reseller channels.

- Spas and Health Clubs : Most high-quality day spas and health clubs (and many upscale spas at resort properties) use generic products. (Much like the hair salon industry before Aveda.) Our goal will be to develop affiliations with select spas in urban areas and vacation destinations. Our manufacturing partnerships will allow us to offer these customers bulk product at favorable prices to them while allowing us excellent margins.

- Lifestyle Retailers : Our target retailer will be lifestyle-based rather than the typical soaps and potions or natural product retailers. These retailers exist in almost every city. Whether it is Wilkes Bashford in San Francisco, Mario’s in Seattle, Harold’s in several south central cities, Fred Segal in Los Angeles, Bergdorf Goodman in New York or Colette in Paris. These retailers have developed a loyal and sophisticated customer base. They understand the concept of lifestyle.

- Cosmetic Specialty Retailers : Sephora is the major force in this category.

- Boutique Department Stores : This category is composed of what was once called "Carriage Trade" retailers. We will limit our distribution within this segment to Saks, Niemans and Barneys.

Current Alternatives

Because we will develop our brand image and market positioning primarily through our skin care line, we will focus our competitive review on that segment of the market. The skin care market is very broad. It includes products labeled as body crème that range in price from $10 for a five-ounce container to over $300 an ounce. Our market positioning will be in the lower price quadrant of high quality natural products.

Our primary competitors for this customer are:

Kiehl’s : Founded in 1851, this brand has an image that is well established with the consumer. Their main strength has been that the products work. Kiehl’s has been a family business for four generations. The products are being made in small batches in a New York City facility. They have a wide and varied distribution strategy. Their packaging and labeling is very clinical in appearance. In recent years the brand has experienced almost geometric growth. This has caused them serious internal problems. They have been unable to meet demand and have stopped adding customers. In spring 2000 Estee Lauder acquired them. According to internal sources Lauder will move the manufacturing to OEM facilities and shut down the internal capabilities. They plan to focus growth on traditional department stores and on a roll out of Kiehl’s own stores. The obvious plus of this marriage is the availability of cash and technical resources. The potential risk is that Lauder will associate the brand closely with Department stores and that the OEM manufacturing will result in the changing of certain formulas and a reduction in product effectiveness.

Aveda : Founded in 1978 by Horst Rechelbacher (an artist), Aveda has become synonymous with quality hair-care products and salons. They are distributed, worldwide, by over 3,000 Aveda salons. It has nurtured a well-defined image and secured a very effective distribution network. Aveda salons are a combination of licensed properties and company owned locations. Their product philosophy is centered in Ayurveda healing and aromatherapy. Recently Estee Lauder acquired them.

Fresh : Fresh distributes body and skin care products through their own stores, a consumer catalogue and wholesales globally to department and specialty stores. Their products are more "fashion" influenced than treatment based. They currently have two stores in New York City and one in Boston. Their target market is younger and less affluent than Bluespas’.

Essential Elements : A former stock analyst started essential Elements in 1995. The products are botanical based natural body crèmes and lotions. They are distributed primarily through day spas and specialty stores. Informed sources say they will be launching a consumer catalogue. Their main target for increasing distribution is through day spas and resorts.

Our Advantages

Bluespa will occupy a unique market position. No other brand offers a specialty line that includes skin care, cosmetics, fitness apparel and accessories. However, within each category significant brands do exist. Quality and price vary widely within each group. Bluespa will be positioned as a quality brand. We have eliminated the drugstore and discount brands from this comparison.

The commercial brands are primarily sold through department stores. They vary widely in quality from Origins to Shesheido. They also vary widely in price. Their major advantage is their financial strength and their department store relationships.

The clinical brands are perceived to be "authentic." Their image is based upon the perception of treatment qualities verses purely cosmetic benefits. These brands are sold through their own retail outlets, specialty stores, department stores and/or health food stores. Kiehl’s is perceived as one of the most authentic of the clinical brand.

The spa brands are sold almost exclusively at the spas they are associated with. This close affiliation provides a validation for the products but limits their ability to achieve wide market distribution. Bliss and Aveda are notable exceptions. These two brands have achieved wide market distribution and brand recognition.

In fitness apparel and accessories the female customer has been grossly overlooked. Reebok and Avia had the best chance of capturing her at one time. However Reebok abandoned her to try to become a "legitimate" sports brand and acquired Avia. Avia has since been sold and has all but disappeared. Meanwhile the big two brands (Nike and Adidas) have ignored her. Recently Nike announced the formation of a women’s division as a separate business unit. While this offers the possibility of a major competitor in the women’s fitness category, it also highlights the opportunity. Puma is the only brand that has developed a line of fitness apparel focused specifically at this consumer. Their Nuala line has been developed with Christy Turlington. They have positioned this line to sell through women’s specialty stores rather than traditional sport retailers. Early sales have been exceptional, further highlighting the potential within this category.

Bluespa will develop our market position by combining a retail strategy that includes a day spa with a wholesale distribution strategy. Bluespa will acquire the validity afforded the spa brands and access to broad distribution. Bluespa skin care and cosmetic products will offer therapeutic benefits to the user based upon the principles of Thalasso therapy in our water line and Botanical treatments in our earth line. Our color cosmetics will be mineral based and provide the user with esthetic benefits while nourishing the skin. In addition to providing retail appropriate packaging we will develop bulk sizes for distribution within the spa trade. Most day spas use generic products and do not have the ability to develop a private label line. The apparel and accessory lines will combine the newest in technical fabrics with fit specifications that allow the wearer full range of movement. We have developed affiliations with select yoga and fitness facilities for our apparel. All of our products will be positioned at the quality conscious consumer. Our marketing campaign and PR positioning will reinforce the Bluespa image. Our message will be to identify the benefits of our products and to develop an image that makes Bluespa products highly desirable. Meanwhile, our pricing strategy will be to maintain retail price points in the lower quadrant of the top quality brands. A detailed comparison of our pricing as it relates to our target market is in the appendix.

Keys to Success

Our keys to success are:

- Quality product.

- Product logistics and quality control.

- Product placement in key retail accounts.

- A vertical retail presence in brick and mortar, catalogue and e-commerce.

- The creation of a "buzz" about this "hot…new" brand among opinion leaders through a combination of PR and product placement.

Marketing & Sales

Marketing plan.

Bluespa will utilize a brand building (pull) strategy as the basis for our marketing plan. We will position our print media spend in magazines that influence our target consumer and validate the brand. The publications we will utilize are: W, Vogue, Wallpaper, Cosmopolitan, Travel & Leisure, Vanity Fair, Departures, In Style, Food & Wine, Shape, Town and Country and the New York Times Sunday edition. These are the same publications retail buyers and trend analysts scour to find emerging brands or trends. In addition to paid ads in regional issues of the publications mentioned, we will retain a PR firm to develop a grass roots program for obtaining product placement and celebrity/trainer endorsements. Our media and PR strategy will bring the brand to the forefront for the consumer and set the stage for our image development. We will have a separate plan to market to spas and retailers at trade shows. In addition we will develop a unique in-store graphic and communication package that explains our products benefits and advantages at point of sale.

Our retail sales strategy consists of just two parts. First we will hire and train people who fit the Bluespa image and lifestyle. Our training programs will insure that they have the product knowledge necessary to serve the customers needs and close the sale. Second, our commission and retention programs will insure we recognize and reward performance. Our sales people will be on a commission program that compensates for follow up sales at progressively higher rates. This will provide an incentive for consumer follow up and the creation of repeat business. Our commission program will also insure that individual performance is monitored and recognized. Top performers will be singled out for recognition and poor performers will be given additional training or encouraged to seek a profession more suitable to their skills.

Locations & Facilities

The company’s main office is located in Portland Oregon. The office is approximately 400 square feet. An additional 800 square feet of office space can be made available within the building. This should be sufficient for planned staff size within the first few years. The company has a five-year lease on the current space with an additional five-year option. An option exists on the expansion space as well.

Distribution in the first year will be managed from a facility in Southwest Portland. In years two through five we plan to manage distribution through a contract resource capable of handling both wholesale distribution and retail fulfillment.

Skin and body care products will be developed and produced at our contract facilities in Pontrieux and Nice, France and Compton, California.

Production of apparel products will be managed through our contract manufacturer of sport-related apparel. They have a 50,000 square foot production facility in Portland, Oregon for high-quality technical apparel and a 200,000 square foot facility in Mexico for the production of t-shirts and other knitwear.

Production of accessories will be managed through a contract with a manufacturer of quality sports-related accessories including: bags, hats, totes and socks for the wholesale market. Their office and distribution facilities are located in southern California.

Milestones & Metrics

Milestones table, key metrics.

Our key metrics are

- Cost of goods of products – we have a lot of customers that can’t afford very expensive products, we need to keep an eye on the cost to stay competitive

- Facebook page views

- Twitter tweets and retweets

- Blog shares

- Website

- Community events

Ownership & Structure

The initial management team is very compact. Our CEO and founder is the only current (full-time) employee. However we have utilized significant external resources and have secured a committed and talented team to join Bluespa as our funding gets in place. Ms. Kelly Anderson will be our director of retail and spa operations. Mr. Dane Johnson will join us as creative director. (Mr. Johnson is currently a creative director for Nike.) Ms. Brunner will be the director of product development. Ms. Fran Wonnacott will join the team as administrative assistant to Mr. Brunner. In addition to our internal resources we have access to a significant pool of senior management and design talent. This resource has been detailed in the management team section.

Management Team

Ray G. Brunner, president and CEO:

Mr. Brunner has over 30 years of retail experience. During his career he has successfully held senior management positions with several major retailers.

He joined the GAP Inc. as a regional manager. During his 10 year career with GAP he managed every region in the U.S. The then-new president, Millard Drexler, tapped him for the position of vice president of visual merchandising. In this capacity, Mr. Brunner played a significant role in the repositioning of GAP.

Mr. Brunner was then assigned the responsibility of developing a kids business for GAP. This resulted in the creation of GAPKIDS where he served as VP and general manager until he joined Storehouse PLC as president and CEO of Conran’s Habitat North America. His responsibilities there included developing a U.S. roll out strategy for that business. After selling the business, Mr. Brunner joined Eddie Bauer as VP of real estate and retail operations. While in this capacity he was instrumental in developing a complete face-lift for the core business as well as assisting in the development of the Eddie Bauer home concept.

Then Mr. Brunner left Eddie Bauer to begin a very specialized consulting business. His clients have included Esprit Europe, Asia and America, Fruit of The Loom, The Luchesse Boot Company, Adidas International, The Guggenheim Museum and Adidas America. The nature of each of these consulting engagements has been to assist the client company in developing a strategy for a retail rollout or expansion and to oversee the successful execution of these strategies. Adidas America decided to execute a retail strategy developed in conjunction with Mr. Brunner’s consultancy, on the condition that he agreed to manage the business and launch the strategy. He served in the capacity of president for retail operations with Adidas America. He planned and managed the development of the Adidas in-line retail stores now open in Los Angeles, Seattle and Boston. In addition, he coordinated the development of the organizational structure and rollout strategy for this business.

Mr. Brunner attended Western Connecticut State College and did graduate work at UCLA.

Barbara Brunner, vice president product development:

Ms. Brunner has over 25 years of retail experience. Her career started with GAP as an assistant store manager. She quickly became a store manager and then a senior store manager responsible for overseeing the Washington DC metro. Then she was tapped to become one of the first managers in the new Banana Republic Division, where she opened and successfully managed the South Coast Plaza store. Ms. Brunner then joined Ann Taylor to manage the Beverly Hills and Century City stores. As a training manager she was instrumental in developing top store talent for this prestigious retailer.

Ms. Brunner co-founded Planet Stores in Seattle Washington. Planet quickly became a recognized leader in the market and grew to five stores in the Pacific Northwest. The retail scene was beginning to change and the Brunner’s sensed an opportunity to develop a quality lifestyle business that focused on personal care. The new business would go beyond just body care creams, lotions and essential oils. It would extend into the other areas this customer spends her personal time in, such as yoga and fitness training.

When the Planet store locations were sold and the idea for Bluespa began to take shape.

Personnel Table

Our outside management advisors provide a significant asset to Bluespa. They provide management with a valuable sounding board for strategic and creative decisions. They provide a deep experience base in all critical areas.

Dane Johnson – marketing and graphic design: Mr. Johnson has been a senior marketing executive with Adidas and Nike. He has extensive experience in both media and product design.

J. Victor Fandel – real estate and strategic planning: Mr. Fandel was the co-founder of Terranomics realty. He sold Terranomics to Federal Realty and started Fandel Realty Group. His clients include Polo-Ralph Lauren, AnnTaylor, Donna Karen, LVMH and Adidas.

W. John Short – strategic planning and finance: Mr. Short began his career with Citibank in Latin America and Hong Kong in their Corporate Finance and Commercial Banking Group. After nine years with Citibank he joined Esprit Far East as president and chief operating officer. Before retiring he had attained the position of president and CEO of Esprit Europe and Esprit International.

R. Gordon Gooding – strategic planning and finance: Mr. Gooding is president and chief financial officer of Naartjie North. Naartjie is a multi-national children’s clothing retailer. Prior to his involvement in the Naartjie project, Gordon spent three years in the private banking industry in the Cayman Islands. Before his banking experience he worked for KPMG in audit and taxation for five years in both the Caymans and Vancouver, Canada. Gordon received a bachelor of commerce degree from the University of British Columbia, and a CA designation from the Canadian Institute of Chartered Accountants.

Devin Wright – apparel design and manufacturing: Mr. Wright is the president and founder of AMG. AMG is a manufacturer of high-quality sports apparel. Their clients include Nike, Adidas and Columbia sportswear.

Karen Alweil – wholesale distribution: Ms. Alweil has over 12 years experience in wholesale sales management. Then she opened her own sales agency in Los Angeles. Her showroom specializes in body care and accessories. She was instrumental in the successful launch of Neal’s Yard aromatherapy line in the United States.

Paul LaBruna – fixture design and manufacture: Mr. LaBruna have created and managed the growth of one of the most successful and highly respected fixture resources in America. They have been instrumental in assisting with major rollouts for The GAP, AnnTaylor, Talbots, Williams Sonoma and Levi Strauss.

Peter Glen – emerging trends and consumer marketing: Mr. Glenn is a respected trend guru. He has written several books on the subject and writes a regular column for Visual Merchandising and Store Design. He is a global trend consultant for many top retailers in the U.S. and Europe.

Wayne Badovinus – strategic planning and catalogue retailing: Mr. Badovinus has over 30 years of retail and catalogue experience with such highly respected firms as Williams Sonoma (where he was President and COO) and Eddie Bauer, where he held the position of president and CEO Under Mr. Badovinus’ guidance Bauer grew from $250 million to over $2 billion.

Financial Plan investor-ready personnel plan .">

Key assumptions.

Our assumptions are detailed in the proceeding tables. We have planned for relatively slow but stable general economic growth and an interest rate on borrowing of 9.5%. Because our business is a combination of retail and wholesale our collection days may look somewhat optimistic. That is caused by our assumption that approximately 70% of our retail sales will be done on credit cards and debit cards. There is a three-day payment lag on these sales. We assumed that wholesale customers would pay on an average of 50 days and that in year one 60% of our business would be on terms. As we develop our customer base (at wholesale) this number is ramped up to 80% by year five. (Our terms will be C.O.D. on all opening orders.) Our payments to vendors are assumed at 45 days.

Revenue by Month

Expenses by month, net profit (or loss) by year, use of funds.

Start-up costs are shown in three areas. The first is in the start-up table, the second is within the cash flow assumptions and the third is in the P&L.

- Start-up expenses: legal (incorporation and trademark registration), stationery (business cards and office supplies), etc., brochures, consultants (graphic design for logo and packaging), research and development (architecture fees for store and trade fixture design).

- Start-up costs expressed in year one cash flow: FF&E for first Bluespa retail store.

- Start-up costs included within year one P&L: brand marketing, management staff, travel costs to coordinate product development.

Start-up Expenses referenced in retained earnings:

Legal $2,500

Stationery etc. $3,000

Brochures $10,000

Consultants $15,000

Research and Development $30,000

Expensed Equipment $60,000

Other $50,000

TOTAL START-UP EXPENSES $170,500

Sources of Funds

The start up expense for this company is $420,000. There is $100,000 in current borrowing, $256,000 from founder Ray and $64,000 from founder Barbara.

Projected Profit & Loss

Projected balance sheet, projected cash flow statement.

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

IMAGES

VIDEO