Language selection

- Français fr

Planning a business

Assessing your readiness, choosing a business structure, market research and writing a business plan.

Most requested

- [Top task hyperlink]

Services and information

Developing your business idea.

Turning your idea into a profitable business model

Types of business ownership

Determining whether incorporation, partnership or sole proprietorship is right for your business

Writing a business plan

How to write a successful business plan

Business plan template

Download templates and examples of a business plan and financial plan

Choosing a location for your business

What to consider when selecting a commercial space for your business

Researching your target market

Get the demographic data you need to better understand your potential customers and their needs

[Feature hyperlink text]

Brief description of the feature being promoted.

On social media

- Facebook: CanadaBusiness

- Twitter: @CanadaBusiness

- Instagram: cdnbusiness

- Innovation, Science and Economic Development Canada

Page details

Business plan tools

A business plan is like a road map. It helps you define your operation’s core objectives and build a detailed plan for how to achieve them.

Free business plan bundles

We want to help make writing your business plan easier. The FCC business plan bundles were designed specifically for Canadian producers, food and beverage entrepreneurs or anyone involved in Canadian agriculture and food.

Bringing our best business management content to your inbox.

- Start free trial

Start selling with Shopify today

Start your free trial with Shopify today—then use these resources to guide you through every step of the process.

Free Business Plan Template for Small Businesses (2024)

Use this free business plan template to write your business plan quickly and efficiently.

A good business plan is essential to successfully starting your business — and the easiest way to simplify the work of writing a business plan is to start with a business plan template.

You’re already investing time and energy in refining your business model and planning your launch—there’s no need to reinvent the wheel when it comes to writing a business plan. Instead, to help build a complete and effective plan, lean on time-tested structures created by other entrepreneurs and startups.

Ahead, learn what it takes to create a solid business plan and download Shopify's free business plan template to get started on your dream today.

What this free business plan template includes

- Executive summary

- Company overview

- Products or services offered

- Market analysis

- Marketing plan

- Logistics and operations plan

- Financial plan

This business plan outline is designed to ensure you’re thinking through all of the important facets of starting a new business. It’s intended to help new business owners and entrepreneurs consider the full scope of running a business and identify functional areas they may not have considered or where they may need to level up their skills as they grow.

That said, it may not include the specific details or structure preferred by a potential investor or lender. If your goal with a business plan is to secure funding , check with your target organizations—typically banks or investors—to see if they have business plan templates you can follow to maximize your chances of success.

Shopify's free business plan template includes seven key elements typically found in the traditional business plan format:

1. Executive summary

This is a one-page summary of your whole plan, typically written after the rest of the plan is completed. The description section of your executive summary will also cover your management team, business objectives and strategy, and other background information about the brand.

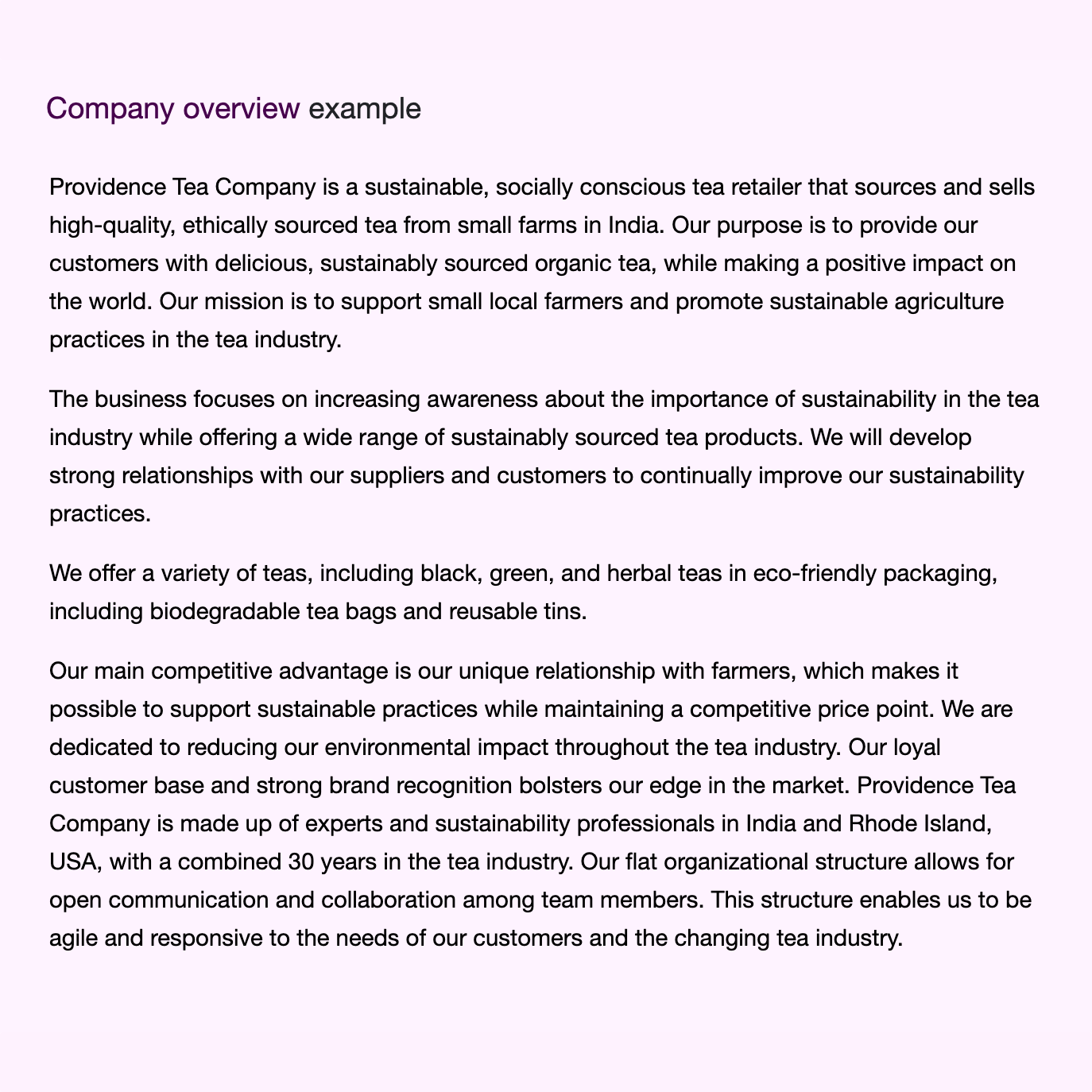

2. Company overview

This section of your business plan will answer two fundamental questions: “Who are you?” and “What do you plan to do?” Answering these questions clarifies why your company exists, what sets it apart from others, and why it’s a good investment opportunity. This section will detail the reasons for your business’s existence, its goals, and its guiding principles.

3. Products or services offered

What you sell and the most important features of your products or services. It also includes any plans for intellectual property, like patent filings or copyright. If you do market research for new product lines, it will show up in this section of your business plan.

4. Market analysis

This section includes everything from estimated market size to your target markets and competitive advantage. It’ll include a competitive analysis of your industry to address competitors’ strengths and weaknesses. Market research is an important part of ensuring you have a viable idea.

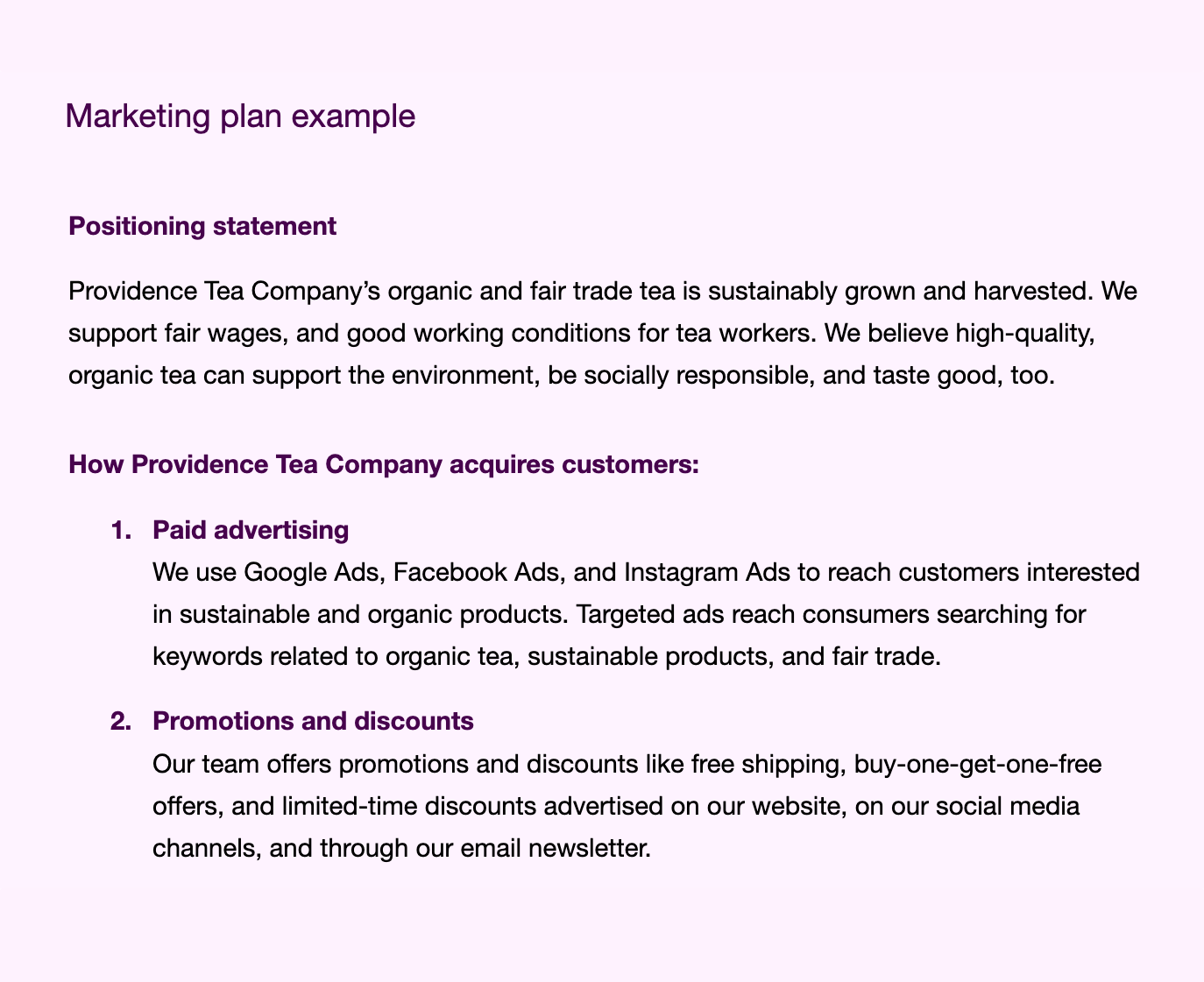

5. Marketing plan

How you intend to get the word out about your business, and what strategic decisions you’ve made about things like your pricing strategy. It also covers potential customers’ demographics, your sales plan, and your metrics and milestones for success.

6. Logistics and operations plan

Everything that needs to happen to turn your raw materials into products and get them into the hands of your customers.

7. Financial plan

It’s important to include a look at your financial projections, including both revenue and expense projections. This section includes templates for three key financial statements: an income statement, a balance sheet, and a cash-flow statement . You can also include whether or not you need a business loan and how much you’ll need.

Business plan examples

What do financial projections look like on paper? How do you write an executive summary? What should your company description include? Business plan examples can help answer some of these questions and transform your business idea into an actionable plan.

Professional business plan example

Inside the template, you'll find a sample business plan featuring a fictional ecommerce business .

The sample is set up to help you get a sense of each section and understand how they apply to the planning and evaluation stages of a business plan. If you’re looking for funding, this example won’t be a complete or formal look at business plans, but it will give you a great place to start and notes about where to expand.

Lean business plan example

A lean business plan format is a shortened version of your more detailed business plan. It’s helpful when modifying your plan for a specific audience, like investors or new hires.

Also known as a one-page business plan, it includes only the most important, need-to-know information, such as:

- Company description

- Key members of your team

- Customer segments

💡 Tip: For a step-by-step guide to creating a lean business plan (including a sample business plan), read Shopify's guide on how to create a lean business plan .

Benefits of writing a solid business plan

It’s tempting to dive right into execution when you’re excited about a new business or side project, but taking the time to write a thorough business plan and get your thoughts on paper allows you to do a number of beneficial things:

- Test the viability of your business idea. Whether you’ve got one business idea or many, business plans can make an idea more tangible, helping you see if it’s truly viable and ensure you’ve found a target market.

- Plan for your next phase. Whether your goal is to start a new business or scale an existing business to the next level, a business plan can help you understand what needs to happen and identify gaps to address.

- Clarify marketing strategy, goals, and tactics. Writing a business plan can show you the actionable next steps to take on a big, abstract idea. It can also help you narrow your strategy and identify clear-cut tactics that will support it.

- Scope the necessary work. Without a concrete plan, cost overruns and delays are all but certain. A business plan can help you see the full scope of work to be done and adjust your investment of time and money accordingly.

- Hire and build partnerships. When you need buy-in from potential employees and business partners, especially in the early stages of your business, a clearly written business plan is one of the best tools at your disposal. A business plan provides a refined look at your goals for the business, letting partners judge for themselves whether or not they agree with your vision.

- Secure funds. Seeking financing for your business—whether from venture capital, financial institutions, or Shopify Capital —is one of the most common reasons to create a business plan.

Why you should you use a template for a business plan

A business plan can be as informal or formal as your situation calls for, but even if you’re a fan of the back-of-the-napkin approach to planning, there are some key benefits to starting your plan from an existing outline or simple business plan template.

No blank-page paralysis

A blank page can be intimidating to even the most seasoned writers. Using an established business planning process and template can help you get past the inertia of starting your business plan, and it allows you to skip the work of building an outline from scratch. You can always adjust a template to suit your needs.

Guidance on what to include in each section

If you’ve never sat through a business class, you might never have created a SWOT analysis or financial projections. Templates that offer guidance—in plain language—about how to fill in each section can help you navigate sometimes-daunting business jargon and create a complete and effective plan.

Knowing you’ve considered every section

In some cases, you may not need to complete every section of a startup business plan template, but its initial structure shows you you’re choosing to omit a section as opposed to forgetting to include it in the first place.

Tips for creating a successful business plan

There are some high-level strategic guidelines beyond the advice included in this free business plan template that can help you write an effective, complete plan while minimizing busywork.

Understand the audience for your plan

If you’re writing a business plan for yourself in order to get clarity on your ideas and your industry as a whole, you may not need to include the same level of detail or polish you would with a business plan you want to send to potential investors. Knowing who will read your plan will help you decide how much time to spend on it.

Know your goals

Understanding the goals of your plan can help you set the right scope. If your goal is to use the plan as a roadmap for growth, you may invest more time in it than if your goal is to understand the competitive landscape of a new industry.

Take it step by step

Writing a 10- to 15-page document can feel daunting, so try to tackle one section at a time. Select a couple of sections you feel most confident writing and start there—you can start on the next few sections once those are complete. Jot down bullet-point notes in each section before you start writing to organize your thoughts and streamline the writing process.

Maximize your business planning efforts

Planning is key to the financial success of any type of business , whether you’re a startup, non-profit, or corporation.

To make sure your efforts are focused on the highest-value parts of your own business planning, like clarifying your goals, setting a strategy, and understanding the target market and competitive landscape, lean on a business plan outline to handle the structure and format for you. Even if you eventually omit sections, you’ll save yourself time and energy by starting with a framework already in place.

Business plan template FAQ

What is the purpose of a business plan.

The purpose of your business plan is to describe a new business opportunity or an existing one. It clarifies the business strategy, marketing plan, financial forecasts, potential providers, and more information about the company.

How do I write a simple business plan?

- Choose a business plan format, such as a traditional or a one-page business plan.

- Find a business plan template.

- Read through a business plan sample.

- Fill in the sections of your business plan.

What is the best business plan template?

If you need help writing a business plan, Shopify’s template is one of the most beginner-friendly options you’ll find. It’s comprehensive, well-written, and helps you fill out every section.

What are the 5 essential parts of a business plan?

The five essential parts of a traditional business plan include:

- Executive summary: This is a brief overview of the business plan, summarizing the key points and highlighting the main points of the plan.

- Business description: This section outlines the business concept and how it will be executed.

- Market analysis: This section provides an in-depth look at the target market and how the business will compete in the marketplace.

- Financial plan: This section details the financial projections for the business, including sales forecasts, capital requirements, and a break-even analysis.

- Management and organization: This section describes the management team and the organizational structure of the business.

Are there any free business plan templates?

There are several free templates for business plans for small business owners available online, including Shopify’s own version.

Keep up with the latest from Shopify

Get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

By entering your email, you agree to receive marketing emails from Shopify.

popular posts

The point of sale for every sale.

Subscribe to our blog and get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

Unsubscribe anytime. By entering your email, you agree to receive marketing emails from Shopify.

Latest from Shopify

Aug 23, 2024

Aug 22, 2024

Learn on the go. Try Shopify for free, and explore all the tools you need to start, run, and grow your business.

Try Shopify for free, no credit card required.

- Business planning and strategy

Business plan writer

The interactive Futurpreneur business plan writer is designed to simplify the business planning process by allowing you to customize your plan. We also provide tips & tricks, and plenty of examples to guide you as you write.

Business plan example

Gain valuable insights from Futurpreneur’s Entrepreneur-in-Residence, Dominik Loncar, to learn how to articulate your vision with clarity and impact. We understand that writing a business plan can feel daunting, there’s so many pieces it’s hard to know where to start. So, to help you get started we’ve created a business plan example that includes insights and rationale from Dominik Loncar. He’s our Entrepreneur-in-Residence and he’s reviewed 100s of business plans from entrepreneurs.

Business plan essentials

Never written a business plan before? Fear not! With this crash course, you’ll be provided with an overview of the different components that make up a solid business plan ensuring you’re launch-ready and poised for success.

Related resources

- Entrepreneurship

- Small Business

- Ways to Bank

- More Scotiabank Sites

- English selected

- Scotia OnLine Mobile

- ScotiaConnect

- Cash & Coin Service

- Advice Centre

Need a business plan? Try our template.

Invest in the future of your business by taking the time to create or update your business plan using our free template.

The importance of your business plan

Perhaps the most important document for any new business is a business plan. Yet too many business owners fail to sit down and prepare or update one.

A business without a plan is adrift. Decisions are made reactively based on the owner’s emotions, rather than prudent research. Employees, vendors, investors and other stakeholders (as well as the owner) are unclear about the direction of the company. That lack of focus results in wasted dollars, energies and resources as the company zigzags along instead of following a well-planned straight line to its goals.

Writing a business plan can seem a daunting task. Many entrepreneurs simply don’t have the time, inclination or the proper tools.

Business planning template

We have developed a template that makes creating your Business Plan easy. And it’s free !

This template guides you through all of the steps required to complete a proper business plan. It has explanations of the terms and definitions. It lets you add your own thoughts and comments.

Once you’ve completed the steps, you’ll have a business plan complete with cover page, contact information, financial tables, product descriptions and marketing details. You can save and print the plan, or send it electronically to anyone.

Use your plan to move your business forward with confidence, to motive your team, or to present to investors or lenders.

Depending on how much research and preparation you’ve already completed, creating your plan won’t consume much time at all. While it’s very easy, don’t worry if you get stuck because help is available throughout the process.

Take your plan to the bank

Once you’ve completed your business plan, you may take it to a Scotiabank Small Business Advisor . The advisor can review your plan, supply feedback, and, if requested, help you to explore your financing options.

Get feedback on your plan

Asking people to review your plan will make it stronger because you’ll receive valuable feedback. Share it with your accountant, lawyer, financial advisor and trusted businesspeople so they can offer their suggestions to improve your plan. If you are really worried about someone reading your secrets, consider attaching a Non-Disclosure Agreement (NDA) to the plan. An NDA is a legal document that prevents others from sharing your information with unauthorized parties.

Try our free business plan template

Related articles

Is your business taking advantage of the low canadian dollar.

Now may be a good time for you to explore introducing your business to potential customers south of the border.

A business plan is key to your success

Business plans are an important tool for all businesses, no matter how big or small.

Path to Impact 2023: Resilient Small Business Owners optimistic for the future despite headwinds

The challenges and opportunities that lie ahead for small businesses in 2024 are not one-size-fits-all.

Find a Branch

- Call 1-800-769-2511

Starting a Business

Go from grand plan to grand opening..

Make your dream of starting a business a reality.

RBC U.S. Direct Checking

Start and grow your business with rbc.

Ready to turn your side hustle, passion or idea into a full-time business? We can help you every step of the way.

Getting Ready—the Planning Stage

From making sure your idea will work to figuring out the money, explore the steps below to find tools, resources and advice to help you plan. Or, download our FREE Starting a Business Guide {pdf} .

Validate Your Business Idea

You have an idea for a business. Congrats! Before you leave your job and invest your hard-earned savings, make sure your idea is feasible. While it can be tempting to dive right in, some up front research and planning will ensure you’re ready to take the plunge.

Revisit your business idea by asking yourself these 7 key questions {pdf} or use our business idea checklist {pdf} to see the steps you may need to take to get to opening day.

Or, download our Starting a Business guide for tips on:

- Conducting market research

- Developing your competitive advantage

- Calculate your estimated revenue - How to calculate revenue

- Identifying your target customer, and more

Learn From the Experts

Create a Business Plan

A well-thought-out business plan explains to others your vision for the business, the gap in the market your business will fill and the steps you will take to succeed. Formally documenting what you want to do, and how you intend to do it, can make the difference between success and failure.

Creating a business plan on your own, however, is not always an easy task. Learn how to create a business plan or, if you’re ready, get started with the Business Plan Builder . It’s a comprehensive tool that guides you through a series of questions, offering resources and providing a framework for success.

Use the FREE Business Plan Builder to:

- Describe what your business will do and the needs it will meet.

- Outline your strengths, weaknesses, opportunities and threats (SWOT). Tip: Use a SWOT Template {pdf} first to make this easier.

- List your startup costs and ongoing expenses—the Cash Flow Forecast Template {pdf} can help you estimate.

- Describe how you will find and market to customers.

Determine Start-up Cost & Working Capital

Knowing how much money you need to start your business and survive your first year is critical. And it’s wise to figure this out before you invest too much time or money into your idea.

There are two types of costs you’ll want to estimate:

- Startup costs , which are one-time costs such as security and utility deposits, licenses and permits, equipment, etc.

- Working capital , which is the money you need on hand to keep your business running and manage fluctuations in cash flow (for example, salaries, rent, advertising, etc.).

To learn more about these costs, see:

Tools to Help You Determine Your Costs

Estimating your startup costs can be daunting, but it’s beneficial to be as realistic and accurate as possible. These tools can help you identify your costs and get a more precise estimate:

Learn more about cash flow planning:

Decide on a Pricing Strategy

Rent. Utilities. Inventory. These are just a few examples of overhead costs your new business might have. Then there’s the good stuff—the profit you want to make. For your business to succeed, the pricing strategy you set for your products or service needs to account for both overhead costs and profit—as well as what customers are willing to pay.

Learn more about pricing and profit:

Choose a Business Structure

Starting a business requires you to make many decisions. And choosing your legal business structure is one of your most important decisions because it affects your taxes, whether you will have personal liability if something goes wrong and more.

In Canada, there are four main business structures:

- Sole proprietorship: You and the business are one and the same.

- Partnership: Two or more people own the business.

- Corporation: The business is considered a separate legal entity.

- Co-operative: The business is controlled by an association of members; often used for non-profits.

Learn more about these business structures and see which one may be right for you.

Explore the pros and cons of these structures:

Register or incorporate with Ownr and get up to $300 back when you open an RBC business account. Legal Disclaimer * Explore Ownr (opens to external site)

Explore Business Financing

What do words like bootstrapping, angels and crowdfunding have in common? They’re all ways to fund a business. Here’s a quick run-down of the main types of business financing—keep in mind that many business owners use a combination of these:

- Bootstrapping: Investing some of your own money in your business (also known as bootstrapping) shows banks and investors that you’re fully committed. It’s also one of the most cost-effective financing methods.

- Money from friends and family: Sometimes called love money, borrowing from your inner circle can be appealing. Just make sure you have clear agreements in place.

- Your bank: Talk to your bank about options that may be available to you. For example, RBC offers business credit cards , overdraft facilities and business credit lines . Tip: Establishing credit under your business name allows your business to build a credit history, which can help with qualifying for other types of financing down the road.

- Angel investors: Angels usually want a share in the business, a specific return on their investment—or both. Search for angels in the National Angel Capital Organization (opens to external site) member directory.

- Crowdfunding: Also called “democratic finance”, crowdfunding can help you attract funding from a diverse mix of people. Visit the National Crowdfunding Association of Canada (opens to external site) for details.

- Government grants and subsidies: The Government of Canada offers loans, grants, loan guarantees and more if you qualify.

What do words like bootstrapping, angels and crowdfunding have in common? They’re a few ways you could fund your new venture.

Some options, such as business credit cards , overdraft facilities and business credit lines can help you establish credit under your business name and allow your business to build a credit history, which can help with qualifying for other types of financing down the road.

Get a run-down of six possible ways to finance a business —and keep in mind that you don’t have to choose just one.

Learn more about business financing resources:

More Investment Tools and Research

Getting Ready—the Launch Stage

From making everything official to marketing your business, explore the steps below to find tools, resources and advice to help you prep for opening day. Or, download our FREE Starting a Business Guide {pdf} .

Register or Incorporate Your Business

Taking the step to make your business official by registering or incorporating is one of the most important things you can do for your new company. In fact, it’s legally required if you choose a corporation as your business structure or you plan to operate a sole proprietorship under something other than your own name.

Registering or incorporating a business involves both federal and provincial requirements and can be confusing. Download the Starting a Business Guide {pdf} to learn more about registering or incorporating your business or check out these resources:

A word about licenses and permits.

Depending on your industry and province, you may also need to apply for certain licences or permits. For example, if you plan to open a restaurant you will need a licence to sell food and alcohol. Visit your province or territory’s official government site to see what’s required.

Open a Business Account

Once you have registered or incorporated (opens to external site) , you can open a business operating account. A word of caution—don’t use your personal account—it will cause an accounting headache.

If you incorporate, you will need to have a business account anyway because the business will be a separate legal entity. At RBC, we require even sole proprietors operating under their own name to have a business account (opens to external site) .

Six Ways a Business Bank Account Can Help You

- Show suppliers, vendors, investors and customers that your business is legitimate

- Track and control your business expenses and keep them separate from personal transactions for convenient bookkeeping

- Easily send and receive business-related payments —for example, pay bills, deposit funds and send transfers

- Simplify your tax filing at the end of the year with all your business transactions in one place

- Access services and offers for RBC business clients

- Simplify applying for business credit or additional banking services

Set Up Your Payments and Other Systems

Whether you plan to do business online or at a physical location, the right payments and cash management solutions can save you time and money, streamline daily tasks that help you get paid faster. Here are a few ways we can help:

Make It Easy for Customers to Pay You

Receive Payments Online, by Cheque and More

Simplify your collections process and put money in your hands sooner with a range of tools and solutions .

Accept Credit and Debit Card Payments

Allow customers to pay by credit and debit card—online, in-store, or on the go with Payment Solutions by Moneris .

Pay Vendors, Suppliers, Employees and the Government

Make Payments Online, on Credit and More

Improve productivity and increase control over cash flow with our wide range of payment solutions .

Automate Payments to Suppliers

Easily send payments to vendors, consolidate funds from multiple sources and manage your accounts payable in one location with RBC PayEdge .

Streamline Payroll and Taxes

Reduce administrative obstacles and save time with ADP payroll, time-tracking and HR services.

Consider Other Business Software

Depending on your business, you may need other software as well. For example, if you plan to sell products online, you will need an ecommerce platform.

Tip: Before you start taking payments or buying things for your business, get set up on a good accounting platform and link it to your business account(s). Having your accouting system set up correctly from the start can save you a lot of time and hassle down the road.

Build Your Online Store

Get everything you need to take your business online and reach more customers—from site to sales to shipping.

Find the Right Digital Solutions

Get help navigating the cloud computing marketplace.

Protect Your Business

Mitigating risk and protecting your business can prevent you from losing precious time and money. Learn how you can safeguard your intellectual property (IP) and what business insurance you might need. Plus, explore ways to improve your fraud, theft and cyber security protection.

See how to protect your business

Download our FREE Starting a Business Guide

Running a business requires a significant amount of time and money so it makes sense to protect your investment—and livelihood. Before you start operating, take steps to identify and protect against the key risks your business could face. Here are four areas to look at:

Intellectual Property (IP)

Trademarks, copyright and patents are the most common types of IP. As a business owner, you need to approach IP from two angles—protecting your own IP and making sure you don’t accidentally infringe on someone else’s.

To learn more about IP, check out:

You can also visit the Canadian Intellectual Property Office (CIPO) .

Business Insurance

Business insurance can help your company survive the loss of a key employee, keep up with loan payments and even protect your family. Be sure to talk to a licensed insurance professional to see what’s right for you.

Fraud and Theft

If you plan to have employees handling money, inventory or the company credit card, take steps to protect yourself against fraud and theft. It’s also important to protect your company’s cashless transactions. For tips, check out: Payments Fraud: How to Recognize it and Protect Your Business .

Cyber Security

Seven out of 10 business leaders say that their cyber security risks are increasing and cyber readiness is more important given the potential risk that an incident poses. In fact, just one cyber event can severely damage your business’ reputation or cause substantial financial losses. To learn how to help your business prepare in advance of a crisis and mitigate certain risks, check out:

For more information on IP, business insurance and protecting against fraud or theft, download our FREE guide:

Hire Your First Employee(s)

Finding candidates with the right skillset and being able to afford employees are two of the top challenges facing new business owners.

If you plan to hire employees, there are several online recruitment tools available. As an RBC business client, you can use Magnet , which can help match your business to the best young talent via Canada’s largest campus recruiting platform.

Simplify your collections process and put money in your hands sooner with a range of tools and solutions.

Tip: Many business owners cite that networking/word of mouth is one of the top ways they find employees.

Promote Your Business

Search engine optimization (SEO). Social media. Email. There’s a dizzying array of options out there to promote your business.

Consider using the Business Plan Builder to start sketching out your marketing plan. It will guide you through a series of questions and provide tips to help you complete each section.

As an RBC business client, you can access offers and services to help you find customers:

Reach potential customers in your neighbourhood with Nextdoor, a hyper-local network that connects local businesses with their neighbours.

Get everything you need to take your business online and reach more customers—from website to sales to shipping.

Find Creative and Marketing Pros

Tell helloDarwin about your needs to get matched with creative and marketing company experts, free of charge.

Explore helloDarwin

Get Consumer Insights and Trends

View demographic data, growth patterns and customer buying trends to help you find an ideal location for your business.

Free Online Course

Thinking of Starting a Business?

Turn your business idea into action with The Founder’s Journey, taught by Ivey Business School faculty.

Bank Accounts

Find the right account for your business in 30 seconds.

Choose from a range of accounts—with no minimum balance required.

Help Me Choose an Account

Register or incorporate your business with Ownr and get up to $300 back when you open an RBC business account. *

Get Started with Ownr

Business Loans to Help Your Company Succeed

Find credit and financing solutions to help your business reach its full potential.

CreditLine for Small Business

An unsecured line of credit with the convenience of a credit card.

Royal Business Operating Line

A simple way to access the working capital you need.

Canada Small Business Financing Loan

A government-sponsored loan program for small businesses.

Offers & Services Beyond Banking

Starting a business is easier with the right support.

Take advantage of money-saving offers and services from our partners—available to RBC business clients.

Register or Incorporate

With Ownr and get up to $300 back * - when you open an RBC business account.

Access Resources and Financing

For entrepreneurs age 18-39 who want access to business resources, financing and mentoring.

Find Government Funding

Get preferred pricing from a leader in securing government funding 1 .

Want to Talk Business?

Get help clarifying your goals, setting up, opening an account and more.

We look forward to meeting with you! Here’s how to get in touch:

Call us 24/7: 1-800-769-2520

Thanks for stopping by. We’re here to help when you’re ready. In the meantime:

Use our FREE step-by-step guide to help make your dream of starting a business a reality.

Stay up-to-date on the latest resources, money-saving offers and business advice.

See How an Advisor Can Help You

RBC business advisors can help your company at every stage—from starting up to simplifying operations and funding growth. An RBC business advisor will work with you to:

- Understand your vision and business goals

- Set up the right financial products and solutions

- Explore options to effectively manage cash flow, pay employees and get paid

- Connect you to a suite of business advice and solutions that go beyond traditional banking

More Advice

Find more business advice and inspiration.

Do You Have What it Takes to Start a Business?

Three Growth Hacks for Your New Business

Your First Years in Business: From Surviving to Thriving [Webinar Recap]

View Legal Disclaimers Hide Legal Disclaimers

How to Start a Business in Ontario

In Ontario , starting your own business is streamlined yet comprehensive, ensuring that new businesses are well-prepared to succeed in the competitive market. If you dream of opening a business in Ontario using your entrepreneurship skills, this guide is for you.

Below are the essential steps for entrepreneurs searching for how to start a small business in Ontario and how to register a business in Ontario:

Conduct Market Research

Market research is the foundation of any small business Ontario. It helps you understand the industry landscape, identify your target market, and gauge the demand for your product or service. This is especially important when you plan to open a business in Ontario to avoid costly mistakes and missed opportunities. Conducting market research will also benefit those looking to start a business in Ontario or those who are already starting a business in Ontario.

How to Conduct Market Research

- Determine who your potential customers are.

- Identify your main competitors and analyze their strengths and weaknesses.

- Use surveys, focus groups, and existing research reports to gather data about your target market and industry.

- Analyze the data to identify trends, opportunities, and potential challenges.

Your market research should answer these questions:

- Who are your potential clients?

- Are they interested in your product or service?

- Who is your ideal client?

- What do people want from your product or service?

- How much are they willing to pay?

- What are the costs of production and shipping?

- Is there enough demand for a successful business?

- What makes you different from competitors?

Come Up with Business Ideas

Some of the most successful businesses arise from ideas that solve problems, such as creating apps, offering cleaning services, starting junk removal companies, becoming professional organizers, working as consultants, monetizing creative skills, leveraging professional experience, turning a passion for products into a business, or developing efficiency improvements. Your small business in Ontario must start here.

Business Plan Development

A business plan details your business idea, short-term and long-term goals, and the resources required for starting your own business in Ontario. If you need assistance in drafting your business plan, our team of expert business plan writers is here to help. Furthermore, you can open business samples on the web or explore our sample business plan template to help you create a business plan and provide you with the ideal business plan format. Following a clear outline is also crucial for effectively preparing your business plan to pitch to investors .

Have Questions? Looking To Get Started?

- Your Name *

- Email Address *

- Phone Number

Choose the Right Business Structure When starting a small business in Ontario, it’s essential to choose the right business structure to suit your needs. The table below is an overview of the four main business structures that you need, each with its unique legal and tax implications, to explore when starting your own business in Ontario.:

| Structure | Advantages | Disadvantages |

Whether you’re looking to start a business, such an LLC Ontario or open corporation Ontario, each business structure offers distinct pros and cons. Your choice should reflect your specific business needs, goals, and risk tolerance. Consider factors such as the level of control you want, the extent of liability you’re willing to accept, the complexity of tax obligations, and your capital requirements. Consulting with a business consulting firm can help ensure you make the best decision for your enterprise.

Register your Business

How do I register a business in Ontario? To register business in Ontario, you must use the Ontario Business Registry. Here’s a guide on how to register a business in Ontario:

1.Registering a business in Ontario requires a working email address for online registration and a valid debit or credit card for payment. The business registration Ontario fee depends on the type of business you are registering.

2.Steps to register a business in Ontario include:

- Search the Ontario Business Registry for free to ensure your business name is available.

- Select your business type and complete the registration:

- To register small business Ontario, as a Business Corporation, you will need an Ontario-biased Nuans name search report to reserve your business name (if not using a number name). A federal Nuans report is not acceptable. Obtain this report from a private company or a local Nuans member .

You will be given a 9-digit Ontario Business Identification Number (BIN) from ServiceOntario, which is needed for incorporation, setting up an import/export account, and registering with the Canadian Revenue Agency (CRA). Note that this BIN is different from the CRA’s Business Number (BN).

Check Licences and Permits

When starting a small business in Ontario, you will need licences and permits to operate according to federal, provincial, or municipal regulations. Use BizPaL , a free online tool, to find the licences and permits you need for your business. BizPaL filters permits based on your location, industry, and business activities.

Determine if you need to charge HST

Most businesses must register for a GST/HST account with the federal government and collect GST/HST on taxable sales. If your Ontario small business makes $30,000 or more in gross revenue over four consecutive calendar quarters, you may need to charge GST/HST. Explore Canada Revenue Agency to learn more.

Know your Tax Obligations

To start your own business in Ontario, you need to understand your tax obligations . Learn about the various taxes collected in Ontario, including corporation tax. Find out if you need to register and pay Employer Health Tax, understand which items are subject to HST, and see if you’re eligible for business tax credits. If you’re self-employed, run an unincorporated business, or are in a partnership, you will need to report your personal income.

Consider Business Insurance

While not mandatory, business insurance is highly recommended, even for home-based small businesses Ontario. The table below shows the main types of business insurance and their features:

| Insurance Type | How it Works |

Learn the Regulations

Understanding the regulations that apply to your business is one of the steps to starting a business in Ontario. Here are some regulations that may apply to your business to ensure compliance:

- Accessibility for Ontario Businesses

- Employment Standards

- Workplace Health and Safety

Get Funding

Starting a new business in Ontario is an exciting venture. The Ontario government provides various grants, loans, and funding programs to assist entrepreneurs. These funding opportunities fall into four main categories: (1) hiring or training employees, (2) research and development projects, (3) business expansion projects, and (4) capital and technology adoption. To open a small business in Ontario, you can seek support and financial assistance through these programs:

Accelerator Centre Start-Up Grants

Advanced Manufacturing and Innovation Competitiveness (AMIC)

Agri-Tech Innovation Cost-Share Program

Angel Investors Ontario

APMA: Equity, Diversity and Inclusion (EDI) Fund

Canada Periodical Fund: Business Innovation

Career-Ready with CTMA: Expanding Opportunities

CME’s Technology Investment Program (TIP)

Community Futures Ontario: Access to Capital

Critical Minerals Infrastructure Fund

Customer Demonstration Program

Eastern Ontario Development Fund (EODF)

Electric Vehicle (EV) ChargeON Program

EnAbling Change Program

ENCQOR 5G SME Technology Development Program (5G SDP)

Farm Credit Canada: Young Farmers Starters Loan

Invest Ontario Fund

FedDev Ontario

Forest Sector Investment and Innovation Program (FSIIP)

Greenhouse Technology Network (GTN)

Intellectual Property Ontario (IPON)

Interactive Digital Media (IDM) Fund

NOHFC INVEST North Program

Jobs and Growth Fund (JGF)

Life Sciences Innovation Fund

Métis Voyageur Development Fund (MVDF)

Northern Ontario Heritage Fund Corporation (NOHFC)

OBIO Capital Access Advisory Program (CAAP)

OBIO Life Sciences Critical Technologies & Commercialization (LSCTC) Program

OCI – Digital Modernization and Adoption Plan (DMAP)

OCI – Technology Demonstration Program

Ontario Disability Support Program

Ontario Agri-Food Research Initiative (OAFRI)

Ontario Automotive Modernization Program (O-AMP)

Ontario Creates Industry Development Program

Ontario Genomics’ BioCreate Program

Ontario Junior Exploration Program (OJEP)

Ontario Vehicle Innovation Network (OVIN) Connected and Autonomous Vehicle (C/AV) & Smart Mobility Program

OSCIA – Honey Bee Health Initiative

NOHFC People & Talent Program

R&D Partnership Fund – Electric Vehicle (EV) Stream 2

Regional Quantum Initiative (RQI) in Southern Ontario

Responsive Advancement for Meat Processing (RAMP)

Rise Small Business Lending Program

Rural Economic Development Fund (RED)

Save on Energy

SCAP – Agri-Food Energy Cost Savings Initiative

SCAP – Biosecurity Enhancement Initiative

SCAP – Resilient Agricultural Landscape Program

Skills Catalyst Fund

Skills Development Fund

Southwestern Ontario Angel Group

Southwestern Ontario Development Fund (SWODF)

Supply Chain Stability and Adaptability Program

Tourism Relief Fund (TRF)

VERGE Capital Start-Up Fund

Yves Landry Foundation Funding

Start Business in Ontario with BSBCON

Our team created this starting a business in Ontario checklist as a valuable resource to ensure you don’t miss any steps in setting up a business in Ontario.

There is plenty of support available if you plan to open a company in Ontario. Learning the essentials before you start your business can save you time and money in the long run. You don’t have to navigate the complexities of business planning alone. Contact us now to make your dream of starting a company in Ontario easier with the help of our experienced consultants.

Let's Get Started!

How can we help you.

Get in touch with us or visit our office

Ownr Blog > Ownrship 101 > Province > Ontario > How to Start a Business in Ontario: The 12-Step Checklist

How to Start a Business in Ontario: The 12-Step Checklist

Do you dream of using your entrepreneurship skills to own your own business? If you’re a would-be entrepreneur looking to start a business in Ontario, we’re here to help you take the plunge.

Before we dive in, it’s important you understand what you’re signing up for. Entrepreneurs often work long hours, face steep learning curves, and juggle a wide variety of tasks. You’ll also take on new financial responsibilities and will likely face stiff competition. So, it’s important to do your research and plan carefully before you launch a new business.

There are many legal requirements and steps to follow when starting a business in Ontario. And, we’re here to help. We’ve put together this complete step-by-step guide, packed with essential information and resources to help you get started as a business owner.

- Legal Requirements for Starting a Business in Ontario

To start your business off right, there are a few legal requirements you’ll need to consider.

- Registering your business

You’ll need to determine your business structure . You have three primary options when registering your business in Ontario :

- Sole proprietorship — You are the sole owner and responsible for assets and liabilities personally.

- Corporation — Incorporating a business creates a separate legal entity, so all assets and liabilities are tied to the professional corporation and not you personally. It’s the most complex of business structures.

- Partnership — You and one or more partners own the business and share responsibilities, assets and liabilities personally.

Registration requirements differ based on the business structure you choose.

If you’re a sole proprietor operating a business under your own legal name, you don’t need to register your business. However, if you want to operate under a different business name, or if your business is a partnership or corporation, you have to register your business with the province. Businesses registered in Ontario are automatically registered federally, too.

If you choose to incorporate your business, you’ll need to incorporate in Ontario and every other province or territory you plan to do business in. It’s worth noting your business name will only be protected in the jurisdictions you incorporate in, but incorporating federally ensures your name is protected and recognized across the country and globally.

Incorporating protects your business name — no other business is legally allowed to use the name. But the legal protection is jurisdictional, meaning if you only incorporate in Ontario, the business name is not protected outside Ontario. When you incorporate federally, it protects the name across the country, even if you aren’t incorporated in every province or territory.

Incorporating is complex, and many entrepreneurs turn to a lawyer for help, but Ownr can help you incorporate your business at a fraction of the cost.

- Applying for a GST/HST number

You’ll also need to decide whether to apply for a GST/HST number . Most sole proprietorships, partnerships and corporations with total revenues under $30,000 per year are defined as a small supplier by the CRA, and they don’t have to collect GST/HST. Once your worldwide business revenues total $30,000 in a single calendar quarter, or in four consecutive quarters, you have to register for a GST/HST number and begin collecting sales tax on all goods and services.

There can be a financial benefit to voluntarily registering to collect GST/HST before you hit the $30,000 revenue threshold. How much GST/HST you remit to the government will depend on how you report your GST/HST (there’s a quick method and long method), so take some time to weigh the potential bump to your income against the time it will take you (or the cost for your accountant) to file your GST/HST returns .

- Obtaining licenses or permits

You may need specific licences or permits to operate your business. You can quickly and easily get a detailed list of all the licences and permits you may need for your type of business with BizPal , an online tool jointly managed by all levels of government.

Now that we’ve covered the basic legal requirements of starting a small business in Ontario, let’s dive into our 12-step checklist for getting your business off the ground.

- 12 Steps to Starting a Business in Ontario

- 1. Come up with a business idea

If you’re reading this, you may already have an awesome business idea in mind and need some guidance to turn it into a reality. But if you’re an aspiring entrepreneur struggling to nail down the right business to start, we have some suggestions to get the ideas flowing.

Some of the most successful business ideas come from entrepreneurs trying to solve a problem. Apps, for example, can help people track their habits, conduct business, order food and so much more. Cleaning services, junk removal companies and professional organizers all help people bring order to their homes. Consultants tackle organizational challenges for businesses and governments.

The problem might even be relatively small. When Tina Nguyen, the founder of XXL & CO , made an extra-extra-large scrunchie for a cousin with super-long hair, it sparked a business idea. She started making XXL scrunchies in her parents’ basement, and within a year, she had hired a team of 15 and moved her operations to a warehouse.

Do you have a creative skill that can be monetized? Or can your professional experience be transferred to a side hustle or full-time service? Perhaps you have a passion for a product, or simply an idea on how to do something more efficiently.

Keep in mind how and where you want to work. If you want to sell products but don’t love working face-to-face with customers, then an e-commerce store would make a lot more sense than opening a bricks and mortar shop.

- 2. Research the market

Conducting market research is an important starting point that helps you understand your customer, the demand for your products or services, and your competitors. It’s a key component to building a successful business.

Your market research should answer the following questions:

- Who are your potential clients or customers?

- Do they want your product or service?

- Who is your hero client—the person most likely to buy your product/service?

- What are people looking for in the product or service you’re offering?

- How much are people willing to pay for your product or service?

- How much does it cost to make or source your product, and ship it to customers?

- Is there enough demand to build a successful business?

- What sets you apart from competitors?

A tremendous amount of market data is available online. Statistics Canada is a great resource for consumer demographic information, and you can find industry trends in the Canadian Industry Statistics database. If you’re opening a business with a physical location, local BIAs can be helpful, and your municipality may have demographic data for neighbourhoods ( Toronto’s is very extensive ). Finally, Small Business Enterprise Centres (SBECs) are also a great resource that offer entrepreneurs tools, resources and workshops.

You may also want to survey or poll potential customers. Online tools such as Survey Monkey , Google Forms , as well as polling features available on social media platforms make it relatively easy to do this.

- 3. Choose a business name

Before you register or incorporate your business, you’ll need to decide on a business name, and it’s well worth taking the time to choose one that’s unique and memorable.

As you brainstorm, Google your potential business names and do a domain search to ensure they’re not already being used by other businesses. A registered sole proprietorship or partnership doesn’t automatically have legal protection for its business name, so it is possible for two or more businesses to have the same name —however, that can lead to customer confusion.

Next, you should search your potential business names on the NUANS database of incorporated businesses and the Canadian trademark database to make sure you choose a distinct name that’s not protected. When you’re incorporating a business in Ontario or federally, you’ll also need to get a NUANS report from a registered search company. With Ownr, you can pre-search up to 30 unique names, which helps you save on search fees.

You can incorporate with an English and/or French name. If you choose to have an English form and a French form of your business name, you must have a separate NUANS report for each name. You may also add a version of your business name in any other language.

All incorporated businesses in Ontario must have a legal entity at the end of the name—either Limited, Limitée, Incorporated or Corporation (Ltd., Ltée, Inc. or Corp. for short).

As an alternative, you can choose to incorporate with a number name (which doesn’t require a NUANS search), and then register a business name with the province and trademark it to protect your brand.

- 4. Choose a business structure and register or incorporate

As we outlined above, the three main types of business structures are sole proprietorships, partnerships and corporations. There are several factors that go into determining which is best for you and your business, including liability, tax rates and funding needs.

In general, sole proprietorships and partnerships are simpler business structures with fewer set-up and reporting requirements. The potential downside is business owners are responsible for any liabilities, so your home, vehicles and personal investments could be at risk. Additionally, your business income is taxed at personal income tax rates. Sole proprietorships operating under a name other than your own and all partnerships have to be registered with the province.

Corporations have the advantage of being distinct legal entities, so liability is attached to the business, not you, ensuring your personal assets are protected. Should your company grow highly profitable, there’s a tax advantage to incorporating and drawing a salary from the company. Lastly, there are more funding options available to corporations, including raising money through the sale of shares and loans with lower interest rates.

Incorporating your business is complex and requires a lot of paperwork to obtain your articles of incorporation, but Ownr simplifies the process. We walk you through the process of registering, compiling documentation, and filing your incorporation to ensure no details are missed. We also store all your important documents in one place. Plans are available for ongoing corporation management, which can save you time and money.

- 5. Purchase a domain name and set up social media accounts

With your business name and structure set, it’s time to purchase a domain for your business page and set up social media accounts.

In a perfect world, your business name will be available for your domain (e.g., yourcompany.ca) and social media handles (@yourcomapny). You may want to check for domain availability before even registering your business name to make sure you can get the .com or .ca at a reasonable price.

If your exact name isn’t available, there’s no need to panic. Consider different variations using abbreviations, acronyms, punctuation or some sort of identifier, such as location. Keep your naming convention consistent across all digital and social media platforms for a strong brand presence.

Don’t be afraid to have fun and get creative with your domain and social media handles. Ontario-based workplace design consultancy Bloom opted for a sophisticated action phrase with the domain buildwithbloom.com , and social media handles, @buildwithbloom. Meanwhile, Toronto-based wellness clinic Wellbe opted to add “hello” to the beginning of its domain ( hellowellbe.com ) and social media handles (@hello.wellbe), reinforcing the warm, welcoming tone of the brand.

Once your domain is purchased and social media accounts are created (and set to private or unpublished until you’re ready to launch your business), you can start building a website and then begin to strategize around your social media posting plan. You’ll need to be clear on your company’s value proposition and target market, as well as have a broad strokes marketing strategy to create an effective website. Web development often goes hand-in-hand with writing your business plan. To reduce development and web maintenance costs, consider using a website building service . If you have the budget, consider hiring a designer to create a logo and visual branding for your website, and a copywriter that specializes in small business websites.

Tip: Even if you’ll only be using one or two social media platforms for your business, we recommend securing your handle across Instagram, Facebook, Twitter, TikTok, YouTube, Pinterest, Snapchat and LinkedIn to protect your brand.

- 6. Write a business plan

A business plan provides you with a roadmap for your business, so be sure to dedicate some time to develop it. If you’re not sure where to start or are feeling overwhelmed by the scope, a business plan template can help.

As you craft your business plan , you’ll sense where you’re in good shape and where you need to allocate more time or financial resources. Speaking of finances, your business plan can help you secure funding from banks or investors. While you may have startup costs covered, it often takes one to two years for many businesses to turn a profit.

You may feel there’s no need to develop a business plan. Especially if you’re a sole proprietor who is established in your field with an extensive network of potential clients. But the process can be invaluable for any business owner. It can help identify new or niche opportunities, define growth goals, or find alignment with clients who have similar values—all of which can boost your bottom line.

Keep in mind your business plan is not set in stone. Your vision will change as your business, and the market, evolves, so aim for a solid plan, not a perfect one.

- 7. Open a business bank account

Keep your business finances straight by opening a business account to separate any of your business’s financial dealings from your personal expenses. For corporations, it’s a legal requirement to have a bank account open under the corporate name. Without one, vendors and customers will not be able to make payments to the corporation. However, even if you’re operating your business as a sole proprietorship or partnership, opening a separate business bank account has many benefits . It helps with bookkeeping best practices and you’ll be grateful for it come tax season. Opening a business bank account will also likely make any potential audits easier to deal with, plus any fees associated with the account can be deducted as a business expense. Depending on your banking priorities, there are plenty of options to explore for different business accounts you can open with RBC .

Opening a business bank account with RBC is easy and quick. You can apply online, and in less than 15 minutes, you’ll receive your business bank account number. To activate and finalize your account, you may need to visit a branch to verify your identity. See more details on opening an RBC business account .

One of the many benefits of registering your business with Ownr is that you’ll get money back when you open a business account. Sole proprietorships can receive $100 and corporations can receive $300 if they open a business bank account with RBC within 60 days. See full details on the offer here .

- 8. Secure funding for your business

While some businesses are launched on a shoestring budget, others need capital to get off the ground. Here are some of the places you can find funding.

Federal government business grants and financing

The Government of Canada has a range of grants, tax credits, financing programs, wage subsidies and other types of funding and resources for small business owners.

If you need short-term support in specific areas—for example, a digital marketing team, web design, programming or event management—the federal student work experience program offers wage subsidies when you hire a student for a work term. This can be an affordable way to accelerate projects and build a network of potential future hires.

Ontario business grants

The province of Ontario has small business funding programs to support Indigenous businesses and small businesses in Northern Ontario, as well as training grants for current and future employees. You can also look into whether your municipality or regional innovation centres offers grants or funding programs for local startups. Learn more about the small business grants available in Ontario .

Angel investors

Angel investors generally provide funding (and in some cases mentorship) for a stake in your company.

Crowdfunding

Crowdfunding sites like Kickstarter , Indiegogo , GoFundMe , and Patreon (for creators) harness the power of people and networks to contribute small amounts to meet a big fundraising goal. Too many choices to choose from? Read this guide on how to choose a crowdfunding platform that’s right for your small business.

- 9. Obtain business licences and permits

Specific licences and permits are required for many types of businesses. As mentioned earlier, BizPal provides a detailed list of the licences and permits you may need for your business. Results can be filtered based on your location, industry, and business activities. It’s important that you know and acquire all licences that are required for your business.

One common licence needed for sole proprietorships and partnerships is the business name registration (formerally known as a Master Business Licence or MBL). This lists basic information about your business, like the business name, address, business number and a description of your business activities.

Keep in mind there may be occasions when additional permits are required beyond those already needed to begin business operations. For example, photographers often need location permits for photoshoots, and special permits are often required for events.

- 10. Protect your company with business insurance

Business insurance is an important consideration. The proper insurance for your business can protect you or your corporation from liability and losses that could be financially devastating. There are a variety of options for small business insurance, and the type of coverage that’s best suited for your business will depend on your business activities. Some business activities are relatively low-risk (for example, if you’re the sole employee and you work from home on your laptop), while some may require additional insurance coverage for protection (like if you provide a public-facing service that involves some degree of risk).

Here are some options to consider when choosing what kind of business insurance your small business needs .

- General liability insurance

- Commercial property insurance

- Business income insurance

- Workers’ compensation insurance

- Professional liability insurance

- Data breach insurance

- Commercial auto insurance

We recommend contanting an experienced commercial insurance broker to advise you on the appropriate coverage for your business operations.

- 11. Build your brand presence

Your business is essentially ready to launch at this point—so it’s time to get the word out and build your customer base. Your marketing strategy will depend on your type of business and marketing budget , but there are several effective ways to connect with customers:

- Build your social media following with engaging content

- Reach customers directly with email marketing to build brand loyalty and drive sales (consider email marketing services like HubSpot or MailChimp if you’d like to outsource this)

- Use paid social media to build your following and reach your market more efficiently

- Advertise with local publications or radio stations to reach specific markets or demographics

- Participate in events to increase brand awareness (and keep an eye out for in-kind sponsorship opportunities)

- Network within your industry among local business groups and marketing and events professionals

- 12. Hire employees and scale your business

As your marketing strategy pays off and your business flourishes, you may consider how to grow and scale your business by automating certain tasks to save you valuable time. Another important milestone is hiring employees for your small business .

One way to set your business up for growth and scaling is to automate tasks and processes wherever possible. You can automate emails to clients, batch upload and schedule social media content, or use apps to send out proposals and invoices, or accept payments. Part-time support can also free up your time for growth. A virtual assistant can manage your calendar and take care of invoices, payments or customer inquiries, while a freelance social media manager can handle strategy, content creation and engagement.

Even solopreneurs may reach a point where the demand for goods or services is more than one person can handle. Whether you have the budget to hire employees or choose to outsource some work, bringing the right people on board can help take your business to the next level.

You may want to consider additional professionals for specific services, such as a lawyer to write a vendor contract or an accountant to manage your books and prepare tax filings.

- Frequently asked questions about starting a business in Ontario

- What do I need to start a business in Ontario?

To start a business in Ontario, you first and foremost need an idea for a service or product that you would like to bring to market. Beyond that, following the 12-step process above will set you up for success with your business in Ontario. Registering your small business with Ownr will help make the process simple, and provide you the peace of mind that your business is fully compliant with all legal requirements.

- How much does it cost to register a small business in Ontario?

The cost to register your small business in Ontario depends on the type of business structure you choose. The cheapest and most simple option is to register your business as a sole proprietorship or partnership which costs $60 online, by mail or email when registering yourself. Incorporation in Ontario can range from $300 to $360.

If you choose to register your business with Ownr, the cost for a sole proprietorship is $49 and ranges from $499 to $599 for Ontario corporation, depending on if you incorporate federally or provincially. Learn more about pricing and the advantages of registering as a sole proprietorship or incorporating your business with Ownr , like a year of free online Minute Book management.

- Do you need a license to operate a business in Ontario?

It depends on your exact location, business structure, and the types of business activities you conduct, but in most cases, you will require a business licence to operate. The easiest way to find out what business licences (and any additional permits) that your business requires is by using BizPal , a free service that lets you search for required permits and licences in your area.

- How can I start a business with no money?

Some small businesses require very little capital to startup, for example a freelance service that you provide from home where you already have most of the necessary tools (like if you provide freelance marketing and writing services or work as a virtual assistant). To make money online , you may not require much to get started beyond the fees to register your business (and if operating as a sole proprietorship with your exact name, you may not be required to register). Other businesses, like those selling a commercial product will require greater startup capital for stock, packaging and marketing materials.

- What are the best businesses to start in Ontario?

The best businesses solve a problem or fill a gap in the market, and the same is true of any small business in Ontario. It’s also important that you as a business owner are interested and invested in your business idea. Get inspired with home business ideas for the best businesses to start on Instagram or check out the best small businesses to start in Toronto .If you already have an amazing business idea in mind, here’s how to validate it or put its potential to the test before you proceed with starting up your small business.

- More resources to help you start a business in Ontario

Here are some additional resources to set you on the path to entrepreneurial success. Local small business centres are also a great resource as they will provide tools, workshops and free local resources to help get you started on your entrepreneurial journey.

- Ownr’s managed corporation plan

- Small business grants for Canadian businesses

- Resources and support for Indigenous entrepreneurs

- Resources for Black-owned businesses

- Everything you need to know about startup costs

Starting a business in Ontario is a lot of hard work and takes careful planning, but with this step-by-step guide, you now know some of the basics to make it happen. Go for it!

This article offers general information only, is current as of the date of publication, and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Ventures Inc. or its affiliates.

WxT Language switcher

Dropdown language (interface text).

- Português, Brasil

- Canada.ca |

- Services |

- Departments

- Business plan guide

What is a business plan and why do I need one?

A business plan is a written document that describes your business, its objectives and strategies, the market you are targeting and your financial forecast. It is important to have a business plan because it helps you set realistic goals, secure external funding, measure your success, clarify operational requirements and establish reasonable financial forecasts. Preparing your plan will also help you focus on how to operate your new business and give it the best chance for success.

Securing financial assistance to start your new business will be directly related to the strength of your business plan. To be considered a viable candidate to receive funds from a financial institution or investors, you must demonstrate that you understand every aspect of your business and its ability to generate profit.

A business plan is more than just something to show lenders and investors, it is also necessary to help you plan for the growth and progress of your business. Your business’s success can depend on your plans for the future.

Listed below are examples of questions to ask yourself when writing your business plan:

- How will I generate a profit?

- How will I run the business if sales are low or if profits are down?

- Who is my competition, and how will we coexist?

- Who is my target market?

What should be included in a business plan?

Although business plans can vary in length and scope, all successful business plans contain common elements. The following points should be included in any business plan:

- Executive summary (business description)

Identifying your business opportunity

Marketing and sales strategy of a business plan, financial forecasts of a business plan, other useful documentation, the executive summary (business description).

The executive summary is an overview of the main points in your business plan and is often considered the most important section. It is positioned at the front of the plan and is usually the first section that a potential investor or lender will read. The summary should:

- Include the main points from each of the other sections to explain the basics of your business

- Be sufficiently interesting to motivate the reader to continue reading the rest of your business plan

- Be brief and concise – no more than two pages long

Although the executive summary is the first section of the plan, it is a good idea to write it last – after the other parts of the plan have been finalized.

In this section of your business plan, you will describe what your business is about – its products and/or services – and your plans for the business. This section usually includes:

- Who you are

- What you do

- What you have to offer

- What market you want to target

Remember that the person reading the plan may not understand your business and its products and services as well as you do, so try to avoid using complicated terms. It is also a good idea to get someone who is not involved in the business to read this section of your plan to make sure that anyone can understand it.

Some of the things you should explain in your plan include:

- Whether it is a new business venture, a purchase of an existing business or the expansion of an existing business

- The industry sector your business is in

- The uniqueness of your product or service

- The advantages that your business has over your competition

- The main objectives of your business

- Your legal business structure (sole proprietorship, partnership, corporation)

You can also include the date the business was registered/incorporated, the name of the business, its address and all contact information.

A strong business plan will include a section that describes specific activities that you will use to promote and sell your products or services. A strong sales and marketing section demonstrates that you have a clear idea of how you will get your product or service into market and can answer the following questions for the reader:

- Who are your customers? Do some research and include details of the types of customers who have shown an interest in your product or service. You can describe how you are going to promote yourself to potential customers.

- How are you going to reach your customers? You should know your customers and the best methods to reach them. Research will help you identify the most effective way to connect with your selected audience, whether it is through the Internet, over the telephone or by in-person contact.

- Who is your competition? Once you understand this, you need to research their strengths and weaknesses and use this information to assess potential opportunities and threats to your business.