Expert business plan and financial models

SBA Loan Application: 6 Steps To Build Solid Financial Projections

- October 7, 2022

- Forecast your business

If you are a small business in the US, chances are you might have already heard of SBA loans . These loans, which range anywhere from $500 to $5.5 million are a great funding option for small businesses.

Yet, SBA loan application criteria are stringent: even if you are eligible, you will need to provide a number of documents to support your application. One of the most important document is your set of financial projections for your business.

Get your SBA loan application approved by building rock-solid financial forecasts for your business. In this article we will cover:

What is a SBA loan?

A SBA loan is a type of loan from a financial institution (e.g. a bank) which is partially guaranteed by the government.

The SBA is an initiative by the SBA (U.S. Small Business Administration), a U.S. government agency. The agency created these loans to simplify access to capital for small businesses. Because SBA loans are guaranteed by the government, banks and other lenders are indeed less reluctant to grant loans to small businesses with higher default risk.

There are a number of SBA loans out there which you can apply for. The most popular SBA loan is the 7(a) loan : it has low-interest rates, long repayment terms, and a very flexible use of loans clause. Yet, for a full list of the different SBA loans and their eligibility criteria, refer to the SBA website here .

However, as the US government guarantees SBA loans (often up to 85%), the eligibility criteria are rather stringent, and the process notoriously thorough.

One of the most important document you will have to provide is a set of financial projections for your business.

Why are SBA loans so attractive?

There are a number of advantages for SBA loans vs. common forms of debt, among which:

Highly competitive rates

Because SBA loans are partially guaranteed by the US government, institutions (banks) are more willing to grant startups loans with lower interest rates. Indeed, in an event of default, they can recover up to 85% their investment (see more on that above).

As per federal rules, SBA lenders are offering SBA loan interest rates as the sum of the prime rate plus a markup rate known as the spread. The prime rate is set by the government and fluctuates over time. As of the date of this article (September 2021), the prime rate was 3.25%. For the current rate applicable, refer to this page here .

For the same reasons mentioned above, SBA loan fees are often much lower vs. bank debt fees. The upfront fee is also referred to as the guarantee fee. For instance the guarantee fee is limited to 2% for loans under $150,000.

Longer repayment terms

SBA loans typically have longer maturity dates (repayment terms). The maturities depends on the type of use of funds for the loan. Currently, the maximum maturities are:

- Working capital or inventory: 10 years

- Equipment: 10 years

- Real estate: 25 years

What are the different SBA loans?

There are a number of different SBA loans, each come with its own terms, eligibility criteria and conditions. We have summed up below the different types with their principal characteristics:

| SBA 7(a) loans | $5 million | Working capital, expansion and equipment purchases |

| SBA Express loans | $1 million ($500,000 from Oct-21) | Fast funding for working capital, expansion and real estate and equipment purchases |

| SBA 504 loans | $5.5 million | Purchase long-term, fixed assets like land, machinery and facilities |

| SBA microloans | $50,000 | Working capital, inventory, supplies, equipment and machinery |

| SBA disaster loans | $2 million | Repair physical damage due to a declared disaster and cover |

| SBA Community Advantage loans | $250,000 | Normal business purposes; cannot be used for revolving credit |

| SBA export working capital loans | $5 million | Working capital to support export sales |

| SBA export express loans | $500,000 | Expedited funding to enhance a business’s export development |

| SBA international trade loans | $5 million | Long-term funding to increase export sales |

What are financial projections?

Financial projections (or financial forecasts), in short, are the forecast of your financial statements, often over a 3- to 5-year period.

When we refer to financial projections, we often refer to the forecast of your profit-and-loss (or “income statement”). Yet, sometimes (especially for loan applications) financial projections require the forecast of all 3 financial statements : P&L, balance sheet and cash flow statement.

What financial projections do I need for a SBA loan?

When it comes to financial projections, SBA loan applications are relatively straightforward.

As per their exact guidelines, you will need to produce “Projected Financial Statements that include month to month cash flow projections, for at least one-year period”.

In simple terms, you will need to prepare financial forecasts of your profit-and-loss (P&L) and cash flow statement over 12 months minimum.

Whilst the forecast of the balance sheet isn’t strictly necessary, you will have to forecast things such as working capital and other cash flow movements that impact balance sheet.

Also, whilst SBA only requires 12 months forecasts, we do recommend preparing 3-year (36 months) forecasts for small businesses with limited financial performance and assets as they often have a higher default risk.

6 steps to build solid SBA loan financial projections

We have listed out below a list of 6 steps you should follow to build rock-solid financial forecasts for your SBA loan application.

Step 1. Start from your actuals

Before you start creating financial forecasts for your business, you should first look at your actuals. From there, we will identify and extrapolate a number of drivers which will allow us to project your revenues and expenses later on.

You don’t necessarily need now to start from your entire profit-and-loss or cash flow statement you would have exported from Xero for instance. Instead, identify what drives the most of your business’ performance: is this the number of customers you have? Is this the commission rate you are charging your customers?

The key drivers will help us estimate your financial forecasts later on. As such, they need to be clearly identified. A few examples of drivers for 3 illustrative businesses are:

- Retail : number of customers, average order value

- Ecommerce : number of visitors, conversion rate, average order value

- SaaS : number of users, churn, average revenue per user

Once you have identified your key drivers, include them as a start to your model. For instance, if you are generating $10,000 sales from 3,000 orders in a given month, your key drivers in that month can be:

- Orders per month: 2,000

- Average order value: $5.0

Step 2. Build your revenue model

Before we estimate revenue based on the drivers discussed earlier (step 1), we need to clearly identify what is your revenue model. Surprisingly enough, one business can have multiple revenue models. For a refresher, read our article on the 8 most popular revenue models .

For example, if you sell subscriptions to customers (e.g. gym membership) yet you also sell one-time services (e.g. dedicated sessions with trainers), these should be listed as two separate revenue models as they work differently. The subscription is a function of the number of users you have, multiplied by a recurring monthly fee for instance. In comparison, sessions are a function of a portion of your users, multiplied by another one-time fee.

Once we have identified your revenue model(s), we need to build out revenue for each of them. Using our gym membership above, subscription revenue will be a function of the number you have over time times the recurring fee. For sessions instead, use a percentage of users who pay for a session each month (based on your historical if any) – for instance 5% of total users – and multiply it by the total number of users and the one-time session price.

The gym membership example above help us understand why we need the key drivers we brought up earlier. Revenue projections should never be a plug – a guessed number from you . Instead, revenue is the function of multiple drivers. There are always at least 2 drivers for each revenue model: volume and price.

Step 3. Forecast your variable costs

Variable costs are expenses that increase or decrease based on the level of sales and/or another factor (e.g. customers for instance). As such, they can’t just be flat over time, instead their amount will vary based on other parameters of your financial plan.

Common variable costs are:

- Raw materials

- Advertising spend (e.g. paid ads)

- Packaging and shipping costs (ecommerce)

- Transportation

- Corporate taxes

If you have historical performance, use your actuals to forecast variable costs. For example, if you pay $10 in shipping costs in average per order, use the same value for your projections.

Instead, new businesses will have to find information either with industry benchmarks , public sources (cost-per-click for paid ads spending can be found for any keyword on Google Planner for instance) or quotes from potential suppliers.

Step 4. Estimate all your fixed costs

Fixed costs in comparison, are easier to estimate as they remain fixed over the projected period. Common examples are:

- Salaries and benefits (for each employee)

- Website hosting

- Rent and utilities

Salaries and other payroll expenses often constitute the bulk of fixed costs. In order to accurately forecast salaries you need to estimate the right amount of people you will need over time, and their salaries. Average salaries for specific jobs and geographies can easily be found in industry benchmarks . The number of people your business will need depends on their function: some teams will increase or decrease based on certain metrics such as revenue (sales and customer success teams often grow in line with revenue) whilst others will remain stable (administrative functions e.g. finance).

Read our article on how to build a flexible hiring plan in Excel for your business for more information on how to efficiently forecast salaries expenses as your business grows.

Step 5. Putting it all together

Once you have projected revenue and expenses based on your key drivers, you can now consolidate it all under your profit-and-loss. Subtract all expenses (fixed and variable) as well as startup costs from revenue to get to net profit .

To calculate your cash flow statement, no need to do anything complicated at this stage: simply use your net profit, and subtract any other cash items (i.e. capital expenditures ), for instance the startup asset purchases discussed above (step 2).

Step 6. Review and adjust

After having built your projected profit-and-loss and (simplified) cash flow statement, take time to review your estimates. Do they make sense to you? Is there anything surprising in your projections?

The review of your financial forecast should help you determine 2 things:

- Are your projections error-free? It’s easy to get lost in spreadsheet and make mistakes in your calculations.

- Are your projections realistic? Now that you take a step back to look at the big picture (revenue, growth, margins, cash flow), it’s easier to assess whether your projections are unrealistic or not.

Related Posts

How Much It Costs to Open a Chiropractic Clinic: Examples

- September 18, 2024

- Startup Costs

How Much It Costs to Start a Medical Practice: Examples & Budget

- September 14, 2024

How Much It Costs to Start a Pilates Studio: Examples & Budget

Privacy overview.

| Cookie | Duration | Description |

|---|---|---|

| BIGipServerwww_ou_edu_cms_servers | session | This cookie is associated with a computer network load balancer by the website host to ensure requests are routed to the correct endpoint and required sessions are managed. |

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| elementor | never | This cookie is used by the website's WordPress theme. It allows the website owner to implement or change the website's content in real-time. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| language | session | This cookie is used to store the language preference of the user. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _ga_QP2X5FY328 | 2 years | This cookie is installed by Google Analytics. |

| _gat_UA-189374473-1 | 1 minute | A variation of the _gat cookie set by Google Analytics and Google Tag Manager to allow website owners to track visitor behaviour and measure site performance. The pattern element in the name contains the unique identity number of the account or website it relates to. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| browser_id | 5 years | This cookie is used for identifying the visitor browser on re-visit to the website. |

| WMF-Last-Access | 1 month 18 hours 11 minutes | This cookie is used to calculate unique devices accessing the website. |

How to Write an SBA Business Plan + Template

Noah Parsons

10 min. read

Updated August 1, 2024

Applying for a Small Business Administration loan typically requires a business plan.

Unfortunately, there’s no SBA loan business plan format that guarantees approval. The SBA even states you should “pick a business plan format that works for you.”

While I agree with this sentiment, I’ve found that entrepreneurs who explain how funds will be used and how they will repay the loan tend to be more successful.

Luckily, these details can be covered using our SBA-lender-approved business plan format . I’ll go over that structure in this article, and focus on the sections that the SBA prioritizes, so you can maximize your chances of getting funded .

You can even download a free SBA-lender-approved business plan template to fill out as you read.

Let’s get started.

- Why you need a business plan for SBA loans

SBA loans require good documentation of your business and personal finances. You’ll need to pull together your past tax returns, bank statements, and various application forms depending on the type of SBA loan you apply for.

The bank issuing the loan will also want to know about the future of your business.

They’ll want to see how the loan will be used and if future cash flow projections are realistic and indicate you can afford loan payments.

That’s where writing an SBA business plan comes in.

Not only will your business plan describe your business to the lender, but it will include the financial projections the bank will use to determine if you qualify for the loan .

- What your business plan should include, according to the SBA

Business plans for SBA loans follow a fairly standard structure, but that doesn’t mean you need to follow it exactly.

The SBA even recommends adjusting the plan outline to serve your needs. If a section does not apply to your business, it’s fine just to remove it.

Here’s the successful business plan structure I recommend for SBA loans:

1. Executive summary

A great executive summary is a short, simple overview of your business. It should be easy for a loan officer to read and clearly understand what your business does.

When applying for an SBA loan, highlight your:

- Business opportunity

- Financial forecast

- How much money you want to borrow and how it will be used

Remember, an executive summary should be short and to the point. The rest of your business plan will provide additional details.

[Dig deeper: How to write an executive summary ]

2. Company description

Some people call this section “Products and Services.” Either option is fine. The important thing is that you use this section to explain what your business opportunity is.

You need to cover:

- The problem you solve

- Who you’re solving it for

- What your solution is and why it’s better

Be specific and tell the story of your business and your customers. Focus on your strengths and what sets you apart from competitors.

If your company is developing a product, include information on:

- What the product life cycle looks like

- Intellectual property filings

- Current research and development

If these topics don’t apply to your product, that’s fine. Just be sure that the description of what you sell is clear.

3. Market analysis

The market analysis chapter explains who your customers are. It provides an overview of your target market, competition, and industry.

Your target market is essentially a description of your ideal customers. Be sure to include specific demographic information (like age, gender, location, income) and psychographic information (hobbies, purchasing behaviors).

This data should reinforce that your target market needs your solution .

It’s helpful to also include information on the size of your target market . Lenders will want to see evidence of enough potential customers to drive growth.

While your target market information describes your customers, an industry overview discusses the type of business you’re in and its potential for growth.

For example: If you’re starting a fast-casual restaurant, your industry overview might discuss the increased interest in fast-casual dining and how more people are eating in these types of restaurants every year.

Finally, you’ll need to include a competitive analysis . This is a list of current competitors and alternatives, with explanations of why your business is a better option.

Your goal is to show how your business is unique, what opportunities and threats there are, and how you plan to address the competition.

4. Organization and management

Also known as your company overview, this section is where you describe your legal structure, history, and team .

For your SBA loan application, you should focus on describing who is managing the business as clearly as possible.

You may want to include an organizational chart. You should provide detailed resumes for everyone in leadership positions. Each team member’s experience, skills and professional qualifications can mitigate risk in the eyes of a lender .

To show you’re thinking ahead, it’s also helpful to include key positions you plan to fill as you grow.

5. Sales and marketing plan

Your goal in this section is to summarize how you will attract, retain, and sell to your customers.

The marketing strategies and sales methods you describe should always have the customer top of mind, and demonstrate that you know how to connect with them.

To help a loan officer visualize this, you can provide examples of marketing messaging, visuals, and promotions. If you have any research or results to show that your strategy has merit, include those as well.

6. Financial projections

SBA lenders typically require 5 years of financial projections — including profit and loss statements , balance sheets , and cash flow statements .

Be sure to include the SBA loan in your projections in the following areas:

- A liability on your balance sheet.

- Payments on your cash flow.

- Interest expenses on your profit and loss statement.

I’ll dive into specific details of what you should focus on in the “how to improve your chances” section.

Your first year of financial projections should include monthly details. After that, annual summaries are usually sufficient for most SBA lenders. Occasionally, a lender might require 24 months of monthly projections, so check with your bank before submitting your business plan.

If your business is up and running, you must also provide historical financial reports for the past 12-24 months of operations—including income statements and a current balance sheet.

Typically, you will also need to provide reports on your personal finances , including any assets you have, such as a home or car.

Finally, include a section explaining your use of funds—what exactly you plan to use the loan for.

7. Appendix

The appendix is your chance to provide additional documents that support sections of your business plan.

When applying for a loan, these may include:

- Employee resumes

- Licenses and permits

- Patents and other legal documents

- Historical financial statements

- Credit histories

Don’t worry about stuffing your appendix full of additional documentation. Only include information if you believe it will strengthen your approval chances, or if your lender specifically asks for it.

- How to improve your chances of being approved for an SBA loan

Your SBA business plan needs to focus on the loan you are applying for and how that will impact your business financially.

Make sure to include the following information in your financial plan to increase your chances of success with your lender:

Funding request

In your executive summary, document how much money you are asking for. It’s best to put your number where it can be clearly read, instead of trying to bury it deep within your business plan.

Remember, there are limitations to how much you can borrow through SBA-backed loans. Most have a maximum loan amount of $5 million, while SBA Express loans have a maximum loan amount of $350,000.

Use of funds

You should also describe how you plan to use the loan and which aspects of the business you want to invest in.

Some SBA loans are designed specifically for expanding export businesses or funding real estate transactions. So, make sure your use of funds description is appropriate for the loan you are applying for.

Cash flow forecast

Be sure to include the loan in your cash flow statements and projections . You want to demonstrate that you’ve planned how you will use and repay the loan.

You need to show:

- When you anticipate receiving the loan.

- How the loan will impact your finances.

- Loan payments for the life of the loan.

Having this prepared won’t just increase the chances of your application being approved—It will make it much easier to manage the loan after you receive funding .

Balance sheet

You’ll also want to put the loan on your projected balance sheet , and show how the loan will get paid down over time.

The money you owe will show up on your balance sheet as a liability, while the cash you receive from the loan will be an asset. Over time, your forecasted balance sheet will show that the loan is getting paid back.

Your lender will want to see that you have forecasted this repayment properly.

Profit & Loss forecast

Your P&L should include the interest expenses for the loan, and show how the interest will impact your profitability in the coming months and years.

- How long does an SBA business plan need to be?

The SBA doesn’t have an official recommended or required business plan length . As a general rule of thumb, you should make your business plan as short and concise as possible.

Your business plan is going to be reviewed by a bank loan officer, and they will be less than excited about the prospect of reading a 50-page business plan.

If possible, keep the written portion of your business plan between 10-15 pages. Your financial forecasts will take up several additional pages.

If you’re struggling to keep it short, try a one-page plan

A great way to start your business plan is with a simple, one-page business plan that provides a brief and compelling overview of your business.

A good one-page plan is easy to read and visually appealing. Once you have your one-page plan, you can expand on the ideas to develop your complete written business plan, and use the one-page plan as your executive summary.

Loan officers will appreciate a concise overview of your business that provides the summary they need before they start looking at your complete business plan and financial plan .

- Resources and tools for writing an SBA business plan

Remember, you can download a free SBA-lender-approved business plan template . It includes detailed instructions to help you write each section, expert guidance and tips, and is formatted as lenders and investors expect.

If you’re looking for a more powerful plan writing tool, one that can also help you create financial forecasts for the use of your loan, I recommend you check out LivePlan .

With LivePlan, you get:

- AI-powered recommendations: Generate and rewrite sections of your plan to be more professional and persuasive.

- Step-by-step instructions: In-app examples, tutorials, and tips to help you write an impressive business plan.

- Automatic financials: Skip the spreadsheets and complex formulas, and quickly create accurate financial forecasts with everything a lender needs.

- A built-in pitch presentation: Print or share your full business plan, one-page pitch, and financial reports—all with a professional and polished look.

Whether you use the template, LivePlan, or try writing a business plan yourself, following the structure and tips from this article will improve your chances of getting an SBA-backed loan.

And for additional SBA-focused resources, check out our guide on how to get an SBA loan .

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

Related Articles

4 Min. Read

The Different SBA Loan Programs Explained

6 Min. Read

What to Do When You Need a Disaster Loan

12 Min. Read

10 Reasons You Don’t Qualify for an SBA Disaster Loan

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Free Financial Templates for a Business Plan

By Andy Marker | July 29, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up expert-tested financial templates for your business plan, all of which are free to download in Excel, Google Sheets, and PDF formats.

Included on this page, you’ll find the essential financial statement templates, including income statement templates , cash flow statement templates , and balance sheet templates . Plus, we cover the key elements of the financial section of a business plan .

Financial Plan Templates

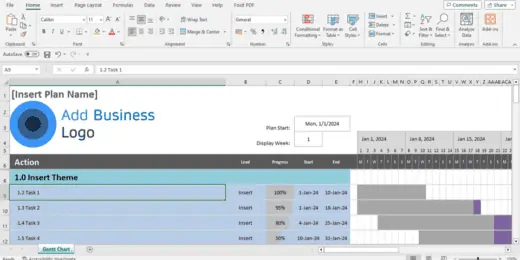

Download and prepare these financial plan templates to include in your business plan. Use historical data and future projections to produce an overview of the financial health of your organization to support your business plan and gain buy-in from stakeholders

Business Financial Plan Template

Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors.

Download Financial Plan Template

Word | PDF | Smartsheet

Financial Plan Projections Template for Startups

This financial plan projections template comes as a set of pro forma templates designed to help startups. The template set includes a 12-month profit and loss statement, a balance sheet, and a cash flow statement for you to detail the current and projected financial position of a business.

Download Startup Financial Projections Template

Excel | Smartsheet

Income Statement Templates for Business Plan

Also called profit and loss statements , these income statement templates will empower you to make critical business decisions by providing insight into your company, as well as illustrating the projected profitability associated with business activities. The numbers prepared in your income statement directly influence the cash flow and balance sheet forecasts.

Pro Forma Income Statement/Profit and Loss Sample

Use this pro forma income statement template to project income and expenses over a three-year time period. Pro forma income statements consider historical or market analysis data to calculate the estimated sales, cost of sales, profits, and more.

Download Pro Forma Income Statement Sample - Excel

Small Business Profit and Loss Statement

Small businesses can use this simple profit and loss statement template to project income and expenses for a specific time period. Enter expected income, cost of goods sold, and business expenses, and the built-in formulas will automatically calculate the net income.

Download Small Business Profit and Loss Template - Excel

3-Year Income Statement Template

Use this income statement template to calculate and assess the profit and loss generated by your business over three years. This template provides room to enter revenue and expenses associated with operating your business and allows you to track performance over time.

Download 3-Year Income Statement Template

For additional resources, including how to use profit and loss statements, visit “ Download Free Profit and Loss Templates .”

Cash Flow Statement Templates for Business Plan

Use these free cash flow statement templates to convey how efficiently your company manages the inflow and outflow of money. Use a cash flow statement to analyze the availability of liquid assets and your company’s ability to grow and sustain itself long term.

Simple Cash Flow Template

Use this basic cash flow template to compare your business cash flows against different time periods. Enter the beginning balance of cash on hand, and then detail itemized cash receipts, payments, costs of goods sold, and expenses. Once you enter those values, the built-in formulas will calculate total cash payments, net cash change, and the month ending cash position.

Download Simple Cash Flow Template

12-Month Cash Flow Forecast Template

Use this cash flow forecast template, also called a pro forma cash flow template, to track and compare expected and actual cash flow outcomes on a monthly and yearly basis. Enter the cash on hand at the beginning of each month, and then add the cash receipts (from customers, issuance of stock, and other operations). Finally, add the cash paid out (purchases made, wage expenses, and other cash outflow). Once you enter those values, the built-in formulas will calculate your cash position for each month with.

Download 12-Month Cash Flow Forecast

3-Year Cash Flow Statement Template Set

Use this cash flow statement template set to analyze the amount of cash your company has compared to its expenses and liabilities. This template set contains a tab to create a monthly cash flow statement, a yearly cash flow statement, and a three-year cash flow statement to track cash flow for the operating, investing, and financing activities of your business.

Download 3-Year Cash Flow Statement Template

For additional information on managing your cash flow, including how to create a cash flow forecast, visit “ Free Cash Flow Statement Templates .”

Balance Sheet Templates for a Business Plan

Use these free balance sheet templates to convey the financial position of your business during a specific time period to potential investors and stakeholders.

Small Business Pro Forma Balance Sheet

Small businesses can use this pro forma balance sheet template to project account balances for assets, liabilities, and equity for a designated period. Established businesses can use this template (and its built-in formulas) to calculate key financial ratios, including working capital.

Download Pro Forma Balance Sheet Template

Monthly and Quarterly Balance Sheet Template

Use this balance sheet template to evaluate your company’s financial health on a monthly, quarterly, and annual basis. You can also use this template to project your financial position for a specified time in the future. Once you complete the balance sheet, you can compare and analyze your assets, liabilities, and equity on a quarter-over-quarter or year-over-year basis.

Download Monthly/Quarterly Balance Sheet Template - Excel

Yearly Balance Sheet Template

Use this balance sheet template to compare your company’s short and long-term assets, liabilities, and equity year-over-year. This template also provides calculations for common financial ratios with built-in formulas, so you can use it to evaluate account balances annually.

Download Yearly Balance Sheet Template - Excel

For more downloadable resources for a wide range of organizations, visit “ Free Balance Sheet Templates .”

Sales Forecast Templates for Business Plan

Sales projections are a fundamental part of a business plan, and should support all other components of your plan, including your market analysis, product offerings, and marketing plan . Use these sales forecast templates to estimate future sales, and ensure the numbers align with the sales numbers provided in your income statement.

Basic Sales Forecast Sample Template

Use this basic forecast template to project the sales of a specific product. Gather historical and industry sales data to generate monthly and yearly estimates of the number of units sold and the price per unit. Then, the pre-built formulas will calculate percentages automatically. You’ll also find details about which months provide the highest sales percentage, and the percentage change in sales month-over-month.

Download Basic Sales Forecast Sample Template

12-Month Sales Forecast Template for Multiple Products

Use this sales forecast template to project the future sales of a business across multiple products or services over the course of a year. Enter your estimated monthly sales, and the built-in formulas will calculate annual totals. There is also space to record and track year-over-year sales, so you can pinpoint sales trends.

Download 12-Month Sales Forecasting Template for Multiple Products

3-Year Sales Forecast Template for Multiple Products

Use this sales forecast template to estimate the monthly and yearly sales for multiple products over a three-year period. Enter the monthly units sold, unit costs, and unit price. Once you enter those values, built-in formulas will automatically calculate revenue, margin per unit, and gross profit. This template also provides bar charts and line graphs to visually display sales and gross profit year over year.

Download 3-Year Sales Forecast Template - Excel

For a wider selection of resources to project your sales, visit “ Free Sales Forecasting Templates .”

Break-Even Analysis Template for Business Plan

A break-even analysis will help you ascertain the point at which a business, product, or service will become profitable. This analysis uses a calculation to pinpoint the number of service or unit sales you need to make to cover costs and make a profit.

Break-Even Analysis Template

Use this break-even analysis template to calculate the number of sales needed to become profitable. Enter the product's selling price at the top of the template, and then add the fixed and variable costs. Once you enter those values, the built-in formulas will calculate the total variable cost, the contribution margin, and break-even units and sales values.

Download Break-Even Analysis Template

For additional resources, visit, “ Free Financial Planning Templates .”

Business Budget Templates for Business Plan

These business budget templates will help you track costs (e.g., fixed and variable) and expenses (e.g., one-time and recurring) associated with starting and running a business. Having a detailed budget enables you to make sound strategic decisions, and should align with the expense values listed on your income statement.

Startup Budget Template

Use this startup budget template to track estimated and actual costs and expenses for various business categories, including administrative, marketing, labor, and other office costs. There is also room to provide funding estimates from investors, banks, and other sources to get a detailed view of the resources you need to start and operate your business.

Download Startup Budget Template

Small Business Budget Template

This business budget template is ideal for small businesses that want to record estimated revenue and expenditures on a monthly and yearly basis. This customizable template comes with a tab to list income, expenses, and a cash flow recording to track cash transactions and balances.

Download Small Business Budget Template

Professional Business Budget Template

Established organizations will appreciate this customizable business budget template, which contains a separate tab to track projected business expenses, actual business expenses, variances, and an expense analysis. Once you enter projected and actual expenses, the built-in formulas will automatically calculate expense variances and populate the included visual charts.

Download Professional Business Budget Template

For additional resources to plan and track your business costs and expenses, visit “ Free Business Budget Templates for Any Company .”

Other Financial Templates for Business Plan

In this section, you’ll find additional financial templates that you may want to include as part of your larger business plan.

Startup Funding Requirements Template

This simple startup funding requirements template is useful for startups and small businesses that require funding to get business off the ground. The numbers generated in this template should align with those in your financial projections, and should detail the allocation of acquired capital to various startup expenses.

Download Startup Funding Requirements Template - Excel

Personnel Plan Template

Use this customizable personnel plan template to map out the current and future staff needed to get — and keep — the business running. This information belongs in the personnel section of a business plan, and details the job title, amount of pay, and hiring timeline for each position. This template calculates the monthly and yearly expenses associated with each role using built-in formulas. Additionally, you can add an organizational chart to provide a visual overview of the company’s structure.

Download Personnel Plan Template - Excel

Elements of the Financial Section of a Business Plan

Whether your organization is a startup, a small business, or an enterprise, the financial plan is the cornerstone of any business plan. The financial section should demonstrate the feasibility and profitability of your idea and should support all other aspects of the business plan.

Below, you’ll find a quick overview of the components of a solid financial plan.

- Financial Overview: This section provides a brief summary of the financial section, and includes key takeaways of the financial statements. If you prefer, you can also add a brief description of each statement in the respective statement’s section.

- Key Assumptions: This component details the basis for your financial projections, including tax and interest rates, economic climate, and other critical, underlying factors.

- Break-Even Analysis: This calculation helps establish the selling price of a product or service, and determines when a product or service should become profitable.

- Pro Forma Income Statement: Also known as a profit and loss statement, this section details the sales, cost of sales, profitability, and other vital financial information to stakeholders.

- Pro Forma Cash Flow Statement: This area outlines the projected cash inflows and outflows the business expects to generate from operating, financing, and investing activities during a specific timeframe.

- Pro Forma Balance Sheet: This document conveys how your business plans to manage assets, including receivables and inventory.

- Key Financial Indicators and Ratios: In this section, highlight key financial indicators and ratios extracted from financial statements that bankers, analysts, and investors can use to evaluate the financial health and position of your business.

Need help putting together the rest of your business plan? Check out our free simple business plan templates to get started. You can learn how to write a successful simple business plan here .

Visit this free non-profit business plan template roundup or download a fill-in-the-blank business plan template to make things easy. If you are looking for a business plan template by file type, visit our pages dedicated specifically to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates. Read our articles offering startup business plan templates or free 30-60-90-day business plan templates to find more tailored options.

Discover a Better Way to Manage Business Plan Financials and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- Virtual CFO

- Tax & Compliance

- Business Management

- Contractors

- Real Estate

- Calculators

The SBA is increasing EIDL limits up to $2,000,000. Here are the details

- As of May 6, 2022, the SBA is no longer processing EIDL loan increase requests or requests for reconsideration of previously declined loan applications due to a lack of available funding.

- The EIDL portal is now closed. Borrowers who need copies of their loan documents will need to create a new account with the SBA .

- You are now required to start making payments on your SBA EIDL loan. Follow this link to learn more about how to set up monthly payments .

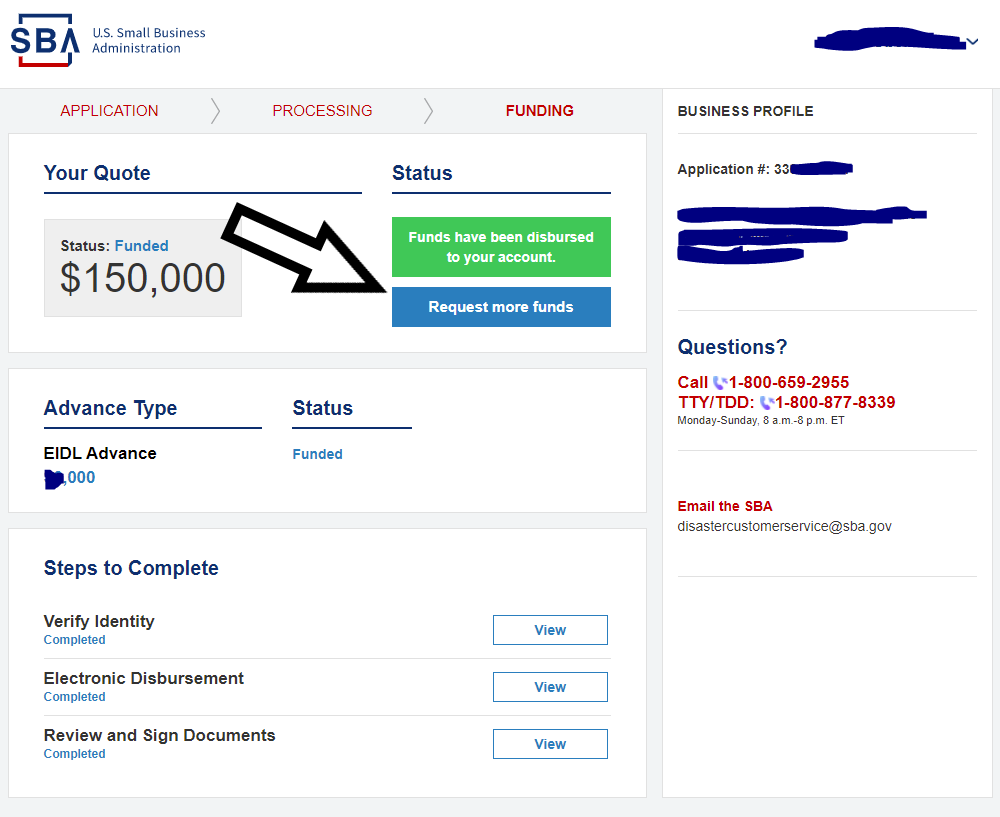

The SBA recently announced a policy change that significantly in creases the EIDL loan limits up to 24 months of economic injury with a maximum loan amount of $2,000,000. The EIDL loans were previously limited to $150,000 and then $500,000.

Here is a refresher on the rules;

- The deadline to apply for the loan or for reconsideration is 12/31/21.

- Borrowers can request increases up to their maximum eligible loan amount for up to two years after their loan origination date, or until the funds are exhausted, whichever is sooner.

- The loan terms will remain the same; 30-year term with a 3.75% fixed rate for businesses and 2.75% for nonprofits.

- For loan amounts over $25,000, SBA will record a UCC filing.

- Real estate collateral will not be required for any loans of $500,000 or less.

- Deferment periods for all EIDL loans have been extended until next year. The first payment due date for loans made in 2020 will be 24 months from the date of the note. For loans made in the calendar year 2021, the first payment is due 18 months from the date of the note.

Here is what's new for this increase round;

- (Gross Profit is your gross revenue less cost of goods)

- SBA will also require an unsecured personal guarantee for loan amounts over $200,000 from any individual with 20 percent or more ownership.

⚠️ Word of caution

- As a reminder, the SBA places a lot of restrictions on how you can use your EIDL Funds. You can't even invest the money in an interest-bearing bank account.

- Even in the case in which you are legally entitled to take this loan, doesn't always mean it's the right thing for you.

- EIDL loans are loans that will need to be paid back; you're taking on debt that you'll have to pay monthly for the next 30 years.

Here are the steps to be taken if you wish to request a loan increase;

The SBA added a “ Request more funds ” button which you can see once logged into your existing loan account. You can log on to your account here . See screenshot below.

If the “ Request more funds ” button is not present, try a different browser. If that doesn't help, reach out to the SBA.

- You will be asked similar questions as in the box below.

- Next, you will use the slider bar to select a new increased loan amount.

- While the SBA initially gave the option to apply via email, your best option would be to apply through your portal as mentioned above.

- Send an email to [email protected]

- Use the subject line "EIDL Increase Request for [insert your 10-digit application number]"

- Be sure to include in the body of your email identifying information for your current loan, including application number, loan number, business name, business address, business owner name(s), and phone number.

- Do not include any financial documents or tax records with your initial request. You will receive a follow-up email notification they'll need additional documents.

- If you applied online and did not hear back from the SBA, your best option would be to log on to your portal and check if it gives you the option to apply.

What happens next?

- Upon emailing them, You may receive an auto-reply as follows "Thank you for contacting the Covid EIDL Increase Team. Your request has been received and will be processed in the order it was received."

- Per SBA, it may take several weeks before you receive a response from them on the next steps.

- Some people already got a reply email but it's unclear who's getting what type of questions. Below is a compiled list of line items from the SBA reply email.

| We have reviewed your request for an EIDL loan increase of the above-referenced disaster loan application. At this time, we are unable to complete the evaluation of your request until the following information is provided: . Schedule of Liabilities for its business.The document must be signed and dated in ink or digital e-certified electronic signature (digitized version of your handwritten signature). The correct tax form filed for your business must be entered on line 6. |

- once approved, you will be able to finalize the application through your SBA portal.

🆕 The IRS will start sending monthly checks to most families with children.

✨ Did you know that Oberlander & Co provides Virtual CFO to clients across the US? learn more here.

Share this blog:

Related articles, some business owners can now apply for ppp forgiveness directly with the sba, the sba launched a new round of eidl advances, where can i see my sba eidl balance and set up a payment schedule.

PROJECTIONS

2 To 3 Years Real Projections .

It's important to provide realistic and well-supported projections to the lender to demonstrate that your business has a viable plan for growth and repayment of the loan. When applying for an SBA 7(a) loan, you'll typically be required to provide several types of projections to help the lender assess the financial viability of your business.

These projections may include: Profit and Loss, Cash Flow, Balance Sheet, and Sales Projections

Profit and loss projections: These projections provide a forecast of your business's income and expenses over a specific period, typically 12-24 months. They can help the lender assess the expected profitability of your business and its ability to generate sufficient cash flow to repay the loan.

Cash flow projections: Cash flow projections show the expected inflows and outflows of cash in your business over a specific period. They provide insight into your business's ability to meet its financial obligations, such as loan payments, and ensure that it has sufficient working capital to operate effectively.

Balance sheet projections: Balance sheet projections provide a snapshot of your business's financial position at a specific point in time. They show your business's assets, liabilities, and equity, which can help the lender assess its overall financial health and capacity to repay the loan.

Sales projections: Sales projections show the expected revenue from your business's products or services over a specific period. They can help the lender assess the growth potential of your business and its ability to generate sufficient revenue to repay the loan.

%20Loans-min.png)

SBA 7(a) Loan

Use of Funds: Working capital, debt restructure, business acquisitions, franchising, equipment, startup, payroll, marketing, expansion, lease hold improvements, commercial property, and the list goes on...

Interest Rate: Prime + 2.75% (Depending on the loan size banks can charge up to 6.5%)

Terms: Up to 10 Years

SBA 504 Loan

Use of Funds: Commercial property for owner use. Must be 51% owner occupied. Not for real estate investing. Can include land, construction, furniture, fixtures, lease improvements.

Terms: Up to 25 Years

SBA Express Loan

Use of Funds: All the same use as the SBA 7(a) loan. It is an SBA 7(a) loan but only up to $500,000 and fast tracked. Very few banks participate and they create unique programs around it. Minimum 1 to 2 years in business.

Our work is reader-supported, meaning that we may earn a commission from the products and services mentioned.

How to Create Financial Projections for your Business Plan

- Last Updated: September 10, 2024

- By: StartUp 101

Advertising Disclosure

Starting a business is an exciting time, but one that can come with some uncertainty. Writing out your business plan helps to increase your success significantly in addition to reducing some of the worries by getting all the ideas out of your head and organized on paper.

Financial projections are an essential component of the business plan to provide a realistic view as to whether or not your business is financially viable for success.

By creating financial plans, you are also able to test some of your assumptions to see the financial impact and analyze whether your business idea is feasible.

What are financial projections?

Financial projections (sometimes referred to as pro forma) are an essential part of a business plan. They are used to forecast a business’s expected sales and expenses and analyze the financial feasibility of the company. These forecasts evaluate past trends, current market conditions, and future expectations. They will also take into account regional sales potential and growth strategies and examine external and internal costs, such as the cost of customer acquisition and the amount of money you can afford to pay team members and yourself.

While it may be tempting to skip this step, not completing it could be costly.

Why are financial projections important?

Financial projections are one of the most critical steps in starting a small business. These figures help show you whether or not your business has a reasonable chance of being profitable. If your company does not reflect a profit based on your projections, you may have to make some adjustments. Financial projections can also help determine realistic price points and sales goals. They can also show you whether or not a profitable market even exists for the product or service you wish to provide.

The sales forecast is also useful in analyzing cash flows from accounts receivable and accounts payable to ensure the company has enough cash to operate.

Another reason financial projections are important is when requesting funding. The bank will review whether you have realistic financial projections before making a business loan.

How to create financial projections?

It is important to understand that financial projections are simply the best estimates you can determine based on the information available.

These figures are next to impossible to predict accurately. While this financial forecast can’t predict how the business will perform in the future, it will provide the analysis to make informed decisions and plans for the business.

Financial projections are typically shown as a 12-month projection in the first year and by quarter in the second year and third year.

To begin with, your business plan financial projections, start by focusing on your revenue potential and likely expenses.

1. Create sales projections

Projecting sales projections (also known as revenue projections) for a new business is difficult, especially if you are new to the type of business you are starting. They are a few approaches you can consider when preparing the sales forecast. Some companies will have multiple sources of revenue. To make these easier to follow, each revenue stream is often put on a separate line in the projections.

Average household spending – The Consumer Expenditure Survey program from the U.S. Bureau of Labor Statistics (scroll down to the Annual Calendar Year Tables) provides data on the expenditures of U.S. consumers. Using the average household spending multiplied by the population in your target area, you can come up with the total potential sales. Try not to get too carried away with your target area as it will have a significant impact on potential sales.

Using the BLS data, you can look up how much people spend on food and beverages (such as food at home, food away at home, bakery products, alcoholic beverages, etc.), appliances, apparel, education, reading – and the list goes on. This information can be assessed against demographic information such as age, income, education level, occupation, race, religion, and more.

Not only can you use this data to provide useful because you can use it to gauge the feasibility of your business. For instance, if there are three competitors in your market, and you need 10% of the market to make an adequate profit, this may be a good indication your business would be successful. If you needed 80% of the market, it would likely be much more challenging.

Trade associations – Depending on the industry you are starting your business in, it’s likely there is an industry association. Do a Google search for “[type of business] industry association” or even find a Facebook group to join and ask questions. Many industry associations have statistics and formulas you can use to estimate sales. Make sure to reference your work, so the bank or prospective investors know you didn’t come up with these numbers out of thin air. Be sure to do your own due diligence as these numbers may be overly optimistic.

Menu of services – Another way to project sales is to create a list of services to assess how many jobs you can do in a day and the pricing of each job.

For instance, if you own a car detailing business and it takes 4 hours per vehicle to detail, you may be able to do up to two vehicles per day, ten vehicles a week, or 40 vehicles a month (you could squeeze in a few more in a month, but let’s keep the math easy for now).

Each vehicle brings in an average of $100 for a total monthly sales revenue of $4,000. Let’s say that after subtracting rent, utilities, supplies, advertising, etc, you are left with $2,000. Now you find that best case, you have a profit of $2,000, and by working 8 hours a day, you would make $12.50 per hour. Now you have to ask yourself that in this best-case scenario where you have clients lined up each and every day and you are making $12.50 per hour, is this business worth your time?

Regardless of how you project sales, be sure to explain the key assumptions in the business plan so the reader can follow the math!

2. Project operating expenses

Next, project the monthly operating expenses of the business. Some expenses are going to be easy to estimate, such as fixed costs like rent, insurance, and utilities. Other expenses need to be carefully examined as they can make a large difference in the projected profit.

The biggest expense for most businesses is the cost of goods sold, sometimes called COGS, cost of sales, or cost of inventory. This is the cost to produce the item being sold, such as the raw materials to produce it. A typical example is a wedding band sold at a jewelry store. The sales price to the customer may have been $1,000, but the jewelry store purchased it for $700. The cost of goods sold in this instance is $700. Many times COGS is represented as a percentage, which in this example would have been 70% ($700 /$1,000).

You can often find the average cost of goods for most businesses by searching for industry publications.

Another major expense for most businesses is employees. This number can be found for many industries as a percentage of sales; however, we would recommend you create a list of the positions needed, the number of employees for each position, the number of hours worked, and wages. By comparing the industry average with your own list, you can have some confidence your numbers are in the ballpark.

Make a list of the monthly expenses and the cost for those expenses to use later in the financial statements.

3. Seasonality

After getting the sales projections completed, you will also want to look at seasonality. Seasonality refers to the fluctuations in monthly sales. Some businesses will be affected more by seasonality than others, but it is important to analyze because it may show your business will run out of cash. Lenders and potential investors will expect some seasonality, but if you have a business that has steady sales, be sure to explain why your sales are consistent.

In most areas, landscapers are a common business that has fluctuating sales. The spring and fall are really busy, while in the winter, there is little to no work.

4. Financial projections

With the sales projections, expenses, and seasonality now out of the way, creating the pro forma financial statements are actually pretty straightforward.

Business plan financial forecasting is typically set up to show a three-year outlook. Depending on the project, especially if it is one that has a significant amount of research and development time before revenues start to come in, some banks and lenders will occasionally want to see a five-year outlook.

There will be three financial statements to create:

- Cash flow statement – Similar to a detailed view of a checkbook, the projected cash flow statement looks at cash coming in and cash going out of the business. Cash flow projections usually look at the first year broken out into 12 months, and the following two years by quarter.

- Profit and loss statement – Also referred to as an income statement, this statement is an annual estimate of the taxable profits (or losses) of the business. The numbers in the P&L statement are similar to the cash flow statement; however, depreciation and amortization are also included.

- Balance sheet – Not every bank will request a proforma balance sheet for a start-up business. The balance sheet is similar to a personal financial statement that looks at assets and liabilities to determine the net worth.

The balance sheet is projected at the end of each year.

5. Sources and uses of funds

The sources and uses of funds section provide an overview of the financing activities, use of working capital, loan repayments, and how the money is spent.

The sources section is a list of where the money is coming from to fund the project. This will commonly have a line for the amount of the bank loan and another line for the amount the owner is investing in the business. Keep in mind when preparing this for the bank that most banks will want to see the business owner invest 15%-25% of their own funds in a start-up business.

The uses section provides details of all the startup costs for the business. Items are usually put into categories such as:

- Real estate

- Renovations

The amount in the sources section should equal the amount in the uses section.

Financial Projection Templates

There are free financial projection templates from Smartsheet , Spreadsheet 123 , and others. LivePlan has a guided approach (like Turbo Tax) to creating financial projections that are pretty thorough and easy to use.

There are free financial projection templates from Smartsheet , Spreadsheet 123 , and others. LivePlan has a guided approach (like Turbo Tax) to creating financial projections that are pretty thorough and easy to use.

I know it says you don’t need to collect sales tax for online orders going out of state in Illinois, so does that mean you need to use it for online in state?

How do we pick the right entity and not get screwed with our taxes?

Why Your Business Shouldn’t Commingle Funds

Founder Vs. CEO – What Title Should A Business Owner Use?

What license/permits are required to operate an online clothing store in the state of Mississippi?

If I file for an LLC as a single member, can I still acquire an EIN number?

Is a business license required for a virtual Delaware business?

Can You Run A Business Out Of Your Home?

Can I open a business bank account without a ein#?

Popular Questions

See more start-up questions

Popular Business Ideas

See more business ideas

Form An LLC

Business ideas, common start-up questions, get in touch.

Contact Form

Rules and regulations for starting a business change frequently. While we do our best to keep this information fully up-to-date, its very difficult to stay on top of the changes for every state. Also, this site is for informational purposes only and does not provide legal or tax advice.

Additionally, Startup101 may earn a small commission from products or services mentioned on this site.

Disclaimer | Privacy

© 2017 – 2024 StartUp101 LLC – All Rights Reserved.

Some (but not all) of the links on StartUp101.com are affiliate links. This means that a special tracking code is used and that we may make a small commission on the sale of an item if you purchase through one of these links. The price of the item is the same for you whether it is an affiliate link or not, and using affiliate links helps us to maintain this website.

StartUp101.com is also a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com .

Our mission is to help businesses start and promoting inferior products and services doesn’t serve that mission. We keep the opinions fair and balanced and not let the commissions influence our opinions.

- Search Search Please fill out this field.

- Building Your Business

How To Create Financial Projections for Your Business

Learn how to anticipate your business’s financial performance

:max_bytes(150000):strip_icc():format(webp)/ScreenShot2020-03-26at1.24.14PM-16d178cb2ee74d71946d658ab027e210.png)

- Understanding Financial Projections & Forecasting

Why Forecasting Is Critical for Your Business

Key financial statements for forecasting, how to create your financial projections, frequently asked questions (faqs).

Maskot / Getty Images

Just like a weather forecast lets you know that wearing closed-toe shoes will be important for that afternoon downpour later, a good financial forecast allows you to better anticipate financial highs and lows for your business.

Neglecting to compile financial projections for your business may signal to investors that you’re unprepared for the future, which may cause you to lose out on funding opportunities.

Read on to learn more about financial projections, how to compile and use them in a business plan, and why they can be crucial for every business owner.

Key Takeaways

- Financial forecasting is a projection of your business's future revenues and expenses based on comparative data analysis, industry research, and more.

- Financial projections are a valuable tool for entrepreneurs as they offer insight into a business's ability to generate profit, increase cash flow, and repay debts, which can be attractive to investors.

- Some of the key components to include in a financial projection include a sales projection, break-even analysis, and pro forma balance sheet and income statement.

- A financial projection can not only attract investors, but helps business owners anticipate fixed costs, find a break-even point, and prepare for the unexpected.

Understanding Financial Projections and Forecasting

Financial forecasting is an educated estimate of future revenues and expenses that involves comparative analysis to get a snapshot of what could happen in your business’s future.

This process helps in making predictions about future business performance based on current financial information, industry trends, and economic conditions. Financial forecasting also helps businesses make decisions about investments, financing sources, inventory management, cost control strategies, and even whether to move into another market.

Developing both short- and mid-term projections is usually necessary to help you determine immediate production and personnel needs as well as future resource requirements for raw materials, equipment, and machinery.

Financial projections are a valuable tool for entrepreneurs as they offer insight into a business's ability to generate profit, increase cash flow, and repay debts. They can also be used to make informed decisions about the business’s plans. Creating an accurate, adaptive financial projection for your business offers many benefits, including:

- Attracting investors and convincing them to fund your business

- Anticipating problems before they arise

- Visualizing your small-business objectives and budgets

- Demonstrating how you will repay small-business loans

- Planning for more significant business expenses

- Showing business growth potential

- Helping with proper pricing and production planning

Financial forecasting is essentially predicting the revenue and expenses for a business venture. Whether your business is new or established, forecasting can play a vital role in helping you plan for the future and budget your funds.

Creating financial projections may be a necessary exercise for many businesses, particularly those that do not have sufficient cash flow or need to rely on customer credit to maintain operations. Compiling financial information, knowing your market, and understanding what your potential investors are looking for can enable you to make intelligent decisions about your assets and resources.

The income statement, balance sheet, and statement of cash flow are three key financial reports needed for forecasting that can also provide analysts with crucial information about a business's financial health. Here is a closer look at each.

Income Statement

An income statement, also known as a profit and loss statement or P&L, is a financial document that provides an overview of an organization's revenues, expenses, and net income.

Balance Sheet

The balance sheet is a snapshot of the business's assets and liabilities at a certain point in time. Sometimes referred to as the “financial portrait” of a business, the balance sheet provides an overview of how much money the business has, what it owes, and its net worth.

The assets side of the balance sheet includes what the business owns as well as future ownership items. The other side of the sheet includes liabilities and equity, which represent what it owes or what others owe to the business.

A balance sheet that shows hypothetical calculations and future financial projections is also referred to as a “pro forma” balance sheet.

Cash Flow Statement

A cash flow statement monitors the business’s inflows and outflows—both cash and non-cash. Cash flow is the business’s projected earnings before interest, taxes, depreciation, and amortization ( EBITDA ) minus capital investments.

Here's how to compile your financial projections and fit the results into the three above statements.

A financial projections spreadsheet for your business should include these metrics and figures:

- Sales forecast

- Balance sheet

- Operating expenses

- Payroll expenses (if applicable)

- Amortization and depreciation

- Cash flow statement

- Income statement

- Cost of goods sold (COGS)

- Break-even analysis

Here are key steps to account for creating your financial projections.

Projecting Sales

The first step for a financial forecast starts with projecting your business’s sales, which are typically derived from past revenue as well as industry research. These projections allow businesses to understand what their risks are and how much they will need in terms of staffing, resources, and funding.

Sales forecasts also enable businesses to decide on important levels such as product variety, price points, and inventory capacity.

Income Statement Calculations

A projected income statement shows how much you expect in revenue and profit—as well as your estimated expenses and losses—over a specific time in the future. Like a standard income statement, elements on a projection include revenue, COGS, and expenses that you’ll calculate to determine figures such as the business’s gross profit margin and net income.

If you’re developing a hypothetical, or pro forma, income statement, you can use historical data from previous years’ income statements. You can also do a comparative analysis of two different income statement periods to come up with your figures.

Anticipate Fixed Costs

Fixed business costs are expenses that do not change based on the number of products sold. The best way to anticipate fixed business costs is to research your industry and prepare a budget using actual numbers from competitors in the industry. Anticipating fixed costs ensures your business doesn’t overpay for its needs and balances out its variable costs. A few examples of fixed business costs include:

- Rent or mortgage payments

- Operating expenses (also called selling, general and administrative expenses or SG&A)

- Utility bills

- Insurance premiums

Unfortunately, it might not be possible to predict accurately how much your fixed costs will change in a year due to variables such as inflation, property, and interest rates. It’s best to slightly overestimate fixed costs just in case you need to account for these potential fluctuations.

Find Your Break-Even Point

The break-even point (BEP) is the number at which a business has the same expenses as its revenue. In other words, it occurs when your operations generate enough revenue to cover all of your business’s costs and expenses. The BEP will differ depending on the type of business, market conditions, and other factors.

To find this number, you need to determine two things: your fixed costs and variable costs. Once you have these figures, you can find your BEP using this formula:

Break-even point = fixed expenses ➗ 1 – (variable expenses ➗ sales)

The BEP is an essential consideration for any projection because it is the point at which total revenue from a project equals total cost. This makes it the point of either profit or loss.

Plan for the Unexpected

It is necessary to have the proper financial safeguards in place to prepare for any unanticipated costs. A sudden vehicle repair, a leaky roof, or broken equipment can quickly derail your budget if you aren't prepared. Cash management is a financial management plan that ensures a business has enough cash on hand to maintain operations and meet short-term obligations.

To maintain cash reserves, you can apply for overdraft protection or an overdraft line of credit. Overdraft protection can be set up by a bank or credit card business and provides short-term loans if the account balance falls below zero. On the other hand, a line of credit is an agreement with a lending institution in which they provide you with an unsecured loan at any time until your balance reaches zero again.

How do you make financial projections for startups?

Financial projections for startups can be hard to complete. Historical financial data may not be available. Find someone with financial projections experience to give insight on risks and outcomes.

Consider business forecasting, too, which incorporates assumptions about the exponential growth of your business.

Startups can also benefit from using EBITDA to get a better look at potential cash flow.

What are the benefits associated with forecasting business finances?

Forecasting can be beneficial for businesses in many ways, including:

- Providing better understanding of your business cash flow

- Easing the process of planning and budgeting for the future based on income

- Improving decision-making

- Providing valuable insight into what's in their future

- Making decisions on how to best allocate resources for success

How many years should your financial forecast be?

Your financial forecast should either be projected over a specific time period or projected into perpetuity. There are various methods for determining how long a financial forecasting projection should go out, but many businesses use one to five years as a standard timeframe.

U.S. Small Business Administration. " Market Research and Competitive Analysis ."

Score. " Financial Projections Template ."

Resource Center

We have gathered together a variety of resources to help as your navigate the loan process. On this page you will find useful checklists, e-books, commonly used business forms and templates, a business dictionary and a list of helpful partners.

Download Our Checklists & eBooks

Buying vs Leasing

Small Business Loan Top Documents

10 Questions to ask before committing to an online business loan

Forms & Templates

Helpful Documents For Loan Applications

- SBA 504 Commercial Real Estate Loan Application

- Articles of Incorporation

- Articles of Organization

- Business Debt Schedule

- Bylaws Amendment

- Commercial Lease Template

- Personal Financial Statement

- Microloan Application & Checklist

- Simple Business Plan Template

- Stock Certificate Template

Helpful Business Templates

- 12-Months Financial Projections Template

- Business Plan Template — CDC Small Business Finance

- Simple Business Plan Template — CDC Small Business Finance

- SCORE Resources

- Office Depot Resources

Legal Templates

- Amendment to Bylaws

- Commercial Lease for EPC

Business Terms Dictionary

Business financing terms can be confusing. Use this dictionary to help you better understand terms you encounter in the loan process.

Helpful Partners

Secretary Of State

- California Secretary of State

- Arizona Secretary of State

- Nevada Secretary of State

Small Business Administration – SBA

- SBA Home Page

- Office of Women’s Business Ownership

- Internal Revenue Service

- IRS Forms & Publications

- Business Tax Articles