Start my free trial

Please fill out the form below and an AlphaSense team member will be in touch within 20 minutes to help set up your trial.

The Value of Equity Research

Equity research is an invaluable asset for anyone looking to stay up-to-date on market and industry trends. In this guide, you will learn about the type of information contained in equity research, the value it offers to corporate professionals, and how the most advanced teams are already leveraging the expertise of Wall Street’s top analysts to inform critical business decisions.

Get the guide

Introduction.

Equity research, which forms a multi-billion dollar industry for investment banks, is produced by thousands of analysts worldwide to provide the market with valuable information on companies, industries, and market trends. Today, over 90% of equity research is consumed by fund managers, who have the Wall Street relationships to acquire it and the analyst resources to mine it for insights. For corporate strategy professionals who lack this access, however, equity research has historically been challenging to obtain and navigate.

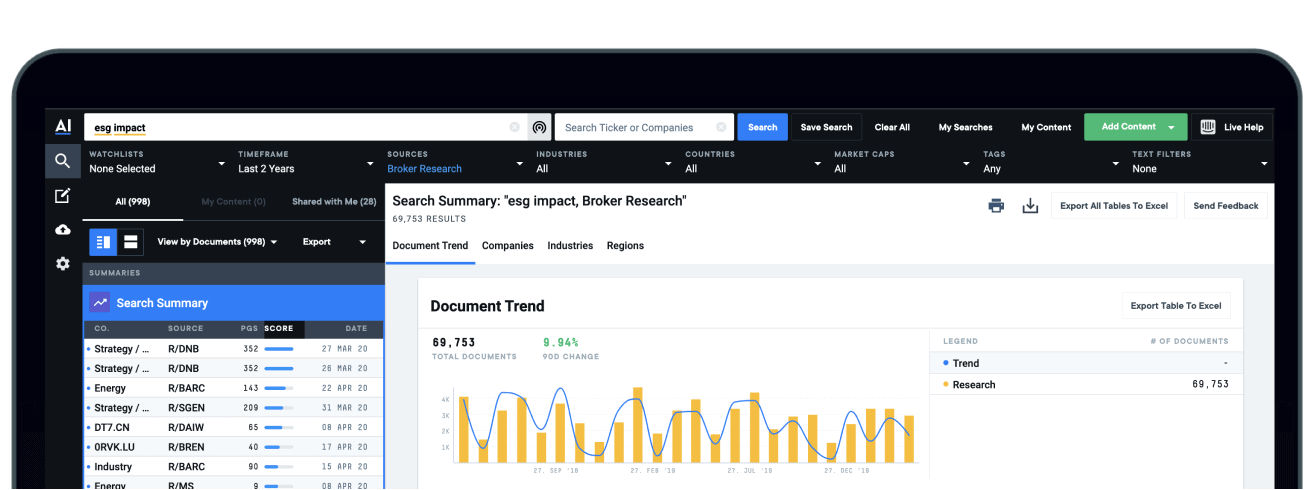

To help corporations circumvent these challenges, AlphaSense has introduced Wall Street Insights, the first and only equity research collection purpose-built for the corporate user. Through the AlphaSense platform, any business making strategic plans or product decisions, conducting competitive analysis, evaluating M&A, or engaging in investor relations can now tap into the deep industry expertise of Wall Street’s top analysts.

What is Equity Research?

Equity research is developed by sell-side firms to help investors and hedge fund managers discover market opportunities and make informed investment decisions. Increasingly, this expert analysis has also been identified by forward-looking corporations as a highly valuable tool to inform strategic decision-making.

There are thousands of sell-side firms that employ expert analysts around the globe to write equity research for the market. The majority of firms producing equity research are hyper-focused and only have one or two analysts developing reports on a specific industry. However, larger firms, such as Morgan Stanley and Bank of America, collectively employ thousands of analysts to write reports on thousands of public companies–covering everything from TMT giants to niche products.

Equity research analysts are deep subject matter experts who are often former executives, industry veterans, or academics. These analysts conduct in-depth research and publish reports on corporations, industries, and macro trends, offering an expert lens into a subject.

Historically, over 90% of equity research was consumed by buy-side fund managers, who had the Wall Street relationships to acquire it and the analyst resources to mine it for insights. For buy-side professionals, equity research is a critical tool to inform sound investment decisions backed by expert insights.

Today, equity research is increasingly relied upon by corporate teams as a high-value source of information. These teams leverage equity research to make strategic business plans, conduct competitive analysis, evaluate mergers and acquisitions, and make product and marketing decisions. For corporations, the value of equity research lies in the detailed coverage of their company, their competitors, and how they are performing related to the marketplace they are within.

What is an Equity Research Report?

An equity research report is a document prepared by an equity research analyst that often provides insight on whether investors should buy, hold, or sell shares of a public company. In an equity research report, an analyst lays out their recommendation, target price, investment thesis, valuation, and risks.

There are multiple forms of equity research, including (but not limited to):

An update report that highlights the latest news, company announcements, earnings reports, Buy Sell Hold ratings, M&A activity, anything that impacts the value of the company.

A comprehensive company report that is compiled when an analyst or firm initiates their coverage of a stock. Initiation reports cover all of the divisions and products of a company in-depth to provide a baseline of what the company is and how it is performing. Initiation reports can be tens to hundreds of pages long, depending on the complexity of a company.

General industry updates that cover a group of similar companies within a sector. Industry-specific reports typically dive into additional factors such as loan growth, interest rates, interest income, net income, and regulatory capital.

A report compiled by research firms either daily or weekly. These reports can often be a great place to get more in-depth insight on commodities and also get market opinions from commodity analysts or traders who write the reports.

A quick 1-2 page report that comments on a news release from a company or other quick information

What is Included in a Typical Equity Research Report?

Research reports don’t need to follow a specific formula. Analysts at different investment banks have some latitude in determining the look and feel of their reports. But more often than not, research reports follow a certain protocol of what investors expect them to look like.

A typical equity research report includes in-depth industry research, management analysis, financial histories, trends, forecasting, valuations, and recommendations for investors. Sometimes called broker research reports or investment research reports, equity research reports are designed to provide a comprehensive snapshot that investors or corporate leaders can leverage to make informed decisions.

Here’s a quick overview of what a standard equity research report covers:

This section covers events, such as quarterly results, guidance, and general company updates.

Upgrades/Downgrades are positive or negative changes in an analyst’s outlook of a particular stock valuation. These updates are usually triggered by qualitative and quantitative analysis that contributes to an increase or decrease in the financial valuation of that security.

Estimates are detailed projections of what a company will earn over the next several years. Valuations of those earnings estimates form price targets. The price target is based on assumptions about the asset’s future supply & demand and fundamentals.

Management Overview and Commentary helps potential investors understand the quality and makeup of a company’s management team. This section can also include a history of leadership within the company and their record with capital allocation, ESG, compensation, incentives, stock ownership. Plus, an overview of the company’s board of directors.

This section covers competitors, industry trends, and a company’s standing among its sector. Industry research includes everything from politics to economics, social trends, technological innovation, and more.

Historical Financial Results typically cover the history of a company’s stock, plus expectations based on the current market and events surrounding it. To determine if a company is at or above market expectations, Analysts must deeply understand the history of a specific industry and find patterns or trends to support their recommendations.

Based on the market analysis, historical financial results, etc., an analyst will run equity valuation models. In some cases, analysts will run more than one valuation model to determine the worth of company stock or asset.

Absolute valuation models : calculates a company’s or asset’s inherent value.

Relative equity valuation models : calculates a company’s or asset’s value relative to another company or asset. Relative valuations base their numbers on price/sales, price/earnings, price/cash flow.

An equity research analyst’s recommendation to buy, hold, or sell. The analyst also will have a target price that tells investors where they expect the stock to be in a year’s time.

What Does an Equity Research Analyst Do?

Equity research analysts exist on both the buy-side and the sell-side of the financial services market. Although these roles differ, both buy-side and sell-side analysts produce reports, projections, and recommendations for specific companies and stocks.

An equity research analyst specializes in a group of companies in a particular industry or country to develop high-level expertise and produce accurate projects and recommendations. Since ER analysts generally focus on a small set of stocks (5-20), they become specialists in those specific companies and industries that they evaluate or follow. These analysts monitor market data and news reports and speak to contacts within the companies/industries they study to update their research daily.

Analysts need to comprehend everything about their ‘coverage’ to give investment endorsements. Equity research analysts must be conversant with the business regulations and regime policies within the country to decide how it will affect the market environment and business in general. The more you understand the industries in detail, the easier it will be for you to decipher market dynamics.

One prevalent aspect of an equity research analyst’s job is building and maintaining valuable relationships with corporate leaders, clients, and peers. Equity research is largely about an analyst’s ability to service clients and provide insightful ideas that positively influence their investing strategy.

EQUITY RESEARCH ANALYSTS:

- Analyze stocks to help portfolio managers make better-informed investment decisions.

- Analyze a stock against market activity to predict a stock’s outlook.

- Develop investment models and provide trading strategies.

- Provide expertise on markets and industries based on their competitive analysis, business analysis, and market research.

- Use data to model and measure the financial risk associated with particular investment decisions.

- Understand the details of various markets to compare a company’s and sector’s stock

Buy-Side vs. Sell-Side Analysts

Although the roles of buy-side and sell-side analysts do overlap in some respects, the purpose of their research differs.

How Do Corporates Currently Access Equity Research?

If you were to Google “equity research reports,” you would not get access to equity research, earnings call transcripts or trade journals. You would, however, discover an unmanageable amount of noise to sift through.

Accessing equity research reports is highly dependent on relationships and entitlements, particularly for corporate teams. Unlike financial firms and investor relations teams, who can access equity research by procuring the right entitlements, corporate teams have a much harder time finding and purchasing high-quality equity research.

If you were to search online for equity research, for example, you would be presented with sub-par options such as:

Some websites allow you to search for research reports on companies or by firms. Some of the reports are free, but you must pay for most of them. Prices range from just $15 to thousands of dollars.

If you want just the bottom-line recommendations from analysts, many sites summarize the data. Nearly all the websites that provide stock quotes also compile analyst recommendations, however, you will only get the big picture and not any of the detailed analysis.

Some independent research providers sell their reports directly to investors. These reports typically include an overview of what a stock’s price could be, plus an analysis of the company’s earnings. These reports often cost less than $100 but can be more.

The majority of equity research is completely unsearchable, which is why AlphaSense’s Wall Street Insights is changing the game for corporations globally. Now, with WSI, corporations can leverage this high-quality research to augment their understanding of specific companies and industries; plus, AlphaSense’s corporate clients can now conduct more meaningful analysis and make more data-driven decisions.

Real-Time Research : Real-Time research is available to eligible users (based on an entitlement) immediately upon publication by the broker. Financial Services users with entitlements are the primary consumers of real-time research, while some Corporate professionals are also eligible. Payment for real-time research is made directly from clients to brokers through trading commissions or hard dollar agreements.

Aftermarket Research : Aftermarket research is a collection of many of the same documents as the real-time collection, but it is available after a zero to fifteen-day delay. Investment bankers, consultants, and corporate users are the primary consumers of Aftermarket research.

What is Wall Street Insights?

Wall Street Insights is the first and only equity research collection purpose-built for the corporate market, providing corporations unprecedented access to a deep pool of equity research reports from thousands of expert analysts.

Through partnerships with Morgan Stanley, Bank of America, Barclays, Bernstein, Bernstein Autonomous, Cowen, Deutsche Bank, Evercore ISI, HSBC, and others, corporate professionals can now access the world’s most revered equity research, indexed and searchable in the AlphaSense platform.

From macro market trends and industry analyses to company deep-dives, the Wall Street Insights content collection provides corporate professionals with a 360-degree view of every market. With the valuable expertise of thousands of analysts on your side, corporate teams can quickly compare insights, validate internal assumptions, and generate new ideas to guide critical business decisions and strategies.

In terms of search and accessibility, Wall Street Insights is the first of its kind. Not only does AlphaSense offer hard-to-find equity research reports, but we also provide a robust and seamless search experience.

What Research Do You Get Access to with WSI?

Get access to the world’s leading equity research with Wall Street Insights. Download the e-book to learn more about equity research from Morgan Stanley, Barclays, Bernstein, Deutsche Bank, and more.

“We are delighted to partner with AlphaSense to expand access to Morgan Stanley’s global research platform,” says Simon Bound, Global Head of Research at Morgan Stanley. We have over 600 publishing analysts covering companies, industries, commodities, and macroeconomic developments across more than 50 countries. Morgan Stanley will bring corporates a unique perspective from our best in class analysts, a global platform, and a collaborative culture that enables us to unravel the most complex market and industry trends.”

How Can Companies Leverage Equity Research?

Discover how the world’s most innovative companies leverage Wall Street Insights to make critical business decisions every day. Download the e-book to read real case studies from a Corporate Development team and a Corporate Strategy team.

“AlphaSense’s corporate users are typically Corporate Strategy, Corporate Development, and Investor Relations professionals. Today, thousands of enterprises rely on equity research to power data-driven decision making. These teams leverage equity research reports to:”

- Create investment ideas

- Monitor peers in real-time (and discover what equity research is being produced about them)

- Model and evaluate companies (for M&A or general benchmarking)

- Dive deep into customers, partners, and prospects

- Get up-to-speed quickly on specific industry trends

- Prepare for earnings season

Ready to explore the world’s leading equity research

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here . By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service .

Member Sign In

Don't Know Your Password?

- Zacks #1 Rank

- Zacks Industry Rank

- Zacks Sector Rank

Equity Research

- Mutual Funds

- Mutual Fund Screener

- ETF Screener

- Earnings Calendar

- Earnings Releases

- Earnings ESP

- Earnings ESP Filter

- Stock Screener

- Premium Screens

- Basic Screens

- Thematic Screens

- Research Wizard

- Personal Finance

- Money Management

- Retirement Planning

- Tax Information

- My Portfolio

- Create Portfolio

- Style Scores

- Testimonials

- Zacks.com Tutorial

Services Overview

- Zacks Ultimate

- Zacks Investor Collection

- Zacks Premium

Investor Services

- ETF Investor

- Home Run Investor

- Income Investor

- Stocks Under $10

- Value Investor

- Top 10 Stocks

Other Services

- Method for Trading

- Zacks Confidential

Trading Services

- Black Box Trader

- Counterstrike

- Headline Trader

- Insider Trader

- Large-Cap Trader

- Options Trader

- Short Sell List

- Surprise Trader

- Alternative Energy

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK . If you do not, click Cancel.

Research Daily

Top research reports for alphabet, unitedhealth & chubb.

by Mark Vickery

Today's Research Daily features new research reports on 16 major stocks, including Alphabet Inc. (GOOGL), UnitedHealth Group Incorporated (UNH) and Chubb Limited (CB), as well as two micro-cap stocks Key Tronic Corporation (KTCC) and Massimo Group (MAMO).

Weekly Market Analysis

Q3 earnings season kicks off strong as the soft landing continues.

by Mayur Thaker

Q3 earnings continue to show strength, but cracks remain in lesser watched bellwethers.

Market Outlook

5 paper & related products stocks to ride on positive industry trends, industry outlook, quarterly steps to a better investing life, economic outlook, tech eps growth lights up q3: zacks oct strategy, market strategy, what do q3 earnings results show, earnings preview, mag 7 earnings loom: what can investors expect, earnings trends, zacks equity research 15/16.

We cover more than 1,000 of the most widely followed stocks in our Equity Research Reports. Each report features independent research from our analysts and provides in-depth analysis on a company, its fundamentals and its growth prospects. Quickly access reports for New Upgrades and New Downgrades.

You can also find a report on the ticker of your choice, or access all of the stock reports covered by Zacks analysts.

View All Zacks Equity Research Reports

Zacks Analyst Reports

New upgrades: blk , lyft , googl , ipar , unfi , snps , sna , syf , ffiv , csgp, blackrock fin ( blk quick quote blk ) upgraded: 10/23/24.

BlackRock is well-poised for growth thanks to its strong AUM balance, product diversification, expansion through acquisitions, enhancing private markets capabilities and active equity business focus.

View Report

Lyft ( LYFT Quick Quote LYFT ) Upgraded: 10/23/24

Lyft stands to benefit from the improving rideshare market.

Alphabet ( GOOGL Quick Quote GOOGL ) Upgraded: 10/22/24

Google has shown good execution to date. Its dominant search market share is a positive. Its expanding cloud footprint and strengthening presence in the smart home market remain noteworthy.

Interparfums, Inc. ( IPAR Quick Quote IPAR ) Upgraded: 10/22/24

Inter Parfums is capitalizing on positive trends in the fragrance market, with strong sales from new licenses.

United Natural Foods ( UNFI Quick Quote UNFI ) Upgraded: 10/19/24

United Natural is benefiting from operational improvements like shrink reduction and streamlined SG&A expenses.

Synopsys ( SNPS Quick Quote SNPS ) Upgraded: 10/19/24

The company’s recent product launches, acquisitions and deal wins will boost results. Also, unique intellectual properties and global support provided by the company are other positives.

SnapOn ( SNA Quick Quote SNA ) Upgraded: 10/18/24

Snap-on expects continued progress by leveraging capabilities in the automotive repair arena. Management remains on track with its value-creation plans.

Synchrony Financial ( SYF Quick Quote SYF ) Upgraded: 10/18/24

Solid organic and inorganic growth, the CareCredit platform, balance sheet strength and efficiency-boosting moves pave the way for its long-term growth.

F5 ( FFIV Quick Quote FFIV ) Upgraded: 10/16/24

Transition toward multi-cloud environments, rising demand for application security, acquisitions and partnerships are aiding F5’s growth. Ample liquidity and an aggressive shareholder return policy are other positives.

CoStar Group ( CSGP Quick Quote CSGP ) Upgraded: 10/05/24

CoStar benefits from a robust portfolio of offerings, growing traffic at its different sites, solid contributions from acquisitions and a strong balance sheet.

New Downgrades: NUE , GPC , FANG , RCKT , SPB , CVS , AGNC , SU , SAM , MTDR

Nucor ( nue quick quote nue ) downgraded: 10/24/24.

The weakness in heavy equipment and rail cars may weigh on the company's shipments. Lower steel prices are also expected to hurt margins. The steel industry is also reeling under oversupply.

Genuine Parts ( GPC Quick Quote GPC ) Downgraded: 10/24/24

Fluctuating demand, high SG&A costs, stiff competition and forex woes pose concerns.

Diamondback Energy ( FANG Quick Quote FANG ) Downgraded: 10/24/24

appears to be on the higher side.

Rocket Pharmaceuticals ( RCKT Quick Quote RCKT ) Downgraded: 10/22/24

With no approved products in its commercial portfolio, Rocket Pharmaceuticals lacks a source of generating regular income. Any pipeline setback could also hurt the stock.

Spectrum Brands ( SPB Quick Quote SPB ) Downgraded: 10/22/24

Spectrum Brands has been witnessing geopolitical and macroeconomic uncertainty for a while now. Also, foreign currency translations acted as deterrents.

CVS Health ( CVS Quick Quote CVS ) Downgraded: 10/22/24

Elevated medical cost trends impede CVS Health's profitability. A highly competitive market and pressure on margins remain a concern.

AGNC Investment ( AGNC Quick Quote AGNC ) Downgraded: 10/19/24

High interest rates will increase funding costs and adversely affect AGNC Investment’s book value. Robust returns are likely to remain elusive as risk management needs to be prioritized.

Suncor Energy ( SU Quick Quote SU ) Downgraded: 10/19/24

Pipeline construction in Canada has failed to keep pace with the rising domestic oil, forcing producers like Suncor to sell their products at a discounted rate.

The Boston Beer Company ( SAM Quick Quote SAM ) Downgraded: 10/18/24

Boston Beer’s second-quarter 2024 results reflected softness in depletions, as well as continued challenges in the hard seltzer category.

Matador Resources ( MTDR Quick Quote MTDR ) Downgraded: 09/21/24

Higher operating expenses are affecting Matador's margins.

Featured Reports: TSN , AEO , DAL , GOOGL , NVDA , HRL , AVGO , KR , GM , MSFT

Tyson foods ( tsn quick quote tsn ) upgraded: 10/21/24.

Tyson Foods' strategy is anchored in operational excellence, customer and consumer obsession and sustainability. The company prioritizes innovation, marketing and customer alliances to fuel growth.

American Eagle Outfitters ( AEO Quick Quote AEO ) Upgraded: 10/24/24

American Eagle remains well placed on the back of cost-reduction efforts, strength in Aerie and a solid online show. In addition, its Powering Profitable Growth plan bodes well.

Delta Air Lines ( DAL Quick Quote DAL ) Upgraded: 10/21/24

Strong air-travel demand promises growth. A good liquidity position gives operational flexibility while the dividend hike indicates cash flow stability and a shareholder-friendly stance.

Alphabet ( GOOGL Quick Quote GOOGL ) Upgraded: 10/24/24

Nvidia ( nvda quick quote nvda ) upgraded: 10/22/24.

Growth opportunities in ray-traced gaming, high-performance computing, AI and self-driving cars are encouraging.

Hormel Foods ( HRL Quick Quote HRL ) Upgraded: 10/24/24

Hormel Foods intends to strengthen its business on the back of strategic acquisitions. The company is investing in growth, innovation, cost savings and automation.

Broadcom ( AVGO Quick Quote AVGO ) Upgraded: 10/22/24

Broadcom is a leading player in the semiconductor market based on its expanding product portfolio, multiple target markets, accretive acquisitions and strong cash flow.

The Kroger Co. ( KR Quick Quote KR ) Upgraded: 10/22/24

Kroger's well-defined customer segmentation strategy, emphasis on value and focus on its 'Our Brands' portfolio have enabled it to maintain a competitive position effectively.

General Motors ( GM Quick Quote GM ) Upgraded: 10/23/24

General Motors is riding on its robust vehicle offerings, strong demand especially in North America, cost cut efforts, solid liquidity and electrification strides.

Microsoft ( MSFT Quick Quote MSFT ) Upgraded: 10/22/24

The enterprise refresh cycle, new subscription model, Azure and strength in Gaming segment will continue to generate sizeable cash flows.

Find a Report

Get timely analysis that provides the reason behind the Zacks Rank for more than 4,400 stocks

This file is used for Yahoo remarketing pixel add

Due to inactivity, you will be signed out in approximately:

LSEG Workspace

Features market quotes, earnings estimates, financial fundamentals, press releases, transaction data, corporate filings, ownership profiles and sell-side equity research.

Features market quotes, earnings estimates, financial fundamentals, ESG data, press releases, transaction data, corporate filings, ownership profiles and sell-side equity research. Note: After Market Research (AMR) from several highly ranked investment firms are not included in LSEG Workspace access (ex. Sanford Bernstein, Goldman Sachs).

Install Excel Add-In and Windows desktop application

HBS Faculty, Students, and Staff

Remote access available

HBS Executive Education & Fellows

In person access only

Harvard Faculty, Students, and Staff

Additional information.

Each user may view and/or download up to 150 billable AMR pages per 24 hour period (Usage Day). User will be notified at 150 billable pages downloaded in any given Usage Day and further usage will be suspended for that User until the next Usage Day commences.

Learn with Baker Library: LSEG Workspace

Investment analyst reports (equity research reports), financial databases: certification and training, company databases: which database to choose, still need help.

Our expert librarians are here to help you find what you’re looking for.

Get 14 Days Free

Morningstar Equity Research - published in last 90 days

- All Sectors

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- All Star Ratings

- Company Website

- Our Signature Methodologies

Connect With Us

- Global Contacts

- Advertising Opportunities

Terms of Use Privacy Policy Modern Slavery Statement Cookie Settings Disclosures

The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. It is projection/opinion and not a statement of fact. Morningstar assigns star ratings based on an analyst’s estimate of a stock's fair value. Four components drive the Star Rating: (1) our assessment of the firm’s economic moat, (2) our estimate of the stock’s fair value, (3) our uncertainty around that fair value estimate and (4) the current market price. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance. For detail information about the Morningstar Star Rating for Stocks, please visit here

The Morningstar Medalist Rating is the summary expression of Morningstar’s forward-looking analysis of investment strategies as offered via specific vehicles using a rating scale of Gold, Silver, Bronze, Neutral, and Negative. The Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time. Investment products are evaluated on three key pillars (People, Parent, and Process) which, when coupled with a fee assessment, forms the basis for Morningstar’s conviction in those products’ investment merits and determines the Medalist Rating they’re assigned. Pillar ratings take the form of Low, Below Average, Average, Above Average, and High. Pillars may be evaluated via an analyst’s qualitative assessment (either directly to a vehicle the analyst covers or indirectly when the pillar ratings of a covered vehicle are mapped to a related uncovered vehicle) or using algorithmic techniques. Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. When analysts directly cover a vehicle, they assign the three pillar ratings based on their qualitative assessment, subject to the oversight of the Analyst Rating Committee, and monitor and reevaluate them at least every 14 months. When the vehicles are covered either indirectly by analysts or by algorithm, the ratings are assigned monthly. For more detailed information about these ratings, including their methodology, please go to here

Institutional Equity Research

Illuminating company- and industry-level insights.

Access trustworthy equity research

Without trading or banking revenues, we are wholly dependent on adding value through our research. Our independence ensures that our analysts remain conflict-free and can express both positive and negative opinions. Every investment conclusion we make has only the end investor’s interests in mind.

Gain a competitive advantage, our research team analyzes industries and businesses, seeking sources of economic moats. we then use those insights to forecast future cash flows, allowing for fluctuations in market pricing and sentiment, to provide investment opportunities..

Give insights a global scale

Our global coverage uses the same consistent research framework in every region. When looking across geographies, we help expand insights into new territories and countries.

Put our institutional equity research to work, company reports.

Validate your thesis and discover new opportunities. Each report contains our investment thesis and information on corporate management, economic moat, trends, valuation, growth and profitability.

Interactive Models

Use our interactive models to easily compare data to your existing models. Each model includes more than five years of explicit earnings forecasts.

Moat Frameworks

Economic moat framework reports explain moat and trend ratings for companies within our coverage universe.

Thematic Research

Obtain a long-term view of your investment strategy. our thematic research delves into industries, companies, and emerging trends that directly affect the companies we cover., research and analyst access packages.

Proprietary Research Package

Access global equity research..

- 1,500 global reports

- Interactive models

- Moat frameworks

- Thematic research

Proprietary Research + Analyst Access

Access global equity research and the analysts behind it..

- Phone calls

- The Management Behind the Moat Conference

- In-person meetings

Consumer Observer

The restaurant industry is hardly immune to the digital disruption of the past two decades, and as the space transforms, investors must change accordingly. Morningstar and PitchBook collaborated to produce a summary of key findings from our full-length, in-depth report on the topic. The analysis draws on public and private markets data, plus conversations with public and private company executives, investors and others. The summary includes 10 predictions for how the industry needs to evolve. The full 148-page report is available to Morningstar Institutional Equity Research clients.