Underwriting Assistant Cover Letter Example for 2024 (Free Templates)

Craft an exceptional Underwriting Assistant Cover Letter with the help of our online builder. Explore professional example cover letter templates tailored for various levels and specialties. Make a strong impression on employers with a refined, professional Cover Letter. Secure your dream job today!

Table of Contents

As an aspiring Underwriting Assistant, crafting a well-structured cover letter is your first step toward a rewarding career in the insurance industry. A compelling cover letter not only highlights your qualifications but also showcases your enthusiasm for the role, making it an essential component of your job application. In this comprehensive guide, you'll discover valuable insights and expert tips that will help you create an impactful cover letter that stands out to potential employers. We’ll delve into the key elements of an effective cover letter, including:

- Understanding the specific role and responsibilities of an Underwriting Assistant

- Tailoring your cover letter to the job description

- Highlighting relevant skills and experiences

- Crafting an engaging introduction and conclusion

- Utilizing industry-specific language and terminology

- Providing a polished format and structure for your letter

With a practical cover letter example included, you’ll have the tools you need to write a letter that effectively communicates your qualifications and eagerness for the position. Let’s unlock the secrets to making your application shine!

What does a Underwriting Assistant Cover Letter accomplish?

A cover letter for an Underwriting Assistant plays a crucial role in highlighting the applicant’s relevant skills, experience, and enthusiasm for the position, effectively complementing their resume. It serves as a personalized introduction that allows candidates to convey their understanding of underwriting processes, attention to detail, and ability to support underwriters in evaluating risk. By demonstrating a keen interest in the role and showcasing how their qualifications align with the job requirements, candidates can make a strong impression on potential employers. For those seeking guidance on crafting a compelling letter, a cover letter guide can provide valuable insights, while a cover letter builder can streamline the creation process, ensuring that applicants present their best selves.

Key Components of a Underwriting Assistant Cover Letter

- Introduction and Purpose : Start with a strong opening that captures the hiring manager's attention. Clearly state the position you are applying for and express your enthusiasm for the role of Underwriting Assistant. Mention how you found the job listing and include a brief overview of your qualifications.

- Relevant Skills and Experience : Highlight your relevant skills and experiences that make you a suitable candidate for the Underwriting Assistant position. Discuss your familiarity with underwriting processes, attention to detail, and any specific software or tools you are proficient in. Use examples to demonstrate how your background aligns with the job requirements.

- Knowledge of the Industry : Show your understanding of the insurance industry and underwriting practices. Mention any relevant coursework, certifications, or previous roles that have equipped you with the knowledge necessary for this position. This demonstrates your commitment to the field and your ability to contribute effectively.

- Closing and Call to Action : Conclude your cover letter with a strong closing statement. Thank the hiring manager for considering your application and express your desire for an interview to discuss your qualifications further. Reinforce your enthusiasm for the Underwriting Assistant role and provide your contact information for follow-up.

For more insights on writing effective cover letters, you can explore cover letter examples and learn about the best cover letter format .

How to Format a Underwriting Assistant Cover Letter

As an aspiring Underwriting Assistant, I am eager to present my qualifications and enthusiasm for the role. My background in finance, paired with strong analytical skills and attention to detail, positions me as a valuable asset to your underwriting team. Below are key components to consider when formatting an impactful cover letter for this position:

- Start with a professional header that includes your name, address, phone number, and email, followed by the date and the employer's contact information.

- Address the hiring manager by name, if possible, to personalize the letter and demonstrate your interest in the specific role.

- Open with a compelling introduction that states the position you are applying for and where you found the job listing.

- Clearly express your enthusiasm for the company and the underwriting field, highlighting what attracts you to this specific role.

- Briefly outline your relevant experience, focusing on skills that directly relate to underwriting, such as risk assessment and data analysis.

- Mention any relevant education, certifications, or training that enhances your candidacy, such as a degree in finance or an insurance-related certification.

- Emphasize your attention to detail and organizational skills, providing examples of how these abilities have contributed to your success in previous roles.

- Highlight your ability to work collaboratively within a team and communicate effectively, as these are essential skills in underwriting.

- Conclude with a strong closing statement that reiterates your interest in the position and your eagerness to contribute to the company.

- Include a polite call to action, inviting the hiring manager to contact you for further discussion or an interview.

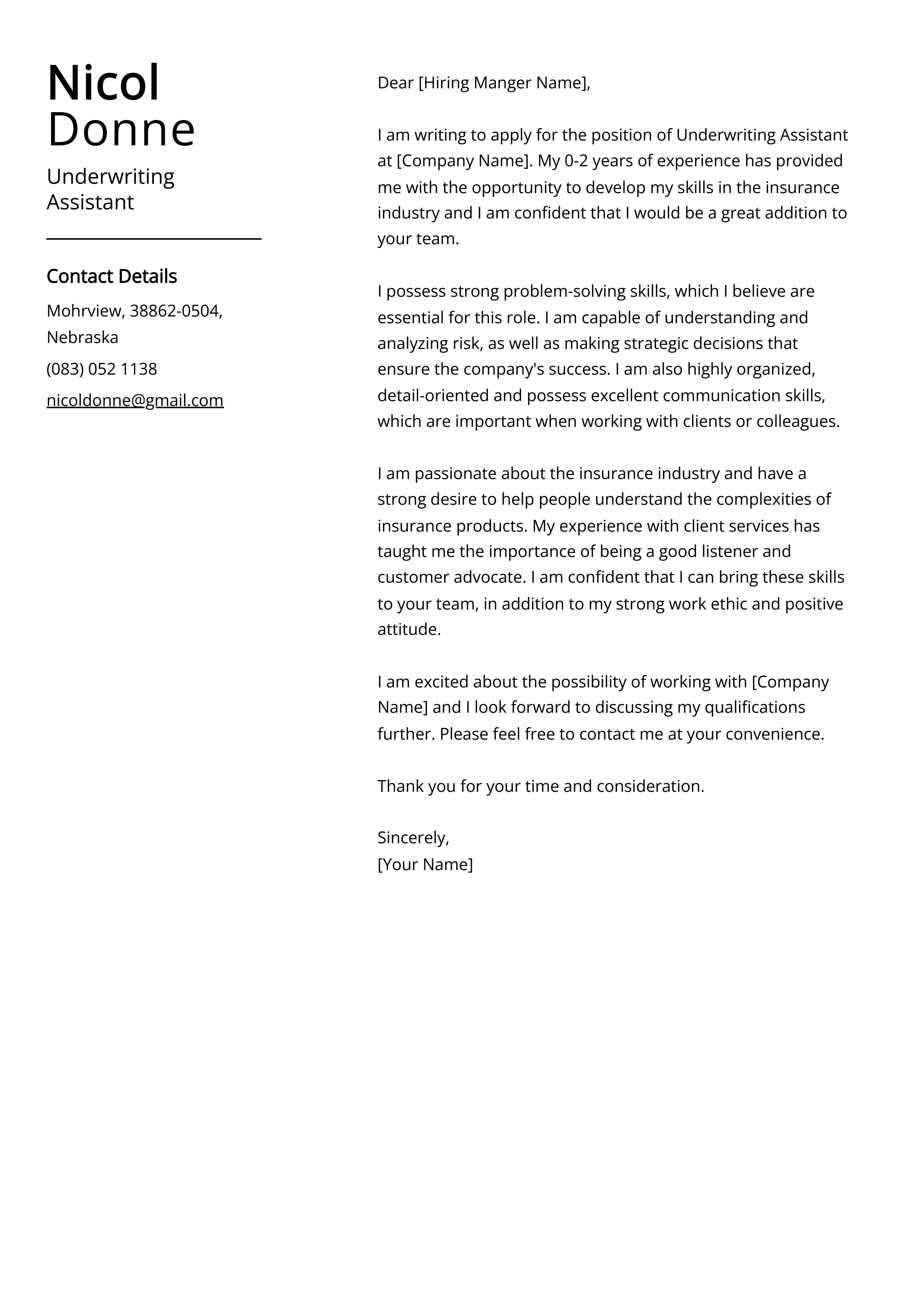

Underwriting Assistant Entry-Level Cover Letter Example #1

I am writing to express my interest in the Underwriting Assistant position at [Company Name] as advertised on [Where You Found the Job Posting]. As a recent graduate with a degree in Finance from [University Name], I have developed a strong foundation in risk assessment, data analysis, and financial evaluation. My academic background, combined with my passion for the insurance industry, makes me a suitable candidate for this role.

During my time at [University Name], I completed an internship at [Previous Internship Company], where I assisted the underwriting team in evaluating insurance applications and analyzing risk factors. This experience allowed me to hone my analytical skills, as I was tasked with reviewing applicant data, conducting market research, and preparing reports for senior underwriters. I learned the importance of attention to detail and the impact that accurate information has on underwriting decisions. Additionally, my coursework in statistics and financial modeling has equipped me with the necessary skills to interpret data effectively and support the underwriting process.

Furthermore, I possess strong organizational and communication skills, which I believe are crucial for a successful Underwriting Assistant. In my previous role as a part-time administrative assistant at [Company/Organization Name], I managed multiple tasks, including scheduling meetings, maintaining records, and preparing documentation, all while providing exceptional customer service. I understand the importance of collaboration within teams and am eager to contribute my skills and enthusiasm to [Company Name].

I am excited about the opportunity to join your team and contribute to the important work of assessing and managing risk. I am confident that my background and eagerness to learn will make me a valuable asset to [Company Name]. Thank you for considering my application. I look forward to the possibility of discussing my candidacy further.

Underwriting Assistant Mid-Level Cover Letter Example #2

I am writing to express my interest in the Underwriting Assistant position at [Company Name], as advertised on [where you found the job posting]. With over [X years] of experience in the insurance industry and a solid background in underwriting support, I am confident in my ability to contribute effectively to your team and help streamline your underwriting processes.

In my previous role as an Underwriting Assistant at [Previous Company Name], I honed my skills in analyzing risk factors and assisting underwriters in making informed decisions. I was responsible for reviewing and processing applications, conducting thorough research on potential clients, and gathering necessary documentation to ensure compliance with company policies. My attention to detail allowed me to identify discrepancies and recommend necessary adjustments, which contributed to a reduction in processing time by [X %] and improved accuracy in our assessments.

Additionally, I have developed strong communication skills through my interactions with clients, brokers, and other stakeholders. I pride myself on my ability to explain complex underwriting concepts in a clear and concise manner, which has fostered positive relationships and facilitated smoother communication between departments. My proficiency in using underwriting software and databases has also enabled me to efficiently manage workflows and maintain organized records, allowing my team to focus on strategic decision-making.

I am particularly drawn to the opportunity at [Company Name] because of your commitment to innovation and excellence in the insurance field. I am eager to bring my analytical skills, attention to detail, and collaborative spirit to your organization. I am excited about the possibility of contributing to your team and supporting the underwriting process to achieve optimal outcomes for both the company and its clients.

Thank you for considering my application. I look forward to the opportunity to discuss how my experience and skills align with the needs of your team. I am eager to bring my passion for underwriting and commitment to excellence to [Company Name].

Underwriting Assistant Experienced Cover Letter Example #3

I am writing to express my interest in the Underwriting Assistant position at [Company Name] as advertised. With over [X years] of comprehensive experience in the insurance industry, particularly within underwriting support, I possess a deep understanding of the underwriting process and a proven track record of assisting underwriters in evaluating risk and facilitating the underwriting workflow efficiently.

In my previous role at [Previous Company Name], I successfully managed the processing of insurance applications, ensuring that all documentation was complete and accurate. My attention to detail enabled me to identify discrepancies early on, which not only improved turnaround times but also enhanced the overall quality of our underwriting decisions. I developed strong relationships with underwriters, enabling me to understand their specific needs and preferences, which in turn allowed me to tailor my support effectively. My efforts contributed to a [specific achievement, e.g., 20% reduction in processing time or a significant increase in customer satisfaction ratings].

Additionally, I have experience in utilizing underwriting software and tools, including [specific software or tools], which has allowed me to streamline data entry and analysis. I have actively participated in training sessions aimed at improving team efficiency, and I am always eager to adopt new technologies that enhance our capabilities. My ability to analyze complex data sets and extract actionable insights has been instrumental in assisting underwriters with risk assessments, ensuring that we maintain our competitive edge in the market.

Moreover, my strong organizational skills and ability to prioritize tasks effectively have allowed me to excel in fast-paced environments. I have successfully coordinated multiple projects simultaneously while maintaining a high level of accuracy and compliance with company policies and industry regulations. I am adept at communicating with various stakeholders, including clients, agents, and internal teams, fostering collaboration that drives successful outcomes.

I am excited about the opportunity to bring my expertise in underwriting support to [Company Name]. I am confident that my extensive experience, combined with my proactive approach and dedication to excellence, would make me a valuable asset to your team. I look forward to the possibility of discussing how I can contribute to the continued success of your underwriting department. Thank you for considering my application.

Cover Letter Tips for Underwriting Assistant

When crafting a cover letter for an Underwriting Assistant position, it's crucial to highlight both your analytical skills and attention to detail, as these are key components of the role. Begin with a strong opening that captures your enthusiasm for the position and the company. Tailor your letter to reflect your understanding of the underwriting process and how your background and skills align with the requirements of the job. Use specific examples from your experience to demonstrate your capabilities, and remember to convey your eagerness to contribute to the team. Finally, ensure your letter is well-organized and free from errors, as this reflects your professionalism and precision—qualities essential in underwriting.

- Tailor Your Letter: Customize your cover letter for each application, addressing the specific job description and company culture.

- Highlight Relevant Skills: Focus on skills such as data analysis, attention to detail, and familiarity with underwriting processes.

- Use Specific Examples: Include concrete examples from your previous experience to illustrate your qualifications and achievements in related tasks.

- Show Enthusiasm: Convey genuine interest in the position and the insurance industry, and explain why you are passionate about underwriting.

- Keep It Professional: Maintain a formal tone and structure. Use clear language and avoid jargon that may not be understood by everyone.

- Proofread Carefully: Ensure your cover letter is free of grammatical errors and typos, as these can undermine your professionalism.

- Include Metrics: Where possible, quantify your achievements (e.g., "Processed X number of applications per week") to showcase your efficiency and effectiveness.

- Mention Soft Skills: Don’t forget to highlight soft skills like communication, teamwork, and problem-solving, which are vital in collaborative underwriting environments.

How to Start a Underwriting Assistant Cover Letter

As you begin your cover letter for the Underwriting Assistant position, it's essential to make a strong first impression. Here are some effective introductory paragraphs to consider:

I am excited to apply for the Underwriting Assistant position at [Company Name]. With a solid foundation in insurance principles and a keen eye for detail, I am eager to support your underwriting team in delivering exceptional service and accurate risk assessments. With a background in administrative support and a passion for the insurance industry, I am thrilled to submit my application for the Underwriting Assistant role at [Company Name]. I am confident that my skills in data management and customer service will contribute to your team’s success. I am writing to express my interest in the Underwriting Assistant position listed on [Job Board/Website]. My experience in analyzing data and assisting in underwriting processes aligns well with the requirements of this role, and I am excited about the opportunity to contribute to [Company Name]. As a detail-oriented professional with a strong analytical mindset, I am eager to apply for the Underwriting Assistant position at [Company Name]. My previous experience in the insurance sector has equipped me with the skills necessary to excel in supporting your underwriting team. I am enthusiastic about the opportunity to join [Company Name] as an Underwriting Assistant. With a background in finance and a commitment to accuracy, I am prepared to assist in streamlining your underwriting processes and providing valuable insights to support decision-making.

How to Close a Underwriting Assistant Cover Letter

As you conclude your cover letter for the Underwriting Assistant position, it's essential to leave a lasting impression that reinforces your enthusiasm and suitability for the role. Here are some effective closing examples:

“I am excited about the opportunity to contribute to your underwriting team and am eager to bring my skills in analysis and attention to detail to [Company Name]. I look forward to the possibility of discussing how I can support your goals.”

“Thank you for considering my application. I am passionate about the underwriting field and would be thrilled to leverage my organizational skills and commitment to excellence at [Company Name]. I hope to speak with you soon.”

“I appreciate your time in reviewing my application. I am confident that my proactive approach and ability to work collaboratively will be beneficial for [Company Name]. I look forward to the opportunity to discuss my application further.”

“Thank you for the opportunity to apply for the Underwriting Assistant position. I am eager to bring my strong analytical abilities and dedication to your team and am looking forward to the possibility of contributing to [Company Name].”

Common Mistakes to Avoid in a Underwriting Assistant Cover Letter

When applying for the position of an Underwriting Assistant, your cover letter serves as a critical first impression that can set you apart from other candidates. Crafting a compelling cover letter requires attention to detail and an understanding of what employers are looking for. However, many applicants make common mistakes that can undermine their chances of landing an interview. To help you create a standout cover letter, here are some pitfalls to avoid:

- Using a Generic Template : Failing to personalize your cover letter for the specific job and company can make it seem insincere.

- Neglecting to Highlight Relevant Skills : Not emphasizing skills specific to underwriting, such as analytical thinking or attention to detail, can weaken your application.

- Being Overly Formal or Casual : Striking the right tone is crucial; being too formal can seem stiff, while being too casual may come off as unprofessional.

- Focusing Too Much on Responsibilities Instead of Achievements : Employers prefer to see how you’ve made an impact in your previous roles rather than just listing duties.

- Ignoring the Job Description : Not aligning your cover letter with the qualifications and responsibilities outlined in the job posting can make you seem unfit for the role.

- Making Spelling and Grammar Errors : Typos or grammatical mistakes can signal a lack of attention to detail, which is crucial in underwriting.

- Failing to Include a Call to Action : Not encouraging the reader to follow up or expressing your desire for an interview can make your cover letter seem lackluster.

- Writing Too Much or Too Little : A cover letter should be concise and focused, ideally one page, so avoid rambling or being overly brief.

- Not Researching the Company : Showing a lack of knowledge about the company can indicate disinterest; demonstrating understanding can help you stand out.

- Using Clichés or Generic Phrases : Overused phrases can make your letter feel unoriginal; strive for authenticity and specificity in your writing.

Key Takeaways for a Underwriting Assistant Cover Letter

In conclusion, a well-crafted cover letter for the Underwriting Assistant position can significantly enhance your chances of making a strong impression on potential employers. Highlighting your attention to detail, analytical skills, and ability to work collaboratively with underwriters will demonstrate your suitability for the role. Make sure to tailor your letter to reflect the specific requirements of the job and showcase relevant experiences that align with the responsibilities of an underwriting assistant.

To further streamline your cover letter creation process, consider utilizing professional cover letter templates or a cover letter builder . These resources can provide you with structured formats and tips, ensuring that your cover letter is not only well-organized but also visually appealing. By investing time in this crucial document, you can effectively convey your qualifications and enthusiasm for the underwriting industry.

Build your Cover Letter in minutes

Use an AI-powered cover letter builder and have your letter done in 5 minutes. Just select your template and our software will guide you through the process.

Make a cover letter in minutes

Pick your template, fill in a few details, and our builder will do the rest.

Resume Worded | Career Strategy

14 assistant underwriter cover letters.

Approved by real hiring managers, these Assistant Underwriter cover letters have been proven to get people hired in 2024. A hiring manager explains why.

Table of contents

- Assistant Underwriter

- Senior Underwriter

- Senior Underwriting Analyst

- Underwriting Assistant

- Junior Underwriter

- Commercial Lines Underwriter

- Underwriting Specialist

- Alternative introductions for your cover letter

- Assistant Underwriter resume examples

Assistant Underwriter Cover Letter Example

Why this cover letter works in 2024, personal connection to the industry.

Sharing a personal anecdote about growing up with a parent in the insurance industry helps create an authentic connection to the company and showcases genuine interest in the field.

Specific Accomplishments

Highlighting specific accomplishments, such as developing an algorithm and integrating underwriting software, demonstrates the candidate's problem-solving abilities and relevance to the role.

Combining Passion and Skills

Expressing excitement about working at the company and combining passion for insurance with a drive to make a difference shows the candidate's enthusiasm and commitment to the role.

Highlighting Specific Achievements

Remember, employers love data. By emphasizing your contribution to risk assessment accuracy at a previous job, you're providing tangible evidence of your skills. This not only shows you understand what’s important in your role, but also that you can deliver results. However, don't just state the achievement, explain how you did it. The more specific you can be, the more credible your claim becomes.

Showcase Efficiency Improvements

The ability to streamline processes and improve efficiency is highly valued in any role, but particularly for an Assistant Underwriter. Reducing claim processing time directly impacts customer satisfaction and company profitability. By showing you've done this, you demonstrate a focus on productivity and a proactive approach to problem-solving.

Showcase Your Achievements Concretely

When you mention how you've successfully streamlined processes and reduced assessment times, it's fantastic because it shows you're proactive, innovative and results-oriented. This tangible evidence of your effectiveness is exactly what hiring managers look for. You're not only talking about your duties but importantly, you're highlighting the impact of your work.

Highlight Your Team Contributions

The fact that you developed a training module for new underwriters is impressive. It suggests that you're not just a great individual worker but also someone who contributes significantly to the team and thinks about the bigger picture. Demonstrating that you can help others improve their skills is a wonderful asset.

Match Their Culture

You've clearly done your homework about the company's values and goals. By expressing excitement about working with a team that uses data science in underwriting, you're signalling that you're not just interested in the role, but that you're a perfect cultural fit as well.

Reiterate Your Value

By summarising your skills and experience, and how they can contribute to the employer's success, you remind the employer once again why you would be a valuable asset. It's a strong conclusion that leaves a lasting impression.

End on a Positive and Expectant Note

Appreciating the opportunity and expressing anticipation about potential discussions is a polite and positive way to wrap up your cover letter. It leaves the ball in their court, subtly encouraging them to invite you for an interview.

Show your genuine interest in underwriting

When you share a personal story about your early fascination with insurance, it makes your enthusiasm for the assistant underwriter role feel genuine.

Highlight your practical experience

Describing a specific project where you improved a process shows you can apply your skills to make a real difference.

Demonstrate your ability to communicate

Stating that you can explain complex concepts clearly proves you can be a bridge between technical teams and clients.

Align your values with the company's

Mentioning that you share the company's commitment to innovation shows you've done your homework and see yourself fitting in.

Express gratitude in your closing

A simple thank you can make your cover letter feel polite and professional, leaving a positive impression.

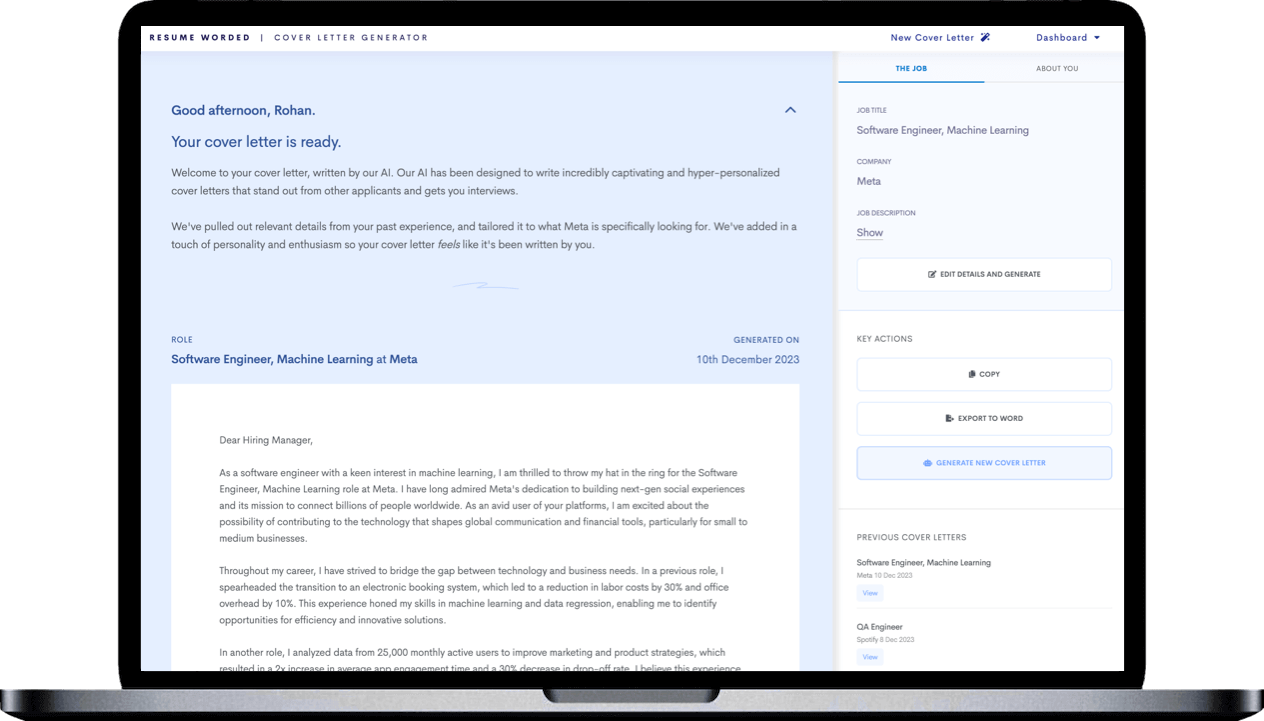

Does writing cover letters feel pointless? Use our AI

Dear Job Seeker, Writing a great cover letter is tough and time-consuming. But every employer asks for one. And if you don't submit one, you'll look like you didn't put enough effort into your application. But here's the good news: our new AI tool can generate a winning cover letter for you in seconds, tailored to each job you apply for. No more staring at a blank page, wondering what to write. Imagine being able to apply to dozens of jobs in the time it used to take you to write one cover letter. With our tool, that's a reality. And more applications mean more chances of landing your dream job. Write me a cover letter It's helped thousands of people speed up their job search. The best part? It's free to try - your first cover letter is on us. Sincerely, The Resume Worded Team

Want to see how the cover letter generator works? See this 30 second video.

Share your initial fascination

Starting with your early interest in insurance and underwriting shows a long-standing commitment to the field.

Highlight your professional journey

Discussing your progress in risk assessment and problem-solving demonstrates growth and readiness for the assistant underwriter role.

Speak to your confidence and passion

Stating your confidence based on technical skills and passion suggests you will be a motivated and dedicated team member.

Align with the company’s vision

Sharing that the company’s goals match your own shows that you’re not just looking for any job, but a place where you can belong and excel.

Close with a forward-looking statement

An offer to discuss your contribution in more detail indicates you’re proactive and serious about the role.

Show your early passion

Telling us about your early interest in insurance helps us see your genuine enthusiasm for the field. This is good to know.

Highlight real-world experience

Explaining how you improved a process during your internship shows you can bring real value to our team with practical skills.

Demonstrate ongoing development

By sharing how you've built on your analytical skills, you're showing us that you're always looking to improve and contribute more effectively.

Express excitement for growth

When you talk about what excites you regarding the role, it makes us believe you're ready to invest your energy and grow with us.

Close with a strong future focus

Ending your letter by looking forward to a discussion about your potential contribution sets a positive, forward-moving tone.

Senior Underwriter Cover Letter Example

Demonstrate impact on customer retention.

As a Senior Underwriter, your work impacts not just risk assessment but also customer retention. Highlighting an increase in policy renewal rate shows you understand the importance of customer engagement and can take strategic action to improve it. This evidence of your capacity to secure customer loyalty can make you a strong candidate.

Show Your Innovative Approach

Insurance is a field that benefits from fresh perspectives, so showcasing your innovative approach to risk assessment is smart. A boost in underwriting accuracy not only shows your capability to perform exceptionally in your role but also illustrates your potential to bring creative solutions and a different perspective to the team.

Senior Underwriting Analyst Cover Letter Example

Highlight your leadership.

You're not just talking about what you've done, but what you've led. This is a great way to show that you are capable of managing projects and teams. Plus, your mention of concrete results, like the 20% improvement in risk prediction accuracy, reinforces your effectiveness as a leader.

Emphasize Innovation

Leading a partnership to integrate AI into risk assessment processes is a clear indicator of your innovative mindset. In an industry that is continuously evolving, showing that you're ahead of the curve and can leverage new technologies is a huge win.

Align Your Aspirations

Highlighting the company's use of technology and how it aligns with your professional goals is a smart move. It shows compatibility between your aspirations and the company's direction, making you a compelling candidate.

Affirm Your Value

By summarizing all your key skills and how they can contribute to their mission, you're effectively saying, "Here's what I bring to the table." It's a strong conclusion that leaves no doubt about your suitability for the role.

Express Enthusiasm and Gratitude

The thank you note at the end, paired with the anticipation of a possible discussion, creates a warm, positive ending. It's a great way to finish your cover letter, encouraging the reader to respond positively by inviting you for an interview.

Underwriting Assistant Cover Letter Example

Connect your education to your career goals.

Pointing out relevant courses you've taken demonstrates a strong foundation and a clear direction towards underwriting.

Emphasize teamwork and critical thinking

Sharing experiences that highlight your ability to work in a team and tackle complex problems shows you're a well-rounded candidate.

Share your internship success

Talking about your achievements during an internship provides concrete evidence of your potential as an underwriting assistant.

Show enthusiasm for the role

Expressing excitement about the opportunity to contribute to the company indicates you're motivated and eager to make an impact.

Your closing remarks should reflect your eagerness to support the company's mission, suggesting a future where you're part of their success.

Show your passion for the insurance industry

Starting your cover letter with a personal story that connects to the industry can show me you're not just looking for any job, but that you have a genuine interest in insurance.

Highlight your achievements with numbers

When you mention saving the company money, it tells me you're not only capable but also bring tangible benefits. It's important to quantify your success.

Express excitement for the role

Your enthusiasm for the position and the company can be contagious. It makes me believe you'll be a motivated and engaged team member.

Link your experience to company resources

By aligning your skills with our tools, you're showing me you understand and are already thinking about how you can contribute to our team.

Close with eagerness to contribute

Ending your letter by expressing a desire to help the company succeed demonstrates that you're team-oriented and focused on making an impact.

Junior Underwriter Cover Letter Example

Start with a personal connection.

Talking about how you entered the insurance field shows you have a genuine interest, which is more appealing than just having skills.

Detail your relevant experiences

Describing a specific project where you identified risks that others missed proves your ability to add value as a junior underwriter.

Showcase your analytical skills

Highlighting your analytical and communication skills prepares you for the complex tasks in the insurance industry.

Connect your skills to the job

Confidence in your relevant skills hints you're a good fit for the role and ready to contribute from day one.

Express gratitude and eagerness

A polite thank you note and expressing eagerness shows professionalism and enthusiasm for the opportunity.

Connect your passion to the underwriter role

Illustrating your love for math and problem-solving directly relates to the core of underwriting, showing me you have the right mindset for the job.

Showcase practical experience

Describing your hands-on experience during your internship gives me confidence in your ability to jump right into the role and start contributing.

Express alignment with company values

When you highlight your excitement for our innovation and customer service, it tells me you've done your homework and see yourself fitting in with our culture.

Demonstrate confidence in your ability to excel

Stating your confidence in your skills and enthusiasm to learn shows me you're prepared to tackle challenges and grow in the role.

End with a forward-looking statement

Your closing remark about contributing to our success paints a picture of you as a future valuable team member, eager to advance both the company and your career.

Commercial Lines Underwriter Cover Letter Example

Personal connection to the field.

Starting with your personal background connects you to the commercial insurance field in a unique, memorable way.

Showcase impactful achievements

Describing how you created a more accurate rating system proves you're capable of making significant improvements that benefit the company.

Emphasize alignment with company values

Mentioning your appreciation for customized solutions aligns your values with ours, making you a potentially great fit.

Communicate confidence in your ability

Stating your confidence in contributing to our growth reassures us of your potential value to the team.

Invite further discussion

Ending with an invitation to discuss how you can add value shows you're proactive and ready for the next step.

Underwriting Specialist Cover Letter Example

Show your passion for underwriting and risk management.

When you talk about your excitement for finance and risk management, it helps us see that you are truly interested in the field. This kind of enthusiasm is what we look for in candidates.

Demonstrate measurable achievements in underwriting

Mentioning specific results, like reducing turnaround time and improving customer satisfaction, shows that you not only understand your role but also excel at it. It's proof of your ability to make a positive impact.

Highlight excitement for diverse client work

Expressing eagerness to work with a variety of clients indicates that you're ready for challenges and adaptable. This trait is highly valued in underwriting, where understanding different industries is key.

Connect your skills to the company's needs

By confidently stating that your passion and track record can contribute to the company, you're showing that you understand what the role entails and that you're capable of filling it successfully.

Express eagerness for a personal meeting

Asking for a chance to discuss how you can contribute to the team highlights your proactive attitude. It's a subtle call to action that can encourage a hiring manager to move forward with your application.

Alternative Introductions

If you're struggling to start your cover letter, here are 6 different variations that have worked for others, along with why they worked. Use them as inspiration for your introductory paragraph.

Cover Letters For Jobs Similar To Assistant Underwriter Roles

- Assistant Underwriter Cover Letter Guide

- Commercial Underwriter Cover Letter Guide

- Credit Underwriter Cover Letter Guide

- Loan Underwriter Cover Letter Guide

- Underwriter Cover Letter Guide

Other Legal Cover Letters

- Attorney Cover Letter Guide

- Contract Specialist Cover Letter Guide

- Lawyer Cover Letter Guide

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

16+ Underwriting Assistant Cover Letter Examples & Samples

Discover over 15 underwriting assistant cover letter examples for 2024, complete with tips and best practices to help you stand out in the insurance industry. Learn how to craft a compelling cover letter that highlights relevant skills and effectively showcases your qualifications for underwriting positions. Explore our resource-rich page to elevate your job application and make a strong impression.

In the dynamic world of the insurance industry, underwriting assistants play a pivotal role in ensuring that risks are accurately assessed and processed, contributing significantly to the organization's overall success. As an aspiring underwriting assistant, showcasing your qualifications through a well-crafted cover letter is essential for capturing the attention of hiring managers. Employers typically seek candidates with a blend of technical skills—such as data analysis and knowledge of underwriting procedures—and essential soft skills like communication and attention to detail. A tailored cover letter not only highlights your relevant skills and experience but also serves as a powerful tool to differentiate you from the competition. In this guide, you will find over 15 underwriting assistant cover letter examples for 2024, along with valuable writing tips and formatting best practices that will empower you to create an impactful application. Let us help you effectively convey your passion for the underwriting field and maximize your chances of landing an interview by exploring these resources designed specifically for your success.

Underwriting Assistant Cover Letter Example

How to write a underwriting assistant cover letter.

Crafting an impactful underwriting assistant cover letter is essential for making a lasting impression on hiring managers in the insurance industry. A well-organized cover letter not only outlines your relevant skills and experiences but also showcases your professional traits, such as attention to detail and strong communication skills. In the world of underwriting, where precision and clarity are paramount, the format of your cover letter can significantly influence your chances of securing an interview.

Purpose of This Section

In this section, we will guide you through the essential components of formatting a cover letter specifically for underwriting positions. We will provide profession-specific insights, tips, and examples to help you create a compelling document that communicates your expertise and suitability for the role. Remember, a well-formatted cover letter serves as your introduction to potential employers, making a strong case for your candidacy.

Key Components of an Underwriting Assistant Cover Letter

Cover Letter Header

- This section establishes your professionalism by including your contact information and the date, ensuring that hiring managers can easily reach out for follow-up.

Cover Letter Greeting

- A personalized greeting demonstrates your attention to detail and respect for the hiring process, making it essential to address the recipient appropriately.

Cover Letter Introduction

- The introduction is your opportunity to hook the reader by clearly stating the position you are applying for and conveying your enthusiasm for underwriting, setting the tone for the rest of the letter.

Cover Letter Body

- In this section, elaborate on your relevant skills for an underwriting assistant role and provide examples from your experience that illustrate your qualifications, aligning your abilities with the needs of the employer.

Cover Letter Closing

- The closing reinforces your interest in the position and encourages further conversation. A strong finish proves your commitment and invites the employer to take the next step in the hiring process.

Each part of your underwriting assistant cover letter plays a crucial role in showcasing your professionalism and suitability for the position. Let’s dive deeper into each section to highlight what to focus on and ensure your cover letter stands out among other applicants for underwriting assistant roles.

Cover Letter Header Examples for Underwriting Assistant

Great header.

(555) 123-4567

Explanation

The cover letter header serves as your first introduction to potential employers, establishing a professional tone right from the start. For an Underwriting Assistant position, a precise and clear header is vital, as it conveys your organizational skills and attention to detail—both of which are crucial in the insurance industry. A well-crafted header not only provides essential contact information but also sets the stage for your qualifications and interest in the role.

What to Focus on with Your Cover Letter Header

In crafting the header for your cover letter as an Underwriting Assistant, ensure that it is professionally formatted and includes all critical contact information. This includes your full name, a professional email address, a reliable phone number, and the date you are submitting the application. Additionally, address the letter directly to the hiring manager with their full name and title, along with the organization’s name. Consistency in formatting across your cover letter, resume, and any other documents will project professionalism and attention to detail. Avoid using abbreviations or informal language, as clarity is key in this role.

Common Mistakes to Avoid

- Using an unprofessional email address (e.g., [email protected])

- Failing to include a complete recipient's name

- Using an informal phone number format

- Not aligning the header properly with the rest of the document

To ensure your header stands out for the Underwriting Assistant position, use a clean, professional font and organize the information neatly. Your email should be simple and appropriate, and the date must be current and clearly formatted. Be consistent in formatting with the rest of your application materials to create a cohesive, polished look that reflects your professionalism in the underwriting field.

Cover Letter Greeting Examples for Underwriting Assistant

Great greeting.

Dear Ms. Rodriguez,

Bad greeting

The greeting of your cover letter is pivotal as it is the initial point of contact with the hiring manager or the hiring committee. It sets the tone for your overall application and provides insight into your professionalism and attention to detail. For the position of Underwriting Assistant, a well-crafted greeting indicates your respect for the organization and your understanding of the industry, which often values precision and formality.

How to Get Your Cover Letter Greeting Right

When addressing a cover letter for an Underwriting Assistant position, strive to use a greeting that is both formal and specific. If you know the name of the hiring manager or the head of the underwriting department, use it in your greeting, such as 'Dear Ms. Smith,' or 'Dear Mr. Johnson.' If you do not have a name, an appropriate alternative would be 'Dear Hiring Group' or 'Dear Underwriting Team.' Avoid vague or overly casual greetings like 'To Whom It May Concern' or 'Hi there,' as they can suggest a lack of effort or professionalism.

For the best cover letter greeting as an Underwriting Assistant, prioritize professionalism and specificity. Utilize the hiring manager's name if possible, but if you can't find it, opt for a title or department name to show your respect and interest in the role.

Cover Letter Intro Examples for Underwriting Assistant

Great intro.

As an experienced insurance professional with over four years of experience in underwriting support, I am thrilled to apply for the Underwriting Assistant position at your company. My strong analytical skills and attention to detail have enabled me to excel in risk assessment and ensure compliance with underwriting guidelines. I admire your commitment to innovation in the insurance sector and am eager to contribute to a team that prioritizes both integrity and excellence in underwriting practices.

I am applying for the Underwriting Assistant role at your company. I have some experience in insurance and believe I would be a good fit. I like the idea of working in underwriting and hope to learn more.

The introduction of your cover letter is crucial for making a strong first impression on the hiring manager for an Underwriting Assistant position. It serves as an opportunity to succinctly convey your relevant experience, skills, and enthusiasm for the role. This is particularly important in the underwriting field, where attention to detail and analytical skills are paramount. A well-crafted introduction not only showcases your qualifications but also aligns your values with those of the company, emphasizing your commitment to the underwriting profession.

How to Craft an Effective Cover Letter Introduction

When applying for an Underwriting Assistant position, your introduction should grab attention by highlighting your relevant experience in insurance or finance. Start with a concise overview of your background that showcases your analytical thinking and attention to detail. Show your genuine interest in the role by mentioning specific aspects of the company or its values that resonate with you. Ensure that your introduction reflects your understanding of the underwriting process and the importance of risk assessment and management.

- Starting with a generic statement that lacks specificity and fails to engage the reader.

- Focusing solely on your qualifications without connecting them to the company's needs.

- Using jargon or technical terms that may not be clearly understood by all hiring managers.

- Neglecting to mention why you are passionate about underwriting and how that aligns with the organization’s values.

To make your cover letter introduction stand out, emphasize your passion for the underwriting field and your commitment to accuracy and thoroughness. Include specific examples of your achievements or skills that directly relate to the requirements of the Underwriting Assistant role. Highlighting how your career goals align with the company's commitment to excellence can effectively capture the hiring manager's attention.

Cover Letter Body Examples for Underwriting Assistant

As a detail-oriented professional with two years of experience as an underwriting assistant, I have developed a robust understanding of risk assessment principles and the underwriting process. In my previous role at ABC Insurance, I assisted senior underwriters in evaluating insurance applications, where I effectively analyzed data and identified potential risks. My keen eye for detail enabled me to reduce errors in documentation by 30%, thereby enhancing team efficiency. I am proficient in utilizing software tools such as Excel and underwriting databases, which has allowed me to streamline processes and support accurate decision-making. I am eager to bring my strong analytical skills and commitment to excellence to your team, contributing to your firm's goals in delivering exceptional underwriting service.

I have worked in an office for a few years and have some experience with paperwork. I think I could do well as an underwriting assistant because I like working with numbers. I'm familiar with general office tasks and have a good attitude. I want to apply for this position at your company because it seems interesting. I believe I can learn a lot on the job and contribute positively.

The body of your cover letter is critical in an underwriting assistant application because it provides a platform to present your relevant experience, skills, and the unique contributions you can offer to the underwriting team. This section should articulate your understanding of risk assessment, data analysis, and effective communication with stakeholders, which are key aspects of the role. Being specific in your experiences and backing them up with concrete examples is vital for illustrating your preparedness for this position.

How to Craft an Effective Cover Letter Body

In crafting the body of your cover letter for the underwriting assistant position, focus on showcasing your analytical skills and attention to detail. Highlight specific experiences where you contributed to risk assessment, supported the underwriting process, or collaborated with senior underwriters on complex cases. Discuss any relevant software proficiencies you have, such as familiarity with underwriting tools or data management systems. Clearly communicate your commitment to maintaining accuracy and efficiency in underwriting tasks, linking your experiences to the specific needs of the prospective employer.

- Using generic job descriptions instead of specific examples from your experience.

- Failing to demonstrate knowledge of the underwriting process or industry.

- Overlooking the importance of effective communication and teamwork in the role.

- Neglecting to highlight relevant skills, such as attention to detail and analytical abilities.

To make your cover letter body stand out, emphasize your analytical achievements and how they relate to underwriting. Use specific examples, such as successful data analyses or improvements made in the underwriting process, to demonstrate your impact and dedication. This will highlight your qualifications and enthusiasm for the underwriting assistant role.

Cover Letter Closing Paragraph Examples for Underwriting Assistant

Great closing.

With my strong analytical skills and a keen eye for detail, I am excited about the opportunity to assist your underwriting team in evaluating and managing risk effectively. My background in data analysis combined with my customer service experience positions me uniquely to contribute to your organization’s success. I look forward to the possibility of discussing how I can support your team in detail.

Bad closing

I think I can help with underwriting if you hire me. I am interested in this position and hope you will get back to me soon.

The closing paragraph of your cover letter is your final chance to impress the hiring manager, specifically for the role of an Underwriting Assistant. This section should encapsulate your qualifications and your commitment to supporting the underwriting process. By effectively closing your cover letter, you reinforce your professional capability and eagerness to contribute to the company, which is crucial in a detail-oriented field like insurance underwriting.

How to Craft an Effective Cover Letter Closing

When crafting your closing paragraph as an Underwriting Assistant, emphasize your understanding of risk assessment and attention to detail. Highlight any experience with data analysis and customer service, as these skills are vital for the position. Clearly express your enthusiasm for the opportunity to support the underwriter team and indicate your readiness to discuss your qualifications in a follow-up interview. A decisive and confident close will resonate with employers who value meticulousness and dedication.

- Closing with a generic statement that fails to reiterate your excitement for the specific role and company.

- Neglecting to connect your skills and experiences back to the job requirements or the company’s mission.

- Using weak language that undercuts your confidence in your abilities.

- Failing to express a desire for follow-up or next steps, leaving uncertainty about your interest.

To close your cover letter effectively, focus on expressing your excitement for the Underwriting Assistant role and how your skills align with the team's needs. Make sure to convey your eagerness for an interview to discuss your qualifications in depth. A strong closing can significantly impact the hiring manager's perception of your application.

Cover Letter Writing Tips for Underwriting Assistants

Highlight your analytical skills.

As an Underwriting Assistant, it’s essential to showcase your analytical abilities in your cover letter. Discuss your experience in evaluating risk and reviewing policies. Emphasize your attention to detail when conducting research and analyzing financial information. For example, mention how you successfully identified key data trends that led to more informed underwriting decisions. This will illustrate your competence in the analytical aspects of the role.

Demonstrate Your Knowledge of Insurance Policies

Employers look for candidates who possess a solid understanding of underwriting processes and insurance products. Use your cover letter to detail your familiarity with different types of insurance policies, such as property, casualty, or life insurance. Provide examples of how your knowledge has allowed you to contribute effectively to underwriting teams or how you've supported underwriters in assessing applications based on specific policy guidelines.

Showcase Your Communication Skills

Excellent communication skills are vital for an Underwriting Assistant, as you will often interact with underwriters, clients, and other stakeholders. Highlight your ability to convey complex information clearly and concisely. Mention any experience you have in drafting reports, summarizing case studies, or providing updates to team members. This demonstrates to employers that you are capable of facilitating effective collaboration and maintaining transparent communication.

Tailor Your Cover Letter to the Specific Role

To make your cover letter stand out, tailor it to the Underwriting Assistant position you’re applying for. Research the company’s values, recent projects, and specific underwriting practices. Incorporate this information into your cover letter to show your genuine interest in the role and how your qualifications align with the company's goals. This personalization indicates to employers that you are invested in the opportunity.

Maintain a Professional and Polished Format

A well-structured and professional cover letter is essential. Ensure that your letter is clearly organized, with an engaging introduction, informative body paragraphs, and a concise conclusion. Use professional language and avoid jargon that may not be familiar to all readers. Don’t forget to proofread for grammatical errors and typos, as attention to detail is critical in the underwriting field. A polished cover letter reflects your professionalism and suitability for the role of Underwriting Assistant.

Cover Letter Mistakes to Avoid as an Underwriting Assistant

Including irrelevant information.

One of the most common mistakes applicants make in their cover letters for the Underwriting Assistant role is including irrelevant information. Candidates often list experiences or qualifications that do not directly pertain to underwriting, leading to a lack of focus. This can dilute the effectiveness of your cover letter, making it difficult for hiring managers to identify your suitability for the role.

Impact of the Mistake : Including irrelevant details can confuse hiring managers and distract from key qualifications that showcase your ability to excel as an Underwriting Assistant.

Corrective Advice : Focus on highlighting your relevant skills and experiences, such as prior roles in insurance, data analysis, or customer service. For example, instead of mentioning a job in retail, emphasize your experience with data entry or risk assessment. Tailor your letter to reflect the specific duties and skills outlined in the job description.

Overlooking Attention to Detail

Underwriting Assistants must demonstrate strong attention to detail, yet many candidates neglect to proofread their cover letters. Common mistakes may include typos, grammatical errors, or inconsistent formatting. Such oversights can signal to employers that you may carry the same approach into your work.

Impact of the Mistake : An unpolished cover letter can create a poor first impression, suggesting a lack of professionalism and seriousness about the application process.

Corrective Advice : Carefully review your cover letter for errors before submission. Consider tools like grammar checkers or enlist a trusted friend or mentor for a second opinion to catch any mistakes you might have overlooked.

Failing to Convey Industry Knowledge

Many job seekers overlook the importance of showcasing their understanding of the underwriting process and related regulations. A common mistake is writing a generic cover letter without highlighting knowledge relevant to the insurance industry and the specific underwriting requirements for the company.

Impact of the Mistake : Failing to demonstrate industry knowledge may indicate to hiring managers that you are not genuinely interested in the role or have not taken the time to research the company and its practices.

Corrective Advice : Incorporate examples that show your understanding of underwriting principles, such as risk assessment and policy documentation. Mention any relevant certifications or coursework in insurance or finance that could strengthen your application.

Neglecting Soft Skills

While technical skills are important in the underwriting field, neglecting to mention soft skills in your cover letter can be a significant oversight. Underwriting Assistants often work as part of a team and must communicate effectively with underwriters and clients alike.

Impact of the Mistake : By focusing solely on technical skills, you risk presenting yourself as a one-dimensional candidate. Hiring managers seek well-rounded individuals who can contribute positively to the team dynamic.

Corrective Advice : In your cover letter, emphasize soft skills such as effective communication, teamwork, and problem-solving abilities. Provide examples from past experiences that demonstrate these skills, such as collaborating on projects or assisting clients through complex policy inquiries.

Sending a Generic Cover Letter

A frequent mistake among Underwriting Assistant applicants is sending out a generic cover letter that fails to address the specific needs of the employer. Generic letters reflect a lack of effort and enthusiasm for the position.

Impact of the Mistake : A one-size-fits-all approach can make you appear disinterested in the specific role, reducing your chances of making a strong impression on hiring managers.

Corrective Advice : Customize your cover letter for each application by mentioning the specific company name and tailoring your experiences to the role. Highlight how your background aligns with the company's values or goals, such as commitment to accuracy or excellence in customer service. This personalized touch can significantly enhance your appeal as a candidate.

By avoiding these common cover letter mistakes, you can present yourself as a strong candidate for the Underwriting Assistant position. Take the time to review your letter carefully and tailor it to reflect your relevant skills and experiences. Doing so will improve your chances of standing out to hiring managers and securing an interview.

Cover Letter FAQs

How should i structure my underwriting assistant cover letter.

Start your cover letter with an engaging introduction that includes your current title and a brief overview of your relevant experience in the insurance industry or in roles that required analytical skills. Follow with a paragraph that details specific skills, such as attention to detail, data analysis, and familiarity with underwriting processes. Make sure to align your experiences with the job description, emphasizing how you can contribute to the underwriting team. Conclude with a strong closing statement that expresses your enthusiasm for the position and your eagerness to support the company's goals.

What key skills should I emphasize in my underwriting assistant cover letter?

Highlight critical skills such as analytical thinking, proficiency with underwriting software, strong communication abilities, and attention to detail. Explain how these skills have been beneficial in previous roles. For example, discuss how your analytical skills helped improve decision-making in assessing risks or how effective communication with clients led to better service delivery.

How can I tailor my cover letter for an underwriting assistant role?

To tailor your cover letter, carefully read the job description and identify the key qualifications and responsibilities. Make sure to use similar terminology and highlight experiences that directly relate to those requirements. For instance, if the description mentions evaluating insurance applications, provide an example from your past where you successfully conducted similar evaluations.

What should I include in the opening paragraph of my underwriting assistant cover letter?

In the opening paragraph, briefly introduce yourself and mention the specific position you are applying for. You might also want to include a statement about your enthusiasm for the insurance industry or a relevant accomplishment that can grab the hiring manager's attention. For example, 'As a detail-oriented professional with over three years of experience in the insurance sector, I am excited to apply for the Underwriting Assistant position at [Company].'

How long should my underwriting assistant cover letter be?

Your cover letter should ideally be one page, easily readable and succinct. Focus on delivering a clear narrative about your qualifications and how they relate to the underwriting assistant role. Avoid copying your resume; instead, supplement it with additional anecdotes and insights that showcase your suitability for the position.

What common mistakes should I avoid in my underwriting assistant cover letter?

Avoid using generic templates that don't reflect your unique qualifications for the position. Be wary of making your letter too verbose or irrelevant by including unrelated work experiences. Ensure that every paragraph relates back to the prerequisites of the underwriting assistant role, clearly demonstrating your suitability for the position.

How can I effectively demonstrate my understanding of the insurance industry in my cover letter?

Showcase your knowledge of the insurance industry by mentioning relevant trends or recent changes in underwriting practices. For instance, you might discuss how evolving regulations impact risk assessment. Including this context illustrates your commitment to staying informed and highlights your readiness to contribute effectively within the role.

What tips can you provide for writing a compelling closing paragraph?

In your closing paragraph, express your genuine enthusiasm for the underwriting assistant role and mention your willingness to discuss further how your skills can benefit the company. Reiterate your interest in contributing to the team and indicate your readiness for a follow-up interview. For example, 'I am eager to bring my analytical skills and strong attention to detail to [Company], and I look forward to the opportunity to discuss how I can contribute to your underwriting team.'

How can I highlight relevant experiences from past jobs in my underwriting assistant cover letter?

Identify specific experiences that showcase your relevant skills, such as internships, previous employment in insurance companies, or jobs requiring analytical skills. Use the STAR method (Situation, Task, Action, Result) to frame your experiences, ensuring you clearly articulate your contributions and the positive outcomes they produced.

Underwriting Analyst Cover Letter Example

Underwriting coordinator cover letter example, junior underwriter cover letter example, insurance underwriting assistant cover letter example, senior underwriting assistant cover letter example, underwriting support specialist cover letter example, underwriting technician cover letter example, underwriting intern cover letter example, risk management assistant cover letter example, insurance assistant cover letter example, policy assistant cover letter example, claims assistant cover letter example, commercial underwriting assistant cover letter example, residential underwriting assistant cover letter example, underwriting operations associate cover letter example, related cover letter samples.

Field Underwriter

Compliance Officer

Insurance Consultant

Insurance Appraiser

Sales Consultant

Policy Analyst

Insurance Claims Investigator

Insurance Examiner

New Business Coordinator

Get Hired Fast — with AI-Powered Job Applications

Just upload your resume, and let our genius AI auto-apply to hundreds of jobs for you.

Written Samples

15 sample cover letters for underwriter positions.

Competition for underwriter jobs at insurance companies and financial institutions can be fierce.

An expertly written cover letter is essential for grabbing the attention of hiring managers and landing an interview.

While your resume highlights your qualifications, your cover letter is an opportunity to showcase your unique combination of skills and experience that make you an ideal candidate for the underwriter position.

It allows you to infuse some personality and passion that can set you apart from the crowd.

Sample Cover Letters For Underwriter Positions

The following 15 sample cover letters for various underwriting roles provide inspiration and guidance for crafting your compelling letter.

From entry-level underwriter assistant positions to senior-level management, you’ll find a range of approaches and styles to model after.

Customize these samples to fit your background and the requirements of the job you’re targeting.

With a strong, personalized cover letter, you’ll be one step closer to the underwriter job you’re pursuing.

Entry-Level Commercial Lines Underwriter

Dear Hiring Manager,

I am excited to apply for the entry-level Commercial Lines Underwriter position with ABC Insurance Company that I discovered on your website. As a recent graduate of XYZ University’s esteemed Risk Management and Insurance program, I am eager to launch my underwriting career with a reputable firm like yours.

During my studies, I developed a strong foundation in risk assessment, financial analysis, and insurance principles. Elective coursework in commercial property and liability further grew my interest in this specialization. Highlights of my qualifications include:

- Internship with DEF Insurance Agency, where I assisted the commercial lines department in processing new policies, preparing quotes, and servicing small business accounts.

- Passed the CPCU 500 and 520 exams, demonstrating proficiency in risk management, insurance operations, and commercial underwriting. Currently pursuing CPCU designation.

- Refined analytical and problem-solving skills through case studies and a senior capstone project on commercial property valuation.

- Strong technology acumen, including experience with AIM, Microsoft Office, and various insurance rating platforms.

I am a diligent, detail-oriented professional with excellent communication and interpersonal abilities. My internship experience collaborating with agents, brokers, and insureds has prepared me to thrive in your team-based culture and provide exceptional service.

The chance to launch my underwriting career with ABC Insurance Company truly excites me. I would welcome the opportunity to discuss how my education and experience would contribute to your commercial lines department. Feel free to contact me at your convenience to schedule an interview. Thank you for your consideration.

John Q. Applicant

Experienced Personal Lines Underwriter

Dear Ms. Jones,

I am writing to express my strong interest in the Personal Lines Underwriter position posted on LinkedIn. With six years of underwriting experience at two nationally known insurance carriers, I am confident I have the expertise to drive profitable growth for LMN Insurance Company.

Since earning a B.S. in Finance and completing CPCU certification, I have demonstrated success in underwriting a range of personal lines products including auto, property, umbrella, and recreational policies. My background aligns well with the qualifications you are seeking:

- Refined risk assessment and sound judgment to profitably underwrite new and renewal business that meets company guidelines.

- Experience rating, quoting, and issuing policies in a high-volume environment while ensuring superior accuracy and turnaround times.

- Solid knowledge of personal lines products, coverage forms, rating procedures, and underwriting guidelines.

- Track record of achieving sales goals and profitability targets. Grew new business premium 15% in the most recent year.

- Proven ability to analyze loss trends and market conditions to recommend changes to underwriting eligibility and rating.

Additionally, I am a tech-savvy professional skilled in using various underwriting software and platforms. My excellent interpersonal and communication abilities allow me to partner effectively with agents and colleagues.

LMN Insurance’s reputation for product innovation and exceptional service resonates with my professional standards. I would welcome the chance to contribute my personal lines expertise to your underwriting team.

I have attached my resume with additional details on my background. Please feel free to contact me at your convenience to discuss this opportunity in more detail. Thank you for your consideration. I look forward to speaking with you.

Mary M. Applicant

Middle Market Commercial Underwriter

Dear Mr. Smith,

Are you seeking an accomplished Commercial Underwriter who can hit the ground running to help grow your middle market book of business? If so, I invite you to consider my enclosed resume detailing eight years of experience at XYZ Carrier underwriting a diverse book of mid-size property and casualty accounts.

As a relationship-focused underwriter, I have a track record of developing profitable business by partnering closely with select brokers and agents. Successful initiatives have included expanding into new industry segments, revamping underperforming programs, and developing new product options to meet emerging customer needs.

Relevant highlights of my background include:

- Underwriting expertise spanning diverse commercial segments including manufacturing, wholesaling, professional services, commercial real estate and construction accounts.

- Proven success growing new business and renewal premium while maintaining target loss ratios. Average annual new business writings of $5M.

- Sharp financial acumen and analytical skills to assess complex risks, develop appropriate rating, and structure profitable deals.

- Extensive knowledge of commercial lines policy forms, ISO classifications, coverage options, and risk control methods.

- Ability to manage underwriting authorities in alignment with corporate strategies, risk appetites, and underwriting guidelines.

On a personal level, I am a dynamic underwriter who thrives in collaborative, entrepreneurial environments focused on aggressive business growth. The opportunity to apply my skills to help DEF Company expand its middle market presence is highly appealing to me.

I would welcome the chance to discuss your team’s goals and explore this opportunity in more detail. Please feel free to contact me at your convenience to schedule a meeting. Thank you for your consideration.

John D. Applicant

Senior Commercial Property Underwriter

Dear Ms. Johnson,

Are you looking for a strategic-minded Commercial Property Underwriter who will drive profitable growth for your large account division? Consider my 12+ years of experience at two major national carriers underwriting complex property exposures for large corporations across multiple industry segments.

During my career, I have been consistently recognized for developing innovative underwriting solutions to address non-standard property risks and unique market challenges. Proficiency areas include:

- Underwriting expertise in high-hazard occupancies including chemical, energy, forest products, heavy manufacturing, and real estate portfolios.

- Experience structuring layered and shared programs, determining appropriate retentions, and maintaining capacity through effective reinsurance placement.

- Solid knowledge of coverage nuances, loss control measures, risk modeling tools, and property valuation methodologies.

- Track record of achieving strict profitability targets through sound risk assessment and savvy broker negotiations. Grew book 25% while improving the loss ratio from 78% to 60% over the last 3 years.

- Proven people leadership and development of junior underwriting staff.

My collaborative but assertive underwriting style has enabled me to forge strong broker relationships that consistently generate referrals and new business opportunities. I am a strategic thinker with a talent for balancing the need for revenue growth with disciplined risk selection.

The chance to apply my large property expertise in your dynamic, growth-oriented firm is a strong draw for me. I would welcome the opportunity to discuss your needs and goals in more detail. Please feel free to contact me at your convenience.

Jane A. Applicant

Ocean Marine Underwriter

Dear Hiring Executive,

Your posting for an experienced Ocean Marine Underwriter immediately captured my attention. As a senior-level cargo and hull underwriter with 10+ years in the marine insurance market, I am confident I could make a substantial impact on your organization’s global expansion plans.

Since entering the marine field in 2013, I have earned a reputation as a solutions-focused underwriter with deep technical expertise in both wet and dry marine risks. Key areas of proficiency that may benefit your team include:

- Experience underwriting diverse cargo accounts including refrigerated goods, liquid bulk, oversized equipment, and containerized freight.

- Proficiency in assessing complex hull risks for a range of commercial blue and brown water vessels and pleasure craft.

- Success in structuring international programs spanning multiple countries. Well-versed in foreign regulations and exposures.

- Proven profit and loss responsibility. Adept at analyzing loss experience and market trends to develop rate guidelines and coverage parameters that drive positive underwriting results.

Additionally, I am a persuasive communicator with a knack for building strong relationships with brokers, clients, and colleagues around the globe. My ability to adapt to local business customs across different cultures has been pivotal to my success.

As ABC Company prepares to expand its marine portfolio internationally, I am confident my underwriting expertise and global perspective would be an asset to your team. I would appreciate the chance to discuss this opportunity with you in person and explore how I can support your strategic goals.

Please feel free to contact me at your earliest convenience. Thank you for your time and consideration.

John M. Applicant

Inland Marine Underwriter

Dear Mr. Davis,

When I learned of your need for an Inland Marine Underwriter, I was eager to submit my credentials for your consideration. As a dedicated inland marine specialist with seven years of experience managing diverse commercial equipment and builder’s risk accounts, I am well prepared to provide the technical expertise you are seeking.

My career includes progressive experience underwriting a range of construction and contractor equipment, electronic data processing, medical diagnostic equipment, fine arts, motor truck cargo, and related inland marine risks. Specific proficiencies I offer include:

- Success collaborating with agents and brokers to gather detailed information on risk characteristics, exposures, and loss control measures to determine appropriate coverage options.

- Solid knowledge of policy forms, endorsements, underwriting guidelines, and insurance to value considerations for diverse inland marine risks.

- Proven ability to analyze loss experience, identify adverse trends and implement appropriate rate actions or program adjustments.

- Experience managing underwriting assistants and support staff to maintain service standards in a high-volume department.

On a personal level, I am an ambitious professional who thrives in team environments dedicated to achieving challenging goals. Underwriting inland marine business allows me to leverage my analytical and problem-solving skills while building strong producer relationships.

The opportunity to join your industry-leading team and contribute to the growth of your specialty portfolio is highly appealing. Please feel free to contact me at your earliest convenience to schedule an interview. I look forward to discussing the value I can bring to this role.

Mary I. Applicant

Workers Compensation Underwriter

Dear Ms. Smith,