- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Tips White Papers

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

How to Start a Business With Student Loans and Not Go Broke Launching a business when you have thousands of dollars in debt is a tricky move. Here's what you should know before you take the leap.

By Monica Mehta Edited by Dan Bova Aug 7, 2013

Opinions expressed by Entrepreneur contributors are their own.

Finance expert Monica Mehta offers advice to entrepreneurs tackling real-world personal finance issues. Ask her a question and your query might be the inspiration for a future column.

Q: I want to quit my job to pursue a startup, but have $35,000 of student loan debt. Is there a way to shrink my loan payments while we are trying to get off the ground? -- Eric Lee, Austin, Texas

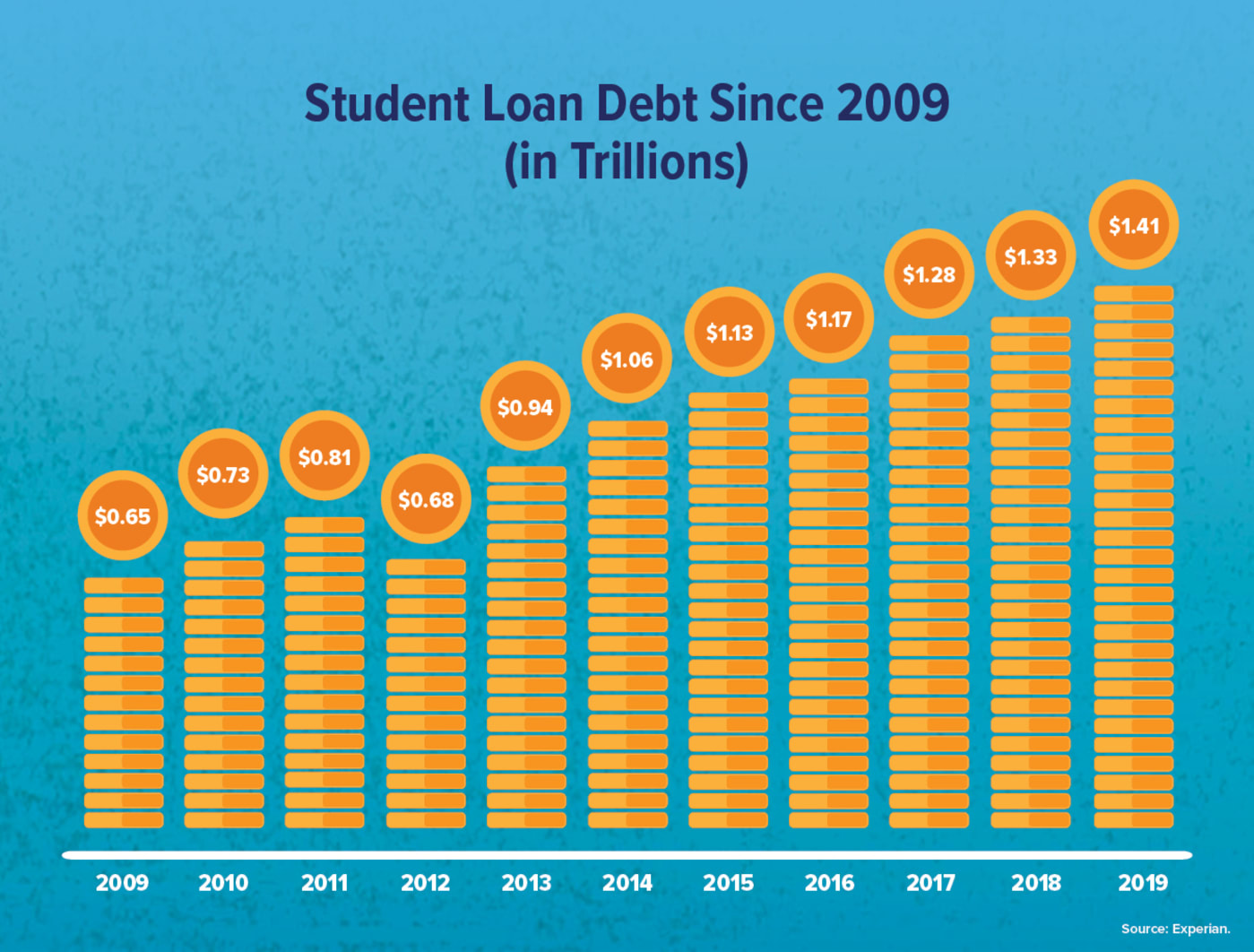

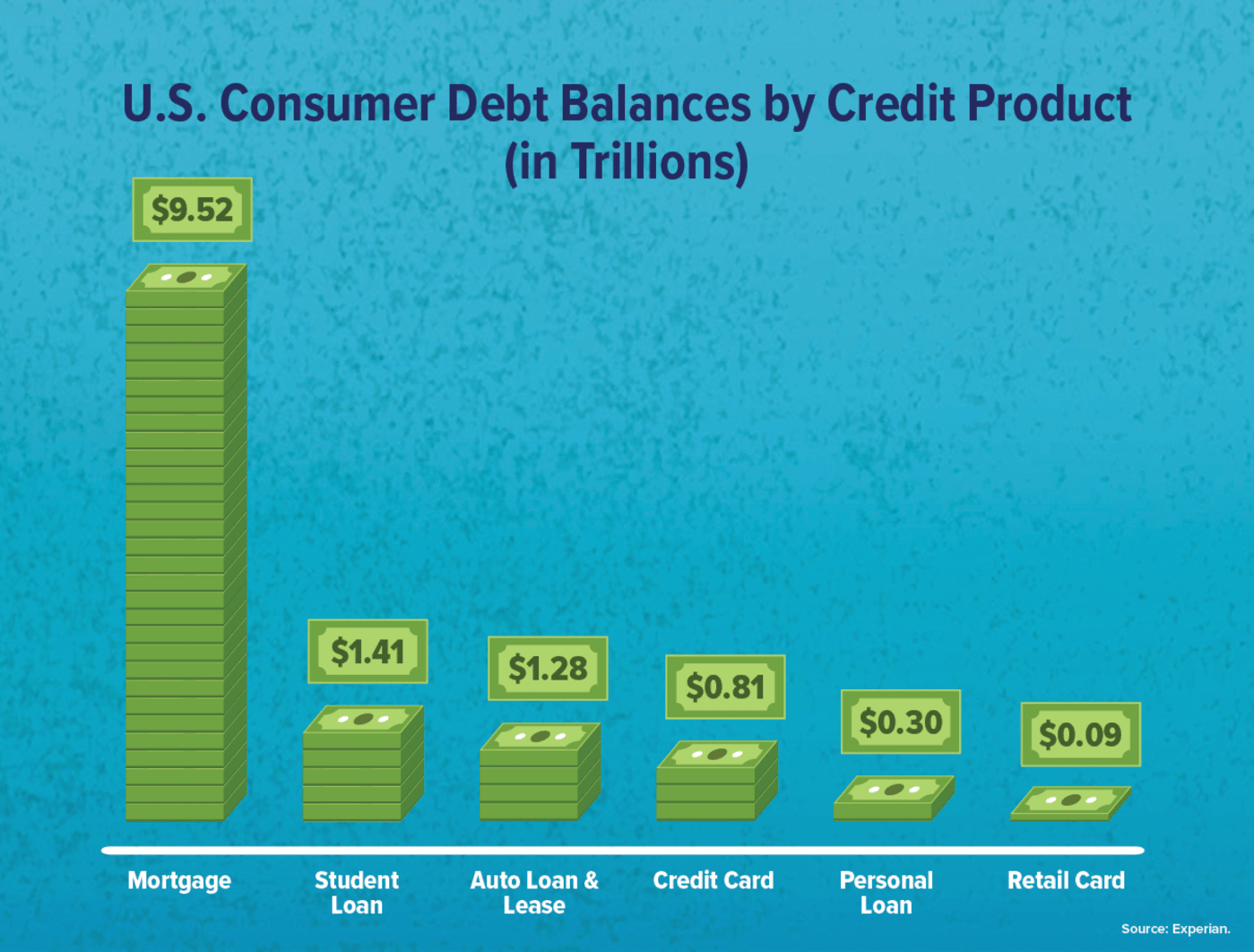

Today student loans represent the single largest debt burden for people under 40. In fact, from 2004 to 2009, only 37 percent of federal borrowers managed to make timely payments without postponing or becoming delinquent. Those most likely to default are unemployed or underemployed. Startup life, where income is anything but certain, qualifies you for the high risk camp, so it's important to know your options.

There are a handful of alternatives to help you reduce your debt burden in the short term. The first step is to identify whether your student loans are federal, private or a combination of the two.

Federal loans can be consolidated to reduce monthly payments. While you won't be able to lower your rate, extending your term from 10 to 25 years will reduce the amount you owe each month by 40 percent, from $402 to $267 per month. Selecting a graduated pay option can further minimize upfront payments. Borrowers start with a reduced monthly payment, which gradually increases after year two and four, settling into a higher standard monthly payment in year six for the duration of the loan.

Federal borrowers facing periods of low or no income can also file for Income Based Repayment (IBR) or Pay As You Earn (PAYE), which cap your monthly payments to a percentage of what you earn, not what you owe, according to Gary Carpenter, CPA and Executive Director of National College Advocacy Group, which supplies information regarding student loans. This means that if your income suddenly drops or stops altogether, you may have a zero monthly balance.

Monthly payments under IBR and PAYE repayment plans are capped at 15 or 10 percent of your discretionary income, based on federal guidelines. Borrowers must qualify and file an application annually with the Department of Education. And under new law, any balance remaining after 20 to 25 years of consistent payment will be forgiven.

As of 2012, only 700,000 borrowers were enrolled in IBR. The Obama Administration estimates that IBR could reduce payments for 1.6 million borrowers.

Options to defer private student loans are more limited. Few private lenders consolidate loans, and even those that do won't reduce your rate or extend repayment terms. Most will offer need-based forbearance, or a 12-month break from making payments. Some offer up to three 12-month grace periods to defer payments.

It's important to note that short-term debt relief is not without long-term pitfalls. Reducing your monthly payments does not make the debt go away. Simply stretching the term of a $35,000 federal loan from 10 to 25 years triples the interest due over the lifetime of the loan, from $13,000 to $39,000. And when the amount you pay each month doesn't cover interest, negative amortization can cause your loan balance to grow exponentially.

Taking the easy road today may set you up for a tough climb later. "Young people often focus on today's cash flow, ignoring they have the work of their life ahead of them," says Eleanor Blayney consumer advocate for the CFP Board, a non-profit that qualifies investment professional to become certified financial planners. "Electing for a long repayment cycle can set you up for debt drag that eclipses other important milestones in life such as buying a home, preparing for retirement and saving for marriage and children."

As an alternative to dragging out your loans, consider crafting a pre-emptive savings strategy to help you stay current while income is influx. In Eric's case, that means you'd aim to save two years worth of payments or $10,000 for an outstanding balance of $35,000. To build your nest egg, consider working in your present job a little longer or take on a consulting gig to throw off extra income.

Budget six to eight months to earn more and make lifestyle sacrifices such as taking on a roommate, cutting down meals out and extraneous expenses to help you save. An easy to use monthly payment calculator can help you determine your budget.

Despite the inability to shake student loan debt, more than 14 percent of borrowers have loans that are overdue. "If down the road you get into trouble, don't ignore your student loans. They can't be discharged in bankruptcy. They will be around no matter what," says Carpenter. "Contact your lender to create an alternative payment plan They don't want to see your loan go into collection either."

The bottom line is that getting a pass today means you're electing to double-down on your future success. Adding $26,000 to your interest burden won't seem like a lot if your business is successful but there's no escaping the fact that you are digging the hole deeper and reducing your financial flexibility. The preferred solution would be to find a way to save as much money as you can during the startup phase and leave the structure of your debt unchanged. Think about how you can really rein in personal expenses in the near term. You'll be better positioned to pursue the startup route and will maintain some of your financial freedom.

Author and Investor at Seventh Capital

Monica Mehta has spent the past 15 years investing in and advising hundreds of entrepreneurs. She is an investor at New York-based Seventh Capital and author of The Entrepreneurial Instinct (McGraw-Hill, Sept 2012). Read more at monicamehta.com .

Want to be an Entrepreneur Leadership Network contributor? Apply now to join.

Editor's Pick Red Arrow

- Lock How to Design a Work Session That Tricks Your Brain Into Peak Performance, According to a Neuroscientist

- She Launched Her Black-Owned Beauty Brand with $1,500 in Her Pockets — Now Her Products Are on Sephora's Shelves

- No One Explained a 401(k) Until He Reached the NFL. So He Started Putting His Money to Work — and Helping Others Do the Same .

- Lock How to Land Your Next Job Without Sending a Single Resume

- Kevin O'Leary Says This Is the One Skill He Looks For in a Leader — But It's 'Almost Impossible to Find'

- Food Franchisees Are Shifting to Non-Food Investments — And You Should, Too

Most Popular Red Arrow

Mark zuckerberg commissioned a giant statue of his wife priscilla chan and placed it in the yard.

The sculpture was created by artist Daniel Arsham.

Mathnasium is the Top Rated Math Franchise in North America

Driven by competitiveness in education and growing STEM job markets, the demand for math education is booming which makes it an opportune time to enter the education and math tutoring industry.

She Launched Her Black-Owned Beauty Brand with $1,500 in Her Pockets — Now Her Products Are on Sephora's Shelves.

On her journey to disrupt the beauty industry with her brand OUI the People, here are three lessons founder Karen Young shares.

This Is How to Separate Fact From AI Fiction During Election Season, According to an Adobe Executive

The problem of misleading AI pictures and videos could be solved with another technology: content credentials.

Everyone's Social Security Number Has Reportedly Been Compromised in a Massive Data Hack

A hacking group allegedly leaked 2.7 billion pieces of data.

ChatGPT Is Writing Lots of Job Applications, But Companies Are Quickly Catching On. Here's How.

AI tools may help write your cover letter, but it's also doubling the number of applicants.

Successfully copied link

- Request Site Access

- Member Website

- Prospective Members

- Online Courses

- Agency Finder

- Debt Management Plans

Connect with a counselor, today!

- How we help

- Credit Card Debt

- Military and Veterans

- Distressed Renters

- Self Employed

Get connected with a counselor today!

How to Start a Business While Paying Off Student Loans

For many entrepreneurs, starting a business means more purpose, flexibility, freedom and control at work. But when student loans take up a big portion of your budget, that dream may be harder to achieve. The median monthly student loan bill among those in repayment is $222, according to data retrieved by Student Loan Hero. That doesn’t leave much room for financial risk-taking for those fresh out of college. In fact, the share of entrepreneurs between 20 and 34 years old decreased from 34% in 1996 to 24% in 2016, according to the Ewing Marion Kauffman Foundation’s most recent Startup Activity report . With ingenuity and forethought, though, there’s no reason why young entrepreneurs should hold off trying to start a business while paying off student loans.

Start with an idea that is low-risk

If you’re currently working full time, consider starting a business on the side so you can keep any benefits you currently receive, like health care and access to an employer match on retirement savings. That will also help you evaluate the viability of your business idea without going all in. Make sure you secure any insurance, permits, licenses or certifications you might need for the business. Just because it’s a side hustle, doesn’t mean you can avoid red tape aimed at keeping clients, and yourself, safe. As a self-employed individual, you’ll also likely have to pay quarterly estimated taxes on side income, if federal and state income taxes aren’t automatically withheld from it. Alternatively, you can ask your primary employer if you’re still working full- or part-time for a separate company to take more tax out of your paycheck to avoid paying additional estimated tax.

Adjust your student loan payment

Reducing your bills, like those for student loans, can provide more freedom to fund and launch your business. Some options to consider are: Consolidation and refinancing: If you have good credit — typically defined as a credit score of 670 or higher — or access to a creditworthy cosigner, you may be able to refinance student loans to a lower interest rate . This process is also referred to as private student loan consolidation. It’s an especially worthwhile option for high-interest private student loans. When you refinance federal loans, you’ll lose the ability to sign up for forgiveness programs and alternative payment plans. But private loans come with fewer payment-reduction options, so you have less to lose — and more to gain in interest savings, as their rates are often higher than federal loans’ rates. When you refinance, you may have the choice to stretch your repayment term over a longer period, which could lower your monthly payments. But when you make payments for a longer time, you’ll pay more in interest, which can cut into the overall savings refinancing provides. Forbearance and deferment: It’s possible to postpone your student loan payments altogether through deferment or forbearance (depending on your circumstances) while you start your business. You can apply for deferment if you’re unemployed or are experiencing economic hardship. If you have federal subsidized or Perkins loans, interest will not accrue during the deferment period. You can request forbearance for a wider variety of financial reasons for up to 12 months at a time, and extend it if you need it. But unlike deferment, interest will accrue on all types of federal loans during forbearance. That means you may owe more once the forbearance period has ended. Contact your student loan servicer to discuss which option is best for you, and how much it would cost over time. Income-driven repayment plans: If you have federal loans, consider signing up for an income-driven repayment plan. Your payments will be 10-20% of your discretionary income, depending on the plan, which can lower your bill significantly if you’re working less for an employer while starting a business. Your payments may not cover all the interest that accrues, which could mean a growing balance. Income-driven plans do provide forgiveness after 20 or 25 years, however, any forgiven amount may be taxed as income. The government’s repayment estimator tool can provide line of sight into how much you’ll pay overall — and potentially get forgiven — if you switch to one of these plans.

Work with a mentor

You don’t have to start a business all on your own. In fact, seeking the help of a mentor early can give you ideas for how to develop a business plan and get funding while keeping your own finances in shape. Use the U.S. Small Business Administration’s local assistance tool to find a small business development center or other free support in your area. You can also request a mentor through SCORE, a national nonprofit that pairs entrepreneurs with volunteer business experts. Finally, tap into your college’s alumni network to see if other entrepreneurs are interested in sharing their expertise. Ask the alumni services department if anyone comes to mind as a potential mentor for you, including professors and industry experts at the school. Or, search LinkedIn for entrepreneurs from your alma mater who may be willing to guide you.

Explore funding sources

Startup funding might feel like the biggest barrier to entrepreneurship when you have student loans. Banks and community organizations, for instance, offer loans backed by the U.S. Small Business Administration. But without a history of profitability as an established business, it can be hard to qualify. You may also not have a long personal credit history as a relatively recent graduate, which can be another barrier to getting traditional small business financing. Self-funding a business is an option, but with limited resources as a result of student loans, you may be tempted to rely on credit cards. This can be a viable method for some businesses, but your first priority should be to make all your student loan payments on time. Missed payments will negatively impact your credit score, affecting your ability to get business financing and even a mortgage or personal credit card in the future. If you use credit cards to start a business, make a plan to pay off the charges in a reasonable amount of time to avoid ballooning interest.

Consider these other methods of financing, too, which may be more accessible — even with existing debt to pay off. Crowdfunding: Loans from friends and family give you the ability to set the terms, including how long you’ll have to pay them back and whether the loans will accrue interest. Have a candid conversation about your ability to repay others investing in your business, and keep the lines of communication open if you find it’s harder than expected to keep to the terms you agreed to. Crowdfunding, however, gives you the opportunity to raise money from a larger pool of investors than just friends and family — without having to repay the funds. Platforms including Kickstarter, Indiegogo and GoFundMe let you list a product or business others can contribute to, and you can offer rewards to investors in exchange for contributing. Check each site’s pricing page for details on how much they charge. You might see platform fees to list a campaign, transaction fees when a backer contributes to the campaign and transfer fees when funds move to your personal bank account. Lending circles: Lending circles provide interest-free loans to low-income individuals and small businesses while helping borrowers improve their credit at the same time. In a lending circle, a group of community members pays into a central pot, and members take turns receiving a loan. Monthly payments into the fund are reported to the credit bureaus, helping participants build a credit profile. You’ll need to apply and take a financial education course in order to participate. But you can use the loan you receive to help with startup costs, and to build credit so you can apply for traditional funding in the future. Search for a lending circle through local community organizations using the nonprofit Mission Asset Fund’s lookup tool . Online lenders: You can search for funding from online-only lenders like OnDeck Capital or Kabbage to pay for a range of business expenses, including equipment and marketing. Online lenders generally offer faster application processes than traditional small business loans, and they may be easier to qualify for. The trade-off, however, lies in online loans’ interest rates. Without good personal credit, you could see interest rates much higher than typical rates for credit cards, for example. Taking on debt for your new venture on top of student loans can be risky, so compare online lenders carefully and borrow only as much as you know you’ll be able to repay. Paying off student loans can make financing a business difficult to start. But seeking advice from a mentor and making thoughtful decisions about how to launch it will move you closer to your vision of entrepreneurship.

Blog / Student Loans / How to Start a Business While Paying Off Student Loans

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Student Loan Repayment Options: Find the Best Plan For You

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

If you want to pay less interest

If you want lower monthly payments and student loan forgiveness, if income-driven repayment doesn't make sense with your salary, if you don't want payments tied to your income, if you want to pay off your loans more quickly, if you need to temporarily pause payments, if you qualify for public service loan forgiveness, have private student loans.

Borrowers can choose from four types of federal student loan repayment plans. But the best one for you will likely be the standard repayment plan or an income-driven repayment plan, depending on your goals.

Standard repayment lasts 10 years and is the best one to stick with to pay less in interest over time.

Income-driven repayment (IDR) options tie the amount you pay to a portion of your income and extend the length of time you're in repayment to 20 or 25 years. When the term is over, you can get income-driven loan forgiveness for your remaining debt. IDR is best if you're having difficulty meeting your monthly payment and need something more manageable. There are four types of IDR plans.

Graduated repayment lowers your monthly payments and then increases the amount you pay every two years for a total of 10 years.

Extended repayment starts payment amounts low and then increases every two years for a total of 25 years. Or you can choose a fixed version which splits payment amounts evenly over 25 years.

Before changing student loan repayment plans , plug your information into the Education Department's Loan Simulator to see what you’ll owe on each plan. Any option that decreases your monthly payments will likely result in you paying more interest overall.

Here's how to decide which payment plan is right for you:

Best repayment option: standard repayment.

On the standard student loan repayment plan, you make equal monthly payments for 10 years. If you can afford the standard plan, you’ll pay less in interest and pay off your loans faster than you would on other federal repayment plans.

How to enroll in this plan: You’re automatically placed in the standard plan when you enter repayment.

Best repayment option: income-driven repayment.

The government offers four IDR plans: income-based repayment , income-contingent repayment , Pay As You Earn (PAYE) and Saving on a Valuable Education (SAVE). These options are best if your income is too low to afford the standard repayment.

Income-driven plans set monthly payments between 10% and 20% of your discretionary income . Payments can be as small as $0 if you're unemployed or underemployed and can change annually. Income-driven plans extend your loan term to 20 or 25 years, depending on the type of debt you have. At the end of that term, you get IDR student loan forgiveness on your remaining debt — but you may pay taxes on the forgiven amount.

The Education Department has announced another new IDR plan option that would cut payments by at least half and forgive some borrowers' debt after 10 years, instead of 20 or 25. It's not yet finalized or available to borrowers; rollout will begin at the end of 2023.

How to enroll in these plans: You can apply for income-driven repayment with your federal student loan servicer or at studentaid.gov . When you apply, you can choose which plan you want or opt for the lowest payment. Taking the lowest payment is best in most cases, though you may want to examine your options if your tax filing status is married filing jointly.

» MORE: Which income-driven repayment plan is right for you?

Best repayment option: graduated student loan repayment plan.

If your income is high, but you want lower payments, a graduated plan may make sense for you.

Graduated repayment decreases your payments at first — potentially to as little as the interest accruing on your loan — then increases them every two years to finish repayment in 10 years.

If your income is high compared with your debt, you may initially pay less under graduated repayment than an income-driven plan. This could free up money in the short term for a different goal, like a down payment on a home, without costing you as much interest as an income-driven plan. You would still pay more interest than under standard repayment.

Initial payments on the graduated plan can eventually triple in size. You need to be confident you’ll be able to make the larger payments if you choose this plan. Generally speaking, it’s best to stick with the standard plan if you can afford it.

How to enroll in these plans: Your federal student loan servicer can change your repayment plan to graduated repayment.

Best repayment option: extended student loan repayment plan.

The extended plan lowers payments by stretching your repayment period to as long as 25 years. You must owe more than $30,000 in federal student loans to qualify for extended repayment.

You can choose to pay the same amount each month over that new loan term — like under the standard repayment plan — or you can opt for graduated payments. Whether you choose equal or graduated extended payments, you’ll have a good idea of what you’ll pay each month in the future.

Extended repayment does not offer loan forgiveness like income-driven repayment plans do; you will pay off the loan completely by the end of the repayment term.

How to enroll in these plans: Your federal student loan servicer can change your repayment plan to extended repayment.

To get rid of your debt sooner than your monthly payments allow, you can prepay loans. This will save you interest with any repayment plan, but the impact will be greatest under standard repayment. Just be sure to tell your student loan servicer to apply the extra payment to your principal balance instead of toward your next monthly payment.

» MORE: How to pay off student loans fast

You may be able to temporarily postpone repayment altogether with deferment or forbearance . Some loans accrue interest during deferment, and all accrue interest during normal forbearance periods. This increases the amount you owe.

If your financial struggles are pay-related, income-driven repayment is a better option. Income-driven repayment plans can reduce payments to $0 — and those payments count toward forgiveness.

Public Service Loan Forgiveness is a federal program available to government, public school teachers and certain nonprofit employees. If you’re eligible, your remaining loan balance could be forgiven tax-free after you make 120 qualifying loan payments.

Only payments made under the standard repayment plan or an income-driven repayment plan qualify for PSLF. To benefit, you need to make most of the 120 payments on an income-driven plan. On the standard plan, you would pay off the loan before it’s eligible for forgiveness.

How to enroll in these plans: You can apply for income-driven repayment with your servicer or at studentaid.gov .

Private student loans don’t qualify for income-driven repayment, though some lenders offer student loan repayment options that temporarily reduce payments. If you’re struggling to repay private student loans , call your lender and ask about your options.

If you have a credit score in at least the high-600s — or a cosigner who does — there’s little downside to refinancing private student loans at a lower interest rate. Dozens of lenders offer student loan refinancing; compare your options before you apply to get the lowest possible rate.

How much could refinancing save you?

Note: This calculator assumes that after you refinance, you’ll make minimum monthly payments.

Step 4 : Compare NerdWallet's top-rated student loan refi lenders .

| Lender | Fixed APR | Min. credit score | Variable APR | |

|---|---|---|---|---|

| Earnest Student Loan Refinance NerdWallet's ratings are determined by our editorial team. The scoring formula for student loan products takes into account more than 50 data points across multiple categories, including repayment options, customer service, lender transparency, loan eligibility and underwriting criteria. | Actual rate and available repayment terms will vary based on your income. Fixed rates range from 5.14% APR to 9.99% APR (excludes 0.25% Auto Pay discount). Variable rates range from 6.14% APR to 9.99% APR (excludes 0.25% Auto Pay discount). Earnest variable interest rate student loan refinance loans are based on a publicly available index, the 30-day Average Secured Overnight Financing Rate (SOFR) published by the Federal Reserve Bank of New York. The variable rate is based on the rate published on the 25th day, or the next business day, of the preceding calendar month, rounded to the nearest hundredth of a percent. The rate will not increase more than once per month. The maximum rate for your loan is 8.95% if your loan term is 10 years or less. For loan terms of more than 10 years to 15 years, the interest rate will never exceed 9.95%. For loan terms over 15 years, the interest rate will never exceed 11.95%. Please note, we are not able to offer variable rate loans in AK, IL, MN, NH, OH, TN, and TX. Our lowest rates are only available for our most credit qualified borrowers and contain our .25% auto pay discount from a checking or savings account. | Actual rate and available repayment terms will vary based on your income. Fixed rates range from 5.14% APR to 9.99% APR (excludes 0.25% Auto Pay discount). Variable rates range from 6.14% APR to 9.99% APR (excludes 0.25% Auto Pay discount). Earnest variable interest rate student loan refinance loans are based on a publicly available index, the 30-day Average Secured Overnight Financing Rate (SOFR) published by the Federal Reserve Bank of New York. The variable rate is based on the rate published on the 25th day, or the next business day, of the preceding calendar month, rounded to the nearest hundredth of a percent. The rate will not increase more than once per month. The maximum rate for your loan is 8.95% if your loan term is 10 years or less. For loan terms of more than 10 years to 15 years, the interest rate will never exceed 9.95%. For loan terms over 15 years, the interest rate will never exceed 11.95%. Please note, we are not able to offer variable rate loans in AK, IL, MN, NH, OH, TN, and TX. Our lowest rates are only available for our most credit qualified borrowers and contain our .25% auto pay discount from a checking or savings account. | Visit this lender's site to take next steps. | |

| SoFi Student Loan Refinancing NerdWallet's ratings are determined by our editorial team. The scoring formula for student loan products takes into account more than 50 data points across multiple categories, including repayment options, customer service, lender transparency, loan eligibility and underwriting criteria. | Fixed rates range from 5.24% APR to 9.99% APR with 0.25% autopay discount. Variable rates range from 6.24% APR to 9.99% APR with a 0.25% autopay discount. Unless required to be lower to comply with applicable law, Variable Interest rates on 5-, 7-, and 10-year terms are capped at 13.95% APR; 15- and 20- year terms are capped at 13.95% APR. SoFi rate ranges are current as of 02/06/24 and are subject to change at any time. Your actual rate will be within the range of rates listed above and will depend on the term you select, evaluation of your creditworthiness, income, presence of a co-signer and a variety of other factors. Lowest rates reserved for the most creditworthy borrowers. For the SoFi variable-rate product, the variable interest rate for a given month is derived by adding a margin to the 30-day average SOFR index, published two business days preceding such calendar month, rounded up to the nearest one hundredth of one percent (0.01% or 0.0001). APRs for variable-rate loans may increase after origination if the SOFR index increases. The SoFi 0.25% autopay interest rate reduction requires you to agree to make monthly principal and interest payments by an automatic monthly deduction from a savings or checking account. This benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. The benefit lowers your interest rate but does not change the amount of your monthly payment. This benefit is suspended during periods of deferment and forbearance. Autopay is not required to receive a loan from SoFi. You may pay more interest over the life of the loan if you refinance with an extended term. | Fixed rates range from 5.24% APR to 9.99% APR with 0.25% autopay discount. Variable rates range from 6.24% APR to 9.99% APR with a 0.25% autopay discount. Unless required to be lower to comply with applicable law, Variable Interest rates on 5-, 7-, and 10-year terms are capped at 13.95% APR; 15- and 20- year terms are capped at 13.95% APR. SoFi rate ranges are current as of 02/06/24 and are subject to change at any time. Your actual rate will be within the range of rates listed above and will depend on the term you select, evaluation of your creditworthiness, income, presence of a co-signer and a variety of other factors. Lowest rates reserved for the most creditworthy borrowers. For the SoFi variable-rate product, the variable interest rate for a given month is derived by adding a margin to the 30-day average SOFR index, published two business days preceding such calendar month, rounded up to the nearest one hundredth of one percent (0.01% or 0.0001). APRs for variable-rate loans may increase after origination if the SOFR index increases. The SoFi 0.25% autopay interest rate reduction requires you to agree to make monthly principal and interest payments by an automatic monthly deduction from a savings or checking account. This benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. The benefit lowers your interest rate but does not change the amount of your monthly payment. This benefit is suspended during periods of deferment and forbearance. Autopay is not required to receive a loan from SoFi. You may pay more interest over the life of the loan if you refinance with an extended term. | Visit this lender's site to take next steps. | |

| LendKey Student Loan Refinance NerdWallet's ratings are determined by our editorial team. The scoring formula for student loan products takes into account more than 50 data points across multiple categories, including repayment options, customer service, lender transparency, loan eligibility and underwriting criteria. | See LendKey's full terms and conditions at https://www.lendkey.com/disclaimers | See LendKey's full terms and conditions at https://www.lendkey.com/disclaimers | Visit this lender's site to take next steps. Credible lets you check with multiple student loan lenders to get rates with no impact to your credit score. Visit their website to take the next steps. | |

| Education Loan Finance Student Loan Refinance NerdWallet's ratings are determined by our editorial team. The scoring formula for student loan products takes into account more than 50 data points across multiple categories, including repayment options, customer service, lender transparency, loan eligibility and underwriting criteria. | Subject to credit approval. Terms and conditions apply. https://www.elfi.com/terms/ | Subject to credit approval. Terms and conditions apply. https://www.elfi.com/terms/ | Visit this lender's site to take next steps. Credible lets you check with multiple student loan lenders to get rates with no impact to your credit score. Visit their website to take the next steps. | |

| Splash Financial Student Loan Refinance NerdWallet's ratings are determined by our editorial team. The scoring formula for student loan products takes into account more than 50 data points across multiple categories, including repayment options, customer service, lender transparency, loan eligibility and underwriting criteria. | Splash Financial, Inc. (NMLS # 1630038) reserves the right to modify or discontinue products and benefits at any time without notice. The information you provide is an inquiry to determine whether Splash’s lending partners can make you a loan offer, but does not guarantee you will receive any loan offers. Terms and conditions apply. Products may not be available in all states. These rates are subject to change at any time. If you do not use the specific link included on this website, offers on the Splash website may include other offers from lending partners that may have a higher rate. Fixed Rate options range from 6.64% APR - 8.95% APR (without autopay). Variable rate options range from 7.60% APR (with autopay) to 7.85% APR (without autopay). Variable APRs and amounts subject to increase or decrease. Lowest rates are reserved for the highest qualified borrowers and may require an autopay discount of 0.25%. Some of the rates are based on the one-month London Interbank Offered Rate (“LIBOR”) index and some are derived by adding a margin to the 30-day average SOFR index, published two business days preceding such calendar month, rounded up to the nearest one hundredth of one percent (0.01% or 0.0001). Fixed loans feature repayment terms of 5 to 20 years. For example, the monthly payment for a sample $10,000 with an APR of 5.47% for a 12-year term would be $94.86. Variable loans feature repayment terms of 5 to 25 years. For example, the monthly payment for a sample $10,000 with an APR of 5.90% for a 15-year term would be $83.85. | Splash Financial, Inc. (NMLS # 1630038) reserves the right to modify or discontinue products and benefits at any time without notice. The information you provide is an inquiry to determine whether Splash’s lending partners can make you a loan offer, but does not guarantee you will receive any loan offers. Terms and conditions apply. Products may not be available in all states. These rates are subject to change at any time. If you do not use the specific link included on this website, offers on the Splash website may include other offers from lending partners that may have a higher rate. Fixed Rate options range from 6.64% APR - 8.95% APR (without autopay). Variable rate options range from 7.60% APR (with autopay) to 7.85% APR (without autopay). Variable APRs and amounts subject to increase or decrease. Lowest rates are reserved for the highest qualified borrowers and may require an autopay discount of 0.25%. Some of the rates are based on the one-month London Interbank Offered Rate (“LIBOR”) index and some are derived by adding a margin to the 30-day average SOFR index, published two business days preceding such calendar month, rounded up to the nearest one hundredth of one percent (0.01% or 0.0001). Fixed loans feature repayment terms of 5 to 20 years. For example, the monthly payment for a sample $10,000 with an APR of 5.47% for a 12-year term would be $94.86. Variable loans feature repayment terms of 5 to 25 years. For example, the monthly payment for a sample $10,000 with an APR of 5.90% for a 15-year term would be $83.85. | Visit this lender's site to take next steps. |

Private lenders also refinance federal student loans , which can save you money if you qualify for a lower interest rate. But refinancing federal student loans is risky because you lose access to benefits like income-driven repayment plans and loan forgiveness. Refinance federal loans only if you’re comfortable giving up those options.

On a similar note...

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

Choosing A Student Loan

Via Ascent's Website

How Do Student Loans Work?

Updated: Apr 17, 2024

Student loans are a type of installment loan that pay for college and its related costs, including tuition, fees, books and living expenses. There are two types—federal and private—and the type of loan you receive dictates how your interest rate is calculated, your repayment options and the consumer protections available.

Like other types of loans, student loans are borrowed funds that you’ll eventually repay, along with any interest and fees associated with them. Below, explore how student loans work so that you can borrow and pay them off with confidence.

Types of Student Loans

How does student loan interest work, how to apply for student loans, what can student loans be used for, how much do student loans cost, student loan repayment options, frequently asked questions (faqs).

The government provides federal student loans, while private student loans are available through private entities, like banks, credit unions and online lenders.

Federal Student Loans

These loans are available through the U.S. Department of Education. You must submit a Free Application for Federal Student Aid, known as the FAFSA , to access them. Most federal student loans, with the exception of PLUS loans , do not require a credit check. Their interest rates also aren’t credit-based; they’re set by federal law, and are typically lower than private loan rates.

Depending on your financial need, you may have several federal loan options:

- Direct subsidized loans. Available to undergraduate students based on financial need . The amount you qualify for depends on your year in school and whether you’re considered financially independent from your parents. These loans are subsidized by the government, meaning interest doesn’t accrue while you’re in school or during periods of deferment . But it does begin accruing when you graduate or drop below half-time status.

- Direct unsubsidized loans. Available to undergraduate, graduate and professional students regardless of financial need. Since these loans are unsubsidized, interest accrues during all periods.

- Direct PLUS loans. Available to graduate and professional students and parents of dependent undergraduate students to cover costs that other financial aid doesn’t. For instance, if you receive some subsidized or unsubsidized loans but need more money to fill in a funding gap, you could opt for a direct PLUS loan. If you want to get a PLUS loan, a credit check is required.

- Direct consolidation loans. This option lets you combine multiple federal student loans into one loan with a single loan servicer and interest rate. This can extend your repayment term, lowering your monthly bill, but could mean paying more in interest over time.

- Private Student Loans

These loans are available through banks, credit unions and online lenders. While federal student loans have fixed interest rates, and most come with maximum loan amounts , the same isn’t true for private student loans .

Lenders typically use their own standards to set borrower requirements, but in general, a good or excellent credit score—generally 670 or higher—will get you the most competitive rates and terms. That makes it difficult for undergraduates to borrow private student loans independently, since they have shorter credit histories. Undergraduates generally must use a co-signer to qualify for private loans. In some cases, though, it’s possible to get a student loan without a co-signer .

Most importantly, private student loans do not come with borrower protections that federal student loan borrowers enjoy. Private loan borrowers won’t get access to income-driven repayment plans , forgiveness if you work in certain public service fields or generous payment-postponement programs if you experience financial hardship. That means it’s generally best to max out federal loans before turning to private loans.

Related: Find The Best Student Loan Options

Interest is a fee that the lender charges you to borrow money, usually expressed as a percentage of the amount you borrow. Student loans can have fixed interest rates—which remain the same over the life of the loan—or variable interest rates, which fluctuate over time based on certain economic conditions.

For most types of student loans, interest begins accruing as soon as you receive the money. That means the loan you took out freshman year will accrue interest during your time in school—and if you don’t make payments until you graduate, your balance will be larger than what you originally borrowed. The exception to this rule is federal subsidized loans ; if you qualify for these, the government will pay the interest while you’re in school or when your loans are deferred.

When you make a student loan payment, your money is first applied to any interest that has accrued since your last payment. Any remaining amount is then applied to your loan’s balance. When you first start repaying your loans, a large portion of your payments will be eaten up by interest charges. But as your loan slowly shrinks and your repayment progresses, more and more of your money will be applied directly to your loan balance.

Interest on student loans is typically charged daily. The interest you accrue will also become capitalized at certain times. When interest is capitalized , any accrued interest is added to your loan balance—so you begin accruing interest on your existing interest. When interest becomes capitalized depends on your exact loan, but it often occurs when you enter into repayment or a temporary forbearance ends.

If you’re applying for federal student loans , your starting point is the FAFSA.

Before you can start the FAFSA, you’ll need a Federal Student Aid ID (FSA ID). Both parents and students will need an FSA ID if the student is a dependent. It serves as your electronic signature as you complete the various federal student aid documents.

If you’re a parent completing the FAFSA for your child, or with them, you can head to FAFSA.gov to start your application. You’ll enter personal information for both the student and parent, including names, Social Security numbers and dates of birth. You’ll also fill out demographics and financial information before signing and submitting the form.

Once you’ve been accepted to colleges, you’ll get an award letter from the school. Your award letter will detail how much student aid you get, which can include grants, federal work-study funds and federal student loans. You’ll have the opportunity to respond to your award letter and accept or reject the student loans you’ve been offered.

If you still need money after you’ve maxed out federal student aid, you can apply for private student loans . To apply, you’ll need to visit each lender individually. Some lenders let you see if you prequalify for a loan first, based on your credit score and history. Others only allow you to see if you qualify after you’ve applied.

Private student loan applications vary by lender, but typically require financial and school information plus the amount of money you need, when you plan to graduate and whether you’ll apply with a co-signer.

Your school determines its total cost of attendance , which includes all the expenses a student must pay to obtain a degree, including tuition, fees, living expenses and transportation. If you plan to use student loans to cover these costs, your loan funds can be used for purposes like:

- Tuition and fees

- Supplies and other equipment

- Meal plans and groceries

- Room and board (including an apartment and utilities)

- Technology expenses, like a computer

- Transportation costs, like gas or public transit passes

Most private student loans mirror federal student loan allowances, but you might find that some lenders have limitations in place on what you can and can’t use loans for.

Congress sets federal student loan interest rates, which are different depending on the type of student loan you borrow. For instance, if you have a direct unsubsidized loan and a direct PLUS loan, you’ll pay different interest rates for both.

Here are the interest rates on loans for the 2022-2023 school year:

- 4.99% for direct subsidized and unsubsidized loans for undergraduates

- 6.54% for direct unsubsidized loans for graduate and professional students

- 7.54% for direct PLUS loans for graduate or professional students, and parents of dependent students

Your federal student loans consist of the principal, or the amount you borrowed, plus interest.

Once you’ve taken out your federal loan, the interest rate will not change. If you eventually combine your federal loans using a direct consolidation loan, the interest rate will be the average of your original loans’ rates rounded up. The only other time your interest rate changes is if you refinance your student loans .

Private student lenders determine your interest rate based on your creditworthiness, or that of your co-signer, if you have one. Some private student loans also charge fees, like origination or late fees. While federal student loans have fixed interest rates that don’t change over the life of the loan, private student loans often let you choose between fixed or variable interest rates.

Keep in mind that the lowest interest rates on private loans are available to borrowers with the strongest credit scores. The lower your credit score, the higher your interest rate will generally be.

Compare Student Loan Rates In Minutes

Compare rates from participating lenders via Credible.com

Federal student loans have some of the friendliest repayment terms . Federal loans also offer a six-month grace period, which means you’re not obligated to start paying your loan back until six months after graduation.

The standard repayment plan for federal student loans assumes you’ll pay off your loans within 10 years of graduation. But you can also choose to enroll in an alternative repayment plan. Some of these, called income-driven repayment (IDR) plans, tie your monthly bill to your discretionary income. There are four types:

- Income-based repayment (IBR) . Your monthly payments will be 10% to 15% of your discretionary income. If you haven’t paid your loan off in 20 or 25 years, your remaining balance will be forgiven. Whether you qualify to pay 10% or 15% of your income, and win forgiveness after 20 years or 25, depends on the year you first borrowed. Those who first took out federal loans after July 1, 2014 qualify for the more generous terms: payments at 10% of income and forgiveness after 20 years.

- Income-contingent repayment (ICR) . Your monthly payments will be 20% of your discretionary income or the amount you’d pay on a fixed payment plan over 12 years. Any outstanding balance is forgiven after 25 years.

- Pay As You Earn (PAYE) . This plan caps your monthly payments at 10% of discretionary income and will never be more than what you’d pay under the standard repayment plan. Your remaining balance will be forgiven after 20 years.

- Revised Pay As You Earn (REPAYE) . Your monthly payment will be 10% of your discretionary income, but it’s not guaranteed that you’ll pay less compared to a standard repayment plan. Any balance remaining after 20 or 25 years will be forgiven. REPAYE doesn’t have an income requirement like other IDR plans do, meaning any borrower with federal loans can sign up, regardless of income.

Federal student loans also have deferment and forbearance options, which allow you to temporarily pause payments without hurting your credit score or defaulting on your loan.

Most private student loans have repayment schedules of five to 20 years or more, and many offer grace periods. But keep in mind that interest typically accrues while you’re in school and during periods when you postpone payments. Private lenders also aren’t required to offer the same amount of forbearance in case you can’t make payments, with limits typically at 12 or 24 months throughout the duration of the loan term. Federal loans offer up to three years of forbearance or deferment, depending on the circumstance.

What happens to student loan debt when you die?

If you are the primary borrower, your federal student loans can be forgiven if you die . Parent PLUS loans can be forgiven if either the parent borrower or the student who benefitted from the loan dies.

It’s less clear what happens to your private student loans if you die, since policies vary by lender. Many lenders will discharge the debt if the primary borrower dies, but you should check your lender’s exact policy to confirm.

How long does it take to pay off student loans on average?

How long it takes to pay off your student loans depends on the type of loan you have and your repayment plan. The standard repayment schedule for federal student loans has you pay off your debt in 10 years, but alternative plans allow for 20, 25 or 30 years of repayment.

Private student loan terms vary by lender, but you can often choose between five, seven, 10, 15 and 20 year repayment periods. Shorter repayment terms typically come with lower interest rates, and the faster you repay your debt, the less you’ll pay overall.

What happens if you don’t pay your student loans?

If you don’t pay your federal student loans , your loan will become delinquent on the first day of your missed payment. You may be charged late fees, and after 90 days, your missed payments will be reported to the credit bureaus. If your loan remains delinquent for 270 days (about 9 months), you’ll enter default.

If you default on your federal loans, your credit will be seriously damaged and the entire loan balance can become due. Lenders may also garnish your wages, tax refunds or Social Security payments to recoup their money. You might be sued by the lender or be forced to deal with aggressive collection agencies.

Private student loans follow a similar path, but the timeline is shorter. Your loan will become delinquent on the first day of your missed payment and can enter default after just 90 days. After 120 days, the lender may charge off your debt—that is, sell it to a collections agency who will work to make you pay up. Your credit will be seriously damaged, fees will accrue and you could be sued to allow the lender to garnish your wages.

Forbes Advisor adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners.

- All Categories

Explore Top-Rated Student Loan Reviews

Explore Student Loan Providers

Explore Student Loan Refinancing

- Ascent Student Loans Review

- Sallie Mae Student Loans Review

- Earnest Student Loans Review

- SoFi Student Loans Review

- College Ave Student Loans Review

- Citizens Bank Student Loans Review

- Parent Loans For College

- Nursing School Loans

- Low-Interest Student Loans

- Medical School Loans

- MBA Student Loans

- Student Loans For Bad Or No Credit

- Student Loans Without A Co-signer

- Student Loans For Summer Classes

- Student Loan Refinance Lenders

- Banks For Student Loan Refinancing

- Student Loan Refinance Rates

- Credit Unions That Refinance Student Loans

- Student Loan Refinance With Low-Income

See More Less

Loans Rating & Review Methodology

Learn more about how Forbes Advisor rates lenders, and our editorial process

Student Loans

Student Loan Articles

Aug 20, 2024

Best Private Student Loans Of August 2024

After you’ve used subsidized and unsubsidized federal student loans, private student loans can help pay for remaining school costs. Private student loans come from banks, credit unions and online lenders, and unlike federal student loans for undergraduates, they require a...

Private Student Loan Rates: August 20, 2024—Loan Rates Slip

Last week, the average interest rate on 10-year fixed-rate private student loans inched down. This drop in rates is good news for borrowers interested in pursuing private student loans to make up for a gap in college funding.For borrowers with...

Aug 13, 2024

Private Student Loan Rates: August 13, 2024—Loan Rates Increase

Last week, the average interest rate on 10-year fixed-rate private student loans jumped up. Yet for many borrowers, it could be a good time to apply for a private student loan. Rates are still relatively low.The average fixed interest rate...

Aug 06, 2024

Private Student Loan Rates: August 6, 2024—Loan Rates Stay Put

The average interest rate on 10-year fixed-rate private student loans remained the same last week. For borrowers pursuing private loans to fill in gaps to pay for higher education expenses, rates remain relatively low for borrowers with solid credit.The average...

Aug 01, 2024

Rising College Expenses: 5 Things To Consider

In the coming weeks, millions of young Americans and their families will make one of the most significant yet costly financial decisions of their lives: financing college. With tuition rates increasing up to 169% over the last few decades, many...

Jul 30, 2024

Private Student Loan Rates: July 30, 2024—Loan Rates Move Down

Last week, the average interest rate on 10-year fixed-rate private student loans dropped. Yet for many borrowers, it could be a good time to apply for a private student loan. Rates are still relatively low.For borrowers with a credit score...

Jul 24, 2024

How To Pay For College With No Money

Prices on everything from housing to food are more expensive, and wages haven't kept pace. Those two issues combined make it very difficult for families to save for higher education. A 2022 study released by Discover Student Loans found that...

Jul 23, 2024

Can You Use Student Loans To Pay Past-Due Tuition?

When deciding how to pay for school, understanding the nuances of how loans and financial aid work can feel like solving a mystery.Occasionally, I get reader messages asking for help navigating the financial aid process. The latest is from a...

Private Student Loan Rates: July 23, 2024—Loan Rates Move Up

Last week, the average interest rate on 10-year fixed-rate private student loans rose. Overall, rates remain fairly low, making private student loan a worthwhile option for borrowers looking to make up a gap in college funding.From July 15 to July...

Jul 16, 2024

Private Student Loan Rates: July 16, 2024—Loan Rates Slip

Rates on 10-year fixed-rate private student loans inched down last week. If you're interested in picking up a private student loan, you can still get a relatively low rate.For borrowers with a credit score of 720 or higher who prequalified...

Got Student Loans? What Small Business Owners Need to Know

Although the student loan forgiveness plan came to a halt after the Supreme Court shot it down, there is still a path toward student loan forgiveness: the SAVE Repayment Plan . This plan is harder to challenge legally because it’s an adjustment to an already existing repayment plan. It could ease the burden of small business owners across the country who are struggling to pay off their debt and run their businesses.

You can run — and fund — a small business even if you still have student loan debt. Here’s what you need to know about student loan forgiveness and managing your debt as a small business owner.

Get Personalized Loan Options For Your Business

Let our experts connect you to lenders based on your unique business data.

1. Apply for the SAVE Plan

The SAVE Plan stands for Saving on a Valuable Education and is a change from the previous REPAYE income-based repayment plans on federal student loans. For anyone who qualifies, it can significantly reduce your monthly payments and lower the amount you’ll pay in interest over time. In fact, you may qualify to pay $0 on your student loans — and interest won’t accumulate.

Plus, if you’re borrowing less than $12,000, your loans will be forgiven after 10 years of regular payments (even if those payments are $0). For larger amounts, your loans can still be forgiven, but you’ll add one year for every additional $1,000 borrowed. You can apply for the SAVE Plan here.

If you’re not sure whether the SAVE Plan is right for you, use the Loan Simulator provided by FederalStudentAid.gov to walk through your repayment options before you apply.

2. Consider Other Repayment Plans for Federal Loans

If you don’t qualify for the SAVE Plan but you’re struggling to make payments each month, consider a different repayment plan. Federal loans are placed automatically on a 10-year standard plan. This plan may save you interest over time, so it’s a good idea to remain on it if you can afford it. But you may not have to stick with it if your payments are too high.

Here are the other repayment options that you may qualify for:

Graduated repayment plan

- Who it’s for : Any federal student loan borrower.

- How it works : It increases loan payments over time, usually every two years. This plan gives borrowers time to earn a higher income that may match the payment increases.

- Length of repayment period : Must pay off loan in 10 years.

Extended repayment plan

- Who it’s for : Direct loan borrowers with more than $30,000 in loans.

- How it works : Borrowers can have fixed or graduated plans with more time to pay it back.

- Length of repayment period : Must pay off loan in 25 years, so the repayment period is longer than others.

Pay as you earn repayment plan (PAYE)

- Who it’s for : Any new borrower on or after October 1, 2007 that got a direct loan disbursement on or after October 1, 2011. Must prove you can’t afford payments.

- How it works : You pay 10% of your discretionary income (but never more than the standard plan would charge). Each year, you must resubmit your income, even if nothing has changed.

- Length of repayment period : After 20 years of payments, your remaining undergraduate student loans are forgiven (it’s 25 years for graduate loans).

Income-based repayment plan (IBR)

- Who it’s for : Borrowers who can prove they have high debt in relation to their income level.

- How it works : You’ll pay either 10% or 15% of your discretionary income, depending on your loan start date (but never more than you would have paid with the standard plan). You have to resubmit your income each year even if your details stayed the same. Spouse’s income counts if you file joint taxes.

- Length of repayment period : Your remaining balance is forgiven after 20 or 25 years of making payments, depending on the start date of your loans.

Income-contingent repayment plan (ICR)

- Who it’s for : Any borrower with qualifying loans.

- How it works : You’ll pay the lower amount of either 20% of your discretionary income or the total you would owe on a fixed 12-year payment plan that has been modified for your income level. Your spouse’s income is counted if you file joint taxes.

- Length of repayment period : After you make payments for 25 years, your balance will be forgiven.

Income-sensitive repayment plan

- Who it’s for : Any borrower with FFEL Program loans.

- How it works : Your monthly payment depends on your annual income.

- Length of repayment period : Your loans will be completely paid off after 15 years.

Before signing up for any repayment plan, make sure you know what you’re required to pay each month. Also, check the interest you’ll be charged over time. The standard plan is typically the option that will charge the least interest long term.

3. Pay Close Attention to Your Loans

You’ll want to be aware of several aspects of your student loans, including due dates, how much you owe, and the interest on each one — especially with the changes coming. Student loan repayments will restart in October 2023. Put the due date on your calendar to make sure you have enough cash on hand.

Also, try to pay off the student loan with the highest interest rate first. You can see the details, including the interest rate, of each loan after logging into your account on your loan servicer’s website. Direct any extra payments toward the loan with the highest rate until it’s paid off.

4. Make On-Time Payments

Missing several payments can affect your personal credit score. A lower credit score may impact your ability to get the business credit cards and small business loans you need to grow your business, so make sure you pay on time.

This is true even if that payment is $0. You may still need to sign up for automatic payments with a $0 payment — make sure to follow your lender’s instructions.

5. Combine Private Loans

If you have more than one private student loan, consider consolidating them into one, also called refinancing. Doing this may make monthly repayment easier and make you less likely to forget a payment — especially if you’re paying multiple companies or lenders every month.

However, try to make sure you aren’t swapping a fixed-rate loan (where the interest rate never changes) for a variable-rate loan (where the interest rate can increase). And make sure you won’t lose certain benefits or access to income-based repayment plans before you refinance.

How Nav Can Help Your Small Business

Consider Nav your small business partner. Just like student loans don’t need to hold your business back, neither should a lack of funding. When you’re ready to make your next move, we’re here to guide you through the financing process. It’s quick and easy to use Nav today — just input your business details to see your best funding options instantly.

Compare your financing options with confidence

Spend more time crushing goals than crunching numbers. Instantly, compare your best financial options based on your unique business data. Know what business financing you can qualify for before you apply, with Nav.

This article was originally written on August 24, 2022 and updated on August 25, 2023.

Rate This Article

This article currently has 3 ratings with an average of 5 stars.

Tiffany Verbeck

Tiffany Verbeck is a Digital Marketing Copywriter for Nav. She uses the skills she learned from her master’s degree in writing to provide guidance to small businesses trying to navigate the ins-and-outs of financing. Previously, she ran a writing business for three years, and her work has appeared on sites like Business Insider, VaroWorth, and Mission Lane.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers. Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name and email in this browser for the next time I comment.

Using Student Loans to Start a Business: Is It Worth the Risk?

Ever wondered if it's possible to use student loans for your new business? Read on to learn the pros and cons.

Chances are, you’ve heard stories of young adults using their student loans to pay for trendy clothes, international trips, fancy dinners—nearly everything except their education. Maybe you know a few of them yourself.

While “living the life” is alluring, what if you put those funds toward starting a business instead? You may be wondering: Is it possible? And more importantly, is it legal ?

Well, keep reading to find out.

Can You Use Student Loans for Your New Business?

Overestimating the cost of attending college happens more often than you think. But if you find yourself with funds left over from your student loans, are you allowed to do whatever you want with them?

Technically, it depends on the terms of the loan agreement you signed with your lender. Contracts for federal student loans typically have very explicit terms for what the money can be used for. On the other hand, the agreements for private loans are often more open-ended.

Of course, these legal documents haven’t stopped borrowers from using their private or federal loans for personal expenses. A 2019 survey from Student Loan Hero found that, over summer break, only 10% of student respondents used their loans strictly for tuition. Instead, many used the money for:

- Bills (38%)

- Clothes (26%)

- Traveling (20%)

Colleges and universities can’t track what recipients use the money for, so unless you borrow more than the cost of attendance, there’s usually no way for them to find out if you’re using the money for non-specified purposes.

But while it’s not outright illegal to use your student loan money to fund your startup, there’s still plenty of risk involved.

If they find out, lenders can terminate your contract and take the funds back, which also means you’ll need to repay any money you’ve already spent (ugh, more monthly payments). You may also face legal action from your lender and even the federal government—adding legal costs, fees, and penalties to your final bill.

Because of the far-reaching repercussions of this decision, it’s best to raise startup funds in other ways and use your student loans as a last resort. If you feel that there’s no other option available to you, read on for the pros and cons of using student loans for your new venture, plus some ways to help minimize your risk.

Related Articles

Pros and Cons of Using Student Loans to Start a Business

- Many students will find it easier to qualify for student loans compared to traditional business financing options, as lenders are typically more lenient with their requirements for student loan borrowers.

- You may be able to get a better interest rate with student loans than with business loans, personal loans, or credit cards—especially if you haven’t built up your credit yet or don’t have the best credit score.

- Student loans allow you to pay back the amount over a much longer period of time, and you can adjust your repayment options if you need to. For instance, some allow for missed payments or temporary payment deferrals. Student loan payments generally start after graduation too, so you don’t have an immediate monthly payment to make like you do with credit cards.

- As mentioned earlier, using your student loans for your business is a risky move. Getting caught could expose you to a slew of financial and legal consequences.

- You’ll take on even more student debt—debt that may follow you for years after graduation (and endless monthly payments to budget for). Borrowing more money than you need to will also increase the total amount you owe over time, due to accruing interest.

- Compared to business loans, personal loans, and credit card debt, you can’t discharge student loan debt during bankruptcy. You’ll still be responsible for making payments on the debt even if you don’t have the means to repay.

4 Ways to Reduce the Risk of Using Student Loans for Your Business

1. determine how much you need to start your business.

Draw up a business plan to ensure you know exactly how much money you need to cover your startup costs. Some things to take into consideration include:

- Fees, licenses, and credentials needed to establish your business and authority

- Average marketing budget for startups in your niche

- Cost of producing or buying inventory

- Cost of setting up a website or online store

- Money to pay your employees or contractors

- Contingency budget for unexpected expenses

- Any other essential equipment, software, or resources needed to run your business

This exercise also has the added benefit of testing whether your idea is profitable enough to outweigh the risks of using student loans in the first place.

2. Cut Down on Your Living Expenses

Save money on textbooks, rent, food, and other expenses—and put that money toward your business—to reduce your total student debt. This comprehensive list offers college students 50 ways to save money and stretch their budget further.

Keep your cost of living down, cut back on impulse purchases, and sacrifice some of your enjoyment (and discretionary income) today so it pays off in a big way down the road.

3. Find a Business Partner

A business partner willing to finance your startup idea (or one who can access other means of funding thanks to a great credit score) can help lighten the load on your shoulders. The best business partners also carry a wealth of industry-specific expertise that can be even more valuable than the financial resources they bring to the table.

4. Look For Alternative Financing Options

The best way to minimize your risk with student loans is to avoid using them for your business altogether. But if you feel that it’s a necessary risk to take, consider using it as a supplement to other financing options so you use as little of your loan money as possible.

Here are some other ways to raise money for your business:

- Apply for a small business loan backed by the Small Business Administration for the most straightforward way to get business financing.

- Use a credit card to finance your business, since getting one is often easier than applying for a loan. Keep in mind, though, that credit cards typically carry higher interest rates than loans do.

- Look into online lenders. Many offer faster application processes than their brick-and-mortar counterparts, but they may also come with higher interest rates.

- Get a part-time job—or work full-time during the summer—and use the money you earn to fund your startup. Use this opportunity to learn what it takes to run a business and apply those lessons to your own company.

If you do siphon some of your student loan money for your startup, just make sure that all of your educational expenses are covered first. Otherwise, you’ll find yourself taking out even more student loans to cover the difference.

Is It Worth It to Use Student Loans for Your Business? The Decision Is Yours

If you’re a student with a business idea you’re excited about, funding your startup with your student loans might sound like the easiest way to get started. Even so, take some time to make sure that this is the best move for your personal finances too.

Student loan debt is a large financial burden that often sticks around for years—even decades—after you receive your diploma. Plus, there’s also the chance that you may get caught using the money for non-educational purposes.

Remember that student loans aren’t the only way to finance your business. Sure, the story of angel investors swooping in to save the day is nice, but keep in mind that many young entrepreneurs before you have started business empires with a shoestring budget. Think of this as your call to rise to the challenge too.

Written by Feli Oliveros , Freelance Contributor

Posted on March 16, 2022

Freshly picked for you

Thanks for subscribing to the FreshBooks Blog Newsletter.

Expect the first one to arrive in your inbox in the next two weeks. Happy reading!

- Kreyòl Ayisyen

I'm interested in starting a business, but I have student debt. What do I need to know?

It is possible to have student loans and start a business, but it may be harder to access business credit and save enough cash to cover startup costs.

The impact of student loans on your ability to get a business loan

By understanding the impact student debt can have on your credit and taking advantage of alternative payment options on your federal loans, you may be able to get closer to your goal of starting a business.

If you’ve been unable to make your monthly payments on your student debt, your credit score will be negatively impacted. Many business lenders consider personal credit history in deciding whether or not to give you a loan. This requirement may put new graduates or those with high student debt at a disadvantage – and may be a roadblock if you are an aspiring entrepreneur. By repaying your student loans on time and in full each month, you can boost your credit profile .

If you have federal student loans, you may be able to lower your monthly payments by enrolling in Income-Driven Repayment . If you have a private student loan, you may be able to refinance your loans to lower your interest rate . Having a lower monthly payment will allow you to make your student loan payments while also investing in your new business.

More resources for small business owners .

Don't see what you're looking for?

Browse related questions.

- What do I do if I think a lender discriminated against me?

- Do student loans affect my credit score?

- Learn more about student loans

Search for your question

Searches are limited to 75 characters.

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Reminder to employers and employees: Educational assistance programs can be used to help pay workers’ student loans; free IRS webinar will offer details

More in news.

- Topics in the news

- News releases for frequently asked questions

- Multimedia center

- Tax relief in disaster situations

- Inflation Reduction Act

- Taxpayer First Act

- Tax scams and consumer alerts

- The tax gap

- Fact sheets

- IRS Tax Tips

- e-News subscriptions

- IRS guidance

- Media contacts

- IRS statements and announcements

IR-2023-152, Aug. 24, 2023