What are Financial Statements?

- #1 Financial Statements Example – Cash Flow Statement

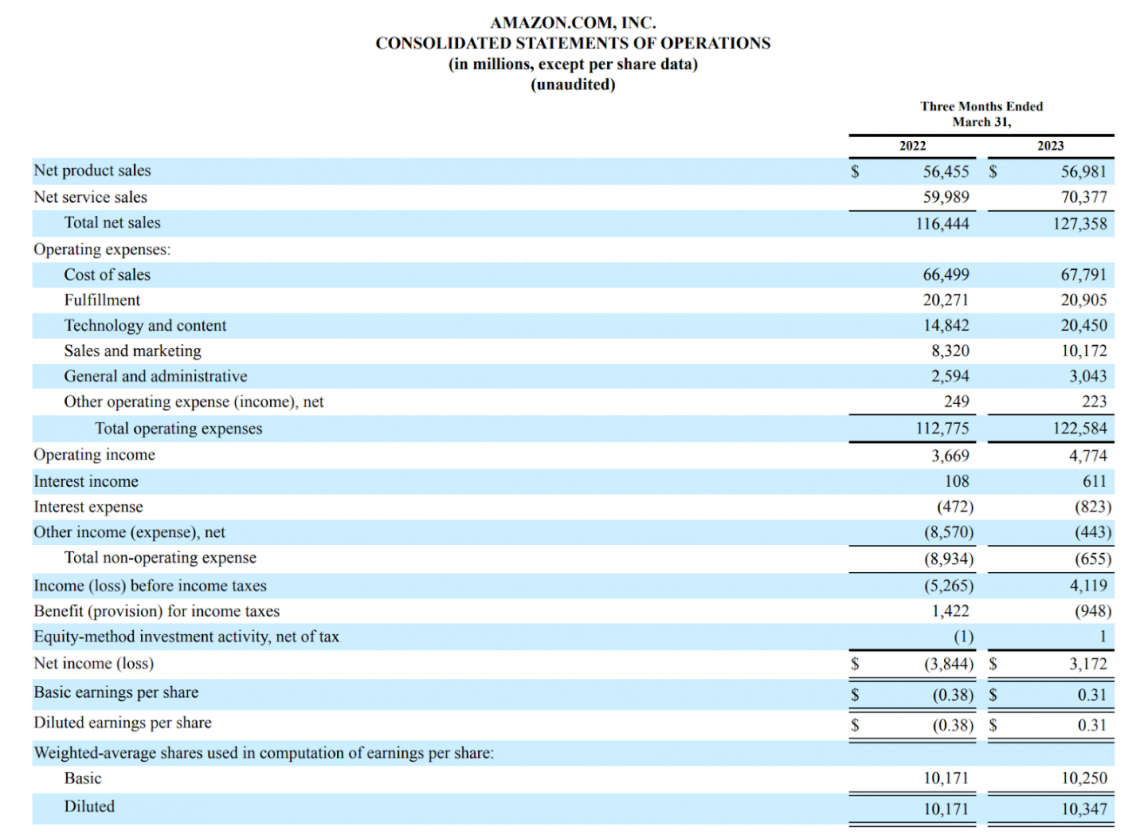

- #2 Financial Statements Example – Income Statement

- #3 Financial Statements Example – Balance Sheet

Additional Resources

Financial statements examples – amazon case study.

An in-depth look at Amazon's financial statements

Financial statements are the records of a company’s financial condition and activities during a period of time. Financial statements show the financial performance and strength of a company . The three core financial statements are the income statement , balance sheet , and cash flow statement . These three statements are linked together to create the three statement financial model . Analyzing financial statements can help an analyst assess the profitability and liquidity of a company. Financial statements are complex. It is best to become familiar with them by looking at financial statements examples.

In this article, we will take a look at some financial statement examples from Amazon.com, Inc. for a more in-depth look at the accounts and line items presented on financial statements.

Learn to analyze financial statements with Corporate Finance Institute’s Reading Financial Statements course!

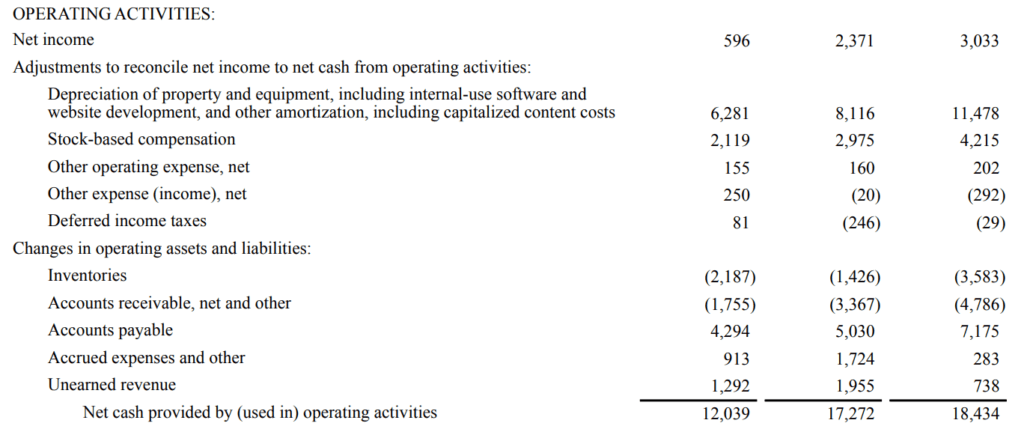

#1 Financial Statements Example – Cash Flow Statement

The first of our financial statements examples is the cash flow statement. The cash flow statement shows the changes in a company’s cash position during a fiscal period. The cash flow statement uses the net income figure from the income statement and adjusts it for non-cash expenses. This is done to find the change in cash from the beginning of the period to the end of the period.

Most companies begin their financial statements with the income statement. However, Amazon (NASDAQ: AMZN) begins its financial statements section in its annual 10-K report with its cash flow statement.

The cash flow statement begins with the net income and adjusts it for non-cash expenses, changes to balance sheet accounts, and other usages and receipts of cash. The adjustments are grouped under operating activities , investing activities , and financing activities .

The following are explanations for the line items listed in Amazon’s cash flow statement. Please note that certain items such as “Other operating expenses, net” are often defined differently by different companies:

Operating Activities:

Depreciation of property and equipment (…) : a non-cash expense representing the deterioration of an asset (e.g. factory equipment).

Stock-based compensation : a non-cash expense as a company awards stock options or other stock-based forms of compensation to employees as part of their compensation and wage agreements.

Other operating expense, net: a non-cash expense primarily relating to the amortization of Amazon’s intangible assets .

Other expense (income), net: a non-cash expense relating to foreign currency and equity warrant valuations.

Deferred income taxes : temporary differences between book tax and actual income tax. The amount of tax the company pays may be different from what it shows on its financial statements.

Changes in operating assets and liabilities : non-cash changes in operating assets or liabilities. For example, an increase in accounts receivable is a sale or a source of income where no actual cash was received, thus resulting in a deduction. Conversely, an increase in accounts payable is a purchase or expense where no actual cash was used, resulting in an addition to net cash.

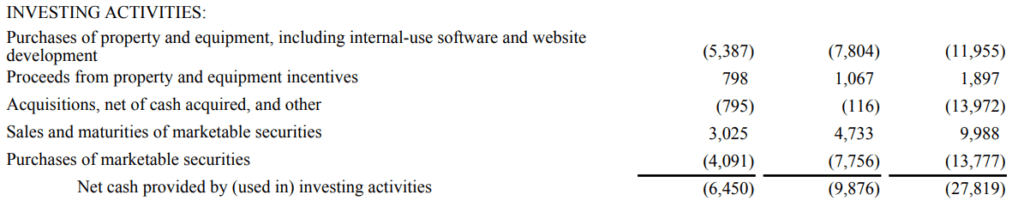

Investing Activities:

Purchases of property and equipment (…): purchases of plants, property, and equipment are usages of cash. A deduction from net cash.

Proceeds from property and equipment incentives: this line is added for additional detail on Amazon’s property and equipment purchases. Incentives received from property and equipment vendors are recorded as a reduction in Amazon’s costs and thus a reduction in cash usage.

Acquisitions , net of cash acquired, and other: cash used towards acquisitions of other companies, net of cash acquired as a result of the acquisition. A deduction from net cash.

Sales and maturities of marketable securities : the sale or proceeds obtained from holding marketable securities (short-term financial instruments that mature within a year) to maturity. An addition to net cash.

Purchases of marketable securities: the purchase of marketable securities. A deduction from net cash.

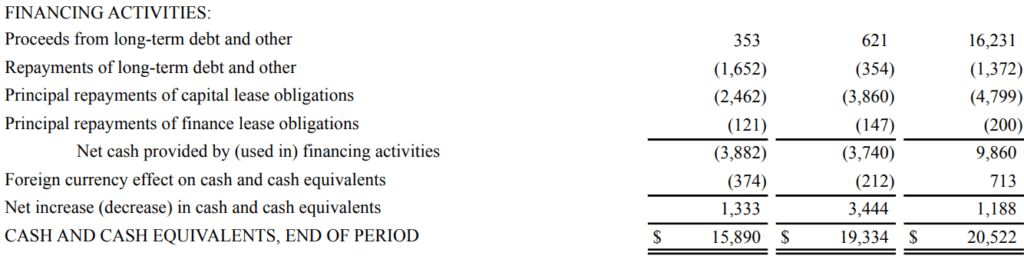

Financing Activities:

Proceeds from long-term debt and other: cash obtained from raising capital by issuing long-term debt. An addition to net cash.

Repayments of long-term debt and other: cash used to repay long-term debt obligations. A deduction from net cash.

Principal repayments of capital lease obligations: cash used to repay the principal amount of capital lease obligations. A deduction from net cash.

Principal repayments of finance lease obligations: cash used to repay the principal amount of finance lease obligations. A deduction from net cash.

Foreign currency effect on cash and cash equivalents : the effect of foreign exchange rates on cash held in foreign currencies.

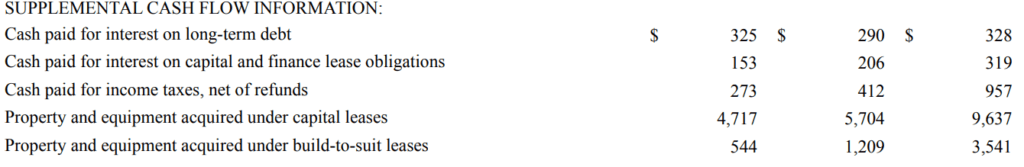

Supplemental Cash Flow Information:

Cash paid for interest on long-term debt: cash usages to pay accumulated interest from long-term debt.

Cash paid for interest on capital and finance lease obligations: cash usages to pay accumulated interest from capital and finance lease obligations.

Cash paid for income taxes , net of refunds: cash usages to pay income taxes.

Property and equipment acquired under capital leases: the value of property and equipment acquired under new capital leases in the fiscal period.

Property and equipment acquired under build-to-suit leases: the value of property and equipment acquired under new build-to-suit leases in the fiscal period.

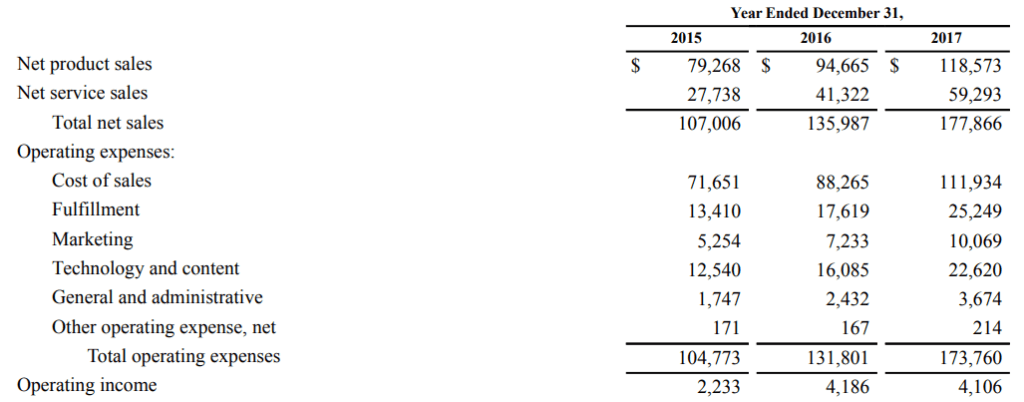

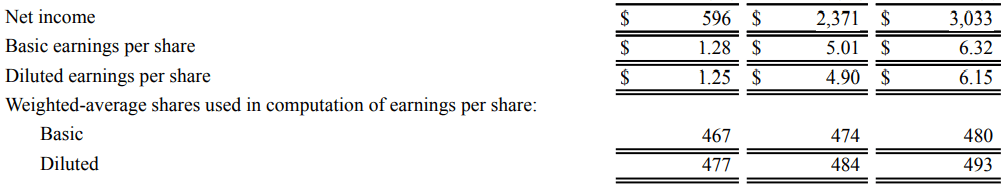

#2 Financial Statements Example – Income Statement

The next statement in our financial statements examples is the income statement. The income statement is the first place for an analyst to look at if they want to assess a company’s profitability .

Want to learn more about financial analysis and assessing a company’s profitability? Financial Modeling & Valuation Analyst (FMVA)® Certification Program will teach you everything you need to know to become a world-class financial analyst!

The income statement provides a look at a company’s financial performance throughout a certain period, usually a fiscal quarter or year. This period is usually denoted at the top of the statement, as can be seen above. The income statement contains information regarding sales , costs of sales , operating expenses, and other expenses.

The following are explanations for the line items listed in Amazon’s income statement:

Operating Income (EBIT):

Net product sales: revenue derived from Amazon’s product sales such as Amazon’s first-party retail sales and proprietary products (e.g., Amazon Echo)

Net services sales: revenue generated from the sale of Amazon’s services. This includes proceeds from Amazon Web Services (AWS) , subscription services, etc.

Cost of sales: costs directly associated with the sale of Amazon products and services. For example, the cost of raw materials used to manufacture Amazon products is a cost of sales.

Fulfillment: expenses relating to Amazon’s fulfillment process. Amazon’s fulfillment process includes storing, picking, packing, shipping, and handling customer service for products.

Marketing : expenses pertaining to advertising and marketing for Amazon and its products and services. Marketing expense is often grouped with selling, general, and administrative expenses (SG&A) but Amazon has chosen to break it out as its own line item.

Technology and content: costs relating to operating Amazon’s AWS segment.

General and administrative : operating expenses that are not directly related to producing Amazon’s products or services. These expenses are sometimes referred to as non-manufacturing costs or overhead costs. These include rent, insurance, managerial salaries, utilities, and other similar expenses.

Other operating expenses, net: expenses primarily relating to the amortization of Amazon’s intangible assets.

Operating income : the income left over after all operating expenses (expenses directly related to the operation of the business) are deducted. Also known as EBIT .

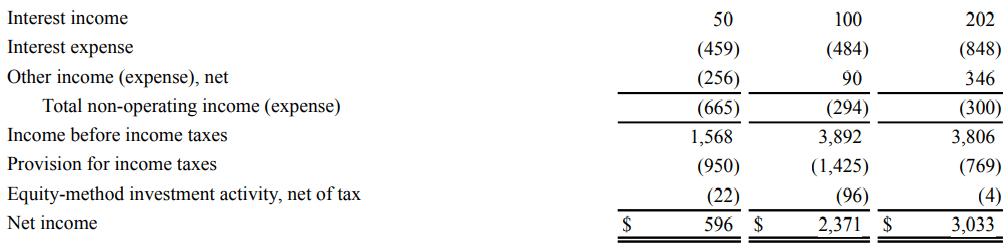

Net Income:

Interest income: income generated by Amazon from investing excess cash. Amazon typically invests excess cash in investment-grade , short to intermediate-term fixed income securities , and AAA-rated money market funds.

Interest expense : expenses relating to accumulated interest from capital and finance lease obligations and long-term debt.

Other income (expense), net: income or expenses relating to foreign currency and equity warrant valuations.

Income before income taxes : Amazon’s income after operating and non-operating expenses have been deducted.

Provision for income taxes: the expense relating to the amount of income tax Amazon must pay within the fiscal year .

Equity-method investment activity, net of tax: proportionate losses or earnings from companies where Amazon owns a minority stake .

Net income: the amount of income left over after Amazon has paid off all its expenses.

Earnings per Share (EPS):

Basic earnings per share : earnings per share calculated using the basic number of shares outstanding.

Diluted earnings per share: earnings per share calculated using the diluted number of shares outstanding.

Weighted-average shares used in the computation of earnings per share: a weighted average number of shares to account for new stock issuances throughout the year. The way the calculation works is by taking the weighted average number of shares outstanding during the fiscal period covered.

For example, a company has 100 shares outstanding at the beginning of the year. At the end of the first quarter, the company issues another 50 shares, bringing the total number of shares outstanding to 150. The calculation for the weighted average number of shares would look like below:

100*0.25 + 150*0.75 = 131.25

Basic: the number of shares outstanding in the market at the date of the financial statement.

Diluted : the number of shares outstanding if all convertible securities (e.g. convertible preferred stock, convertible bonds ) are exercised.

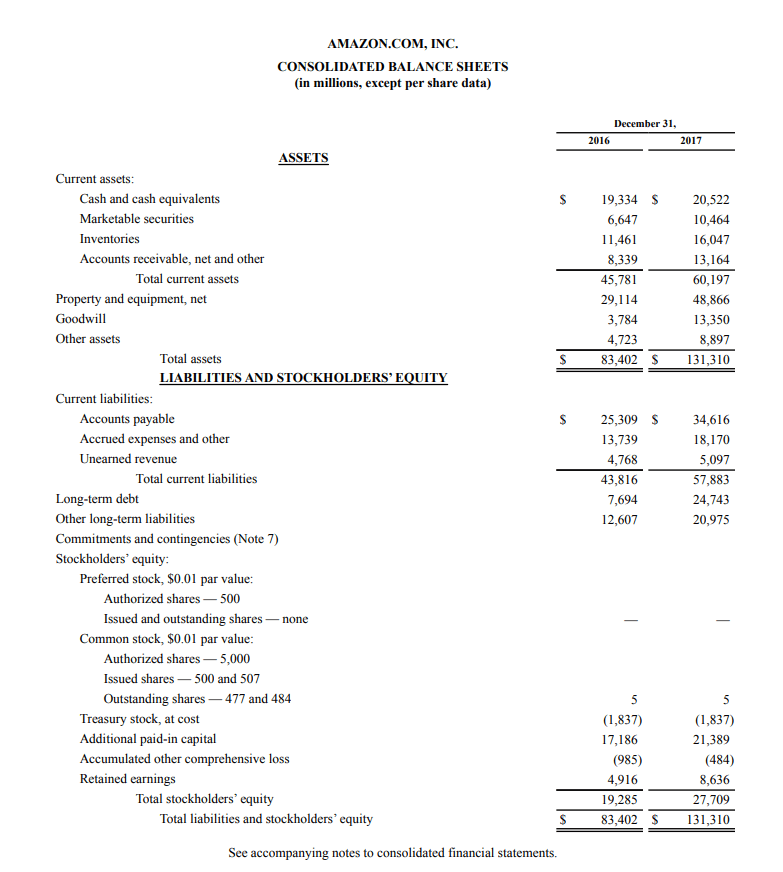

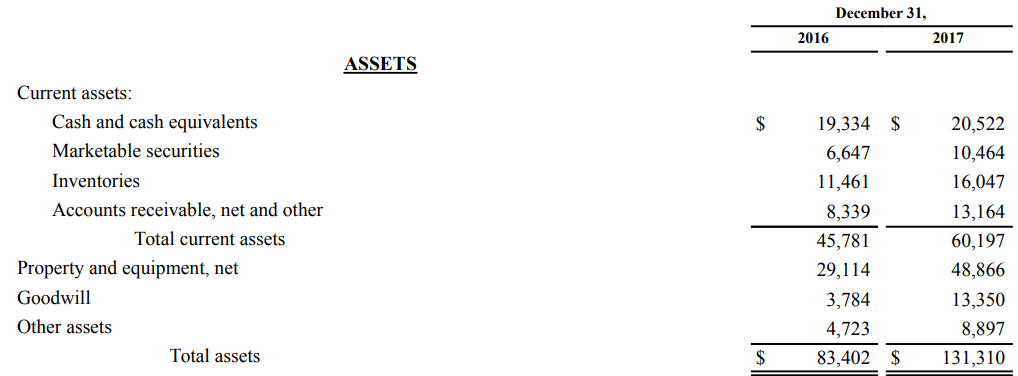

#3 Financial Statements Example – Balance Sheet

The last statement we will look at with our financial statements examples is the balance sheet. The balance sheet shows the company’s assets , liabilities , and stockholders’ equity at a specific point in time.

Learn how a world-class financial analyst uses these three financial statements with CFI’s Financial Modeling & Valuation Analyst (FMVA)® Certification Program !

Unlike the income statement and the cash flow statement, which display financial information for the company during a fiscal period, the balance sheet is a snapshot of the company’s finances at a specific point in time. It can be seen above in the line regarding the date.

Compared to the Cash Flow Statement and Statement of Income, it states ‘December 31, 2017’ as opposed to ‘Year Ended December 31, 2017’. By displaying snapshots from different periods, the balance sheet shows changes in the accounts of a company.

The following are explanations for the line items listed in Amazon’s balance sheet:

Cash and cash equivalents : cash or highly liquid assets and short-term commitments that can be quickly converted into cash.

Marketable securities: short-term financial instruments that mature within a year.

Inventories : goods currently held in stock for sale, in-process goods, and materials to be used in the production of goods or services.

Accounts receivable , net and other: credit sales of a business that have not yet been fully paid by customers.

Goodwill : the difference between the price paid in an acquisition of a company and the fair market value of the target company’s net assets.

Other assets: Amazon’s acquired intangible assets, net of amortization. This includes items such as video, music content, and long-term deferred tax assets.

Liabilities:

Accounts payable : short-term liabilities incurred when Amazon purchases goods from suppliers on credit.

Accrued expenses and other: liabilities primarily related to Amazon’s unredeemed gift cards, leases and asset retirement obligations, current debt, acquired digital media content, etc.

Unearned revenue : revenue generated when payment is received for goods or services that have not yet been delivered or fulfilled. Unearned revenue is a result of revenue recognition principles outlined by U.S. GAAP and IFRS .

Long-term debt: the amount of outstanding debt a company holds that has a maturity of 12 months or longer.

Other long-term liabilities: Amazon’s other long-term liabilities, which include long-term capital and finance lease obligations, construction liabilities, tax contingencies, long-term deferred tax liabilities, etc. (Note 6 of Amazon’s 2017 annual report).

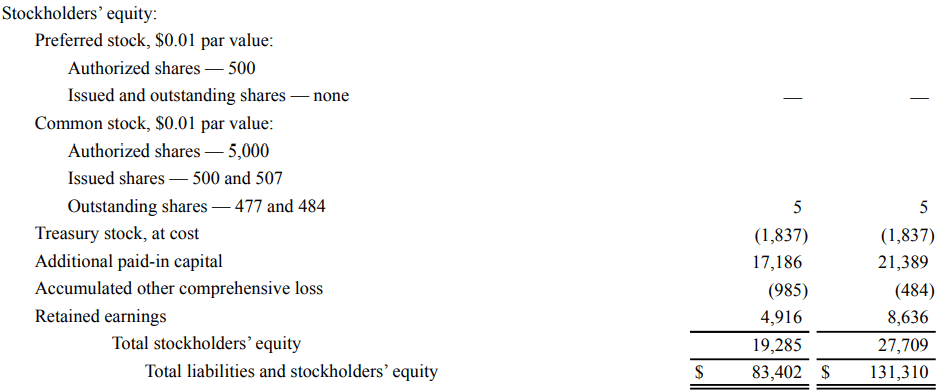

Stockholders’ Equity:

Preferred stock : stock issued by a corporation that represents ownership in the corporation. Preferred stockholders have a priority claim on the company’s assets and earnings over common stockholders. Preferred stockholders are prioritized with regard to dividends but do not have any voting rights in the corporation.

Common stock : stock issued by a corporation that represents ownership in the corporation. Common stockholders can participate in corporate decisions through voting.

Treasury stock , at cost: also known as reacquired stock, treasury stock represents outstanding shares that have been repurchased from the stockholder by the company.

Additional paid-in capital : the value of share capital above its stated par value in the above line item for common stock ($0.01 in the case of Amazon). In Amazon’s case, the value of its issued share capital is $17,186 million more than the par value of its common stock, which is worth $5 million.

Accumulated other comprehensive loss: accounts for foreign currency translation adjustments and unrealized gains and losses on available-for-sale/marketable securities.

Retained earnings : the portion of a company’s profits that is held for reinvestment back into the business, as opposed to being distributed as dividends to stockholders.

As you can see from the above financial statements examples, financial statements are complex and closely linked. There are many accounts in financial statements that can be used to represent amounts regarding different business activities. Many of these accounts are typically labeled “other” type accounts, such as “Other operating expenses, net”. In our financial statements examples, we examined how these accounts functioned for Amazon.

Now that you have become more proficient in reading the financial statements examples, round out your skills with some of our other resources. Corporate Finance Institute has resources that will help you expand your knowledge and advance your career! Check out the links below:

- Financial Modeling & Valuation Analyst (FMVA)® Certification Program

- Financial Analysis Fundamentals

- Three Financial Statements Summary

- Free CFI Accounting eBook

- See all accounting resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

Training for Financial Services

Financial Case Study Analysis

In the fast-paced world of finance, through the labyrinth of data can be akin to finding a needle in a haystack. However, with the right tools and methodologies, you can extract invaluable insights that drive strategic decision-making and foster business growth.

By diving into a financial case study analysis, you'll uncover not just numbers on a page but a narrative that reveals the true heartbeat of a company. Understanding this narrative can be the key to a treasure trove of opportunities and mitigating potential risks.

Key Takeaways

- Evaluate financial health for informed decisions.

- Identify areas for improvement and performance enhancement.

- Compare metrics with industry peers for benchmarking.

- Analyze trends, risks, and make data-driven strategic decisions.

Importance of Financial Analysis

Why is financial analysis essential for making informed business decisions?

Financial analysis plays a critical role in providing a thorough understanding of a company's financial health. Through financial health assessment, businesses can evaluate their current financial standing, identify areas of improvement, and make strategic decisions to enhance overall performance.

By conducting performance benchmarking, companies can compare their financial metrics with industry peers or competitors to gain insights into their relative position and identify areas where they may need to catch up or where they excel.

Profitability analysis is another key aspect of financial analysis that helps businesses assess the efficiency of their operations and identify opportunities to increase profitability. By analyzing various financial ratios and metrics, organizations can pinpoint areas where they can cut costs, optimize resources, or explore new investment opportunities to drive growth and enhance their financial performance.

Identifying Key Financial Indicators

To effectively assess a company's financial health and performance, it's fundamental to identify key financial indicators that provide valuable insights into its operational efficiency and profitability. Key ratios play an essential role in this assessment, offering a snapshot of various aspects of a company's financial status.

Here are four key financial indicators to contemplate when evaluating a company's financial health:

- Profit Margin : This ratio indicates the company's profitability by showing how much profit it generates for each dollar of revenue.

- Return on Investment (ROI) : ROI measures the return on an investment relative to its cost, providing insight into the efficiency of capital deployment.

- Debt-to-Equity Ratio : This ratio reveals the proportion of debt and equity a company is using to finance its assets, indicating its financial leverage.

- Current Ratio : The current ratio assesses the company's ability to cover its short-term liabilities with its short-term assets, reflecting its liquidity position.

Analyzing Financial Trends

When analyzing financial trends, you'll focus on:

- Revenue growth analysis

- Expense trend evaluation

These two vital points provide essential insights into the financial health and performance of a company. By examining these trends, you can identify patterns, make informed decisions, and drive strategic actions.

Revenue Growth Analysis

Analyzing revenue growth trends provides valuable insights into the financial performance and potential future success of a company. When examining revenue growth, consider the following:

- Revenue Forecasting: Utilize historical data and market trends to predict future revenue streams accurately.

- Competitive Analysis: Compare your revenue growth to industry competitors to evaluate your market position.

- Market Segmentation: Identify which market segments are driving revenue growth for targeted strategies.

- Pricing Strategy: Assess the impact of pricing changes on revenue growth and adjust strategies accordingly.

Expense Trend Evaluation

In evaluating financial trends, closely monitor and analyze expense trends to guarantee the company's operational efficiency and cost management practices. By examining expense reduction strategies and utilizing trend forecasting techniques, you can pinpoint areas where costs can be optimized.

Analyzing expense trends over time allows you to pinpoint any spikes or dips, enabling you to take proactive measures to maintain financial stability. Look for patterns in expenses and compare them to revenue trends to safeguard a balanced financial strategy.

Implementing effective cost control measures based on these analyses can lead to improved profitability and sustainability for the organization. Keep a keen eye on expense trends as they can provide valuable information for strategic decision-making and long-term financial health.

Evaluating Potential Risks

To assess the potential risks associated with the financial case study, identify and prioritize key risk factors that may impact the analysis. When evaluating potential risks in the financial case study, consider the following:

- Risk Assessment : Begin by conducting a thorough risk assessment to identify all potential threats to the financial analysis process. This includes market risks, regulatory risks, and operational risks that could impact the outcomes.

- Mitigation Strategies : Once risks are identified, develop effective mitigation strategies to address each risk factor. This may involve diversifying investments, implementing hedging strategies, or establishing contingency plans to minimize potential negative impacts.

- Financial Health Evaluation : Evaluate the overall financial health of the organization under study to understand its resilience to different risk scenarios. This will help in determining the level of risk tolerance and the ability to withstand financial shocks.

- Scenario Planning : Engage in scenario planning to simulate different risk scenarios and assess their potential impact on the financial analysis. By considering various outcomes, you can better prepare for uncertainties and make informed decisions.

Uncovering Insights for Decision Making

Explore the data to unearth key insights important for informed decision-making in the financial case study analysis. By delving into financial metrics and adopting an analytical approach, you can extract valuable decision insights with significant financial implications. Through a meticulous examination of the data points and trends, you can identify patterns, outliers, and correlations that provide a deeper understanding of the financial landscape under scrutiny.

Analyzing financial metrics such as revenue growth, profit margins, return on investment, and cash flow patterns can offer vital insights into the financial health and performance of the entity in question. These insights can guide decision-making processes, helping you make informed choices based on concrete data rather than intuition or speculation.

Strategic Guidance Through Analysis

When analyzing financial case studies, strategic planning tips serve as important pillars for decision-making processes.

By leveraging data-driven insights, you can navigate complexities and uncertainties with more clarity.

Strategic guidance through analysis empowers you to make informed choices that align with your long-term objectives.

Strategic Planning Tips

Utilize a structured approach to strategic planning by integrating key performance indicators with market trends analysis. When making strategic decisions and financial forecasts, consider the following tips:

- Set Clear Goals: Define specific and measurable objectives aligned with the overall business strategy.

- Evaluate Competitor Strategies: Analyze competitors' moves to anticipate market shifts and stay ahead.

- Regularly Review KPIs: Monitor key performance indicators to track progress towards goals and adapt strategies accordingly.

- Stay Agile: Be prepared to adjust plans swiftly in response to changing market conditions or unforeseen challenges.

Data-Driven Decision Making

To better align your strategic planning efforts with data-driven decision making, integrate key performance indicators with thorough market analysis for enhanced strategic guidance. Data analysis plays an important role in informing your decision-making process by providing valuable insights into market trends, customer behavior, and financial performance.

By utilizing data-driven approaches, you can identify opportunities for growth, pinpoint areas for improvement, and make informed decisions that are backed by evidence. Effective decision making hinges on the ability to interpret and leverage data effectively.

Incorporating data analysis into your strategic planning allows you to stay agile, responsive to market changes, and proactive in addressing challenges. Embracing a data-driven mindset empowers you to navigate complexities with confidence and make strategic choices that drive success.

Driving Business Success

Implementing a strategic approach to operations is imperative for driving business success in today's competitive market environment. To achieve this, consider the following key strategies:

- Efficiency Enhancement : Streamlining processes and workflows can lead to performance improvement and cost reduction. Implementing automation and optimizing resource allocation can help maximize output while minimizing expenses.

- Market Analysis : Conduct thorough market research to identify opportunities for growth and profit maximization. Understanding consumer needs and competitor strategies can provide insights for developing effective business plans.

- Customer Relationship Management : Building strong relationships with customers can enhance loyalty and drive repeat business. Implementing customer feedback mechanisms and personalized services can lead to increased customer satisfaction and retention.

- Employee Development : Investing in employee training and development can boost productivity and morale. Engaged and skilled employees are more likely to contribute positively to the company's overall success.

Practical Tips for Evaluation

To evaluate the effectiveness of the key strategies discussed in driving business success, practical tips for evaluation can provide valuable insights into the overall performance and impact of these initiatives.

Evaluation techniques play an important role in understanding the outcomes of implemented strategies. Conducting case studies can aid in appraising real-world applications of these strategies, offering practical insights into their success or areas needing improvement.

Utilizing financial metrics such as return on investment (ROI), profitability ratios, and cash flow analysis can provide a quantitative understanding of the impact on the financial health of the business. Decision support tools can assist in making informed choices based on performance analysis.

Benchmarking strategies against industry standards can offer a comparative perspective to gauge the effectiveness of the implemented strategies. By applying these practical evaluation methods, you can gain a thorough understanding of the success and areas of development within your business strategies.

Conducting Thorough Analysis

Conducting a thorough analysis involves delving deep into the data to extract meaningful insights that can drive informed decision-making and strategic planning within your business. To make sure your analysis is exhaustive and effective, consider the following steps:

- Utilize Industry Benchmarks : Compare your financial data against industry standards to identify areas of strength and weakness. This benchmarking process can provide valuable context for evaluating your company's performance.

- Perform Competitor Analysis : Analyze your competitors' financial statements and key performance metrics to understand how your business stacks up against industry rivals. This insight can help you identify opportunities for improvement and areas where you excel.

- Identify Key Financial Ratios : Calculate and analyze important financial ratios such as profitability ratios, liquidity ratios, and leverage ratios. These ratios can offer valuable insights into your business's financial health and performance.

- Consider Trend Analysis : Examine historical financial data to identify trends and patterns that can help you forecast future performance and make more informed decisions. Trend analysis can provide valuable insights into your business's trajectory and potential areas for growth.

As you navigate the financial landscape, remember that analysis is your compass, guiding you through the complexities of numbers and trends.

Just like a skilled chef tasting a dish to adjust the seasoning, your financial analysis allows you to fine-tune your decisions for success.

Trust in the power of data to steer you towards your goals and guarantee your financial journey is as smooth as a well-balanced recipe.

Similar Posts

Adapting to Regulatory Compliance Technology: Strategies for Financial Institutions

Navigating the complexities of regulatory compliance technology is essential for financial institutions to thrive in a rapidly changing landscape – find out how in this insightful guide.

The Importance of Continuing Financial Education: A Guide for Professionals

Navigate the evolving landscape of finance with insights on the importance of continuous learning for professionals, setting the stage for career growth and success.

Top Finance Certifications Reviewed for 2024

Welcome to our comprehensive guide on the top finance certifications available for 2024. Whether you’re a fresh graduate looking to kickstart your career in finance or a working professional aiming to boost your credentials, obtaining a finance certification can open doors to exciting opportunities and increase your employability in the competitive finance industry. In this…

Econometrics for Quants

Kickstart your journey into the world of quantitative finance with Econometrics for Quants, where data and models intertwine to unlock profitable insights.

Quantitative Finance Proficiency: A Comprehensive Guide

Open the door to mastering quantitative finance skills and unlock the secrets to excelling in a data-driven financial world.

Financial Modelling Challenges

Leverage insights on overcoming complex financial modelling challenges to illuminate your path to success.

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Corporate Finance Resources

- Technical Skills

- Accounting Articles

Financial Statements Examples – Amazon Case Study

Financial Statements are informational records detailing a company’s business activities over a period.

Austin has been working with Ernst & Young for over four years, starting as a senior consultant before being promoted to a manager. At EY, he focuses on strategy, process and operations improvement, and business transformation consulting services focused on health provider, payer, and public health organizations. Austin specializes in the health industry but supports clients across multiple industries.

Austin has a Bachelor of Science in Engineering and a Masters of Business Administration in Strategy, Management and Organization, both from the University of Michigan.

- What Are Financial Statements?

Amazon’s Balance Sheet

Amazon’s income statement, amazon’s cash flow statement, usage of financial statements, amazon case study faqs, what are financial statements.

Investors need financial statements to gain a full understanding of how a company operates in relation to competitors. In the case of Amazon , profitability metrics used to analyze most businesses cannot be used to compare the company to businesses in the same sector.

Amazon remains low in profitability continuously to reinvest in growing operations and new business opportunities. Instead, investors can point to the metrics signified in Amazon’s cash flow statement to demonstrate growth in revenue generation over the long term.

There are three main types of financial statements, all of which provide a current or potential investor with a different viewpoint of a company’s financials. These include the following below.

Balance Sheet

The balance sheet represents a company’s total assets, liabilities, and shareholder ’s equity at a certain time.

Assets are all items owned by a company with tangible or intangible value, while liabilities are all debts a company must repay in the future.

Shareholders' equity is simply calculated by subtracting total assets from total liabilities. This represents the book value of a business.

Income Statement

The income statement represents a company’s total generated income minus expenses over a specified range of time. This can be 3 months in a quarterly report or a year in an annual report .

Revenue includes the total money a company makes over a set time.

This includes operating revenue from business activities and non-operating revenue, such as interest from a company bank account.

Expenses include the total amount of money spent by a company over time. These can be grouped into two separate categories, Primary expenses occur from generating revenue, and secondary expenses appear from debt financing and selling off held assets.

Cash Flow Statement

The cash flow statement represents a company’s total cash inflows and outflows over a specified time range, similar to the income statement. Cash in a business can come from operating, investing, or financing activities.

Operating activities are events in which the business produces or spends money to sell its products or services. This would be income from the sales of goods or services or interest payments and expenses such as wages and rent payments for company facilities.

Investing activities include selling or purchasing assets, which can include investing in business equipment or purchasing short-term securities. Financing activities include the payment of loans and the issuance of dividends or stock repurchases.

Key Takeaways

- Financial statements have information relevant for investors to understand the operations and profitability of a business over a specified time.

- Fundamental analysis typically focuses on the main three financial statements: the balance sheet, income statement, and cash flow statement.

- Although analyzing business financials can provide an unaltered outlook into the operations of a business, the numbers don’t always demonstrate the full story, and investors should always conduct thorough due diligence beyond pure statistics.

- Investors must ensure all of a company's financial statements are analyzed before forming a thesis, as inconsistencies in one sheet may be caused by an unusual one-time expense or dictated by a global measure out of the company’s control (ex., COVID-19).

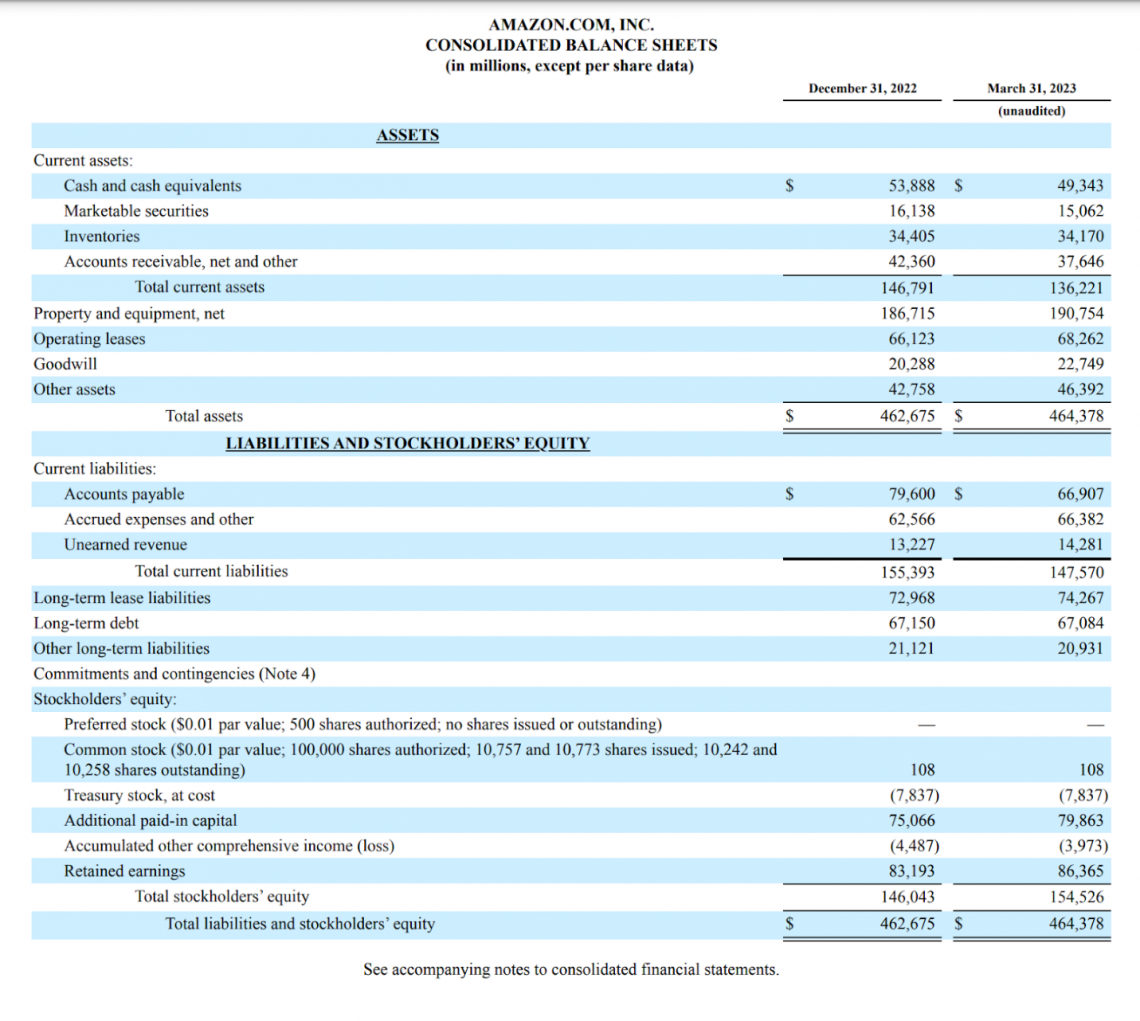

Now that we have a general understanding of the financial statements, we can begin to take a look at Amazon’s most recent quarterly filing.

Company filings can be found by using EDGAR (database of regulatory filings for investors by the SEC) or from Amazon’s investor relations website.

Before we begin analyzing this sheet, it is important to take note of the statement just below the title, indicating that the data is being displayed in millions.

This can throw off newcomers, who may be very confused upon seeing Amazon’s revenue is $53,888. Amazon’s quarterly revenue is indeed $53.8 billion as calculated in millions.

When looking at Amazon’s assets, it is important to note the difference between current and total assets. Current assets are categorized separately due to the expectation that they can be converted to cash within the fiscal year.

Current assets can be used in the current ratio to analyze Amazon’s ability to pay off its short-term obligations. The current ratio formula is:

Current Ratio = Current Assets / Current Liabilities

Amazon’s current ratio sits at 0.92, which is below the e-commerce industry average of 2.09 as of March 2023 (Source: Macrotrends ).

This could mean that Amazon is potentially overvalued compared to competitors, but this is only one metric and should ultimately be all of an investment decision, especially considering the capital-intensive nature of Amazon’s business model.

It is also important to understand all of the vocabulary used to detail items in Amazon’s balance sheet. Some of the major items’ definitions can be found below:

Assets are classified as follows.

- Cash and cash equivalents: Assets of high liquidity, such as certificates of deposit or treasury bonds.

- Marketable securities: Liquid securities can be sold in the public market, such as stock in another company or corporate bonds.

- Accounts receivable (A/R): Money owed to the company that has not been received yet, such as from items previously bought on credit.

- Inventories: Unsold finished or unfinished products from a company that has yet to be sold.

- Property and equipment (PP&E): Assets owned by a company that is used for business activities. It may include factory assets or other types of real estate.

- Operating leases: Assets rented by a business for operational purposes. Calculated as the net present value on the balance sheet.

- Goodwill: Calculates intangible assets that cannot be sold or directly measured, such as customer reputation and loyalty.

Liabilities are of the following types.

- Accounts payable (A/P): Obligations accrued through business activities that must be paid off shortly.

- Accrued expenses: Current liabilities for a business that must be paid in the next 12 months.

- Unearned revenue: This represents revenue earned by a business that has not yet received. Prevents profits from being overstated for a specific period.

- Long-term debt: Debts in which payments are required over 12 months.

- Lease liabilities: Payment obligations of a lease taken out by a company.

- Stockholders’ equity: Net worth of a business/asset value to shareholders.

- Retained earnings: Net profit remaining for a company after all liabilities are paid.

Amazon’s next statement in its quarterly filing is the income statement. The income statement is useful for comparing a company’s growth over time and matching it up against competitors in the same or different sectors.

An essential factor to note when looking at a company’s income statement is whether its revenue and net income are consistently growing year over year. Investors should also be aware of Wall Street expectations, as they can heavily influence the business’s share price.

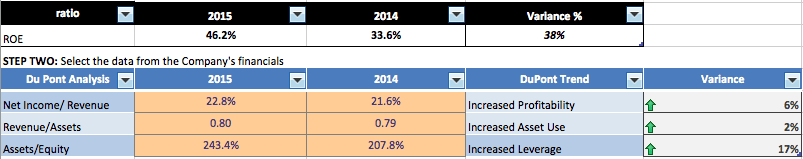

Many important ratios are used when analyzing a company’s income statement. Some of the most notable ones include:

- EV/EBITDA = (Market Capitalization + Debt - Cash) / (Revenue - Cost of Goods Sold - Operating Expenses)

- Gross Margin = (Revenue - Cost of Goods Sold) / Revenue

- Operating Margin = Operating Income / Revenue

- Net Margin = Net Income / Revenue

- Return on Equity (ROE) = Net Income / Average Shareholder Equity (End Value + Beginning Value / 2)

- Earnings Per Share = Net Income / Shares Outstanding

Let’s use these ratios to conduct a comparables analysis between Amazon and eBay, a company at a much lower valuation relative to the e-commerce giant. Here are their ratios side-by-side, as of Amazon’s Q1 2023 and eBay’s Q1 2023 filings:

| Ratio | Amazon | eBay |

|---|---|---|

| 25.3x | 8.4x | |

| Gross Margin | 46.8% | 72.1% |

| Operating Margin | 3.75% | 29.1% |

| Net Margin | 2.49% | 22.6% |

| -1.86% | -24.6% | |

| Earnings Per Share | -$0.27 | $1.05 |

* = EV/EBITDA ratios sourced from finbox.com , March 2023 trailing twelve months (TTM)

Looking at these statistics on paper, it is clear to see that Amazon seems overvalued compared to eBay due to lower margins, negative earnings per share, and an EV/EBITDA multiple over three times as high as the business.

However, pure stats on an income statement cannot fully justify purchasing one company or another. The statement merely shows what a company is doing without a corporate spin.

One thing to note that is unique about Amazon’s business model is how the company invests huge amounts of capital into R&D and technology to expand its operations continuously.

Their numbers don’t account for the massive cash flows and growth opportunities that the business takes advantage of.

When conducting fundamental analysis, an investor must consider all aspects of a business beyond the financial statements, including comparing business models to competitors and setting benchmarks encompassing the overall sector.

Amazon’s cash flow statement is where the company begins to shine compared to its competitors in the online commerce sector. The company has consistently increased cash flow from operating activities and constantly returns value to shareholders in the form of capital appreciation.

It is notable for focusing on what the company is doing inside of its cash flow statements to get a better picture of why its income or stock price is trending a certain way.

For example, an explosive drop in net income in an otherwise stable company could be due to mismanagement or hampered growth but is most likely due to M&A activity charged in a quarter that may be skewing the numbers. The cash flow statement clears this up.

Compared to 2022, Amazon has increased its annual cash from operating activities by over 38% from the previous year based on a 12-month rolling basis.

This increase has also resulted in an 11.7% increase in investment expenditures, which should allow Amazon to continue growing faster than similar companies.

In comparison, according to eBay’s most recent 10-K filing , the company generated an 82% growth in operating cash flow (OCF), however, this stat can be very misleading due to the company’s lack of investment in processes such as R&D and SG&A.

In 2022, the company reported $92M in investing activities, representing only 26% of operating cash flows. Amazon reported over $37.6B in investing activities representing approximately 88% of its OCF.

The income statement can misrepresent how well a company is doing, as while eBay has a higher net income, Amazon strategically reinvests its cash flows into R&D and other expenses to produce more over time continuously.

What makes the cash flow statement so essential to fundamental analysis is the fact that it is tough to manipulate its numbers through financial engineering or clever accounting.

The statement purely shows precisely where all of the money a company makes is being used. Many investors use the cash flow statement to tell the true financial health of a business, as profits can often not be indicative of a growth company's value.

The stock price of a company can easily be swayed by sentiment or the market cycle , and the income statement can be skewed through large one-time transactions or large amounts of financed revenue. The amount of money in the possession of a company is very hard to adjust.

Amazon currently has much better growth prospects than eBay and thus sells at a higher premium in the open market , but you wouldn’t understand why unless you took in the full picture of the company.

Everything You Need To Master Valuation Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Financial statements are excellent tools to learn more about a business in terms of an overall market or sector of operation. Using financial statements to determine the current value of a business is essential for understanding a company’s stock price.

Along with the ratios mentioned, analysts often form their methodologies over time to focus on companies that are strong in specific financial circumstances.

Tools such as stock screeners can sort millions of companies by certain factors. For instance, some investors may seek defensive companies with consistent dividend growth over long periods, while others may seek growth companies with the most innovative new technology.

Investors should keep all of this information in mind, as well as pay attention to the reports of analysts with varied performance outlooks. It is essential to seek out the opinions of multiple sources before establishing an opinion on a business.

Looking at reports from analysts specializing in the industry can also ensure that your expectations are reasonable compared to industry experts.

If your thesis results in Amazon growing its revenues by 20% a year while analysts across the country are only expecting growth in the range of 5-7%, it could be a sign that you may have overlooked a key factor in your due diligence .

The overall goal of using financial statements is to fully understand the company you are investing in to justify a position. Although your views may slightly differ from experts, quality due diligence can result in somewhat varied outcomes based on an investor’s outlook for the future.

Using EBITDA instead of net income strips away the capital structure and taxation of a business to analyze the pure earnings potential of a business. This is more practical for investors to see the general trajectory of a company’s income over time.

For example, companies may decide on completing a merger or acquiring another company. This will require a company to report its current and acquired assets on its balance sheet .

Over time, these assets must be recorded as expenses through the use of depreciation, which is the process of deducting from gross revenue to account for the decreasing value of company plant assets.

If these assets increase in value over time, this could decrease revenues over time not due to company performance but because of increased prices for equipment outside of the company’s control.

Without looking at EBITDA, company financials may paint a completely different picture with the use of net income that may or may not be justified at all.

ROE is an important metric to distinguish how good a company is at generating profits with investor capital compared to its share price and competitors. It is yet another indicator used to analyze the trajectory of a business over time.

Using ROE can also demonstrate how much financing a company requires to generate its revenue and if investors are really getting a great return for the amount of money shareholders contribute.

A startup that has recently gone public on the stock exchange may have a very low to negative ROE compared to an established company. Still, the startup may have the margins and growth to justify its valuation .

Much like every financial ratio, ROE doesn’t demonstrate the entire story of a business, and the full picture of a business must be considered to decide on an equity investment.

To proliferate and take market share from competitors, Amazon undercuts prices on many products to decrease competition and remain the top player in the industry.

Amazon, like many other companies recently since the pandemic, has also faced significant increases in operating expenses , thus lowering operating and net margins in the short term. Once Amazon begins to slow expansion, these margins are expected to rise.

Amazon’s net income is very low for many of the same reasons. The company is profitable yet is constantly reinvesting into new businesses and products to further grow cash flows for future expenditures.

Amazon investors are not focused on income but rather on its ability to continuously grow in the long term. Growth companies like Amazon do not issue dividends because they believe that the money is better reinvested in business operations.

Everything You Need To Master Financial Statement Modeling

To Help you Thrive in the Most Prestigious Jobs on Wall Street.

Researched and Authored by Tanner Hertz | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

- Accounting Conservatism

- Accounting Equation

- Accounting Ratios

- Three Financial Statements in FP&A

- Working Capital Cycle

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

Newly Launched - AI Presentation Maker

Researched by Consultants from Top-Tier Management Companies

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Must-Have Financial Case Study Examples with Samples and Templates

Mayuri Gangwal

Case studies are valuable tools for understanding the real-world applications of financial concepts and strategies. They provide insights into practical scenarios, showcasing the decision-making processes and outcomes in various financial situations. Whether you are a student, professional, entrepreneur, having access to well-crafted financial case study templates can be immensely beneficial in developing a deeper understanding of financial principles and honing your analytical skills.

SlideTeam’s premium PPT templates help you grasp complex financial concepts like investment analysis, financial planning, risk management, etc. Each case study offers a unique scenario, presenting a problem or challenge that requires thoughtful analysis and strategic decision-making.

By using these content-ready slides, you can enhance your problem-solving abilities, learn from real-world success stories and mistakes, and gain valuable insights into the intricacies of financial decision-making. The included samples and templates are practical tools for structuring your case studies, enabling you to apply your knowledge and skills to different financial scenarios.

Whether preparing for exams, a professional seeking to broaden your financial expertise, or an entrepreneur looking to make informed business decisions, these financial case study examples, samples, and templates are indispensable resources to elevate your financial understanding and make well-informed decisions in your personal or professional life.

Financial Case Study Templates

Template 1: financial case study environment business solution problems.

Introducing our ready to use template designed to elevate your content and make you look like a presentation pro. With a wide range of PPT slides covering various topics, this deck encompasses all the core areas of your business needs.

The deck focuses on Financial Case Study Environment Business Solution Problems, offering professionally designed templates that combine suitable graphics and relevant content. With eight slides, thoughtfully crafted to enhance your message and captivate your audience.

Don't miss out on this opportunity to impress your audience with visually stunning slides and compelling content. Click the download button and access our pre-designed PPT presentation and take your presentations to the next level. We also have templates to propose a business case if you aim for a higher company turnover.

Download Now

Template 2: Case Study for Financial Management PowerPoint Template

Introducing our captivating case study template designed to provide an environment conducive to productive discussions and effective decision-making. This template is perfect for showcasing real-life examples and analyzing financial management scenarios visually engagingly.

With its three-stage process, this template simplifies complex concepts and guides your audience through the essential components of a comprehensive business case study. It enables you to present your findings, solutions, and recommendations.

Whether you are analyzing past financial performances, identifying challenges , or proposing solutions, this template provides a flexible framework for organizing and presenting your ideas. You can also elevate your financial management presentations with our marketing Case Study for Financial Management PowerPoint Template . Download it now and unlock a wealth of possibilities to engage your audience, foster integration, and showcase your expertise in financial management.

Download Now

Conclusion

Financial case studies are invaluable tools for understanding real-world financial scenarios and developing practical solutions. By examining concrete examples, individuals and organizations can gain insights into financial challenges, apply analytical techniques, and make informed decisions.

This article has highlighted the importance of collecting financial case study examples and accompanying samples and templates as valuable resources for learning and applying financial principles in various contexts. These resources can serve as guides for conducting comprehensive analyses, formulating recommendations, and ultimately achieving financial success.

FAQs on Financial Case Study

What is a case study in finance.

A case study in finance is an in-depth analysis of a specific financial situation, company, investment, or financial strategy. It involves examining real-world scenarios, often based on actual events, to understand and evaluate the financial implications, decision-making processes, and outcomes.

In finance, case studies are commonly used as a teaching and learning tool to assess and explore complex financial issues in academic and professional settings. They provide a practical approach to understanding financial theories, concepts, and practices by applying them to real-life situations.

A finance case study typically involves the following elements:

- Background: The case study begins by presenting relevant information about the company, industry, or financial situation under examination. This includes details about the organization's financial statements, market conditions, competitive landscape, and other pertinent background information.

- Problem or Challenge: The case study outlines the specific financial problem or challenge that needs to be addressed. This could be related to financial analysis, investment decisions, capital budgeting, risk management, financial restructuring, or any other financial aspect of the organization.

- Data Analysis: The case study analyzes financial data, such as income statements, balance sheets, cash flow statements, and key financial ratios. Various financial analysis tools and techniques, such as ratio analysis, discounted cash flow analysis, or valuation models, may be used to evaluate the situation.

- Alternatives and Solutions: Based on the analysis, different alternatives or solutions are identified to address the financial problem or challenge. These could include recommendations for financial strategies, investment decisions, capital allocation, cost reduction measures, or other relevant actions.

- Decision-Making and Implementation: The case study explores the decision-making process, considering risk, return, financial feasibility, and strategic considerations. It also discusses the potential implementation of the recommended solution and the expected outcomes.

- Lessons Learned: The case study concludes by discussing the lessons learned from the financial situation or decision-making process. This may involve reflections on successful strategies, potential pitfalls, and broader implications for financial management and decision-making in similar contexts.

How do you write a financial case study?

Writing a financial case study involves analyzing a real or hypothetical financial situation or problem and presenting a detailed examination of the facts, analysis, and potential solutions. Here is a step-by-step guide on how to write a financial case study:

- Identify the purpose and scope: Clearly define the purpose of the case study and the specific financial issue you want to address. Determine the scope of the study, including the period, entities involved, and relevant financial data.

- Gather information: Collect all relevant financial data and supporting documents related to the case. This may include financial statements, transaction records, market data, industry reports, and any other information necessary for the analysis.

- Describe the background: Provide an overview of the company or individual involved in the case study. Include relevant details such as the company's history, industry , size, key stakeholders, and any recent events or developments that may have a financial impact.

- State the problem or objective: Clearly define the financial problem or objective that needs to be addressed. Identify the key challenges or issues the company or individual faces and explain why they are essential.

- Conduct financial analysis: Analyze the financial data and apply appropriate financial analysis techniques to evaluate the situation. This may involve calculating financial ratios, conducting trend analysis, performing a discounted cash flow analysis, or any other relevant method to gain insights into the financial performance and position of the entity.

- Present findings: Summarize the results of the financial analysis clearly and concisely. Highlight key findings, trends, and any significant financial situation factors. Use graphs, charts, or tables to present data effectively.

- Discuss alternative solutions: Propose different options or strategies to address the financial problem or achieve the objective. Determine the advantages and drawbacks of each solution and provide supporting evidence or calculations to justify your recommendations.

- Make recommendations: Make clear and actionable recommendations based on analyzing and evaluating the alternative solutions. Support your recommendations with logical reasoning and explain how they can improve the financial situation or achieve the desired outcome.

- Provide a conclusion: Summarize the main points of the case study and restate the recommendations. Highlight any potential risks or challenges associated with implementing the proposed solutions.

- Include references and citations: If you have used external sources or references, provide proper citations to give credit to the authors and avoid duplicity or redundancy.

- Edit and proofread: Review the case study for clarity, coherence, and accuracy. Check for any grammatical or spelling errors. Ensure that the document is well-structured and easy to understand.

What is finance study?

Finance study refers to the field of knowledge and an academic discipline that focuses on managing, creating, and allocating financial resources. It involves studying various aspects of financial systems, instruments, markets, and institutions. Finance encompasses the theory and practice of managing money, investments, and financial decision-making.

The study of finance covers a wide range of topics, including:

- Corporate Finance: This area focuses on financial decisions and strategies within corporations. It includes capital budgeting, investment analysis, financial planning, risk management, and corporate valuation.

- Investments: This field examines allocating money to different financial assets including, stocks, mutual funds, real estate, and other derivatives. It involves analyzing risk and return, portfolio management, asset pricing models, and investment strategies.

- Financial Institutions and Markets: This area explores the functioning of financial institutions (such as banks, insurance companies, and investment firms) and financial markets (such as stock markets, bond markets, and foreign exchange markets). It involves studying the role of these institutions and markets in facilitating the flow of funds, managing risks, and pricing financial assets.

- International Finance: This branch focuses on financial transactions and relationships between countries and across borders. It covers foreign exchange rates, international investment, multinational corporations, and global financial markets.

- Personal Finance: This area focuses on individual or household financial management. It involves budgeting, saving, investing, retirement planning, taxation, and managing personal debt.

Related posts:

- How Financial Management Templates Can Make a Money Master Out of You

- Top 5 Capital Budgeting Templates with Samples and Examples

- The Ultimate Spokes Diagram Templates to Enhance Business Presentation

- Top 5 One-page Quarterly Report Templates with Examples and Samples

Liked this blog? Please recommend us

Top 5 Daily Appointment Templates with Samples and Examples

Top 5 Portfolio Project Status Report Templates with Examples and Samples

2 thoughts on “must-have financial case study examples with samples and templates”.

This form is protected by reCAPTCHA - the Google Privacy Policy and Terms of Service apply.

--> Digital revolution powerpoint presentation slides

--> Sales funnel results presentation layouts

--> 3d men joinning circular jigsaw puzzles ppt graphics icons

--> Business Strategic Planning Template For Organizations Powerpoint Presentation Slides

--> Future plan powerpoint template slide

--> Project Management Team Powerpoint Presentation Slides

--> Brand marketing powerpoint presentation slides

--> Launching a new service powerpoint presentation with slides go to market

--> Agenda powerpoint slide show

--> Four key metrics donut chart with percentage

--> Engineering and technology ppt inspiration example introduction continuous process improvement

--> Meet our team representing in circular format

- Digital Marketing

- Facebook Marketing

- Instagram Marketing

- Ecommerce Marketing

- Content Marketing

- Data Science Certification

- Machine Learning

- Artificial Intelligence

- Data Analytics

- Graphic Design

- Adobe Illustrator

- Web Designing

- UX UI Design

- Interior Design

- Front End Development

- Back End Development Courses

- Business Analytics

- Entrepreneurship

- Supply Chain

- Financial Modeling

- Corporate Finance

- Project Finance

- Harvard University

- Stanford University

- Yale University

- Princeton University

- Duke University

- UC Berkeley

- Harvard University Executive Programs

- MIT Executive Programs

- Stanford University Executive Programs

- Oxford University Executive Programs

- Cambridge University Executive Programs

- Yale University Executive Programs

- Kellog Executive Programs

- CMU Executive Programs

- 45000+ Free Courses

- Free Certification Courses

- Free DigitalDefynd Certificate

- Free Harvard University Courses

- Free MIT Courses

- Free Excel Courses

- Free Google Courses

- Free Finance Courses

- Free Coding Courses

- Free Digital Marketing Courses

10 Financial Analytics Case Studies [2024]

Financial analytics merges the precision of data science with the strategic depth of financial theory, creating an indispensable toolkit for navigating the complexities of the modern business landscape. This field utilizes sophisticated data analysis techniques alongside financial insights to bolster strategic decision-making, enhance financial performance, and influence policy formulation. Its broad applicability spans a multitude of activities, including advanced risk management practices, nuanced investment analysis, and the optimization of financial strategies, playing a pivotal role in guiding companies through the intricacies of the financial markets.

The discussion presents ten illustrative case studies that spotlight the significant impact of financial analytics across various industries. These examples reveal how entities ranging from burgeoning startups to established corporate giants have leveraged analytical methodologies to address pressing challenges, capitalize on emerging opportunities, and propel their strategic goals. Through this exploration, we aim to shed light on the practical deployment of financial analytics, underscoring its potential to not only resolve complex dilemmas but also to drive innovation, streamline operations, and foster sustainable growth. Through the lens of these narratives, financial analytics is revealed as a cornerstone of competitive advantage and organizational resilience, demonstrating its critical role in enabling businesses to maneuver adeptly through the evolving financial terrain.

10 Financial Analytics Case Studies

1. risk management in banking sector: jpmorgan chase & co..

JPMorgan Chase & Co. has harnessed the power of big data analytics and machine learning to revolutionize its approach to risk management. The bank’s use of advanced algorithms enables the analysis of vast datasets, identifying subtle patterns of fraudulent activities and potential credit risk that would be impossible for human analysts to detect. This capability is powered by AI technologies that learn from data over time, improving their predictive accuracy with each transaction analyzed.

Furthermore, JPMorgan employs predictive analytics to forecast future financial risks, allowing for preemptive measures to be taken. The bank has also developed sophisticated simulation models that can assess the potential impact of various market scenarios on its portfolio, enhancing its stress testing processes. These technological advancements have not only bolstered the bank’s resilience against financial uncertainties but have also led to a more dynamic and responsive risk management strategy. The adoption of these technologies has yielded significant benefits, including reduced operational costs, minimized losses from fraud, and an overall improvement in financial health and stability.

Related: How Can AI Be Used in Financial Analytics?

2. Portfolio Optimization for an Investment Firm: BlackRock

BlackRock’s proprietary platform, Aladdin, stands as a testament to the integration of cutting-edge technology in financial analytics for portfolio management. Aladdin’s comprehensive suite combines risk analytics, portfolio management, and trading tools into a single platform. This integration allows for real-time analysis and optimization of investment portfolios. The platform employs quantitative models that leverage historical and current market data to simulate various investment strategies, assessing their potential risks and returns.

Moreover, Aladdin utilizes machine learning to refine its predictive capabilities, enabling more accurate forecasting of market movements and asset performance. This allows BlackRock to tailor investment portfolios that are closely aligned with the client’s risk tolerance and financial goals, achieving optimal risk-adjusted returns. The use of such sophisticated analytics tools has empowered BlackRock to navigate complex markets more effectively, ensuring strategic asset allocation and informed decision-making. Clients benefit from enhanced portfolio performance, greater transparency in investment processes, and improved risk management.

3. Revenue Forecasting for a Retail Chain: Walmart

Walmart’s approach to revenue forecasting exemplifies the strategic use of data analytics and machine learning in retail. By analyzing a diverse array of data sources, including sales records, customer demographics, and buying patterns, Walmart applies sophisticated forecasting models that incorporate seasonal trends, promotional impacts, and economic indicators. This analytical rigor enables Walmart to make accurate predictions about future sales trends, which is essential for inventory management and marketing strategy formulation.

The retail giant’s investment in machine learning technologies further refines its forecasting models, allowing for adjustments in real time based on emerging data. This dynamic approach to forecasting supports Walmart in maintaining optimal inventory levels, reducing stockouts or overstock situations, and maximizing sales opportunities. Additionally, Walmart leverages these insights to tailor marketing efforts, enhancing customer engagement and satisfaction. The integration of these advanced technologies into Walmart’s operational framework has led to significant improvements in efficiency, cost savings, and overall financial performance, setting a benchmark for the retail industry.

Related: How Can CFO Use Financial Analytics?

4. Financial Analytics in Healthcare Cost Reduction: Kaiser Permanente

Kaiser Permanente utilizes a comprehensive approach to financial analytics, integrating predictive analytics, data visualization, and advanced statistical models to scrutinize patient care data, treatment outcomes, and operational costs comprehensively. This multifaceted analysis allows Kaiser to identify inefficiencies and areas where improvements can be made without compromising the quality of patient care. For instance, by employing predictive analytics, Kaiser can forecast patient admissions and manage staffing levels more efficiently, reducing unnecessary labor costs.

Data visualization tools are beneficial for conveying intricate data insights throughout an organization, enabling informed decision-making based on data. These technologies have enabled Kaiser Permanente to implement strategic cost-saving measures, such as optimizing supply chain logistics for medical supplies and reducing readmission rates through better patient care programs. The result is a dual achievement: maintaining high standards of patient care while significantly reducing operational costs, demonstrating the power of financial analytics in balancing cost efficiency with quality healthcare delivery.

5. Enhancing Customer Loyalty through Analytics: American Express

American Express’s strategy for enhancing customer loyalty involves a sophisticated analytics infrastructure that leverages big data, machine learning, and predictive analytics. The company analyzes vast datasets encompassing spending patterns, customer feedback, and engagement levels to gain deep insights into customer behavior and preferences. Machine learning models are then employed to personalize offerings and rewards, tailoring services to individual customer needs and expectations.

This personalized approach is made possible by American Express’s investment in AI and natural language processing (NLP) technologies, which enable the company to analyze unstructured data sources, such as customer feedback on social media and review platforms. The insights derived from these analyses inform targeted marketing campaigns and loyalty programs, fostering a sense of value and recognition among customers. This strategy has proven effective in strengthening customer relationships, enhancing satisfaction, and, ultimately, driving loyalty and retention in the competitive financial services market.

Related: Will AI Replace Financial Analysts?

6. Predictive Analytics in Credit Scoring: Kabbage

Kabbage’s innovative approach to credit scoring exemplifies the transformative potential of financial analytics in fintech. By leveraging machine learning algorithms and big data analytics, Kabbage analyzes a wide array of non-traditional data sources, including online sales, banking transactions, and social media activity, to assess the creditworthiness of small businesses. This data-driven approach allows Kabbage to generate more accurate and nuanced credit profiles, especially for businesses with limited credit histories or those traditionally underserved by conventional banks.

The technology stack employed by Kabbage includes advanced machine learning models that continuously learn and adapt based on new data, improving the accuracy of credit assessments over time. Furthermore, Kabbage utilizes natural language processing to analyze textual data from social media and other digital platforms, gaining insights into the business’s customer engagement and market presence. This comprehensive and inclusive approach to credit scoring has not only enabled Kabbage to expand access to credit for small businesses but has also streamlined the application and approval process, making it faster and more user-friendly.

7. Operational Efficiency through Process Analytics: Toyota

Toyota’s implementation of the Toyota Production System (TPS) is a benchmark in manufacturing excellence, deeply integrated with real-time data analysis and financial metrics to enhance operational efficiency. The TPS, known for its principles of Just-In-Time (JIT) production and continuous improvement (Kaizen), is further empowered by financial analytics to reduce waste and optimize production flow. Toyota employs advanced data analytics tools to monitor every aspect of the production process, from inventory levels to equipment efficiency, allowing for immediate adjustments that reduce downtime and material waste.

The integration of Internet of Things (IoT) technology into Toyota’s manufacturing processes allows for the collection of real-time data from machinery and equipment, enabling predictive maintenance and reducing unplanned outages. By correlating this operational data with financial performance, Toyota can directly measure the impact of process improvements on cost savings and productivity, ensuring that its manufacturing operations are not only efficient but also cost-effective. This holistic approach to operational excellence through data analytics has kept Toyota at the forefront of the automotive industry.

Related: Role of Data Analytics in FinTech?

8. Real Estate Investment Analysis: Zillow

Zillow leverages a sophisticated combination of financial analytics, machine learning, and big data to revolutionize real estate investment analysis. The platform’s Zestimate feature employs statistical and machine learning models to analyze millions of property listings, sales data, and regional market trends, providing an accurate estimate of a home’s market value. This technology enables investors and homebuyers to identify potential investment opportunities and assess property values with a high degree of accuracy.

Beyond Zestimate, Zillow uses geospatial analysis and predictive modeling to understand local real estate trends, demographic shifts, and economic indicators that could affect property values. This comprehensive analytical approach allows Zillow to offer a suite of tools and insights that empower users to make informed decisions in the real estate market. For investors, this means the ability to quickly identify undervalued properties, predict future market movements, and optimize investment portfolios according to changing market conditions.

9. Strategic Planning for a Tech Giant: Google

Google’s strategic planning and decision-making processes are deeply rooted in financial analytics, leveraging the company’s vast data resources and AI capabilities. Google uses predictive modeling and scenario analysis to forecast market trends, consumer behavior, and technological advancements. This enables the tech giant to identify emerging business opportunities, assess the viability of new products, and allocate resources effectively.

Google’s investment in cloud computing and AI technologies, such as TensorFlow for machine learning and BigQuery for data analytics, exemplifies its commitment to harnessing data for strategic advantage. These tools allow Google to process and analyze large datasets quickly, deriving insights that inform its innovation strategies and support data-driven decisions. By continuously analyzing financial metrics in conjunction with market data, Google can navigate market uncertainties, capitalize on new opportunities, and sustain its leadership in the tech industry.

Related: How to Become a Financial Analyst?

10. Enhancing Supply Chain Resilience: Procter & Gamble (P&G)

P&G’s approach to enhancing supply chain resilience is a prime example of financial analytics applied to operational challenges. The company utilizes digital twin technology, which creates a virtual model of the supply chain, enabling P&G to simulate various scenarios and predict the impact of disruptions. This predictive capability, combined with real-time analytics, allows P&G to anticipate supply chain vulnerabilities, optimize inventory management, and maintain product availability even in the face of unforeseen challenges.