- Sample Business Plans

- Finance & Investing

Financial Advisor Business Plan

If you are a financial advisor, chances are you’d want to have your own business at some point in your career.

After all, having a business lets you pick the clients you want to work with, it lets you pick the kind of work you want to do, and it gives you autonomy on a lot of other aspects too. Also, having a business makes you feel more responsible.

If you are planning to start a new financial advisor business, the first thing you will need is a business plan. Use our sample financial advisor business plan to start writing your business plan in no time.

Before you start writing your business plan for your new financial advisor business, spend as much time as you can reading through some examples of finance and investment-related business plans .

Industry Overview

The financial planning and advice industry stood at a market value of 56.9 billion dollars in the US in 2021 and has experienced and has experienced a whopping growth rate of 7.7 percent.

The major reason for the growth and potential expansion of the financial planning sector is the growing average age of the population.

As many people are reaching retirement age in the US, estate and financial planning services have grown in demand. The median age is expected to grow and so is the size of the sector.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

Things to Consider Before Writing a Financial Advisor Business Plan

You need to have a motivation bigger than money.

The truly passionate people know that financial planning isn’t just about money. Money is a major factor in getting into any business, but it shouldn’t be the only factor that drives you.

Against popular belief, any finance-related field isn’t all about money. It is about a passion for analysis, critical thinking, decision-making, and a little risk.

So, before you go ahead, try to figure out what drives you to do this business.

Have the plan to keep adding to your skillset

Everything is becoming more advanced and rapid today. And as the pace of this world increases, the need to keep adding and improving your skills increases too.

Especially, in the financial planning world, you’ll need to have unique ideas and sharp problem-solving skills.

Have a customer retention plan

As a financial advisor, retaining your customers is probably even more important than getting new ones. The increase in your credibility is proportionate to the number of clients you can retain.

Also, it gives you experience with how planning changes as the finances grow.

Hence, having a framework that helps you retain your customers is important. Keep that in mind while planning.

Know the risks and prepare for them as well as you can

All of us know that financial planning comes with its set of risks, and though we can make accurate predictions, they need not be necessarily true.

Be prepared for such risks and know what next steps you’ll take if things go wrong. It helps you deal with such situations better and has more satisfied customers.

Chalking Out Your Business Plan

The biggest problem is, many of us do not know where to start. Well, you don’t need to worry about that anymore. A financial advisor business plan can help you with that.

From setting your business goals to building a thriving and profitable business, a business plan is your ultimate guide to all of that and more!

Reading sample business plans will give you a good idea of what you’re aiming for. It will also show you the different sections that different entrepreneurs include and the language they use to write about themselves and their business plans.

We have created this sample financial advisor business plan for you to get a good idea about how perfect a financial advisor business plan should look and what details you will need to include in your stunning business plan.

Financial Advisor Business Plan Outline

This is the standard financial advisor business plan outline which will cover all important sections that you should include in your business plan.

- Customer Focus

- Success Factors

- Mission Statement

- Vision Statement

- 3 Year profit forecast

- Business Structure

- Startup cost

- Products and Services

- Industry Analysis

- Market Trends

- Target Market

- SWOT Analysis

- Targeted Cold Calls

- Publications

- Direct Mail

- Pricing Strategy

- Important Assumptions

- Brake-even Analysis

- Profit Yearly

- Gross Margin Yearly

- Projected Cash Flow

- Projected Balance Sheet

- Business Ratios

After getting started with Upmetrics , you can copy this sample financial advisor business plan into your business plan and modify the required information and download your financial advisor business plan pdf or doc file.

It’s the fastest and easiest way to start writing your business plan.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Download a sample financial advisor business plan

Need help writing your business plan from scratch? Here you go; download our free financial advisor business plan pdf to start.

It’s a modern business plan template specifically designed for your financial advisor business. Use the example business plan as a guide for writing your own.

Related Posts

Loan Office Business Plan

Mortgage Broker Business Plan

Business Plan Writing Steps

Financial Plan Writing Guide

3-Year Business Plan

5-Year Business Plan

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Turn your business idea into a solid business plan

Explore Plan Builder

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

Advancing Knowledge in Financial Planning

- Close Search

- Live Webinars

- Financial Planning Value Summit

- Digital Marketing Summit

- Business Solutions

- Advicer Manifesto

- AdvisorTech

- FP Productivity

- FinTech Map

- AdvisorTech Directory

- Master Conference List

- Best Of Posts

- CFP Scholarships

- How To Contribute

- Financial Advisor Success

- Kitces & Carl

- Apply/Recommend Guest

- Client Trust & Communication

- Conferences

- Debt & Liabilities

- Estate Planning

- General Planning

- Human Capital

- Industry News

- Investments

- Personal/Career Development

- Planning Profession

- Practice Management

- Regulation & Compliance

- Retirement Planning

- Technology & Advisor FinTech

- Weekend Reading

- CE Eligible

- Nerd’s Eye View

Please contact your Firm's Group Admin

IAR CE is only available if your organization contracts with Kitces.com for the credit. Please contact your firm's group administrator to enable this feature. If you do not know who your group administrator is you may contact [email protected]

Kitces Financial Planning Value Summit 2024

See how successful advisors are demonstrating their value to clients.

Thursday, December 12, 12-4 PM ET

Want CE Credit for reading articles like this?

Essential requirements in crafting a one-page financial advisor business plan.

August 17, 2015 07:01 am 21 Comments CATEGORY: Practice Management

Executive Summary

In a world where most advisory firms are relatively small businesses, having a formal business plan is a remarkably rare occurrence. For most advisors, they can “keep track” of the business in their head, making the process of creating a formal business plan on paper to seem unnecessary.

Yet the reality is that crafting a business plan is about more than just setting some business goals to pursue. Like financial planning, the process of thinking through the plan is still valuable, regardless of whether the final document at the end gets put to use. In fact, for many advisory firms, a simple “one-page” financial advisor business plan may be the best output of the business planning process – a single-page document with concrete goals to which the advisor can hold himself/herself accountable.

So what should the (one-page) financial advisor business plan actually cover? As the included sample template shows, there are six key areas to define for the business: who will it serve, what will you do for them, how will you reach them, how will you know if it’s working, where will you focus your time, and what must you do to strengthen (or build) the foundation to make it possible? Ideally, this should be accompanied by a second page to the business plan, which includes a budget or financial projection of the key revenue and expense areas of the business, to affirm that it is a financially viable plan (and what the financial goals really are!).

And in fact, because one of the virtues of a financial advisor business plan is the accountability it can create, advisors should not only craft the plan, but share it – with coaches and colleagues, and even with prospective or current clients. Doing so becomes an opportunity to not only to get feedback and constructive criticism about the goals, but in the process of articulating a clear plan for the business, the vetting process can also be a means to talk about the business and who it will serve, creating referral opportunities in the process!

Author: Michael Kitces

Michael Kitces is Head of Planning Strategy at Buckingham Strategic Wealth , which provides an evidence-based approach to private wealth management for near- and current retirees, and Buckingham Strategic Partners , a turnkey wealth management services provider supporting thousands of independent financial advisors through the scaling phase of growth.

In addition, he is a co-founder of the XY Planning Network , AdvicePay , fpPathfinder , and New Planner Recruiting , the former Practitioner Editor of the Journal of Financial Planning, the host of the Financial Advisor Success podcast, and the publisher of the popular financial planning industry blog Nerd’s Eye View through his website Kitces.com , dedicated to advancing knowledge in financial planning. In 2010, Michael was recognized with one of the FPA’s “Heart of Financial Planning” awards for his dedication and work in advancing the profession.

Read all of Michael’s articles here .

Why A Business Plan Matters For Financial Advisors

There’s no end to the number of articles and even entire books that have been written about how to craft a business plan , yet in practice I find that remarkably few financial advisors have ever created any kind of formal (written or unwritten) business plan. Given that the overwhelming majority of financial advisors essentially operate as solo practitioners or small partnerships, this perhaps isn’t entirely surprising – when you can keep track of the entire business in your head in the first place, is there really much value to going through a formal process of crafting a financial advisor business plan?

Having been a part of the creation and growth of numerous businesses , I have to admit that my answer to “does a[n individual] financial advisor really need a business plan?” is a resounding yes . But not because you’re just trying to figure out what the basics of your business will be, which you may well have “figured out” in your head (or as the business grows, perhaps figured out in conversations with your partner). The reason a business plan matters is all about focus , and the ability to keep focus in proceeding towards your core objectives, and accountable to achieving them, even in a dynamic real-world environment full of distractions.

Click To Tweet

As the famous military saying goes, “ no battle plan ever survives contact with the enemy ”, because the outcomes of battle contact itself change the context, and it’s almost impossible to predict what exactly will come next. Nonetheless, crafting a battle plan in advance is a standard for military leadership. Because even if the plan will change as it’s being executed, having a clearly articulated objective allows everyone, even (and especially) in the heat of battle, to keep progressing towards a common agreed-upon goal. In other words, the objective stated in the battle plan provides a common point of focus for everyone to move towards, even as the (battle) landscape shifts around them. And the business plan serves the exact same role within a business.

Essential Elements Required In A Financial Advisor Business Plan

Because the reality is that in business – as in battle? – the real world will not likely conform perfectly to an extensively crafted business (or battle) plan written in advance, I am not a fan of crafting an extensively detailed business plan, especially for new advisors just getting started, or even a ‘typical’ solo advisory firm. While it’s valuable to think through all the elements in depth – the process of thinking through a business plan is part of what helps to crystallize the key goals to work towards – as with financial planning itself, the process of planning can actually be more valuable than “the plan” that is written out at the end .

Accordingly, for most financial advisors trying to figure out how to write a business plan, I’m an advocate of crafting a form of “one-page business plan” that captures the essential elements of the business, and provides direction about where to focus, especially focus the time of the advisor-owner in particular. In other words, the purpose for a financial advisor business plan is simply to give clear marching orders towards a clear objective, with clear metrics about what is trying to be achieved along the way, so you know where to focus your own time and energy!

Of course, the reality is that what constitutes the most important goals for an advisory firm – as well as the challenges it must surmount – will vary a lot, depending not just on the nature of the firm, but simply on its size, scope, and business stage. Financial advisors just getting started launching a new RIA face very different business and growth issues than a solo advisor who has been operating for several years but now hit a “wall” in the business , and the challenges of a solo advisor are different than those of a larger firm with multiple partners who need to find alignment in their common business goals. Nonetheless, the core essential elements that any business plan is required to cover are remarkably similar.

Requirements For An Effective Financial Advisor Business Plan

While there are many areas that can potentially be covered, the six core elements that must be considered as the template for a financial advisor business plan are:

6 Required Elements Of A (One Page) Business Plan For Financial Advisors 1) Who will you serve? This is the most basic question of all, but more complex than it may seem at first. The easy answer is “anyone who will pay me”, but in practice I find that one of the most common reasons a new advisor fails is that their initial outreach is so unfocused, there’s absolutely no possibility to gain any momentum over time. In the past, when you could cold-call your way to success by just trying to pump your products on every person who answered the phone until you found a buyer, this might have been feasible. But if you want to get paid for your advice itself, you need to be able to demonstrate your expertise. And since you can’t possibly be an expert at everything for everyone, you have to pick someone for whom you will become a bona fide specialist (which also provides crucial differentiation from other advisors the potential client might choose to work with instead ). In other words, you need to choose what type of niche clientele you’re going to target to differentiate yourself. And notably, this problem isn’t unique to new advisors; many established advisors ultimately hit a wall in their business, in part because it’s so time-consuming trying to be everything to everyone, that they reach their personal capacity in serving clients earlier than they ‘should’. Focusing on a particular clientele – to the point that you can anticipate all of their problems and issues in advance – allows the business to be radically more efficient. So who, really , do you want to serve? 2) What will you do for them? Once you’ve chosen who you will serve, the next task is to figure out what you will actually do for them – in other words, what services will you deliver. The reason it’s necessary to first figure out who you will serve, is that the nature of your target niche clientele may well dictate what kind of services you’re going to provide them; in fact, part of the process of identifying and refining your niche in the first place should be to interview a number of people in your niche , and really find out what they want and need that’s important to them (not just the standard ‘comprehensive financial plan’ that too many advisors deliver in the same undifferentiated manner ). For instance, if you’re really serious about targeting retirees, you might not only provide comprehensive financial planning, but investment management services (for their retirement portfolios), a specific retirement income distribution strategy, assistance with long-term care insurance, and guidance on enrolling in Medicare and making decisions about the timing of when to start Social Security benefits . On the other hand, if you hope to work with entrepreneurs, you might need to form relationships with attorneys and accountants who can help facilitate creating new business entities, and your business model should probably be on a retainer basis, as charging for assets under management may be difficult (as entrepreneurs tend to plow their dollars back into their businesses!). If your goal is to work with new doctors, on the other hand, your advice will probably focus more on career guidance, working down a potential mountain of student debt, and cash flow/budgeting strategies. Ultimately, these adjustments will help to formulate the ongoing client service calendar you might craft to articulate what you’ll do with clients (especially if you plan to work with them on an ongoing basis), and the exact business model of how you’ll get paid (Insurance commissions? Investment commissions? AUM fees? Annual retainers? Monthly retainers ? Hourly fees?). 3) How will you reach them? Once you’ve decided who you want to reach, and what you will do for them, it’s time to figure out how you will reach them – in other words, what will be your process for finding prospective clients you might be able to work with? If you’re targeting a particular niche, who are the centers of influence you want to build relationships with? What publications do they read, where you could write? What conferences do they attend, where you might speak? What organizations are they involved with, where you might also volunteer and get involved? If you’re going to utilize an inbound marketing digital strategy as an advisor , what are the topics you can write about that would draw interest and organic search traffic, and what giveaway will you provide in order to get them to sign up for your mailing list so you can continue to drip market to them? In today’s competitive world, it’s not enough to just launch a firm, hang your (virtual) shingle, and wait for people to walk in off the street or call your office. You need to have a plan about how you will get out there to get started! 4) How will you know if it’s working? Once you’ve set a goal for who you want to serve, what you want to do for them, and how you will reach them, it’s time to figure out how to measure whether it’s working. The caveat for most financial advisory businesses, though, is that measuring outcomes is tough because of the small sample size – in a world where you might have to reach out to dozens of strangers just to find a dozen prospects, and then meet with all those prospects just to get a client or two, it’s hard to tell whether a strategy that nets one extra client in a quarter was really a “better strategy” or just random good luck that won’t repeat. As a result, in practice it’s often better to measure activity than results , especially as a newer advisory firm. In other words, if you think you’ll have to meet 10 Centers Of Influence (COIs) to get introductions to 30 prospects to get 3 clients, then measure whether you’re meeting your activity goals of 10 COIs and 30 prospect meetings, and not necessarily whether you got 2, 3, or 4 clients out of the last stint of efforts. Not that you shouldn’t ultimately have results-oriented goals of clients and revenue as well, but activity is often the easier and more salient item to measure, whether it’s phone calls made, articles written, subscribers added to your drip marketing list, prospect meetings, COI introductions, or something else. So when you’re defining the goals of your business plan, be certain you’re setting both goals for the results you want to achieve, and the key performance indicator (KPI) measures you want to evaluate to regarding your activities along the way? 5) Where will you focus your time in the business? When an advisory firm is getting started, the role of the advisor-as-business-owner is to do “everything” – as the saying goes, you’re both the chief cook and the bottle washer . However, the reality is that the quickest way to failure in an advisory firm is to get so caught up on doing “everything” that you fail to focus on the essential activities necessary to really move the business forward (that’s the whole reason for having a plan to define what those activities are, and a measure to determine whether you’re succeeding at them!). Though in truth, the challenge of needing to focus where you spend your time in the business never ends – as a business grows and evolves, so too does the role of the advisor-owner as the leader, which often means that wherever you spent your time and effort to get your business to this point is not where you need to focus it to keep moving forward from here. From gathering clients as an advisor to learning to transition clients to another advisor, from being responsible for the firm’s business development to hiring a marketing manager, from making investment decisions and executing trades to hiring an investment analyst and trader. By making a proactive decision about where you will spend your time, and also deliberately deciding what you will stop doing, it also becomes feasible to determine what other resources you may need to support you, in order to ensure you’re always spending your time focused on whatever is your highest and best use. In addition, the process can also reveal gaps where you may need to invest into and improve yourself, to take on the responsibilities you haven’t in the past but need to excel at to move forward from here. 6) How must you strengthen the foundation? The point of this section is not about what you must do to achieve the goals you’ve set, but what else needs to be done in the business in order to maximize your ability to make those business goals a reality. In other words, if you’re going to focus your time on its highest and best use in the business, what foundation to you need to support you to make that happen? If you’re a startup advisory firm, what business entity do you need to create, what are the tools/technology you’ll need to launch your firm , and what licensing/registrations must you complete? Will you operate with a ‘traditional’ office or from a home office , or run an entirely virtual “location-independent” advisory firm ? What are the expenses you’re budgeting to operate the business? If you’re an advisor who’s hit a growth wall , what are the essential hire(s) you’ll make in the near future where/how else will you reinvest to get over the wall and keep moving forward? At the most basic level, the key point here is that if you’re going to execute on this business plan to move the business forward from here, you need a sound foundation to build upon – so what do you need to do to shore up your foundation, so you can keep building? But remember, the goal here is to do what is necessary to move forward, not everything ; as with so much in the business, waiting until perfection may mean nothing gets done at all.

Creating A Budget And Financial Projections For Your Advisory Business

In addition to crafting a (one-page) financial planner business plan, the second step to your business planning process should be crafting a budget or financial projection for your business for the upcoming year (or possibly out 2-3 years).

Key areas to cover in budget projections for a financial advisory firm are:

Revenue - What are the revenue source(s) of your business, and realistically what revenue can you grow in the coming year(s)? - If you have several types of revenue, what are you goals and targets for each? How many hourly clients? How much in retainers? How much in AUM fees? What commission-based products do you plan to sell, and in what amounts? Expenses - What are the core expenses to operate the business on an ongoing basis? (E.g., ongoing salary or office space overhead, core technology you need to operate the business, etc.) - What are the one-time expenses you may need to contend with this year? (Whether start-up expenses to launch your advisory firm , new hires to add, significant one-time projects to complete, etc.)

An ongoing advisory firm may project out for the next 1-3 years, while a newer advisors firm may even prefer a more granular month-by-month budget projection to have regular targets to assess.

Ultimately, the purpose of the budgeting process here is two-fold. The first reason for doing so is simply to have an understanding of the prospective expenses to operate the business, so you can understand if you do hit your goals, what the potential income and profits of the business will be (and/or whether you need to make any changes, if the business projections aren’t viable!). The second reason is that by setting a budget, for both expenses and revenue, you not only set targets for what you will spend in the business to track on track, but you have revenue goals to be held accountable to in trying to assess whether the business is succeeding as planned.

Vetting Your Business Plan By Soliciting Constructive Criticism And Feedback

The last essential step of crafting an effective financial planner business plan is to vet it – by soliciting feedback and constructive criticism about the gaps and holes. Are there aspects of the financial projections that seem unrealistic? Is the target of who the business will serve narrow and specific enough to be differentiated, such that the person you’re talking to would clearly know who is appropriate to refer to you? Are the services that will be offered truly unique and relevant to that target clientele, and priced in a manner that’s realistically affordable and valuable to them?

In terms of who should help to vet your financial advisor business plan, most seem to get their plan vetted by talking to a business coach or consultant to assess the plan. While that’s certainly a reasonable path, another option is actually to take the business plan to fellow advisors to vet, particularly if you’re part of an advisor study (or “mastermind”) group ; the reason is that not only do fellow advisors have an intimate understanding of the business and potential challenges, but if their target clientele is different than yours, it becomes an opportunity to explain what you do and create the potential for future referrals! In other words, “asking for advice on your business plan” also becomes a great opportunity to “tell you about who I work with in my business that you could refer to me” as well! (In fact, one of the great virtues of a clearly defined niche practice as an advisor is that you can generate referrals from other advisors who have a different niche than yours !)

Similarly, the reality is that another great potential source for feedback about your business plan are Centers of Influence already in your niche in the first place. While you might not share with your potential clients the details of your business financial projections (which is why I advocate that those be separate from the one-page business plan), the essential aspects of the business plan – who you will serve, what you will provide them, how you will charge, and how you will try to reach them – is an area that the target clientele themselves may be best positioned to provide constructive feedback. And in the process, once again you’ll effectively be explaining exactly what your niche business does to target clientele who could either do business with you directly, or refer business to you , even as you’re asking for their advice about how to make the business better (to serve people just like them!). So whether it’s people you’re not yet doing business with but want to, or an existing client advisory board with whom you want to go deeper, vetting your plan with prospective and current clients is an excellent opportunity to talk about and promote your business, even as you’re going through the process of refining it and making it better!

And notably, the other benefit of vetting your business plan with others – whether it’s a coach, colleague, prospects, or clients – is that the process of talking through the business plan and goals with them also implicitly commits to them that you plan to act on the plan and really do what’s there. In turn, what this means is that once you’ve publicly and openly committed to the business plan with them, it’s now fair game for them to ask you how it’s going, and whether you’re achieving the goals you set forth for yourself in the plan – an essential point of accountability to help you ensure that you’re following through on and executing the business plan you’ve created!

So what do you think? Have you ever created a formal business plan for yourself? If you have, what worked for you – a longer plan, or a shorter one? If you haven’t created a business plan for yourself, why not? Do you think the kind of one-page financial advisor business plan template articulated here would help? Have you checked out our financial advisor business plan sample template for yourself? Do you have a financial advisor business plan example you're willing to share in the comments below?

Quality? Nerdy? Relevant?

We really do use your feedback to shape our future content!

- About Michael

- Career Opportunities

- Permissions / Reprints

- Disclosures / Disclaimers

- Privacy Policy

- Terms of Use

Showcase YOUR Expertise

How To Contribute Submit Podcast Guest Submit Guest Webinar Submit Guest Post Submit Summit Guest Presentation

Stay In Touch

General Inquiries: [email protected]

Members Assistance: [email protected]

All Other Questions, Or Reach Michael Directly:

This browser is no longer supported by Microsoft and may have performance, security, or missing functionality issues. For the best experience using Kitces.com we recommend using one of the following browsers.

- Microsoft Edge

- Mozilla Firefox

- Google Chrome

- Safari for Mac

Financial Advisor Business Plan Template

Written by Dave Lavinsky

Business Plan Outline

- Financial Advisor Business Plan Home

- 1. Executive Summary

- 2. Company Overview

- 3. Industry Analysis

- 4. Customer Analysis

- 5. Competitive Analysis

- 6. Marketing Plan

- 7. Operations Plan

- 8. Management Team

- 9. Financial Plan

Financial Advisor Business Plan

You’ve come to the right place to create your financial advisor business plan.

We have helped over 10,000 entrepreneurs and business owners create business plans and many have used them to start or grow their financial advisor businesses. Our financial advisor business plan template will help you create your business plan, ensuring that you have all the necessary elements to make your financial advisor business a success.

To write a successful financial advisor business plan, you will first need to decide what type of financial advisor services you will offer. Will you be working with small businesses? Or are your target customers individuals saving for retirement?

You will need to gather information about your business and the financial advisor industry. This type of information includes business goals, customer demographics, market research, and financial statements.

Below are links to each section of a financial advisor business plan example:

Next Section: Executive Summary >

Financial Advisor Business Plan FAQs

What is a financial advisor business plan.

A financial advisor business plan is a plan to start and/or grow your financial advisor business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your financial advisor business plan using our Financial Advisor Business Plan Template here .

What Are the Main Types of Financial Advisor Companies?

There are different types of financial advisor firms . The most common kinds are the investment advisors, broker-dealers and brokers, certified financial planners, financial consultants, wealth advisors, and portfolio, investment, and asset managers. There are also digital platforms that provide automated, algorithm-driven investment services with little to no human supervision called robo-advisors.

What Are the Main Sources of Revenues & Expenses for Financial Advisors?

Financial advisors make money on client fees for financial planning services. These are usually charged on an hourly basis or as a percentage of client assets under management. Another source of income are commissions for certain financial transactions, such as the sale of insurance products or the buying and selling of securities.

The key expenses are salaries and wages, and office space rent.

How to Start a Financial Advisor Business?

Starting a financial advisor business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

- Write A Financial Advisor Business Plan - The first step in starting a business is to create a detailed business plan that outlines all aspects of the venture. This should include market research on the financial industry and potential target market size, information on the services and/or products you will offer, marketing strategies, pricing details, competitive analysis and a solid financial forecast.

- Choose Your Legal Structure - It's important to select an appropriate legal entity for your business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your financial advisor business is in compliance with local laws.

- Register Your Business - Once you have chosen a legal structure, the next step is to register your financial advisor business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

- Identify Financing Options - It’s likely that you’ll need some capital to start your business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

- Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

- Hire Employees - There are several ways to find qualified employees and a top notch management team, including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

- Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your business. Marketing efforts includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising to reach your target audience.

Learn more about how to start a Financial Advisor business:

- How to Start a Financial Advisor Business

How Do You Get Funding for Your Financial Advisor Business Plan?

Financial advisor businesses are typically funded through small business loans, personal savings, credit card financing and angel investors.

A financial advisor's business plan should include a detailed financial plan to secure any type of potential investor. This is true for all types of financial advisor business plans including a financial planner business plan and a wealth management business plan.

Where Can I Get a Financial Advisor Business Plan PDF?

You can download our free financial advisor business plan template PDF here. This is a sample financial advisor business plan template you can use in PDF format.

Sample Financial Advisor Business Plan

Writing a business plan is a crucial step in starting a financial advisor business. Not only does it provide structure and guidance for the future, but it also helps to create funding opportunities and attract potential investors. For aspiring financial advisors, having access to a sample financial advisor business plan can be especially helpful in providing direction and gaining insight into how to draft their own financial advisor business plan.

Download our Ultimate Financial Advisor Business Plan Template

Having a thorough business plan in place is critical for any successful financial advisor venture. It will serve as the foundation for your operations, setting out the goals and objectives that will help guide your decisions and actions. A well-written business plan can give you clarity on realistic financial projections and help you secure financing from lenders or investors. A financial advisor business plan example can be a great resource to draw upon when creating your own plan, making sure that all the key components are included in your document.

The financial advisor business plan sample below will give you an idea of what one should look like. It is not as comprehensive and successful in raising capital for your financial advisor as Growthink’s Ultimate Financial Advisor Business Plan Template , but it can help you write a financial advisor business plan of your own.

Financial Advisor Business Plan Example – WealthWise Planning

Table of contents, executive summary, company overview, industry analysis, customer analysis, competitive analysis, marketing plan, operations plan, management team, financial plan.

At WealthWise Planning, we are a new Financial Advisor based in Detroit, MI, dedicated to filling a significant gap in the local market by providing high-quality financial advice and services. Our offerings include Financial Planning, Investment Management, Retirement Planning, Estate Planning, and Tax Advisory, all tailored to meet the unique financial goals and situations of our clients. Our holistic approach ensures comprehensive care for our clients’ financial health, guiding them towards financial security and prosperity. Strategically located in the heart of Detroit, our deep understanding of the local economic environment positions us as the go-to financial advisor in the area.

We are uniquely positioned for success, thanks to the invaluable experience of our founder in running a successful financial advisory business, and our commitment to offering superior financial planning services. Our team’s expertise and dedication to client well-being are at the core of our operations. Since our founding on January 5, 2024, we have achieved significant milestones, including designing our logo, developing our company name, and securing an excellent location for our operations. These accomplishments demonstrate our dedication to becoming the leading financial advisor in Detroit, MI.

The Financial Advisor industry in the United States, with a market size of over $66 billion in 2020 and an average annual growth rate of 5.7% over the past decade, is poised for continued expansion. With a projected market size of over $80 billion by 2025, driven by an aging population, increased financial market complexity, and the rise of digital financial advice platforms, the industry’s future looks promising. WealthWise Planning, serving Detroit, MI, is well-placed to capitalize on these trends by offering tailored financial solutions and personalized advice, aiming to establish itself as a trusted partner for individuals seeking to achieve their financial goals.

WealthWise Planning targets a diverse customer base in Detroit, MI, including young professionals, retirees, small business owners, and families. Our services are designed to address the unique financial needs of these groups, from managing burgeoning finances and preserving wealth to navigating business growth and securing financial futures for families. By providing personalized financial advice and planning strategies, we aim to become a trusted advisor for long-term financial well-being in our community.

WealthWise Planning’s main competitors include Zhang Financial, known for its wealth management and transparent fee structure; Bloom Advisors, which offers personalized financial planning; and Peak Wealth Management, specializing in wealth management and estate planning. Our competitive advantage lies in our personalized approach to financial planning and our commitment to leveraging the latest technology to enhance service delivery and client experience. This, combined with our dedication to client satisfaction, positions WealthWise Planning as a leader in the financial advisory landscape.

WealthWise Planning offers a suite of financial services designed to cater to various needs, with transparent pricing and a client-centric approach. Our comprehensive services include Financial Planning, Investment Management, Retirement Planning, Estate Planning, and Tax Advisory. Our promotional strategy encompasses online marketing, SEO, PPC advertising, social media marketing, email marketing, community outreach, networking, and leveraging client testimonials. By utilizing a multifaceted promotional approach, we aim to stand out in Detroit, MI, and build a solid client base, ensuring we reach potential clients effectively and build lasting relationships.

To ensure WealthWise Planning’s success, our key operational processes include detailed CRM activities, comprehensive financial analysis and planning, market research, compliance and regulatory reporting, professional development, client portfolio management, client meetings and reviews, operational efficiency improvements, risk management, and targeted marketing for client acquisition. Upcoming milestones include launching our business, developing a comprehensive marketing strategy, building a robust client onboarding process, establishing strategic partnerships, hiring additional staff, implementing advanced financial planning tools, and achieving specific revenue targets. These efforts will establish us as a successful, reputable financial advisor in Detroit, MI.

Under the leadership of Aiden Scott, our President, WealthWise Planning boasts a management team with the experience and expertise necessary for success. Scott’s background in financial advisory services, strategic foresight, and leadership skills, along with his deep understanding of the financial industry, are instrumental in guiding our company towards its goals. His expertise ensures that WealthWise Planning remains at the forefront of delivering exceptional financial advisory services.

WealthWise Planning is a new Financial Advisor serving customers in Detroit, MI. As a local financial advisor, we understand the financial landscape and challenges that our community faces. Currently, there are no high-quality local financial advisors in the area, which positions us to fill a significant gap in the market and serve our community with unparalleled financial services.

At WealthWise Planning, our offerings are designed to cater to a broad spectrum of financial needs. Our products and services include Financial Planning, Investment Management, Retirement Planning, Estate Planning, and Tax Advisory. These services are tailored to meet the unique financial goals and situations of our clients in Detroit, MI. Our holistic approach ensures that every aspect of our clients’ financial health is addressed, setting them on a path to financial security and prosperity.

Located in the heart of Detroit, MI, WealthWise Planning is strategically positioned to serve our local community. Our deep understanding of the local economic environment enhances our ability to provide targeted and effective financial advice, making us the go-to financial advisor in Detroit.

WealthWise Planning is uniquely qualified to succeed for several reasons. Our founder brings invaluable experience from previously running a successful financial advisor business. This experience, combined with our commitment to offering better financial planning services than our competition, sets us apart and ensures our success. Our team’s expertise and dedication to our clients’ financial well-being are at the core of everything we do.

Founded on 2024-01-05, WealthWise Planning has quickly made strides in establishing itself as a trusted financial advisor. We are a Limited Liability Company, which reflects our professionalism and commitment to operating with the highest standards of integrity and transparency. To date, our accomplishments include designing our logo, developing our company name, and finding a great location for our operations. These steps mark the beginning of our journey to becoming the leading financial advisor in Detroit, MI, and a testament to our dedication to serving our community.

The Financial Advisor industry in the United States is a booming sector, with a market size of over $66 billion in 2020. This industry has been steadily growing over the past decade, with an average annual growth rate of 5.7%. The increasing demand for financial advice and services, coupled with the growing number of individuals seeking help with their investments, has contributed to the expansion of this market.

Looking ahead, the Financial Advisor industry is expected to continue its growth trajectory, with market analysts projecting a market size of over $80 billion by 2025. This anticipated growth is driven by several factors, including an aging population seeking retirement planning services, increased complexity in financial markets, and the rise of digital platforms offering financial advice. As more individuals recognize the importance of professional financial guidance, the market for Financial Advisors is poised for further expansion.

These trends in the Financial Advisor industry bode well for WealthWise Planning, a new Financial Advisor serving customers in Detroit, MI. With the increasing demand for financial advice and services, WealthWise Planning has a significant opportunity to carve out a niche in this growing market. By providing tailored financial solutions and personalized advice to clients, WealthWise Planning can capitalize on the expanding market and establish itself as a trusted partner for individuals seeking to achieve their financial goals.

Below is a description of our target customers and their core needs.

Target Customers

Local residents will form the primary customer base for WealthWise Planning. This demographic is diverse, encompassing young professionals eager to manage their burgeoning finances and retirees focused on preserving their wealth. WealthWise Planning will tailor its services to meet the unique needs of these local individuals, providing personalized financial advice and planning strategies.

Small business owners in Detroit are another significant segment that WealthWise Planning will target. These entrepreneurs require specialized financial guidance to navigate the complexities of business growth, tax planning, and asset management. WealthWise Planning will offer custom solutions that address the specific challenges faced by these business owners, helping them to achieve financial stability and growth.

In addition to these groups, WealthWise Planning will also cater to families seeking to secure their financial future. These services will include college savings plans, retirement planning, and wealth transfer strategies. By addressing the financial concerns that are most relevant to families in Detroit, WealthWise Planning will establish itself as a trusted advisor for long-term financial well-being.

Customer Needs

WealthWise Planning offers high-quality financial advisory services that cater to the diverse needs of residents seeking to enhance their financial well-being. Customers can expect personalized financial strategies that align with their goals, whether they’re saving for a home, investing for retirement, or managing debt. This level of customization ensures that every financial plan is as unique as the individual’s circumstances, addressing a crucial need for tailored financial guidance.

In addition to personalized financial planning, WealthWise Planning understands the importance of financial education and empowerment. Customers have access to resources and tools that help demystify complex financial concepts and decisions. This empowers them to make informed choices about their financial futures, fostering a sense of confidence and control over their financial destiny.

Furthermore, WealthWise Planning prioritizes accessibility and convenience, recognizing that time is a valuable asset for its customers. By offering flexible consultation schedules and leveraging technology for virtual meetings, clients can easily integrate financial planning into their busy lives. This approach addresses the need for professional financial advice that is both accessible and adaptable to the modern lifestyle of Detroit residents.

WealthWise Planning’s competitors include the following companies.

Zhang Financial

Zhang Financial offers a wide range of services including wealth management, financial planning, and investment advisory services. They cater to high-net-worth individuals and families, providing bespoke solutions tailored to their clients’ unique financial situations. Their price points are typically based on a percentage of assets under management, aligning the firm’s interests with those of their clients.

Zhang Financial is known for its transparent fee structure and has been recognized for its commitment to providing fiduciary advice. The firm operates in multiple locations, with a strong presence in Michigan, which allows them to serve a broad geographic area. They target affluent clients seeking comprehensive financial planning and investment management services.

One of Zhang Financial’s key strengths is their team of highly qualified professionals, including Certified Financial Planners (CFPs) and Chartered Financial Analysts (CFAs), who bring a depth of expertise to their client engagements. However, their focus on high-net-worth individuals may limit accessibility for potential clients with lower levels of investable assets.

Bloom Advisors

Bloom Advisors offers financial planning, retirement planning, and investment management services. They focus on creating personalized financial plans that address the unique needs of each client, emphasizing long-term relationships. Their pricing model is based on a combination of a flat fee for financial planning and a percentage of assets under management for investment services.

Located in Michigan, Bloom Advisors serves a diverse clientele, including families, professionals, and retirees. They are particularly noted for their comprehensive approach to retirement planning. Their market segment includes individuals and families looking for personalized financial guidance and strategies.

Bloom Advisors’ strength lies in their personalized service and holistic approach to financial planning. However, their weakness may be perceived in terms of scalability, as the highly personalized nature of their services could limit their capacity to grow their client base rapidly.

Peak Wealth Management

Peak Wealth Management specializes in wealth management, financial planning, and estate planning services. They aim to help clients grow and protect their wealth through customized investment strategies and comprehensive financial planning. Pricing at Peak Wealth Management typically involves a fee based on the percentage of assets under management, along with possible flat fees for specific planning services.

With a presence in Michigan, Peak Wealth Management targets a broad range of clients, including individuals, families, and business owners. Their services are designed to cater to a wide spectrum of financial needs, from young professionals to retirees. This allows them to serve a diverse customer base within the region.

The firm’s key strength is its integrated approach to wealth management, combining investment management with financial planning to provide a holistic service offering. A potential weakness could be the challenge of differentiating their services in a crowded market, where many firms offer similar wealth management solutions.

Competitive Advantages

At WealthWise Planning, we pride ourselves on delivering superior financial planning services that set us apart from our competitors. Our team of experienced professionals employs a personalized approach to financial planning, ensuring that each client’s unique needs and goals are meticulously addressed. We understand that financial planning is not a one-size-fits-all service, which is why we tailor our strategies to fit the individual circumstances of our clients. This bespoke service model enables us to provide more accurate, relevant, and effective financial advice, making a significant difference in our clients’ financial well-being and future security.

Furthermore, our competitive advantage extends beyond just the quality of our financial planning services. We are deeply committed to leveraging the latest technology to enhance our service delivery and client experience. From advanced financial modeling tools to seamless digital communication platforms, we ensure that our clients have access to cutting-edge resources. This technological edge not only improves the efficiency and effectiveness of our financial planning solutions but also provides our clients with a level of convenience and accessibility that is rare in the financial advisory sector. Coupled with our unwavering commitment to client satisfaction, WealthWise Planning stands as a beacon of excellence in the financial advisory landscape, ready to guide our clients towards achieving their financial dreams with confidence and clarity.

Our marketing plan, included below, details our products/services, pricing and promotions plan.

Products and Services

Understanding the financial landscape can be daunting for many. This is why WealthWise Planning steps in to offer comprehensive financial services designed to meet a variety of needs. From crafting personalized financial plans to managing investments, WealthWise Planning ensures that its clients are well-prepared for the future, regardless of their current financial situation. Below is a detailed overview of the products and services offered, along with their average selling prices, enabling clients to make informed decisions.

Financial Planning is one of the cornerstone services offered. It encompasses a thorough analysis of the client’s current financial status and the development of strategies to meet future goals. Clients can expect to pay an average of $2,500 for a comprehensive financial plan. This service is tailored to provide a roadmap that covers savings, budgeting, and strategic investment recommendations.

Investment Management is another critical service provided. WealthWise Planning adopts a proactive approach to portfolio management, ensuring that clients’ investments align with their risk tolerance and financial objectives. The cost for this service typically averages 1% of the assets under management (AUM) annually. This fee structure ensures that the firm’s interests are directly aligned with the client’s success.

Retirement Planning is crucial for anyone looking to secure their financial future post-employment. WealthWise Planning helps clients navigate the complex world of retirement savings, pension plans, and Social Security benefits. Clients can expect to pay an average of $1,500 for a retirement plan, which is a small price for the peace of mind and security it brings in one’s golden years.

Estate Planning is also offered, ensuring that clients’ financial affairs are in order, and their legacies are preserved according to their wishes. The service includes guidance on wills, trusts, and estate taxes, among other elements. The average cost for estate planning services is around $3,000, depending on the complexity of the client’s estate and goals.

Tax Advisory services round out WealthWise Planning’s offerings, providing clients with strategies to minimize tax liabilities and ensure compliance with tax laws. This service, priced at an average of $500 annually, is invaluable for both individual and corporate clients looking to optimize their tax situations.

In summary, WealthWise Planning offers a suite of financial services designed to cater to various needs, from financial planning and investment management to retirement, estate planning, and tax advisory. With transparent pricing and a client-centric approach, WealthWise Planning is committed to helping its clients achieve financial well-being and security.

Promotions Plan

Attracting customers in the dynamic financial advisory market requires a multifaceted promotional approach. WealthWise Planning embraces a variety of methods to ensure it stands out in Detroit, MI, and builds a solid client base. Online marketing forms the cornerstone of their promotional strategy, leveraging the power of digital platforms to reach potential clients effectively.

One key aspect of online marketing is search engine optimization (SEO). WealthWise Planning will optimize its website with relevant keywords to ensure it ranks high in search results related to financial advice in Detroit. This strategy will increase visibility and attract organic traffic to their site. Alongside SEO, they will engage in pay-per-click (PPC) advertising, targeting individuals searching for financial planning services. PPC campaigns will allow WealthWise Planning to appear at the top of search results, offering immediate visibility.

Social media marketing is another pillar of their promotional efforts. WealthWise Planning will establish a strong presence on platforms such as LinkedIn, Facebook, and Instagram. By sharing informative content, financial tips, and insights into the financial planning process, they will build a relationship with their audience and establish themselves as thought leaders in the industry. Social media ads, tailored to target demographics in Detroit, will further enhance their visibility and attract potential clients.

Email marketing will also play a crucial role in WealthWise Planning’s promotional strategy. By collecting email addresses through their website and social media channels, they will send out newsletters, financial advice, and updates about their services. This direct form of communication will keep WealthWise Planning top of mind among potential clients and encourage engagement with their services.

Beyond online marketing, WealthWise Planning will engage in community outreach and networking. Hosting financial planning workshops and seminars in Detroit will allow them to demonstrate their expertise and engage directly with potential clients. They will also form partnerships with local businesses and organizations to expand their reach and establish a referral network. These face-to-face interactions will complement their online efforts, creating a comprehensive promotional strategy that builds trust and credibility in the community.

Finally, WealthWise Planning will leverage client testimonials and case studies to showcase their success stories and the value they provide. Sharing these testimonials on their website and social media channels will help build confidence among potential clients, illustrating the positive impact of their financial advisory services.

By integrating online marketing with community engagement and direct communication, WealthWise Planning positions itself to attract a diverse client base in Detroit. Their comprehensive approach ensures they not only reach potential clients but also build lasting relationships that foster trust and credibility in the financial advisory space.

Our Operations Plan details:

- The key day-to-day processes that our business performs to serve our customers

- The key business milestones that our company expects to accomplish as we grow

Key Operational Processes

To ensure the success of WealthWise Planning, there are several key day-to-day operational processes that we will perform.

- Customer Relationship Management (CRM) Activities: We will maintain detailed records of all interactions with clients, including calls, meetings, and emails. This ensures personalized and timely communication, fostering strong relationships.

- Financial Analysis and Planning: We will conduct comprehensive financial analysis for each client, considering their income, expenses, investments, and financial goals. This allows us to provide tailored financial advice and planning services.

- Market Research: We will continuously monitor financial markets and economic indicators to stay informed about trends and opportunities that can impact our clients’ investment strategies.

- Compliance and Regulatory Reporting: We will ensure that all operations comply with financial regulations and laws. This includes preparing and submitting required reports to regulatory bodies in a timely manner.

- Professional Development: We will invest in ongoing education and training for our advisors to keep them abreast of the latest financial planning strategies, tools, and regulatory changes.

- Client Portfolio Management: We will actively manage client portfolios, making adjustments as needed based on market conditions and client objectives. This includes buying and selling assets, rebalancing portfolios, and ensuring diversification.

- Client Meetings and Reviews: We will schedule regular meetings with clients to review their financial plans, discuss any changes in their financial situation, and adjust their investment strategies accordingly.

- Operational Efficiency: We will continuously seek ways to improve operational efficiency, including automating routine tasks, optimizing internal processes, and utilizing technology to enhance service delivery.

- Risk Management: We will implement strategies to identify, assess, and mitigate risks that could impact our clients’ investments or the operation of WealthWise Planning. This includes ensuring cybersecurity measures are in place to protect client information.

- Marketing and Client Acquisition: We will execute targeted marketing campaigns to attract new clients and retain existing ones. This will include digital marketing, community engagement, and networking events.

WealthWise Planning expects to complete the following milestones in the coming months in order to ensure its success:

- Launch our Financial Advisor Business : This initial step involves setting up the legal structure of the business, securing an office space in Detroit, MI, and ensuring all regulatory and compliance measures are met to operate as a financial advisor within the state. This includes obtaining necessary licenses and registrations with state and federal financial regulatory bodies.

- Develop and Implement a Comprehensive Marketing Strategy : Create a multi-channel marketing strategy that includes digital marketing (SEO, social media, email marketing), local advertising, and community engagement to build brand awareness and attract initial clients.

- Build a Robust Client Onboarding Process : Design and implement a streamlined onboarding process that ensures a smooth and professional experience for new clients. This includes client intake forms, assessment of financial goals and risk tolerance, and initial financial planning and advisement sessions.

- Establish Strategic Partnerships with Local Businesses and Communities : Form partnerships with local businesses, community organizations, and professionals (such as accountants and lawyers) to build referral networks and increase client base through trusted sources.

- Hire and Train Additional Financial Advisors and Support Staff : As the client base grows, recruit, hire, and train additional qualified financial advisors and support staff to maintain high service quality and client satisfaction. Focus on team members with strong expertise and excellent client service skills.

- Implement Cutting-Edge Financial Planning Software and Tools : Invest in advanced financial planning software and tools to enhance service delivery, improve client experience, and increase operational efficiency. Ensure staff are trained on these technologies.

- Achieve $5,000/Month in Revenue : This milestone signifies the business’s initial traction and market acceptance. It involves acquiring enough clients and managing enough assets to generate this level of recurring revenue.

- Develop and Launch a Client Retention and Expansion Program : Create programs aimed at retaining existing clients and encouraging referrals, such as regular financial education workshops, personalized financial health reports, and client appreciation events.

- Get to $15,000/Month in Revenue : This critical milestone indicates that WealthWise Planning has successfully scaled its client base and service offerings to a sustainable level. Achieving this target requires consistent marketing efforts, excellent client service, and a focus on expanding services to meet client needs. By systematically achieving these milestones, WealthWise Planning aims to establish itself as a successful and reputable financial advisor in Detroit, MI, positioning itself for long-term growth and success in the financial services industry.

WealthWise Planning management team, which includes the following members, has the experience and expertise to successfully execute on our business plan:

Aiden Scott, President

Aiden Scott brings to WealthWise Planning not only his title of President but also a rich background in financial advisory services. Having successfully led a financial advisory firm in the past, Scott has demonstrated a keen ability to navigate the complex landscape of financial planning and investment management. His track record speaks volumes about his strategic foresight, leadership skills, and his deep understanding of the financial industry. Under his stewardship, WealthWise Planning is poised to benefit from Scott’s experience in creating value for clients and steering the company towards lasting success. His expertise is instrumental in shaping the strategic direction of WealthWise Planning, ensuring that the firm remains at the forefront of delivering exceptional financial advisory services.

To achieve our growth goals, WealthWise Planning requires $182,000 in funding. This funding will be allocated towards capital investments such as location buildout, furniture, equipment, and non-capital investments including working capital, initial rent, staff salaries, marketing, supplies, and insurance. These investments are critical for establishing our operations in Detroit, MI, and positioning WealthWise Planning for long-term success and sustainability in the financial services industry.

Financial Statements

Balance sheet.

[insert balance sheet]

Income Statement

[insert income statement]

Cash Flow Statement

[insert cash flow statement]

Financial Advisor Business Plan Example PDF

Download our Financial Advisor Business Plan PDF here. This is a free financial advisor business plan example to help you get started on your own financial advisor plan.

How to Finish Your Financial Advisor Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your financial advisor business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Financial Advisor Business Plan Template [Updated 2024]

Financial Advisor Business Plan Template

If you want to start a Financial Advisor business or expand your current Financial Advisor or Financial Planning Business, you need a business plan.

Fortunately, you’re in the right place. Our team has helped develop over 100,000 business plans over the past 20 years, including thousands of financial advisory company business plans.

You can download our Business Plan Template (including a full, customizable financial model) to your computer here.

Sample Business Plan For Financial Advisors

The following financial advisor business plan template gives you the key elements you must include in your plan.

I. Executive Summary

Business overview.

[Company Name], located at [insert location here] is a new wealth management firm providing financial advisory and investments to its clients. The Company will operate in a Professional setting, conveniently located next to [notable bank] in the center of the financial district. [Company Name] is headed by [Founder’s Name], an MBA Graduate from UCLA with 20 years of experience working as a financial advisor in such firms as Merrill Lynch Wealth Management.

Products Served

[Company Name] will focus on close client relationships. It has a full time assistant who, among other things, will focus on answering client’s daily questions and drafting newsletters to increase client communication.

The founder, [Founder’s Name], will also focus on answering his clientele’s needs. In addition to newsletters and email updates, [Founder’s Name] will hold seminars on financial strategies and investment presentations for his clients.

[Company’s Name] services include private wealth management, retirement services and other financial planning, and life insurance offerings.

Customer Focus

[Company Name] will primarily serve the residents within a 20-mile radius of our location. The demographics of these customers are as follows:

- [Number of residents]

- [Average or median income]

- [% married, % families]

- [% professional occupations]

- [Median age]

In addition to this prime adult demographic for a wealth management firm, there are four large banks in the area. Working professionals, especially those in the financial sector, realize the importance of early retirement planning and investment advice and create a perfect target market.

Management Team

[Company Name]’s most valuable asset is the expertise and experience of its founder, [full name]. [First name] has been a certified financial advisor for the past 20 years. He has spent much of his career working at Merrill Lynch’s Wealth Management division. He spent the more recent portion of his career at a smaller firm, Century Asset Management, where his client base doubled and his assets-under management tripled in 8 years.

[Company name] will also employ an experienced assistant to help with various administrative duties around the office. [Assistant’s name] has experience working with C-level executives and has spent significant time as an administrator.

Success Factors

[Company Name] is uniquely qualified to succeed due to the following reasons:

- The Company will fill a specific market niche in the growing community we are entering. In addition, we have surveyed the local population and received extremely positive feedback saying that they explicitly want to make use of our services when launched.

- Our location is in a high-volume area with easy access from multiple residential and commercial district zones.

- The management team has a track record of success in the private wealth management business.

- The local area is currently under served and does not have specialized financial advisors.

Financial Highlights

[Company Name] is currently seeking $125,000 to launch. Specifically, these funds will be used as follows:

- Store design/build: $60,000

- Working capital: $65,000 to pay for Marketing, salaries, and lease costs until [Company Name] reaches break-even

Topline projections over the next five years are as follows:

II. Company Overview

Who is [company name].

[Company Name], located at [insert location here] is a new wealth management firm providing financial advisory and investments to its clients. The Company will operate in a Professional setting, conveniently located next to [notable bank.] [Company Name] is headed by [Founder’s Name], an MBA Graduate from UCLA with 20 years of experience working for Merrill Lynch.

[Company Name] was founded by [Founder’s Name]. While [Founder’s Name] has been in the financial services sector for some time, it was in [month, year] that he decided to launch [Company Name]. Specifically, during this time, [Founder] met with a former friend and fellow independent financial advisor in Fort Lauderdale who has had tremendous success. After discussing the business at length, [Founder’s Name] clearly understood that a similar business would enjoy significant success in his hometown.

Specifically, the customer demographics and competitive situations in the Fort Lauderdale location and in his hometown were so similar that he knew the business would work. After surveying the local population, [Founder’s name] went ahead and founded [company name].

[Company Name]’s History

Upon returning from Fort Lauderdale, surveying the local customer base, and finding a potential retail office, [Founder’s Name] incorporated [Company Name] as an S-Corporation on [date of incorporation].

The business is currently being run out of [Founder’s Name] home office, but once the lease on [Company Name]’s office location is finalized, all operations will be run from there.

Since incorporation, the Company has achieved the following milestones:

- Found office space and signed Letter of Intent to lease it

- Developed the company’s name, logo and website located at [website]

- Hired an interior designer for the decor and furniture layout

- Determined equipment and fixture requirements

- Began recruiting key employees

[Company Name]’s Products & Services

[Founder’s Name] will be able to provide clients with the following services:

- Asset Management: investing and managing client’s savings depending on portfolio preferences.

- Financial Planning: detailed planning and a structured layout for retirement or child’s funds for college.

- Hourly Advice: advising clients that do not have assets with [Company Name] on an hourly basis.

- Life Insurance: providing the option of life insurance to clients as part of their long term and retirement planning.

As [Founder’s Name] understands, the key to a successful advisory business is being accessible and staying in contact with clients. [Founder’s Name] will have a full time assistant on hand who, among other things, will manage client’s phone calls and answer questions as possible.

[Company Name] will also feature a Bloomberg Terminal and several major publications in order to stay informed on important news and market trends.

III. Industry Analysis

The financial advisory services industry is strongly correlated with the strength of the economy as a whole. Last year, industry revenues fell as the market fell, declining by 34% to $37.6 billion. Revenues are expected to recover again this year, reaching the $38 billion mark.

Most of the industry consists of small, independent financial advisors and firms. The lion’s share of the private wealth management industry is composed of these individual advisors. Large firms often pay significant amounts for an independent advisor to join them and bring their client base along. Overall, employment in the industry is currently declining. It is estimated that 225,000 people were employed in financial advisory services in last year, and that only 213,800 will be employed this year.

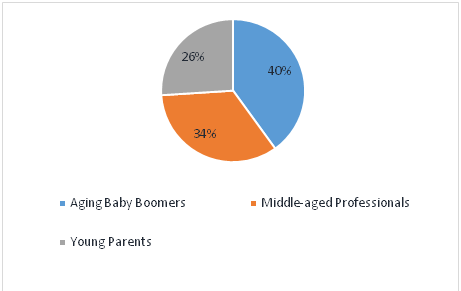

The market served by financial advisors is a diverse one. 47% of the client base is made up of High Net Worth Individuals, HNWIs for short. These are classified by the Securities and Exchange Commission as people with at least $750,000 in investment-ready assets, or $1.5 million in investment-ready assets held in a marriage. These clients tend to be aging individuals who are beginning to consider retirement. This fits with the industry trend toward retirement planning services. Financial advisory services are not reserved exclusively for HNWIs, however. There are an estimated 120 million households with $17 trillion in assets in the United States, many of which require such services.