Royalty Income: Everything You Need to Know

Royalty income is a type of payment for an intangible work or other intellectual property that is patented, trademarked, or copyrighted. 3 min read updated on February 01, 2023

Updated November 5, 2020:

Royalty income is a type of payment for an intangible work or other intellectual property that is patented, trademarked, or copyrighted. These payments occur when another person is profiting from something you've created with your permission. You'll also receive royalty income if you invest in a mineral operation such as gas or oil. Simply put, you can profit from other person using your property by charging royalties. In most cases, royalty agreements are legally binding.

Types of Royalties

Common types of royalties include:

- Performance royalties for the use of copyrighted music

- Royalties for the use of online images and artworks, such as stock photography

- Book royalties that publishers pay to a book's author

- Patent royalties paid to the owner of a patented invention by a third party who makes and sells the invention

- Franchise royalties paid to the owner of a business' name and assets

- Mineral rights paid when natural resources are extracted from a person's land by a utility company

- Royalties paid to celebrities who use their name to promote a fashion line

Terms of Royalty Agreements

While royalty contracts can vary in terms, most require payment of a percentage of the revenue earned while using the property in question. The license agreement must specify the length of the agreement, the product that is given in exchange for the royalty payment, the amount of the royalty payment, and any geographic limitations for use of the product. Note whether the property is being licensed for one-time or perpetual use.

This agreement should also indicate when payments will be made, how records should be kept, and whether an advance payment (sometimes called an earn-out) is required. A common example is with an author contract; he or she receives an advance from the publisher and after royalty amounts exceed that advance, the author will begin receiving royalty payments.

The description of the property in question must be given in detail, and the name of the existing owner provided. For example, if you are licensing a group of stock images, the contract would describe each of them in detail and note that they would heretofore be referred to as "the Images."

Royalty rates vary depending on a number of factors including exclusivity, market demand, and the existence of available alternatives to the product in question. The rate is often a fixed or variable percentage of gross sales and may be subject to a minimum royalty amount. With a royalty agreement, you are selling the property itself and receiving payments depending on the revenue it generates. You can also make an arrangement, called licensing, in which you retain ownership of the property but charge another entity money to use it.

Tax Implications of Royalty Payments

Royalties are both taxable as income and deductible as a business expense. These payments must be reported to the IRS and are usually recorded on Schedule E: Supplemental Income and Loss. However, this depends on whether you own a business, the type of property in question, and who retains ownership of the property.

If you own a business as a sole proprietor or single-member LLC, the income must be reported on Schedule C . Corporations must show royalty income on their balance sheets. An advance on future royalty income is also taxable in the year it is received.

Royalties you pay another entity for the use of intellectual property can be deducted as a business expense. If you are purchasing the property itself and not just the license, it is considered an asset and must be amortized over time.

If you sell your royalty interest, it will likely be considered a capital gain and thus subject to capital gains tax.

Royalty Income Trusts

Royalty income trusts are a type of legal entity known as an investment trust. This financial vehicle is used to hold investments and/or associated cash flows in an operating company. These trusts purchase royalty rights from a natural resource company and pass the profits on to owners of units in the trust. This investment provides a higher yield than bonds and stocks do and are thus attractive to companies that want to sell assets that produce cash flow.

If you need help with royalty income, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Royalty Law

- What Are Royalty Sales?

- Patent Royalty

- Patent Licensing Royalty Rates

- Royalty Financing

- Product Royalty Agreement

- What is Royalty Fee in Franchise

- Royalties On Patents

- Marketing License Agreement

- Licensing Contracts

- We provide data globally

- Our clients

- Where can you use our data?

- How to purchase

- EU Projects

- EU anti tax avoidance package

- Transfer pricing

- What is transfer pricing?

- Transfer pricing terminology

- What is functional analysis?

- Transfer pricing documentation services

- How to set food royalty rates

- Belgian patent box

- Patent box Italia

- Licence agreement examples

- Royalty data features

- Royalty reports

- Taxpayer education

- DEMPE analytics tool

- Identifying intangibles and risks for DEMPE

- DEMPE explained

- DEMPE functional analysis

- DEMPE functions

- DEMPE: six steps

- DEMPE white paper

- CompID – Companies database

- Royalty Rates database

- Service Fees database

- Loan Rates database

- Whole Transfer Pricing Solution

- TP benchmarking tool

- Royalty benchmarking tool

- Credit rating estimation tool

- Database subscriptions

- Ready-made One Searches

- Benchmarking services

- Ready-made benchmarks

- Request a live demo or trial access today

Login to Your Account

Reset your email adress.

Enter your email address below and we'll send you a link to verify your email and set your password.

Royalty payments: how do they work?

Share on LinkedIn

Share on Twitter

Share on Facebook

A guide to royalty payments: from calculation methods to tax implications

RoyaltyRange

For any company looking to enter into a license agreement, understanding the fundamentals of royalty payments is essential: how they work, how they’re calculated, and how they’re treated from a tax perspective.

Royalty payments allow intellectual property (IP) owners to monetise their creations and receive compensation for their use by others. They also enable licensees to invest in new assets in a cost-effective way.

Below we take a closer look at how royalty payments work, along with financial regulations, tax considerations, and how these vary in some key global territories.

For help determining royalty payments, check out our royalty rates database , relied on by multinational enterprises, global consulting companies, international law firms and tax authorities around the globe, and our royalty rate benchmarking tool here .

Royalty payments: the fundamentals

What are royalty payments?

Royalty payments are legally binding payments made by a third party to an individual or company for the ongoing use of their assets, which are usually in the form of ‘intangibles’, i.e. “something which is not a physical asset or a financial asset, which is capable of being owned or controlled for use in commercial activities, and whose use or transfer would be compensated had it occurred in a transaction between independent parties in comparable circumstances”.

What different types of royalty payments are there?

The payment of royalties provides a vital function in creating a fair and equitable way for innovators or owners of IP to receive due compensation for their work. Royalties also play a pivotal role for businesses, giving them legal rights to IP without impinging on an owner’s exclusive rights.

Royalty payments can apply under the terms of licensing agreements for:

- Art – including books, music, performing and visual arts

- Photography, video, and digital content

- Patents, trademarks, copyright, and know-how

- Business franchises

- Oil and gas mining royalties

What are common royalty payment structures?

Royalties are typically agreed as part of licensing agreements between a licensor and the licensee. Depending on the type of asset or other factors, various payment structures may be used.

Most structures involve determining payments based on a percentage of the revenue or profits earned from using the IP. For patents, in particular, royalty payment structures are often based on a fixed percentage of sales or a flat fee per unit sold. Franchises often involve a significant initial royalty fee, in addition to percentage royalties, to account for the brand equity already established in the franchise. For newer IPs, the initial royalty percentage may start small and increase as sales take off.

How are royalty payments calculated?

Of course, it’s essential that all parties agree on fair royalty rates. Rates may be negotiated based on a number of factors, such as exclusivity, market demand, brand recognition, geographical region, and competitor analysis. It is also important for parties to consider industry benchmarks, market research, and the potential value the IP will bring to the licensee.

To determine accurate royalty rates, parties typically rely on access to high-quality comparative data. Commercial databases are a practical and cost-effective way of identifying external comparables. They can provide the most reliable source of information, giving parties confidence that their royalty agreement features optimum royalty rates for all concerned.

Learn more about how to calculate royalty payments with our benchmarking tool here .

Royalty payments and tax considerations

Below you can see how royalty payments are accounted for in different countries from a tax perspective.

Royalties are part of business income, counting towards annual tax. Individuals receiving royalties must declare earnings on their self-assessment but can make use of the trading allowance of £1000 to reduce the tax burden.

In 2017, a government consultation regarding the impact of the digital economy resulted in tweaks to royalty taxation. Under the current system, companies making royalty payments in specific areas will need to deduct withholding tax at 20% from those royalties.

Under the EU Interest and Royalties Directive (IRD), EU companies are allowed to make certain interest and royalty payments to associated companies within the EU without deducting tax. Since Brexit, this no longer applies to the UK.

Businesses can generally take a tax deduction for royalty payments as expenses. The IRS treats royalty income as ordinary income reportable either on Schedule E for Supplemental Income & Loss or Schedule C for self-employed people. Paying royalties or licensing fees might fall under business expenses, and payments over $10 a year must be reported on a 1099-MISC form to show total payments.

International

International transactions involving royalty payments may require compliance with transfer pricing regulations, which aim to ensure that royalty payments are conducted at arm’s length. These regulations prevent tax evasion and ensure that intercompany transactions are conducted at fair market value. You can read more about arm’s length transactions in our blog post here .

Royalty payments: Looking to the future

As the world becomes increasingly digitised and intangibles such as digital content and software transform the landscapes of technology and creative industries, royalties will continue to play a crucial role for creators and businesses alike. New forms of IP are emerging in the global economy, making the calculation, tracking and enforcement of royalties ever more challenging.

“Although advancements are continually occurring, it is reliable, accessible comparative data that remains the key to royalty agreements that provide mutually beneficial payment terms, as well as encourage collaboration and innovation,” says Kris Rudzika, Managing Partner at RoyaltyRange.

When it comes to finding the highest quality data for setting fair and accurate royalty rates, the RoyaltyRange database is the go-to tool for multinational enterprises, global consulting companies, international law firms and tax authorities in more than 70 countries around the world.

Ready to get started? Use the search box on the right to begin your royalty rates search.

Or, if you’d like to find out more, read about how our royalty rates search service works .

The information provided below is for general informational purposes only and should not be construed as legal or tax advice. It is not a substitute for consulting with a qualified legal or tax professional.

Request royalty rate search

We will perform the search and deliver the initial results within hours, at no cost., finalize your request, within hours, you will receive a detailed list of reports from our search at no cost. if you are happy with the results of our search, you can then choose to pay for and download the data for a fee of . the fee for an optional write-up is ., your contact information.

How to Buy Royalties: A Guide to Royalty Investing

In the words of author H. W. Charles, the key is to work extremely hard for a short period, create abundant wealth, and then make more money through wise investments that generate passive income for life.

There are a few ways you can go about generating passive income — and one of the most interesting is to buy royalties.

What Are Royalties?

Royalties are a popular type of alternative investment. When you invest in a royalty, you receive compensation for the ongoing use or ownership of a physical or intellectual asset — like a song or a product.

During a royalty negotiation , both parties agree to terms and lay them out in an official licensing agreement. The royalty rate that you receive is typically expressed either as a payment per unit or as a percentage of sales for a specific period — up to and including “in perpetuity.”

Property owners often decide to sell royalties because they need funding. For example, a songwriter, band, or record label may sell royalties to their music to fund a new personal or business-related project.

In another example, someone might sell a piece of intellectual property to turn an idea like a new invention into liquid capital. The person may have a great idea but lack the means to turn it into a viable product.

As a seasoned investor, you’d be wise to keep your eye out for royalty opportunities. If you come across a surefire money-maker, it could be worth providing funding, becoming a rightsholder, and potentially receiving royalty income payouts.

But as you can imagine, royalty investing isn’t for the faint of heart.

Learn More:

- Best Passive Income Ideas

Types of Royalties

There are several types of royalties that you can invest in, including copyrighted works, natural resources, and businesses.

Copyright Royalties

Copyright royalties can include items like books, works of art, and music.

For example, you might invest in a new or classic song from Eminem or Rihanna or a book from a leading author like John Grisham. Another option would be to buy the rights to a classic film like Trading Places starring Eddie Murphy — one of my faves!

Performance Royalties

Performance royalties are fees that users pay for the right to play someone else’s music in a public environment.

For example, bars and restaurants, streaming services like Spotify, and radio stations all commonly pay performance royalties to trending artists.

Mechanical Royalties

A mechanical royalty is a fee specifically for reproducing a musical composition. Mechanical royalties can apply to physical, digital, download-to-own, and streaming services.

Print Music Royalties

Musicians often sell their music in printed sheets to publishers for reproduction. In exchange, publishers pay print music royalties for the right to sell their material in physical or digital form.

Synch Royalties

Content producers pay synch royalties when using copyrighted music in audiovisual productions like movies, advertisements, and television shows.

Mineral Royalties

Extractors often pay property owners for the right to take natural resources from their property.

For example, a property owner sitting on a lucrative piece of land might want to make money selling oil and gas royalty licenses to buyers for an agreed-upon period of time. In this case, an extractor would pay the owner for mineral royalty rights.

By securing mineral rights, you can legally remove, process, and profit from someone else’s raw materials.

Patent Royalties

Inventors commonly make their money by patenting products and then creating licensing agreements that allow other people to use their models.

As an investor, you can buy patent royalties and invest in intellectual property.

Franchise Royalties

Business owners often pay companies a fee for the right to open a franchise under their name. This type of royalty is common in the fast-food industry — like McDonald’s and Chick-fil-A.

How to Buy Royalties

Investing in royalties may seem complicated at first. But truth be told, it actually has a surprisingly low barrier to entry.

Use the following steps to start investing in royalties and increasing your earnings.

Step 1: Make Sure You are Ready to Take on Risk

All investments carry some amount of risk, and royalties are far from an exception. So before you do anything, make sure you can afford to take on risk in your portfolio.

For example, music, art, and entertainment all carry valuation risk. In other words, you may overpay for someone else’s property. There’s also the threat of counterparty risk. That being the case, you must do your due diligence and ensure that the person selling an asset owns what they’re hawking.

Additional factors to consider include inflation, changing regulatory policies, and technological innovation — all of which can impact the value of an asset. There are simply no guarantees that your royalty interests will pan out.

This is especially important to consider when buying property like a patent or business. Just because something looks good on paper — or maybe you have even connected with it emotionally — doesn’t mean it will pan out and turn into a viable or secure source of revenue.

Step 2: Pick a Type of Royalty

Ready to move forward? The next step is to figure out what type of royalty you want to invest in.

My advice is to keep it simple. As with any investment, focus your resources and energy on something you understand.

For example, if you are looking for passive long-term growth and you have above-average knowledge of fine art, then investing in art and entertainment royalties could be the way to go.

If you’re a foodie and have some restaurant experience, you may want to franchise a fast-food business. If you’re a tech guru or inventor, you could invest in someone’s intellectual property.

Whatever you decide, figure out a direction that you’re comfortable with and excited about and proceed from there.

Step 3: Select an Exchange

To buy royalties, you typically have to go through an online exchange.

Here are some of the top online marketplaces to check out if you’re interested in investing in this space.

Royalty Exchange

Royalty Exchange is a leading royalty marketplace for buyers and sellers. Here you can buy royalties in music, film, books, oil, and pharmaceutical companies.

SongVest is another app that makes it easy to buy and sell royalties. This platform deals solely with music.

This is a great place to invest in new and old albums in a way that is convenient and secure.

Step 4: Research Thoroughly

Once you have an idea of the type of royalty that you want to purchase, the next step is to hunker down and research the targeted asset.

For example, you might find a hit song that you think has long-term playability. But before you put money into it, you should do some market research and try to get a sense of how solid the artist is. During this process, it pays to look into the musician’s reputation, popularity, and customer base.

Try and get a sense of who would play the artist’s music and when. Does the artist have a solid following on social media?

Keep in mind that a song that is wildly popular one minute could easily disappear from the music charts the next minute, reducing its potential to generate revenue.

The main takeaway here is to treat a royalty like any serious investment. Avoid making emotional decisions and make sure the long-term potential looks promising before putting any money into it.

Why Should You Invest in Royalties?

Here are some of the reasons why you might want to invest in royalties.

Generate a Recurring Cash Flow

Royalty streams can be an effective way to put steady money in your pocket without having to go through the trouble of producing something of value — like a song or book — or starting up a restaurant from scratch.

For example, you might structure a music royalty in a way that enables you to get a commission every time someone downloads a song or plays one in a bar. This strategy allows you to use other peoples’ hard work, ideas, and assets as a way to generate income for yourself.

Of course, if you’re a talented musician, you can also sell the rights to a new song you write and produce and receive steady payments for your work without having to play gigs every night.

Obtain Higher-Yield Investments

Another great reason to invest in royalties is you can potentially generate much stronger returns on your investments.

For example, music catalogs often have royalty investments that promote yields of 10% or more.

Diversify your Portfolio

Most investors start by putting money into the stock market and investing in equities, bonds, ETFs, and funds. But once you establish yourself as an investor and build a foundational portfolio, it’s a good idea to branch out and explore some different types of alternative assets .

Royalty assets provide a great way to diversify your portfolio and shield yourself from market volatility. They also give you exposure to different types of investments that can lead to stronger profits.

Frequently Asked Questions

What is a life of rights document.

A life of rights document gives you the right to collect royalties from an asset during the duration of the specified agreement. It’s one of the most critical pieces of documentation that you can collect when buying royalties — and something you should carefully scour before signing.

Are royalties a good investment?

It largely depends on the type of royalty you’re considering. Some royalties can be a great investment, while others can turn out to be complete disasters.

Personally, I prefer to invest in the stock market. But every investor has different goals and preferences.

Where can I buy royalties?

You can secure most royalties through an online marketplace like Royalty Exchange. These apps make the royalty-buying process easy and provide a wealth of insights to help you make informed decisions.

Royalty Investing Can be Risky but Profitable

One of the secrets to making money is to always keep your ears and eyes open for new investment opportunities. Expanding into a different asset class like royalties can boost your income stream and help diversify your portfolio.

However, getting to the point where you can collect royalty payments isn’t easy, and you need to be aware of the risks that come with this type of investment .

Putting money into the music industry or film industry can lead to big gains, but it can also be pretty risky if you don’t know what you’re doing-especially if you invest a lot of money.

The good news is that you could make a small fortune if you play your cards right. But if you play the wrong hand, you could seriously set yourself back financially.

My two cents: Don’t consider royalty investing until you already have a well-rounded, six-figure stock portfolio built up, plus six months’ worth of expenses stashed away in cash .

At the end of the day, you need to remember that there are no shortcuts to prosperity. But if you are willing to hustle and make smart financial decisions, anything is possible.

Here’s to making the smartest decisions on your journey to financial freedom!

No comments yet. Add your own

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Advertiser Disclosure

This website is an independent, advertising-supported comparison service. We want to help you make personal finance decisions with confidence by providing you with free interactive tools, helpful data points, and by publishing original and objective content.

We work hard to share thorough research and our honest experience with products and brands. Of course, personal finance is personal so one person’s experience may differ from someone else’s, and estimates based on past performance do not guarantee future results. As such, our advice may not apply directly to your individual situation. We are not financial advisors and we recommend you consult with a financial professional before making any serious financial decisions.

How We Make Money

We make money from affiliate relationships with companies that we personally believe in. This means that, at no additional cost to you, we may get paid when you click on a link.

This compensation may impact how and where products appear on this site (including, for example, the order in which they appear), but does not influence our editorial integrity. We do not sell specific rankings on any of our “best of” posts or take money in exchange for a positive review.

At the end of the day, our readers come first and your trust is very important to us. We will always share our sincere opinions, and we are selective when choosing which companies to partner with.

The revenue these partnerships generate gives us the opportunity to pay our great team of writers for their work, as well as continue to improve the website and its content.

Editorial Disclosure

Opinions expressed in our articles are solely those of the writer. The information regarding any product was independently collected and was not provided nor reviewed by the company or issuer. The rates, terms and fees presented are accurate at the time of publication, but these change often. We recommend verifying with the source to confirm the most up to date information.

Learn more in our full disclaimer

Advertisement

What Is Royalty Income and How Is It Taxed?

- Share Content on Facebook

- Share Content on LinkedIn

- Share Content on Flipboard

- Share Content on Reddit

- Share Content via Email

If you've ever created anything — like music , art or literature — and someone else profits from its use, you may be entitled to royalty income. In other words, if others use your work to make money, you get money. Royalties are payments for use of intangible works (not services). You can also receive royalty income through investment in a mineral operation, like gas or oil.

Artists can negotiate their royalties in different ways. For example, you can sell your work (also called property ) to an investor in return for a constant percentage of royalties on the revenue the investor makes. Or you can simply receive a royalty any time anyone uses your property to make money (called licensing .) No matter how or why you receive royalties, the federal government sees them as income , and expects you to report that income on your taxes [source: IRS ].

Taxes paid on royalty income depend on many factors, including the following:

- Whether the creative work is a trade or a business

- The timing and kind of income received

- Who owns the property (an individual or a corporation, for example)

Although there is no blanket equation for royalty taxes, typically royalties received from your work are reported as self-employment income and are taxed at a higher rate. You report these on Schedule C of IRS form 1040. If you earn more than $400 through self-employment, including royalties, you must report that income on your tax return.

Royalties from one-time earnings (a gig that isn't your primary job), or mineral interests, are reported on Schedule E of IRS Form 1040. Let's look at a few real-life examples.

Say you write and publish a book outside of your regular job. In the eyes of the government, you're not self-employed as a writer, so your royalties wouldn't be reported as self-employment under Schedule C. Instead, report them under Schedule E, Supplemental Income. However, if you're a full-time writer, or you regularly revise/update your book, the government considers you self-employed as a writer and you would report your royalties under Schedule C, Profit or Loss from Business [source: Saenz ].

Of course, it's not always so cut and dried. Often, artists receive advance royalties before a work is completed. For example, a record company might pay a songwriter advance royalties of $10,000 for the rights to 10 songs, plus a percentage of proceeds of the songs' sales. But if the songs end up not making any money, the songwriter still gets to keep the $10,000. So even though that money is called advance "royalties," the taxman actually sees that $10,000 as money for services rendered, reported on IRS Form 1099-Misc, Non-Employee Compensation [source: Kelley ].

In the streaming era, musicians earn small royalties every time their song is streamed on services like Spotify and Pandora. Interestingly, streaming royalties are paid to both the performer and writer of a song, while royalties for songs played on the radio are only paid to the writer. The average per-stream payouts are a miniscule $0.006 to $0.0084; [source: Wang ]. In an era of declining royalties, musicians have to get creative to earn a decent living, whether it's with live events, exclusive content to subscribers, advertising deals or selling merchandise.

If you need more guidance on royalties, a tax adviser can point you in the right direction.

Royalty Income FAQ

What is royalty income, are royalty payments tax deductible, are royalties earned or unearned income, is royalty income considered investment income, are royalties a business income, lots more information, related articles.

- Are moving expenses tax deductible?

- Is your hobby income taxable?

- Is child support tax deductible?

- How Itemized Deductions Work

- How do depreciation and amortization affect your taxes?

- Adkins, W.D. "Royalties Subject to Self-Employment Tax." Houston Chronicle. 2014. (Sept. 26, 2014) http://smallbusiness.chron.com/royalties-subject-selfemployment-tax-12596.html

- Financial Web. "Reporting Royalties In Your Federal Income Tax Schedule." 2014. (Sept. 25, 2014) http://www.finweb.com/taxes/reporting-royalties-in-your-federal-income-tax-schedule.html#axzz3ETO7CD00

- Investopedia. "Royalty." 2014. (Sept. 26, 2014) http://www.investopedia.com/terms/r/royalty.asp

- Kelley, Claudia L., Ph.D., CPA, and Kowalczyk, Tamara, Ph.D., CPA. "Tax Issues for Individuals Who Create Intellectual Property." American Institute of CPAs. Dec. 1, 2014. (Sept. 25, 2014) https://www.thetaxadviser.com/issues/2013/dec/kelley-dec2013.html

- Saenz, George. "Royalties deemed ordinary income." Bankrate. Oct. 11, 2007. (Sept. 26, 2014) https://www.bankrate.com/finance/taxes/reporting-royalty-income-for-textbook.aspx

- Wang, Amy X. "How Musicians Make Money -- or Don't At All -- in 2018." Rolling Stone. Aug. 8, 2018 (Feb. 3, 2021) https://www.rollingstone.com/pro/features/how-musicians-make-money-or-dont-at-all-in-2018-706745/

Please copy/paste the following text to properly cite this HowStuffWorks.com article:

What are Royalties & How do Royalty Payments Work?

Table of Contents

Royalty payments are what encourage and protect creativity and inventions around the world. From the photograph hanging on your wall, the song playing from your radio–even the fuel powering your car (which started as crude oil extracted from someone’s land). Royalty payments ensure that the creators and owners of these properties are appropriately compensated.

Essentially, royalty payments are payments received through license agreements or royalty agreements that compensate owners for the use of their intellectual property, creative works, or mineral rights for natural resources like oil and gas extracted from their land.

Royalties provide cash flow to owners through a legal contract for a royalty-based license that pays a percentage of gross revenue, net sales, or another negotiated rate during the license term.

This article defines royalties, royalty payments, royalty income, and royalty fees. It provides insights into types of royalties and typical royalty percentages.

What are Royalties?

Royalties are payments that purchase the rights to use, have or make changes to someone else’s property, whether it’s intellectual property or other creative works. The royalty rate is usually negotiated and determined between the licensor and licensee

What Works Can be Copyrighted to Receive Royalties?

The U.S. Copyright Office is used to register and copyright these types of works before publication:

- Literary works

- Performing arts

- Visual arts

- Other digital content

- Motion pictures, and

- Photographs.

Types of Royalties

Types of royalties include:

- Songwriters, composers, and their publishers owning the copyright

- Book publishing royalties

- Digital content and social media influencers

- paid to mineral rights owners with a royalty interest

- Franchise fees in franchising businesses

- Patent royalties

Transform the way your finance team works.

Bring scale and efficiency to your business with fully-automated, end-to-end payables.

Royalty Income vs. Royalty Payments vs. Royalty Fees

Royalty payments, royalty income, and royalty fees differ based on the license agreement and the type of royalty.

What is Royalty Income?

Royalty income is the amount received through a licensing or rights agreement for the use of copyrighted works, influencer endorsements, intellectual property like patents, or natural resources like oil and gas properties, often including an upfront payment and ongoing earnings and payments.

What are Royalty Payments?

Royalty payments are funds paid to owners through a royalty agreement for rights to publish or use copyrighted writing, music, movies, other intellectual property like patents or types of tangible property like oil & gas land for drilling rights.

What are Royalty Fees?

Royalty fees are amounts earned upfront and subsequently upon making product sales from their licensers or publishers of copyrighted works of literature, music, or other types of property like patents or oil & gas land. In the franchising industry, the franchisee pays the franchise company ongoing franchise royalty fees as a percentage of revenues to remain in the franchise.

Average franchising royalty fees are 6%, according to franchise industry software provider, FranConnect.

Royalty Payments and Royalty Income Examples

What are royalties in music.

According to Songtrust, music industry royalties include Composition Royalties, which are performance royalties and mechanical royalties related to physically reproducing, digitally streaming, or downloading musical compositions. Music royalties also include Master Recording royalties for digital performance royalties and master recording revenues.

Performance royalties are royalty fees paid by public broadcasters and users of copyrighted performance royalties. Triggers include radio stations playing songs or music, movies, television shows, advertisements, and public events with theme songs or music used at political campaign rallies.

ASCAP is the organization for songwriters, composers, and music publishers that helps them register their music and see royalty statements online to collect royalties. BMI is the largest U.S. non-profit music rights organization that connects songwriters and music owners to the companies and organizations that want to play their music publicly.

Distributors in the music industry, like CD Baby, structure agreements to receive either fixed fees or percentage distribution royalties from the artist’s master recording royalties.

Book Publishing Royalties

Book publishing companies pay royalties to an author for their copyrighted work when they purchase the rights to publish their book. Published authors receive both advances and future royalties income based on book sales. Once books are sold, the book royalties are payable, then paid once or twice a year, according to the publisher, Penguin books.

Digital and video content

Companies are turning to online content creators—bloggers, vloggers, dancers, music artists, and more—for a new take on digital marketing. From web videos to blogs, creative partners run the gamut of content specialties and niches. Consider YouTube: creators are producing comedy skits, DIY, daily vloggers, gaming streams, pranks, challenges, cooking videos—and that’s just one video platform!

The diverse content specialties demonstrate that every collaboration is its own production, which means a standard royalty rate doesn’t exist. In a Collaborator Academy course , YouTube shared a list of various costs to keep in mind when collaborating with a content partner:

Talent: paying for the on-air talent and whether that contract is exclusive, non-commit, or just a talent fee.

Production: the work behind the scenes, such as special effects or on-location fees.

Intellectual property: the rights and terms to use the video for commercial use.

Distribution: placing the content on the websites.

Media amplification: promoting the video collaboration through social channels.

These pricing considerations can also apply to other partnerships with other creators like lifestyle bloggers or songwriters. Understanding the various aspects of producing content will help you develop a productive partnership with creative content creators domestically and abroad.

Under U.S. copyright law , original works receive “copyright protection the moment it is created and fixed in a tangible form that it is perceptible either directly or with the aid of a machine or device.” In other words, any original work produced by a content creator is automatically copyrighted, which gives the creator the right to license the asset and charge royalties for ongoing use of it. The royalty rate is calculated according to specific terms defined in a licensing agreement; the terms include restrictions on geographic distribution, time period, or the number of uses of the licensed asset. A typical calculation for a royalty rate is paying a specific percentage of the sales generated from the asset.

Franchisee to Franchisor Royalties

According to the Small Business Administration (SBA), in franchising, franchisees pay monthly franchise royalties ( franchise fees ) to a franchisor as 4% to 12%+ of gross sales to “own and operate the business.”

Oil and Gas Royalties to Mineral Rights Owners

Oil & gas producers pay royalties to land mineral rights owners monthly based on their royalty interest for production. The royalty payment is the negotiated percentage of gross revenue from production, based on the oil & gas lease.

Patent Royalties

A patent licensee pays the patent owner for the rights to use the invention based on a negotiated agreement. The patent license may either be a fixed-rate contract or a royalties-based license fee. The arrangement may be exclusive or non-exclusive use of the patent’s intellectual property, providing the know-how to become a licensed product and legal protection. The length of the patent license is determined in the license agreement.

What is Royalty Payments Tax Treatment in the U.S.?

In the U.S., businesses can generally take a tax deduction for royalty payments as expenses.

The IRS treats royalty income received as ordinary income reportable either on Schedule E for Supplemental Income and Loss or Schedule C for self-employed individuals. IRS Publication 525 has more detailed information about Taxable and Nontaxable Income.

Payers report royalties of $10 or more paid to recipients in Box 2 of the information return, Form 1099- MISC . Payers send or file a copy of each form with the IRS, any applicable state, and the recipients to prepare their income tax returns.

How Do Royalty Payments Work?

Royalty payments are negotiated once through a legal agreement and paid on a continuing basis by licensees to owners granting a license to use their intellectual property or assets over the term of the license period. Royalty payments are often structured as a percentage of gross or net revenues.

What is a Royalty Deal?

A royalty deal is when an investor gives funds to a company–not the individual–in exchange for a certain percentage of total sales. For example, let’s say an investor invests in a clothing company and receives 5% of gross sales. This means the investor earns $2.50 on every $50 shirt sold.

Example of Automated Royalty Payment Processing

Because royalty payments are made to many payees at once, using a system for mass payment automation is essential to streamline the process.

Lean operations are the ideal in many industries, but it’s critical for companies that deal with digital creative services.

Izo, Digital Media Firm, Automates Tax Identification Process

Izo, the parent company of Dance On, is well aware of the challenge. The Los Angeles-based digital media firm partners with thousands of dance groups around the world to produce videos aimed at Millennial and Gen-Z audiences. Izo’s influence network is best known for creating dance music videos to Silentó’s “Watch Me (Whip/Nae Nae),” helping propel it as the top trending song in 2015.

That’s the heart of its business—collaborating and distributing content—but Izo knew that cumbersome back-end processes would distract the company from its focus.

“For a lot of early-stage digital media entertainment companies, in order for them to become cashflow positive, it behooves them to run very lean,” Izo Chief Finance Officer Dan Steinberg told Tipalti. “Digital media involves much more guerrilla approaches to production. You’re filming a lot more with lower budgets, and ideally employing data-driven approaches to extend the value of content.”

With the help of the Tipalti mass payment platform , Izo improved its royalties payment workflow by automating tasks related to tax identification. Previously, Izo had to request, collect, and validate the tax identification of its growing community of content creators. But after implementing the Tipalti platform, new artists and partners were able to complete digital IRS W-9 and W-8 documents through Tipalti’s onboarding portal. The streamlined workflow reduced the paperwork for partners and Izo management, enabling the company to run a lean finance operation.

“From our partners’ standpoint, the process is smooth and transparent,” Steinberg said. “We don’t hear complaints. That’s the golden indicator that nothing is going wrong, and that’s the payment experience you want.”

Use Automation to Create a Lean Finance Operation

Simply put, automation is the key to unlocking the secret behind global creator and royalty payments. A lean finance operation enables Izo to put its business growth efforts where it matters most: growing its influencer network, creating exciting new content, and connecting with new audiences.

Why put geographic limits on creative collaboration and marketing reach? Automation is the key to unlocking the secret behind growing your global creator network while scaling your royalty payment capabilities. A mass payment platform like Tipalti takes on the manual tasks, such as verifying country-specific tax compliance, and keeps you focused on partnering with influencers and other creatives without geographic limitations.

That Germany-based video creator you’ve been dying to partner with? You can now reach out in confidence, knowing your business operations will support global partners.

Creative partners are the driving force of change, continually serving up new ways to share information or tell stories. Lean business operations using automation enable media producers to focus on where it matters: producing innovative content with the growing community of creatives around the world.

Conclusion – Royalties and How Royalty Payment Works

Businesses and organizations pay royalties to owners to use their creative works and pay owners for their intellectual property or ownership interests like mineral rights. Users pay royalties based on the terms of a legal license agreement. A royalty payment received by licensees is royalty income to the recipient, subject to U.S. ordinary income taxation.

Streamlining the royalty payment process with AP automation software significantly increases business efficiency. If your business pays royalties, refer to this link to find out how to make royalty payments efficiently to attract and retain creative talent.

Comparing the Top Global Payment Methods

There are numerous options for paying international suppliers, from prepaid debit cards to international ACH to wire transfers and more. Each has benefits and drawbacks that impact the satisfaction of your suppliers and the workload of your finance team

Download the eBook to discover:

- The current state of supplier payments

- Today’s top global payment methods

- Comparing Wire Transfers, Domestic ACH, Global ACH, Paper Checks, Prepaid Debit Cards, and PayPal

- How automation enables multiple payment methods

Fill out the form to get your free eBook.

About the Author

Barbara Cook

RELATED ARTICLES

- Search Search Please fill out this field.

- Building Your Business

- Business Taxes

What Are Royalties?

How royalties work, examples and types of royalties, frequently asked questions (faqs).

MoMo Productions / Getty Images

Royalties are payments to owners of property for use of that property. Royalties often deal with payments for the right to use intellectual property (IP) such as copyrights, patents, and trademarks.

Key Takeaways

- Royalties are payments that buy the right to use someone else's property.

- Licensing agreements outline the details of royalty payments.

- Royalty payments may cover many different types of property, including patented inventions, the use of artwork, or the mining of resources.

- Royalties may be reported as business income or expenses.

- Typically, you have to report royalties on Schedule E when you file your taxes.

Royalties are payments that buy the right to use someone else's property. Royalties stem from licensing, which is the process of giving or getting permission to have, produce, or use something that someone else has created or owns.

In other words, when you keep the ownership of the property and get royalties from someone for use of that property, that is licensing. Licensing your business's intellectual property and getting royalties from these licenses is a common way to increase your business income. Royalties also protect the buyer from claims by the owner for improper use.

Royalty fees and payment amounts can be set in a variety of ways. For example, in a franchise situation, fees can be set as a fixed or variable percentage of gross sales. In many cases, there is a minimum royalty. Some common forms of royalty payments include:

- Royalties for specific products (like a book, a piece of music, a patented product, or a concert); these are generally based on the number of units sold.

- Royalties for oil, gas, and mineral properties; these may be based on either revenue or on units, such as barrels of oil or tons of coal.

A variable percentage is often used for newly created IP. In this case, the royalty percentage might be small in the beginning because sales are low. As sales increase, the royalty percentage might increase to a maximum amount.

Some royalties are paid for public licenses. The Copyright Office collects royalty fees in several scenarios, including:

- Cable operators retransmitting TV and radio broadcasts

- Satellite carriers retransmitting network and non-network signals

- Distribution of digital audio recording devices and media

Each type of royalty payment has benefits and drawbacks for each party. The owner of the property will negotiate the specifics of royalty payments with potential buyers as they create a contract.

While royalty contracts differ depending on the type of royalty, there are some common features in royalty contracts.

The contract will include a detailed description of the subject matter (the property) and who owns it. For example, if you are selling the right to use a group of your images to an online image company such as Getty Images, you would describe your images in detail (maybe with a listing), then the following references to the photos could simply call them "the Images."

The contract will detail the scope and limits of the use of the property. For example, you might allow someone just one-time use, or you might allow perpetual use of your images.

The contract will also include the payments (the royalties themselves). The section covering payments should include:

- When the payments are to be made

- How the amount of payments is determined

- How records are to be kept

- Any advance payments

The contract could also establish an " earnout " arrangement that bases royalty payments on the performance of the property being licensed. In an author contract, for example, there may be an advance. When the author's portion of royalties from book sales exceeds the amount of the advance, the author will begin receiving additional royalty payments.

Like other legal business contracts, licensing and royalty contracts may vary based on state laws. Check with an attorney who practices in your state to get more details.

Like other forms of payment in a business, royalties are taxable income and also a business expense.

If you receive royalties from someone for use of your property, you must claim these payments as business income, usually on Schedule E (Form 1040). Royalties from copyrights, patents, and oil, gas, and mineral properties are taxable as ordinary income. In general, any royalties you receive are considered as income in the year you receive them.

If you are paying royalties or licensing fees, these payments might fall under legitimate business expenses . If the payments are for the purchase of property, the property becomes an asset on your business balance sheet, and the payments might need to be amortized . If you pay more than $10 in royalties in a year, you must give the payee a 1099-MISC form to show the total of your payments for the year.

The question of how this expense is entered on your business tax return depends on the specifics of your situation. Before you attempt to include any of these royalties or licensing fees as expenses, check with your tax professional.

In music, royalties are paid to owners of copyrighted music. These are called performance royalties. You may pay this royalty if you want to play a song on your radio station or use the song in your movie.

A musician may register a trademark or copyright with a private performing rights organization (PRO) such as ASCAP or BMI. The PRO assumes responsibility for collecting royalties, then it distributes the royalties to the owner.

Royalties may be paid for the use of images, such as when you want to add stock photography to your website. Another type of royalty is a book royalty, which publishers pay to authors for every book they sell.

If someone wants to make or use a patented product, like a new invention, they will have to pay a royalty to the person who owns the patent.

In franchised businesses, such as 7-Eleven convenience stores, the franchise holder pays franchise royalties to the main company for the use of the name and other assets.

Royalties may also be paid in the context of rights to take minerals from the property of someone else. These are often called mineral rights, rather than royalties, but they work the same way. For example, oil and gas producers in the U.S. pay a royalty of 12.5% of production value for onshore operations.

What are examples of royalties?

Royalties can be paid out to an author for books sales, a songwriter for a song, or to a musician for an album.

How are royalties paid?

Royalties can be paid at a flat percentage of sales, for example, or via a variable percentage rate that starts out lower and increases as sales of the property increase.

IRS. " Publication 525: Taxable and Nontaxable Income ." Page 17.

Royalty Rates. " Intellectual Property Royalties—Everything You Need To Know ."

Copyright Office. " Circular 75: The Licensing Division of the Copyright Office ." Page 1.

The Steve Laube Agency. " The Myth of the Unearned Advance ."

Contracts Counsel. " Royalty Agreement ."

CCH AnswerConnect. " Business Expense Deductions for Rents and Royalties ."

IRS. " About Form 1099-MISC, Miscellanious Income ."

Department of the Interior. " Revenues ."

- Royalty and Residual Income Management

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on January 24, 2024

Get Any Financial Question Answered

Table of contents, what is royalty and residual income management.

Effective royalty and residual income management are essential for maximizing earnings, ensuring financial stability, and growing wealth over time. Proper management involves tracking income sources, negotiating favorable agreements, and implementing tax and investment strategies .

Royalty income refers to the earnings generated from the use or sale of intellectual property, such as patents, copyrights, and trademarks. Royalty income is typically received by the creator or owner of the intellectual property in exchange for granting others the right to use or sell their creations.

Residual income, also known as passive income , is the money earned on a regular basis with little to no effort required to maintain the income stream. Examples of residual income sources include rental properties, dividend stocks, and income from network marketing.

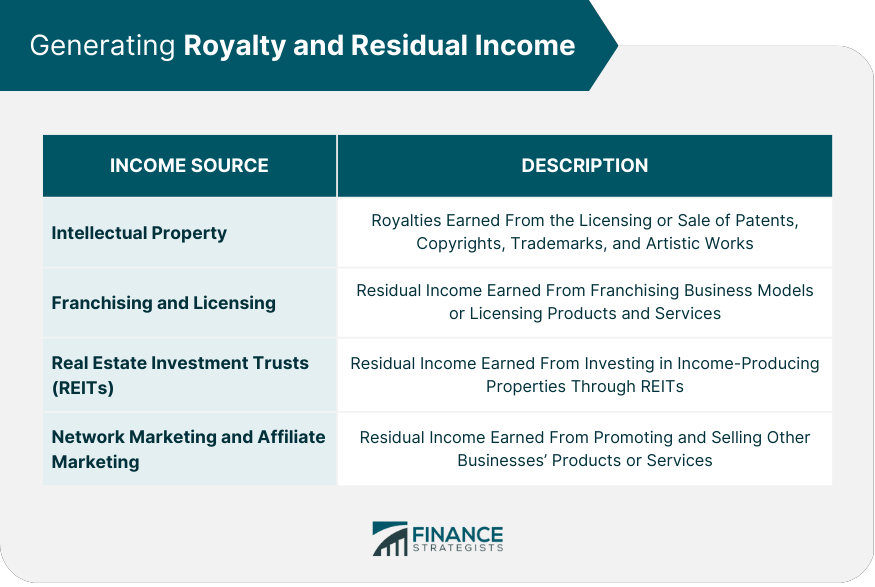

Generating Royalty and Residual Income

Intellectual property royalties.

Patents grant inventors the exclusive right to make, use, or sell their inventions for a limited period, typically 20 years. Patent owners can earn royalty income by licensing their inventions to others or by selling their patented products.

Copyrights protect original works of authorship, such as books, music, and films. Copyright holders can earn royalty income by licensing their works for reproduction, distribution, or public performance.

Trademarks protect brand names, logos, and other distinctive marks used in commerce. Trademark owners can earn royalty income by licensing their marks for use by other businesses.

Artistic Works

Musicians, composers, and songwriters can earn royalty income from various sources, including record sales, streaming services, and public performances of their music.

Books and Literature

Authors and publishers can earn royalty income from the sale of books, e-books, and audiobooks, as well as licensing their works for adaptation into films, television shows, and other media formats.

Visual artists can earn royalty income from the sale or licensing of their artwork, such as paintings, sculptures, or photographs.

Franchising and Licensing

Business owners can earn residual income by franchising their business models or licensing their products and services to other businesses.

Real Estate Investment Trusts

Investors can earn residual income from real estate investment trusts (REITs) , which own, manage, and lease income-producing properties. REITs typically distribute their income to shareholders in the form of dividends .

Network Marketing and Affiliate Marketing

Individuals can earn residual income through network marketing or affiliate marketing by promoting and selling products or services offered by other businesses.

Tracking and Monitoring Royalty and Residual Income

Record-keeping systems.

Maintaining accurate and up-to-date records of royalty and residual income sources is crucial for effective income management. Record-keeping systems can include spreadsheets, financial software, or specialized accounting tools.

Royalty and Residual Income Statements

Regularly reviewing royalty and residual income statements can help ensure accurate reporting and timely payment of earnings. These statements typically include information on income sources, payment dates, and amounts.

Auditing and Verification

Periodically auditing and verifying royalty and residual income payments can help identify discrepancies or underpayments, ensuring that income is accurately reported and received.

Industry-Specific Accounting Software and Tools

Using industry-specific accounting software and tools can help streamline the tracking and management of royalty and residual income sources, ensuring accurate and efficient record-keeping.

Tax Implications and Planning

Reporting royalty and residual income.

Royalty and residual income must be reported on individual or business income tax returns. Proper record-keeping and accurate reporting of income and expenses are essential for ensuring compliance with tax laws.

Deductible Expenses

Taxpayers can deduct certain expenses related to earning royalty and residual income, such as licensing fees, legal fees, and other business-related expenses . Understanding and maximizing deductible expenses can help minimize tax liabilities.

Tax Strategies and Planning

Effective tax planning can help individuals and businesses manage their tax liabilities related to royalty and residual income. Strategies may include structuring income streams to minimize taxes, utilizing tax-deferred investment accounts, or leveraging tax credits and deductions.

Impact of Tax Law Changes

Staying informed about changes to tax laws that may impact royalty and residual income is essential for effective income management. Adjusting income strategies to account for tax law changes can help ensure continued financial success.

Negotiating Royalty and Residual Income Agreements

Factors affecting royalty rates.

Various factors can affect royalty rates, such as the type of intellectual property, the size of the market, the licensee's experience, and the exclusivity of the agreement. Understanding these factors can help individuals and businesses negotiate favorable royalty rates.

Licensing and Royalty Agreements

Licensing and royalty agreements should clearly outline the terms of the arrangement, including payment terms, duration, and any restrictions on the use or sale of the intellectual property. Properly drafted agreements can help ensure fair compensation and protect the rights of both parties.

Legal Considerations and Protections

Seeking legal advice when negotiating and drafting royalty and residual income agreements can help ensure that the agreements comply with applicable laws and protect the rights of both parties.

International Agreements and Cross-Border Royalties

When dealing with international agreements and cross-border royalties, it is essential to consider differences in legal systems, currency exchange rates , and tax implications. Consulting with legal and financial experts familiar with international transactions can help navigate these complexities.

Managing Royalty and Residual Income Streams

Diversifying income sources.

Diversifying royalty and residual income sources can help manage risks and ensure financial stability. Building a diverse portfolio of income-producing assets can provide a more consistent and reliable income stream.

Adjusting to Market Trends and Changes

Monitoring market trends and adjusting income strategies accordingly can help individuals and businesses capitalize on new opportunities and maintain financial success.

Ensuring Timely Payments and Collections

Implementing efficient payment and collection processes can help ensure consistent cash flow from royalty and residual income sources. This may involve using payment processing tools, invoicing systems, or collection agencies.

Managing Disputes and Conflicts

Effectively resolving disputes and conflicts related to royalty and residual income can help maintain positive relationships with licensors, licensees, and other stakeholders . This may involve negotiation, mediation, or legal action, depending on the nature of the dispute.

Financial Planning and Wealth Management

Budgeting and cash flow management.

Developing a budget and managing cash flow is essential for effectively managing royalty and residual income. A budget can help identify income trends, track expenses, and plan for future financial goals .

Savings and Investment Strategies

Investing a portion of royalty and residual income in savings and investment vehicles can help grow wealth and achieve long-term financial goals. Consideration should be given to factors such as risk tolerance , investment time horizon , and financial objectives when developing investment strategies.

Retirement Planning

Incorporating royalty and residual income sources into retirement planning can help ensure a comfortable and secure retirement . Retirement planning should consider factors such as projected income needs, life expectancy, and inflation.

Estate Planning and Wealth Transfer

Effective estate planning can help ensure that royalty and residual income-producing assets are transferred to heirs or beneficiaries according to the individual's wishes. Estate planning strategies may involve the use of trusts , wills , or other legal instruments.

Protecting Intellectual Property and Assets

Intellectual property registration and enforcement.

Registering and enforcing intellectual property rights, such as patents, copyrights, and trademarks, is crucial for protecting and maximizing royalty income.

This may involve filing applications with government agencies, monitoring potential infringements, and pursuing legal action when necessary.

Monitoring Potential Infringements

Regularly monitoring the marketplace for potential infringements of intellectual property rights can help ensure that royalty income is protected. Monitoring may involve conducting online searches, subscribing to industry publications, or utilizing specialized monitoring services.

Legal Recourse and Remedies

Pursuing legal recourse and remedies for intellectual property infringements can help protect royalty income and deter future violations. Legal remedies may include obtaining injunctions, recovering damages, or pursuing criminal charges in cases of willful infringement.

Cybersecurity and Digital Asset Protection

Implementing cybersecurity measures and protecting digital assets, such as copyrighted works or licensed software, can help safeguard royalty income sources. This may involve using encryption, secure file storage, or access controls to prevent unauthorized use or distribution of digital assets.

Leveraging Royalty and Residual Income for Growth

Reinvesting income for business expansion.

Reinvesting a portion of royalty and residual income back into the business can help fuel growth and expansion. This may involve developing new products or services, expanding into new markets, or acquiring complementary businesses.

Acquiring Additional Income-Producing Assets

Acquiring additional income-producing assets, such as real estate, businesses, or intellectual property, can help grow and diversify royalty and residual income streams.

Careful analysis of potential acquisitions and a clear understanding of the associated risks and rewards are essential for successful expansion.

Networking and Strategic Partnerships

Building a network of contacts and forming strategic partnerships can help individuals and businesses identify new opportunities for generating royalty and residual income.

Networking can be accomplished through attending industry events, joining professional organizations, or participating in online forums and social media groups.

Building a Personal Brand and Reputation

Developing a strong personal brand and reputation can help attract new opportunities for generating royalty and residual income.

This may involve creating a professional website, publishing articles or books, speaking at conferences, or leveraging social media to build a following and establish credibility.

Effective royalty and residual income management is crucial for achieving financial success and realizing the full potential of income-producing assets . A well-planned income strategy can provide consistent cash flow, capital appreciation, and financial stability .

By understanding the key factors involved in generating and managing royalty and residual income, individuals and businesses can develop strategies to maximize their income potential.

These strategies may include diversifying income sources , negotiating favorable agreements, and implementing tax and investment planning.

Regular monitoring and adjusting of royalty and residual income strategies are essential for maintaining financial success in a changing marketplace.

Ongoing management and planning can help individuals and businesses navigate challenges and seize new opportunities, ensuring continued growth and prosperity.

Royalty and Residual Income Management FAQs

What is royalty and residual income management.

Royalty and residual income management involves the management and distribution of income generated from intellectual property rights, such as patents, copyrights, and trademarks.

What types of income fall under royalty and residual income management?

Income that falls under royalty and residual income management includes royalty payments, licensing fees, residuals from creative works, and other forms of passive income generated from intellectual property.

What are some strategies for managing royalty and residual income?

Strategies for managing royalty and residual income include negotiating favorable licensing agreements, diversifying income streams, protecting intellectual property rights, and investing in other income-generating assets.

How is royalty and residual income taxed?

Royalty and residual income is generally taxed as ordinary income at the recipient's marginal tax rate. However, there may be deductions and credits available to offset the tax liability.

What are some risks associated with royalty and residual income management?

Risks include changes in the market for intellectual property rights, expiration of patents and copyrights, infringement by competitors, and changes in tax laws. It is important to have a contingency plan in place to address these risks and to consult with a financial or legal professional to ensure that royalty and residual income management is aligned with long-term financial goals.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- After-Tax Income

- Annual Income

- Asset Decumulation

- Gross Annual Income

- Growth and Income Investing

- Income Growth Investing

- Income Investing

- Income Sources

- Income-Oriented ETFs

- Individual Federal Income Taxes

- Lifetime Income

- Portfolio Income Strategies

- Rental Property Income Planning

- Unearned Income

- Affordable Care Act's (ACA) Medicaid

- Aggressive Investing

- Behavioral Finance

- Brick and Mortar

- Cash Flow From Operating Activities

- Cash Flow Management

- Debt Reduction Strategies

- Depreciation Recapture

- Divorce Financial Planning

- Education Planning

Ask a Financial Professional Any Question

Meet top certified financial advisors near you, find advisor near you, our recommended advisors.

Taylor Kovar, CFP®

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

To Ensure One Vote Per Person, Please Include the Following Info

Great thank you for voting..

Member Login

- Get Listed Today

Royalty Income: What Is It & How Is It Taxed?

Royalty income can be defined as a form of payment received by individuals or businesses as a payment for the use of intellectual property, such as copyrights, trademarks, patents, or mineral rights.

Individuals and businesses can efficiently manage their tax obligations and improve their financial outcomes by understanding how royalty income is taxed. The aim of this article is to define what royalty income is and how it is taxed. We will also find out how it is reported—what is needed to report it, the deductions available and any other factors that might be important enough to those that receive this form of income.

What is Royalty Income?