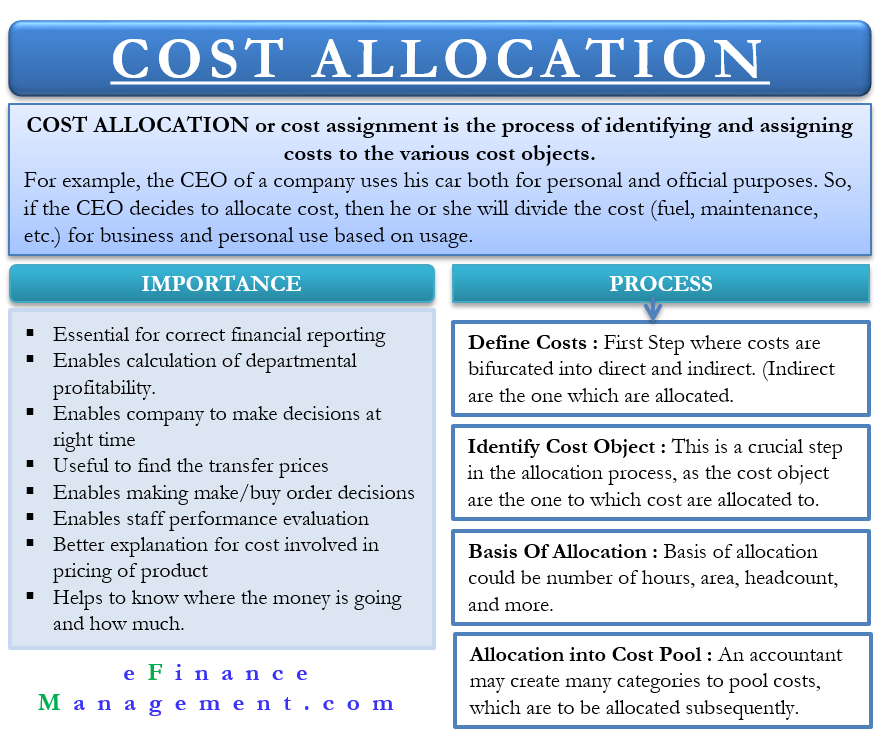

Cost Allocation – Meaning, Importance, Process and More

Cost Allocation or cost assignment is the process of identifying and assigning costs to the various cost objects. These cost objects could be those for which the company needs to find out the cost separately. A few examples of cost objects can be a product, customer, project, department, and so on.

The need for cost allocation arises because some costs are not directly attributable to the particular cost object. In other words, these costs are incurred for various objects, and then the sum is split and allocated to multiple cost objects. These costs are generally indirect. Since these costs are not directly traceable, an accountant uses their due diligence to allocate these costs in the best possible way. It results in an allocation that could be partially arbitrary, and thus, many refer cost allocation exercise as the spreading of a cost.

Examples of Cost Allocation

- Cost Allocation – Importance

Cost Allocation Method

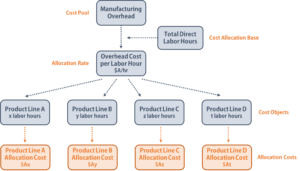

Define costs, identify cost objects, basis of allocation, accumulate costs into cost pool.

For example, a company’s CEO uses his car for personal and official purposes. So, if the CEO decides to allocate costs, then they will divide the cost (fuel, maintenance, etc.) for business and personal use based on usage.

The following examples will help us understand the cost allocation concept better:

- A company has a building in which there are various departments. One can allocate depreciation costs to the department on the basis square ft area of each department. This cost will then be further assigned to the products on which the department works.

- An accountant can attribute electricity that a production facility consumes to different departments. Then the accountant can assign the department’s electricity cost to the products that the department works on.

- An employee works on three products for a month. To attribute their salary to three products, an accountant can use the number of hours the employee gave to each product.

Cost Allocation – Importance

The following points reflect the importance of allocating costs:

- Allocating cost is essential for financial reporting, i.e., to correctly assign the cost among the cost objects.

- It allows the company to calculate the true profitability of the department or function. This profitability could serve as the basis for making further decisions for that department or service.

- If cost allocation is correct, it allows the business to identify and understand the costs at each stage and their impact on the profit or loss. On the other hand, if the allocation is incorrect, the company may end up making wrong or inconsistent decisions concerning the distribution of resources amongst various cost objects.

- The concept is also useful for finding the transfer prices when there is a transaction between subsidiaries.

- It helps a company make better economic decisions, such as whether or not to accept a new order.

- One can also use the concept to evaluate the performance of the staff.

- It helps in better explaining to the customers the costs that went into the pricing of a product or service.

- Allocation cost helps a company know where the money is going and how much. It will assist the company in using the resources effectively. Pool costs, if not allocated, may give an unbalanced view of the cost of various objects.

As such, there is no specific method to allocate costs. So, an accountant needs to use his or her due diligence to assign a cost to the cost object. Of course, they are considering the practice adopted in a similar industry. For instance, the accountant may decide to allocate expenses based on headcount, area, weightage, and so on.

Also Read: Cost Object – Meaning, Advantages, Types and More

Irrespective of the method an accountant uses, their objective should be to allocate the cost as fairly as possible. Or to allocate cost in a way that is in line with the nature of the cost object. Or to lower the arbitrariness in awarding costs.

Several efforts are underway to better cost allocation techniques. For instance, the overhead allocation for manufacturers, which was on plant-wide rates, is now based on departmental standards. Also, accountants use machine hours instead of direct labor hours for allocation.

Moreover, some accountants are also implementing activity-based costing to better the allocation. So, there can be several ways to allocate costs. But, whatever form the company selects, it is essential to document the reasons backing that method, and that need to be followed consistently for several periods.

A company can ensure documentation by developing allocation formulas or tables. Moreover, if a company wants, it can also pass supporting journal entries to transfer costs to the cost objects or do it via the chargeback module in the ERP system.

Also Read: Cost Hierarchy – Meaning, Levels and Example

Nowadays, cost allocation systems are available to assist in cost allocation. Such systems track the entity that produces the goods or services and the body that consumes those goods or services. The system also identifies the basis to distribute the cost.

The process to Allocate cost

As said above, there are no specific methods for allocating costs. Similarly, there is no particular process for it, as well. However, the process we are detailing is one of the most popular, and many companies use it for allocating costs. Following is the process:

Before allocating the cost, a company must define the various types of costs. Generally, there are three types of costs – direct, indirect, and overhead. Direct costs are those that one can easily attribute to a product or service, such as wages to factory workers or raw material for the specific product.

Indirect costs are ones that a company needs to incur for its operations, such as administration costs. Primarily, these are the costs that a company needs to allocate as it is difficult to attribute them directly to a product or service or any other cost object.

Another type of cost is an overhead cost , which is also an indirect cost. These costs are incurred for the production and selling of goods or services. Such costs do not vary based on production or sales. A company needs to pay them even if it is not producing or selling anything. Research and development costs, rent, etc., are good examples of such a cost.

The company or the accountant must know the cost objects for which they need to allocate the cost. It is crucial as we can’t assign costs to something on which we have no information. A cost object could be the product, customer, region, department, etc.

Along with the cost object , the company must also determine the basis on which it would allocate the cost. This basis could be the number of hours, area, headcount, and more. For example, if headcount is the basis of allocation for insurance costs and a company has 500 employees, then the department with 100 employees will account for 20% of the insurance cost. Experts recommend choosing a cost allocation base that is a crucial cost driver as well.

A cost driver is a variable whose increase or decrease leads to an increase or decrease in the cost as well. For instance, the number of purchase orders could be a cost driver for the cost of the purchasing department.

An accountant may create many categories to pool costs, which are to be allocated subsequently. It is the account head where the costs should be accumulated before assigning them to the cost objects. Cost pools can be insurance, fuel consumption, electricity, rent, depreciation, etc. The selection of the cost pool primarily depends on the use of the cost allocation base.

Continue reading – Costing Terms .

RELATED POSTS

- Cost Structure

- Types of Costs and their Classification

- Cost Accounting and Management Accounting

- Types of Cost Accounting

- Cost Accumulation: Meaning, Types, and More

- Types of Costing

Sanjay Bulaki Borad

MBA-Finance, CMA, CS, Insolvency Professional, B'Com

Sanjay Borad, Founder of eFinanceManagement, is a Management Consultant with 7 years of MNC experience and 11 years in Consultancy. He caters to clients with turnovers from 200 Million to 12,000 Million, including listed entities, and has vast industry experience in over 20 sectors. Additionally, he serves as a visiting faculty for Finance and Costing in MBA Colleges and CA, CMA Coaching Classes.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Sign me up for the newsletter!

This device is too small

If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience.

- Small Business

- The Top 10 Accounting Software for Small Businesses

Why Allocating Costs Is Important for Your Small Business

See Full Bio

Our Small Business Expert

Business owners use cost allocation to assign costs to specific cost objects. Cost objects include products, departments, programs, and jobs. Cost allocation is necessary for any type of business, but it's more frequently used in manufacturing businesses that incur a wider variety of costs.

Overview: What is cost allocation?

Part of doing business is incurring costs. To ensure accurate financial reporting, it’s vital these costs are allocated to the appropriate cost object.

While bookkeepers and accounting clerks may need some guidance in properly allocating expenses, using accounting software can help to automate and simplify the entire process considerably.

To track and allocate costs, the cost needs to first be associated with a specific cost object. For example, your company pays $3500 property insurance annually for two buildings you currently own.

One building is 4,000 square feet, while the other building is 8,000 square feet. Your cost object is the square footage of each building, which will be used to allocate the cost to the correct building.

3 types of costs

Most businesses incur a variety of costs while doing business. These costs can range from the cost of materials needed to produce a finished product, to the direct labor wages paid to the employee running the machine used to assemble the product, to the overhead costs you incur every day simply by opening your doors.

Before you get started, familiarize yourself with the various types of costs your business is likely to incur.

1. Direct costs

A direct cost is anything that your business can directly connect to a cost object. Tied directly to production, direct costs are the only costs that need not be allocated, but instead are used when calculating cost of goods sold.

The most common direct costs that a business incurs include direct labor, direct materials, and manufacturing supplies. An employee working the assembly line is considered direct labor, a direct cost.

Same goes for the plastic needed to manufacture a toy, or the glue that holds pieces of the toy together. Direct costs are almost always variable because they vary based on production levels. However, if production remains constant, direct costs may remain constant as well.

2. Indirect costs

Indirect costs are costs incurred in the day to day operations of your business. Indirect costs cannot be tied back to one particular product, but are still considered necessary for production to occur or services to be delivered.

Indirect costs, such as utilities and line supervisor salaries are considered necessary for production, but are not tied to a specific product or service, so they’ll need to be allocated accordingly.

3. Overhead costs

Overhead costs, also known as operating costs are the everyday cost of doing business. Overhead costs are never tied to production, either directly or indirectly, but instead are the costs that your business incurs whether or not they’re producing goods or providing services.

For example, rent, insurance, and office supplies are considered overhead costs, which are costs incurred regardless of production levels.

Some overhead costs such as supplies and printing can be variable, while others, such as rent, insurance, and management salaries are all fixed costs, since the cost does not change from month to month. Like indirect costs, overhead costs will need to be allocated regularly in order to determine actual product cost.

Cost allocation examples

Cost allocation isn’t only necessary for manufacturing companies. There are plenty of reasons other companies may need to allocate costs.

Allocating an employee’s salary between two departments, allocating a utility bill between administrative and manufacturing facilities, or a nonprofit that needs to allocate costs between various programs are just a few reasons almost any business may need to regularly allocate costs.

When allocating costs, there are four allocation methods to choose from.

- Direct labor

- Machine time used

- Square footage

- Units produced

In the examples below, we used the square footage and the units produced methods to calculate the appropriate cost allocation.

Cost allocation example 1

Ken owns a small manufacturing plant, with administrative offices housed on the second floor. The square footage of the plant is 5,000 square feet, while the administrative offices are 2,500 square feet, with rent for the entire facility $15,000 per month. Rent must be allocated between the two departments.

The calculation would be:

$15,000 (rent) ÷ 7,500 (square feet) = $2 per square foot

Next, Ken, will calculate the rental cost for the plant:

$2 x 5,000 = $10,000

That means that Ken can allocate $10,000 to overhead expenses for the factory.

Next, Ken will calculate the rental cost for the administrative offices:

$2 x 2,500 = $5,000

The balance of the rent, $5,000, will be allocated to the administrative offices.

Cost allocation example 2

Carrie’s manufacturing company manufactures backpacks. In July, Carrie produced 2,000 backpacks with direct material costs of $5.50 per backpack, and $ 2.25 direct labor costs per backpack.

She also had $7,250 in overhead costs for the month of July. Using the number of units produced as the allocation method, we can calculate overhead costs using the following overhead cost formula:

$7,250 ÷ 2,000 = $3.63 per backpack

When added to Carrie’s direct costs, the cost to produce each backpack is $11.38, calculated as follows:

- Direct Materials: $ 5.50 per backpack

- Direct Labor: $ 2.25 per backpack

- Overhead: $ 3.63 per backpack

- Total Cost: $11.38 per backpack

If Carrie did not allocate the overhead costs, she probably would have underpriced the backpacks, resulting in a loss of income.

No, cost allocation is necessary for any business including service businesses and nonprofit organizations.

To track and allocate costs, the cost needs to be identified with a cost object, which costs are assigned to. Cost objects can include:

- Departments

Almost anything can be considered a cost object if you’re able to assign a cost to it.

Yes. While larger companies may have a greater need to allocate costs, smaller businesses can also benefit from allocating costs properly.

For example, even a small car repair shop will need to allocate parts and labor costs properly, while a small consulting business will need to allocate travel costs to the appropriate customer.

Why you should be allocating costs

Cost allocation is important for any business, large or small. How can you determine how much to charge for goods or services if you have no idea how much it costs to produce the goods or services you currently offer your customers?

Properly allocating costs is also essential for accurate financial reporting. Business owners rely on financial statements to make management decisions, and if the reports are inaccurate, it’s likely the decisions made will negatively affect the business.

Finally, allocating costs properly can help you identify profitable areas of your business and products or services that may be losing money, enabling you to make proactive decisions regarding both.

There’s no good reason not to allocate your business costs, so why not get started today?

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

Copyright © 2018 - 2024 The Ascent. All rights reserved.

Our Recommendations

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Small Business Resources

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

- Sales & Marketing

- Social Media

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

- Women in Business

- Personal Growth

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

- Salesforce vs. HubSpot: Which CRM Is Right for Your Business?

- Rippling vs Gusto: An In-Depth Comparison

- RingCentral vs. Ooma Comparison

- Choosing a Business Phone System: A Buyer’s Guide

- Equipment Leasing: A Guide for Business Owners

- HR Solutions

- Financial Solutions

- Marketing Solutions

- Security Solutions

- Retail Solutions

- SMB Solutions

Business News Daily provides resources, advice and product reviews to drive business growth. Our mission is to equip business owners with the knowledge and confidence to make informed decisions. As part of that, we recommend products and services for their success.

We collaborate with business-to-business vendors, connecting them with potential buyers. In some cases, we earn commissions when sales are made through our referrals. These financial relationships support our content but do not dictate our recommendations. Our editorial team independently evaluates products based on thousands of hours of research. We are committed to providing trustworthy advice for businesses. Learn more about our full process and see who our partners are here .

What Is Cost Allocation?

Cost allocation is a process businesses use to identify costs. Here's everything you need to know.

Table of Contents

Entrepreneurs, small business owners and managers need accurate, timely financial data to run their operations. Specifically, understanding and connecting costs to items or departments helps them create budgets, develop strategies and make the best business decisions for their organizations. This is where cost allocation comes in. Detailed cost allocation reports help businesses ensure they’re charging enough to cover expenses and make a profit.

While a detailed cost allocation report may not be vital for extremely small businesses, more complex businesses require cost allocation to optimize profitability and productivity.

What is cost allocation?

Cost allocation is the process of identifying and assigning costs to business objects, such as products, projects, departments or individual company branches. Business owners use cost allocation to calculate profitability. Costs are separated or allocated, into different categories based on the business area they impact. These amounts are then used in accounting reports .

For example, say you’re a small clothing manufacturer. Your product line’s cost allocation would include materials, shipping and labor costs. It would also include a portion of the operation’s overhead costs. Calculating these costs consistently helps business leaders determine if profits from sales are higher than the costs of producing the product line. If not, it can help the owner pinpoint where to raise prices or cut expenses .

For a larger company, cost allocation is applied to each department or business location . Many companies also use cost allocation to determine annual bonuses for each area.

Types of costs

If you’re starting a business , the cost allocation process is relatively straightforward. However, larger businesses have many more costs that can be divided into two primary categories: direct and indirect costs:

- Purchased inventory

- Materials used to make inventory

- Direct labor costs for employees who make inventory

- Payroll for those who work in operations

- Manufacturing overhead, including rent, insurance and utilities costs

- Other overhead costs, including expenses that support the company but aren’t directly related to production, such as marketing and human resources

What is a cost driver?

A cost driver is a variable that affects business costs, such as the number of invoices issued, employee hours worked or units of electricity used. Unlike cost objects, such as units produced or departments, a cost driver reflects the reason for the incurred cost amounts.

How to allocate costs

While cost objects vary by business type, the cost allocation process is the same regardless of what your company produces. Here are the steps involved.

1. Identify your business’s cost objects.

Determine the cost objects to which you want to allocate costs, such as units of production, number of employees or departments. Remember that anything within your business that generates an expense is a cost object. Review each product line, project and department to ensure you’ve gathered all cost objects for which you must allocate costs.

2. Create a cost pool.

Next, create a detailed list of all business costs. Categories should cover utilities, business insurance policies, rent and any other expenses your business incurs.

3. Choose the best cost allocation method for your needs.

After identifying your business’s cost objects and creating a cost pool, you must choose a cost allocation method. Several methods exist, including the following standard ones:

- Direct materials cost method: This cost allocation method assumes all products have the same allocation base and variable rate.

- Direct labor cost method: This cost allocation method is most helpful if labor costs can be allocated to one product or if expenses vary directly with labor costs.

- High/low method. This cost allocation method is best if you have more than one cost driver and each driver has different fixed or variable rates.

- Step-up or step-down method: With this cost allocation method, departments are first ranked and then the cost of services is allocated from one service department to another in a series of steps.

- Full absorption costing (FAC): This cost allocation method combines direct material and direct labor costs with a predetermined FAC rate based on company historical data or industry standards.

- Variable costing: Consider this cost allocation method if your business has many variable cost allocations (costs that vary by quantity) and uses significant direct labor.

4. Allocate costs.

Now that you’ve listed cost objects, created a cost pool and chosen a cost allocation method, you’re ready to allocate costs.

Here’s a cost allocation example to help you visualize the process:

Dave owns a business that manufactures eyeglasses. In January, Dave’s overhead costs totaled $5,000. In the same month, he produced 3,000 eyeglasses with $2 in direct labor per product. Direct materials for each pair of eyeglasses totaled $5. Here’s what cost allocation would look like for Dave: Direct costs: $5 direct materials + $2 direct labor = $7 direct costs per pair Indirect costs: Overhead allocation: $5,000 ÷ 3,000 pairs = $1.66 overhead costs per pair Direct costs: $7 per pair + Indirect costs: $1.66 per pair Total cost: $8.66 per pair

As you can see, cost allocation helps Dave determine how much he must charge wholesale for each pair of eyeglasses to make a profit. Larger companies would apply this same process to each department and product to ensure sufficient sales goals.

5. Review and adjust cost allocations.

Cost allocations are never static. To be meaningful, they must be monitored and adjusted constantly as circumstances change.

What are the benefits of cost allocation?

Accurate, regular cost allocation can bring your business the following benefits:

- Helps you run your business: The information you glean from cost allocation reports helps you perform vital functions like preparing income tax returns and creating financial reports for investors, creditors and regulators.

- Informs business decisions: Cost allocation is an excellent business decision tool that can help you monitor productivity and justify expenses. Cost allocation gives a detailed overview of how your business expenses are used. From this perspective, you can determine which products and services are profitable and which departments are most productive.

- Helps produce accurate business reports: Tax accounting, financial accounting and management accounting all require some kind of cost allocation. This information is the foundation of accurate business reports.

- Can reveal accurate production costs: Knowing what it costs to create a product, including all expenses allocated to it, is essential to making good pricing decisions and allocating resources efficiently.

- Helps you evaluate staff: Cost allocation can help you assess the performance of different departments and staff members. If a department is not profitable, staff productivity may need improvement.

Common cost allocation mistakes

To get the most from cost allocation, avoid these common mistakes:

- Equal or inflexible allocation : Cost allocation is not as simple as allocating any given cost over different product lines or departments. Some cost objects require more time, expense or labor than others, for example.

- Missing costs: Costing is meaningless if it doesn’t include all expenses. Don’t forget costs, such as overhead, time spent and intangible expenses.

- Failing to adjust as needed: Costs and priorities in business are changing constantly. Be sure your cost allocations are monitored and adjusted to meet your information needs.

- Not considering fluctuating revenue with indirect costs: If your business is seasonal or fluctuates over time, it’s important to account for that when allocating costs.

Cost allocation and your business

Even if you operate a very small business, it’s essential to properly allocate your expenses. Otherwise, you could make all-too-common mistakes, such as charging too little for your product or spending too much on overhead. Whether you choose to start allocating costs on your own with software or with the help of a professional small business accountant , cost allocation is a process no business owner can afford to overlook.

Dachondra Cason contributed to this article.

Building Better Businesses

Insights on business strategy and culture, right to your inbox. Part of the business.com network.

- Cost Classifications

- Relevant Cost of Material

- Manufacturing Overhead Costs

- Conversion Costs

- Quality Costs

- Revenue Expenditure

- Product Cost vs Period Cost

- Direct Costs and Indirect Costs

- Prime Costs and Conversion Costs

- Relevant vs Irrelevant Costs

- Avoidable and Unavoidable Costs

- Cost Allocation

- Joint Products

- Accounting for Joint Costs

- Service Department Cost Allocation

- Repeated Distribution Method

- Simultaneous Equation Method

- Specific Order of Closing Method

- Direct Allocation Method

Cost allocation is the process by which the indirect costs are distributed among different cost objects such as a project, a department, a branch, a customer, etc. It involves identifying the cost object, identifying and accumulating the costs that are incurred and assigning them to the cost object on some reasonable basis.

Cost allocation is important for both pricing and planning and control decisions. If costs are not accurately calculated, a business might never know which products are making money and which ones are losing money. If cost are mis-allocated, a business may be charging wrong price to its customers and/or it might be wasting resources on products that are wrongly categorized as profitable.

Cost allocation is a sub-process of cost assignment , which is the overall process of finding total cost of a cost object. Cost assignment involves both cost tracing and cost allocation. Cost tracing encompasses finding direct costs of a cost object while the cost allocation is concerned with indirect cost charge.

Steps in cost allocation process

Typical cost allocation mechanism involves:

- Identifying the object to which the costs have to be assigned,

- Accumulating the costs in different pools,

- Identifying the most appropriate basis/method for allocating the cost.

Cost object

A cost object is an item for which a business need to separately estimate cost.

Examples of cost object include a branch, a product line, a service line, a customer, a department, a brand, a project, etc.

A cost pool is the account head in which costs are accumulated for further assignment to cost objects.

Examples of cost pools include factory rent, insurance, machine maintenance cost, factory fuel, etc. Selection of cost pool depends on the cost allocation base used. For example if a company uses just one allocation base say direct labor hours, it might use a broad cost pool such as fixed manufacturing overheads. However, if it uses more specific cost allocation bases, for example labor hours, machine hours, etc. it might define narrower cost pools.

Cost driver

A cost driver is any variable that ‘drives’ some cost. If increase or decrease in a variable causes an increase or decrease is a cost that variable is a cost driver for that cost.

Examples of cost driver include:

- Number of payments processed can be a good cost driver for salaries of Accounts Payable section of accounting department,

- Number of purchase orders can be a good cost driver for cost of purchasing department,

- Number of invoices sent can be a good cost driver for cost of billing department,

- Number of units shipped can be a good cost driver for cost of distribution department, etc.

While direct costs are easily traced to cost objects, indirect costs are allocated using some systematic approach.

Cost allocation base

Cost allocation base is the variable that is used for allocating/assigning costs in different cost pools to different cost objects. A good cost allocation base is something which is an appropriate cost driver for a particular cost pool.

T2F is a university café owned an operated by a student. While it has plans for expansion it currently offers two products: (a) tea & coffee and (b) shakes. It employs 2 people: Mr. A, who looks after tea & coffee and Mr. B who prepares and serves shakes & desserts.

Its costs for the first quarter are as follows:

| Mr. A salary | 16,000 |

| Mr. B salary | 12,000 |

| Rent | 10,000 |

| Electricity | 8,000 |

| Direct materials consumed in making tea & coffee | 7,000 |

| Direct raw materials for shakes | 6,000 |

| Music rentals paid | 800 |

| Internet & wi-fi subscription | 500 |

| Magazines | 400 |

Total tea and coffee sales and shakes sales were $50,000 & $60,000 respectively. Number of customers who ordered tea or coffee were 10,000 while those ordering shakes were 8,000.

The owner is interested in finding out which product performed better.

Salaries of Mr. A & B and direct materials consumed are direct costs which do not need any allocation. They are traced directly to the products. The rest of the costs are indirect costs and need some basis for allocation.

Cost objects in this situation are the products: hot beverages (i.e. tea & coffee) & shakes. Cost pools include rent, electricity, music, internet and wi-fi subscription and magazines.

Appropriate cost drivers for the indirect costs are as follows:

| Rent | 10,000 | Number of customers |

| Electricity | 8,000 | United consumed by each product |

| Music rentals paid | 800 | Number of customers |

| Internet & wifi subscription | 500 | Number of customers |

| Magazines | 400 | Number of customers |

| 19,700 |

Since number of customers is a good cost driver for almost all the costs, the costs can be accumulated together to form one cost pool called manufacturing overheads. This would simply the cost allocation.

Total manufacturing overheads for the first quarter are $19,700. Total number of customers who ordered either product are 18,000. This gives us a cost allocation base of $1.1 per customer ($19,700/18,000).

A detailed cost assignment is as follows:

| Tea & Coffee | Shakes | |

| Revenue | 50,000 | 60,000 |

| Costs: | ||

| Salaries | 16,000 | 12,000 |

| Direct materials | 7,000 | 6,000 |

| Manufacturing overheads allocated | 11,000 | 8,800 |

| Total costs | 34,000 | 26,800 |

| Profit earned | 16,000 | 33,200 |

Manufacturing overheads allocated to Tea & Cofee = $1.1×10,000

Manufacturing overheads allocated to Shakes = $1.1×8,000

by Irfanullah Jan, ACCA and last modified on Jul 22, 2020

Related Topics

- Cost Behavior

All Chapters in Accounting

- Intl. Financial Reporting Standards

- Introduction

- Accounting Principles

- Business Combinations

- Accounting Cycle

- Financial Statements

- Non-Current Assets

- Fixed Assets

- Investments

- Revenue Recognition

- Current Assets

- Receivables

- Inventories

- Shareholders' Equity

- Liability Accounts

- Accounting for Taxes

- Employee Benefits

- Accounting for Partnerships

- Financial Ratios

- Cost Accounting Systems

- CVP Analysis

- Relevant Costing

- Capital Budgeting

- Master Budget

- Inventory Management

- Cash Management

- Standard Costing

Current Chapter

XPLAIND.com is a free educational website; of students, by students, and for students. You are welcome to learn a range of topics from accounting, economics, finance and more. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable. Let's connect!

Copyright © 2010-2024 XPLAIND.com

The Comprehensive Guide to Cost Allocation in Accounting

Accounting is a fascinating field, and cost allocation is one of the most important concepts in accounting. Whether you’re an accounting student or an accountant just starting out, it’s important to understand how to allocate costs.

In this comprehensive guide, we’ll cover everything from what it means to its pros and cons.

How Can Costs Be Allocated Among Departments or Product Lines When There Is No Clear Source?

Allocation is distributing costs among different departments or product lines in an organization. Trying to accurately estimate the cost of producing a good or rendering a service is a common challenge for many businesses.

This is especially true when there is no apparent source of the costs, as it requires the use of various techniques and methods to distribute the expenses fairly and reasonably.

What Is the Concept of Allocation?

Allocation (also known as “cost allocation”) is a process used to distribute the costs of a shared resource or expense among different departments, product lines, or activities within an organization.

This process is necessary to accurately determine the cost of producing a product, providing a service, or running a business. Allocation allows firms to identify the expenses incurred by each department or product line and helps make informed decisions about allocating resources.

The allocation concept has existed for centuries and is a fundamental part of modern accounting and financial management. The cost allocation process involves assigning costs to specific departments or product lines based on objective criteria, such as resource use or the benefit received from the expense.

The objective criteria used in the allocation process may vary depending on the type of business, but the goal is always to distribute the costs fairly and reasonably.

One of the main challenges of allocation is that many expenses cannot be traced directly to a specific department or product line. For example, the cost of electricity used to run a manufacturing plant cannot be directly traced to one particular product line.

In such cases, the cost of electricity must be allocated to different departments or product lines based on objective criteria, such as the number of hours each department uses the electricity or the production output of each product line.

There are different methods of allocation, each with its strengths and weaknesses. Some of the most common ways include direct allocation, step-down allocation, sequential allocation, and activity-based allocation. Each mode uses a different approach to allocating costs, but the goal is always to ensure that the costs are distributed fairly and reasonably.

What Doesn’t the Term Allocation Mean?

The term allocation” is commonly used in various contexts, such as finance, economics, project management, and resource management. However, it’s essential to understand that allocation ” doesn’t mean “equal distribution” or “uniform distribution” of resources.

Allocation refers to assigning a portion of resources, such as time, money, or labor, to specific tasks or activities. The goal of allocation is to optimize the use of resources to achieve the desired outcomes.

One of the most common misunderstandings about allocation is that it means dividing resources equally among tasks or activities. However, this is only sometimes the case. Resources are often not distributed evenly because different tasks or activities have different requirements and priorities.

For example, in project management, some jobs may require more time, money, or labor than others. In such cases, the project manager must allocate more resources to these critical tasks to ensure the project’s success.

Another misunderstanding about allocation is that it means distributing resources inflexibly and rigidly. Allocation is a flexible process that can be adjusted based on priorities or changes in resource availability. For example, in a business setting, the budget allocation may change based on market conditions or changes in customer demand. In these situations, the business must be able to reallocate its resources to respond to these changes.

The allocation also doesn’t mean that the resources are assigned once and never adjusted. Allocation is an ongoing process requiring constant monitoring and adjustments to ensure that resources are used optimally.

For example, in finance, the allocation of investments must be reviewed regularly to ensure that the portfolio is aligned with the investor’s goals and objectives.

Another misconception about allocation is that it only applies to tangible resources, such as money or equipment. However, allocation also applies to intangible resources like time and labor. These intangible resources are often more critical and limited than tangible ones. For example, allocating time is crucial in project management to ensure that projects are completed on time and within budget.

As you can see, allocation is a complex and flexible process that requires careful consideration of multiple factors, such as resource availability, priorities, and goals. It’s essential to understand that allocation doesn’t mean equal distribution or limited distribution of resources.

Instead, it’s a dynamic process that requires ongoing monitoring and adjustments to ensure the optimal use of resources. By avoiding common misconceptions about allocation, individuals and organizations can more effectively allocate their resources and achieve their desired outcomes.

Where the Term Allocation Originated From?

The word “allocation” comes from the Latin word “allocare.” The word allocation ” refers to setting aside or assigning a particular portion, amount, or portion of something for a specific purpose or recipient.

The allocation comes from the Latin prefix ad- (meaning “to”) and the noun loci (meaning “place”). The combination of these two words implies the idea of assigning a place, or portion of something, for a specific purpose.

In finance and economics, “allocation” refers to distributing resources, such as money, to different projects or initiatives based on their perceived importance and likelihood of success.

The allocation concept is ancient and can be traced back to the earliest civilizations, where resources were allocated based on the community’s needs. In early societies, central planning or direct control by the ruling class were common methods of allocation.

However, with the advent of market-based economies, the allocation has become more decentralized and is now primarily done through the market mechanism of supply and demand.

In modern economies, allocation is crucial in ensuring that resources are used efficiently and effectively. For example, in capital allocation, investors allocate their funds to different projects and businesses based on the perceived potential return on investment. This helps direct investment toward the most promising and profitable opportunities, thereby increasing the economy’s overall efficiency.

Similarly, prices play a crucial role in allocating goods and services in directing resources to where they are most needed. In a market economy, the interaction of supply and demand determines prices. When demand for a particular good or service is high, the price will increase, directing more resources toward its production. On the other hand, when demand is low, the price will decrease, reducing the allocation of resources to its production.

Government policies and regulations can also have an impact on allocation in addition to the market mechanism. For example, the government may allocate resources to specific sectors through funding or subsidies, such as education or healthcare.

Similarly, government regulations and taxes can also impact the allocation of resources by affecting the incentives for businesses and individuals to allocate their resources in a particular way.

How Allocation Relates to Accounting?

In accounting, allocation determines the cost of producing a product or providing a service. This information is then used to create accurate financial statements and make informed decisions about allocating resources in the future.

For example, a company may allocate resources to a new product line based on the expected revenue it will generate or distribute costs to specific departments based on their usage of resources.

The allocation also plays a crucial role in cost accounting . Cost accounting involves analyzing the cost of production, including direct and indirect costs, and using this information to make decisions about pricing and resource allocation.

By accurately allocating costs, a company can determine the actual cost of production and make informed decisions about pricing , production volume, and resource allocation.

In addition, allocation is used to allocate the costs of long-term assets, such as property, plant, and equipment. This is done through the process of depreciation, which is a systematic allocation of the cost of an asset over its useful life. Depreciation is used to determine the value of an investment for financial reporting purposes and the amount of tax that a company must pay.

Finally, allocation is also used in the budgeting process. In budgeting, an organization allocates resources to various departments and activities based on their priorities and goals. By accurately allocating resources, a company can ensure that it has enough resources to meet its goals and objectives while staying within its budget.

3 Examples of Allocation Being Used in Accounting Practice

Example #1 of allocation being used in accounting practice.

Allocating the Cost of Goods Sold In accounting, “cost of goods sold” (COGS) refers to the direct costs associated with producing a product or providing a service. These costs include the raw materials, labor, and overhead expenses incurred to produce the goods. COGS is crucial in determining a company’s gross profit because it represents the cost of producing and selling a product.

One example of allocation in accounting practice is when a company allocates the cost of goods sold to each product. This is done to understand the cost of producing each product and identify the most profitable products.

The allocation process involves dividing the total COGS by the number of units sold to arrive at an average cost per unit. This average cost per unit is then applied to each unit of product sold to determine the COGS for that specific product.

This allocation process is vital because it allows the company to accurately determine the cost of producing each product. This information is then used to make informed business decisions such as pricing strategies, production decisions, and cost control measures.

For example, suppose a company realizes that the cost of producing one product is much higher than the cost of producing another. In that case, it may choose to discontinue the higher-cost product or find ways to reduce the cost of production.

Example #2 of Allocation Being Used in Accounting Practice

One example of allocation in accounting practice is allocating indirect costs to different departments or products within a company. Indirect costs, such as rent, utilities, and office supplies, cannot be directly traced to a specific product or department. These costs must be allocated among different departments or products to calculate the cost of each accurately.

For example, consider a manufacturing company with three departments: production, research and development, and administration. The company has a total indirect cost of $100,000 for the year, which includes rent, utilities, and office supplies.

The company might determine the proportion of space each department uses to allocate these costs. If production uses 40% of the total space, R&D uses 30%, and administration uses 30%, the company would allocate 40% of the indirect costs to production, 30% to R&D, and 30% to administration.

Next, the company might allocate indirect costs based on the number of employees in each department. If production has 20 employees, R&D has 15, and administration has 10, the company would allocate indirect costs based on the ratio of employees in each department.

In this example, production would receive 40% of the indirect costs, R&D would receive 30%, and administration would receive 30%.

Finally, the company might allocate indirect costs based on the number of products produced in each department. If production produces 1000 products, R&D produces 500, and administration produces none, the company would allocate indirect costs based on the ratio of products produced in each department.

In this example, production would receive 67% of the indirect costs, R&D would receive 25%, and administration would receive 8%.

Example #3 of Allocation Being Used in Accounting Practice

Suppose a manufacturing company produces two products: Product A and Product B. To determine the cost of each product, the company must allocate the factory overhead costs, including utilities, rent, maintenance, and supplies, among other expenses. The overhead costs must be assigned to each product based on the proportion of total machine hours used to produce each product.

For example, if the company uses 60% of the total machine hours to produce Product A and 40% to produce Product B, then 60% of the factory overhead costs would be allocated to Product A and 40% to Product B. The company would then use the allocated overhead costs and the direct costs of material and labor to calculate the total cost of each product.

The allocation of overhead costs to each product is critical for the company to accurately determine the cost of goods sold and price its products competitively. The company can use an allocation method to ensure a fair and accurate picture of the costs of producing each product.

How to Do Cost Allocation in Simple Steps?

Cost allocation can be complex, but it doesn’t have to be. Here are five simple steps for cost allocation:

Step 1: Identify the Costs That Need to Be Allocated

The first step in cost allocation is identifying the costs that need to be allocated. This includes both direct and indirect costs. Direct costs can be easily traced to specific products or services, while indirect costs, such as rent and utilities, cannot.

Step 2: Choose the Appropriate Method of Cost Allocation

Once you have identified the costs that need to be allocated, the next step is to choose the appropriate cost allocation method. The most common methods include direct cost allocation, step-down allocation, sequential allocation, and activity-based costing. The method chosen will depend on the nature of the costs and the objectives of the cost allocation process.

Step 3: Determine the Allocation Base

The allocation base is the basis on which the costs will be allocated. This can be the number of units produced, the number of employees, or any other relevant factor that can be used to determine the cost of goods or services.

Step 4: Allocate the Costs

Once you have determined the allocation base, the next step is to allocate the costs. This can be done by dividing the total cost by the number of units, employees, or another relevant factor and multiplying this by the number of units, employees, or another relevant factor for each product, service, or department.

Step 5: Review and Adjust the Cost Allocation

Once the costs have been allocated, the final step is to review and adjust the cost allocation as necessary. This may involve reallocating costs based on new information or changes in the business.

Which Industries Can Cost Allocation Be Applied?

With the proper guidance, cost allocation can be applied to almost any industry. It’s all about the data you have and how you use it.

Let’s take a look at some of the industries that could benefit from cost allocation:

The healthcare industry is one of the most expensive in the world. It is also one of the most heavily regulated. These factors make cost allocation a necessity for many healthcare providers.

Healthcare organizations have many different costs, but the most significant sources are labor and supplies. Labor costs can be very high in this industry because it requires highly skilled people to perform various tasks, including surgery, patient care, and patient education. Supplies like bandages and IV bags are also expensive because they have to be sterile and meet regulatory requirements.

A hospital’s supply department has much control over its budget, but it also has little control over what happens in other departments, such as surgery or patient care. This makes it difficult to allocate costs accurately when they don’t know how much they will spend on supplies or how many patients they’ll see each year.

Cost allocation helps solve these problems by allowing managers to see which departments are consuming the most resources. They can adjust accordingly without guessing what’s happening behind closed doors (or behind locked doors).

Manufacturing

The manufacturing industry is one of the most common places where cost allocation can be applied. In this industry, it is crucial to know how much it costs to make each product and how much it costs to produce goods (including materials and labor) for sale.

With this information, manufacturers can determine how much they need to charge for their products to cover all of their expenses, including overhead costs like rent or electricity bills.

Cost allocation can also help manufacturers determine which products are more profitable than others so that they can focus on those areas instead of wasting time and money on less popular lines of goods. For example, suppose a company produces clothing and electronics but finds its clothing line more popular among consumers than its electronics line.

In that case, it may want to stop producing electronics altogether because there would need to be more demand for these products for them to make any money off of them.

This is an industry that benefits from cost allocation. Energy companies have long been able to allocate costs to different projects and branches, but they often face challenges when assigning overhead expenses. That’s because overhead costs are shared among the company’s functions, making them difficult to track.

Cost allocation software can help energy companies assign overhead expenses in a way that makes sense for each project or branch. The software also allows them to better understand where their money is going and gives them more flexibility in budgeting and forecasting future expenses.

Retailers are a great example of an industry that can benefit from cost allocation.

Retailers are often sold on the idea of one-stop shopping: you go to a store and buy everything you need, from clothing to food to furniture. But in reality, there are many different types of retailers, such as grocery stores, department stores, clothing stores, etc. And each has its own distinct set of costs for running that type of business. So how do these retailers know how much each product line contributes to their overall profits? They use cost allocation.

Cost allocation is a technique for allocating overhead costs across product lines based on their relative importance to the company’s overall performance. This way, retailers can determine which products contribute most (or least) to their bottom line and make decisions accordingly.

Information Technology

Information technology (IT) is one of the most significant cost allocation areas. IT costs are often divided into two categories: direct costs and indirect costs. The former refers to those costs that can be directly attributed to a particular project or product, while the latter refers to those costs that cannot be directly attributed.

Cost allocation in IT has many benefits. It helps managers determine how much it costs to develop a new product or service and where inefficiencies lie in their IT departments.

It also allows them to understand better how much revenue they’re generating from each product or service line, which will help them make better decisions about future investments in the company’s infrastructure.

Construction

This is one of the most apparent industries to apply cost allocation. Construction projects are often massive and complex, with many different stakeholders involved in the planning, execution, and completion of a project. It’s common for construction projects to have hundreds or thousands of contracts with hundreds or thousands of different suppliers.

Cost allocation helps ensure that those involved in the project are paid what they’re owed without overpaying anyone else who participated. It’s also used to ensure that a company only spends a little money on a project by ensuring that every expense is only charged once.

Transportation

This is the industry that can benefit the most from cost allocation.

Transportation has many parts that must work in unison to transport goods or passengers. It can be difficult to determine which part of a vehicle’s operation should be allocated to specific parts, and it usually requires a lot of math.

Cost allocation can make it easier for companies in this industry to understand which parts are costing them more than they expected so that they can make changes accordingly.

Food and Beverage

Food and beverage companies can benefit significantly from cost allocation. These companies are typically comprised of many different departments that must be managed to ensure the entire business runs smoothly. Each department has specific costs that it incurs, so allocating those costs among all of the departments will help you understand where your money is going and how it can be used most effectively.

Cost allocation is also helpful when dealing with food or beverage products because it allows you to track the costs associated with each product line and make sure you profit on every product line. This way, you know what kinds of products are selling well, which ones aren’t selling as well, and how much money each product line has made for your company.

Real Estate

This is one of the most common industries to use cost allocation methods. Real estate developers often create multiple project phases, which must be accounted for separately. The costs of these phases are usually allocated to determine how much profit (or loss) will be made in each phase.

This lets developers decide which phases should be completed first and what incentives may be offered to convince buyers to purchase units from those phases.

Utilities are another excellent example of an industry where cost allocation can be used.

They must deal with various costs, including purchasing raw materials, paying for labor, and buying equipment. The type of utility and the sector it operates in determine the cost of each of these. For example, a water utility may have very high costs for purchasing raw materials but low costs for labor and employee benefits because they only need a few employees or benefit packages.

Cost allocation can help utilities determine how much money they should spend on each part of their business so that they’re not overspending on one part while underinvesting in another.

Pros of Cost Allocation

Cost allocation is a common business practice. Companies use it to help determine the profitability of individual products, services, and departments within a company. Here are the pros of cost allocation:

Improved Decision Making

Cost allocation helps businesses make informed decisions by accurately determining the cost of goods or services. Companies can make informed decisions on pricing, production, and marketing strategies with a better understanding of the costs associated with producing a product or offering a service.

Better Resource Allocation

Cost allocation helps businesses to determine the costs associated with different departments, products, or services. This information can then be used to allocate resources more efficiently and allocate more resources to more profitable areas.

Increased Profitability

By allocating costs accurately, businesses can identify less profitable areas and make changes to improve profitability. This could involve reducing costs, improving efficiency, or adjusting pricing.

Better Budget Planning

Cost allocation helps businesses to create more accurate budgets. Companies can plan their budgets more effectively as they understand the costs associated with each product, service, or department.

Improved Internal Control

Cost allocation helps businesses to maintain better internal control over their operations. By allocating costs accurately, companies can track expenses and identify improvement areas. This helps to prevent fraud and embezzlement and increases accountability within the company.

Better Understanding of Overhead Costs

Overhead costs can be challenging to understand and allocate accurately. Cost allocation helps businesses to understand these costs better and allocate them to the proper departments or products. This allows companies to make informed decisions on pricing and production.

Improved Cost Reporting

Cost allocation helps businesses to produce more accurate cost reports. This allows companies to make informed pricing, production, and marketing strategies decisions. Cost reports are also essential for tax purposes and to meet regulatory requirements.

Better Negotiations

Cost allocation helps businesses to understand their costs better, which can be used in negotiations with suppliers and customers. Companies can better understand costs and negotiate better prices, terms, and conditions with suppliers and customers. This helps businesses to maintain better relationships and increase profitability.

Cons of Cost Allocation

Cost allocation can be an excellent tool for helping you understand where your money is going and how to save it, but this method has some drawbacks.

Time-Consuming Process

Cost allocation can be time-consuming and requires significant effort from various departments within the company. This can divert resources from other important tasks and may slow down other processes.

Increased Complexity

Cost allocation can be complex, especially for large organizations with multiple departments and products. This complexity can result in errors and misunderstandings, negatively impacting the accuracy of cost reports and other important financial information.

Implementing a cost allocation system can be expensive and require a significant investment in technology, software, and training. This cost can be a barrier for smaller organizations or those with limited resources.

Unreliable Data

Cost allocation is only as accurate as the data used in the process. Poor quality data, errors in data entry, and outdated data can all result in inaccurate cost reports and inefficient resource allocation.

Resistance to Change

Some employees may resist implementing a cost allocation system, especially if they feel the process may negatively impact their department or lead to job loss.

Limited Flexibility

Cost allocation systems are often rigid and lack the flexibility to adapt to changes in business conditions. This can result in inefficiencies and limit the ability of the company to respond to new opportunities or challenges.

Potential for Misallocation

If not implemented correctly, cost allocation can misallocate costs, negatively impacting decision-making and profitability.

Dependence on Cost Allocation

Overreliance on cost allocation can lead to a lack of creativity and initiative within departments. Employees may become too focused on cost allocation and need to be more focused on driving innovation and growth for the company. This can limit the ability of the company to adapt to changing market conditions.

Frequently Asked Questions- Cost Allocation in Accounting

What are the main objectives of cost allocation.

The main objectives of cost allocation are to accurately determine the cost of goods or services, improve resource allocation, increase profitability, create more accurate budgets, improve internal control, and provide better cost reporting.

What Is Direct Cost Allocation?

Direct cost allocation refers to assigning costs directly to specific products or services. This method is used when the costs can be easily traced to specific business areas.

What Is Step-Down Allocation?

Step-down allocation refers to allocating costs from one department to another department or product. This method is used when costs cannot be directly traced to specific products or services.

What Is Sequential Allocation?

Sequential allocation refers to allocating costs based on the sequence in which they are incurred. This method is used when costs cannot be directly traced to specific products or services.

What Is Activity-Based Costing?

Activity-based costing refers to allocating costs based on the activities involved in producing a product or offering a service. This method is used when multiple activities are involved in creating a product or service.

Why Is Cost Allocation Important for Businesses?

Cost allocation is essential for businesses as it helps them understand the costs associated with each business area and make informed pricing, production, and resource allocation decisions. This leads to improved profitability and better resource allocation.

How Does Cost Allocation Impact Resource Allocation?

Cost allocation helps companies determine the costs associated with each department, product, or service, which are used to allocate resources more efficiently. By allocating resources based on accurate cost

How Does Cost Allocation Impact Pricing Decisions?

Cost allocation helps companies understand the costs associated with each product or service used to make informed pricing decisions. By accurately determining the cost of goods or services, companies can ensure that their pricing is based on a solid understanding of the costs involved.

The Comprehensive Guide to Cost Allocation in Accounting – Conclusion

Allocation of costs is a critical component of any business. By allocating costs, you can ensure that your company makes the best use of its resources and operates efficiently.

The ability to allocate costs allows you to make strategic decisions about your business’s operations and management and take appropriate actions regarding financial reporting.

The Comprehensive Guide to Cost Allocation in Accounting – Recommended Reading

Corporate Accountant: What Are the Responsibilities, Duties, & Salary of a Corporate Accountant?

How Can Business Intelligence Help with Budget Planning (in 2023)

Standard Costing- Common Problems (And How to Solve Them)

Updated: 5/19/2023

Meet The Author

Danica De Vera

Related posts.

The Price of Happiness: Examining Trade-Offs Between Wealth and Well-Being

In today’s society, the pursuit of wealth often leads to trade-offs in well-being. True contentment encompasses mental, emotional, and physical health, purpose, and relationships. Wealth does not guarantee happiness and can impact mental health, relationships, and sustainable living. Balancing wealth with well-being results in a more fulfilling life.

How Can Diversity of Thought Lead to Good Ethical Decisions?

Diversity of thought, or cognitive diversity, encompasses varied perspectives and beliefs. Embracing this diversity leads to better ethical decision-making by broadening perspectives, enhancing critical thinking, mitigating groupthink, fostering cultural competence, strengthening stakeholder engagement, promoting ethical leadership, improving risk management, and fostering employee engagement.

The 26 Most Influential Leadership Quotes from Silicon Valley Icons

Silicon Valley, a hotbed of innovation and entrepreneurship, is driven by a unique culture of risk-taking, an abundant talent pool, access to capital, and a strong sense of community. The region’s success is propelled by visionary leadership, resilience, innovation, risk-taking, and customer-centric approaches.

Subscribe to discover my secrets to success. Get 3 valuable downloads, free exclusive tips, offers, and discounts that we only share with my email subscribers.

Social media.

Quick links

- Terms of Service

Other Pages

Contact indo.

- 302-981-1733

- [email protected]

© Accounting Professor 2023. All rights reserved

Discover more from accounting professor.org.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

What is Cost Assignment?

Share This...

Cost assignment.

Cost assignment is the process of associating costs with cost objects, such as products, services, departments, or projects. It encompasses the identification, measurement, and allocation of both direct and indirect costs to ensure a comprehensive understanding of the resources consumed by various cost objects within an organization. Cost assignment is a crucial aspect of cost accounting and management accounting, as it helps organizations make informed decisions about pricing, resource allocation, budgeting, and performance evaluation.

There are two main components of cost assignment:

- Direct cost assignment: Direct costs are those costs that can be specifically traced or identified with a particular cost object. Examples of direct costs include direct materials, such as raw materials used in manufacturing a product, and direct labor, such as the wages paid to workers directly involved in producing a product or providing a service. Direct cost assignment involves linking these costs directly to the relevant cost objects, typically through invoices, timesheets, or other documentation.

- Indirect cost assignment (Cost allocation): Indirect costs, also known as overhead or shared costs, are those costs that cannot be directly traced to a specific cost object or are not economically feasible to trace directly. Examples of indirect costs include rent, utilities, depreciation, insurance, and administrative expenses. Since indirect costs cannot be assigned directly to cost objects, organizations use various cost allocation methods to distribute these costs in a systematic and rational manner. Some common cost allocation methods include direct allocation, step-down allocation, reciprocal allocation, and activity-based costing (ABC).

In summary, cost assignment is the process of associating both direct and indirect costs with cost objects, such as products, services, departments, or projects. It plays a critical role in cost accounting and management accounting by providing organizations with the necessary information to make informed decisions about pricing, resource allocation, budgeting, and performance evaluation.

Example of Cost Assignment

Let’s consider an example of cost assignment at a bakery called “BreadHeaven” that produces two types of bread: white bread and whole wheat bread.

BreadHeaven incurs various direct and indirect costs to produce the bread. Here’s how the company would assign these costs to the two types of bread:

- Direct cost assignment:

Direct costs can be specifically traced to each type of bread. In this case, the direct costs include:

- Direct materials: BreadHeaven purchases flour, yeast, salt, and other ingredients required to make the bread. The cost of these ingredients can be directly traced to each type of bread.

- Direct labor: BreadHeaven employs bakers who are directly involved in making the bread. The wages paid to these bakers can be directly traced to each type of bread based on the time spent working on each bread type.

For example, if BreadHeaven spent $2,000 on direct materials and $1,500 on direct labor for white bread, and $3,000 on direct materials and $2,500 on direct labor for whole wheat bread, these costs would be directly assigned to each bread type.

- Indirect cost assignment (Cost allocation):

Indirect costs, such as rent, utilities, equipment maintenance, and administrative expenses, cannot be directly traced to each type of bread. BreadHeaven uses a cost allocation method to assign these costs to the two types of bread.

Suppose the total indirect costs for the month are $6,000. BreadHeaven decides to use the number of loaves produced as the allocation base , as it believes that indirect costs are driven by the production volume. During the month, the bakery produces 3,000 loaves of white bread and 2,000 loaves of whole wheat bread, totaling 5,000 loaves.

The allocation rate per loaf is:

Allocation Rate = Total Indirect Costs / Total Loaves Allocation Rate = $6,000 / 5,000 loaves = $1.20 per loaf

BreadHeaven allocates the indirect costs to each type of bread using the allocation rate and the number of loaves produced:

- White bread: 3,000 loaves × $1.20 per loaf = $3,600

- Whole wheat bread: 2,000 loaves × $1.20 per loaf = $2,400

After completing the cost assignment, BreadHeaven can determine the total costs for each type of bread:

- White bread: $2,000 (direct materials) + $1,500 (direct labor) + $3,600 (indirect costs) = $7,100

- Whole wheat bread: $3,000 (direct materials) + $2,500 (direct labor) + $2,400 (indirect costs) = $7,900

By assigning both direct and indirect costs to each type of bread, BreadHeaven gains a better understanding of the full cost of producing each bread type, which can inform pricing decisions, resource allocation, and performance evaluation.

Other Posts You'll Like...

BAR CPA Exam: How to Perform a SWOT Analysis on a Business to Assess the Entity’s Options to Achieve Its Overall Strategic Aims

BAR CPA Exam: Understanding the Impact of a Proposed Transaction on Key Performance Measures of an Entity

BAR CPA Exam: How to Compare Various Strategies for Managing the Working Capital of an Entity

BAR CPA Exam: Understanding the Strategies to Mitigate Financial Risks

BAR CPA Exam: How to Apply the COSO ERM Framework to Identify Risk or Opportunity Scenarios in an Entity

BAR CPA Exam: Understanding How the COSO ERM Framework Can be Applied to Identify, Respond to, and Report ESG Related Risks

Helpful links.

- Learn to Study "Strategically"

- How to Pass a Failed CPA Exam

- Samples of SFCPA Study Tools

- SuperfastCPA Podcast

Scoring in the High 90s While Working Full-Time? How Scott Passed His CPA Exams

How Studying from Her Phone Helped Meaghan Pass the CPA Exams

How Ron Passed His CPA Exams by Going All In

From 8hrs a Day to 2hrs a Day: How Matt Passed the CPA Exams

How Brittany Crushed the CPA Exams, Despite Being Very Busy

How Jamie Passed Her CPA Exams by Constantly Improving Her Study Process

Want to pass as fast as possible, ( and avoid failing sections ), watch one of our free "study hacks" trainings for a free walkthrough of the superfastcpa study methods that have helped so many candidates pass their sections faster and avoid failing scores....

Make Your Study Process Easier and more effective with SuperfastCPA

Take Your CPA Exams with Confidence

- Free "Study Hacks" Training

- SuperfastCPA PRO Course

- SuperfastCPA Review Notes

- SuperfastCPA Audio Notes

- SuperfastCPA Quizzes

Get Started

- Free "Study Hacks Training"

- Read Reviews of SuperfastCPA

- Busy Candidate's Guide to Passing

- Subscribe to the Podcast

- Purchase Now

- Nate's Story

- Interviews with SFCPA Customers

- Our Study Methods

- SuperfastCPA Reviews

- CPA Score Release Dates

- The "Best" CPA Review Course

- Do You Really Need the CPA License?

- 7 Habits of Successful Candidates

- "Deep Work" & CPA Study

15 Cost Management Strategies in Business: with Examples

In today’s competitive business landscape, managing finances effectively is more crucial than ever.

Employing robust cost management strategies in business is not just about reducing expenses; it’s about optimizing your operations to maximize both efficiency and profitability.

Whether you’re a budding entrepreneur or the head of an established company, understanding and implementing these strategies can drastically improve your financial health.

In this blog post, we’ll explore 15 essential cost management strategies in business, complete with practical examples to illustrate how these techniques can be applied in real-world scenarios.

Dive into these cost management strategies examples to see how you can transform your business operations and achieve sustainable growth.

What is a cost management strategy? Benefits

Download the below infographic in PDF

A cost management strategy is like a game plan for how a business can handle its money smartly to avoid overspending and make the most of its budget.

This strategy helps businesses figure out where they can spend less, such as finding cheaper materials or using technology to do things more efficiently.

It also involves keeping a close eye on how much they’re spending throughout the year to make sure it matches what they planned to spend.

This isn’t just about cutting costs left and right; it’s about smart spending to help the business grow and succeed while keeping expenses under control.

Benefits of a Cost Management Strategy:

- Better Budget Control: With a solid strategy, businesses can better manage their budgets. They know how much money they can spend and what they can spend it on, which helps prevent overspending and ensures they have enough cash for important things.