Home » Pros and Cons » 14 Pros and Cons of a Business Plan

14 Pros and Cons of a Business Plan

Should you create a business plan? Most people will say that you should have at least some sort of outline that helps you guide your business. Yet sometimes an opportunity is so great that you’ve just got to jump right in and grab it before it disappears. If you want funding or growth to be sustainable, however, there is a good chance that you’ll need to create a business plan of some sort in order to find success. Here are some of the pros and cons of a business plan to consider as you go about the process of creating and then running your business.

What Are the Pros of a Business Plan?

A business plan is a guide that you can use to make money. By understanding what your business is about and how it is likely to perform, you’ll be able to see how each result receive can impact your bottom line. With comprehensive plans in place, you’ll be prepared to take action no matter what happens over the course of any given day. Here are some more benefits to think about.

1. It gives you a glimpse of the future. A business plan helps you to forecast an idea to see if it has the potential to be successful. There’s no reason to proceed with the implementation of an idea if it is just going to cost you money, but that’s what you do if you go all-in without thinking about things. Even if the future seems uncertain, you’ll still get a glimpse of where your business should be.

2. You’ll know how to allocate your resources. How much inventory should you be holding right now? What kind of budget should you have? Some resources that your business needs to have are going to be scare. When you can see what your potential financial future is going to be, you can make adjustments to your journey so that you can avoid the obstacles that get in your way on the path toward success.

3. It is necessary to have a business plan for credit. In order for a financial institution to give you a line of credit, you’ll need to present them with your business plan. This plan gives the financial institution a chance to see how organized you happen to be so they can more accurately gauge their lending risks. Most institutions won’t even give you an appointment to discuss financing unless you have a formal business plan created and operational.

4. A business plan puts everyone onto the same page. When you’re working with multiple people, then you’re going to have multiple viewpoints as to what will bring about the most success. That’s not to say that the opinions of others are unimportant. If there isn’t any structure involved with a business, then people with a differing opinion tend to go rogue and just do their own thing. By making sure that everyone is on the same page with a business plan, you can funnel those creative energies into ideas that bring your company a greater chance of success.

5. It allows others to know that you’re taking this business seriously. It’s one thing to float an idea out to the internet to see if there is the potential of a business being formed from it. Creating a business plan for that idea means you’re taking the idea more seriously. It shows others that you have confidence in its value and that you’re willing to back it up. You are able to communicate your intentions more effectively, explain the value of your idea, and show how its growth can help others.

6. It’s an easy way to identify core demographics. No matter what business idea you have, you’re going to need customers in order for it to succeed. Whether you’re in the service industry or you’re selling products online, you’ll need to identify who your core prospects are going to be. Once that identification takes place, you can then clone those prospects in other demographics to continue a growth curve. Without plans in place that allow you to identify these people, you’re just guessing at who will want to do business with you and that’s about as reliable as throwing darts at a dartboard while blindfolded.

7. There is a marketing element included with a good business plan. This allows you to know how you’ll be able to reach future markets with your current products or services. You’ll also be able to hone your value proposition, giving your brand a more effective presence in each demographic.

What Are the Cons of a Business Plan?

A business plan takes time to create. Depending on the size of your business, it could be a time investment that takes away from your initial profits. Short-term losses might happen when you’re working on a plan, but the goal is to great long-term gains. For businesses operating on a shoestring budget, one short-term loss may be enough to cause that business to shut their doors. Here are some of the other disadvantages that should be considered.

1. A business plan can turn out to be inaccurate. It is important to involve the “right” people in the business planning process. These are the people who are going to be influencing the long-term vision of your business. Many small business owners feel like they can avoid this negative by just creating the business plan on their own, but that requires expertise in multiple fields for it to be successful. A broad range of opinions and input is usually necessary for the best possible business plan because otherwise the blind spots of inaccuracy can lead to many unintended consequences.

2. Too much time can be spent on analysis. Maybe you’ve heard the expression “paralysis by analysis.” It cute and catchy, but it also accurately describes the struggle that many have in the creation of a business plan. Focus on the essentials of your business and how it will grow. Sure – you’ll need to buy toilet paper for the bathroom and you’ll want a cleaning service twice per week, but is that more important than knowing how you can reach potential customers? Of course not.

3. There is often a lack of accountability. Because one person is generally responsible for the creation of a business plan, it is difficult to hold that person accountable to the process. The plans become their view of the company and the success they’d like to see. It also means the business plan gets created on their timetable instead of what is best for the business and since there isn’t anyone else involved, it can be difficult to hold their feet to the fire to get the job done.

4. A great business plan requires great implementation practices. Many businesses create a plan that just sits somewhere on a shelf or on a drive somewhere because it was made for one specific purpose: funding. When a solid business plan has assigned specific responsibilities to specific job positions and creates the foundation for information gathering and metric creation, it should become an integral part of the company. Unfortunately poor implementation has ruined many great business plans over the years.

5. It restricts the freedom you once had. Business plans dictate what you should do and how you should do it. A vibrant business sometimes needs its most creative people to have the freedom to develop innovative new ideas. Instead the average plan tends to create an environment where the executives of the company dictate the goals and the mission of everyone. The people who are on the front lines are often not given the chance to influence the implementation of the business plan, which ultimately puts a company at a disadvantage.

6. It creates an environment of false certainty. It is important to remember that a business plan is nothing more than a forecast based on plans and facts that are present today. We live in a changing world where nothing is 100% certain. If there is too much certainty in the business plan that has been created, then it can make a business be unable to adapt to the changes that the world is placing on it. Or worse – it can cause a business to miss an exciting new opportunity because they are so tunnel-visioned on what must be done to meet one specific goal.

7. There are no guarantees. Even with all of the best research, the best workers, and a comprehensive business plan all working on your behalf, failure is more likely to happen than success. In the next 5 years, 95 out of 100 companies that start-up today will be out of business and many of them will have created comprehensive business plans.

The pros and cons of a business plan show that it may be an essential component of good business, but a comprehensive plan may not be necessary in all circumstances. The goal of a business plan should be clear: to analyze the present so a best guess at future results can be obtained. You’re plotting out a journey for that company. If you can also plan for detours, then you’ll be able to increase your chances to experience success.

Related Posts:

- 25 Best Ways to Overcome the Fear of Failure

- 30 Best Student Action Plan Examples

- 100 Most Profitable Food Business Ideas

- 10 Amazon Pricing Strategies with Examples

Your Internet Explorer version is not supported

Why am i seeing this message.

We support most browsers but yours is now more than 5 years old and we don't support it. We recommend using a faster and more secure browser .

How can I upgrade?

For a faster, more secure internet follow these quick upgrade steps .

I can't upgrade

Speak to your IT team about upgrading. A faster more secure internet experience could benefit your whole organisation.

If your organisation still requires Internet Explorer 8 or earlier to support certain applications you can still get the benefits of upgrading. Ask your IT team to consider managing their policy using chrome with legacy browser support .

Got a smartphone or tablet?

We support all major smartphones and tablets so you can get quotes and bind on the go, or whilst your IT team upgrades your browser.

Need help? 0800 640 6600

Mon - Fri 08:30 - 17:30 (local rate & mobile friendly)

What are the advantages and disadvantages of a business plan?

Almost every business starts with a business plan. These documents are used to map out the steps you want to take to get your business off the ground. However, do these strategy documents work for all businesses?

Whether you’re an entrepreneur or an investor, business plans are considered an essential part of starting a new business . For business owners and other stakeholders, it acts as a manual that can be used to chart a business’ success. Similarly, business plans can generate confidence, helping to convince potential lenders that investment is a risk worth taking.

However, business plans can also be expensive and time-consuming to create. Additionally, there is also no guarantee that a business will succeed just because a sound plan has been put in place.

To help you decide if a business plan would benefit your new venture, this guide runs through the main advantages and disadvantages.

The advantages of a business plan

Although a business plan takes time and money to create, it can help save both in the future if done properly. Below we take a look at some of the key advantages of creating a business plan:

1. It helps you forecast future steps The primary purpose of a business plan is to give you (and investors) an idea of whether your business has the potential to be successful. By mapping out your next steps and setting milestones, you can spot strengths and weaknesses in your ideas and set targets. This is helpful as it may prevent you from proceeding with a business idea that may end up costing you money.

On the other hand, these initial forecasts may provide the positive projections you need to actually get started and even attract outside investment. Even if your business plan produces an uncertain forecast, it still provides a small glimpse of the direction your business wants to head in and how it may perform on the way. This is valuable information, both for business owners and third-party stakeholders.

2. It is required if you want to apply for credit In order to secure a business loan from an official lender, a business plan is essential. Most banks will not even meet with you to discuss financing unless you have a business plan to present. This is because financial institutions like banks and credit unions need a way to accurately gauge their lending risks.

A well-thought-out business plan gives you the opportunity to show lenders how organised and prepared you are. It should explain how your business will use any capital you are lent and how you intend to make repayments. This level of detail can help to instil confidence in your business by persuading lenders you are a good risk.

3. It helps you to identify future cash flow issues A business plan should contain detailed cash flow forecasts and analysis. This shows potential lenders how money is expected to travel in and out of your business. It can also be useful for owners to determine if/when the business is expected to have cash flow problems under certain strategies. Having this information at hand can make it easier to financially plan, ensuring the business is always properly funded.

4. It helps you to allocate resources One of the biggest challenges for new business owners is resource management. From how much inventory you should buy to setting initial budgets, these decisions can be difficult. A business plan encourages you to create a workable budget and allocate resources before you start spending. This ensures you can afford everything you need and you don’t overspend before your business can start making money.

5. It helps you better understand your competition Creating a business plan requires a great deal of industry research. While you may think you have a strong handle on what you want your business to achieve, only by analysing your competition will you be able to see the full picture. A business plan can help you produce highly valuable insights into competitor demographics. This includes existing consumer trends and preferences, as well as costing insights. These findings are not always viable without conducting business plan competitor analysis.

6. It can help to secure talent In order for a business to be successful, attracting talented workers is crucial. A business plan can help to secure this talent by setting out a clear vision for the business. From management to skilled entry level staff, by showing individuals the direction and potential of the business, you can start to build a strong and coherent team.

The disadvantages of a business plan

Business plans can be time-consuming and expensive to produce. On top of this, there is also no guarantee that they will be accurate or help you to achieve the investment you are looking for. With this in mind, below we outline a number of disadvantages when it comes to creating a business plan:

1. It may not be accurate Putting together credible business plans is a highly skilled process. For this reason, many businesses seek the help of experienced business advisors when creating one. However, even with the help of a broad range of expert opinions, there is no guarantee that what is produced will be accurate. Industries and even wider business climates can change very quickly. This means that even taking the time and money to create an in-depth business plan can be risky.

2. It can make you become ‘tunnel-visioned’ In a world where nothing is 100% certain, treating your business plan as an uncompromising manual is a bad idea. The fact is, they are nothing more than a set of forecasts. If followed religiously, these strategy documents can ultimately do more harm than good. This is especially true if you become tunnel-visioned by your business plan and fail to adapt when market forces and changing economic environments demand it.

3. It can waste precious time and money Creating a business plan can take a lot of time and money to produce. It may require the help of third-party experts, such as business advisors, lawyers and accountants, all of which will charge for their services. Additionally, it can also take you and other employees away from the day-to-day tasks involved with launching a new business. This can lead to precious resources being wasted on a task whose cost may exceed its benefits.

The above points show that although business plans represent an essential component for most new businesses, comprehensive plans may not be 100% necessary in all circumstances. Luckily, if you are looking to put one together but are struggling to know where to start, the Markel Law Hub can help. We have a simple, easy-to-follow business plan template for you to download. To learn how you can access the Markel Law Hub, click here .

Insurance FAQs

Insurance guides

COVID-19 help and guidance

Cyber & IT security guides

Marketing tips

Risk tips and how to prevent claims

Productivity FAQs

Start up hub

Need some help?

0800 640 6600

Mon - Fri 08:30 - 17:30

Local rate and mobile friendly

Frequently asked questions

Business insurance from £5 a month

Related articles.

What is professional indemnity insurance?

What is public liability insurance?

How to handle late paying customers

How to keep clients' data safe and secure

14 Reasons Why You Need a Business Plan

10 min. read

Updated May 10, 2024

There’s no question that starting and running a business is hard work. But it’s also incredibly rewarding. And, one of the most important things you can do to increase your chances of success is to have a business plan.

A business plan is a foundational document that is essential for any company, no matter the size or age. From attracting potential investors to keeping your business on track—a business plan helps you achieve important milestones and grow in the right direction.

A business plan isn’t just a document you put together once when starting your business. It’s a living, breathing guide for existing businesses – one that business owners should revisit and update regularly.

Unfortunately, writing a business plan is often a daunting task for potential entrepreneurs. So, do you really need a business plan? Is it really worth the investment of time and resources? Can’t you just wing it and skip the whole planning process?

Good questions. Here’s every reason why you need a business plan.

- 1. Business planning is proven to help you grow 30 percent faster

Writing a business plan isn’t about producing a document that accurately predicts the future of your company. The process of writing your plan is what’s important. Writing your plan and reviewing it regularly gives you a better window into what you need to do to achieve your goals and succeed.

You don’t have to just take our word for it. Studies have proven that companies that plan and review their results regularly grow 30 percent faster. Beyond faster growth, research also shows that companies that plan actually perform better. They’re less likely to become one of those woeful failure statistics, or experience cash flow crises that threaten to close them down.

- 2. Planning is a necessary part of the fundraising process

One of the top reasons to have a business plan is to make it easier to raise money for your business. Without a business plan, it’s difficult to know how much money you need to raise, how you will spend the money once you raise it, and what your budget should be.

Investors want to know that you have a solid plan in place – that your business is headed in the right direction and that there is long-term potential in your venture.

A business plan shows that your business is serious and that there are clearly defined steps on how it aims to become successful. It also demonstrates that you have the necessary competence to make that vision a reality.

Investors, partners, and creditors will want to see detailed financial forecasts for your business that shows how you plan to grow and how you plan on spending their money.

- 3. Having a business plan minimizes your risk

When you’re just starting out, there’s so much you don’t know—about your customers, your competition, and even about operations.

As a business owner, you signed up for some of that uncertainty when you started your business, but there’s a lot you can do to reduce your risk . Creating and reviewing your business plan regularly is a great way to uncover your weak spots—the flaws, gaps, and assumptions you’ve made—and develop contingency plans.

Your business plan will also help you define budgets and revenue goals. And, if you’re not meeting your goals, you can quickly adjust spending plans and create more realistic budgets to keep your business healthy.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- 4. Crafts a roadmap to achieve important milestones

A business plan is like a roadmap for your business. It helps you set, track and reach business milestones.

For your plan to function in this way, your business plan should first outline your company’s short- and long-term goals. You can then fill in the specific steps necessary to reach those goals. This ensures that you measure your progress (or lack thereof) and make necessary adjustments along the way to stay on track while avoiding costly detours.

In fact, one of the top reasons why new businesses fail is due to bad business planning. Combine this with inflexibility and you have a recipe for disaster.

And planning is not just for startups. Established businesses benefit greatly from revisiting their business plan. It keeps them on track, even when the global market rapidly shifts as we’ve seen in recent years.

- 5. A plan helps you figure out if your idea can become a business

To turn your idea into reality, you need to accurately assess the feasibility of your business idea.

You need to verify:

- If there is a market for your product or service

- Who your target audience is

- How you will gain an edge over the current competition

- If your business can run profitably

A business plan forces you to take a step back and look at your business objectively, which makes it far easier to make tough decisions down the road. Additionally, a business plan helps you to identify risks and opportunities early on, providing you with the necessary time to come up with strategies to address them properly.

Finally, a business plan helps you work through the nuts and bolts of how your business will work financially and if it can become sustainable over time.

6. You’ll make big spending decisions with confidence

As your business grows, you’ll have to figure out when to hire new employees, when to expand to a new location, or whether you can afford a major purchase.

These are always major spending decisions, and if you’re regularly reviewing the forecasts you mapped out in your business plan, you’re going to have better information to use to make your decisions.

7. You’re more likely to catch critical cash flow challenges early

The other side of those major spending decisions is understanding and monitoring your business’s cash flow. Your cash flow statement is one of the three key financial statements you’ll put together for your business plan. (The other two are your balance sheet and your income statement (P&L).

Reviewing your cash flow statement regularly as part of your regular business plan review will help you see potential cash flow challenges earlier so you can take action to avoid a cash crisis where you can’t pay your bills.

- 8. Position your brand against the competition

Competitors are one of the factors that you need to take into account when starting a business. Luckily, competitive research is an integral part of writing a business plan. It encourages you to ask questions like:

- What is your competition doing well? What are they doing poorly?

- What can you do to set yourself apart?

- What can you learn from them?

- How can you make your business stand out?

- What key business areas can you outcompete?

- How can you identify your target market?

Finding answers to these questions helps you solidify a strategic market position and identify ways to differentiate yourself. It also proves to potential investors that you’ve done your homework and understand how to compete.

- 9. Determines financial needs and revenue models

A vital part of starting a business is understanding what your expenses will be and how you will generate revenue to cover those expenses. Creating a business plan helps you do just that while also defining ongoing financial needs to keep in mind.

Without a business model, it’s difficult to know whether your business idea will generate revenue. By detailing how you plan to make money, you can effectively assess the viability and scalability of your business.

Understanding this early on can help you avoid unnecessary risks and start with the confidence that your business is set up to succeed.

- 10. Helps you think through your marketing strategy

A business plan is a great way to document your marketing plan. This will ensure that all of your marketing activities are aligned with your overall goals. After all, a business can’t grow without customers and you’ll need a strategy for acquiring those customers.

Your business plan should include information about your target market, your marketing strategy, and your marketing budget. Detail things like how you plan to attract and retain customers, acquire new leads, how the digital marketing funnel will work, etc.

Having a documented marketing plan will help you to automate business operations, stay on track and ensure that you’re making the most of your marketing dollars.

- 11. Clarifies your vision and ensures everyone is on the same page

In order to create a successful business, you need a clear vision and a plan for how you’re going to achieve it. This is all detailed with your mission statement, which defines the purpose of your business, and your personnel plan, which outlines the roles and responsibilities of current and future employees. Together, they establish the long-term vision you have in mind and who will need to be involved to get there.

Additionally, your business plan is a great tool for getting your team in sync. Through consistent plan reviews, you can easily get everyone in your company on the same page and direct your workforce toward tasks that truly move the needle.

- 12. Future-proof your business

A business plan helps you to evaluate your current situation and make realistic projections for the future.

This is an essential step in growing your business, and it’s one that’s often overlooked. When you have a business plan in place, it’s easier to identify opportunities and make informed decisions based on data.

Therefore, it requires you to outline goals, strategies, and tactics to help the organization stay focused on what’s important.

By regularly revisiting your business plan, especially when the global market changes, you’ll be better equipped to handle whatever challenges come your way, and pivot faster.

You’ll also be in a better position to seize opportunities as they arise.

Further Reading: 5 fundamental principles of business planning

- 13. Tracks your progress and measures success

An often overlooked purpose of a business plan is as a tool to define success metrics. A key part of writing your plan involves pulling together a viable financial plan. This includes financial statements such as your profit and loss, cash flow, balance sheet, and sales forecast.

By housing these financial metrics within your business plan, you suddenly have an easy way to relate your strategy to actual performance. You can track progress, measure results, and follow up on how the company is progressing. Without a plan, it’s almost impossible to gauge whether you’re on track or not.

Additionally, by evaluating your successes and failures, you learn what works and what doesn’t and you can make necessary changes to your plan. In short, having a business plan gives you a framework for measuring your success. It also helps with building up a “lessons learned” knowledge database to avoid costly mistakes in the future.

- 14. Your business plan is an asset if you ever want to sell

Down the road, you might decide that you want to sell your business or position yourself for acquisition. Having a solid business plan is going to help you make the case for a higher valuation. Your business is likely to be worth more to a buyer if it’s easy for them to understand your business model, your target market, and your overall potential to grow and scale.

Free business plan template

Join over 1-million businesses and make planning easy with our simple, modern, investor-approved business plan template.

Download Template

- Writing your business plan

By taking the time to create a business plan, you ensure that your business is heading in the right direction and that you have a roadmap to get there. We hope that this post has shown you just how important and valuable a business plan can be. While it may still seem daunting, the benefits far outweigh the time investment and learning curve for writing one.

Luckily, you can write a plan in as little as 30 minutes. And there are plenty of excellent planning tools and business plan templates out there if you’re looking for more step-by-step guidance. Whatever it takes, write your plan and you’ll quickly see how useful it can be.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- 6. You’ll make big spending decisions with confidence

- 7. You’re more likely to catch critical cash flow challenges early

Related Articles

11 Min. Read

Use This Simple Business Plan Outline Example to Organize Your Plan

7 Min. Read

5 Consequences of Skipping a Business Plan

5 Min. Read

How to Run a Productive Monthly Business Plan Review Meeting

8 Business Plan Templates You Can Get for Free

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Try for free

Business Plan

Who should write a business plan, pros and cons of a business plan, the anatomy of a business plan, .css-uphcpb{position:absolute;left:0;top:-87px;} what is a business plan, definition of a business plan.

A business plan is a strategic document which details the strategic objectives for a growing business or startup, and how it plans to achieve them.

In a nutshell, a business plan is a written expression of a business idea and will describe your business model, your product or service, how it will be priced, who will be your target market, and which tactics you plan to use to reach commercial success.

Whilst every enterprise should have a plan of some sort, a business plan is of particular importance during the investment process. Banks, venture capitalists, and angel investors alike will need to see a detailed plan in order to make sound investment decisions — think of your plan as a way of convincing them your idea is worth their resources.

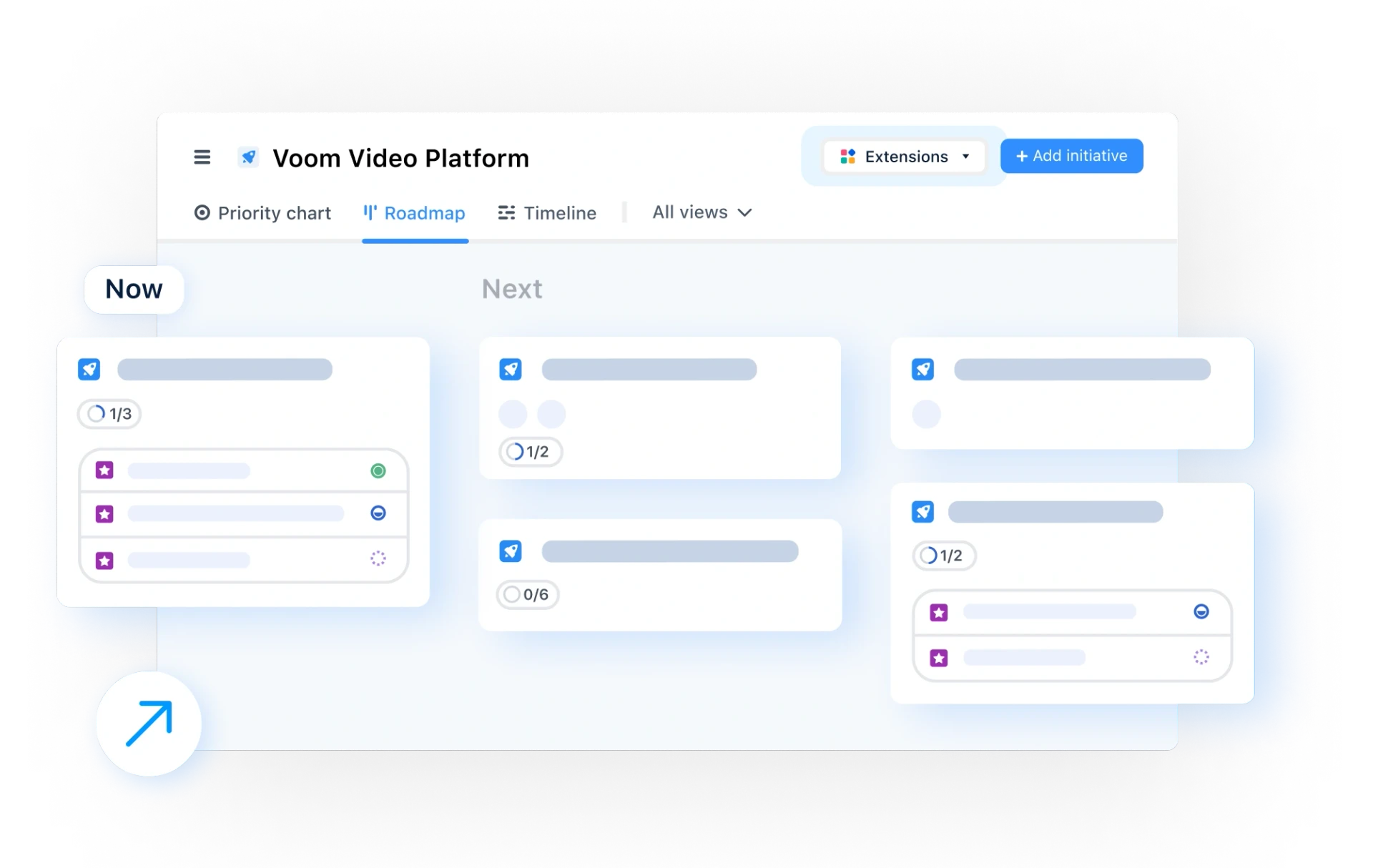

Roadmapping From A to Z

Business plans can also be useful as a guide to keeping a new business on track, especially in the first few months or years when the road ahead isn’t too clear.

Starting a business isn’t an exact science. Some companies organically develop out of trial and error, while others are plotted out from start to finish.

So if you’re asking whether your company needs a lengthy business plan, the answer would be ‘no’. That said, there are definitely a few situations in which writing a plan makes sense and can help increase the chances of a business becoming successful:

In situations when the market is new and untested — or simply volatile — it can be very helpful to have a business plan to refer back to when the road ahead isn’t clear.

For those who have an exciting business idea but haven’t necessarily distilled it down into black-and-white. Writing a business plan is a great way to look at a concept from all angles and spot any potential pitfalls.

How to write a business plan?

The most important step in writing a business plan is to identify its purpose.

Who are you trying to attract with it, and why?

Here are a few key pointers for writing a business plan:

Are you looking to secure a bank loan, get funding from private investors, or to lure skilled professionals to join you?

Include a brief history of your business, the concept, and the products or services. Keep it professional and transparent.

Don’t exaggerate your experience or skills, and definitely don’t leave out information investors need to know. They’ll find out at some point, and if they discover you lied, they could break off their involvement. Trust is crucial.

Explain what the product or service your business offers in simplistic terms.

Watch out for complex language and do whatever you can to prevent readers from becoming confused.

Focus on the benefits the business offers, how it solves the core audience’s problem(s), and what evidence you have to prove that there is a space in the market for your idea. It’s important to touch on the market your business will operate in, and who your main competitors are.

Another essential aspect of writing an effective business plan is to keep it short and sweet. Just focus on delivering the crucial information the reader has to know in order to make a decision. They can always ask you to elaborate on certain points later.

Still, deciding whether or not a business plan will benefit you at this stage of your venture?

Let’s look at a few reasons why you might (or might not) want to write a business plan.

A business plan will help you to secure funding even when you have no trading history. At the seed stage, funding is all-important — especially for tech and SaaS companies. It’s here that a business plan can become an absolute lifesaver.

Your business plan will maintain a strategic focus as time goes on. If you’ve ever heard of “mission creep”, you’ll know how important an agreed can be — and your business plan serves exactly that purpose.

Having a plan down in black and white will help you get other people on board . Again, with no trading history, it can be hard to convince new partners that you know what you’re doing. A business plan elegantly solves this problem.

Your business plan can cause you to stop looking outward. Sometimes, especially in business, you need to be reactive to market conditions. If you focus too much on your original business plan, you might make mistakes that can be costly or miss golden opportunities because they weren’t in the plan.

A lot of time can be wasted analyzing performance. It’s easy to become too focused on the goals and objectives in your business plan — especially when you’re not achieving them. By spending too much time analyzing past performance and looking back, you may miss out on other ways to push the business forward.

A business plan is out of date as soon as it’s written. We all know how quickly market conditions change. And, unfortunately, certain elements in your business plan may have lost relevance by the time you’re ready to launch. But there is another way — by transferring your strategic plan into an actionable roadmap , you can get the best of both worlds. The business plan contains important detail that is less likely to change, such as your mission statement and target audience, and the roadmap clarifies a flexible, adaptable, route forward.

So, you’ve decided to write a business plan — a great choice!

But now comes the tricky task of actually writing it.

This part can be a little frustrating because there is no one-size-fits-all template appropriate for all business plans. The best approach, in fact, is to look at common ingredients of a business plan and pick out the ones that make sense for your venture.

The key elements of a great business plan include:

An overview of the business concept . This is sometimes referred to as an executive summary and it’s essentially the elevator pitch for your business.

A detailed description of the product or service. It’s here that you’ll describe exactly what your core offering will be — what’s your USP , and what value do you deliver?

An explanation of the target audience. You need a good understanding of who you’ll be selling your product or service to, backed up by recent market research.

Your sales and marketing strategy. Now that you know who you’re targeting, how do you plan to reach them? Here you can list primary tactics for finding and maintaining an engaged client base.

Your core team . This section is all about people: do you have a team behind you already? If not, how will you build this team and what will the timeline be? Why are you the right group of people to bring this idea to the market? This section is incredibly important when seeking external investment — in most cases, passion can get you much further than professional experience.

Financial forecasts . Some investors will skim the executive summary and skip straight to the finances — so expect your forecasts to be scrutinized in a lot of detail. Writing a business plan for your eyes only? That’s fine, but you should still take time to map out your financial requirements: how much money do you need to start? How do you plan to keep money coming in? How long will it take to break even ? Remember, cash is king. So you need a cash flow forecast that is realistic, achievable and keeps your business afloat, especially in the tricky first few years.

General FAQ

Glossary categories.

Feedback Management

Prioritization

Product Management

Product Strategy

Roadmapping

Build great roadmaps

Book a demo

Experience the new way of doing product management

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One CURRENT ARTICLE

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

A business plan is a document that outlines a company's goals and the strategies to achieve them. It's valuable for both startups and established companies. For startups, a well-crafted business plan is crucial for attracting potential lenders and investors. Established businesses use business plans to stay on track and aligned with their growth objectives. This article will explain the key components of an effective business plan and guidance on how to write one.

Key Takeaways

- A business plan is a document detailing a company's business activities and strategies for achieving its goals.

- Startup companies use business plans to launch their venture and to attract outside investors.

- For established companies, a business plan helps keep the executive team focused on short- and long-term objectives.

- There's no single required format for a business plan, but certain key elements are essential for most companies.

Investopedia / Ryan Oakley

Any new business should have a business plan in place before beginning operations. Banks and venture capital firms often want to see a business plan before considering making a loan or providing capital to new businesses.

Even if a company doesn't need additional funding, having a business plan helps it stay focused on its goals. Research from the University of Oregon shows that businesses with a plan are significantly more likely to secure funding than those without one. Moreover, companies with a business plan grow 30% faster than those that don't plan. According to a Harvard Business Review article, entrepreneurs who write formal plans are 16% more likely to achieve viability than those who don't.

A business plan should ideally be reviewed and updated periodically to reflect achieved goals or changes in direction. An established business moving in a new direction might even create an entirely new plan.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. It allows for careful consideration of ideas before significant investment, highlights potential obstacles to success, and provides a tool for seeking objective feedback from trusted outsiders. A business plan may also help ensure that a company’s executive team remains aligned on strategic action items and priorities.

While business plans vary widely, even among competitors in the same industry, they often share basic elements detailed below.

A well-crafted business plan is essential for attracting investors and guiding a company's strategic growth. It should address market needs and investor requirements and provide clear financial projections.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, gathering the basic information into a 15- to 25-page document is best. Any additional crucial elements, such as patent applications, can be referenced in the main document and included as appendices.

Common elements in many business plans include:

- Executive summary : This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services : Describe the products and services the company offers or plans to introduce. Include details on pricing, product lifespan, and unique consumer benefits. Mention production and manufacturing processes, relevant patents , proprietary technology , and research and development (R&D) information.

- Market analysis : Explain the current state of the industry and the competition. Detail where the company fits in, the types of customers it plans to target, and how it plans to capture market share from competitors.

- Marketing strategy : Outline the company's plans to attract and retain customers, including anticipated advertising and marketing campaigns. Describe the distribution channels that will be used to deliver products or services to consumers.

- Financial plans and projections : Established businesses should include financial statements, balance sheets, and other relevant financial information. New businesses should provide financial targets and estimates for the first few years. This section may also include any funding requests.

Investors want to see a clear exit strategy, expected returns, and a timeline for cashing out. It's likely a good idea to provide five-year profitability forecasts and realistic financial estimates.

2 Types of Business Plans

Business plans can vary in format, often categorized into traditional and lean startup plans. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These are detailed and lengthy, requiring more effort to create but offering comprehensive information that can be persuasive to potential investors.

- Lean startup business plans : These are concise, sometimes just one page, and focus on key elements. While they save time, companies should be ready to provide additional details if requested by investors or lenders.

Why Do Business Plans Fail?

A business plan isn't a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections. Markets and the economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All this calls for building flexibility into your plan, so you can pivot to a new course if needed.

How Often Should a Business Plan Be Updated?

How frequently a business plan needs to be revised will depend on its nature. Updating your business plan is crucial due to changes in external factors (market trends, competition, and regulations) and internal developments (like employee growth and new products). While a well-established business might want to review its plan once a year and make changes if necessary, a new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is ideal for quickly explaining a business, especially for new companies that don't have much information yet. Key sections may include a value proposition , major activities and advantages, resources (staff, intellectual property, and capital), partnerships, customer segments, and revenue sources.

A well-crafted business plan is crucial for any company, whether it's a startup looking for investment or an established business wanting to stay on course. It outlines goals and strategies, boosting a company's chances of securing funding and achieving growth.

As your business and the market change, update your business plan regularly. This keeps it relevant and aligned with your current goals and conditions. Think of your business plan as a living document that evolves with your company, not something carved in stone.

University of Oregon Department of Economics. " Evaluation of the Effectiveness of Business Planning Using Palo Alto's Business Plan Pro ." Eason Ding & Tim Hursey.

Bplans. " Do You Need a Business Plan? Scientific Research Says Yes ."

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

Harvard Business Review. " How to Write a Winning Business Plan ."

U.S. Small Business Administration. " Write Your Business Plan ."

SCORE. " When and Why Should You Review Your Business Plan? "

:max_bytes(150000):strip_icc():format(webp)/GettyImages-904536858-c089bc26f4fd4025b23f536345ba73ae.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

Do you REALLY need a business plan?

The top three questions that I get asked most frequently as a professional business plan writer will probably not surprise you:

- What is the purpose of a business plan – why is it really required?

- How is it going to benefit my business if I write a business plan?

- Is a business plan really that important – how can I actually use it?

Keep reading to get my take on what the most essential advantages of preparing a business plan are—and why you may (not) need to prepare one.

The importance, purpose and benefit of a business plan is in that it enables you to validate a business idea, secure funding, set strategic goals – and then take organized action on those goals by making decisions, managing resources, risk and change, while effectively communicating with stakeholders.

Let’s take a closer look at how each of the important business planning benefits can catapult your business forward:

1. Validate Your Business Idea

The process of writing your business plan will force you to ask the difficult questions about the major components of your business, including:

- External: industry, target market of prospective customers, competitive landscape

- Internal: business model, unique selling proposition, operations, marketing, finance

Business planning connects the dots to draw a big picture of the entire business.

And imagine how much time and money you would save if working through a business plan revealed that your business idea is untenable. You would be surprised how often that happens – an idea that once sounded so very promising may easily fall apart after you actually write down all the facts, details and numbers.

While you may be tempted to jump directly into start-up mode, writing a business plan is an essential first step to check the feasibility of a business before investing too much time and money into it. Business plans help to confirm that the idea you are so passionate and convinced about is solid from business point of view.

Take the time to do the necessary research and work through a proper business plan. The more you know, the higher the likelihood that your business will succeed.

2. Set and Track Goals

Successful businesses are dynamic and continuously evolve. And so are good business plans that allow you to:

- Priorities: Regularly set goals, targets (e.g., sales revenues reached), milestones (e.g. number of employees hired), performance indicators and metrics for short, mid and long term

- Accountability: Track your progress toward goals and benchmarks

- Course-correction: make changes to your business as you learn more about your market and what works and what does not

- Mission: Refer to a clear set of values to help steer your business through any times of trouble

Essentially, business plan is a blueprint and an important strategic tool that keeps you focused, motivated and accountable to keep your business on track. When used properly and consulted regularly, it can help you measure and manage what you are working so hard to create – your long-term vision.

As humans, we work better when we have clear goals we can work towards. The everyday business hustle makes it challenging to keep an eye on the strategic priorities. The business planning process serves as a useful reminder.

3. Take Action

A business plan is also a plan of action . At its core, your plan identifies where you are now, where you want your business to go, and how you will get there.

Planning out exactly how you are going to turn your vision into a successful business is perhaps the most important step between an idea and reality. Success comes not only from having a vision but working towards that vision in a systematic and organized way.

A good business plan clearly outlines specific steps necessary to turn the business objectives into reality. Think of it as a roadmap to success. The strategy and tactics need to be in alignment to make sure that your day-to-day activities lead to the achievement of your business goals.

4. Manage Resources

A business plan also provides insight on how resources required for achieving your business goals will be structured and allocated according to their strategic priority. For example:

Large Spending Decisions

- Assets: When and in what amount will the business commit resources to buy/lease new assets, such as computers or vehicles.

- Human Resources: Objectives for hiring new employees, including not only their pay but how they will help the business grow and flourish.

- Business Space: Information on costs of renting/buying space for offices, retail, manufacturing or other operations, for example when expanding to a new location.

Cash Flow It is essential that a business carefully plans and manages cash flows to ensure that there are optimal levels of cash in the bank at all times and avoid situations where the business could run out of cash and could not afford to pay its bills.

Revenues v. Expenses In addition, your business plan will compare your revenue forecasts to the budgeted costs to make sure that your financials are healthy and the business is set up for success.

5. Make Decisions

Whether you are starting a small business or expanding an existing one, a business plan is an important tool to help guide your decisions:

Sound decisions Gathering information for the business plan boosts your knowledge across many important areas of the business:

- Industry, market, customers and competitors

- Financial projections (e.g., revenue, expenses, assets, cash flow)

- Operations, technology and logistics

- Human resources (management and staff)

- Creating value for your customer through products and services

Decision-making skills The business planning process involves thorough research and critical thinking about many intertwined and complex business issues. As a result, it solidifies the decision-making skills of the business owner and builds a solid foundation for strategic planning , prioritization and sound decision making in your business. The more you understand, the better your decisions will be.

Planning Thorough planning allows you to determine the answer to some of the most critical business decisions ahead of time , prepare for anticipate problems before they arise, and ensure that any tactical solutions are in line with the overall strategy and goals.

If you do not take time to plan, you risk becoming overwhelmed by countless options and conflicting directions because you are not unclear about the mission , vision and strategy for your business.

6. Manage Risk

Some level of uncertainty is inherent in every business, but there is a lot you can do to reduce and manage the risk, starting with a business plan to uncover your weak spots.

You will need to take a realistic and pragmatic look at the hard facts and identify:

- Major risks , challenges and obstacles that you can expect on the way – so you can prepare to deal with them.

- Weaknesses in your business idea, business model and strategy – so you can fix them.

- Critical mistakes before they arise – so you can avoid them.

Essentially, the business plan is your safety net . Naturally, business plan cannot entirely eliminate risk, but it can significantly reduce it and prepare you for any challenges you may encounter.

7. Communicate Internally

Attract talent For a business to succeed, attracting talented workers and partners is of vital importance.

A business plan can be used as a communication tool to attract the right talent at all levels, from skilled staff to executive management, to work for your business by explaining the direction and growth potential of the business in a presentable format.

Align performance Sharing your business plan with all team members helps to ensure that everyone is on the same page when it comes to the long-term vision and strategy.

You need their buy-in from the beginning, because aligning your team with your priorities will increase the efficiency of your business as everyone is working towards a common goal .

If everyone on your team understands that their piece of work matters and how it fits into the big picture, they are more invested in achieving the objectives of the business.

It also makes it easier to track and communicate on your progress.

Share and explain business objectives with your management team, employees and new hires. Make selected portions of your business plan part of your new employee training.

8. Communicate Externally

Alliances If you are interested in partnerships or joint ventures, you may share selected sections of your plan with the potential business partners in order to develop new alliances.

Suppliers A business plan can play a part in attracting reliable suppliers and getting approved for business credit from suppliers. Suppliers who feel confident that your business will succeed (e.g., sales projections) will be much more likely to extend credit.

In addition, suppliers may want to ensure their products are being represented in the right way .

Professional Services Having a business plan in place allows you to easily share relevant sections with those you rely on to support the organization, including attorneys, accountants, and other professional consultants as needed, to make sure that everyone is on the same page.

Advisors Share the plan with experts and professionals who are in a position to give you valuable advice.

Landlord Some landlords and property managers require businesses to submit a business plan to be considered for a lease to prove that your business will have sufficient cash flows to pay the rent.

Customers The business plan may also function as a prospectus for potential customers, especially when it comes to large corporate accounts and exclusive customer relationships.

9. Secure Funding

If you intend to seek outside financing for your business, you are likely going to need a business plan.

Whether you are seeking debt financing (e.g. loan or credit line) from a lender (e.g., bank or financial institution) or equity capital financing from investors (e.g., venture or angel capital), a business plan can make the difference between whether or not – and how much – someone decides to invest.

Investors and financiers are always looking at the risk of default and the earning potential based on facts and figures. Understandably, anyone who is interested in supporting your business will want to check that you know what you are doing, that their money is in good hands, and that the venture is viable in the long run.

Business plans tend to be the most effective ways of proving that. A presentation may pique their interest , but they will most probably request a well-written document they can study in detail before they will be prepared to make any financial commitment.

That is why a business plan can often be the single most important document you can present to potential investors/financiers that will provide the structure and confidence that they need to make decisions about funding and supporting your company.

Be prepared to have your business plan scrutinized . Investors and financiers will conduct extensive checks and analyses to be certain that what is written in your business plan faithful representation of the truth.

10. Grow and Change

It is a very common misconception that a business plan is a static document that a new business prepares once in the start-up phase and then happily forgets about.

But businesses are not static. And neither are business plans. The business plan for any business will change over time as the company evolves and expands .

In the growth phase, an updated business plan is particularly useful for:

Raising additional capital for expansion

- Seeking financing for new assets , such as equipment or property

- Securing financing to support steady cash flows (e.g., seasonality, market downturns, timing of sale/purchase invoices)

- Forecasting to allocate resources according to strategic priority and operational needs

- Valuation (e.g., mergers & acquisitions, tax issues, transactions related to divorce, inheritance, estate planning)

Keeping the business plan updated gives established businesses better chance of getting the money they need to grow or even keep operating.

Business plan is also an excellent tool for planning an exit as it would include the strategy and timelines for a transfer to new ownership or dissolution of the company.

Also, if you ever make the decision to sell your business or position yourself for a merger or an acquisition , a strong business plan in hand is going to help you to maximize the business valuation.

Valuation is the process of establishing the worth of a business by a valuation expert who will draw on professional experience as well as a business plan that will outline what you have, what it’s worth now and how much will it likely produce in the future.

Your business is likely to be worth more to a buyer if they clearly understand your business model, your market, your assets and your overall potential to grow and scale .

Related Questions

Business plan purpose: what is the purpose of a business plan.

The purpose of a business plan is to articulate a strategy for starting a new business or growing an existing one by identifying where the business is going and how it will get there to test the viability of a business idea and maximize the chances of securing funding and achieving business goals and success.

Business Plan Benefits: What are the benefits of a business plan?

A business plan benefits businesses by serving as a strategic tool outlining the steps and resources required to achieve goals and make business ideas succeed, as well as a communication tool allowing businesses to articulate their strategy to stakeholders that support the business.

Business Plan Importance: Why is business plan important?

The importance of a business plan lies in it being a roadmap that guides the decisions of a business on the road to success, providing clarity on all aspects of its operations. This blueprint outlines the goals of the business and what exactly is needed to achieve them through effective management.

Sign up for our Newsletter

Get more articles just like this straight into your mailbox.

Related Posts

Recent Posts

BENEFITS OF A BUSINESS PLAN: Benefits and Drawbacks

- by Folakemi Adegbaju

- August 15, 2023

Table of Contents Hide

#1. you gain an understanding of your market, #2. evaluate risk, #3. you can get outside funding, #4. you can check the financial numbers, #5. you focus your strategies, #6. it will help you steer your business as you start and grow, #1. a great business plan requires great implementation practices, #2. a business plan can turn out to be inaccurate, #3. it creates an environment of false certainty, benefits of a business plan for an entrepreneur, final thoughts, what is the main purpose of a business plan, what needs to be in a business plan, who reads a business plan and what information are they looking for.

A good business plan can be said to be a road map to success, outlining all parts of your company, from marketing and finance to operations, products, services, and people, as well as how you will outperform your competitor. However, does the thought of writing your first business plan seem intimidating? Well, you’re not alone. Many entrepreneurs deal with this crucial phase of starting a business. This article will outline and explain the benefits and drawbacks of writing a business plan for you as an entrepreneur.

Are you ready? Enjoy the ride with us.

Benefits of a Business Plan

A business plan can assist you in determining the profitability of a business before putting too much time or money into it if you are thinking of starting one. It also includes information on the procedures to take, the resources needed to achieve your business objectives, and a schedule for potential results. The style and content of a business plan can vary significantly.

You’ll be reactive rather than proactive if you don’t have a business plan, and growth will be much more difficult. More importantly, the lack of a business plan would discourage potential investors and creditors, making it incredibly difficult to raise funds. Finally, if you don’t have a business plan, you won’t have anything to fall back on if things don’t go your way, so even a minor problem might quickly escalate.

If you’re starting a business, there are a couple of things that come first, including; registration of your business name, getting a tax ID, choosing a business structure, applying for the necessary permissions and licenses, and so on. For example, let’s say you need to start up a jewelry business. These and more are what you’d have to consider. However, just to take the stress off your plate, we already have a comprehensive jewelry business plan with a 3-year financial projection in place. All you’d need at this point is a business name.

So, what can a good business plan help you achieve? Here are six benefits of writing a business plan:

Knowing how to conduct a market analysis is one of the benefits of writing a business plan. You examine your industry, target market, and rivals when conducting this research. You can spot patterns in decisions that may benefit or hurt your business.

One of the benefits of writing a business plan is the ability to learn from other people’s mistakes. Learning from the mistakes of others takes less time and money than learning from your own mistakes. The better prepared you are to cope with the many components of your market, the easier it will be to deal with problems later on.

A business plan can also assist you in evaluating the risks involved with your business. To avoid failure, you must first identify and manage risks. A business plan will require you to consider the risks you’re taking and decide whether they’re worth taking or if you should change your plan.

A business plan is required to obtain funds from lenders or investors. Lenders want to know they’re putting their money into a business that will stay and flourish. You must present a business plan to lenders that outlines the steps you will follow as a business owner. It’s a good idea to structure your ideas, even if your lenders are friends and relatives.

A business plan aids others in comprehending your passion and determining where their money will be spent. Clearly communicating your ideas to investors can help you demonstrate that you can get your business off the ground and grow it. You’ll also need to know how to construct a business plan’s exit strategy. A successful business is useless to your investors if they can’t get their money back at some point.

Financial estimates for your organization are included in business plans. While the forecasts aren’t a look into the future, they do reflect a prediction of your financial situation. It will be critical to plan for expenses in order to keep operations running smoothly. Cash flow estimates allow you to understand if your objectives are realistic. They also point out patterns that could be detrimental to your company. The quicker you recognize potential problems, the faster you can fix them.

Make sure your estimates are in line with your expectations. Have you set aside sufficient funds to complete the job at hand? Check your figures again to make sure you’re ready to handle your finances in the future.

The entrepreneur in you is itching to get started right away. A business plan, on the other hand, can assist you in determining the ideal methods for your business. Work on all the crucial aspects before venturing into ownership.

This benefit of a business plan also aids in work prioritization. You can determine which difficulties to handle first by examining the big vision of your business. A business plan might also assist you in deciding which activities to tackle later.

Consider a business plan to be a GPS to get your business up and running. Another one of the benefits of writing a good business plan is that it will walk you through each step of beginning and running a business. Your business plan will serve as a road map for how to establish, run, and grow your new business. It’s a technique to think about and outline all of the important aspects of how your business will operate.

Drawbacks of a Business Plan

A business plan has its own benefits and drawbacks, one of which is the stress involved in putting together all you need. So, as an entrepreneur, you’d always need to talk to a professional to make it easier for you to write a business plan.

And guess what? We have a team here at BusinessYield Consult to provide you with the necessary information you’d need starting out.

Meanwhile, here are other drawbacks you need to consider in writing a business plan:

Many businesses make a plan that sits on a bookshelf or on a storage device since it was created for one specific reason: to raise funds. A great business plan should become an inherent part of the organization once it has allocated particular responsibilities to specific job categories and laid the groundwork for data collection and metric production. Unfortunately, over the years, bad implementation has ruined many outstanding business plans.

Involving the “proper” people in the business planning process is critical. These are the people who will have an impact on the long-term plan of your business. Most business owners believe they can avoid these drawbacks by writing their own business plan, but this takes skill in a variety of sectors to be effective. For the greatest possible business plan, a diverse variety of perspectives and input is normally required, because otherwise, blind spots of inaccuracy can lead to plenty of unforeseen effects.

This basically means you’d need professionals like BusinessYield Consult for more optimal results.

It’s crucial to remember that a business plan is nothing more than a forecast based on current plans and data. We live in an ever-changing world where nothing is guaranteed. If a business plan has too much predictability, it may be unable to adjust to the changes that the world forces upon it. It might cause a business to miss out on an intriguing new opportunity because they are so focused on achieving one particular objective.

The benefits and drawbacks of a business plan illustrate that it is an important component of a good business but a thorough plan may not be required in all situations. The purpose of a business plan should be apparent to assess the current in order to make the best prediction of future results. You’ll be able to boost your chances of success if you can plan for disruptions as well. For example, if you want to start a car detailing business and you feel there might be a disruption or crisis, in the long run, a good business plan can help you fix any issues. But either way, you may also need to speak with professionals to help you out.

Every entrepreneur needs a business to build and develop their business. A business plan comes with a lot of benefits for you as an entrepreneur.

Here are some of the benefits of a business plan for an entrepreneur:

- Provides guidance for opening new or expanding existing business /adaptability

- It acts as a management tool for the business/monitoring tool / identifies strengths

- It’s a tool for evaluating business performance

- It lays the strategy to be used in marketing the products

- Facilitates acquisition of loans from financial institutions and other financiers

The benefits of a business plan are more than the drawbacks and you can see why it is necessary for you to get a business plan as soon as possible. It is compulsory for you to know the benefits and drawbacks of a business plan so as to know how to fix things right in your business plan as an entrepreneur.

The main purpose of a Business Plan is to evaluate, characterize, and analyze a business opportunity or an existing business, as well as to assess its technological, economic, and financial viability.

An executive overview, products and services, marketing strategy and analysis, financial planning, and a budget should all be included in a good business plan.

It’s the lenders. A financial institution will want to examine a well-written business plan before approving a business loan. This assists the lender in determining whether the business objectives are reasonable and whether you’ve accurately forecasted various expenses and potential earnings.

Related Articles

- 4 MAIN PARTS OF A BUSINESS PLAN: 4 Necessary Business Plan Components

- Advantages of a Business Plan: Definition and What It Entails

Folakemi Adegbaju

She is a passionate copywriter and a good listener

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Best Cheap Car Insurance for New Drivers in the UK

Scottish widows life insurance reviews.

Last Updated on August 16, 2023 by Folakemi Adegbaju

The Advantages and Disadvantages of Different Business Plan Strategies

Fundrising Ready

MAC & PC Compatible

Immediate Download

Related Blogs

- Unlocking the Benefits of Outsourcing

- A Step-by-Step Guide to the Business Registration Process

- Uncover The Benefits & Power of Customer Segmentation

- Exploring the Benefits of Strategic Partnerships

- Strategies for Building Customer Loyalty

In the dynamic world of entrepreneurship, understanding the advantages and disadvantages of various business plan strategies is essential for sustainable growth. From the detailed structure of a traditional business plan to the agile approach of a lean startup, each method presents unique benefits and challenges. This exploration will equip you with the insights needed to choose the right strategy for your venture's success.

What are the key components of a traditional business plan strategy?

Definition and purpose of a traditional business plan.

A traditional business plan serves as a comprehensive roadmap for a business, outlining its objectives, strategies, and the means to achieve them. This type of plan is typically detailed, spanning several pages, and it is often utilized by entrepreneurs to secure funding or guide their business decisions. The primary purpose is to provide clarity and direction for both the business owner and potential investors, ensuring that all parties understand the business's vision and operational plans.

Common sections included

A traditional business plan generally includes several key sections that collectively create a holistic view of the business. Some of the most common sections are:

- Executive Summary: A concise overview of the business, its mission, and the key points of the plan.

- Market Analysis: An assessment of the industry, market size, and competitive landscape using various market analysis techniques .

- Organization and Management: Details about the business structure, ownership, and the management team.

- Products or Services: Information on what the business offers, including its unique selling propositions.

- Marketing Strategy: A detailed plan on how the business will attract and retain customers.

- Funding Request: A clear outline of the funding needed and how it will be used.

- Financial Projections: Forecasts that demonstrate the potential for profitability, including projections for income, expenses, and cash flow.

Importance of financial projections and funding requirements

Financial projections are a critical component of any traditional business plan. They not only illustrate the business's potential for profitability but also serve as a key tool for attracting investors. Well-prepared financial projections provide insights into:

- Revenue Streams: Identifying how the business will generate income.

- Cost Analysis: Understanding the costs associated with running the business and producing products or services.

- Break-even Analysis: Determining when the business will start making a profit.

- Funding Requirements: Clearly stating how much funding is needed, what it will be used for, and potential returns for investors.

By presenting detailed financial projections in business plans, entrepreneurs can foster trust and confidence among stakeholders, which is essential for establishing strong investor relations .

- Ensure that your financial projections are realistic and supported by data to avoid potential pitfalls.

- Regularly update your traditional business plan to reflect changing market conditions and business dynamics.

How does a lean startup strategy differ from a traditional business plan?

Emphasis on rapid prototyping and customer feedback.