- assignments benefits creditors abcs basics california

Assignments for the Benefits of Creditors - "ABC's" - The Basics in California

An assignment for the benefit of creditors (“ABC”) is a contract by which an economically troubled entity ("Assignor") transfers legal and equitable title, as well as custody and control, of its assets and property to an independent third party ("Assignee") in trust, who is required to apply the proceeds of sale of the property to the assignor's creditors in accord with priorities established by law.

ABCs are a well-established common law tool and alternative to formal bankruptcy proceedings. The method only makes sense if there are significant assets to liquidate. ABCs are most successful when the Assignor, Assignee and creditors cooperate but can be imposed even if the creditors are not supportive.

Assignors - Rights and Duties

Generally, any debtor – an individual, partnership, corporation or LLC - may make an assignment for the benefit of creditors. Individuals seldom utilize ABCs, though, because there is no discharge of all debts as there would normally occur in a completed bankruptcy filing. Thus, the protection and benefit of the process is quite limited for any personal obligor.

ABCs can benefit individual principals who have personally guaranteed company obligations or have personal liability on tax claims. Once the Assignment Agreement has been executed, a trust is automatically put in place over the assets transferred. The Assignor can neither rescind the contract nor control the proceedings, but the Assignor may be consulted as necessary and appropriate by the Assignee during the liquidation process.

Assets to be Assigned

Assignor may assign any non-exempt real, personal, and/or general intangible property that can be sold or conveyed. Note that such assets as intellectual property, trade names, logos, etc. may be so transferred and sold. When a corporation makes an assignment, all corporate property, tangible and intangible is transferred including accounts, and rights and credits of all kinds, both in law and equity. The assets only can be sold, not the corporation or its stock. Thus the corporation remains existing, albeit without any significant assets left. It becomes, effectively, a shell.

Assets are typically sold without representations or warranties. The sale is free and clear of known liens, claims and encumbrances - with the consent or full payoff of lien holders. Generally, Assignee warrants only that Assignee has title to the assets.

Assignees - Rights and Duties

The Assignee is generally an unrelated professional liquidator selected by the Assignor. The Assignee gathers the Assignor’s assets and sells the Assignor’s right, title and interest in those assets, then distributes the proceeds to Creditors in accordance with statutory priorities.

The Assignee has a fiduciary duty to the Creditors. Assignee’s duties include protecting the assets of the estate, administering them fairly and representing the estate. Assignee is free to enter into contracts to recover assets or liquidated claims, e.g. filing suit or taking other action.

The Assignee may be removed by a court for violations of the Assignment contract or nonfeasance (failure to act appropriately). The Assignee may not give up his/her/its duties without liability or a superior court order until creditors receive distribution of the proceeds of sale of the assets transferred.

Assignee usually prepares the Assignment documents, though the attorney for the Assignor may draft them as well. Often the terms are negotiated at length.

Preferential Claims and Avoidance

Assignee has statutory avoidance powers, similar to those granted to a Chapter 7 bankruptcy trustee. [See Calif. CCP § 493.030 (termination of lien of attachment or temporary protective order), § 1800 et seq. (avoidance of preferential transfers); Calif. Civ.C. § 3439 et seq. (avoidance of fraudulent conveyances)]

Even so, courts may question this right outside a bankruptcy proceeding. There is also disagreement between the Federal Court (Ninth Circuit) and California state courts whether the Bankruptcy Code preempts the assignee's preference avoidance power under California statutory law.

Creditors - Rights and Duties

While not required to consent to an Assignment, secured creditors often must agree in advance since their cooperation frequently affects the liquidation of the assets. Secured creditors are not barred from enforcing their security by such an assignment. The acceptance of an Assignment by unsecured creditors is not necessary, since under common law the proceedings are deemed to benefit them through equality of treatment.

Note that all Creditors must file their claims within the statutory 150-180 day claim filing period.

ABCs in California do not require a public court filing, but most corporations require both board and shareholder approval. Costs and expenses, including the assignee’s fees, legal expenses and costs of administration, are paid first, just as in a Chapter 7 bankruptcy . Because an assignee’s fee is often based on a percentage value of the assigned assets, it can be difficult to procure assignees for smaller estates.

- Assignment Agreement is executed and ratified. Assignor turns over and assigns to Assignee all right, title and interest in the assets being assigned.

- Assignor gives Assignee a complete, certified list of creditors, including addresses and amounts owed.

- Assignee notifies Creditors within 30 days of execution that assignment has been made, provides an estimate of the probable distribution, and provides a claim form for each Creditor to file a claim in the Assignment estate.

- Creditors have 150-180 days from the date of written notice of the assignment to file their claims.

- After claim forms are returned and/or the Bar Date has passed, Assignee reconciles the claims and/or objects to any improper claim amounts.

- After liquidation, Assignee determines distribution amounts. Claim priority is determined first by state statute, then by Bankruptcy Code. First are secured creditors, then follow tax & wage claims.

- Assignee generally informs the IRS that assignment has been made and files notice with local Recorder.

- Assignee immediately searches for any previously undisclosed liens (UCC or real estate) to ensure complete notice to all creditors and interest holders.

- Assignee secures all assets. In limited situations where the business has enough cash, Assignee may continue to operate the business to maintain going-concern value - if no further debt will be incurred.

It normally takes about 12 months to conclude an ABC.

Effects of ABC

An ABC generally is faster and less costly than a bankruptcy proceeding. Parties can often agree and determine what is going to happen prior to execution of the assignment.

However, ABCs do not discharge individual Assignors from their debts, and do not provide for the reorganization of the business. There is no automatic stay, though in practice an ABC results in an informal and/or incomplete automatic stay if the creditors determine that the assets are beyond their reach.

Creditors are able to continue to pursue the Assignor. ABCs often block judgment creditors from attaching assets because the Assignor no longer has title to or interest in the assigned assets. Sometimes the Assignee is willing to allow the judgment if the judgment creditor submits its claim as described above. The assignee may also defend against a claim if the plaintiff is seeking a judgment which is unjustified and not fair to other creditors.

An ABC also provides grounds for filing an involuntary bankruptcy petition within 120 days of assignment.

The Statutes: California Code of Civil Procedure

§§493.010-493.060 “Effect of Bankruptcy Proceedings and General Assignments for the Benefit of Creditors”

§§1800-1802 “Recovery of Preferences and Exempt Property in an Assignment for the Benefit of Creditors”

A Chapter 11 Reorganization can cost hundreds of thousands of dollars and even a business Chapter 7 Liquidation bankruptcy can easily cost tens of thousands or more. The Assignment method, which pays the Assignee normally by a percentage of the assets sold, is cost-efficient but limited in the protection it may afford the Assignor, as described above. Before this method is attempted, competent legal counsel and certified public accountants should be consulted.

Founded in 1939, our law firm combines the ability to represent clients in domestic or international matters with the personal interaction with clients that is traditional to a long established law firm.

Read more about our firm

© 2024, Stimmel, Stimmel & Roeser, All rights reserved | Terms of Use | Site by Bay Design

assignment for benefit of creditors

Primary tabs.

Assignment for the benefit of the creditors (ABC)(also known as general assignment for the benefit of the creditors) is a voluntary alternative to formal bankruptcy proceedings that transfers all of the assets from a debtor to a trust for liquidating and distributing its assets. The trustee will manage the assets to pay off debt to creditors, and if any assets are left over, they will be transferred back to the debtor.

ABC can provide many benefits to an insolvent business in lieu of bankruptcy . First, unlike in bankruptcy proceedings, the business can choose the trustee overseeing the process who might know the specifics of the business better than an appointed trustee. Second, bankruptcy proceedings can take much more time, involve more steps, and further restrict how the business is liquidated compared to an ABC which avoids judicial oversight. Thirdly, dissolving or transferring a company through an ABC often avoids the negative publicity that bankruptcy generates. Lastly, a company trying to purchase assets of a struggling company can avoid liability to unsecured creditors of the failing company. This is important because most other options would expose the acquiring business to all the debt of the struggling business.

ABC has risen in popularity since the early 2000s, but it varies based on the state. California embraces ABC with common law oversight while many states use stricter statutory ABC structures such as Florida. Also, depending on the state’s corporate law and the company’s charter , the struggling business may be forced to get shareholder approval to use ABC which can be difficult in large corporations.

[Last updated in June of 2021 by the Wex Definitions Team ]

- commercial activities

- financial services

- business law

- landlord & tenant

- property & real estate law

- trusts, inheritances & estates

- wex definitions

Assignments for the Benefit of Creditors – an often-overlooked state law alternative to Chapter 7 bankruptcy

For some folks the three letters ABC are a reminder of elementary school and singing a song to learn the alphabet. For others, it is a throw back to the early 70’s when the Jackson Five and its lead singer Michael, still with his adolescent high voice, sang a catchy love song. Then there is a select group of people in the world of corporate workouts, liquidations and bankruptcies, who know those three letters to stand for the A ssignment for the B enefit of C reditors – a voluntary state law liquidation process that may arguably offer a hospitable and friendly alternative to federal bankruptcy. This article is a brief summary of this potentially attractive alternative to bankruptcy.

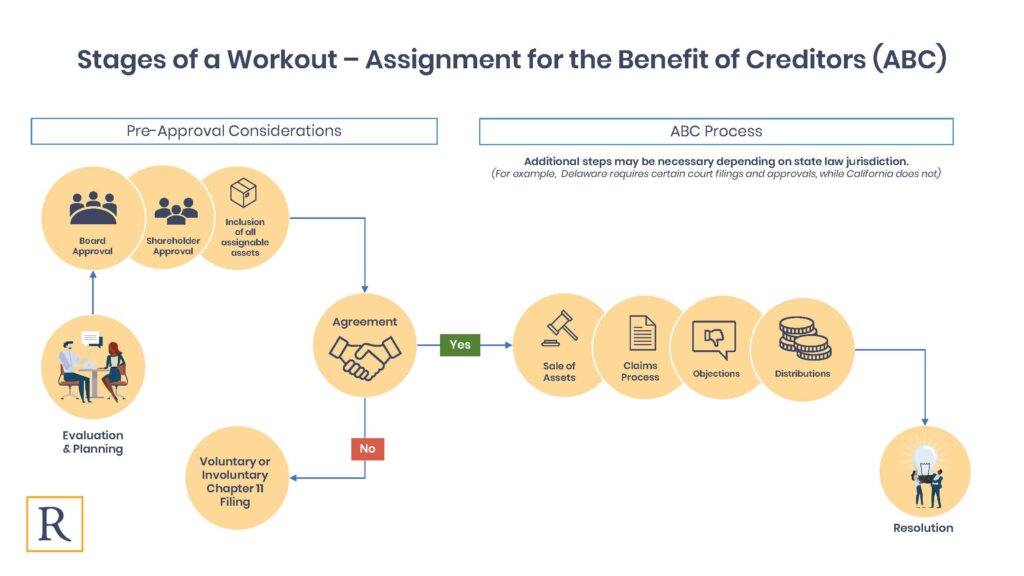

The Assignment for the Benefit of Creditors (“ABC”), also known as a General Assignment, is a state law procedure governed by state statute or common law. Over 30 states have codified statutes, and the remainder of states rely on common law. See Practical Issues in Assignments for the Benefit of Creditors , by Robert Richards & Nancy Ross, ABI Law Review Vol. 17:5 (2009) at p. 6 (listing state statutes). In some states, the statutory authority and common law can coexist. At its most basic, the ABC process involves the transfer of all assets by a financially distressed debtor (the assignor) to an individual or entity (the assignee) with fiduciary obligations who then liquidates the assets and pays creditors. The assignment agreement is essentially a contract involving the transfer and control of property, in trust, to a third party. In some states that have enacted a statute, state courts may supervise the process (and at different levels of involvement depending on the statute). The statutory scheme in other states such as California and Nevada, and in states where common law govern, do not provide for judicial oversight..

ABCs are promoted as less expensive and more flexible than a chapter 7 liquidation and may proceed substantially faster than bankruptcy liquidation. See generally Practical Issues in Assignments for the Benefit of Creditors , ABI Law Review Vol. 17:5 (2009) at p. 8 (citations omitted). In addition, the ABC process may provide four other noteworthy benefits not available in a bankruptcy. First, the liquidating company chooses the assignee, there is no appointment of a random trustee or formal election required like in a bankruptcy. This freedom of choice allows the assignor to evaluate the reputation and experience of proposed assignees, as well as select an assignee with familiarity in the nature of the assignor’s business and/or with more expansive contacts in the industry to facilitate the sale/liquidation. Second, the ABC process generally falls under the radar of the media (particularly in states that do not require court supervision), and the assignor may avoid publicity, often negative, that can be associated with bankruptcy proceedings. Third, with an ABC, the assignee has the ability to sell the assets without the imposition of potentially cumbersome requirements of Section 363 of the Bankruptcy Code, and in some cases, can conduct a sale the same day as the general assignment. Finally, the ABC process generally authorizes the sale of assets free of unsecured creditor debt. In essence, in an ABC, a company buying assets from a distressed business does not acquire the debt of the assignor.

On the down side, ABCs do not provide the protection of the automatic stay that is triggered upon the filing of a bankruptcy petition. In some situations, the debtor entity needs to stop the pursuit of creditors immediately, and a bankruptcy proceeding will supply this relief. Unlike bankruptcy, the sale through an ABC: i) is not free and clear of liens; ii) unexpired leases cannot be assumed and assigned without the consent of the contract counter-party; and iii) insolvency can trigger a default under an unexpired lease or executory contract. See generally Practical Issues in Assignments for the Benefit of Creditors , ABI Law Review Vol. 17:5 (2009) at p. 20. In general, an ABC is not a good choice for debtors that have secured creditors that do not consent because there is no mechanism for using cash collateral or transferring assets free and clear of liens without the secured creditors’ consent. In cases where junior lienholders are out of the money, there is no incentive for those creditors to voluntarily release their liens. In addition, while unsecured creditors do not have to consent to the general assignment for it to be valid, choosing this alternative forum may cause concern for creditors (particularly those used to the transparency of a court-supervised bankruptcy or receivership proceeding) and invite the filing of an involuntary bankruptcy. Therefore, it is prudent to involve major creditors in the process, and perhaps even in the pre-assignment planning. In addition, if an involuntary petition is filed, the assignee could request that the bankruptcy court abstain in order to proceed with the ABC.

Using the ABC state process in lieu of filing for bankruptcy in federal court may result in a more streamlined, efficient liquidation process that is less expensive and likely completed quicker than a federal bankruptcy proceeding. In some jurisdictions, such as New Jersey, workout professionals note anecdotally that corporate clients fare better under this state law alternative rather than the lengthy, more complicated federal bankruptcy proceedings.

Many bankruptcy professionals are unfamiliar with the procedures of ABC and are reluctant to recommend it as a method for liquidating assets and administering claims. This lack of familiarity may be a disservice to potential clients.

[ View source .]

Related Posts

- New Jersey Bankruptcy Courts Remain a Strong Option for Debtors Seeking to Obtain a Third-Party Release in a post-Purdue Pharma World Following the BowFlex Decision

- The Impact of Purdue Pharma

- New Jersey Releases New Chapter 11 Complex Procedures and Other Rule Updates

- Who’s a Party in Interest? The Supreme Court’s Ruling in Truck Insurance Exchange v. Kaiser Gypsum Co. Inc. Opens the Door for Insurers to Intervene in Certain Bankruptcy Proceedings

- The More Things Change, The More They Stay The Same? Survival Of Small Businesses Again Dependent On Action From Congress

- Mediation in Bankruptcy: A Glimpse

- In re The Hacienda Company, LLC – Round 2: Bankruptcy Courts May be Available to Non-Operating Cannabis Companies to Liquidate Assets

- PAGA Dischargeable in Bankruptcy?

DISCLAIMER: Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations. Attorney Advertising.

Refine your interests »

Written by:

PUBLISH YOUR CONTENT ON JD SUPRA NOW

- Increased visibility

- Actionable analytics

- Ongoing guidance

Published In:

Fox rothschild llp on:.

"My best business intelligence, in one easy email…"

(858) 481-1300 [email protected]

- Health & Safety Receiverships

- Partition Referee Matters

- Business Dispute Receiverships

- Cannabis Receiverships

- Rents & Profits Receiverships

- Post-Judgment Receiverships

- Legal Representation of Receivers & Referees

- Property Examples

- Meet the Team

- In the News

- Career Opportunities

Assignment for the Benefit of Creditors: A Remedy to Avoid Bankruptcy

May 24, 2021

When it comes to California contract law, ABC contracts are a well-established tool that can help individuals and entities avoid a formal bankruptcy filing. “ABC” stands for “Assignment for the Benefit of Creditors,” and the term describes a contract in which an economically troubled “Assignor” transfers control of its assets and property to an independent third party. This third party is called the “Assignee,” and they liquidate and wind-up the entity.

How Do ABCs Work?

When a business is struggling financially without much hope of recovery, bankruptcy isn’t the only option. ABC contracts can help the entity avoid traditional or formal bankruptcy proceedings.

These contracts work when there are significant assets that are ready to be liquidated. If the entity doesn’t have valuable assets, then an ABC contract is not typically a realistic option. However, in these circumstances where there are significant assets, the Assignor transfers all custody, control, and title to a neutral third party.

This neutral third party navigates and facilitates the liquidation of assets and transfer of funds to the assignor’s creditors.

Benefits of Using an ABC

There are several benefits to using an ABC.

One of the biggest factors for most entities is avoiding Chapter 11 or Chapter 7 bankruptcy. Because ABCs are governed by state law, not federal law, struggling companies can pursue an ABC contract on their own without going through the courts.

Working with a neutral third party can take away a lot of the stress that accompanies economic difficulties. Instead of trying to liquidate assets and transfer funds to creditors, struggling companies can pass those challenges on to the Assignee.

Lastly, Assignors get to choose their own Assignees. That means that they are not at the mercy of the court to assign a bankruptcy trustee they don’t know or trust. When a company pursues an ABC contract, they maintain more control over process and costs.

Going through financial difficulties can lead to feelings of helplessness and a loss of control, but this is something that you continue to have control over.

Responsibilities of an Assignee

When the Assignor assigns property to the Assignee, that can include all corporate property, both tangible and intangible, as well as accounts, rights, and credits, including law and equity credits.

The Assignee liquidates and sells these assets. (Note that the Assignee cannot sell the corporation or the stock.) Importantly, the corporation continues to exist during this process, even though there are no assets left by the end of the process.

The Assignee typically sells all assets without any representation or warranty. An as-is sale allows things to proceed quickly; ABCs are known for being one of the fastest ways to address significant debt issues.

Assignees protect the assets of the estate or corporation. They are required to administer those assets fairly and in the interest of the Assignor and its creditors.

How to Choose an Assignee

Choosing an Assignee is about finding the right third party representative. We recommend that you look for the following characteristics in your chosen Assignee:

- Experience: Choose an Assignee who has significant experience with managing and liquidating assets for struggling businesses.

- Reputation: These days, reputation means everything. It’s easy to find out through some searching if a potential Assignee is qualified and reputable.

- Knowledge: A knowledgeable Assignee will be able to answer your questions about the process and chart out likely outcomes.

Do You Need an Assignee?

Griswold Law regularly manages and sells business assets. We serve as court-appointed receivers as well as ABC-contracted Assignees. To learn more about ABCs and how we can help you avoid bankruptcy, reach out today .

- There are no suggestions because the search field is empty.

- Court-Appointed Receivership (64)

- Real Estate (53)

- Partition Referee (29)

- Real Estate Finance (28)

- Real Estate Transaction (28)

- Partition Action (25)

- Commercial Properties (21)

- Hoarding (21)

- Enforcing Judgments (20)

- Business Litigation (19)

- Commercial Leases (19)

- Tenants' Rights (18)

- Foreclosure Law (17)

- Business Owners (16)

- receivership (16)

- Contract Disputes (15)

- Collections Law (14)

- Construction Law (13)

- Business Formation: Asset Protection (11)

- Uncategorized (11)

- California (10)

- health & safety (9)

- receiver (9)

- Consumer Class Action (8)

- Loan Modification (8)

- Receivership Remedy (8)

- abandoned property (8)

- receiverships (8)

- Consumer Fraud (7)

- Health and Safety receivership (7)

- health and safety code (6)

- Health & Safety Code (5)

- code enforcement (5)

- fire hazard (5)

- healthy & safety receiver (5)

- Employment Law (4)

- Fraud against Senior Citizens (4)

- Landlord (4)

- Marijuana Dispensaries (4)

- San Diego (4)

- Trade Secrets (4)

- abandoned (4)

- code enforcement officers (4)

- creditor (4)

- money judgment (4)

- nuisance property (4)

- Cannabis (3)

- Employment Class Action (3)

- Employment Discrimination (3)

- Health & Safety Code Receiver (3)

- Trademark Law (3)

- business disputes (3)

- collection (3)

- court-appointed receiver (3)

- health and safety (3)

- hoarder (3)

- real estate. california (3)

- real property (3)

- rents and profits (3)

- substandard conditions (3)

- Attorneys' Fees Clauses (2)

- City of San Diego (2)

- Health and Safety Receivership Process (2)

- Post-Judgment Receiver (2)

- Unlawful Detainer (2)

- abandoned building (2)

- bankruptcy (2)

- business (2)

- complaint (2)

- debt collection (2)

- dispute (2)

- distressed properties (2)

- foreclosure (2)

- habitability (2)

- health and saftey code (2)

- hoarders (2)

- hoarding support (2)

- judgment (2)

- judgment creditor (2)

- judgment debtor (2)

- partnership agreement (2)

- property (2)

- property value (2)

- san diego county (2)

- slumlord (2)

- tenant rights (2)

- Animal Hoarding (1)

- City of Chula Vista (1)

- Distressed Business (1)

- Historic Properties (1)

- Liquor License Receiverships (1)

- Mills Act (1)

- Neighborgood Blight (1)

- Partition Remedy (1)

- Post-Judgment Receivership(s) (1)

- Reimbursement of Employee Business Expenses (Labor (1)

- The Health and Safety Receivership Process (1)

- absentee landlord (1)

- abstract of judgment (1)

- account levy (1)

- assignment for the benefit of creditors (1)

- bank garnish (1)

- bank levy (1)

- bitcoin (1)

- board of directors (1)

- business formation (1)

- business owner (1)

- california receivership laws (1)

- city attorney (1)

- collecting judgment (1)

- commercial project (1)

- company (1)

- confidential information (1)

- confidentiality agreement (1)

- court award (1)

- court order (1)

- covid-19 (1)

- cryptocurrency (1)

- deceased owner (1)

- demolition (1)

- diliberti (1)

- disposable earnings (1)

- family law (1)

- general partnership (1)

- habitability requirements (1)

- hospitality assets (1)

- human smuggling (1)

- illegal business (1)

- illegal cannabis dispensary (1)

- illegal gambling parlor (1)

- initial inspection (1)

- joseph diliberti (1)

- judgment collection (1)

- judgment lien (1)

- lease term (1)

- liquidation (1)

- litigation (1)

- lodging properties (1)

- massage parlors (1)

- misappropriation (1)

- negligent landlord (1)

- new business (1)

- occupant relocation (1)

- partnership (1)

- partnership disputes (1)

- post-judgment collection (1)

- provisional director (1)

- public safety (1)

- real property lien (1)

- real property receiver (1)

- relocation (1)

- residential zoning laws (1)

- retail center (1)

- right of possession (1)

- san diego real estate (1)

- sex trafficking (1)

- short-term rental (1)

- sober living house (1)

- struggling hotels (1)

- substandard hotel (1)

- tenancy (1)

- unlicensed in-home business (1)

- wage garnishment (1)

- warranty of habitability (1)

- weed abatement (1)

- writ of execution (1)

Recent Posts

For more information please contact Griswold Law

Phone: (858) 481-1300

Email: [email protected]

Address: 171 Saxony Road, Suite 205, Encinitas, CA 92024

No communication via email or content posted on this website creates an attorney-client privilege. The information on this website is purely hypothetical. The information on this website should not be relied upon. If you have legal questions or are seeking legal assistance, you should contact an attorney immediately.

- California Department of Real Estate

- California Secretary of State

- State of California Courts

- U.S. Department of Housing and Urban Development

- United States District Court, Southern District of California

- United States Patent and Trademark Office

Assignment For The Benefit Of Creditors: An Overview

Contributor.

What is an assignment for the benefit of creditors? An assignment for the benefit of creditors ("ABC") is an alternative to a chapter 7 bankruptcy proceeding. As in a chapter 7, the debtor's assets are shepherded and liquidated for the benefit of the debtor's creditors. An ABC is governed by statute and can either be court-supervised or conducted out of court. In New York, an ABC is governed by Article 2 of the Debtor and Creditor Law.

In an ABC proceeding, the debtor is referred to as an assignor, because it makes a transfer of all its assets to an assignee who serves as a trustee. The assignee is charged with placing all the assets in trust in order to liquidate and distribute the proceeds to creditors. While an ABC has many similarities with a chapter 7 liquidation, the two do differ in two important regards:

- an ABC does not afford a debtor an automatic stay from creditor collection; and

- a sale does not provide the purchaser with the right to purchase the assets free and clear of liens – unlike a 363 sale in Bankruptcy.

To commence an ABC, an assignor executes an assignment conveying all its assets to the assignee, who becomes a fiduciary on behalf of the assignor and its creditors. The assignee then collects and liquidates assets by collecting accounts receivable, conducting an auction sale, sometimes to a stalking horse bidder who starts the bidding, or through a going out of business sale.

An assignor also has powers under state law to recover fraudulent pre-ABC transfers of assets and preferential payments made to creditors. In New York, the "look-back period" for recovering these transfers is four years.

When it comes to distribution of the assets collected by the assignee, an ABC proceeding follows an established order of priority, which is set forth in either the state's unique ABC laws or in the deed of assignment. The assignee tallies the proofs of claim that were filed by the creditors in the proceeding and pays the claims, either in full or on a pro rata basis in accordance with the priority scheme.

After the assignor's assets have been liquidated and creditors have been paid out, the assignee must prepare an accounting detailing the flows of monies in and out of the estate during the case, which may have to be filed with the court supervising the proceedings. As part of the accounting process, the assignee asks the court to close the estate, which notifies all interested parties that (i) the estate has been fully administered, (ii) that the assignee's work is complete, (iii) that no further distributions need be made, and (iv) that the assignment is terminated.

An ABC is a useful, cost-effective alternative to a traditional chapter 7 bankruptcy liquidation, and may suitably serve liquidation requirements in some situations.

Originally published 03/07/2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

Insolvency/Bankruptcy/Re-Structuring

United states.

Mondaq uses cookies on this website. By using our website you agree to our use of cookies as set out in our Privacy Policy.

- Legal Topics

- Research Laws

- Find a Lawyer

- Legal Forms

Assignment for the Benefit of Creditors

In lieu of filing for Chapter 7 liquidation bankruptcy, a business may wish to settle its debts by entering into an assignment for the benefit of creditors. An assignment is a streamlined liquidation procedure that allows a business to pay off its creditors while avoiding the costs, time, and stigma associated with bankruptcy.

How Does It Work?

Ask a business law question, get an answer ASAP! Thousands of highly rated, verified business lawyers. Click here to chat with a lawyer about your rights.

While almost anyone can assign assets to an assignee, most assignors are corporations or partnerships. The business transfers control and title of its assets, include its accounts receivable, to an assignee. The business cannot rescind an assignment once it has been made.

The law of trusts applies to assignments. The assignee has the same duties and responsibilities to creditors as a trustee would have to the beneficiaries of a trust. The assignee liquidates the debtor’s assets and distributes the proceeds to creditors. The creditors may require the debtor to satisfy any deficiencies, or accept the proceeds as full satisfaction of the debt, also known as a “composition with creditors.” The costs of administering the assignment are paid first from the money generated by liquidation of the estate. Any surplus funds are returned to the business. Secured and Unsecured Creditors, Consent, and Cooperation A creditor does not need to consent to assignment of the asset. However, cooperation with securred creditors is generally sought to maximize the amount recovered from the sale or disposition of the asset. Likewise, while a secured creditor may choose to take back collateral, creditors often cooperate with the assignee to maximize returns on the asset.

Advantages and Disadvantages of Assignments

While business owners may also simply walk away from a failing business, this does nothing to protect the business’s owners or investors. An assignment allows for the opportunity to pay off creditors and to obtain orderly estate administration. An assignee may often be able to sell an asset for a greater price or pursue litigation that a bankruptcy trustee is unable to pursue. Secured creditors consenting to assignment eliminate the costs and litigation associated with the foreclosure and sale of an asset. An assignment may generate less publicity than that of bankruptcy.

There is limited court oversight involved in an assignment, and the automatic stay that prevents creditors from collecting on debts during the pendency of a bankruptcy case does not apply to an assignment case. If the business is not satisfied with the assignment case, it can still file for voluntary bankruptcy. As well, creditors may seek to impose an involuntary bankruptcy under Chapter 11 if they are not satisfied with how the assignment case is proceeding.

Our Services

Business advisory.

Turnaround & Restructuring

Appraisals & Valuations

Fiduciary Services

Forensic Accounting

Financial Advisory

Litigation Support

Interim Management

Real Estate Solutions

Corporate trust, what is assignment for the benefit of creditors, explaining an emerging alternative to bankruptcy to resolve distress.

What is an ABC?

Assignment for the benefit of creditors (ABC) is a state law winddown procedure that allows for the orderly winddown of a company. The ABC provides for the appointment of an independent fiduciary representative – known as an assignee. The assignee manages the orderly wind down of the business and monetizes the company’s assets for the benefit of the company’s creditors. The assignee will then distribute the proceeds generated from the sale of the company’s assets to the company’s creditors according to state law.

Important pre-approval considerations :

- The decision must be approved by both the board and shareholders.

- Jurisdiction matters – 35 states have some form of an ABC in its laws. Each state will have different considerations and procedures to follow.

What are the benefits of an ABC?

- Choice: Unlike a receivership or a Chapter 7 Case, the board has the ability to select the assignee.

- Time: A bankruptcy case is a lengthy process with many procedural requirements. Most ABCs are significantly less time-consuming than a bankruptcy case or a receivership.

- Savings: The shortened engagement time for ABCs means billing is leaner – many times, ABCs can provide higher returns.

- Distributions to Creditors: Since the cost of an ABC is usually less than a bankruptcy case or a receivership, the actual return to creditors is usually greater in an ABC than in a bankruptcy case or a receivership. In addition, due to the expedited nature of an ABC, distributions to creditors will usually occur sooner in an ABC than in a bankruptcy case or a receivership.

What else should be considered in ABCs?

ABCs have some key differences from bankruptcies which should be carefully considered. For example, there are no automatic stays or statutory caps for landlord claims or employment claims in ABC. Leases and other executory contracts may be more difficult to assign in an ABC than in a bankruptcy case. In addition, ABCs can only be used for a winddown or sale of the business, not reorganization of the business

Interested in learning more?

Resolute’s team of experts include Steve O’Neill , who has more than 35 years of legal experience in ABCs, complex bankruptcy cases, and sale/winddown of companies; and Jeremiah Foster , who has served bankruptcy trustee and liquidating trustee in a variety of ventures.

Please contact us if you would if you’d like to learn more about ABCs or explore your company’s options.

Assignments for the Benefit of Creditors: Overview | Practical Law

Assignments for the Benefit of Creditors: Overview

Practical law practice note overview w-006-7771 (approx. 19 pages).

| Maintained • USA (National/Federal) |

- Skip to main content

- Skip to footer

Force 10 Partners

An advisory firm specializing in corporate restructuring, challenged businesses, litigation, and other special situations.

Assignment for the Benefit of Creditors

When we serve as the Assignee in an Assignments for the Benefit of Creditors (ABCs), Force 10 takes on the problems and risks for an insolvent business. We sell the assets and wind down the company’s affairs, protecting creditors’ interests while keeping them informed.

ABCs are based on state law, not the federal bankruptcy code, and vary by state. Where laws favor out-of-court dissolutions, an ABC with a fiduciary as the assignee, works well for closely-held entities with secured or unsecured debt. The process resembles a Chapter 7 bankruptcy without court oversight.

In this role, we…

Subject all buyers put forth by insolvent companies to an overbid process, to ensure the best outcome for creditors., manage dealings with various state and local taxing authorities, and the irs, as well as vendors with claims., liquidate and distribute net proceeds to maximize recovery for creditors., act as an objective fiduciary throughout what is often a contentious process., ready to act, having pioneered solutions in so many novel situations, we can take control quickly, with little ramp-up time needed., we insist on integrity. our like-minded team’s sense of professional ownership carries through in each engagement, motivating us to do the right thing, and do it well., buyers are welcome, to secure the best result, we tap into our vast network of potential asset buyers, working our relationships and market insights..

A proven ability to identify productive solutions in challenging situations and offer value-creating strategic advice to firms across a wide range of industries.

Engagements

CarbonLITE Industries: Confirmation of Chapter 11 Plan of Reorganization

Over $250mm of asset sales within Chapter 11 proceeding resulted in significant distributions to unsecured creditors.

Watsonville Hospital: Confirmed Chapter 11 Reorganization and Trustee over Plan Trust

The hospital was plagued by ongoing losses putting access to local care in jeopardy. Hospital district was formed to purchase the facility and effectuate the reorganization.

Rothenberg Ventures: Venture Capital Fund Management

Financial advisor and fund manager to venture fund family that fell victim to sponsor misappropriations.

Let’s discuss your situation

Contact us for an objective, candid assessment of your situation and a conversation about how our expertise and track record of success could address your needs.

Legal Lingo: Assignment for Benefit of Creditors

Understanding the language of the law is the first step to understanding the law, and in such a complex profession with such a wide array of terms, it’s easy to feel as if you’re visiting a foreign country just by walking into a courthouse or lawyers office. The term “Assignment for the Benefit of Creditors” or an ABC has been in the news quite a bit lately. From the collapse of Butler and Hosch in mid-May to discount luxury travel site site Luxury Link , and retailer Body Central it seems as if this “bankruptcy alternative” is becoming a mainstream term. So let’s crack it open and have a look at what this term really means.

The ABCs of an ABC

An Assignment for Benefit of Creditors is an analog to the more widely understood Chapter 7 Bankruptcy liquidation. It is a voluntary transfer of the debtor’s property in trust to a third entity for liquidation and satisfaction of the creditors’ claims. The trustee will then liquidate all nonexempt property and satisfy the creditors as much as possible. This is not a one size fits all plan, and it may not be suitable for certain companies in financial straits that will require a bankruptcy. If the company is in dire financial straits, with no lender willing to finance, no liquidity, and no cash flow, or if filing a Chapter 7 would not generate the best payouts for creditors, or if the debtor wants to avoid a Chapter 7 bankruptcy altogether, an ABC might just be a speedier and more agreeable way out for all parties.

- Company A transfers all property including rights, deeds, titles, and control of all assets and independent third entity who we will call the Trustee. They then walk away and have no further say in the disposition of their former property.

- The trustee liquidate the assets and distributes the monies to Company A’s creditors.

- Secured creditors – those who have a right to repossess or foreclose on collateral – are paid from the proceeds and are relieved of the time and expense of selling their collateral interest.

- Unsecured creditors- those that lend money without collateral such as credit cards – must follow a formal claims process called “proof of claims” which allows the trustee to confirm and control unsecured liabilities.

Very often a trustee specializing in ABC’s will be more efficient in the disposition of property than a court appointed trustee, especially when one is selected who has experience in this area of law. Assignment for Benefit of Creditors is less costly, less public, and often much speedier to resolve than your average bankruptcy. It is never easy to lose a business that you may have spent a lifetime building, but by waiting and hoping you may actually be making your situation worse.

At Van Horn Law Group, we understand all of the complex processes of relieving financial distress and helping our clients resolve their debts.

Related Post

Recent posts, navigating contractor bankruptcy: challenges and solutions.

The construction industry is no stranger to financial turbulence, with contractors facing a growing threat…

- Economic Outlook

Understanding the Sahm Rule: What It Means for Your Financial Security

What Is the Sahm Rule? Implications for Your Financial Stability | Van Horn Law Group

- Bankruptcy for Businesses

Navigating Economic Challenges: A Guide for Struggling Truckers

Facing financial difficulties in the trucking industry? Discover how Van Horn Law Group can help…

Surviving a Slumping Housing Market: Support for Struggling Realtors

The real estate market has seen its fair share of ups and downs, and recent…

Florida Governor Signs Bill Increasing Motor Vehicle Exemption in Bankruptcy

The Florida Governor today signed bill SB158 into law, which increases the value of motor…

- Get Out of Debt

Here’s How to Actually KEEP Your Financial Resolutions This Year

There are many reasons why there is a high rate of financial resolutions this year.…

There is a problem.

A server-side error has occurred.

IMAGES

VIDEO

COMMENTS

An assignment for the benefit of creditors is an effective tool for acquiring and winding down distressed businesses, while minimizing negative publicity and potential liability. ... The common law assignment by simple transfer in trust, in many cases, is a superior liquidation mechanism when compared to using the more cumbersome statutory ...

An assignment for the benefit of creditors ("ABC") is a contract by which an economically troubled entity ("Assignor") transfers legal and equitable title, as well as custody and control, of its assets and property to an independent third party ("Assignee") in trust, who is required to apply the proceeds of sale of the property to the assignor's creditors in accord with priorities ...

Assignment for the benefit of the creditors (ABC)(also known as general assignment for the benefit of the creditors) is a voluntary alternative to formal bankruptcy proceedings that transfers all of the assets from a debtor to a trust for liquidating and distributing its assets. The trustee will manage the assets to pay off debt to creditors, and if any assets are left over, they will be ...

Assignee, in trust for its creditors. of assets within thirty days with the Chancery Court. 10 Del. C. Much like a Chapter 7 bankruptcy trustee, the Assignee owes a fiduciary duty to preserve assets for the benefit of the Assignor's creditors. Initiating a Delaware ABC for a corporation requires board

See generally Practical Issues in Assignments for the Benefit of Creditors, ABI Law Review Vol. 17:5 (2009) at p. 8 (citations omitted). In addition, the ABC process may provide four other ...

May 24, 2021. When it comes to California contract law, ABC contracts are a well-established tool that can help individuals and entities avoid a formal bankruptcy filing. "ABC" stands for "Assignment for the Benefit of Creditors," and the term describes a contract in which an economically troubled "Assignor" transfers control of its ...

An assignment for the benefit of creditors ("ABC") is an alternative to a chapter 7 bankruptcy proceeding. United States Home About Mondaq Topics. Back Topics; ... The assignee is charged with placing all the assets in trust in order to liquidate and distribute the proceeds to creditors. While an ABC has many similarities with a chapter 7 ...

The third alternative to liquidating your own business or filing for bankruptcy is to follow a procedure called an "assignment for the benefit of creditors," or ABC. An ABC, as the name would suggest, is an assignment with the purpose of liquidating assets to benefit creditors by getting them paid. Here you, the assignor, work with one of the ...

Assignment for Benefit of Creditors vs. Chapter 7 Bankruptcy. Assignment for benefit of creditors is also called general assignment, or abbreviated to ABC. It is generally referred to as an alternative to bankruptcy. An ABC involves a company assigning all of its assets to a third party who takes title to the company's assets in trust, then ...

An assignment for the benefit of creditors ("ABC") is an alternative to a chapter 7 bankruptcy proceeding. As in a chapter 7, the debtor's assets are shepherded and liquidated for the benefit of the debtor's creditors. An ABC is governed by statute and can either be court-supervised or conducted out of court. In New York, an ABC is ...

assignee in trust for the assignor's creditors. The Delaware Code does not have a prescribed form of an assignment agreement, so general principles of contract and trust law apply. However, an assignment may be deemed void if its provisions either: A Q&A guide to an assignment for the benefit of creditors (ABC) in Delaware. This Q&A addresses

Assignment for the Benefit of Creditors. In lieu of filing for Chapter 7 liquidation bankruptcy, a business may wish to settle its debts by entering into an assignment for the benefit of creditors. An assignment is a streamlined liquidation procedure that allows a business to pay off its creditors while avoiding the costs, time, and stigma ...

Assignment for the benefit of creditors (ABC) is a state law winddown procedure that allows for the orderly winddown of a company. The ABC provides for the appointment of an independent fiduciary representative - known as an assignee. The assignee manages the orderly wind down of the business and monetizes the company's assets for the ...

Maintained • USA (National/Federal) A Practice Note providing an overview of assignments for the benefit of creditors. This Note addresses the basic process by which assignments are generally administered and considerations when determining whether an assignment for the benefit of creditors is the appropriate course for liquidating a business.

Assignments for the Benefit of Creditors: Florida Within 30 days after the filing date, examining, or deposing, the assignor under oath, concerning the acts, conduct, assets, liabilities, and financial condition of the assignor. Giving notice to creditors of all matters concerning the administration

1. Upon acceptance of the assignment, the assignee gives notice of the assignment to creditors; 2. Creditors are provided with a reasonable period of time to file proofs of claim with the assignee and therefore to be included in the pool of creditors who can share in the proceeds of the liquidation of the business' assets; 3.

I. DEFINITION AND HISTORY. A general assignment, or as it is frequently termed, a deed of trust for the benefit of creditors, may be defined as "a transfer, without compulsion of law, by a debtor, of his property to an assignee or trustee, in trust to apply the same, or the proceeds thereof, to the payments of his debts, and to return the ...

When we serve as the Assignee in an Assignments for the Benefit of Creditors (ABCs), Force 10 takes on the problems and risks for an insolvent business. We sell the assets and wind down the company's affairs, protecting creditors' interests while keeping them informed. ABCs are based on state law, not the federal bankruptcy code, and vary ...

An Assignment for Benefit of Creditors is an analog to the more widely understood Chapter 7 Bankruptcy liquidation. It is a voluntary transfer of the debtor's property in trust to a third entity for liquidation and satisfaction of the creditors' claims. The trustee will then liquidate all nonexempt property and satisfy the creditors as much ...

As such, the board may decide that a more streamlined, efficient and cost-effective approach for maximizing value is appropriate - an assignment for the benefit of creditors (ABC). An ABC is initiated by the distressed company (the assignor) that enters into an agreement to assign its assets to an unaffiliated, independent entity (the ...

(the "Assignee") in a fiduciary capacity for the benefit of the Assignors creditors. The assignment agreement is a contract under which the Assignor transfers all of its right, title, interest in, and custody and control of its property to the third-party Assignee in trust. The Assignee liqui-dates the property and distributes the proceeds to the

United States. In the United States, a general assignment or an assignment for the benefit of creditors is simply a contract whereby the insolvent entity ("Assignor") transfers legal and equitable title, as well as custody and control of its property, to a third party ("Assignee") in trust, to apply the proceeds of sale to the assignor's ...

Filed under: Assignments for benefit of creditors. A practical summary of the law of assignments in trust for the benefit of creditors : with an appendix of forms (Hilliard, Gray & Co., 1835), by Joseph K. Angell (page images at HathiTrust) Deeds of arrangement (Gee & Co., 1921), by Gerald P. Hargreaves and David Price Davies (page images at ...