By submitting my information, I agree to the Privacy Policy and Terms of Service .

Already have an account? Sign In

Forgot Password?

Don't have an account? Sign Up

What is Efficient Market Hypothesis? | EMH Theory Explained

The efficient market hypothesis (EMH) can help explain why many investors opt for passive investing strategies, such as buying index funds or exchange-traded funds ( ETFs ), which generate consistent returns over an extended period. However, the EMH theory remains controversial and has found as many opponents as proponents. This guide will explain the efficient market hypothesis, how it works, and why it is so contradictory.

Best Crypto Exchange for Intermediate Traders and Investors

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

Copy top-performing traders in real time, automatically.

eToro USA is registered with FINRA for securities trading.

What is the efficient market hypothesis?

The efficient market hypothesis (EMH) claims that all assets are always fairly and accurately priced and trade at their fair market value on exchanges. If this theory is true, nothing can give you an edge to outperform the market using different investing strategies and make excess profits compared to those who follow market indexes.

Efficient market definition

An efficient market is where all asset prices listed on exchanges fully reflect their true and only value, thus making it impossible for investors to “beat the market” and profit from price discrepancies between the market price and the stock’s intrinsic value. The EMH claims the stock’s fair value, also called intrinsic value , is much the same as its market value , and finding undervalued or overvalued assets is non-viable.

Intrinsic value refers to an asset’s true, actual value, which is calculated using fundamental and technical analysis, whereas the market price is the currently listed price at which stock is bought and sold. When markets are efficient, the two values should be the same, but when they differ, it poses opportunities for investors to make an excess profit.

For markets to be completely efficient, all information should already be accounted for in stock prices and are trading on exchanges at their fair market value, which is practically impossible.

Hypothesis definition

A hypothesis is merely an assumption, an idea, or an argument that can be tested and reasoned not to be true. Something that isn’t fully supported by full facts or doesn’t match applied research.

For example, if sugar causes cavities, people who eat a lot of sweets are prone to cavities. And if the same applies here – if all information is reflected in a stock’s price, then its fair value should be the same as its market value and can not differ or be impacted by any other factors.

Beginners’ corner:

- What is Investing? Putting Money to Work ;

- 17 Common Investing Mistakes to Avoid ;

- 15 Top-Rated Investment Books of All Time ;

- How to Buy Stocks? Complete Beginner’s Guide ;

- 10 Best Stock Trading Books for Beginners ;

- 15 Highest-Rated Crypto Books for Beginners ;

- 6 Basic Rules of Investing ;

- Dividend Investing for Beginners ;

- Top 6 Real Estate Investing Books for Beginners ;

- 5 Passive Income Investment Ideas .

Fundamental and technical analysis in an efficient market

According to the EMH, stock prices are already accurately priced and consider all possible information. If markets are fully efficient, then no fundamental or technical analysis can help investors find anomalies and make an extra profit.

Fundamental analysis is a method to calculate a stock’s fair or intrinsic value by looking beyond the current market price by examining additional external factors like financial statements, the overall state of the economy, and competition, which can help define whether the stock is undervalued.

Also relevant is technical analysis , a method of forecasting the value of stocks by analyzing the historical price data, mainly looking at price and volume fluctuations occurring daily, weekly, or any other constant period, usually displayed on a chart.

The efficient market theory directly contradicts the possibility of outperforming the market using these two strategies; however, there are three different versions of EMH, and each slightly differs from the other.

Three forms of market efficiency

The efficient market hypothesis can take three different forms , depending on how efficient the markets are and which information is considered in theory:

1. Strong form efficiency

Strong form efficiency is the EMH’s purest form, and it is an assumption that all current and historical, both public and private, information that could affect the asset’s price is already considered in a stock’s price and reflects its actual value. According to this theory, stock prices listed on exchanges are entirely accurate.

Investors who support this theory trust that even inside information can’t give a trader an advantage, meaning that no matter how much extra information they have access to or how much analysis and research they do, they can not exceed standard returns.

Burton G. Malkiel, a leading proponent of the strong-form market efficiency hypothesis, doesn’t believe any analysis can help identify price discrepancies. Instead, he firmly believes in buy-and-hold investing, trusting it is the best way to maximize profits. However, factual research doesn’t support the possibility of a strong form of efficiency in any market.

2. Semi-strong form efficiency

The semi-strong version of the EMH suggests that only current and historical public (and not private) information is considered in the stock’s listed share prices. It is the most appropriate form of the efficient market hypothesis, and factual evidence supports that most capital markets in developed countries are generally semi-strong efficient.

This form of efficiency relies on the fact that public news about a particular stock or security has an immediate effect on the stock prices in the market and also suggests that technical and fundamental analysis can’t be used to make excess profits.

A semi-strong form of market efficiency theory accepts that investors can gain an advantage in trading only when they have access to any unknown private information unknown to the rest of the market.

3. Weak form efficiency

Weak market efficiency, also called a random walk theory, implies that investors can’t predict prices by analyzing past events, they are entirely random, and technical analysis cannot be used to beat the market.

Random walk theory proclaims stock prices always take a randomized path and are unpredictable, that investors can’t use past price changes and historical data trends to predict future prices, and that stock prices already reflect all current information.

For example, advocates of this form see no or limited benefit to technical analysis to discover investment opportunities. Instead, they would maintain a passive investment portfolio by buying index funds that track the overall market performance.

For example, the momentum investing method analyzes past price movements of stocks to predict future prices – it goes directly against the weak form efficiency, where all the current and past information is already reflected in their market prices.

A brief history of the efficient market hypothesis

The concept of the efficient market hypothesis is based on a Ph.D. dissertation by Eugene Fama , an American economist, and it assumes all prices of stocks or other financial instruments in the market are entirely accurate.

In 1970, Fama published this theory in “Efficient Capital Markets: A Review of Theory and Empirical Work,” which outlines his vision where he describes the efficient market as: “A market in which prices always “fully reflect” available information is called “efficient.”

Another theory based on the EMH, the random walk theory by Burton G. Malkiel , states that prices are completely random and not dependent on any factor. Not even past information, and that outperforming the market is a matter of chance and luck and not a point of skill.

Fama has acknowledged that the term can be misleading and that markets can’t be efficient 100% of the time, as there is no accurate way of measuring it. The EMH accepts that random and unexpected events can affect prices but claims they will always be leveled out and revert to their fair market value.

What is an inefficient market?

The efficient market hypothesis is a theory, and in reality, most markets always display some inefficiencies to a certain extent. It means that market prices don’t always reflect their true value and sometimes fail to incorporate all available information to be priced accurately.

In extreme cases, an inefficient market may even lead to a market failure and can occur for several reasons.

An inefficient market can happen due to:

- A lack of buyers and sellers;

- Absence of information;

- Delayed price reaction to the news;

- Transaction costs;

- Human emotion;

- Market psychology.

The EMH claims that in an efficiently operating market, all asset prices are always correct and consider all information; however, in an inefficient market, all available information isn’t reflected in the price, making bargain opportunities possible.

Moreover, the fact that there are inefficient markets in the world directly contradicts the efficient market theory, proving that some assets can be overvalued or undervalued, creating investment opportunities for excess gains.

Validity of the efficient market hypothesis

With several arguments and real-life proof that assets can become under- or overvalued, the efficient market hypothesis has some inconsistencies, and its validity has repeatedly been questioned.

While supporters argue that searching for undervalued stock opportunities using technical and fundamental analysis to predict trends is pointless, opponents have proven otherwise. Although academics have proof supporting the EMH, there’s also evidence that overturns it.

The EMH implies there are no chances for investors to beat the market, but for example, investing strategies like arbitrage trading or value investing rely on minor discrepancies between the listed prices and the actual value of the assets.

A prime example is Warren Buffet, one of the world’s wealthiest and most successful investors, who has consistently beaten the market over more extended periods through value investing approach, which by definition of EMH is unfeasible.

Another example is the stock market crash in 1987, when the Dow Jones Industrial Average (DJIA) fell over 20% on the same day, which shows that asset prices can significantly deviate from their values.

Moreover, the fact that active traders and active investing techniques exist also displays some evidence of inconsistencies and that a completely efficient market is, in reality, impossible.

Contrasting beliefs about the efficient market hypothesis

Although the EMH has been largely accepted as the cornerstone of modern financial theory, it is also controversial. The proponents of the EMH argue that those who outperform the market and generate an excess profit have managed to do so purely out of luck, that there is no skill involved, and that stocks can still, without a real cause or reason, outperform, whereas others underperform.

Moreover, it is necessary to consider that even new information takes time to take effect in prices, and in actual efficiency, prices should adjust immediately. If the EMH allows for these inefficiencies, it is a question of whether an absolute market efficiency, strong form efficiency, is at all possible. But as this theory implies, there is little room for beating the market, and believers can rely on returns from a passive index investing strategy.

Even though possible, proponents assume neither technical nor fundamental analysis can help predict trends and produce excess profits consistently, and theoretically, only inside information could result in outsized returns.

Moreover, several anomalies contradict the market efficiency, including the January anomaly, size anomaly, and winners-losers anomaly, but as usual, factual evidence both contradicts and supports these anomalies.

Parting opinions about the different versions of the EMH reflect in investors’ investing strategies. For example, supporters of the strong form efficiency might opt for passive investing strategies like buying index funds. In contrast, practitioners of the weak form of efficiency might leverage arbitrage trading to generate profits.

Marketing strategies in an efficient and inefficient market

On the one side, some academics and investors support Fama’s theory and most likely opt for passive investing strategies. On the other, some investors believe assets can become undervalued and try to use skill and analysis to outperform the market via active trading.

Passive investing

Passive investing is a buy-and-hold strategy where investors seek to generate stable gains over a more extended period as fewer complexities are involved, such as less time and tax spent compared to an actively managed portfolio.

People who believe in the efficient market hypothesis use passive investing techniques to create lower yet stable gains and use strategies with optimal gains through maximizing returns and minimizing risk.

Proponents of the EMH would use passive investing, for example:

- Invest in Index Funds;

- Invest in Exchange-traded Funds (ETFs).

However, it is important to note that other mutual funds also use active portfolio management intending to outperform indices, and passive investing strategies aren’t only for those who believe in the EMH.

Active investing

Active portfolio managers use research, analysis, skill, and experience to discover market inefficiencies to generate a higher profit over a shorter period and exceed the benchmark returns.

Generally, passive investing strategies generate returns in the long run, whereas active investing can generate higher returns in the short term.

Opponents of the EMH might use active investing techniques, for example:

- Arbitrage and speculation;

- Momentum investing ;

- Value investing .

The fact that these active trading strategies exist and have proven to generate above-market returns shows that prices don’t always reflect their market value.

For instance, if a technology company launches a new innovative product, it might not be immediately reflected in its stock price and have a delayed reaction in the market.

Suppose a trader has access to unpublished and private inside information. In that case, it will allow them to purchase stocks at a much lower value and sell for a profit after the announcement goes public, capitalizing on the speculated price movements.

Passive and active portfolio managers are often compared in terms of performance, e.g., investment returns, and research hasn’t fully concluded which one outperforms the other,

Efficient market examples

Investors and academics have divided opinions about the efficient market hypothesis, and there have been cases where this theory has been overturned and proven inaccurate, especially with strong form efficiency. However, proof from the real world has shown how financial information directly affects the prices of assets and securities, making the market more efficient.

For example, when the Sarbanes-Oxley Act in the United States, which required more financial transparency through quarterly reporting from publicly traded businesses, came into effect in 2002, it affected stock price volatility. Every time a company released its quarterly numbers, stock market prices were deemed more credible, reliable, and accurate, making markets more efficient.

Example of a semi-strong form efficient market hypothesis

Let’s assume that ‘stock X’ is trading at $40 per share and is about to release its quarterly financial results. In addition, there was some unofficial and unconfirmed information that the company has achieved impressive growth, which increased the stock price to $50 per share.

After the release of the actual results, the stock price decreased to $30 per share instead. So whereas the general talk before the official announcement made the stock price jump, the official news launch dropped it.

Only investors who had inside private information would have known to short-sell the stock , and the ones who followed the publicly available information would have bought it at a high price and incurred a loss.

What can make markets more efficient?

There are a few ways markets can become more efficient, and even though it is easy to prove the EMH has no solid base, there is some evidence its relevance is growing.

First , markets become more efficient when more people participate, buy and sell and engage, and bring more information to be incorporated into the stock prices. Moreover, as markets become more liquid, it brings arbitrage opportunities; arbitrageurs exploiting these inefficiencies will, in turn, contribute to a more efficient market.

Secondly , given the faster speed and availability of information and its quality, markets can become more efficient, thus reducing above-market return opportunities. A thoroughly efficient market, strong efficiency, is characterized by the complete and instant transmission of information.

To make this possible, there should be:

- Complete absence of human emotion in investing decisions;

- Universal access to high-speed pricing analysis systems;

- Universally accepted system for pricing stocks;

- All investors accept identical returns and losses.

The bottom line

At its core, market efficiency is the ability to incorporate all information in stock prices and provide the most accurate opportunities for investors; however, it isn’t easy to imagine a fully efficient market.

Research has shown that most developed capital markets fall into the semi-strong efficient category. However, whether or not stock markets can be fully efficient conclusively and to what degree continues to be a heated debate among academics and investors.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs on the efficient market hypothesis

The efficient market hypothesis (EMH) claims that prices of assets such as stocks are trading at accurate market prices, leaving no opportunities to generate outsized returns. As a result, nothing could give investors an edge to outperform the market, and assets can’t become under- or overvalued.

What are three forms of the efficient market hypothesis?

The efficient market hypothesis takes three forms: first, the purest form is strong form efficiency, which considers current and past information. The second form is semi-strong efficiency, which includes only current and past public, and not private, information. Finally, the third version is weak form efficiency, which claims stock prices always take a randomized path.

What contradicts the efficient market hypothesis?

The efficient market hypothesis directly contradicts the existence of investment strategies, and cases that have proved to generate excess gains are possible, for example, via approaches like value or momentum investing.

When more investors engage in the market by buying and selling, they also bring more information that can be incorporated into the stock prices and make them more accurate. Moreover, the faster movement of information and news nowadays increases accuracy and data quality, thus making markets more efficient.

Finance Digest

By subscribing you agree with Finbold T&C’s & Privacy Policy

Related guides

CMO For Hire: Maximize Growth With A Marketing Executive

Dark Pools and Institutional Investing—and What It Means for Retail Traders

The History of Insider Trading: Top 10 Largest Stock Trades in the US Government

What Is ‘Smart Money’ and How Can You Benefit from It?

Us senators trades.

Stay up-to-date on the trading activity of US Senators. Get started

Disclaimer: The information on this website is for general informational and educational purposes only and does not constitute financial, legal, tax, or investment advice. This site does not make any financial promotions, and all content is strictly informational. By using this site, you agree to our full disclaimer and terms of use. For more information, please read our complete Global Disclaimer .

Trending Courses

Course Categories

Certification Programs

Free Courses

Financial Market Resources

- Career Guides

- Interview Prep Guides

- Free Practice Tests

- Excel Cheatsheets

FEW SEATS LEFT- COURSES UPTO 90%OFF

Efficient market hypothesis.

Last Updated :

21 Aug, 2024

Blog Author :

Wallstreetmojo Team

Edited by :

Pallabi Banerjee

Reviewed by :

Dheeraj Vaidya, CFA, FRM

Table Of Contents

What Is Efficient Market Hypothesis?

The Efficient Market Hypothesis (EMH) states that the stock asset prices indicate all relevant information very quickly and rationally. Such information is shared universally, making it impossible for investors to earn above-average returns consistently. The assumptions of this theory are criticized highly by behavioral economists or others who believe in the inherent inefficiencies of the market.

According to this hypothesis, the efficient market will not provide any profitable opportunity for trading. Thus, attaining a superior return consistently in such a condition is impossible. Time is an essential factor within which the market spreads information. This time gap provides traders the opportunity to exploit the inefficiency. Economist Eugene Fama gave the efficient market hypothesis in the 1960s.

Table of contents What Is Efficient Market Hypothesis? Assumptions Of EMH Forms Example Criticism Implication Recommended Articles

- The Efficient Market Hypothesis (EMH) states that the stock prices show all pertinent details. This information is shared globally, making it impossible for investors to gain above-average returns constantly. Behavioral economists or others who believe in the market's inherent inefficiencies criticize the theory assumptions highly.

- In the 1960s, economist Eugene Fama provided the efficient market hypothesis.

- The Efficient Market Hypothesis (EMH) forms are weak, semi-strong, and strong.

- This theory is criticized because it has market bubbles and consistently wins against the market.

Efficient Market Hypothesis Explained

Efficient market hypothesis theory is a situation in which all assets are priced to show any new or recent information. This does not give any window to capture excess returns. However, traders who can exploit this time gap within which the market is inefficient, can earn extra returns. It can be said that trading is the way in which the new information is incorporated in the asset prices. The speed with which information is adjusted is actually the time taken foe the trade to get executed. This time frame may also be less than one minute.

Assumptions Of EMH

Let us look at some assumptions of the efficient market hypothesis theory .

- Investors in the market may act rationally or normally. If there is unusual information, the investor will react unusually, which is normal behavior, or doing what everyone else is doing is also considered normal behavior.

- The stock price indicates all the relevant information shared universally among the investors.

- It also states that the investors cannot exploit the market since they need to act as per the market information and make decisions accordingly.

Let us look at the different forms of the concept of efficient market hypothesis.

The strength of the Efficient Market Hypothesis (EMH) theory's assumptions depends upon the forms of EMH. The following are the forms of EMH: -

- Weak Form: This form states that the stock prices indicate the public market information, and the past performance has nothing to do with future costs.

- Semi-Strong Form: This form states that the stock prices reflect both the market and non-market public information.

- Strong Form: This form says that public and private information instantly characterizes stock prices.

The below given example will help in understanding the concept of efficient market hypothesis.

Suppose a person named Johnson holds 900 shares of an automobile company, and the current price of these shares trades at $156.50. Johnson had some relations with an insider of the same company who informed Johnson that the company had failed in their new project and the price of a share would decline in the next few days.

Johnson had no faith in the insider and held all his shares. Then, after a few days, the company announces the project’s failure, dropping the share price to $106.00.

The market modifies the newly available information. To realize the gross gain, Johnson sold his shares at $106.00 and a gross gain of $95,500. If Johnson had sold his 900 shares at $156.50 earlier by taking the insider's advice, he would have earned $140,850. So, his loss for the sale of 900 shares is $140,850-$95,500 i.e., $45,350.

Given below are the importance of efficient market hypothesis.

- This theory takes into account the fact that there are always some special cases or outliers who are able to use the time gap between the old pices and change in price due to new information to earn extra return.

- The importance of efficient market hypothesis also lies in the fact that it is useful in the asset pricing models.

- There is no need of government intervention since stock prices adjust automatically.

- Existence of Market Bubbles: One of the biggest reasons behind the criticism of the efficient market hypothesis is market bubbles . So, if such assumptions were correct, there was no possibility of bubbles and crashing incidents such as stock market crash and housing bubbles in 2008 or the tech bubble of the 1990s. Such companies were trading at high values before hitting. Thus, this criticism is an important argument for efficient market hypothesis testing.

- Wins against the Market: Some investors, such as Warren Buffett, won against the market consistently. He had consistently earned above-average profit from the market for over 50 years through his value investing strategy. On the other hand, some behavioral economists also highly criticize the efficient market hypothesis theory because they believe that past performances help predict future prices.

Implication

The efficient market hypothesis implies that the market is unbeatable because the stock price already contains all the relevant information. It created a conflict in the minds of the investors. They started believing they could not beat the market as it is not predictable, and future prices depend upon today’s news, not the trends or the company’s past performances. However, many economists criticized this theory. theory for the purpose of efficient market hypothesis testing.

Efficient Market Hypothesis Vs Behavioral Finance

Efficient market hypothesis states that markets are efficient since information quickly spreads whereas behavioral finance states that investors tend to be irrational in their judgement. Let us look at their differences.

Frequently Asked Questions (FAQs)

The author analyzes recent research on behavioral finance, momentum investing, and popular fundamental ratios that aims to differ from the theory and concludes that it is optional in the long run. Thus, the Efficient Market Hypothesis remains true.

The weak form Efficient Market Hypothesis, also known as the random walk theory, denotes that future securities' prices are unexpected and not affected by past events. The advocates of weak form efficiency state that all existing information is shown in stock prices. In addition, the past data has no relationship with current market prices.

The Efficient Market Hypothesis is essential because it has political implications by adhering to liberal economic thought. It suggests that no governmental intervention is required because stock prices are always traded at a 'fair' market value.

Violation of these markets suggests that markets could be more efficient. Hence, here are a few scenarios that could potentially challenge the assumptions of EMH, market anomalies, insider trading, market manipulation, behavioral biases, information asymmetry, and inefficiencies in the market microstructure

Recommended Articles

This article is a guide to what is Efficient Market Hypothesis. We explain its assumptions, forms, implications, examples, criticisms & importance. You can learn more about accounting from the following articles: -

- How to Read a Stock Chart?

- Inefficient Market

- Efficient Frontier

- Stock Market Crash in 1987

- Efficient Market Theory

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on June 08, 2023

Are You Retirement Ready?

Table of contents, what is efficient market theory (emt).

Efficient market theory (EMT) is a concept in finance that asserts that financial markets are highly efficient and that prices of assets fully reflect all available information.

EMT has been a prominent topic of debate among finance academics and practitioners since its inception.

It has been a widely studied and researched topic for decades, and its applications have had significant implications for investment decision-making, portfolio management, and market regulation.

The concept of EMT has its roots in the works of Eugene Fama , who introduced it in 1965.

EMT is grounded in the notion that market participants are rational and have access to all relevant information.

Therefore, in an efficient market, prices of securities are determined by market forces, and any new information is immediately incorporated into prices.

This implies that it is impossible to outperform the market consistently, as prices already reflect all available information.

Forms of Efficient Market Theory

EMT is commonly categorized into three forms, which include the weak form, semi-strong form, and strong form.

Weak Form: The weak form of EMT asserts that all past prices of securities are reflected in current prices, and it is impossible to use past prices to predict future prices.

Semi-strong Form: The semi-strong form of EMT suggests that current prices reflect all publicly available information, including financial statements and other disclosures.

Strong Form: The strong form of EMT suggests that current prices reflect all available information, including public and private information. In this case, insider trading would not be profitable, as prices already reflect all available information.

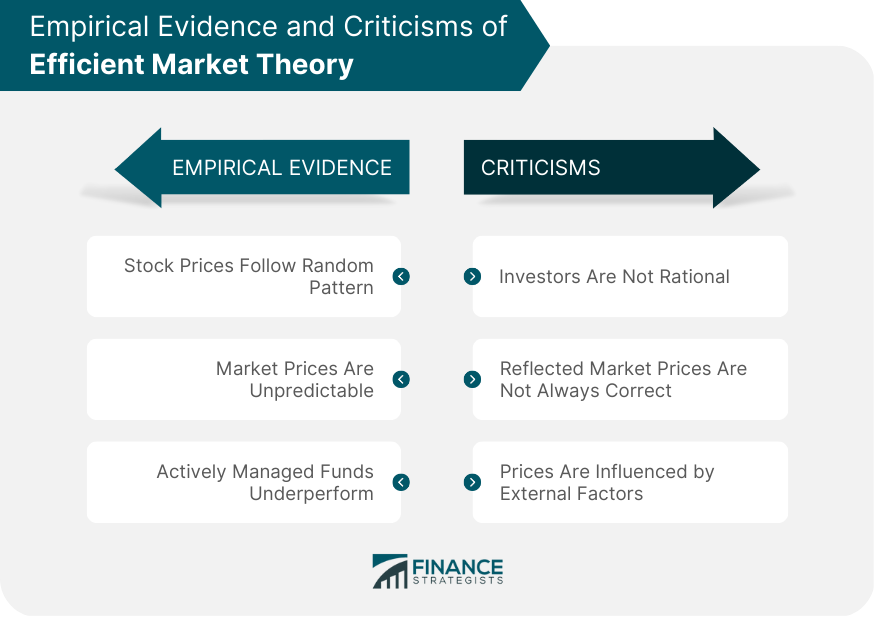

Empirical Evidence in Support of Efficient Market Theory

Numerous empirical studies have been conducted to test the validity of EMT.

Stock Prices Follow Random Pattern

One of the earliest and most influential studies was conducted by Fama himself. In his study, he found that stock prices in the United States followed a random walk pattern and were not predictable.

Market Prices Are Unpredictable

Other studies have found similar results, suggesting that market prices are unpredictable and follow a random walk pattern.

Actively Managed Funds Underperform

In addition, some studies have found that actively managed funds, which seek to outperform the market, often underperform the market after accounting for fees and transaction costs.

Criticisms of Efficient Market Theory

Despite the empirical evidence in support of EMT, there are several criticisms of the theory.

Investors Are Not Rational

Another criticism is that EMT assumes that all market participants are rational and have access to all relevant information. In reality, investors may not be rational, and access to information may be limited or biased.

Reflected Market Prices Are Not Always Correct

This assumption implies that the market always incorporates all relevant information into prices, which critics argue may not be true due to behavioral biases and other external factors that can impact market prices.

Prices Are Influenced by External Factors

Prices can be influenced by irrational market behavior or by external factors such as political events or natural disasters.

Behavioral Finance and Efficient Market Theory

Behavioral finance is a field of study that seeks to understand how psychological factors influence investor behavior and market outcomes.

Behavioral finance suggests that investors are not always rational and that market prices may not always reflect all available information. Therefore, behavioral finance challenges the underlying assumptions of EMT.

Behavioral finance has identified several cognitive biases that can influence investor behavior, such as overconfidence, herd mentality, and loss aversion. These biases can lead to market inefficiencies and opportunities for skilled investors to outperform the market.

Implications of Efficient Market Theory

The implications of EMT are far-reaching and have significant implications on the following:

Portfolio Management

EMT suggests that it is impossible to outperform the market consistently, and as such, active portfolio management strategies, such as stock picking and market timing are unlikely to be successful in the long run.

Instead, EMT suggests that investors should focus on passive investment strategies such as index funds that aim to replicate market performance.

Market Regulation

The implications of EMT for market regulation are also significant. If prices are always efficient, then it may not be necessary to regulate markets to ensure that prices are fair.

However, some argue that regulation is still necessary to prevent fraud and market manipulation, which can lead to market inefficiencies and undermine investor confidence.

Alternatives to Efficient Market Theory

There are several alternative theories and perspectives to EMT:

Technical Analysis

A popular approach to investing that involves analyzing past market data, such as price and volume, to predict future price movements.

Fundamental Analysis

This involves analyzing a company's financial statements, industry trends, and macroeconomic factors to determine its intrinsic value .

Value Investing

This strategy involves identifying undervalued securities and investing in them with the expectation that their value will increase over time.

Final Thoughts

Efficient Market Theory is a cornerstone of financial economics, positing that financial markets are efficient and that asset prices reflect all available information.

The concept has significant implications for investment decision-making, portfolio management, and market regulation.

However, the debate surrounding EMT remains ongoing, with some scholars pointing to empirical evidence that supports the theory while others criticize its underlying assumptions.

Despite the criticisms, the concept of EMT continues to be relevant in financial markets today. Investors must carefully consider the underlying assumptions of the theory and alternative approaches to investing when making investment decisions.

Understanding the implications of EMT for investment decision-making, portfolio management, and market regulation is critical to success in today's financial markets.

While EMT has limitations, it remains a valuable tool for understanding the behavior of financial markets and the pricing of financial assets. For more information on efficient market theory and support in applying it to your circumstances, you may consult a wealth management professional.

Efficient Market Theory FAQs

What is efficient market theory.

Efficient market theory is a concept in finance that asserts that financial markets are highly efficient and that prices of assets fully reflect all available information.

What are the forms of efficient market theory?

Is there empirical evidence to support efficient market theory.

Numerous empirical studies have been conducted to test the validity of EMT. Some studies have found evidence in support of EMT, while others have found evidence that contradicts the theory.

What are the criticisms of efficient market theory?

The criticisms of EMT center around the difficulty in defining what constitutes relevant information, the assumption that all market participants are rational and have access to all relevant information, and the assumption that market prices are always correct.

What are the implications of efficient market theory for investment decision-making?

EMT suggests that it is impossible to outperform the market consistently, and as such, active portfolio management strategies such as stock picking and market timing are unlikely to be successful in the long run. Instead, EMT suggests that investors should focus on passive investment strategies, such as index funds that aim to replicate market performance.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Bear Market

- Bull Market

- Capital Markets

- Hollywood Stock Exchange (HSX)

- How Bonds Affect the Stock Market

- How to Protect Your 401(k) During a Stock Market Crash

- New York Stock Exchange (NYSE)

- Oil and Energy Investing

- Stock Market

- Stock Market Crash

- Active vs Passive Investment Management

- Asset Management Careers

- Asset Management Company (AMC)

- Asset Management Company (AMC) Fees

- Asset Management Company (AMC) vs Brokerage House

- Asset Management Ratios

- Asset Management Trends

- Asset Management vs Hedge Fund

- Asset Management vs Investment Management

- Asset Management vs Private Equity

- Asset Management vs Property Management

- Asset Manager

- Asset-Liability Management

- Benefits of Digital Asset Management

- Benefits of Fixed Asset Management

- Best Hedge Fund Strategies

- Chartered Asset Manager (CAM)

- Crypto Asset Management

Ask a Financial Professional Any Question

Discover wealth management solutions near you.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

To ensure one vote per person, please include the following info, great thank you for voting., get in touch with a financial advisor, submit your info below and someone will get back to you shortly..

- Search Search Please fill out this field.

- Assets & Markets

- Mutual Funds

Efficient Markets Hypothesis (EMH)

EMH Definition and Forms

:max_bytes(150000):strip_icc():format(webp)/ScreenShot2020-03-23at2.04.43PM-59de96b153e540c498f1f1da8ce5c965.png)

What Is Efficient Market Hypothesis?

What are the types of emh, emh and investing strategies, the bottom line, frequently asked questions (faqs).

The Efficient Market Hypothesis (EMH) is one of the main reasons some investors may choose a passive investing strategy. It helps to explain the valid rationale of buying these passive mutual funds and exchange-traded funds (ETFs).

The Efficient Market Hypothesis (EMH) essentially says that all known information about investment securities, such as stocks, is already factored into the prices of those securities. If that is true, no amount of analysis can give you an edge over "the market."

EMH does not require that investors be rational; it says that individual investors will act randomly. But as a whole, the market is always "right." In simple terms, "efficient" implies "normal."

For example, an unusual reaction to unusual information is normal. If a crowd suddenly starts running in one direction, it's normal for you to run that way as well, even if there isn't a rational reason for doing so.

There are three forms of EMH: weak, semi-strong, and strong. Here's what each says about the market.

- Weak Form EMH: Weak form EMH suggests that all past information is priced into securities. Fundamental analysis of securities can provide you with information to produce returns above market averages in the short term. But no "patterns" exist. Therefore, fundamental analysis does not provide a long-term advantage, and technical analysis will not work.

- Semi-Strong Form EMH: Semi-strong form EMH implies that neither fundamental analysis nor technical analysis can provide you with an advantage. It also suggests that new information is instantly priced into securities.

- Strong Form EMH: Strong form EMH says that all information, both public and private, is priced into stocks; therefore, no investor can gain advantage over the market as a whole. Strong form EMH does not say it's impossible to get an abnormally high return. That's because there are always outliers included in the averages.

EMH does not say that you can never outperform the market . It says that there are outliers who can beat the market averages. But there are also outliers who lose big to the market. The majority is closer to the median. Those who "win" are lucky; those who "lose" are unlucky.

Proponents of EMH, even in its weak form, often invest in index funds or certain ETFs. That is because those funds are passively managed and simply attempt to match, not beat, overall market returns.

Index investors might say they are going along with this common saying: "If you can't beat 'em, join 'em." Instead of trying to beat the market, they will buy an index fund that invests in the same securities as the benchmark index.

Some investors will still try to beat the market, believing that the movement of stock prices can be predicted, at least to some degree. For that reason, EMH does not align with a day trading strategy. Traders study short-term trends and patterns. Then, they attempt to figure out when to buy and sell based on these patterns. Day traders would reject the strong form of EMH.

For more on EMH, including arguments against it, check out the EMH paper from economist Burton G. Malkiel. Malkiel is also the author of the investing book "A Random Walk Down Main Street." The random walk theory says that movements in stock prices are random.

If you believe that you can't predict the stock market, you would most often support the EMH. But a short-term trader might reject the ideas put forth by EMH, because they believe that they are able to predict changes in stock prices.

For most investors, a passive, buy-and-hold , long-term strategy is useful. Capital markets are mostly unpredictable with random up and down movements in price.

When did the Efficient Market Hypothesis first emerge?

At the core of EMH is the theory that, in general, even professional traders are unable to beat the market in the long term with fundamental or technical analysis . That idea has roots in the 19th century and the "random walk" stock theory. EMH as a specific title is sometimes attributed to Eugene Fama's 1970 paper "Efficient Capital Markets: A Review of Theory and Empirical Work."

How is the Efficient Market Hypothesis used in the real world?

Investors who utilize EMH in their real-world portfolios are likely to make fewer decisions than investors who use fundamental or technical analysis. They are more likely to simply invest in broad market products, such as S&P 500 and total market funds.

Corporate Finance Institute. " Efficient Markets Hypothesis ."

IG.com. " Random Walk Theory Definition ."

Market Efficiency

Preparing for the CFA Exam requires a solid understanding of Market Efficiency, a fundamental concept in financial theory. Mastery of the Efficient Market Hypothesis (EMH), including weak, semi-strong, and strong forms, is essential. This knowledge aids in analyzing asset pricing, market anomalies, and investment strategies, crucial for achieving a high CFA score.

Learning Objective

In studying “Market Efficiency” for the CFA Exam, you should aim to understand the Efficient Market Hypothesis (EMH) and its implications for asset pricing and investment strategies. Analyze the three forms of market efficiency—weak, semi-strong, and strong—and their impact on the ability to achieve abnormal returns. Evaluate the underlying principles and evidence supporting each form, including market anomalies and behavioral finance perspectives. Additionally, explore how EMH influences portfolio management decisions, trading strategies, and financial models. Apply this understanding to interpret market dynamics and assess the effectiveness of active versus passive investment strategies in CFA exam practice scenarios.

What is Market Efficiency?

Market Efficiency is the concept that asset prices fully reflect all available information, making it impossible to consistently achieve above-average returns through market timing or stock selection

Forms of Market Efficiency

Market Efficiency is commonly classified into three forms, each representing different levels of information reflected in asset prices:

1. Weak Form Efficiency

- Definition : This form assumes that all past trading information, such as historical prices and volume, is already reflected in current stock prices.

- Implication : Since past price data is already included in current prices, technical analysis (which relies on past prices to predict future movements) cannot consistently yield abnormal returns. However, fundamental analysis, which uses financial data, may still have some value in predicting prices.

2. Semi-Strong Form Efficiency

- Definition : This form of efficiency posits that all publicly available information, including financial statements, economic news, and other public announcements, is fully reflected in stock prices.

- Implication : Neither technical analysis nor fundamental analysis can provide investors with an advantage, as prices adjust quickly to new public information. Investment strategies based solely on public information are therefore unlikely to outperform the market.

3. Strong Form Efficiency

- Definition : In this form, all information—both public and private (insider information)—is already incorporated into asset prices.

- Implication : Even individuals with insider information cannot consistently achieve abnormal returns, as prices reflect all knowledge, both publicly accessible and confidential. Strong form efficiency implies that no investor, regardless of their level of information, can gain an edge over the market.

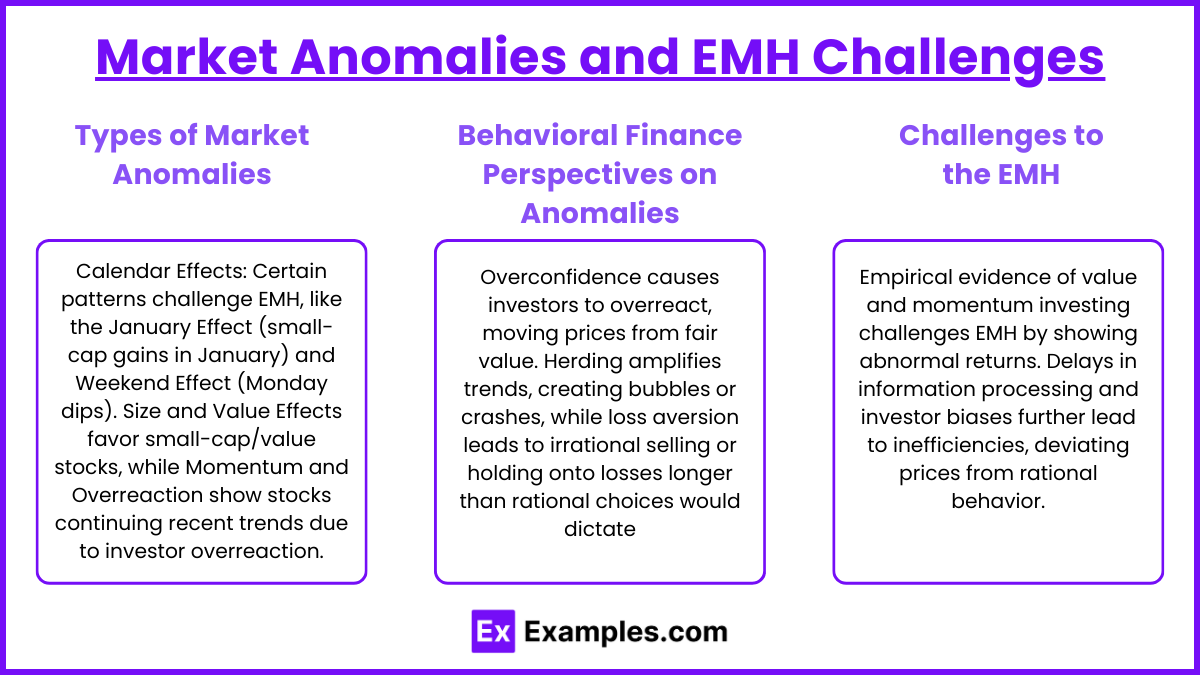

Market Anomalies and EMH Challenges

While the Efficient Market Hypothesis (EMH) suggests that asset prices reflect all available information, market anomalies present evidence that prices sometimes deviate from true value, allowing investors to potentially earn above-average returns. These anomalies challenge the idea that markets are fully efficient and offer insights into market inefficiencies often explained by behavioral finance.

1. Types of Market Anomalies

- January Effect : Stocks, especially small-cap ones, often show higher returns in January, possibly due to tax-related selling in December followed by buying in January.

- Weekend Effect : Historically, stock prices tend to drop on Mondays, potentially due to negative news over weekends or traders’ expectations of lower prices.

- Size and Value Effects : Studies have shown that smaller-cap stocks and undervalued stocks (low price-to-earnings or low price-to-book ratios) can outperform larger or growth-oriented stocks, contrary to what EMH predicts.

- Momentum and Overreaction : Stocks with strong recent performance often continue to perform well in the short term, while poorly performing stocks continue to decline, suggesting a momentum effect. Similarly, overreaction refers to the tendency of investors to push prices too high or low in response to news, leading to corrections as the market adjusts.

2. Behavioral Finance Perspectives on Anomalies

- Overconfidence and Overreaction : Investors may become overconfident in their ability to predict market movements, causing them to overreact to recent information and drive prices away from fair value.

- Herding Behavior : Investors often follow the actions of others, especially in times of uncertainty, which can create bubbles (overpriced assets) or crashes (underpriced assets) as trends are amplified.

- Loss Aversion and Prospect Theory : Behavioral finance suggests that investors are more sensitive to losses than gains, which may cause irrational selling or holding of losing investments longer than rational economic decisions would suggest.

3. Challenges to the EMH

- Empirical Evidence : Numerous studies have shown that certain strategies, like value investing or momentum-based investing, can yield abnormal returns, which challenges the EMH, particularly in its semi-strong and strong forms.

- Information Processing Delays : Prices may not always react instantly to new information due to delays in processing or asymmetric access to information, creating temporary inefficiencies.

- Limitations of Rationality : EMH assumes rational behavior, but psychological biases frequently drive investors’ actions, leading to deviations from expected price behavior.

Example 1: Earnings Announcement Impact

When a company releases its earnings report, stock prices often react almost instantly, reflecting the new information. In a semi-strong form efficient market, this rapid adjustment leaves little opportunity for investors to profit from analyzing the earnings report after its release. For instance, if a company reports higher-than-expected profits, an efficient market would quickly adjust the stock price upward, meaning latecomers would miss out on these gains.

Example 2: Stock Price Response to Economic News

Consider an interest rate cut announced by the central bank. In an efficient market, stock prices would immediately incorporate the impact of lower rates on company profits, borrowing costs, and economic growth. Investors who react after the initial price adjustment would not achieve abnormal returns, as the market already reflects the implications of the interest rate change.

Example 3: Insider Trading and Strong Form Efficiency

In a perfectly strong-form efficient market, even private, insider information would be reflected in stock prices. For example, if an executive privately knows about an upcoming merger, theoretically, the stock price should already incorporate this information. However, in reality, most markets are not strong-form efficient, and insider trading can often lead to abnormal profits. This limitation of strong-form efficiency reveals that not all private information is priced into the market.

Example 4: January Effect and Market Anomalies

The January Effect is a seasonal anomaly where stocks, particularly small-cap stocks, tend to perform better in January than in other months. This pattern challenges market efficiency by suggesting that seasonal factors, unrelated to company fundamentals, can influence stock prices. The January Effect implies that some investors may achieve abnormal returns by investing in small-cap stocks before the new year, contradicting EMH’s assumption that all relevant information is already priced in.

Example 5: Momentum Effect in Stocks

The EMH suggests that past stock price movements should not predict future returns in a weak-form efficient market. However, the momentum effect challenges this by showing that stocks with strong recent performance often continue to perform well in the short term, and poorly performing stocks tend to continue declining. Investors who exploit these trends may achieve abnormal returns, which contradicts weak-form efficiency and suggests that patterns in stock prices are sometimes predictable.

Practice Questions

What is the primary purpose of a market index?

A) To provide a benchmark for portfolio performance comparison. B) To ensure efficient market operations. C) To regulate the securities market. D) To facilitate insider trading.

Answer: A) To provide a benchmark for portfolio performance comparison.

Explanation: A market index tracks the performance of a specific set of stocks, representing a particular market segment or the market as a whole. Investors and portfolio managers use these indexes as benchmarks to compare the performance of individual stocks or portfolios against the broader market, assessing relative performance.

Which of the following is not a characteristic of a well-constructed market index?

A) Transparency B) Subjectivity in stock selection C) Representativeness D) Investability

Answer: B) Subjectivity in stock selection.

Explanation: A well-constructed market index should be transparent, representative, and investable, meaning that the criteria for selecting stocks are clear, the index accurately reflects the market or market segment, and the stocks within the index are sufficiently liquid and available for investment. Subjectivity in stock selection undermines the objectivity and reliability of the index as a market benchmark.

Which index would most likely use a market-capitalization weighting method?

A) An equally-weighted index B) A price-weighted index C) A market-capitalization weighted index D) A fundamental index

Answer: C) A market-capitalization weighted index.

Explanation: In a market-capitalization weighted index, the impact of each stock on the index’s overall performance is proportional to its market capitalization, which is the total market value of the company’s outstanding shares. This is the most common method used by major indexes, such as the S&P 500, as it reflects the size and influence of each company within the market.

Efficient Market Hypothesis

Definition of Efficient Market Hypothesis It is the idea that the price of stocks and financial securities reflects all available information about them. If new information about a company becomes available, the price will quickly change to reflect this.

Three Types of Efficient market hypothesis

- Weak EMH. This states all past market prices and data are fully reflected in the price of securities and stocks. However, some information about events shaping the company may not be fully reflected in the price. In other words, technical analysis of prices is of no use.

- Semistrong EMH. This states asserts that all publicly available information is fully reflected in securities prices. In other words, fundamental analysis is of no use.

- Strong Form of EMH asserts that all information is fully reflected in securities prices. In other words, even insider information is of no use.

The Efficient Market hypothesis requires certain assumptions.

- Many buyers and sellers

- Agents have rational expectations and on average make good decisions about buying shares/stocks

- Perfect information about market trends and profit of firms.

Implications of the Efficient Market Hypothesis

- Markets are efficient in determining the prices of financial securities.

- Investors tend to be rational.

- It is not possible (except through luck) to outperform the market.

- Prices may not determine future stock performance e.g. the market may not know about an event which will lead to lower profit.

- It is easy to buy and sell. For example, housing markets are less close to the model of efficient market hypothesis because there are significant time lags in buying selling and stamp duty e.t.c.

If we assume an efficient market hypothesis it suggests regulators need to do little, if anything to prevent asset/stock market bubbles. Because according to this theory, irrational asset price bubbles shouldn’t occur. However, if the efficient market hypothesis is not true, then there is a greater role for regulators to intervene in asset/stock bubbles to prevent a boom and bust. (assuming regulators don’t get caught up in the same irrational exuberance as investors)

If some investors ignore data and get caught up in bubbles, then in theory ‘efficient investors’ should be able to profit by ‘shorting’ a boom. (see: short selling explained ) But as Keynes said, the market can remain irrational for longer than you can remain solvent. In other words, a bubble may last for a long time and your short positions may fail before you finally benefit from the collapse in prices.

Criticisms of the efficient market hypothesis

Stock Prices often reflect evidence of:

- Irrational exuberance – people getting carried away by booms and asset bubbles (e.g. US house prices in the 2000s, Dot Com Bubble and Bust.

- Behavioural economics places greater emphasis on the irrationality of human behaviour in making economic decisions e.g. herding effect e.t.c

Empirical evidence that stock prices do not reflect. E.g. According to Dreman, in a 1995 paper, low P/E stocks have greater returns.

Even the founder of EMH, Eugene Fama found in a 1990s study that many stocks didn’t follow a random walk model but that ‘value’ stocks outperformed. They also found a ‘momentum effect’ where stocks which had done well in the past, often continued to do well in the future. Fama tried to defend his theory by saying cheap stocks had a greater risk.

Joseph Stiglitz published a proof saying that if the efficient market hypothesis was true it would be logically irrational to spend money on research – which people clearly do.

6 thoughts on “Efficient Market Hypothesis”

how do individuals make profit in an efficient market

It is totally possible to make profit because markets are NOT efficient…

efficient market does not mean you dont make a profit.You make risk-adjusted profits,however you can not make abnormal profits because prices follow random paths and are unpredictable.Best ways to say it is that you can not make abnormal profits consistently.

I have a an economics question I need help with. List 5 markets that are efficient and tell why you believe that are. List 5 markets that are inefficient and tell why you believe they are. HELP!!!

List 5 markets that you feel are efficient and tell why you think they are efficient. List 5 markets that you feel are inefficient and tell me why you think they are inefficient.

- Pingback: Neo-Classical Synthesis - Economics Blog

Comments are closed.

- Search Search Please fill out this field.

Efficient Market Hypothesis (EMH) Tenets and Variations

Problems of emh, qualifying the emh, increasing market efficiency, the bottom line, efficient market hypothesis: is the stock market efficient.

:max_bytes(150000):strip_icc():format(webp)/dhir__rajeev_dhir-5bfc262c46e0fb00260a216d.jpeg)

An important debate among investors is whether the stock market is efficient—that is, whether it reflects all the information made available to market participants at any given time. The efficient market hypothesis (EMH) maintains that all stocks are perfectly priced according to their inherent investment properties, the knowledge of which all market participants possess equally.

Financial theories are subjective. In other words, there are no proven laws in finance. Instead, ideas try to explain how the market works. Here, we take a look at where the efficient market hypothesis has fallen short in terms of explaining the stock market's behavior. While it may be easy to see a number of deficiencies in the theory, it's important to explore its relevance in the modern investing environment.

Key Takeaways

- The Efficient Market Hypothesis assumes all stocks trade at their fair value.

- The weak tenet implies stock prices reflect all available information, the semi-strong implies stock prices are factored into all publicly available information, and the strong tenet implies all information is already factored into the stock prices.

- The theory assumes it would be impossible to outperform the market and that all investors interpret available information the same way.

- Although most decisions are still made by humans, the use of computers to analyze information may be making the theory more relevant.

There are three tenets to the efficient market hypothesis: the weak, the semi-strong, and the strong.

The weak make the assumption that current stock prices reflect all available information. It goes further to say past performance is irrelevant to what the future holds for the stock. Therefore, it assumes that technical analysis can't be used to achieve returns.

The semi-strong form of the theory contends stock prices are factored into all information that is publicly available. Therefore, investors can't use fundamental analysis to beat the market and make significant gains.

In the strong form of the theory, all information—both public and private—are already factored into the stock prices. So it assumes no one has an advantage to the information available, whether that's someone on the inside or out. Therefore, it implies the market is perfect, and making excessive profits from the market is next to impossible.

The EMH was developed from economist Eugene Fama's Ph.D. dissertation in the 1960s.

While it may sound great, this theory is not without criticism. Other schools of thought, such as Alphanomics , argue that markets can be inefficient.

First, the efficient market hypothesis assumes all investors perceive all available information in precisely the same manner. The different methods for analyzing and valuing stocks pose some problems for the validity of the EMH. If one investor looks for undervalued market opportunities while another evaluates a stock on the basis of its growth potential, these two investors will already have arrived at a different assessment of the stock's fair market value . Therefore, one argument against the EMH points out that since investors value stocks differently, it is impossible to determine what a stock should be worth in an efficient market.

Proponents of the EMH conclude investors may profit from investing in a low-cost, passive portfolio.

Secondly, no single investor is ever able to attain greater profitability than another with the same amount of invested funds under the efficient market hypothesis. Since they both have the same information, they can only achieve identical returns. But consider the wide range of investment returns attained by the entire universe of investors, investment funds , and so forth. If no investor had any clear advantage over another, would there be a range of yearly returns in the mutual fund industry, from significant losses to 50% profits or more? According to the EMH, if one investor is profitable, it means every investor is profitable. But this is far from true.

Thirdly (and closely related to the second point), under the efficient market hypothesis, no investor should ever be able to beat the market or the average annual returns that all investors and funds are able to achieve using their best efforts. This would naturally imply, as many market experts often maintain, the absolute best investment strategy is simply to place all of one's investment funds into an index fund. This would increase or decrease according to the overall level of corporate profitability or losses. But there are many investors who have consistently beaten the market. Warren Buffett is one of those who's managed to outpace the averages year after year.

Eugene Fama never imagined that his efficient market would be 100% efficient all the time. That would be impossible, as it takes time for stock prices to respond to new information. The efficient hypothesis, however, doesn't give a strict definition of how much time prices need to revert to fair value . Moreover, under an efficient market, random events are entirely acceptable, but will always be ironed out as prices revert to the norm.

But it's important to ask whether EMH undermines itself by allowing random occurrences or environmental eventualities. There is no doubt that such eventualities must be considered under market efficiency but, by definition, true efficiency accounts for those factors immediately. In other words, prices should respond nearly instantaneously with the release of new information that can be expected to affect a stock's investment characteristics. So, if the EMH allows for inefficiencies, it may have to admit that absolute market efficiency is impossible.

Although it's relatively easy to pour cold water on the efficient market hypothesis, its relevance may actually be growing. With the rise of computerized systems to analyze stock investments, trades, and corporations, investments are becoming increasingly automated on the basis of strict mathematical or fundamental analytical methods. Given the right power and speed, some computers can immediately process any and all available information, and even translate such analysis into an immediate trade execution.

Despite the increasing use of computers, most decision-making is still done by human beings and is therefore subject to human error. Even at an institutional level, the use of analytical machines is anything but universal. While the success of stock market investing is based mostly on the skill of individual or institutional investors, people will continually search for the surefire method of achieving greater returns than the market averages.

It's safe to say the market is not going to achieve perfect efficiency anytime soon. For greater efficiency to occur, all of these things must happen:

- Universal access to high-speed and advanced systems of pricing analysis.

- A universally accepted analysis system of pricing stocks.

- An absolute absence of human emotion in investment decision-making.

- The willingness of all investors to accept that their returns or losses will be exactly identical to all other market participants.

It is hard to imagine even one of these criteria of market efficiency ever being met.

:max_bytes(150000):strip_icc():format(webp)/thinkstockphotos_493208894-5bfc2b9746e0fb0051bde2b8.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

IMAGES

VIDEO

COMMENTS

The EMH has three forms. The strong form assumes that all past and current information in a market, whether public or private, is accounted for in prices. The semi-strong form assumes that only ...

The Efficient Market Hypothesis is a crucial financial theory positing that all available information is reflected in market prices, making it impossible to consistently outperform the market. It manifests in three forms, each with distinct implications. The weak form asserts that all historical market information is accounted for in current ...

The Efficient Market Hypothesis (EMH) is an investment theory stating that share prices reflect all information and consistent alpha generation is impossible. ... Semi-strong efficiency: This form ...

The efficient market hypothesis takes three forms: first, the purest form is strong form efficiency, which considers current and past information. The second form is semi-strong efficiency, which includes only current and past public, and not private, information. Finally, the third version is weak form efficiency, which claims stock prices ...

Strong form efficient market hypothesis followers believe that all information, both public and private, is incorporated into a security's current price. In this way, not even insider ...

Three forms of efficient-market hypothesis. The efficient-market hypothesis says that financial markets are effective in processing and reflecting all available information with little or no waste, making it impossible for investors to consistently outperform the market based on information already known to the public. One area of debate is how ...

A replication of Martineau (2022). The efficient-market hypothesis (EMH) [a] is a hypothesis in financial economics that states that asset prices reflect all available information. A direct implication is that it is impossible to "beat the market" consistently on a risk-adjusted basis since market prices should only react to new information.

The Efficient Market Hypothesis (EMH) forms are weak, semi-strong, and strong. This theory is criticized because it has market bubbles and consistently wins against the market. Efficient Market Hypothesis Explained. Efficient market hypothesis theory is a situation in which all assets are priced to show any new or recent information. This does ...

The Efficient Markets Hypothesis (EMH) is an investment theory primarily derived from concepts attributed to Eugene Fama's research as detailed in his 1970 book, "Efficient Capital Markets: A Review of Theory and Empirical Work.". Fama put forth the basic idea that it is virtually impossible to consistently "beat the market" - to ...

Efficient Market Theory is a cornerstone of financial economics, positing that financial markets are efficient and that asset prices reflect all available information. The concept has significant implications for investment decision-making, portfolio management, and market regulation. However, the debate surrounding EMT remains ongoing, with ...

The Efficient Market Hypothesis (EMH) is one of the main reasons some investors may choose a passive investing strategy. It helps to explain the valid rationale of buying these passive mutual funds and exchange-traded funds (ETFs). ... Strong Form EMH: Strong form EMH says that all information, both public and private, is priced into stocks ...

The Efficient Market Hypothesis: ... During the next decades, more and more studies started to invalidate the hypothesis in all its three forms, weak, semi-strong and strong. In 1970, Eugene Fama published in his article, besides the definition of efficient markets, also the distinction between the three forms of efficiency â€" weak, semi ...

1 Randomness implies that there is an equal chance. time. ential tax rates andadvan. agestransactions on someinvestorscosts, relative to others.Definitions of market efficiency are also information is available to investors and of market efficiency that assumes that all in.

In studying "Market Efficiency" for the CFA Exam, you should aim to understand the Efficient Market Hypothesis (EMH) and its implications for asset pricing and investment strategies. Analyze the three forms of market efficiency—weak, semi-strong, and strong—and their impact on the ability to achieve abnormal returns.

Semi-strong form efficiency is an aspect of the Efficient Market Hypothesis that assumes that current stock prices adjust rapidly to the release of all new public information. Basics of Semi ...

Efficient Market Hypothesis Testing. Marius-Christian Frunza, in Solving Modern Crime in Financial Markets, 2016. Abstract. The efficient market hypothesis represents the foundation of the modern financial theories from derivatives valuation to capital assets pricing. Practitioners and academics are aware that most of the markets are not efficient and so have developed alternative avenues.