Cybersecurity in Banking: Importance, Threats, Challenges

Home Blog Security Cybersecurity in Banking: Importance, Threats, Challenges

As we transition to a digital economy, cybersecurity in banking is becoming a serious concern. Utilizing methods and procedures created to safeguard the data is essential for a successful digital revolution. The effectiveness of cybersecurity in banks influences the safety of our Personally Identifiable Information (PII), whether it be an unintentional breach or a well-planned cyberattack.

The stakes are high in the banking and financial industry since substantial financial sums are at risk and the potential for significant economic upheaval if banks and other financial systems are compromised. With an exponential increase in financial cybersecurity, there is high demand for the profession of cybersecurity. Take a look at the best Security certifications .

What is Cybersecurity in Banking?

The arrangement of technologies, protocols, and methods referred to as "cybersecurity" is meant to guard against attacks, damage, malware, viruses, hacking, data theft, and unauthorized access to networks, devices, programs, and data.

Protecting the user's assets is the primary goal of cyber security in banking. As more people become cashless, additional acts or transactions go online. People conduct transactions using digital payment methods like debit and credit cards, which must be protected by cybersecurity.

.jpg&w=3840&q=75)

Current State of Cybersecurity in Banks

The market for IT security in banking has maintained its rapid growth in 2024. Since financial institutions are primary attack targets, investments in protection continue to scale. The market value reached $38.72 billion in 2021 , and projections see a compound growth rate of 22.4% and a value of $195.5 billion by 2029.

Between June 2018 and March 2022, Indian banks reported 248 successful data breaches by hackers and criminals; the government notified Parliament on Aug 2, 2022.

The Indian government has reported 11,60,000 cyber-attacks in 2022. It is estimated to be three times more than in 2019. India has been the target of serious cyberattacks, such as the phishing attempt that nearly resulted in a $171 million fraudulent transaction in 2016 against the Union Bank of India.

Another instance of a cyberattack involving online banking was Union Bank of India, resulting in a substantial loss. One of the officials fell for the phishing email and clicked on a dubious link, which allowed the malware to hack the system. The attackers entered the system using fake RBI IDs.

Banks have been mandated to strengthen their IT risk governance framework, which includes a mandate for their Chief Information Security Officer to play a proactive role in addition to the Board and the Board's IT committee playing a proactive role in ensuring compliance with the necessary standards.

Reasons Why Cybersecurity is Important in Banking

The banking industry has prioritized cybersecurity highly. Building credibility and trust is the cornerstone of banking, so it becomes much more essential. Here are five factors that demonstrate the significance of cybersecurity in banking industry and why you should care:

- Everyone looks to be entirely cashless and using digital payment methods like debit and credit cards. In this case, ensuring that the required cybersecurity safeguards are in place to protect your privacy and data is critical.

- After data breaches, it could be difficult to trust financial institutions. That's a significant issue for banks. Data breaches caused by a shoddy cybersecurity solution may easily lead to their consumer base moving their business elsewhere.

- The majority of the time, when a bank's data is compromised, you lose time and money. Recovery from the same can be unpleasant and time-consuming. It would entail canceling cards, reviewing statements, and keeping a watchful lookout for issues.

- Inappropriate use of your private information might be very harmful. Your data is sensitive and could expose a lot of information that could be exploited against you, even if the cards are revoked and fraud is swiftly dealt with.

- Banks need to be more cautious than most other firms. That is the price for banks to retain the kind of valuable personal data they do. If the bank's information is not safeguarded against risks from cybercrime, it could be compromised.

.jpg&w=3840&q=75)

Top Cybersecurity Threats Faced by Banks

Cybercrimes have increased frequently over the past several years to the point where it is thought that they are one of the most significant hazards to the financial sector. Hackers have improved their technology and expertise, making it difficult for any banking sector to thwart the attack consistently. The following are some dangers to banks' cybersecurity:

1. Phishing Attacks

One of the most frequent problems with cyber security in banking sector is phishing assaults. They can be used to enter a financial institution's network and conduct a more severe attack like APT, which can have a disastrous effect on those organizations ( Advanced Persistent Threat ). In an APT, a user who is not permitted can access the system and use it while going unnoticed for a long time. Significant financial, data and reputational losses may result from this. According to the survey , phishing assaults on financial institutions peaked in the first quarter of 2021.

The term "Trojan" is used to designate several dangerous tactics hackers use to cheat their way into secure data. Until it is installed on a computer, a Banker Trojan looks like trustworthy software. However, it is a malicious computer application created to access private data processed or kept by online banking systems. This kind of computer program has a backdoor that enables access to a computer from the outside.

Around the globe, there were roughly 54,000 installation packages for mobile banking trojans in the first quarter of 2022. There has been an increase of more than 53% compared to last year's quarter. After declining for the first three quarters of 2021, the number of trojan packages targeting mobile banking increased in the fourth quarter.

3. Ransomware

A cyber threat known as ransomware encrypts important data and prevents owners from accessing it until they pay a high cost or ransom. Since 90% of banking institutions have faced ransomware in the past year, it poses a severe threat to them.

In addition to posing a threat to financial cybersecurity, ransomware also affects cryptocurrency. Due to their decentralized structure, cryptocurrencies allow fraudsters to break into trading systems and steal money.

4. Spoofing

Hackers use a clone site in this type of cyberattack. By posing as a financial website, they;

- Design a layout that resembles the original one in both appearance and functionality.

- Establish a domain with a modest modification in spelling or domain extension.

The user can access this duplicate website via a third-party messaging service, such as text or email. Hackers can access a user's login information when the person is not paying attention. Seamless multi-factor authentication can solve a lot of these issues.

The Reserve Bank of India (RBI) reported bank frauds of 604 billion Indian rupees in 2022. From more than 1.3 trillion rupees in 2021, this was a decline.

Applications of Cybersecurity in Banking

Cybersecurity threats are constantly evolving, and the banking sector must take action to protect itself. Hackers adapt when new defenses threaten more recent attacks by developing tools and strategies to compromise security. The financial cybersecurity system is only as strong as its weakest link. It is critical to have a selection of cybersecurity tools and approaches available to protect your data and systems. Here are a few crucial cybersecurity tools:

1. Network Security Surveillance

Network monitoring is known as continuously scanning a network for signs of dangerous or intrusive behavior. It is frequently utilized with other security solutions like firewalls, antivirus software, and IDS (Intrusion Detection System). The software allows for either manual or automatic network security monitoring.

2. Software Security

Application security safeguards applications that are essential to business operations. It has features like an application allowing listing and code signing and could help you synchronize your security policies with file-sharing permissions and multi-factor authentication. The use of AI in cybersecurity will inevitably improve software security.

3. Risk Management

Financial cybersecurity includes risk management, data integrity, security awareness training, and risk analysis. Essential elements of risk management include risk evaluation and the prevention of harm from those risks. Data security also addresses the security of sensitive information.

4. Protecting Critical Systems

Wide-area network connections help avoid attacks on massive systems. It upholds the rigid safety standards set by the industry for users to follow when taking cybersecurity steps to protect their devices. It continuously monitors all programs and performs security checks on users, servers, and the network.

How to Make Banking Institutions Cyber Secure?

Security ratings are a great approach to indicate that you're concerned about the organization's cybersecurity. Still, you must also demonstrate that you're following industry and regulatory best practices for IT security and making long-term decisions based on that knowledge. A cybersecurity framework may be beneficial. You can go for Ethical Hacking training to enhance your knowledge further.

Top Cybersecurity Framework for Banks

A cybersecurity framework provides a common language and set of standards for security leaders across countries and industries to understand their security postures and those of their vendors. With a framework, it becomes easier to define the processes and procedures your organization must take to assess, monitor, and mitigate cybersecurity risk.

Let us take a look at some common financial cybersecurity frameworks:

1. NIST Cybersecurity Framework

The former president's executive order, Improving Critical Infrastructure Cybersecurity, asked for increased cooperation between the public and private sectors for recognizing, analyzing, and managing cyber risk. In response, the NIST Cybersecurity Framework was created. NIST has emerged as the gold standard for evaluating cybersecurity maturity, detecting security weaknesses, and adhering to cybersecurity legislation even when compliance is optional. To achieve NIST compliance , organizations can follow the guidelines outlined in the NIST Cybersecurity Framework and undergo rigorous assessments to ensure they meet the necessary standards.

2. The Bank of England's CBEST Vulnerability Testing Framework

CBEST vulnerability testing methodology was developed by the UK Financial Authorities in collaboration with CREST (the Council for Registered Ethical Security Testers) and Digital Shadows. It is an intelligence-led testing framework. CBEST's official debut took place on June 10, 2013.

CBEST leverages intelligence from reputable commercial and government sources to find possible attackers for a specific financial institution. Then, it imitates these potential attackers' methods to see how successfully they can breach the institution's Defenses. This enables a company to identify the weak points in its system and create and implement corrective action plans.

3. Cybersecurity and Privacy Framework for Privately Held Information Systems (the CIPHER Framework)

Computer systems that organizations, both public and private, control and that hold personal data gathered from their clients are referred to as PHISs (Privately Held Information Systems).

CIPHER framework addresses electronic systems, digital information kinds, and methods for data sharing, processing, and upkeep (not paper documents).

The CIPHER methodological framework's primary goal is to suggest procedures and best practices for protecting privately held information systems online (PHIS). The following are the main features of CIPHER methodological framework:

- Technology independence (versatility) refers to the ability to be used by any organization functioning in any field, even as existing technologies deteriorate or are replaced by newer ones.

- PHIS owners, developers, and citizens are the three primary users who focus on this user-centric approach.

- Practicality - outlines possible precautions and controls to improve or verify whether the organization is safeguarding data from online dangers.

- It is simple to use and doesn't require specialized knowledge from businesses or individuals.

Challenges in Implementing Cybersecurity in Banking

Some contributing elements have presented a significant challenge to digital cybersecurity in banking. The following are some of these:

- Lack of Knowledge: The general public's understanding of cybersecurity has been relatively low, and few businesses have significantly invested in raising that awareness.

- Budgets That are Too Small and Poor Management: Due to the low priority given to cybersecurity, it frequently receives short budgetary shrift. Cybersecurity continues to receive little attention from top management, and programs that assist it are accorded low priority. They might have underestimated how serious these risks are, which is why.

- Identities and Access are Poorly Managed: The core component of cybersecurity has always been identity and access management, especially now when hackers are in control and might access a business network with just one compromised login. Although there has been a little progress in this area, much work still needs to be done.

- Increase in Ransomware: Recent computer attacks have brought our attention to the growing threat of ransomware. Cybercriminals are beginning to employ various techniques to avoid being identified by endpoint protection code that concentrates on executable files.

- Smartphones and Apps: The majority of banking organizations now conduct business primarily through mobile devices. Every day the base grows, making it the best option for exploiters. Due to increased mobile phone transactions, mobile phones have become a desirable target for hackers.

- Social Media: Hackers have increased their exploitation as a result of social media adoption. Customers that are less knowledgeable expose their data to the public, which the attackers abuse.

Cybersecurity in Banking Sector as a Career

The banking sector is a prime target for cyber-attacks due to the sensitive financial data it handles. As digital transformation continues to reshape banking, the need for strict cybersecurity measures grows.

This demand has created numerous career opportunities for cybersecurity professionals within the banking industry. According to the Bureau of Labor Statistics, the employment of information security analysts is projected to grow 33% from 2020 to 2030, much faster than the average for all occupations.

The table below explores the job outlook for cybersecurity roles in the banking sector, highlighting key responsibilities, skills, and average salary.

|

|

|

|

Security Analyst | Monitors networks for breaches, installs security software, conducts penetration testing | Firewalls, VPNs, IDS knowledge, strong analytical skills | $151,476 (Source: Glassdoor) |

Cybersecurity Manager | Develops security policies, manages teams, oversees incident response plans, ensures compliance | Leadership abilities, deep cybersecurity understanding, risk management experience, banking regulations knowledge | $1,78,814 (Source: Salary.com) |

Network Security Engineer | Designs secure network solutions, monitors network traffic, ensures network availability | Network protocol proficiency, network security tools experience, strong problem-solving skills | $116,934 (Source: Indeed) |

Security Architect | Designs security architectures, assesses new security technologies, develops security standards | Extensive IT security experience, strong security framework knowledge, scalable security solution design | $2,23,172 (Source: Glassdoor) |

Compliance & Regulatory Analyst | Ensures compliance with regulations, conducts audits, manages compliance documentation | Regulatory requirements understanding, compliance audit experience, legal & technical document interpretation | $94,873 (Source: Salary.com) |

Fraud Analyst | Monitors transactions for fraud, analyzes data for suspicious patterns, collaborates with law enforcement | Strong analytical skills, data analysis tools familiarity, fraud detection techniques knowledge | $61,513 (Source: Bing.com) |

Incident Responder | Responds to security incidents, conducts forensic investigations, develops incident response strategies | Incident management experience, digital forensics knowledge, ability to work under pressure | $116,028 (Source: Bing.com) |

Looking to boost your ITIL knowledge? Join our unique online ITIL Foundation course ! Gain valuable insights and skills to excel in the IT industry. Enroll now and enhance your career prospects. Don't miss out!

Every organization is concerned about cyber security. It is crucial for banks to have the proper cyber security solutions and procedures in place, especially for institutions that store a lot of personal data and transaction lists. Banking cyber security is an issue that cannot be bargained with. Hackers are more likely to target the banking sector as digitalization advances.

KnowledgeHut is a platform that provides hundreds of courses in Data Science, Machine Learning, DevOps, Cybersecurity, Full Stack Development, and People and Process Certifications. With KnowledgeHut top Cybersecurity certifications , you can increase your knowledge about cybersecurity in the banking industry and get the proper training.

Frequently Asked Questions (FAQs)

The goal of cybersecurity in the banking sector is to protect consumer assets. The bank should also take action to thwart the hackers. The number of financial-related acts is growing as more individuals work.

Through fraudulent transactions, cyberattacks can result in significant financial losses for the customer and the banks. Attackers who steal sensitive data from a banking institution may sell it. Data that has been stolen is later misused.

Antivirus software is typically used on bank computers, firewalls, fraud detection, and website encryption, which encrypts data so that only the intended receiver can read it. Your financial institution likely implements these security precautions if you bank online.

Vitesh Sharma

Vitesh Sharma, a distinguished Cyber Security expert with a wealth of experience exceeding 6 years in the Telecom & Networking Industry. Armed with a CCIE and CISA certification, Vitesh possesses expertise in MPLS, Wi-Fi Planning & Designing, High Availability, QoS, IPv6, and IP KPIs. With a robust background in evaluating and optimizing MPLS security for telecom giants, Vitesh has been instrumental in driving large service provider engagements, emphasizing planning, designing, assessment, and optimization. His experience spans prestigious organizations like Barclays, Protiviti, EY, PwC India, Tata Consultancy Services, and more. With a unique blend of technical prowess and management acumen, Vitesh remains at the forefront of ensuring secure and efficient networking solutions, solidifying his position as a notable figure in the cybersecurity landscape.

Avail your free 1:1 mentorship session.

Something went wrong

Upcoming Cyber Security Batches & Dates

| Name | Date | Fee | Know more |

|---|

Impact of Cyber Crime on Internet Banking Essay

- To find inspiration for your paper and overcome writer’s block

- As a source of information (ensure proper referencing)

- As a template for you assignment

Introduction

Digital banking has enabled unrestricted and secure access to accounts anytime, anywhere for customers on their computers, tablets, and smartphones. Customers can now make simple and secure transactions, including checking account balances or getting statements online from the convenience of their gadgets. However, the rise of online banking has brought unintended consequences such as identity theft, credit card fraud, spamming, phishing, and other related cybercrimes. The paper evaluates a con article on ‘The impact of cybercrime on e-banking.’ It analyzes and discusses cyber threats’ impact on online banking and the need to improve security measures.

The study by Chevers seeks to propose a research model that evaluates cybercrime in e-banking to inform future imperial research on the context. It mainly focuses on business-to-consumer (B2C) e-commerce, with particular attention to electronic banking. Electronic banking or e-backing is the use of the internet as a remote delivery channel for banking services via the internet. E-banking is the main mode of transactions for most online business transactions, such as online flight booking, e-commerce purchases, and banking. Nevertheless, users do not fully trust online banking for fear of losing personal information or becoming victims of cybercriminals.

According to the study, people aged 60 years and above suffer the most losses, with 55,043 reported cases, losing a total of $339,474,918. Generally, people have little confidence in the technology despite the security improvements of digital banking and trust services. Other research has also evaluated the awareness and habits of digital banking users and established they lack knowledge of the possible attacks on these digital platforms. Therefore, losses attributed to cybercrime in e-banking are expected to rise as more people gain access to computers and the internet.

Based on Chevers’s literature review, common cybercrime risks and threats include work-at-home frauds, web cloning or online lottery, loan scams, hacking, identity theft, phishing, and retail-based fraud schemes. However, the study focuses on phishing, identity theft, and hacking because they mainly affect financial institutions like insurance companies, banks, and credit unions.

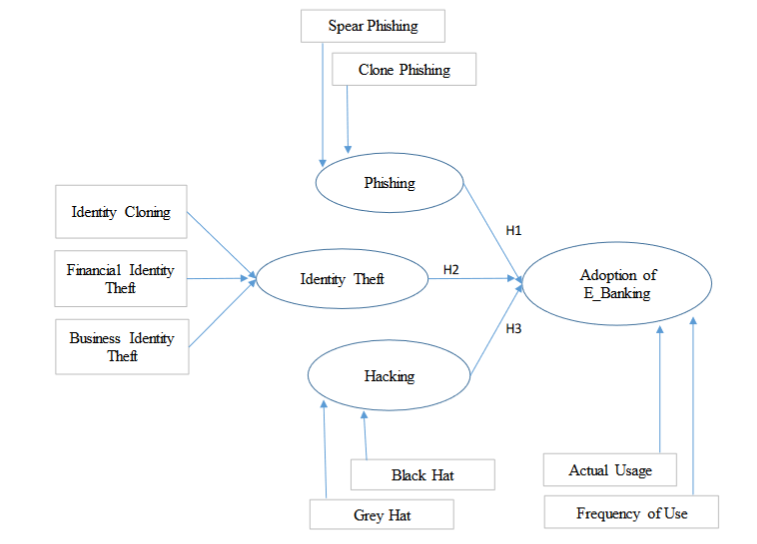

Therefore, the author modeled his research technology acceptance model to combat identity theft, hacking, and phishing. The resulting research model comprises three independent variables (identity theft, hacking, and phishing) and one dependent variable (e-banking), as shown in figure 1.

The study aims to conduct quantitative research requiring a survey to test three hypotheses. The hypothesis includes:

- H1: Phishing will have a negative impact on the adoption of electronic banking.

- H2: Identity theft will have a negative impact on the adoption of electronic banking.

- H3: Hacking will have a negative impact on the adoption of electronic banking.

The study is yet to validate the hypotheses. In the end, the author shall publish the findings on which cybercrime has the greatest impact on e-banking.

Critique of the Paper

Based on the topic and analysis of the content, one would expect the author to develop a model that would be used to test the hypothesis. It is possible to conclude the author is trying to draw attention to elements of modern threats to e-banking rather than proposing a model. Furthermore, the author needed to provide an abstract description of the research model, including how it will use the variables to produce outcomes. For instance, it would help if the author provided details on how the model in figure 1 works.

The paper gives a big picture of e-banking security threats and presents a complete view of the security landscape. More broadly, it draws readers’ attention to the fact that e-banking should be an end-to-end solution. By investigating cybercrime in e-banking from a user perspective through a survey, the author’s effort has resulted in the need to address issues associated with contemporary digital and mobile banking. For instance, the elderly are at risk of cybercrime involving identity theft, hacking, or phishing due to limited knowledge.

Besides, there is a need to define a new set of evaluation criteria for the complete assessment of e-banking security. Banks, e-commerce, and other businesses that accept online transactions also need to embark on extensive campaigns to sensitize their customers and raise general awareness on security issues on e-banking platforms.

E-banking has become an essential part of the banking system and a popular mode of transaction for most people. However, customers must keep vigilant to protect their accounts from cybercriminals. The study users three independent variables (identity theft, hacking, and phishing) and one independent variable (e-banking) to develop a research model for future researchers. However, the study had shortcomings, such as insufficient details on the model and the unclear goal of the research.

Nonetheless, the study raises critical concerns about the need to reevaluate the security of e-banking from the users’ perspective. The statistics suggesting the elderly have become the main victims of cyber criminals on e-banking platforms indicate the need to raise awareness for the users. Besides, the paper provides a basis for future research on the issues with contemporary digital and mobile banking.

D. Chevers, “The impact of cybercrime on e-banking: A proposed,” in International Conference on Information Resources Management (CONF-IRM) , 2019.

W. Wodo, D. Stygar and P. Błaskiewicz, “Security Issues of Electronic and Mobile Banking,” in Proceedings of the 18th International Conference on Security and Cryptography (SECRYPT 2021) , 2021. 10.5220/0010466606310638.

- Identification of Identity Theft and Prevention Techniques

- Digital Forensic Analysis of Fitbit

- Methodology & Data Collection Tools: Commercial Bank of Qatar

- Description and Countering to Phishing

- Phishing as Type of Cybercrime

- Cybersecurity Contingency & Incident Review Process

- Forensic Accounting and Cyber Security

- Information Security Awareness

- Global Cybersecurity in the 21st Century

- The Cybercrime Impact on People and Business

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2023, August 16). Impact of Cyber Crime on Internet Banking. https://ivypanda.com/essays/impact-of-cyber-crime-on-internet-banking/

"Impact of Cyber Crime on Internet Banking." IvyPanda , 16 Aug. 2023, ivypanda.com/essays/impact-of-cyber-crime-on-internet-banking/.

IvyPanda . (2023) 'Impact of Cyber Crime on Internet Banking'. 16 August.

IvyPanda . 2023. "Impact of Cyber Crime on Internet Banking." August 16, 2023. https://ivypanda.com/essays/impact-of-cyber-crime-on-internet-banking/.

1. IvyPanda . "Impact of Cyber Crime on Internet Banking." August 16, 2023. https://ivypanda.com/essays/impact-of-cyber-crime-on-internet-banking/.

Bibliography

IvyPanda . "Impact of Cyber Crime on Internet Banking." August 16, 2023. https://ivypanda.com/essays/impact-of-cyber-crime-on-internet-banking/.

IvyPanda uses cookies and similar technologies to enhance your experience, enabling functionalities such as:

- Basic site functions

- Ensuring secure, safe transactions

- Secure account login

- Remembering account, browser, and regional preferences

- Remembering privacy and security settings

- Analyzing site traffic and usage

- Personalized search, content, and recommendations

- Displaying relevant, targeted ads on and off IvyPanda

Please refer to IvyPanda's Cookies Policy and Privacy Policy for detailed information.

Certain technologies we use are essential for critical functions such as security and site integrity, account authentication, security and privacy preferences, internal site usage and maintenance data, and ensuring the site operates correctly for browsing and transactions.

Cookies and similar technologies are used to enhance your experience by:

- Remembering general and regional preferences

- Personalizing content, search, recommendations, and offers

Some functions, such as personalized recommendations, account preferences, or localization, may not work correctly without these technologies. For more details, please refer to IvyPanda's Cookies Policy .

To enable personalized advertising (such as interest-based ads), we may share your data with our marketing and advertising partners using cookies and other technologies. These partners may have their own information collected about you. Turning off the personalized advertising setting won't stop you from seeing IvyPanda ads, but it may make the ads you see less relevant or more repetitive.

Personalized advertising may be considered a "sale" or "sharing" of the information under California and other state privacy laws, and you may have the right to opt out. Turning off personalized advertising allows you to exercise your right to opt out. Learn more in IvyPanda's Cookies Policy and Privacy Policy .

- Buyer's Guide

- Connect on LinkedIn

- Security Executives

- Integrators

- Video Surveillance

- Access & Identity

- Cybersecurity

- Perimeter Security

- Alarms & Monitoring

- Residential Tech

- Information Security

The state of security in digital banking

Digital banking is skyrocketing in the U.S. as more than three-quarters of the population (around 200 million users) manage their finances from a computer or a phone. And with the rise in ubiquitous online banking comes new security risks that must be acknowledged and addressed. In fact, the US alone saw over 1800 significant data breaches that were publicly reported in 2021, emphasizing how vulnerable users are to security risks.

Quantum Metric’s recent retail banking survey reinforces the need for improved cybersecurity, finding that 31% of banking consumers have recently dealt with data security issues - either by having their account hacked, or their credentials were stolen. While hackers are becoming more advanced online, there are a number of precautions that both consumers and banks can implement to better protect accounts and other sensitive information.

The evolution of digital payments is changing how we manage our finances, sparking new demands for heightened security.

With private banking information now accessible online, banks and consumers must heighten cybersecurity to ensure their sensitive data is not compromised. Without proper precautions, bank accounts and other private information can fall into the hands of hackers relatively easily. This is why it’s important for consumers to comprehend the do’s and don’ts of digital banking, especially as adoption grows.

Before setting up an online bank account, users must understand that securing their identity and digital accounts is paramount. If a person is only relying on a simple username and password to access their funds, it’s possible for a hacker to guess or compromise this information and transfer money out of their account. While this may seem obvious to some consumers, others – especially older generations – are new to online banking and may not know the best ways to protect themselves. In fact, many people over the age of 60 said that they used digital banking for the first time during the pandemic.

Banks are helping by embedding security precautions into the online experience – better protecting accounts, customers and themselves.

While digital banking transactions can expose consumers to cyber risks, it’s a form of banking that isn't going anywhere. To help users safely transition, financial institutions should educate customers on how to securely use digital banking platforms and encourage them to set up features such as multi-factor authentication, SMS or email alerts, and fraud monitoring to prevent suspicious online banking activity.

Internet websites are constantly being breached, and entire password databases are being bought and sold on the underground market. And today's hackers are well-versed in testing stolen credentials to log into as many sensitive websites as possible, including online banking. As a result, consumers can no longer solely rely on a username and password for protection. When a user sets up multi-factor authentication on their online bank account, any logins or suspicious activity would need to be authorized with a second factor, such as a text message, FaceID or email verification code. Multi-factor authentication is especially important, as many people still reuse the same login credentials across multiple websites, instead of making unique passwords for their various online accounts.

In addition to added authentication, users can take advantage of security alerts, which allow banks to immediately notify the customer, via text or email, whenever a significant banking event or a deviation from someone’s normal banking activities occurs. This includes situations like a new device logging into an account, a money transfer over a specified amount, or bank balances dropping below a certain threshold.

All of these measures help enforce that an authorized person is actually logging in from their own device, and to their own account. With a combination of security alerts, multi-factor authentication and caution, even if a user’s credentials were stolen or guessed, the hacker would have an extraordinarily difficult time committing serious fraud against the bank account.

In addition to providing their customers with the right security tools, banks can also utilize a digital analytics platform to better understand their customers' online banking experience and identify specific pain points customers face when trying to set up security controls on their profile - whether due to technical errors or confusing user experience (UX) designs. Once banks identify what’s preventing customers from properly setting up their security controls, they can design the most user-friendly experience that encourages customers to intuitively turn on valuable security features. Moreover, if customers have any setup roadblocks that drive them to back out of turning these features on, banks can pinpoint exactly where that occurred, so they can revise the process and flow, and help future consumers seamlessly finish the setup process.

Banks can’t stop vulnerabilities alone – consumers must also adopt better cyber hygiene practices

While banks have deployed measures to keep their users’ accounts secure, consumers play an important role, too. Digital banking users must practice proper cyber hygiene and take advantage of enhanced security features that guard their accounts.

Cyber hygiene keeps accounts safe, but many Americans don’t practice it or don’t understand what it means. For example, nearly one in three (30%) of respondents who use a password only change it once or twice a year, with an additional 23% admitting to never changing their password. Unfortunately, many people just don’t realize how easily a fraudster can trick an everyday user into revealing their bank account details. The consequences of this could be detrimental: their accounts could be hijacked, their identities stolen, or their bank accounts completely drained. And to make matters worse, some of these actions can take many years to remediate.

The good news is that once consumers understand the serious implications, proper cyber hygiene is easy to practice. To greatly reduce the risks of a bank account getting hacked, consumers can take simple steps like ensuring only trusted, genuine mobile apps are installed from the official App Store, as well as setting up a strong PIN, TouchID and FaceID to protect their mobile devices. They must also be hyper-vigilant around unsolicited calls, texts and emails from their bank, or any entity for that matter. If online banking users make more of an effort to incorporate these steps into their everyday life, they will dramatically increase account protection.

We already addressed how most banks allow customers to set up monitoring and security alerts in their profiles, but the problem is that many consumers don’t take advantage of these features. By enrolling in alerts, consumers can take real-time action against potential hacks, as well as keep a closer eye on their financial activity. Considering two in five consumers (41%) check their bank accounts almost once a day, this makes it more likely for users to spot fraudulent activity in real-time.

Banks usually offer invaluable information on best practices for cybersecurity on their website. For those looking for extra cybersecurity knowledge and tips, educational resources provide information on steps to protect themselves from hacks and breaches. Trusted education technology platforms offer a variety of courses on cybersecurity that use layman's terms to describe all the ways one can be socially engineered on the Internet, as well as the best cyber hygiene practices.

No matter your age, financial history or experience with digital banking, every user should be working in tandem with their bank to be sure that their account is as protected as possible. When both sides are making a meaningful effort to take extra precautions, hackers will be stopped in their tracks from accessing sensitive financial information.

.ebm-content-item .title-wrapper .title-text-wrapper .title-text.items-with-images { font-size: 16px; @container (width > calc(400px + 145px)) { font-size: 22px; } @container (width > calc(600px + 145px)) { font-size: 24px; } @container (width > calc(750px + 145px)) { font-size: 26px; } } Edentify and Innerwall Bring New Security Tool to Online Banking

.ebm-content-item .title-wrapper .title-text-wrapper .title-text.items-with-images { font-size: 16px; @container (width > calc(400px + 145px)) { font-size: 22px; } @container (width > calc(600px + 145px)) { font-size: 24px; } @container (width > calc(750px + 145px)) { font-size: 26px; } } fifth third bank implements enterprise digital video, .ebm-content-item .title-wrapper .title-text-wrapper .title-text.items-with-images { font-size: 16px; @container (width > calc(400px + 145px)) { font-size: 22px; } @container (width > calc(600px + 145px)) { font-size: 24px; } @container (width > calc(750px + 145px)) { font-size: 26px; } } hacker scare at internet bank, latest in information security.

Firewalla Gold Pro for Wi-Fi 7

AI is a Critical Learning Experience

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

On The Online Banking Security

Online banking (Internet banking) is a set of services and technologies allowing managing financial transactions (such as money transfers, tracking accounts, viewing credit card activity and etc.) on a secure website. The main goal is to provide simple way for customers to access accounts through the Internet using web-based systems. Currently online banking has become a hot topic in the modern in banking and financial management e.g. "close to 40% of U.S. households do some banking online". The main question for the customers of online banking is how safe is it? Is it really so secure to make financial transactions via unsecure public networks as in the bank office? What are the main threats and dangers for such systems? In this work we try to answer these questions. The main goal is to analyze and audit security mechanisms of online banking and check how strong they are. We start with reviewing and classification of the existing software for online banking. The common an...

Related Papers

International Journal of Innovative Research in Science, Engineering and Technology

ajer research

Abstract: This research, Securing Online Banking Services in an Insecure Environment sought to address security problems resulting from account credentials theft and all other forms of malicious activities surrounding online banking transactions. A new system implemented using JavaScript for securing online banking transaction has been provided in this research with the aim of increasing security over the existing models. The new system enables the customers and banks to authenticate each other and sign processed transactions online. From the results, the new framework also solves the issues of authentication, confidentiality, integrity and non-repudiation, using an integrated three-tier, trusted and secure channel. In addition to the creation of a secure channel between client’s computers and the bank’s server, a secure algorithm, challenge-Respond security algorithm that would be suitable for clients’ side security (web browser) was implemented. Thus, the secure three-tier transaction model was recommended for banking services as it was found to be suitable for building client trusts.

Dr.Godwin Onochie

Online banking has given us almost everything we asked for as far as banking is concerned, and is still being revolutionized to offer more simplicity in our everyday banking experience. While the internet offers enormous advantages and opportunities, it also presents various security risks. With this in mind, banks take extensive steps to protect its customers and also information transmitted and processed when carrying out banking online. This includes, for example, ensuring that confidential data sent over the internet cannot be accessed or modified by unauthorized third parties. But the banks normally have no influence over the system used by their customers. The choice is entirely up to them. Moreover, the system selected – a personal computer (PC) connected to the internet, for example-will usually be used for a number of other applications as well. The systems used by online banking customers are therefore exposed to risks beyond the banks control. For this reason, the banks cannot assume liability for them. This paper will look into the main security challenges faced by Banks and its customers and in furtherance to that proffer solutions based on the data collected.

Mukta Sharma

Innovation is doing new things, which leads to change. With the growth in information technology, the world has revolutionized. It has actually changed the way of communication, of doing business, of transacting and even of thinking. The impact of information technology especially internet is visible everywhere in almost all domains like hospitality, education, banking, etc. Banking sector has diversely grown. It has been offering various services to the customers. In this paper we will see how much banks and the customers are comfortable using the Internet banking, what kind of services are being offered by various banks, why people were and are rigid, hesitant and reluctant to accept e-banking, what factors and initiative banks should take to bring customers towards e-banking . This paper presents a systematic review of more than 60 research papers which will start from the basic benefits for adopting internet banking, to the issues involved in the same specifically related to the security. To make a decision on the usage of internet banking the most imperative aspect is security. There are various security threats and there are multiple researches going on for providing a better security measure.

Abhineet Anand

International Journal Of Engineering And Computer Science

International Journal of Engineering Research and Technology (IJERT)

IJERT Journal

https://www.ijert.org/security-patches-against-the-loopholes-in-internet-banking https://www.ijert.org/research/security-patches-against-the-loopholes-in-internet-banking-IJERTV3IS052074.pdf The Banking industry is undergoing a major transition after the Introduction of internet banking services. The products & services are available for the customers, just a click away from them, through the internet and communication technology. In the middle of these sophisticated facilities there a lot of security and privacy concerns to be tackled by the banker in order to have an effective and convenient transaction management system. One of the added advantages of internet banking is remote accessing is possible for almost all types of transactions with a faster result. There is an increase in number of loop holes occurs due to diversification of hardware and software used in internet transaction to avail the product and services in Internet banking. There should be an appropriate strategy to deal with this situation. An appropriate authentication mechanism and a cryptosystem can be the most favored technology for increasing the security and reducing the vulnerabilities in internet banking.

Mogos Gabriela

Received Mar 10, 2020 Revised May 11, 2020 Accepted May 25, 2020 Online banking and other e-banking modes are a very convenient way to banking in terms of speed, convenience and delivery costs, but they have brought many risks alongside them. Online banking has created a new risk orientation and even new forms of risk. Technology plays an important role as both a source and a tool for risk control. The purpose of this research is to identify the security situation of the e-banking application and to analyze the risks and attacks that could occur to the customers that, although it’s an ebanking application attacks could happen. Several mitigations were mentioned to overcome attacks like, access control is to mitigate eavesdropping this means that, restricting access to sensitive data is mandatory. Another way to mitigate is, update and patch which is for SQL injection meaning, it's vital to apply patches and updates when it’s available. These attacks may attack the whole applicat...

International Journal of Engineering and Computer Science

ACM Computing Surveys

danny de cock

A survey was conducted to provide a state of the art of online banking authentication and communications security implementations. Between global regions the applied (single or multifactor) authentication schemes differ greatly, as well as the security of SSL/TLS implementations. Three phases for online banking development are identified. It is predicted that mobile banking will enter a third phase, characterized by the use of standard web technologies to develop mobile banking applications for different platforms. This has the potential to make mobile banking a target for attacks in a similar manner that home banking currently is.

Loading Preview

Sorry, preview is currently unavailable. You can download the paper by clicking the button above.

RELATED PAPERS

Procedia Computer Science

Aisha S Alshamsi

IEEE Access

Petr Hanáček

Building A Secure Internet Banking Environment for the Bank

Nashwan G H A L E B Al-Thobhani

Leau Yu Beng

JOURNAL OF THE UNION OF SCIENTISTS - VARNA, ECONOMIC SCIENCES SERIES

Pavel Petrov

Liana ANICA-POPA

International Journal of Advanced Research in Electronics and Communication Engineering (IJARECE)

Minakshi Tumsare

International Journal of Computer Networks and Applications (IJCNA) - SCOPUS Indexed Journal

Gujarat Technological University

vijayendra gupta

Maitri Shukla

2019 Amity International Conference on Artificial Intelligence (AICAI)

Shaurya Gupta

International journal of innovative research and development

eneji eneji

IJSRP Journal

IJTRA Editor

Alexander Decker

Wireless Personal Communications

Chaimaa BELBERGUI

Cyber Attacks In Bank

ADHARSH MANIVANNAN

IJCSE Editor

Adam Ali.Zare hudaib

Jamaludin Ibrahim

Adrian McCullagh

Aaradhana Deshmukh

iJSRED Journal

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Confirm your address and profile details to support your 2025 renewal process! Please visit MyISACA to access your profile.

Home / Resources / ISACA Journal / Issues / 2022 / Volume 1 / Cybersecurity and Technology Risk in Virtual Banking

Cybersecurity and technology risk in virtual banking.

Managing cybersecurity and technology risk is a major challenge for virtual banks. Although cyberattacks and a lack of system resilience can be detrimental for both traditional and virtual banks, they arguably have a greater impact on the latter. This is because virtual banks offer all their products and services online. The banking application is the only “storefront” for the entire banking service, and all transactions are completed at the customer’s fingertips.

Virtual banks must adopt a fit-for-purpose risk management approach that balances the simplicity and convenience of digital platforms and mobile applications with data protection, cybersecurity controls and a highly resilient IT infrastructure. By promoting trust through the use of the latest technology for IT delivery and cyberdefense, virtual banks can provide innovative, reliable and secure banking experiences to all their customers.

With the benefits of a technology-driven operation and a cloud-native banking model, new customer experiences and financial inclusion can be achieved.

Virtual banks vs. traditional banks.

A virtual bank offers banking services primarily, if not entirely, through digital channels, including the Internet and mobile applications. 1 Virtual banks have a limited physical presence; there are no brick-and-mortar branches, and all banking services are performed online. Depending on location, virtual banks are also known as neobanks or challenger banks. A virtual bank’s business operation is based on the application of financial technology (fintech) and innovation. Technology plays a pivotal role in determining what customers want and how their needs can be met. With the benefits of a technology-driven operation and a cloud-native banking model, new customer experiences and financial inclusion can be achieved. Virtual banks can be considered technology-driven financial services enterprises.

Today, nearly all conventional retail banks offer their customers some kind of digital experience. However, most of these service offerings are fragmented and replicate only a portion of the services available at a physical branch. Conventional retail banks have been successful operating in a traditional manner, mostly with legacy systems and infrastructure. Even among conventional retail banks with strong digital agendas, technology plays only a supporting role in enabling the technical functions required for business operations. At best, these enterprises are the frontrunners of banks operating as technology firms (i.e., banks adopting fintech).

Virtual banks aspire to differ from conventional retail banks that offer online services in several ways:

- Enhanced end-to-end customer experience —Gone are the days of long lines at the local bank branch. With virtual banking, customers enjoy a seamless and efficient banking experience. The initial stage of virtual banking includes simple banking products and services, including fast account opening, competitive interest rates on deposits and attractive lending offers. Technology-driven virtual banks are working on leveraging big data analytics to approve loans more quickly, adopt fast payment systems, integrate with automated platforms to manage money and implement chatbots offering real-time banking experiences 24/7. The goal is to have an all-encompassing platform that is capable of handling the basic necessities in customers’ daily lives—shopping, food, accommodations, transportation, healthcare, insurance, bill payments, wealth management—all at the customers’ fingertips.

- Technology-driven business model —Innovative digital services do more than provide an interface between customers and the bank. The importance of regulatory technology (regtech) in supporting and facilitating the interface between banks and regulators cannot be understated. With the increasing complexity, scope and stringency of regulations around the globe and the growing volume of transactions and data that must be processed, this is the right time to automate compliance. For instance, the enhanced accountopening experience can only benefit by an electronic know-your-customer (eKYC) process, combined with big data analytics and machine learning to complement the fraud and antimoney laundering surveillance process. Virtual banking operations are technology-driven from front to back.

- Agile ways of working —The virtual bank’s operating model has shifted from a process-driven model to an agile way of working. In technology delivery, continuous deployment with small repetitive iterations allows the inclusion of improvements and lessons learned in each agile sprint. This model follows the spirit of innovation— start small, fail fast—and enables the rapid delivery of products and services. Cybersecurity practices also follow the agile way of working, including alignment of the security patching schedule and the review of security configurations. The agile way of working does not stop at technology delivery but encompasses all banking processes such as finance, operations and human resources (HR).

- Promoting financial inclusion —“Financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs— transactions, payments, savings, credit and insurance—delivered in a responsible and sustainable way.” 2 Conventional retail banks achieve financial inclusion through their extensive branch networks, whereas virtual banks do so through their low marginal costs. Virtual banks have lower operating costs; for instance, unlike conventional retail banks, they do not have to pay rent for numerous branches, a cost savings that benefits their customers. Although the initial IT infrastructure for a virtual bank might be costly to set up, the scalability of robust IT systems reduces the incremental costs of attracting new customers. These cost savings can be passed on to customers by offering more attractive interest rates. The virtual bank, therefore, has no incentive to impose minimum account balance requirements or low-balance fees on its customers.

Although the initial IT infrastructure for a virtual bank might be costly to set up, the scalability of robust IT systems reduces the incremental costs of attracting new customers.

Key risk factors faced by virtual banks.

The emergence of virtual banking has changed the way banks operate, and the risk profile of a start-up virtual bank is different from that of an established conventional retail bank. With a heavy reliance on technology in the virtual bank business model, the key nonfinancial risk factors include:

- Information and cybersecurity risk —A new, fully digital bank is a high-profile target for cybercriminals. The many promotional events surrounding the launch of a new virtual bank can increase the likelihood of a cyberattack. For instance, a Chinese-based virtual bank suffered a distributed-denial-of-service (DDoS) attack on the first day of its launch, resulting in a significant delay in service. 3 Data leakage and confidentiality breaches due to unauthorized access or cyberattack may result in legal costs and serious damage to the bank’s reputation. A successful cyberattack is a serious matter for a conventional retail bank, but it can be fatal to the entire virtual banking franchise. To counteract the heightened inherent cyberrisk, an expert cyberdefense team and top-notch cyberdefense tools are required.

- Technology stability and resilience risk —Virtual banks’ reliance on technology increases their exposure to risk resulting from unstable IT systems. They have a broader technology stack to manage, and they use vendors and new technology extensively. This significantly increases their exposure to technology issues and cyberthreats—whether they are introduced by the bank’s systems, people, third parties or third parties’ systems. For instance, a promotional campaign for a virtual bank attracted more than the expected number of customers during the initial phase of the launch, causing system capacity issues 4 Any system instability can lead not only to financial losses, but also to potential reputational damage, and it can attract regulatory scrutiny. In simple terms, virtual banks have more to secure and maintain from a cybersecurity and technology governance perspective.

- Personal conduct risk —Senior management’s buy-in is crucial for a successful cybersecurity program in any organization, let alone a technology-driven virtual bank. Depending on jurisdiction, board members or senior management may be held personally liable for any cyberincidents or data breaches. Innovation is in the DNA of virtual banks, and they usually have high-caliber employees, but it is important to strike a balance between innovation and cyberawareness. Something as simple as clicking on a phishing email or answering a social engineering call can compromise confidential data.

- Regulatory risk —As a fully licensed bank, a virtual bank is expected to comply with all applicable regulations. New business processes and the use of new technologies may introduce compliance gaps where existing regulations have not been revised to keep pace with rapid changes in technology. Many financial regulations are based on principles rather than rules, so it may be unavoidable to discuss and interpret how an existing regulation applies to a new technology. As virtual banking matures, regulations may become more conducive to innovation. For example, in Hong Kong, regulations require all virtual banks to achieve the advanced level of cyberresilience maturity. 5 This is different from conventional banks; they can opt for cybermaturity based on the inherent risk assessment results.

- Third-party risk —Adopting certain vendor products is unavoidable in a technology-driven business operation. Completing the cloud governance and third-party due diligence process can be a daunting task. It is critical to ensure vendors, regardless of their size, adhere to the bank’s level of cybercontrols. Thorough due diligence not only involves reviewing policies and standards, but it also includes onsite review of operations and control evidence. The bank’s legal counsel should also prepare standardized legal terms regarding the information security provisioning of the vendors. There is a certain complexity involved in maintaining continuous oversight of third parties on a large scale, particularly with Software as a Service (SaaS) vendors. However, it is important to remember that even though technology and activities are outsourced in a shared responsibility model, accountability is not outsourced. Accountability continues to rest with the the bank’s board and senior management.

As a fully licensed bank, a virtual bank is expected to comply with all applicable regulations.

How to mitigate risk.

A regulated virtual bank should have a low-risk appetite overall and a zero-risk appetite specifically for any major breaches. To reduce a bank’s risk profile, a holistic risk management approach should be in place, with several components:

- Strong governance —The tone at the top is crucial for risk management. Clear roles and responsibilities and regular engagement with business leaders must be established. The existing risk management framework should be leveraged so that adjustments can be tailored to the virtual banking environment.

- Clear guiding principles —There are two categories of controls: mandatory and desirable. Mandatory controls should never be compromised, including customer confidentiality, protection of customers’ deposits and antimoney laundering. Data encryption, secured configuration, timely patching and a highly resilient system architecture must be in place. This should also be aligned with the risk appetite level set by the board. Whether a control is mandatory or desirable also depends on the product delivery phase. A control requirement may be less stringent in a sandbox environment but mandatory in a real-world production environment. “A regulatory sandbox is a framework set up by a regulator that allows fintech start-ups and other innovators to conduct live experiments in a controlled environment under a regulator’s supervision.” 6 For example, in terms of IT resilience, certain outages would be more acceptable in a sandbox environment.

- Regular risk assessments and control testing — Given the more dynamic business environment of a virtual bank, testing to detect control breaks must be conducted more regularly than in a conventional retail bank. When adopting a risk-based approach, material changes to the IT environment and key controls are subjected to a larger sampling size and more frequent and in-depth reviews, aligning with the agile way of working. Depending on the project stage, different types of risk assessments (e.g., rapid risk review, deep dive, read across) will be invoked. A cybersecurity and technology risk and control library should be established, making reference to internationally recognized frameworks such as COBIT ® and the US National Institute of Standards and Technology (NIST) as the control baseline.

- Remediation monitoring —Close monitoring of remediation status should be in place to close any identified gaps. On the technology side, regular system snapshots, encrypted information transmission, and regular patching and review are crucial to ensure a stable and safe IT environment.

- Risk awareness —Risk management is everyone’s responsibility. Process owners should understand and follow the bank’s risk tolerances. A positive risk culture should be established, with career-related rewards for personnel to ensure individual accountability.

Agile Risk Advisory Framework

To strike a balance between enabling an innovative environment and operating safely, a phased approach that aligns with the agile way of working can be used (figure 1 ). The phased approach includes:

- Brainstorming —Exploratory discussions with a low level of risk oversight to avoid hindering innovation

- Exploration —Moderate risk oversight with risk considerations documented

- Solution design —Tangible discussion involving a preliminary risk review of key controls against the established cybersecurity and technology risk and control baselines

- Continuous delivery —High level of oversight and full risk assessment, including sampling to ensure alignment with the risk appetite for product launch

No new type of risk is introduced by virtual banking. But risk managers must be prepared to manage a different risk profile with a greater focus on technology. Risk can be managed once an appropriate risk appetite has been set, followed by regular risk identification and timely remediation. Making good use of regulatory sandboxes enables a new product or service to be tested in a controlled environment to ensure that any risk factors are discovered and managed.

Traditionally, banks are not very technology savvy. But a virtual bank is different from a conventional retail bank in many ways—from its method of operation to the customer experience it provides. More than a decade after the restructuring imposed by the 2008 financial crisis, the banking industry is now at the growth stage in terms of the adoption of technology. Due to the adoption of virtual banks, cybersecurity and technology risk professionals are facing a changing threat landscape that requires them to adapt their perspectives in evaluating and managing associated risk. The heightened cyber and technology resilience risk profiles require an advanced knowledge of tools, increased awareness and intelligent process integration.

1 Investor and Financial Education Council (IFEC), “What Is a Virtual Bank?” 9 December 2019, https://www.ifec.org.hk/web/en/financial-products/fintech/virtual-bank/what-is-a-virtual-bank.page 2 World Bank, “Financial Inclusion,” 2 October 2018, https://www.worldbank.org/en/topic/financialinclusion/overview 3 “Ping An OneConnect Suffered a Cyber Attack on Its Opening Day,” Hong Kong Economic Journal , 5 October 2020 4 Qichang, C.; “WeLab Bank Suspends 9.8% Hong Kong Dollar Time Deposit Flash Event, Saying More Stress Tests Are Needed,” Hong Kong Economic Times , 10 September 2020, https://wealth.hket.com/article/2749151/WeLab%20Bank%E6%9A%AB%E5%81%9C9.8%E5%8E%98%E6%B8%AF%E5%85%83%E5%AE%9A%E6%9C%9F%E5%AD%98%E6%AC%BE%E5%BF%AB%E9%96%83%E6%B4%BB%E5%8B%95%E3%80%80%E7%A8%B1%E9%9C%80%E9%80%B2%E8%A1%8C%E6%9B%B4%E5%A4%9A%E5%A3%93%E5%8A%9B%E6%B8%AC%E8%A9%A6?lcc=aw 5 Hong Kong Monetary Authority, “Cybersecurity Fortification Initiative 2.0,” 3 November 2020, https://www.hkma.gov.hk/media/eng/doc/key-information/guidelines-and-circular/2020/20201103e1.pdf 6 Consultative Group to Assist the Poor (CGAP), “Regulatory Sandboxes: What Have We Learned So Far?” 1 August 2019, https://www.cgap.org/blog/series/regulatory-sandboxes-what-have-we-learned-so-far

Donald Tse, CISA, CISM, CDPSE, CPA

Has a passion for exploring the balance between innovation and cyber and tech controls and making banking simpler and more intuitive. Tse focuses on virtual banking and is a founding member of Mox Bank, a virtual bank backed by Standard Chartered. He has extensive experience shaping and implementing business and technology risk strategies in investment banks such as Deutsche Bank, Credit Suisse and Nomura on a global and regional scale. As a certified public accountant (CPA) and a cyberprofessional, he offers a multidisciplinary approach to bridging the gaps between banking, cybersecurity and technology risk.

Essay Service Examples Business Banking

Online Banking Security

INTRODUCTION

- Proper editing and formatting

- Free revision, title page, and bibliography

- Flexible prices and money-back guarantee

Definition of Computer Security Risks

Types of security risks, malicious codes, trojan horse, unauthorized access and use, hardware theft, software theft, information theft, definition of security measure, type of security measure, data backup, cryptography, anti-spyware, physical access control, human aspect: awareness, scenario of the problem: online banking security.

Our writers will provide you with an essay sample written from scratch: any topic, any deadline, any instructions.

Cite this paper

Related essay topics.

Get your paper done in as fast as 3 hours, 24/7.

Related articles

Most popular essays

Online Banking is one of the major financial activities which will be carried out by any person...

With the invention of the Internet, the rise of technology and bring your own devices, it has...

The World Bank is an international organization that has the largest sources of development...

Money is any item or verifiable record that is generally accepted as payment of goods and services...

- Advantages of Technology

- Disadvantages of Technology

The world is changing at very high rate because of the advancement of technologies. Technologies...

Ethics is a meaning that can change from one person to another. What could be ethic for one...

Banking can be characterized as the business movement of tolerating and defending cash possessed...

- Intelligence

As global technology has evolved over the years, we have moved from Landline phone to Mobile,...

- Indian Economy

Banking as an industry processes cash, credit, and other financial transactions. Banks provide a...

Join our 150k of happy users

- Get original paper written according to your instructions

- Save time for what matters most

Fair Use Policy

EduBirdie considers academic integrity to be the essential part of the learning process and does not support any violation of the academic standards. Should you have any questions regarding our Fair Use Policy or become aware of any violations, please do not hesitate to contact us via [email protected].

We are here 24/7 to write your paper in as fast as 3 hours.

Provide your email, and we'll send you this sample!

By providing your email, you agree to our Terms & Conditions and Privacy Policy .

Say goodbye to copy-pasting!

Get custom-crafted papers for you.

Enter your email, and we'll promptly send you the full essay. No need to copy piece by piece. It's in your inbox!

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

Online Banking Security: How To Protect Your Online Banking Information

Fact Checked

Updated: Apr 19, 2023, 11:55am

Digital banking (online and mobile banking) makes managing finances easy. With digital banking technology, you can pay bills, deposit checks and transfer money from wherever you’re located. Due largely to their convenience, online and mobile banking are the two most popular ways to bank. More than three-quarters of Americans (78%) prefer to bank digitally, according to a March 2022 Ipsos-Forbes Advisor survey.

But how secure are online and mobile banking? And is your information safe?

While reputable financial institutions implement a slew of security measures, you can take some steps on your own to keep your financial and personal details out of the hands of hackers.

6 Ways To Secure Online Banking

It’s easy to protect your information while still leveraging the convenience of online banking. Use these six strategies to ensure you’re the only one eyeballing your balance.

- Choose strong and unique passwords

- Enable two-factor authentication

- Steer clear of public Wi-Fi

- Sign up for banking alerts

- Be wary of phishing scams

- Choose trustworthy financial apps

1. Choose Strong and Unique Passwords

Your password can create an opening for hackers, even if you don’t realize it.

Some common mistakes you may be making with online banking passwords include:

- Using personal information, such as your name, address or date of birth

- Choosing shorter passwords

- Relying on common words or simple number combinations

- Using the same password for multiple logins

- Not updating passwords regularly

Those things can make it easier to remember your passwords, but they make it easier for hackers to guess your password and access your online banking information. Here are some tips for creating stronger passwords for banking online:

- Choose longer passwords, such as a phrase rather than a single word

- Use a mix of upper and lowercase letters

- Include numbers and special characters

- Avoid common sequences, such as “1234”

- Avoid using personal information, such as your name, pets’ names, date of birth, etc.

- Don’t store your login details in your online banking or mobile app

- Don’t write passwords on the back of debit or credit cards or keep them in your wallet

Update your online banking passwords regularly. Change them every three to six months to lower the odds of your password being stolen or decoded by hackers.

And consider using a password manager to store and protect your passwords—and make using longer and more complicated passwords easier.

2. Enable Two-Factor Authentication

Two-factor, or multifactor, authentication can add a second layer of security verification when logging in to your online or mobile banking account. First, you enter your login name and password and then you have to pass a second security test.

For example, you may need to enter a special code, verify your account through an automated phone call, use biometric verification or identify an image. This makes it difficult for a hacker or identity thief to unlock your account, even if they have your online or mobile banking password.

Ask your bank or credit union if two-factor authentication is an option and how to enable it.

3. Steer Clear of Public Wi-Fi

Public Wi-Fi is convenient when you need to stay connected on the go, but you can’t count on it to be secure. According to NortonLifeLock Inc., the consumer cybersecurity provider, some of the most significant security risks posed by public Wi-Fi include:

- Man-in-the-middle attacks, in which hackers can electronically “eavesdrop” on your banking and other online activity

- Data transmissions over unencrypted networks

- Malicious hotspots

- Malware and spyware

It’s best to avoid using online or mobile banking when you’re on a public Wi-Fi network.

If you must access online banking or mobile banking with public Wi-Fi, here are some tips to stay secure.

- Disable public file sharing. Look up how to do this for your operating system.

- Stick with sites that are secure. Look for “https” in the site’s URL, which triggers the lock icon in your browser. Your laptop or mobile device’s firewall may automatically flag sites that are deemed unsafe.

- Consider using a virtual private network (VPN). This creates a private network that only you can access. You can set up a VPN through your mobile device or laptop using a VPN service .

4. Sign Up for Banking Alerts

Banking alerts notify you when certain actions occur. You receive near-instant notifications of any potentially fraudulent or suspicious activity. It’s often possible to receive email or text alerts for the following:

- Low or high balances

- New credit and debit transactions

- New linked external accounts

- Failed login attempts

- Password changes

- Personal information updates

If you get an alert and suspect fraudulent or suspicious activity, contact your bank or credit union immediately and change your online and mobile banking passwords.

5. Be Wary of Phishing Scams

Phishing is one of the most common methods identity thieves use to gain access to personal and financial information. This kind of scam usually involves tricking you into giving up your information.

Phishing scams can take different forms, but they’re often email or text scams. For example, you might get an email that looks like it came from your bank, telling you that you must log in to your account and update your information.

You click the link and log in to what appears to be a legit site but is a dummy site. Or, clicking a link downloads tracking malware to your computer, allowing identity thieves to log your keystrokes.

Either way, you’ve given up your login details without realizing it. For this reason, it’s important to scrutinize closely any emails that request financial or personal information.

Here are some tips for avoiding online banking phishing scams :

- Verify the sender’s email address. Call your bank and ask if it sent you an email. Verify the email address that was used.

- Hover over links. Hovering over a link inside an email can reveal where it will take you.

- Don’t share personal details. If you get an email from your bank asking for information, call your local branch or customer service to verify that it’s legitimate before sharing any details.

6. Choose Trustworthy Financial Apps

Financial apps, including mobile banking apps, can help with banking, paying bills, sending money and shopping. But they’re not equally secure.

If you plan to use your bank’s mobile app, make certain you’re using its official app. The best way to do that is to download the app from your bank’s website. If you’re downloading the app from the App Store or Google Play, verify that it’s legit by checking the developer details and reading reviews.

Consider which apps you allow to access your online and mobile banking details. For example, you might want to use a budgeting app to manage your money. These apps generally ask you to share your login credentials to pull information and create a financial picture, putting your data at risk.

Before downloading a financial app, check its ratings. Research the app’s security policies and look for past data breaches.

Is Online Banking Safe?

Online banking is a safe way to manage your money when your bank follows strict security protocols and you’re aware of how to spot potential security threats.

Banks utilize various security measures to protect customer information. Those measures can include:

- 128-bit or 256-bit data encryption

- Encrypted email messaging

- Automatic logout functionality for online and mobile banking

- Two-factor authentication

- Continuous account monitoring

- Electronic signature verification

Risks of Online Banking

Although it may be tempting to log in to your bank’s website or app from your phone while you’re out and about, using an unsecured network can have real consequences. Watch out for:

- Phishing. Phishing is a means of gathering personal information by posing as a trusted institution—like your bank. Fraudsters can contact you via email or SMS and make it appear as though the message is coming from your bank. Phishing scams ask you to input personal information like passwords or bank accounts into dummy sites that look like ones you have seen before. They use that information to steal your money or your identity.

- Viruses. If your bank doesn’t use secure software, you could be exposed to malware or viruses that can corrupt your computer or phone.

- Maintenance outages. If you rely exclusively on online banking, any potential outage, whether malicious or accidental, could leave you financially stranded.

Benefits of Online Banking

Although there are risks to banking online, secure digital banking has benefits that outweigh those risks. These include:

- Convenience. Being able to transfer money, deposit a check or view your balance before a big purchase is all easy with secure online banking . With appropriate security measures in place, you can plan your life on the go.

- Control. The idea of “banking hours” is obsolete when using online banking. You can deposit or transfer funds no matter what time it is. Some banks even offer around-the-clock online customer support through live chat or interactive FAQs.