- assignments benefits creditors abcs basics california

Assignments for the Benefits of Creditors - "ABC's" - The Basics in California

An assignment for the benefit of creditors (“ABC”) is a contract by which an economically troubled entity ("Assignor") transfers legal and equitable title, as well as custody and control, of its assets and property to an independent third party ("Assignee") in trust, who is required to apply the proceeds of sale of the property to the assignor's creditors in accord with priorities established by law.

ABCs are a well-established common law tool and alternative to formal bankruptcy proceedings. The method only makes sense if there are significant assets to liquidate. ABCs are most successful when the Assignor, Assignee and creditors cooperate but can be imposed even if the creditors are not supportive.

Assignors - Rights and Duties

Generally, any debtor – an individual, partnership, corporation or LLC - may make an assignment for the benefit of creditors. Individuals seldom utilize ABCs, though, because there is no discharge of all debts as there would normally occur in a completed bankruptcy filing. Thus, the protection and benefit of the process is quite limited for any personal obligor.

ABCs can benefit individual principals who have personally guaranteed company obligations or have personal liability on tax claims. Once the Assignment Agreement has been executed, a trust is automatically put in place over the assets transferred. The Assignor can neither rescind the contract nor control the proceedings, but the Assignor may be consulted as necessary and appropriate by the Assignee during the liquidation process.

Assets to be Assigned

Assignor may assign any non-exempt real, personal, and/or general intangible property that can be sold or conveyed. Note that such assets as intellectual property, trade names, logos, etc. may be so transferred and sold. When a corporation makes an assignment, all corporate property, tangible and intangible is transferred including accounts, and rights and credits of all kinds, both in law and equity. The assets only can be sold, not the corporation or its stock. Thus the corporation remains existing, albeit without any significant assets left. It becomes, effectively, a shell.

Assets are typically sold without representations or warranties. The sale is free and clear of known liens, claims and encumbrances - with the consent or full payoff of lien holders. Generally, Assignee warrants only that Assignee has title to the assets.

Assignees - Rights and Duties

The Assignee is generally an unrelated professional liquidator selected by the Assignor. The Assignee gathers the Assignor’s assets and sells the Assignor’s right, title and interest in those assets, then distributes the proceeds to Creditors in accordance with statutory priorities.

The Assignee has a fiduciary duty to the Creditors. Assignee’s duties include protecting the assets of the estate, administering them fairly and representing the estate. Assignee is free to enter into contracts to recover assets or liquidated claims, e.g. filing suit or taking other action.

The Assignee may be removed by a court for violations of the Assignment contract or nonfeasance (failure to act appropriately). The Assignee may not give up his/her/its duties without liability or a superior court order until creditors receive distribution of the proceeds of sale of the assets transferred.

Assignee usually prepares the Assignment documents, though the attorney for the Assignor may draft them as well. Often the terms are negotiated at length.

Preferential Claims and Avoidance

Assignee has statutory avoidance powers, similar to those granted to a Chapter 7 bankruptcy trustee. [See Calif. CCP § 493.030 (termination of lien of attachment or temporary protective order), § 1800 et seq. (avoidance of preferential transfers); Calif. Civ.C. § 3439 et seq. (avoidance of fraudulent conveyances)]

Even so, courts may question this right outside a bankruptcy proceeding. There is also disagreement between the Federal Court (Ninth Circuit) and California state courts whether the Bankruptcy Code preempts the assignee's preference avoidance power under California statutory law.

Creditors - Rights and Duties

While not required to consent to an Assignment, secured creditors often must agree in advance since their cooperation frequently affects the liquidation of the assets. Secured creditors are not barred from enforcing their security by such an assignment. The acceptance of an Assignment by unsecured creditors is not necessary, since under common law the proceedings are deemed to benefit them through equality of treatment.

Note that all Creditors must file their claims within the statutory 150-180 day claim filing period.

ABCs in California do not require a public court filing, but most corporations require both board and shareholder approval. Costs and expenses, including the assignee’s fees, legal expenses and costs of administration, are paid first, just as in a Chapter 7 bankruptcy . Because an assignee’s fee is often based on a percentage value of the assigned assets, it can be difficult to procure assignees for smaller estates.

- Assignment Agreement is executed and ratified. Assignor turns over and assigns to Assignee all right, title and interest in the assets being assigned.

- Assignor gives Assignee a complete, certified list of creditors, including addresses and amounts owed.

- Assignee notifies Creditors within 30 days of execution that assignment has been made, provides an estimate of the probable distribution, and provides a claim form for each Creditor to file a claim in the Assignment estate.

- Creditors have 150-180 days from the date of written notice of the assignment to file their claims.

- After claim forms are returned and/or the Bar Date has passed, Assignee reconciles the claims and/or objects to any improper claim amounts.

- After liquidation, Assignee determines distribution amounts. Claim priority is determined first by state statute, then by Bankruptcy Code. First are secured creditors, then follow tax & wage claims.

- Assignee generally informs the IRS that assignment has been made and files notice with local Recorder.

- Assignee immediately searches for any previously undisclosed liens (UCC or real estate) to ensure complete notice to all creditors and interest holders.

- Assignee secures all assets. In limited situations where the business has enough cash, Assignee may continue to operate the business to maintain going-concern value - if no further debt will be incurred.

It normally takes about 12 months to conclude an ABC.

Effects of ABC

An ABC generally is faster and less costly than a bankruptcy proceeding. Parties can often agree and determine what is going to happen prior to execution of the assignment.

However, ABCs do not discharge individual Assignors from their debts, and do not provide for the reorganization of the business. There is no automatic stay, though in practice an ABC results in an informal and/or incomplete automatic stay if the creditors determine that the assets are beyond their reach.

Creditors are able to continue to pursue the Assignor. ABCs often block judgment creditors from attaching assets because the Assignor no longer has title to or interest in the assigned assets. Sometimes the Assignee is willing to allow the judgment if the judgment creditor submits its claim as described above. The assignee may also defend against a claim if the plaintiff is seeking a judgment which is unjustified and not fair to other creditors.

An ABC also provides grounds for filing an involuntary bankruptcy petition within 120 days of assignment.

The Statutes: California Code of Civil Procedure

§§493.010-493.060 “Effect of Bankruptcy Proceedings and General Assignments for the Benefit of Creditors”

§§1800-1802 “Recovery of Preferences and Exempt Property in an Assignment for the Benefit of Creditors”

A Chapter 11 Reorganization can cost hundreds of thousands of dollars and even a business Chapter 7 Liquidation bankruptcy can easily cost tens of thousands or more. The Assignment method, which pays the Assignee normally by a percentage of the assets sold, is cost-efficient but limited in the protection it may afford the Assignor, as described above. Before this method is attempted, competent legal counsel and certified public accountants should be consulted.

Founded in 1939, our law firm combines the ability to represent clients in domestic or international matters with the personal interaction with clients that is traditional to a long established law firm.

Read more about our firm

© 2024, Stimmel, Stimmel & Roeser, All rights reserved | Terms of Use | Site by Bay Design

Assignments for the Benefit of Creditors – an often-overlooked state law alternative to Chapter 7 bankruptcy

For some folks the three letters ABC are a reminder of elementary school and singing a song to learn the alphabet. For others, it is a throw back to the early 70’s when the Jackson Five and its lead singer Michael, still with his adolescent high voice, sang a catchy love song. Then there is a select group of people in the world of corporate workouts, liquidations and bankruptcies, who know those three letters to stand for the A ssignment for the B enefit of C reditors – a voluntary state law liquidation process that may arguably offer a hospitable and friendly alternative to federal bankruptcy. This article is a brief summary of this potentially attractive alternative to bankruptcy.

The Assignment for the Benefit of Creditors (“ABC”), also known as a General Assignment, is a state law procedure governed by state statute or common law. Over 30 states have codified statutes, and the remainder of states rely on common law. See Practical Issues in Assignments for the Benefit of Creditors , by Robert Richards & Nancy Ross, ABI Law Review Vol. 17:5 (2009) at p. 6 (listing state statutes). In some states, the statutory authority and common law can coexist. At its most basic, the ABC process involves the transfer of all assets by a financially distressed debtor (the assignor) to an individual or entity (the assignee) with fiduciary obligations who then liquidates the assets and pays creditors. The assignment agreement is essentially a contract involving the transfer and control of property, in trust, to a third party. In some states that have enacted a statute, state courts may supervise the process (and at different levels of involvement depending on the statute). The statutory scheme in other states such as California and Nevada, and in states where common law govern, do not provide for judicial oversight..

ABCs are promoted as less expensive and more flexible than a chapter 7 liquidation and may proceed substantially faster than bankruptcy liquidation. See generally Practical Issues in Assignments for the Benefit of Creditors , ABI Law Review Vol. 17:5 (2009) at p. 8 (citations omitted). In addition, the ABC process may provide four other noteworthy benefits not available in a bankruptcy. First, the liquidating company chooses the assignee, there is no appointment of a random trustee or formal election required like in a bankruptcy. This freedom of choice allows the assignor to evaluate the reputation and experience of proposed assignees, as well as select an assignee with familiarity in the nature of the assignor’s business and/or with more expansive contacts in the industry to facilitate the sale/liquidation. Second, the ABC process generally falls under the radar of the media (particularly in states that do not require court supervision), and the assignor may avoid publicity, often negative, that can be associated with bankruptcy proceedings. Third, with an ABC, the assignee has the ability to sell the assets without the imposition of potentially cumbersome requirements of Section 363 of the Bankruptcy Code, and in some cases, can conduct a sale the same day as the general assignment. Finally, the ABC process generally authorizes the sale of assets free of unsecured creditor debt. In essence, in an ABC, a company buying assets from a distressed business does not acquire the debt of the assignor.

On the down side, ABCs do not provide the protection of the automatic stay that is triggered upon the filing of a bankruptcy petition. In some situations, the debtor entity needs to stop the pursuit of creditors immediately, and a bankruptcy proceeding will supply this relief. Unlike bankruptcy, the sale through an ABC: i) is not free and clear of liens; ii) unexpired leases cannot be assumed and assigned without the consent of the contract counter-party; and iii) insolvency can trigger a default under an unexpired lease or executory contract. See generally Practical Issues in Assignments for the Benefit of Creditors , ABI Law Review Vol. 17:5 (2009) at p. 20. In general, an ABC is not a good choice for debtors that have secured creditors that do not consent because there is no mechanism for using cash collateral or transferring assets free and clear of liens without the secured creditors’ consent. In cases where junior lienholders are out of the money, there is no incentive for those creditors to voluntarily release their liens. In addition, while unsecured creditors do not have to consent to the general assignment for it to be valid, choosing this alternative forum may cause concern for creditors (particularly those used to the transparency of a court-supervised bankruptcy or receivership proceeding) and invite the filing of an involuntary bankruptcy. Therefore, it is prudent to involve major creditors in the process, and perhaps even in the pre-assignment planning. In addition, if an involuntary petition is filed, the assignee could request that the bankruptcy court abstain in order to proceed with the ABC.

Using the ABC state process in lieu of filing for bankruptcy in federal court may result in a more streamlined, efficient liquidation process that is less expensive and likely completed quicker than a federal bankruptcy proceeding. In some jurisdictions, such as New Jersey, workout professionals note anecdotally that corporate clients fare better under this state law alternative rather than the lengthy, more complicated federal bankruptcy proceedings.

Many bankruptcy professionals are unfamiliar with the procedures of ABC and are reluctant to recommend it as a method for liquidating assets and administering claims. This lack of familiarity may be a disservice to potential clients.

[ View source .]

Related Posts

- The More Things Change, The More They Stay The Same? Survival Of Small Businesses Again Dependent On Action From Congress

- Mediation in Bankruptcy: A Glimpse

- In re The Hacienda Company, LLC – Round 2: Bankruptcy Courts May be Available to Non-Operating Cannabis Companies to Liquidate Assets

- PAGA Dischargeable in Bankruptcy?

Latest Posts

- Federal Circuit Revamps Obviousness Test for Design Patents

See more »

DISCLAIMER: Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

Refine your interests »

Written by:

PUBLISH YOUR CONTENT ON JD SUPRA NOW

- Increased visibility

- Actionable analytics

- Ongoing guidance

Published In:

Fox rothschild llp on:.

"My best business intelligence, in one easy email…"

Macdonald Fernandez LLP

PROTECTING CLIENTS AND HELPING THEM GROW Since 1993

Assignment for the Benefit of Creditors

Unlike several other states, California’s assignment for the benefit of creditors (ABC) statute law provides for a robust and effective out-of-court procedure for smoothly terminating a business. This process is preferred by many technology companies, startups and entrepreneurs because it helps principals to easily move on to new projects.

An ABC provides for several advantages. For example, an ABC is initiated by the business itself, not by its creditors, and the business can set the stage for a controlled termination. Specifically, the business evaluates and selects its own general assignee to handle the termination, and the professionals who will be involved are known in advance. (By contrast, the trustee appointed in a Chapter 7 bankruptcy case is unknown, and the trustee’s investigation of assets and financial affairs can be expensive and uncomfortable.) Moreover, the business has the opportunity to plan, prepare and marshal its resources prior to initiating the ABC.

A chief advantage is that an ABC allows the business to take steps to maximize value, including by potentially selling assets as a going concern and identifying potential asset purchasers in advance. Approaches to asset sales can be tailored to maximize value, including strategic marketing, private sales, and simple or highly structured auctions. An ABC is also a low-profile, out-of-court procedure that minimizes the principals’ exposure to unwanted scrutiny. Other advantages of an ABC include:

- Streamlined process for finally resolving claims

- Priority claims for employees

- Opportunity to undo certain transactions (fraudulent transfers and preferences)

- Avoidance of unperfected liens

Our lawyers represent businesses, general assignees and creditors in ABCs. Specifically, in one example, we represented a creditor in a large technology company’s ABC. Through careful and practical negotiation, we were able to obtain a carve-out agreement such that our client was entitled to be paid certain funds that would have gone to the former principal of the company while simultaneously preserving key business relationships.

- Find a Lawyer

- Ask a Lawyer

- Research the Law

- Law Schools

- Laws & Regs

- Newsletters

- Justia Connect

- Pro Membership

- Basic Membership

- Justia Lawyer Directory

- Platinum Placements

- Gold Placements

- Justia Elevate

- Justia Amplify

- PPC Management

- Google Business Profile

- Social Media

- Justia Onward Blog

2005 California Code of Civil Procedure Sections 1800-1802 ASSIGNMENT FOR THE BENEFIT OF CREDITORS

Disclaimer: These codes may not be the most recent version. California may have more current or accurate information. We make no warranties or guarantees about the accuracy, completeness, or adequacy of the information contained on this site or the information linked to on the state site. Please check official sources.

Get free summaries of new opinions delivered to your inbox!

- Bankruptcy Lawyers

- Business Lawyers

- Criminal Lawyers

- Employment Lawyers

- Estate Planning Lawyers

- Family Lawyers

- Personal Injury Lawyers

- Estate Planning

- Personal Injury

- Business Formation

- Business Operations

- Intellectual Property

- International Trade

- Real Estate

- Financial Aid

- Course Outlines

- Law Journals

- US Constitution

- Regulations

- Supreme Court

- Circuit Courts

- District Courts

- Dockets & Filings

- State Constitutions

- State Codes

- State Case Law

- Legal Blogs

- Business Forms

- Product Recalls

- Justia Connect Membership

- Justia Premium Placements

- Justia Elevate (SEO, Websites)

- Justia Amplify (PPC, GBP)

- Testimonials

In The (Red)

The Business Bankruptcy Blog

Assignments For The Benefit Of Creditors: Simple As ABC?

Companies in financial trouble are often forced to liquidate their assets to pay creditors. While a Chapter 11 bankruptcy sometimes makes the most sense, other times a Chapter 7 bankruptcy is required, and in still other situations a corporate dissolution may be best. This post examines another of the options, the assignment for the benefit of creditors, commonly known as an "ABC."

A Few Caveats . It’s important to remember that determining which path an insolvent company should take depends on the specific facts and circumstances involved. As in many areas of the law, one size most definitely does not fit all for financially troubled companies. With those caveats in mind, let’s consider one scenario sometimes seen when a venture-backed or other investor-funded company runs out of money.

One Scenario . After a number of rounds of investment, the investors of a privately held corporation have decided not to put in more money to fund the company’s operations. The company will be out of cash within a few months and borrowing from the company’s lender is no longer an option. The accounts payable list is growing (and aging) and some creditors have started to demand payment. A sale of the business may be possible, however, and a term sheet from a potential buyer is anticipated soon. The company’s real property lease will expire in nine months, but it’s possible that a buyer might want to take over the lease.

- A Chapter 11 bankruptcy filing is problematic because there is insufficient cash to fund operations going forward, no significant revenues are being generated, and debtor in possession financing seems highly unlikely unless the buyer itself would make a loan.

- The board prefers to avoid a Chapter 7 bankruptcy because it’s concerned that a bankruptcy trustee, unfamiliar with the company’s technology, would not be able to generate the best recovery for creditors.

The ABC Option . In many states, another option that may be available to companies in financial trouble is an assignment for the benefit of creditors (or "general assignment for the benefit of creditors" as it is sometimes called). The ABC is an insolvency proceeding governed by state law rather than federal bankruptcy law.

California ABCs . In California, where ABCs have been done for years, the primary governing law is found in California Code of Civil Procedure sections 493.010 to 493.060 and sections 1800 to 1802 , among other provisions of California law. California Code of Civil Procedure section 1802 sets forth, in remarkably brief terms, the main procedural requirements for a company (or individual) making, and an assignee accepting, a general assignment for the benefit of creditors:

1802. (a) In any general assignment for the benefit of creditors, as defined in Section 493.010, the assignee shall, within 30 days after the assignment has been accepted in writing, give written notice of the assignment to the assignor’s creditors, equityholders, and other parties in interest as set forth on the list provided by the assignor pursuant to subdivision (c). (b) In the notice given pursuant to subdivision (a), the assignee shall establish a date by which creditors must file their claims to be able to share in the distribution of proceeds of the liquidation of the assignor’s assets. That date shall be not less than 150 days and not greater than 180 days after the date of the first giving of the written notice to creditors and parties in interest. (c) The assignor shall provide to the assignee at the time of the making of the assignment a list of creditors, equityholders, and other parties in interest, signed under penalty of perjury, which shall include the names, addresses, cities, states, and ZIP Codes for each person together with the amount of that person’s anticipated claim in the assignment proceedings.

In California, the company and the assignee enter into a formal "Assignment Agreement." The company must also provide the assignee with a list of creditors, equityholders, and other interested parties (names, addresses, and claim amounts). The assignee is required to give notice to creditors of the assignment, setting a bar date for filing claims with the assignee that is between five to six months later.

ABCs In Other States . Many other states have ABC statutes although in practice they have been used to varying degrees. For example, ABCs have been more common in California than in states on the East Coast, but important exceptions exist. Delaware corporations can generally avail themselves of Delaware’s voluntary assignment statutes , and its procedures have both similarities and important differences from the approach taken in California. Scott Riddle of the Georgia Bankruptcy Law Blog has an interesting post discussing ABC’s under Georgia law . Florida is another state in which ABCs are done under specific statutory procedures . For an excellent book that has information on how ABCs are conducted in various states, see Geoffrey Berman’s General Assignments for the Benefit of Creditors: The ABCs of ABCs , published by the American Bankruptcy Institute .

Important Features Of ABCs . A full analysis of how ABCs function in a particular state and how one might affect a specific company requires legal advice from insolvency counsel. The following highlights some (but by no means all) of the key features of ABCs:

- Court Filing Issue . In California, making an ABC does not require a public court filing. Some other states, however, do require a court filing to initiate or complete an ABC.

- Select The Assignee . Unlike a Chapter 7 bankruptcy trustee, who is randomly appointed from those on an approved panel, a corporation making an assignment is generally able to choose the assignee.

- Shareholder Approval . Most corporations require both board and shareholder approval for an ABC because it involves the transfer to the assignee of substantially all of the corporation’s assets. This makes ABCs impractical for most publicly held corporations.

- Liquidator As Fiduciary . The assignee is a fiduciary to the creditors and is typically a professional liquidator.

- Assignee Fees . The fees charged by assignees often involve an upfront payment and a percentage based on the assets liquidated.

- No Automatic Stay . In many states, including California, an ABC does not give rise to an automatic stay like bankruptcy, although an assignee can often block judgment creditors from attaching assets.

- Event Of Default . The making of a general assignment for the benefit of creditors is typically a default under most contracts. As a result, contracts may be terminated upon the assignment under an ipso facto clause .

- Proof Of Claim . For creditors, an ABC process generally involves the submission to the assignee of a proof of claim by a stated deadline or bar date, similar to bankruptcy. (Click on the link for an example of an ABC proof of claim form .)

- Employee Priority . Employee and other claim priorities are governed by state law and may involve different amounts than apply under the Bankruptcy Code. In California, for example, the employee wage and salary priority is $4,300, not the $10,950 amount currently in force under the Bankruptcy Code.

- 20 Day Goods . Generally, ABC statutes do not have a provision similar to that under Bankruptcy Code Section 503(b)(9) , which gives an administrative claim priority to vendors who sold goods in the ordinary course of business to a debtor during the 20 days before a bankruptcy filing . As a result, these vendors may recover less in an ABC than in a bankruptcy case, subject to assertion of their reclamation rights .

- Landlord Claim . Unlike bankruptcy, there generally is no cap imposed on a landlord’s claim for breach of a real property lease in an ABC.

- Sale Of Assets . In many states, including California, sales by the assignee of the company’s assets are completed as a private transaction without approval of a court. However, unlike a bankruptcy Section 363 sale , there is usually no ability to sell assets "free and clear" of liens and security interests without the consent or full payoff of lienholders. Likewise, leases or executory contracts cannot be assigned without required consents from the other contracting party.

- Avoidance Actions . Most states allow assignees to pursue preferences and fraudulent transfers. However, the U.S. Court of Appeals for the Ninth Circuit has held that the Bankruptcy Code pre-empts California’s preference statute , California Code of Civil Procedure section 1800. Nevertheless, to date the California state courts have refused to follow the Ninth Circuit’s decision and still permit assignees to sue for preferences in California state court . In February 2008, a Delaware state court followed the California state court decisions , refusing either to follow the Ninth Circuit position or to hold that the California preference statute was pre-empted by the Bankruptcy Code. The Delaware court was required to apply California’s ABC preference statute because the avoidance action arose out of an earlier California ABC.

The Scenario Revisited. With this overview in mind, let’s return to our company in distress.

- The prospect of a term sheet from a potential buyer may influence whether our hypothetical company should choose an ABC or another approach. Some buyers will refuse to purchase assets outside of a Chapter 11 bankruptcy or a Chapter 7 case. Others are comfortable with the ABC process and believe it provides an added level of protection from fraudulent transfer claims compared to purchasing the assets directly from the insolvent company. Depending on the value to be generated by a sale, these considerations may lead the company to select one approach over the other available options.

- In states like California where no court approval is required for a sale, the ABC can also mean a much faster closing — often within a day or two of the ABC itself provided that the assignee has had time to perform due diligence on the sale and any alternatives — instead of the more typical 30-60 days required for bankruptcy court approval of a Section 363 sale. Given the speed at which they can be done, in the right situation an ABC can permit a "going concern" sale to be achieved.

- Secured creditors with liens against the assets to be sold will either need to be paid off through the sale or will have to consent to release their liens; forced "free and clear" sales generally are not possible in an ABC.

- If the buyer decides to take the real property lease, the landlord will need to consent to the lease assignment. Unlike bankruptcy, the ABC process generally cannot force a landlord or other third party to accept assignment of a lease or executory contract.

- If the buyer decides not to take the lease, or no sale occurs, the fact that only nine months remains on the lease means that this company would not benefit from bankruptcy’s cap on landlord claims. If the company’s lease had years remaining, and if the landlord were unwilling to agree to a lease termination approximating the result under bankruptcy’s landlord claim cap, the company would need to consider whether a bankruptcy filing was necessary to avoid substantial dilution to other unsecured creditor claims that a large, uncapped landlord claim would produce in an ABC.

- If the potential buyer walks away, the assignee would be responsible for determining whether a sale of all or a part of the assets was still possible. In any event, assets would be liquidated by the assignee to the extent feasible and any proceeds would be distributed to creditors in order of their priority through the ABC’s claims process.

- While other options are available and should be explored, an ABC may make sense for this company depending upon the buyer’s views, the value to creditors and other constituencies that a sale would produce, and a clear-eyed assessment of alternative insolvency methods.

Conclusion . When weighing all of the relevant issues, an insolvent company’s management and board would be well-served to seek the advice of counsel and other insolvency professionals as early as possible in the process. The old song may say that ABC is as "easy as 1-2-3," but assessing whether an assignment for the benefit of creditors is best for an insolvent company involves the analysis of a myriad of complex factors.

(858) 481-1300 [email protected]

- Health & Safety Receiverships

- Partition Referee Matters

- Business Dispute Receiverships

- Cannabis Receiverships

- Rents & Profits Receiverships

- Post-Judgment Receiverships

- Legal Representation of Receivers & Referees

- Property Examples

- Meet the Team

- In the News

- Career Opportunities

Introduction to Assignments for the Benefit of Creditors

August 2, 2023

ABC is an alternative to formal bankruptcy proceedings and is governed by state laws in the United States. In this article, we will explain why an ABC can potentially be a good alternative to bankruptcy, and other reasons why a distressed business should consider it. It is an unfortunate truth that many businesses in all industries are struggling through uncharted economic times.

- Millions of Americans in the workforce died from COVID-19 or had to reduce their hours due to long-COVID symptoms.

- High rates of inflation affected consumers and small business owners alike

- The economy continues to suffer from supply chain issues

When circumstances feel bleak, owners of distressed businesses may start to feel like bankruptcy is their only option. An ABC should, at the very least, be considered.

Assignment for the Benefit of Creditors: An Alternative to Bankruptcy

In an ABC, the business serves as the assignor, who transfers all assets to the control of another person–the assignee. This third-party individual sells the assets and distributes the sale proceeds to the creditors.

Importantly, initiating an ABC does not require a court filing. Thus, it is not subject to ongoing court oversight. Instead, an ABC is merely a contract pursuant to which the company transfers legal and equitable title, as well as custody and control, of its assets to an independent third-party assignee. This assignee is required to sell the transferred assets and distribute the proceeds of their sale.

Choosing an Assignee

Unlike a trustee who is randomly assigned by the bankruptcy court, an ABC assignee is selected by the assigning company. This is important because you can hand-pick an assignee with specialized knowledge and experience.

A hand-picked assignee with the right experience can maximize the value of your assets and help reduce your debt burden to your creditors.

When you choose a highly qualified assignee, the ABC can proceed much faster than bankruptcy, as there is no court oversight and no strict procedural requirements the assignee must follow. This also leads to a lower overall cost compared to other options.

The ABC can also benefit the management of a struggling company by placing the responsibility for winding down the business and disposing of assets directly on the assignee, whose fiduciary duty is to the creditors. The assignor’s burden can be lifted.

Creditors of the assignor must simply submit proofs of claim to the assignee to receive payment by the assignee from the proceeds of the sale of the assignment estate. After liquidation, the assignee determines the distribution amounts based on claim priority frameworks. Generally, an ABC will only be a feasible option if there is buy-in and cooperation from the struggling company’s largest creditors.

Why Should Distressed Companies Consider an ABC?

Some distressed companies may not be qualified to take advantage of Chapter 11 reorganization. For example, California’s cannabis companies are unable to qualify for Chapter 11, as they cannot participate in any federal programs. Other struggling companies may prefer to find a faster, cheaper method to dissolve their business, as opposed to Chapter 11.

Griswold Law–A Receiver Who Can Also Serve as an Assignee

Richardson “Red” Griswold has been appointed as a receiver by the California courts more than 180 times. Much of the work of a receiver overlaps with that of an ABC assignee, which is why Red has also helped companies pursue an Assignment for the Benefit of Creditors.

To learn more about ABCs and if they are the right option for your struggling business, contact us today .

- There are no suggestions because the search field is empty.

- Court-Appointed Receivership (66)

- Real Estate (55)

- Partition Referee (30)

- Real Estate Finance (29)

- Real Estate Transaction (29)

- Partition Action (27)

- Commercial Properties (24)

- Enforcing Judgments (21)

- Commercial Leases (20)

- Hoarding (20)

- Business Litigation (19)

- Foreclosure Law (18)

- Tenants' Rights (18)

- Contract Disputes (17)

- receivership (17)

- Business Owners (16)

- Uncategorized (16)

- Construction Law (15)

- Collections Law (14)

- Business Formation: Asset Protection (11)

- California (10)

- Loan Modification (9)

- abandoned property (9)

- health & safety (9)

- receiver (9)

- Consumer Class Action (8)

- receiverships (8)

- Consumer Fraud (7)

- Receivership Remedy (7)

- health and safety code (6)

- healthy & safety receiver (6)

- Fraud against Senior Citizens (5)

- Health & Safety Code (5)

- code enforcement (5)

- Employment Law (4)

- Landlord (4)

- Marijuana Dispensaries (4)

- San Diego (4)

- Trade Secrets (4)

- abandoned (4)

- creditor (4)

- fire hazard (4)

- money judgment (4)

- nuisance property (4)

- Cannabis (3)

- Employment Class Action (3)

- Employment Discrimination (3)

- Health & Safety Code Receiver (3)

- Health and Safety receivership (3)

- Trademark Law (3)

- abandoned building (3)

- code enforcement officers (3)

- collection (3)

- court-appointed receiver (3)

- health and safety (3)

- hoarder (3)

- real estate. california (3)

- real property (3)

- rents and profits (3)

- substandard conditions (3)

- Attorneys' Fees Clauses (2)

- City of San Diego (2)

- Health and Safety Receivership Process (2)

- Post-Judgment Receiver (2)

- Unlawful Detainer (2)

- bankruptcy (2)

- business (2)

- business disputes (2)

- complaint (2)

- debt collection (2)

- dispute (2)

- distressed properties (2)

- foreclosure (2)

- habitability (2)

- health and saftey code (2)

- hoarders (2)

- hoarding support (2)

- judgment (2)

- judgment creditor (2)

- judgment debtor (2)

- partnership agreement (2)

- property (2)

- property value (2)

- san diego county (2)

- slumlord (2)

- tenant rights (2)

- Animal Hoarding (1)

- City of Chula Vista (1)

- Distressed Business (1)

- Historic Properties (1)

- Liquor License Receiverships (1)

- Mills Act (1)

- Neighborgood Blight (1)

- Partition Remedy (1)

- Post-Judgment Receivership(s) (1)

- Reimbursement of Employee Business Expenses (Labor (1)

- The Health and Safety Receivership Process (1)

- absentee landlord (1)

- abstract of judgment (1)

- account levy (1)

- assignment for the benefit of creditors (1)

- bank garnish (1)

- bank levy (1)

- bitcoin (1)

- board of directors (1)

- business formation (1)

- business owner (1)

- california receivership laws (1)

- city attorney (1)

- collecting judgment (1)

- commercial project (1)

- company (1)

- confidential information (1)

- confidentiality agreement (1)

- court award (1)

- court order (1)

- covid-19 (1)

- cryptocurrency (1)

- deceased owner (1)

- demolition (1)

- diliberti (1)

- disposable earnings (1)

- family law (1)

- general partnership (1)

- habitability requirements (1)

- hospitality assets (1)

- human smuggling (1)

- illegal business (1)

- illegal cannabis dispensary (1)

- illegal gambling parlor (1)

- initial inspection (1)

- joseph diliberti (1)

- judgment collection (1)

- judgment lien (1)

- lease term (1)

- liquidation (1)

- litigation (1)

- lodging properties (1)

- massage parlors (1)

- misappropriation (1)

- negligent landlord (1)

- new business (1)

- occupant relocation (1)

- partnership (1)

- partnership disputes (1)

- post-judgment collection (1)

- provisional director (1)

- public safety (1)

- real property lien (1)

- real property receiver (1)

- relocation (1)

- residential zoning laws (1)

- retail center (1)

- right of possession (1)

- san diego real estate (1)

- sex trafficking (1)

- short-term rental (1)

- sober living house (1)

- squatters (1)

- struggling hotels (1)

- substandard hotel (1)

- tenancy (1)

- unlicensed in-home business (1)

- wage garnishment (1)

- warranty of habitability (1)

- weed abatement (1)

- writ of execution (1)

Recent Posts

For more information please contact Griswold Law

Phone: (858) 481-1300

Email: [email protected]

Address: 705 N. Vulcan Avenue, Encinitas, CA 92024

No communication via email or content posted on this website creates an attorney-client privilege. The information on this website is purely hypothetical. The information on this website should not be relied upon. If you have legal questions or are seeking legal assistance, you should contact an attorney immediately.

- California Department of Real Estate

- California Secretary of State

- State of California Courts

- U.S. Department of Housing and Urban Development

- United States District Court, Southern District of California

- United States Patent and Trademark Office

- Bar Relations

- Diversity, Equity and Inclusion

- Sponsorship and Advertising

- California Lawyers Foundation

- Member Benefits

- Membership Pricing

- Member Discounts

- Law Students

- Volunteer Opportunities

- Knowledge Hub

- Career Center

- Indian and Tribal Law

- Section Publications

- Our Bookstore

- Appellate Practice Network

- Cannabis Law

- Health and Wellness

- Environmental, Social and Governance

- Antitrust and Unfair Competition Law

Business Law

- Criminal Law

- Environmental Law

- Intellectual Property Law

- International Law and Immigration

- Labor and Employment Law

- Law Practice Management and Technology

- New Lawyers

- Privacy Law

- Real Property Law

- Solo and Small Firm

- Trusts and Estates

- Workers’ Compensation

Insolvency Law Committee Updates Assignment for Benefit of Creditors Desk Guide

Six years after publishing the popular First Edition of the Assignment for the Benefit of Creditors Desk Guide, the Insolvency Law Committee of the Business Law Section has updated and enhanced the Guide for continued use by assignors, assignees, creditors, landlords, purchasers of assets, owners, accountants, real and personal property brokers and other related professionals.

The Second Edition captures in an indispensable single volume (electronic with a paper version on its way) updated relevant California and Federal statutes, case law precedents, a bibliography of source materials, an enhanced tax section and commentary on current legal developments regarding preference avoidance and federal preemption issues that sometimes occur during a California Assignment for the Benefit of Creditors.

The Assignment for the Benefit of Creditors Desk Guide, Second Edition is no longer available for purchase.

Related Content

Forgot password.

Enter the email associated with you account. You will then receive a link in your inbox to reset your password.

Registration Information

CLA's member registration page has move to: https://calawyers.org/create-account/

If you have any questions, please contact us at [email protected]

Personal Information

Select section(s).

- Antitrust and Unfair Competition Law $99

- Business Law $99

- Criminal Law $99

- Environmental Law $99

- Family Law $99

- Intellectual Property Law $99

- International Law and Immigration $99

- Labor and Employment Law $99

- Law Practice Management and Technology $99

- Litigation $99

- Privacy Law $99

- Public Law $99

- Real Property Law $99

- Solo and Small Firm $99

- Taxation $99

- Trusts and Estates $99

- Workers' Compensation $99

assignment for benefit of creditors

Primary tabs.

Assignment for the benefit of the creditors (ABC)(also known as general assignment for the benefit of the creditors) is a voluntary alternative to formal bankruptcy proceedings that transfers all of the assets from a debtor to a trust for liquidating and distributing its assets. The trustee will manage the assets to pay off debt to creditors, and if any assets are left over, they will be transferred back to the debtor.

ABC can provide many benefits to an insolvent business in lieu of bankruptcy . First, unlike in bankruptcy proceedings, the business can choose the trustee overseeing the process who might know the specifics of the business better than an appointed trustee. Second, bankruptcy proceedings can take much more time, involve more steps, and further restrict how the business is liquidated compared to an ABC which avoids judicial oversight. Thirdly, dissolving or transferring a company through an ABC often avoids the negative publicity that bankruptcy generates. Lastly, a company trying to purchase assets of a struggling company can avoid liability to unsecured creditors of the failing company. This is important because most other options would expose the acquiring business to all the debt of the struggling business.

ABC has risen in popularity since the early 2000s, but it varies based on the state. California embraces ABC with common law oversight while many states use stricter statutory ABC structures such as Florida. Also, depending on the state’s corporate law and the company’s charter , the struggling business may be forced to get shareholder approval to use ABC which can be difficult in large corporations.

[Last updated in June of 2021 by the Wex Definitions Team ]

- commercial activities

- financial services

- business law

- landlord & tenant

- property & real estate law

- trusts, inheritances & estates

- wex definitions

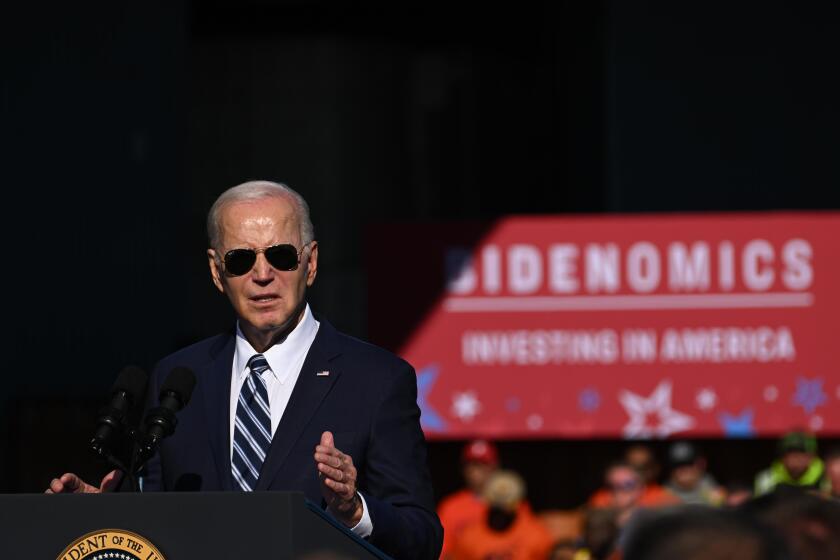

Biden thanks Kenya’s Ruto for sending police to Haiti, defends keeping U.S. forces from the mission

- Show more sharing options

- Copy Link URL Copied!

President Biden on Thursday expressed deep appreciation to Kenyan President William Ruto for the coming deployment of Kenyan police forces to help quell gang violence in Haiti and he defended his decision to withhold American forces from the mission in the beleaguered Caribbean nation.

The United States has agreed to contribute $300 million to a multinational force that will include 1,000 Kenyan police officers, but Biden argued that an American troop presence in Haiti would raise “all kinds of questions that can easily be misrepresented.”

The Democrat came into office in 2021 pledging to end U.S. involvement in so-called endless wars in the aftermath of 20 years of conflict in Afghanistan and Iraq.

“Haiti is in an area of the Caribbean that is very volatile,” Biden said at a news conference with Ruto, who was in Washington for the first state visit to the U.S. by an African leader since 2008. “There’s a lot going on in this hemisphere. So we’re in a situation where we want to do all we can without us looking like America once again is stepping over and deciding this is what must be done.”

Ruto, who will be honored by Biden with a state dinner on the White House grounds in the evening, also gave a climate policy address and met with former President Obama.

World & Nation

‘China has conquered Kenya’: Inside Beijing’s new strategy to win African hearts and minds

Aug. 7, 2017

Ruto is facing legal challenges in Nairobi over the decision to commit Kenyan forces to a conflict thousands of miles from home when his own country has no shortage of economic and security challenges. He said that Kenya, as a democracy, has a duty to help.

“Kenya believes that the responsibility of peace and security anywhere in the world, including in Haiti, is the collective responsibility of all nations and all people who believe in freedom, self-determination, democracy and justice,” Ruto said. “And it is the reason why Kenya took up this responsibility.”

Some analysts say his move could run afoul of a Kenyan High Court ruling in January that found the deployment unconstitutional because of a lack of reciprocal agreements between Kenya and Haiti. A deal was signed in March, before Ariel Henry resigned as Haiti’s prime minister, to try to salvage the plan.

Kenya’s moving ahead “gives the impression that the country is lawless and does not believe in the rule of law,” said Macharia Munene, an international relations professor at United States International University-Africa.

A difficult assignment is ahead for the Kenyan officers.

Haiti has endured poverty, political instability and natural disasters for decades. International intervention in Haiti has a complicated history. A United Nations-approved stabilization mission to Haiti that started in June 2004 was marred by a sexual abuse scandal and the introduction of cholera, which killed nearly 10,000 people. The mission ended in October 2017.

Why California officials traveled to Kenya to find solutions to poverty

Los Angeles County Supervisor Holly Mitchell and Assemblymember Matt Haney of San Francisco visited Kenya to study basic income. They came away with ideas for California.

Aug. 10, 2023

Biden and Ruto also called on economies around the globe to take action to reduce the enormous debt burden crushing Kenya and other developing nations.

The call to action, termed the Nairobi-Washington Vision, comes as Biden presses his appeal to African nations that the U.S. can be a better partner than economic rival China. Beijing has been deepening its investment on the continent — often with high-interest loans and other difficult financing terms.

Biden and Ruto want creditor nations to reduce financing barriers for developing nations that have been constrained by high debt burdens. They also called on international financial institutions to coordinate debt relief and support through multilateral banks and institutions providing better financing terms.

The White House announced $250 million in grants for the International Development Assn., part of the World Bank, to assist poor countries facing crises.

Separately, a $1.2-trillion government funding bill passed by Congress in March allows the U.S. to lend up to $21 billion to an International Monetary Fund trust that provides zero-interest loans to support low-income countries.

“Too many nations are forced to make a choice between development and debt, between investing in their people and paying back their creditors,” Biden said.

U.N. Security Council votes to send Kenya-led multinational force to Haiti

The multinational force’s main mission will be to help combat violent gangs engaged in killings and kidnappings in the troubled country.

Oct. 2, 2023

An Associated Press analysis of a dozen countries most indebted to China — including Kenya — found the debt is consuming an ever-greater amount of tax revenue needed to keep schools open, provide electricity and pay for food and fuel.

Behind the scenes is China’s reluctance to forgive debt and its extreme secrecy about how much money it has lent and on what terms, which has kept other major lenders from stepping in to help.

Kenya’s debt-to-GDP ratio tops 70%, with the bulk of it owed to China. Credit ratings agency Fitch estimates the Kenya will spend almost one-third of its government revenues just on interest payments this year.

The Biden administration has praised Kenya for stepping up in Haiti when so few other countries have agreed to do so. Biden also announced his intention to designate Kenya as a major non-NATO ally, an acknowledgment of the growing security partnership between the countries.

U.S. wants Kenya to lead a 1,000-police force in Haiti. Watchdogs say they’ll export abuse

The United States is praising Kenya’s interest in leading a multinational force in the unstable Caribbean nation, but rights groups have concerns.

Aug. 4, 2023

The designation, while largely symbolic, reflects how Kenya has grown from a regional partner that has long cooperated with U.S. counterterrorism operations on the continent to a major global influence — even extending its reach into the Western Hemisphere. Kenya will be the first sub-Saharan African country to receive the status.

Ruto arrived in Washington on Wednesday and began the visit by meeting with Biden and tech executives from Silicon Valley and Kenya’s growing tech sector.

The White House announced it was working with Congress to make Kenya the first country in Africa to benefit from funding through the CHIPS and Science Act, a 2022 law that aims to reinvigorate the computer chip sector within the United States through tens of billions of dollars in targeted government support.

“I think we have a historic moment to explore investment opportunities between Kenya and the United States,” Ruto said.

Despite the optimistic outlook, Kenya has seen a sharp decline in foreign investment since 2017. Net investment for foreign companies has fallen from $1.35 billion in 2017 to $394 million in 2022, according to the World Bank.

Madhani and Kim write for the Associated Press. AP writers Evelyne Musambi in Nairobi; Josh Boak and Sagar Meghani contributed to this report.

More to Read

U.S. military will begin plans to withdraw troops from Niger

April 20, 2024

Biden administration partners with 50 countries to stifle future pandemics

April 16, 2024

Biden praises Prime Minister Kishida’s leadership and Japan’s growing international clout

April 10, 2024

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.

More From the Los Angeles Times

Four takeaways from UCLA Chancellor Gene Block’s testimony on campus antisemitism, protests

May 23, 2024

Voters, worried about inflation, are favoring Trump in swing states, poll shows

Louisiana lawmakers OK bill classifying abortion pills as controlled dangerous substances

Trump and GOP repeatedly echo Nazi and far-right ideology as they aim to retake White House

IMAGES

VIDEO

COMMENTS

California Code, Code of Civil Procedure - CCP § 493.010. (a) The assignment is an assignment of all the defendant's assets that are transferable and not exempt from enforcement of a money judgment. (b) The assignment is for the benefit of all the defendant's creditors. (c) The assignment does not itself create a preference of one creditor or ...

An assignment for the benefit of creditors ("ABC") is a contract by which an economically troubled entity ("Assignor") transfers legal and equitable title, as well as custody and control, of its assets and property to an independent third party ("Assignee") in trust, who is required to apply the proceeds of sale of the property to the assignor's creditors in accord with priorities ...

493.010. As used in this chapter, "general assignment for the benefit of creditors" means an assignment which satisfies all of the following requirements: (a) The assignment is an assignment of all the defendant's assets that are transferable and not exempt from enforcement of a money judgment.

In discussing assignments for the benefit of creditors, this article will focus primarily on California ABC law. Assignment Process. The process of an ABC is initiated by the distressed entity (assignor) entering an agreement with the party which will be responsible for conducting the wind-down and/or liquidation or going concern sale (assignee ...

493.010. As used in this chapter, "general assignment for the benefit of creditors" means an assignment which satisfies all of the following requirements: (a) The assignment is an assignment of all the defendant's assets that are transferable and not exempt from enforcement of a money judgment.

Section 1204 - Priority of claims when assignment made for benefit of creditors or assignor. When any assignment, whether voluntary or involuntary, and whether formal or informal, is made for the benefit of creditors of the assignor, or results from any proceeding in insolvency or receivership commenced against him or her, or when any property is turned over to the creditors of a person, firm ...

The assignment is for the benefit of all the defendant's creditors. (c) The assignment does not itself create a preference of one creditor or class of creditors over any other creditor or class of creditors, but the assignment may recognize the existence of preferences to which creditors are otherwise entitled.

(b) The assignment is for the benefit of all the defendant's creditors. (c) The assignment does not itself create a preference of one creditor or class of creditors over any other creditor or class of creditors, but the assignment may recognize the existence of preferences to which creditors are otherwise entitled. Ca. Civ. Proc. Code § 493.010

(a) In any general assignment for the benefit of creditors, as defined in Section 493.010, the assignee shall, within 30 days after the assignment has been accepted in writing, give written notice of the assignment to the assignor's creditors, equityholders, and other parties in interest as set forth on the list provided by the assignor pursuant to subdivision (c).

Over 30 states have codified statutes, and the remainder of states rely on common law. See Practical Issues in Assignments for the Benefit of Creditors, by Robert Richards & Nancy Ross, ABI Law ...

Unlike several other states, California's assignment for the benefit of creditors (ABC) statute law provides for a robust and effective out-of-court procedure for smoothly terminating a business. This process is preferred by many technology companies, startups and entrepreneurs because it helps principals to easily move on to new projects.

Justia US Law US Codes and Statutes California Code 2005 California Code California Code of Civil Procedure ASSIGNMENT FOR THE BENEFIT OF CREDITORS - Sections 1800-1802 ... In any general assignment for the benefit of creditors (as defined in Section 493.010), the assignor, if an individual, may choose to retain as exempt property either the ...

1802. (a) In any general assignment for the benefit of creditors, as defined in Section 493.010, the assignee shall, within 30 days after the assignment has been accepted in writing, give written notice of the assignment to the assignor's creditors, equityholders, and other parties in interest as set forth on the list provided by the assignor ...

Griswold Law-A Receiver Who Can Also Serve as an Assignee. Richardson "Red" Griswold has been appointed as a receiver by the California courts more than 180 times. Much of the work of a receiver overlaps with that of an ABC assignee, which is why Red has also helped companies pursue an Assignment for the Benefit of Creditors.

Six years after publishing the popular First Edition of the Assignment for the Benefit of Creditors Desk Guide, the Insolvency Law Committee of the Business Law Section has updated and enhanced the Guide for continued use by assignors, assignees, creditors, landlords, purchasers of assets, owners, accountants, real and personal property brokers and other related professionals.

(explaining "an assignment for the benefit of creditors 'is simply a unique trust arrangement in which the assignee (or trustee) holds property for the benefit of a special group of beneficiaries, the creditors'.") (citation omitted); Linton v. Schmidt, 277 N.W.2d 136, 143 (Wis. 1979) (stating assignment law aims to

Bankruptcy attorneys have another. An ABC is an "Assignment for the Benefit of Creditors," and it provides an alternative to Chapter 7 liquidation for a small business that is shutting down. Let's compare the two approaches to resolving business debts. I. Business Bankruptcy. The Bankruptcy Code is a federal statute enacted pursuant to ...

Section 1802 - Notice of assignment given by assignee (a) In any general assignment for the benefit of creditors, as defined in Section 493.010, the assignee shall, within 30 days after the assignment has been accepted in writing, give written notice of the assignment to the assignor's creditors, equityholders, and other parties in interest as set forth on the list provided by the assignor ...

But here we are talking about a type of business liquidation process in the United States known as an Assignment for the Benefit of Creditors ("ABC"). An ABC is governed by state law and has long been viewed as an alternative to a liquidation under Chapter 7 of the US Bankruptcy Code.

California Code, Civil Code - CIV § 1954.05. In any general assignment for the benefit of creditors, as defined in Section 493.010 of the Code of Civil Procedure, the assignee shall have the right to occupy, for a period of up to 90 days after the date of the assignment, any business premises held under a lease by the assignor upon payment ...

Assignment for the benefit of the creditors (ABC)(also known as general assignment for the benefit of the creditors) is a voluntary alternative to formal bankruptcy proceedings that transfers all of the assets from a debtor to a trust for liquidating and distributing its assets. The trustee will manage the assets to pay off debt to creditors, and if any assets are left over, they will be ...

a petition asking the court to approve the ABC and assignee. a copy of the assignment agreement. a list (or "schedule") of assets. a list of creditors and what is owed to each, and. an attestation verifying that the list of assets and creditors are accurate. Typically, the assignee will file this paperwork for you.

1. Upon acceptance of the assignment, the assignee gives notice of the assignment to creditors; 2. Creditors are provided with a reasonable period of time to file proofs of claim with the assignee and therefore to be included in the pool of creditors who can share in the proceeds of the liquidation of the business' assets; 3.

The White House announced it was working with Congress to make Kenya the first country in Africa to benefit from funding through the CHIPS and Science Act, a 2022 law that aims to reinvigorate the ...