Learning Materials

- Business Studies

- Combined Science

- Computer Science

- Engineering

- English Literature

- Environmental Science

- Human Geography

- Macroeconomics

- Microeconomics

- Disney Pixar Merger Case Study

Disney purchased Pixar in 2006 for approximately $7.4 billion and as of July 2019, Disney Pixar feature films have earned the worldwide box office an average gross of $680 million per film.

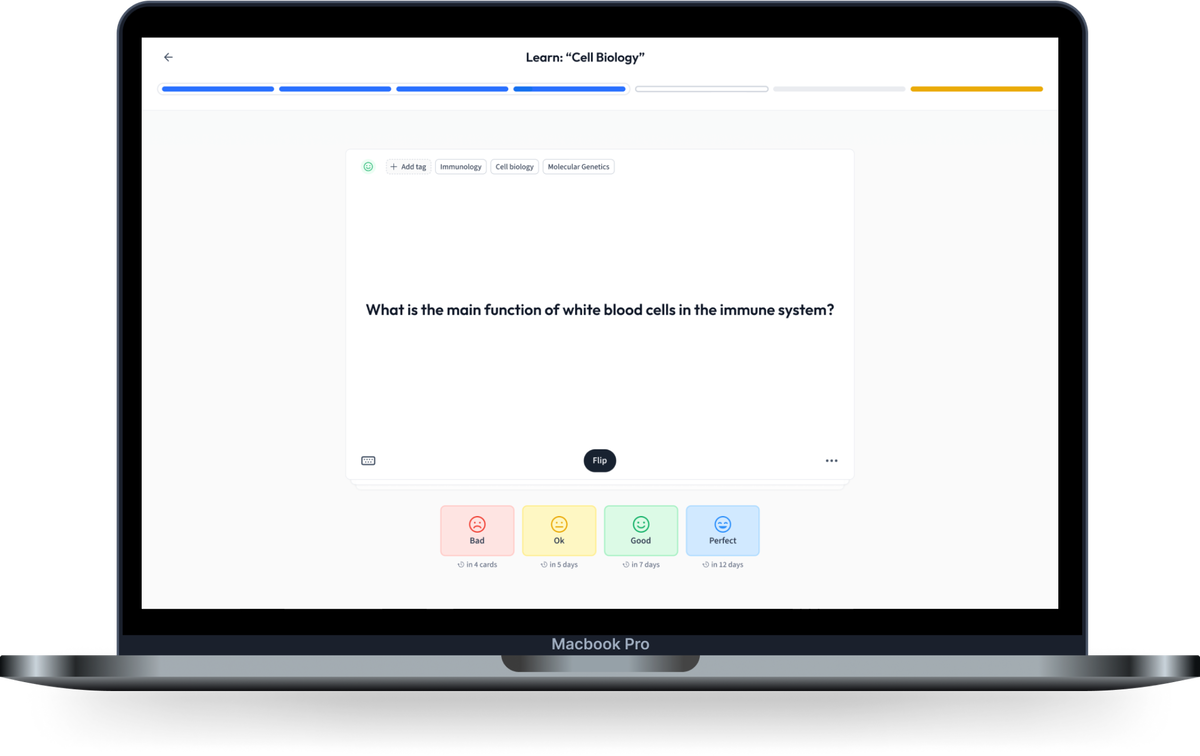

Millions of flashcards designed to help you ace your studies

- Cell Biology

How many films did Disney agree to make with Pixar in the space of 10 years?

when Disney and Pixar merged and made films, such as Toy Story and Cars, was it huge hits with consumers?

What factors led to Disney's decision to merge with Pixar?

To allow for the merger, the studios also needed to ... who would guide the growth of the company.

What is not a benefit of vertical merger?

What are the advantages of Disney-Pixar merger?

A vertical merger is the merge of two or more companies that...

Review generated flashcards

to start learning or create your own AI flashcards

Start learning or create your own AI flashcards

StudySmarter Editorial Team

Team Disney Pixar Merger Case Study Teachers

- 12 minutes reading time

- Checked by StudySmarter Editorial Team

- Actuarial Science in Business

- Business Case Studies

- Amazon Global Business Strategy

- Apple Change Management

- Apple Ethical Issues

- Apple Global Strategy

- Apple Marketing Strategy

- Ben and Jerrys CSR

- Bill And Melinda Gates Foundation

- Bill Gates Leadership Style

- Coca-Cola Business Strategy

- Enron Scandal

- Franchise Model McDonalds

- Google Organisational Culture

- Ikea Foundation

- Ikea Transnational Strategy

- Jeff Bezos Leadership Style

- Kraft Cadbury Takeover

- Mary Barra Leadership Style

- McDonalds Organisational Structure

- Netflix Innovation Strategy

- Nike Marketing Strategy

- Nike Sweatshop Scandal

- Nivea Market Segmentation

- Nokia Change Management

- Organisation Design Case Study

- Oyo Franchise Model

- Porters Five Forces Apple

- Porters Five Forces Starbucks

- Porters Five Forces Walmart

- Pricing Strategy of Nestle Company

- Ryanair Strategic Position

- SWOT analysis of Cadbury

- Starbucks Ethical Issues

- Starbucks International Strategy

- Starbucks Marketing Strategy

- Susan Wojcicki Leadership Style

- Swot Analysis of Apple

- Tesco Organisational Structure

- Tesco SWOT Analysis

- Unilever Outsourcing

- Virgin Media O2 Merger

- Walt Disney CSR Programs

- Warren Buffett Leadership Style

- Zara Franchise Model

- Business Development

- Business Operations

- Change Management

- Corporate Finance

- Financial Performance

- Human Resources

- Influences On Business

- Intermediate Accounting

- Introduction to Business

- Managerial Economics

- Nature of Business

- Operational Management

- Organizational Behavior

- Organizational Communication

- Project Planning & Management

- Strategic Analysis

- Strategic Direction

Jump to a key chapter

Due to the emergence of 3D-Computer graphic films, such as Finding Nemo (a Disney Pixar production), a competitive rise occurred in the computer graphics (CG) industry. Some of the leading companies such as DreamWorks and Pixar emerged as the most promising players in this field. During this period, Walt Disney had a few hits in 2D animation. However, due to the technological limitations of the industry, Disney was struggling to compete with the likes of Pixar.

The case is that if Walt Disney has such technological limitations, then why not acquire a company like Pixar which is skilled at 3D computer graphics? Will Pixar's freedom and creativity fit with Walt Disney's corporate governance, or will it do more harm than good? In this case study, we will investigate Walt Disney's acquisition of Pixar Animation Studios and analyse the relationship that would lead to tremendous success.

Merger of Disney and Pixar

The merger of Disney and Pixar took place in 2006 when Disney bought the Pixar company. Disney was stuck in a conundrum, still producing old-fashioned animation: the company had to innovate; otherwise, it would lose its competitive edge. On the other hand, Pixar's culture and environment were innovative and creative. Therefore, Disney saw this as the perfect opportunity for collaboration . So the two companies merged through a vertical merger.

Introduction to the case

The relationship between Disney and Pixar began in 1991 when they signed a co-production deal to create three animated films, with one of them being Toy Story released in 1995. The success of Toy Story lead to another contract i n 1997, which would allow them to produce five movies together over the next ten years.

Steve Jobs, the previous CEO of Pixar, said that the Disney-Pixar merger would allow the companies to collaborate more effectively, allowing them to focus on what they do best. The merger between Disney and Pixar allowed the two companies to collaborate without any external issues . However, investors were worried that the acquisition would threaten the Disney movie culture.

Disney and Pixar merger

Disney wanted to marry the style of their previous films with the exceptional storytelling techniques of Pixar, eventually resulting in the merger.

Before the merger took place, Disney was caught in a conundrum. The company had two choices: continue making old fashioned hand-drawn movies or make a new type of Disney movie using the digital animation that was now available due to modern technology.

Disney decided to take on the new animation culture with the help of Pixar.

Since the acquisition of Pixar, Disney has implemented some of the company's animation techniques into its films and produced Frozen. This Walt Disney Pixar movie was a box office success.

Disney has been saved in many ways by the work of Pixar Animation Studios. Pixar came in and created eye-catching animated movies that were under the Disney name. However, this also posed a problem, as Disney had lost its animation culture. They were no longer catching the eye of the public with their hand-drawn movies. However, when Disney and Pixar, made films together, they were always big hits.

Pixar case study strategic management

The success of Pixar Animation can be attributed to its unique and distinctive way of creating characters and storylines. Due to the company's unique and innovative approach , they have been able to stand out from the rest of the industry.

Pixar pushed itself to invent its own unique animation techniques. They needed to find a way to attract and retain a creative group of artists that would help them become a successful company.

Aside from technology, Pixar also has a culture that values creativity and innovation. This is evidenced by the company's commitment to continuous improvement and employee education . Ed Catmull has been instrumental in developing the creative department and ensuring that everyone is on the same page. This is also evidenced by the requirement that every new employee spends ten weeks at Pixar University. This program is focused on employee preparation and development . It is also used to prepare new employees for the company's creative department.

To learn more about the internal environment of an organization, take a look at our explanations on human resource management .

Disney and Pixar merger explained

In a vertical merger , two or more companies that produce the same finished products through different supply chain functions team-up. This procedure helps in creating more synergies and cost-efficiency.

A vertical merger can help boost profitability, expand the market, and reduce costs .

For instance, when Walt Disney and Pixar merged, it was a vertical merger because the former has a specialization in distribution whilst also having a strong financial position and the latter owned one of the most innovative animation studios. These two companies were operating at different stages and were responsible for the production of great movies all around the world.

The merger of Walt Disney and Pixar was among the most successful corporate transactions in recent years. It was mainly due to the companies' negotiations. When the preliminary analysis was done, it showed that the merger would be beneficial for both the companies and consumers.

The merger of Disney and Pixar is based on two alliances.

The Sales Alliance involves both the Disney and Pixar companies working together to maximize the profits from their products.

The Investment Alliance, whereby Disney and Pixar have got into an alliance in which they will share profits from the movies.

Disney and Pixar merger analysis

As a result of the merger, Disney and Pixar were able to capitalize on the potential of Pixar to create a brand-new generation of animated movies for Disney. This is also evidenced by the revenue generated from the movies made together by both Disney and Pixar.

Investors saw the potential of the computer-animated character to be used in Disney's vast network market.

The revenue achieved by Cars was about $5 million.

Walt Disney and Pixar also developed other successful films together such as Toy Story and The Incredibles.

Disney kept Pixar's management in place to ensure a smooth transition. This was also necessary for the growth of trust that would allow Steve Jobs to approve the merger. Because of the disruption that Steve had at Disney, the companies had to create a set of guidelines that would safeguard the creative culture of Pixar when acquiring the company.

To allow for the merger, the studios also needed to create a strong team of leaders who would guide the growth of the company.

To learn more about the role of organizational culture have a look at our explanation on change management .

Disney-Pixar merger synergy

Synergy refers to the combined value of two companies, which is greater than the sum of their individual parts. It is often used in the context of mergers and acquisitions (M&A).

Pixar's successful acquisition with Disney has been incredibly profitable, with the company releasing over 10 full feature animated films globally, all of them reaching a total gross of over $360,000,000. Through the years, Disney and Pixar have been able to successfully combine forces and create a profitable business model. Over the course of 18 years, these Disney Pixar films have grossed over $7,244,256,747 worldwide. With a gross profit of $5,893,256,747.

The merger of Disney and Pixar has resulted in greater creative output. Since the acquisition, Disney-Pixar has plans to release movies twice a year as Pixar has the technology to help do so. The value and performance of the Disney and Pixar merger have been very successful because they have made large profits (e.g. Toy Story, A Bugs life, Cars). These have been produced using Pixar technology. This has also benefited Pixar as Disney has given large amounts of funding for their studios so they can create these films and use Disney's name to reach a larger audience, resulting in a synergy.

Pros and cons of the Disney-Pixar merger

One of the most successful mergers in history was the Walt Disney and Pixar merger. Although many mergers fail, they can also be successful.

In most cases, the merger brings advantages such as lower cost of production, better management team, and increased market share but they can also cause job losses and bankruptcy. Most mergers are highly risky but with the right knowledge and intuition, they can succeed. Below is the list of pros and cons of the Walt Disney and Pixar merger.

Pros of Disney-Pixar merger

The acquisition gave Walt Disney access to Pixar's technology, which was very important to them. It also provided Walt Disney with new characters that would help the company create new revenue streams.

Walt Disney also had its existing famous animated characters it could provide Pixar.

Walt Disney also gained market power by acquiring another rival company (Pixar). This would make both Walt Disney and Pixar companies have a stronger position in the market.

Walt Disney had a larger budget , which allowed Pixar to explore other opportunities that they might not have had the resources to pursue. Also, due to Walt Disney having more financial resources, they were able to start more projects and provide more security.

The acquisition would allow Steve Jobs to put Walt Disney content in the App Store, which would provide more revenue for Walt Disney and Pixar.

Walt Disney's large size gives it many advantages, such as a large human resource base, many qualified managers and a large amount of funds.

Pixar is known for its technological expertise in 3D animation. Their in-house creativity is the reason why they can create such innovative films. This was important for Disney to acquire, as they were lacking technological expertise in 3D animation.

Pixar mainly focuses on quality , and this is what makes Pixar different from other companies. They also use the bottom-up approach , where the input of their employees is highly valued.

Cons of Disney-Pixar merger

There were differences in the structure of Walt Disney and Pixar company, with Pixar artists no longer being independent , and Walt Disney now making most of the decisions.

A cultural clash between Walt Disney and Pixar took place. Since Pixar had built an environment based on its innovative culture, Pixar was worried that it would be ruined by Disney.

Conflicts between Walt Disney and Pixar occurred because of the takeover. This happened because of the hostile environment that often accompanies a takeover, which resulted in disagreements between the management and the other parties involved.

When it came to the creative freedom of Pixar, it had a fear that its creation would be restricted under Walt Disney's acquisition.

The main reason for the merger between Disney and Pixar was for Walt Disney to acquire and use the modern animation technology of Pixar to expand its reach in the market, whereas Pixar was now able to use Walt Disney's vast distribution network and funds. The acquisition gave Disney new ideas and technology, which helped the company produce more blockbuster movies. The negotiation that led to the Disney-Pixar merger was also instrumental in the company's success. This was also the reason for the huge revenue that was generated together by both companies.

Disney Pixar Merger Case Study - Key takeaways

In 1991, Walt Disney and Pixar Animation Studios established a relationship that would lead to tremendous success.

Walt Disney purchased Pixar company in 2006 for approximately $7.4 billion.

Walt Disney wanted to marry the style of their previous films with the exceptional storytelling techniques of Pixar.

The merger of Walt Disney and Pixar was among the most successful corporate transactions in recent years. It was mainly due to the companies' negotiations.

Pixar's successful partnership with Walt Disney has been incredibly profitable, with the company releasing over 10 full feature animated films globally, and all of them reaching a total gross of over $360 million.

The main reason for the merger between Disney and Pixar was for Walt Disney to acquire and use the modern animation technology of Pixar to expand its reach in the market, whereas Pixar was now able to use Walt Disney's vast distribution network and funds.

The New York Times: Disney Agrees to Acquire Pixar. https://www.nytimes.com/2006/01/25/business/disney-agrees-to-acquire-pixar-in-a-74-billion-deal.html

Flashcards in Disney Pixar Merger Case Study 14

True or False?

The acquisition gave Walt Disney access to Pixar's technology, which was very important to them. It also provided Walt Disney with new characters that would help the company create new revenue streams.

Pixar is known for its technological expertise in 2D animation. Their in-house creativity is the reason why they can create such innovative films.

A cultural clash between the Walt Disney and Pixar was involved. Since Pixar had built a culture around their corporate culture, Pixar was worried that theirs would be ruined by Disney.

The merger of Walt Disney and Pixar was among the most successful corporate transactions in recent years?

Learn with 14 Disney Pixar Merger Case Study flashcards in the free StudySmarter app

We have 14,000 flashcards about Dynamic Landscapes.

Already have an account? Log in

Frequently Asked Questions about Disney Pixar Merger Case Study

Why was the Disney Pixar merger a success?

The merger of Walt Disney and Pixar was among the most successful corporate transactions in recent years. It was mainly due to the companies' negotiations. When the preliminary analysis was done, it showed that the merger would be beneficial for both the companies and consumers. The value and performance of the Disney and Pixar merger have been very successful because they have made large profits

What type of merger were Disney and Pixar?

Disney and Pixar merger was a vertical merger. In a vertical merger , two or more companies that produce the same finished products through different supply chain functions team up. This procedure helps in creating more synergies and cost-efficiency.

How can the synergies between Disney and Pixar be developed?

Since the acquisition, Disney-Pixar has plans to release movies twice a year as Pixar has the technology to help do so. This has also benefited Pixar as Disney has given large amounts of funding for their studios so they can create these films and use Disney's name to reach a larger audience, resulting in a synergy.

What happened when Disney bought Pixar?

Pixar's successful acquisition with Disney has been incredibly profitable, with the company releasing over 10 full feature animated films globally, all of them reaching a total gross of over $360,000,000.

Was acquiring Pixar a good idea?

Yes, acquiring Pixar was a good idea because Pixar's successful partnership with Walt Disney has been incredibly profitable, with the company releasing over 10 full feature animated films globally, all of them reaching a total gross of over $360 million.

Test your knowledge with multiple choice flashcards

True or False?The acquisition gave Walt Disney access to Pixar's technology, which was very important to them. It also provided Walt Disney with new characters that would help the company create new revenue streams.

True or False?Pixar is known for its technological expertise in 2D animation. Their in-house creativity is the reason why they can create such innovative films.

True or False?A cultural clash between the Walt Disney and Pixar was involved. Since Pixar had built a culture around their corporate culture, Pixar was worried that theirs would be ruined by Disney.

Join the StudySmarter App and learn efficiently with millions of flashcards and more!

Keep learning, you are doing great.

Discover learning materials with the free StudySmarter app

About StudySmarter

StudySmarter is a globally recognized educational technology company, offering a holistic learning platform designed for students of all ages and educational levels. Our platform provides learning support for a wide range of subjects, including STEM, Social Sciences, and Languages and also helps students to successfully master various tests and exams worldwide, such as GCSE, A Level, SAT, ACT, Abitur, and more. We offer an extensive library of learning materials, including interactive flashcards, comprehensive textbook solutions, and detailed explanations. The cutting-edge technology and tools we provide help students create their own learning materials. StudySmarter’s content is not only expert-verified but also regularly updated to ensure accuracy and relevance.

Team Business Studies Teachers

Study anywhere. Anytime.Across all devices.

Create a free account to save this explanation..

Save explanations to your personalised space and access them anytime, anywhere!

By signing up, you agree to the Terms and Conditions and the Privacy Policy of StudySmarter.

Sign up to highlight and take notes. It’s 100% free.

Join over 22 million students in learning with our StudySmarter App

The first learning app that truly has everything you need to ace your exams in one place

- Flashcards & Quizzes

- AI Study Assistant

- Study Planner

- Smart Note-Taking

Arts & Entertainment, Business

Taking Giant Swings: Pixar Acquisition Case Study

Lesson time 24:55 min

Bob breaks down the acquisition of Pixar, including his strategy to convince Steve Jobs—the head of Pixar—and the Disney board. He explains how he overcame the odds with the acquisition and why it was essential to Disney’s future success.

Students give MasterClass an average rating of 4.7 out of 5 stars

Topics include: The Importance of Animation to The Walt Disney Company • Repairing the Relationship Between Steve Jobs and Disney • Getting Steve Jobs on Board • Successfully Merging Cultures • The Payoff

Teaches Business Strategy and Leadership

Disney CEO Bob Iger teaches you the leadership skills and strategies he used to reimagine one of the world’s most beloved brands.

- Great. - Woody, the rocket! - The match! Yes! Thank you, Sid. [CAR APPROACHES] No, no, no, no. No. No, no, no, no, no, no, no. No. - Woody, what are you doing? - Hold still, Buzz. [WOODY LAUGHS] - You did it. Next stop Andy! - Wait a minute. I just lit a rocket. Rockets explode! [ROCKET BOOMS] [LIGHTHEARTED MUSIC] - I think as you look back on something, it seems like it's always the result of a grand plan that was plotted out as you embarked on whatever the endeavor happened to be. It's not always that way, in particular with Steve Jobs and ultimately our acquisition of Pixar. There were a number of steps that I took along the way that were each designed to make some progress in terms of strengthening the relationship or continuing the relationship between Pixar and Disney. But when I began that discussion, or when I embarked on that journey, I didn't necessarily have the end in mind that we ultimately ended up concluding or delivering. I didn't know that it would end up with us acquiring Pixar. When I became the CEO of Disney in 2005, Disney had been through about a decade of struggle when it came to Disney Animation. If you look at the history of the Walt Disney Company going all the way back to the '20s and '30s to the great year of Walt Disney, as animation went, so went the Walt Disney Company. In other words, in times that the company was making great animated films, the overall company soared. You could go back and look at "Snow White" and "Cinderella" and "Dumbo" and "Pinocchio" and "Sleeping Beauty," great movies that Walt made, and then you could dissolve to our move forward to the '80s and the '90s and Michael Eisner's era, the period of "Little Mermaid" and "Beauty and the Beast" and "Aladdin" and, ultimately, "Lion King--" great films, great animated films from Disney Animation, and the company had achieved just phenomenal success. Because Disney had been struggling in animation for about a decade, I knew that my first priority becoming CEO was to turn Disney Animation around. I also knew that if I didn't do that, that my tenure as CEO was likely to be short lived. When I thought about how best to turn Disney Animation around, obviously all roads lead to people. I needed talented people, talented leadership in particular to take the reins at Disney Animation and redirect where we were creatively. And I immediately concluded that the best animators and the best animation leadership was at Pixar. - One of the things that I'm proudest of Pixar of is we have a story crisis on every movie, and production's rolling, and there's mouths to feed, and something's just not working, and we stop. We stop, and we fix the story. - Steve was the controlling shareholder of Pixar, and Pixar had been in a relationship with Disney for quite some time where there was co-funding of their pictures and co-ownership, and Disney marketed and distributed their films. ...

About the Instructor

In an era of disruption, Disney CEO Bob Iger led one of the world’s most beloved brands to unprecedented success with the acquisitions of Pixar, Marvel, and Lucasfilm. Now, through case studies and lessons from 45 years in media, Bob teaches you how to evolve your business and career. Learn strategies for expanding a brand, leading with integrity, and making big moves—from risk management to the art of negotiation.

Featured MasterClass Instructor

- Harvard Business School →

- Faculty & Research →

- March 2009 (Revised November 2021)

- HBS Case Collection

The Walt Disney Company and Pixar Inc.: To Acquire or Not to Acquire?

- Format: Print

- | Language: English

- | Pages: 28

About The Authors

Juan Alcacer

David J. Collis

Related work.

- Faculty Research

- The Walt Disney Company and Pixar Inc.: To Acquire or Not to Acquire? By: Juan Alcacer, David J. Collis and Mary Furey

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Download Free PDF

Disney & Pixar Acquisition: Case Analysis

Related papers

Criticism, 2017

This essay reads Pixar’s ecocatastrophe narrative WALL-E (2008) as an extended meditation on the spatial and economic character of the brand. At once an allegory for Pixar’s corporate history and brand identity, WALL-E also registers concern about the economic configuration of brand value itself---namely by foregrounding the relation between the fictional megabrand Buy n Large’s immaterial assets and their material contexts. Appearing in theaters on the eve of the 2008 financial crisis that would make clear a disjunction between physical assets (like homes) and the market for intangibles (like derivatives) with which they were becoming increasingly bound up, WALL-E aims in part to assess imminent crises both economic and ecological by linking BnL's productless information economy aboard the starship Axiom to the concrete, devastated infrastructures on Earth that underwrite this economy. But the film also invokes, in symptomatic fashion, the reparative de- and re-materializing value of Pixar’s “responsible” managerial capital---namely by modeling Pixar’s brand equity as a species of value that exists beyond material reality yet retains the power to withstand---and even recuperate---material losses. I supplement the essay with readings of Apple’s 2014 Environmental Responsibility Campaign, “Better,” as well as signature “green” architectural projects commissioned by Silicon Valley tech giants including Apple, Facebook, Google, and Amazon, to argue that these artifacts, too, bear the brand’s imprint as a core mode of production within the new economies, encoding visions of value accumulating within closed, “responsible” economies of immaterial labor, barred from and seemingly impervious to material circumstance.

Case overview –This case contains detailed information about Walt Disney Co. that gives knowledge about its business environment, acquisitions & merger, market position & company performance. This study traces the reporting of the financial performance in Walt Disney as compared to the industry. Walt Disney was established in 1923 with a small sketch but now it is a giant as well as the market leader. Walt Disney is a market leader for a long time and is operating efficiently in the market. This case study illustrates its financial performance by comparing its financial data from 1999 to 2013. The company is growing year over year through acquisitions and mergers with the other firms. The company’s performance has been analyzed through various analysis and financial techniques to elaborate the actual financial condition of the company. The experiences gained from the current study will serve the businesses in entertainment industry through providing help full insights for the tactful strategies & elimination of financial risks. The unique analysis of the market helps to manage business environment. Also play a significant role in the development of a theoretical base for further research studies in the field of finance as well as for learning purposes. Expected learning outcomes – The objective of this case study is to demonstrate the critical success factors particularly in financial terms which provides a solid base for a business group to sustain its competitive position & market leader in the industry. The readers are expected to get numerous benefits from this case study. Like an understanding of calculation & interpretation of basis financial ratios & its implications for investors, creditors & financial managers which strengthen their decision making, and it also help researchers who keen about this industry, significance of various financial analyses for a business organization. Keywords: Walt Disney, Entertainment Diversified Industry, Financial Ratio analysis

Proceedings of DRUID Summer Conference, 2004

Paper to be presented at the DRUID Summer Conference 2004 on ... Theme B: Competence Building and its Institutional Underpinnings ... PRODUCTION AND POLITICAL ECONOMY IN THE ANIMATION INDUSTRY: WHY INSOURCING AND OUTSOURCING OCCUR

Loading Preview

Sorry, preview is currently unavailable. You can download the paper by clicking the button above.

Related topics

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

- Share full article

Advertisement

Supported by

Disney and Pixar: The Power of the Prenup

By Brooks Barnes

- June 1, 2008

Los Angeles

IN April, the Walt Disney Company summoned movie theater executives for a rare audience before its reigning king of animation, John Lasseter. A co-founder of Pixar and director of “Toy Story,” Mr. Lasseter was unveiling the roster of films that an aligned Pixar and Walt Disney Animation Studios planned to release over the next four years.

Walking onstage wearing one of his trademark Hawaiian shirts this one with yellow and green palm trees Mr. Lasseter was greeted by giggles and pointing from a smattering of audience members.

“What did you think I’d wear?” he asked amid the titters. A business suit and a pair of mouse ears, most likely.

When Disney bought its rival, Pixar, in 2006 for $7.4 billion, many people assumed the deal would play out like most big media takeovers: abysmally. The worries were twofold: that either Disney would trample Pixar’s esprit de corps (turning Mr. Lasseter into a drone, chanting “Hi Ho” en route to Mickey’s animation mines) or that Pixar animators would act like spoiled brats and rebuke their new owner.

Both companies had a history of acrimony, and Robert A. Iger, the new chief executive of Disney, was a mystery. Could he manage the megawatt personalities Pixar would bring into Disney’s fold? Some analysts, investors and media pundits also questioned the hefty price Disney paid for a small studio that released only one movie a year.

But two years into the integration of Pixar and as the company rolls out “Wall-E,” a risky love story about robots that is estimated to cost at least $180 million the merger is notable for how well it’s faring. Indeed, in an industry where corporate marriages often create internal warfare (Paramount and DreamWorks SKG are the most prominent example) Disney and Pixar have found a way to make it work.

“Most acquisitions, particularly in media, are value-destroying as opposed to value-creating, and that certainly has not turned out to be the case here,” said David A. Price, author of a newly published book from Knopf, “The Pixar Touch: The Making of a Company.”

The smooth ride so far, at least also seems to be pleasing Wall Street, where grumbling about Pixar’s price tag has died down. Disney’s stock has climbed 28 percent since its 52-week low on Jan. 22, in large part because of investor confidence that the company can overcome a difficult economy by leveraging Pixar’s computer-generated characters across its vast empire. In recent months, Disney’s shares have significantly outperformed those of most of its competitors.

“Cars” tells the story. The film was regarded by some critics as one of Pixar’s weaker storytelling efforts, and it generated soft foreign sales when compared with hits like “Finding Nemo.” But “Cars” has pumped billions in profit into Disney via a wide range of ancillary businesses.

The film racked up over $460 million in global ticket sales and has sold 27 million DVDs. Related retail products have generated $5 billion in sales. A “Cars” virtual world is opening on the Internet, a “Cars” ice-skating show will begin touring the nation in September, and work is under way to bring an entire “Cars” experience to the Disneyland Resort in California.

“You can accomplish a lot more as one company than you can as part of a joint venture,” Mr. Iger said in an interview. “It makes a big difference when everyone is working for the same set of shareholders.”

IN a subtle but important shift, Pixar has matured, allowing its strategic thinking to evolve inside a sprawling corporation. For instance, some of the studio’s executives once resisted sequels and direct-to-DVD efforts, arguing that quality and the brand could suffer. While sequels were not out of the question, they said Pixar’s hot streak hinged on pushing boundaries with original material.

But at Mr. Lasseter’s presentation in April, Disney’s first such event in 10 years, he announced “Cars 2,” a 2012 sequel that will take Lightning McQueen and his pals on a tour of foreign countries. Also in the works are four direct-to-DVD movies built around Tinker Bell.

“We are definitely planning on doing more sequels, just as we are more originals,” Mr. Lasseter said in an interview. “We talk with Bob Iger about which ones make sense to do from a business perspective. But each movie has to be absolutely great or you will snuff out a franchise.”

And the Pixar team, which also has oversight of Walt Disney Animation Studios and the DVD-focused DisneyToon Studios, decided that it was O.K. to outsource some direct-to-DVD animation to an Indian company, a departure from its rigid stance that outside animators could not deliver the necessary quality. (Mr. Lasseter will still closely monitor the efforts, however.)

For the first time, Pixar is also scheduled to deliver two movies in a single year: “Newt,” the story of a salamander’s search for love, and “The Bear and the Bow,” an action-adventure starring an imperious Scottish princess; both films will arrive in multiplexes in 2011.

How Disney and Pixar are making the integration work holds lessons for other executives faced with the delicate task of uniting two cultures. Tactics that have served the companies well include the obvious, like effectively communicating changes to employees. Other decisions, including drawing up an explicit map of what elements of Pixar would not change, have been more unusual.

“None of this has been easy,” said Richard Cook, chairman of Walt Disney Studios, “but it helps when everyone has tremendous respect both professionally and personally for one another.”

Mutual respect was scarce at the two companies just three years ago.

Pixar, based in Emeryville, Calif., and Disney, with its headquarters in Burbank, Calif., had a notoriously strained relationship. Pixar’s chairman and chief executive, Steven P. Jobs, abruptly called off talks to continue a lucrative partnership with Disney, which had helped to finance and distributed such Pixar films as “Monsters, Inc.”

Mr. Jobs, also the chief executive of Apple, had bitterly clashed with Michael D. Eisner, who was then running Disney. The rift encompassed many issues, not the least of which was basic trust. In one incident, Mr. Eisner disparaged an Apple advertising slogan before a Congressional committee and then claimed that he hadn’t even though his testimony had been transcribed.

The end result was that Mr. Jobs and others at Pixar didn’t place much faith in what their Disney counterparts told them.

After Mr. Iger took the reins at Disney, he restarted acquisition talks and won some early support at Pixar by talking candidly and clearly about the lessons he learned when his previous employer, the ABC television network, endured two takeovers. Pixar executives recall Mr. Iger joking that if he ever decided to write a book, it would be titled “I’ve Been Bought,” because the two merger experiences were so formative for him.

Edwin Catmull, the president of Pixar who was also put in charge of Walt Disney Animation Studios, said, “It became very clear to us that Bob Iger had been through mergers before, both positive and negative.”

Mr. Iger also agreed to an explicit list of guidelines for protecting Pixar’s creative culture. For instance, Pixar employees were able to keep their relatively plentiful health benefits and weren’t forced to sign employment contracts. Mr. Iger even stipulated that the sign on Pixar’s front gate would remain unchanged.

Still, Mr. Catmull concedes that trust didn’t come easily, especially in an age when some companies promise one thing before a merger and then seem to do another once the deal is done.

“It took about a year before there was a collective letting down the guard,” he said. “Initially people were thinking, ‘Is something going to happen?’ ”

Regarding Disney’s list of promises, Mr. Catmull said: “We’ve never had to go back and look at it. Everything they’ve said they would do they have lived up to.”

Mr. Jobs, who became Disney’s largest shareholder and a board member as a result of the transaction, did not respond to interview requests.

In most acquisitions, the conqueror typically reigns supreme. When NBC bought Universal Studios, executives at the movie studio in Los Angeles were overnight required to start commuting to New York for grueling financial planning meetings at the behest of NBC’s owner, General Electric.

Employees were also startled to wake up on the morning after the acquisition announcement to find that their e-mail addresses had already been altered to “nbcuni.”

An NBC Universal spokeswoman declined to comment. Although analysts generally think that Universal Pictures has been well served by the G.E. takeover, they cited the company’s aggressive handling of the merger as one reason the studio’s respected chairwoman, Stacey Snider, quit the company.

But in the Pixar acquisition, Disney, despite its legendary corporate identity and strong will, held back. Pixar kept its e-mail system. Nobody was shipped to Walt Disney World in Florida to work a shift, part of the initiation that other executives must endure. No switchboard operators at Pixar were asked to end telephone calls with the words “Have a magical day,” as they do elsewhere in the company.

And, of course, Mr. Lasseter continued to wear whatever he wanted, Hawaiian shirts and all.

In fact, a deep Disney “introduction and visit” didn’t come until this spring, when a random selection of 200 of Pixar’s 800 employees spent the day in Burbank touring the live-action studio and consumer products division.

“There is an assumption in the corporate world that you need to integrate swiftly,” Mr. Iger said. “My philosophy is exactly the opposite. You need to be respectful and patient.”

Key to the successful integration, analysts say, has been Mr. Iger’s decision to give incoming talent added duties. Instead of just buying Pixar and moving on, Mr. Iger understood what made the acquisition valuable, said Mr. Price, the author. “If you are acquiring expertise,” he said, “then dispatch your newly purchased experts into other parts of the company and let them stretch their muscles.”

In Disney’s case, Pixar was assigned the difficult task of turning around a storied animation department that had fallen into disrepair as it struggled to find its footing in a new world of computer-generated pictures. At a low point, the 2002 film “Treasure Planet” flopped so badly that Disney was forced to take a $98 million write-down.

A window into how the rebuilding effort is going will come on Nov. 26, with the release of “Bolt,” the tale of a Hollywood dog star who becomes lost in New York and has to make his way back to California. Mr. Lasseter and his team have heavily reworked the project, including playing up a wickedly funny side character, a hamster.

Although some bloodletting has been involved in Pixar’s efforts to rebuild the studio the original director of “Bolt” was replaced, resulting in some hurt feelings Mr. Lasseter said he was pleased with the way the transformation was progressing. “We were very nervous coming in, but to see the change has been amazing,” he said. “Disney has become a filmmaker-led studio and not an executive-led studio. We are very proud of that.”

The relationship could still sour, of course, and big tests loom.

Still very much a work in progress is the turnaround of Walt Disney Animation Studios, where it has taken Mr. Catmull and Mr. Lasseter longer than investors anticipated to sort through the pipeline of existing projects and begin green-lighting new ones.

Disney’s plans for hand-drawn animation are unclear, with only one project currently announced: “The Princess and the Frog,” a musical set in New Orleans that is scheduled to have its premiere in December 2009. A Disney spokeswoman said animators were deeply immersed in marrying older hand-drawn techniques with new technology for future movies, adding that plans for a new headquarters for Disney’s Burbank animators were slowly progressing.

PIXAR’S list of coming movies includes some with unusual concepts that might not lend themselves to the kind of merchandising tie-ins that have made “Cars” a juggernaut. “Up,” the next big Pixar film after “Wall-E,” is a comedy about a cranky, cane-wielding 78-year-old who transports his home to exotic locales by attaching hundreds of helium-filled balloons.

With the exception of “Up,” which is being directed by Pete Docter (“Monsters, Inc.”), Pixar is placing some of its biggest new projects in relatively untested hands. Brenda Chapman, the director of Pixar’s first fairy tale, “The Bear and the Bow,” served as a story supervisor on modern classics like “The Lion King” but has only one previous directing job under her belt, for “The Prince of Egypt.”

Of course, Mr. Lasseter will be helping to guide the way, but he must cope with extreme demands for his time. Aside from overseeing an ambitious slate of movies, Mr. Lasseter, who now shuttles between Burbank, near Los Angeles, and Emeryville, outside San Francisco, is involved in everything from approving special effects for the coming “Cars” ice tour to helping design theme-park attractions.

He also has new corporate responsibilities, from schmoozing with important investors to helping to push Disney’s efforts with high-definition Blu-ray DVDs. All of this juggling, some people say, has made him somewhat inaccessible. One Pixar insider, who requested anonymity because he was not authorized by the company to speak, joked that scheduling a meeting with Mr. Lasseter has become harder than “lining up a chat with the pope.”

Mr. Lasseter, speaking by cellphone during a commute home, said: “The toughest part of my job is probably just managing my schedule. But I think everything is going pretty well.” He added that there have been times in the past such as when he was directing “Cars” that his walk around time at Pixar was limited. “It ebbs and flows,” he said.

FOR now, attention is focused on “Wall-E.” Directed and written by Andrew Stanton, the creative force behind “Finding Nemo,” the picture tells the story of a cuddly trash-compacting robot who lives on an abandoned, heavily polluted Earth 700 years in the future. His sidekick is a perky cockroach named Hal.

“Wall-E,” which features long sequences without dialogue, is under extra pressure to perform at the box office because of soft initial receipts for a recent Disney film, “The Chronicles of Narnia: Prince Caspian.” Adding to the weight are Pixar’s last three films; though all were blockbusters, they have gradually trended downward at the domestic box office. A reversal would quiet critics who say the studio’s best days are behind it. (Disney notes that an increase in foreign box office sales has offset the slide.)

As with “Cars,” Disney is counting on “Wall-E,” set for release on June 27, to take off with a tough crowd: little boys. It has prepared a collection of 300 robot-themed consumer products that will arrive on store shelves over the next month.

“There are some great toys, and we are working on a variety of potential applications for our parks,” said Mr. Iger in a conference call with analysts on May 6. “So we are poised to take advantage of broad and deep success when it comes.”

(He added that he has particularly high hopes for a “Wall-E” remote-controlled robot. “Having played with it, I think it’s going to be a hot seller for Christmas,” he said.)

Wall Street, which closely monitors major animated movies because of their huge cost, is not yet sold on the robot, which was been criticized by some as looking too much like the star of the corny 1986 film “Short Circuit.”

“I can see how it could work and be huge and I can see how it could not,” said Richard Greenfield, an analyst at Pali Research.

By contrast, the competing DreamWorks Animation has received applause for its coming “Kung Fu Panda,” featuring the vocal talents of Jack Black and Angelina Jolie. Ingrid Chung, a media analyst at Goldman Sachs, said recently that she found the film’s concept and execution “strong enough to create a franchise.” When it came to Pixar, Ms. Chung declined to comment.

Detractors might recall that Road Runner and Wile E. Coyote, two of the most beloved cartoon characters of all time, never uttered a word to each other. And movie theater executives, typically tough to please, reacted with robust laughter and applause during a 30-minute peek at “Wall-E” in April.

“It’s some of the best work I’ve ever seen,” said Mr. Catmull, standing in the aisle of the theater afterward as confetti sprinkled from the ceiling. “I am confident it will be the next success story for Disney and Pixar.”

Safalta Exam Preparation Online

Disney's acquisition of pixar: case study on creativity and collaboration.

- Whatsapp Channel

Safalta Expert Published by: Aditi Goyal Updated Mon, 11 Sep 2023 06:11 PM IST

Free Demo Classes

Register here for Free Demo Classes

Waw! Just one step away to get free demo classes.

Source: Safalta.com

Disney's Acquisition of Pixar

What was the first Pixar film released after Disney's acquisition?

How did steve jobs influence the deal between disney and pixar, what were disney's initial concerns about the acquisition of pixar, which films are mentioned as examples of successful collaboration between disney and pixar, how did the collaboration between disney and pixar impact the animation industry as a whole.

Start Learning & Earning

- Digital Marketing

- Job Ready Courses

- Graphic Designing

- Advance Excel

Trending Courses

Master Certification in Digital Marketing Programme (Batch-17)

Now at just ₹ 64999 ₹ 125000 48% off

Professional Certification Programme in Digital Marketing (Batch-11)

Now at just ₹ 49999 ₹ 99999 50% off

Advanced Certification in Digital Marketing Online Programme (Batch-29)

Now at just ₹ 21999 ₹ 35999 39% off

Advance Graphic Designing Course (Batch-12) : 100 Hours of Learning

Now at just ₹ 16999 ₹ 35999 53% off

Flipkart Hot Selling Course in 2024

Now at just ₹ 10000 ₹ 30000 67% off

Advanced Certification in Digital Marketing Classroom Programme (Batch-3)

Now at just ₹ 29999 ₹ 99999 70% off

Basic Digital Marketing Course (Batch-24): 50 Hours Live+ Recorded Classes!

Now at just ₹ 1499 ₹ 9999 85% off

WhatsApp Business Marketing Course

Now at just ₹ 599 ₹ 1599 63% off

Advance Excel Course

Now at just ₹ 2499 ₹ 8000 69% off

अपनी वेबसाइट पर हम डाटा संग्रह टूल्स, जैसे की कुकीज के माध्यम से आपकी जानकारी एकत्र करते हैं ताकि आपको बेहतर अनुभव प्रदान कर सकें, वेबसाइट के ट्रैफिक का विश्लेषण कर सकें, कॉन्टेंट व्यक्तिगत तरीके से पेश कर सकें और हमारे पार्टनर्स, जैसे की Google, और सोशल मीडिया साइट्स, जैसे की Facebook, के साथ लक्षित विज्ञापन पेश करने के लिए उपयोग कर सकें। साथ ही, अगर आप साइन-अप करते हैं, तो हम आपका ईमेल पता, फोन नंबर और अन्य विवरण पूरी तरह सुरक्षित तरीके से स्टोर करते हैं। आप कुकीज नीति पृष्ठ से अपनी कुकीज हटा सकते है और रजिस्टर्ड यूजर अपने प्रोफाइल पेज से अपना व्यक्तिगत डाटा हटा या एक्सपोर्ट कर सकते हैं। हमारी Cookies Policy , Privacy Policy और Terms & Conditions के बारे में पढ़ें और अपनी सहमति देने के लिए Agree पर क्लिक करें।

Download App for Live stream

Live stream is currently not available on web. Kindly download our app.

Popular Searches

- Current Affairs

Most Popular Exams

- CBSE Term 2

You have awarded with Avid Reader-3 for reading 50 ebooks on safalta.com. Keep learning and earn coins and badges.

- Disney and Pixar Merger

- Post last modified: 17 March 2023

- Reading time: 5 mins read

- Post category: Operation Management

This Case Study discusses the case of successful acquisition of Pixar by Disney. It is concerning Corporate Level Strategy .

In 2006, The Walt Disney Company bought Pixar at a value of $7.4 billion, which was one of the biggest transactions made in the animation industry.

The Walt Disney Company was founded in 1923 by Walt and Roy Disney and is known as one of the largest media and entertainment corporations in the world. Pixar Animation Studios, on the other hand, began its journey in 1979 as Graphics Group, a part of the Computer Division of Lucasfilm.

It was acquired by Steve Jobs, the co-founder of Apple Computer, in 1986. Pixar is known as one of the most prominent leaders in the animation industry for its film studio based in Emeryville, California. The studio has earned 16 Academy Awards, 7 Golden Globes, and 11 Grammy Awards, along with many other awards and acknowledgments.

Disney had already been working with Pixar since 1991. It used to look after the distribution of Pixar’s animated films. However, in 2004, due to the differences with Disney’s then-CEO Michael Eisner, Pixar announced that it would partner with another distribution company. But things changed as Robert Iger took over from Eisner in 2005 and revitalized talks with Pixar.

The talk ended up in the successful acquisition of Pixar by Disney which made Steve Jobs, the ex-CEO of Apple Computer Inc., the major shareholder in Disney with an equity stake of around 7%. Not only this, but Jobs had also become a member of Disney’s Board of Directors.

As per Disney’s press release, this acquisition combines Pixar’s preeminent creative and technological resources with Disney’s unparalleled portfolio of world-class family entertainment, characters, theme parks, and other franchises, resulting in vast potential for new landmark creative output and technological innovation that can fuel future growth across Disney’s businesses.

Analysts said that the deal was more important to Disney than to Pixar. The deal gave Disney ownership of the world’s most renowned computer animation studio and its talent. The merger offered the necessary technology edge and direction to Disney. At that time, Disney was facing trouble as its animation films were failing one after another.

The deal provided Disney with a chance to get the necessary push for creativity. On several benefits that Disney would derive, nelson Gayton, Professor at Wharton School of Business said, I believe that the acquisition of Pixar was of utmost strategic importance to Disney, not only because of where Disney’s previous distribution relationship with Pixar seemed headed but also because of Pixar’s potential value to Disney’s ‘family entertainment’ brand and assets, like theme parks and television, that feed off this brand.

Overall, it was a highly successful deal for both companies as the duo together resulted in some of the highest-grossing films of all time. ‘Cars’ in 2006, ‘Ratatouille’ in 2007, ‘Wall-E’ in 2008, ‘Up’ in 2009, ‘Toy Story 3’ in 2010, ‘Cars 2’ in 2011, ‘Brave’ in 2012, ‘Monsters University’ in 2013, ‘The good Dinosaur’ in 2015, ‘Finding Dory’ in 2016 and ‘Cars 3’ in 2017 are the examples of films produced under the Disney-Pixar collaboration.

The basic reason behind the success of the merger was that it turned out to be a win-win deal for both parties. On one hand, the deal helped Disney to get access to the animating expertise of Pixar and produce more hit creations. On the other hand, Pixar got the advantage of using the vast network of Disney for capturing the untapped market. Disney, after all, is the world’s largest entertainment company. It owns television networks; film studios; theme parks and consumer products businesses; and all of these could help Pixar in gaining maximum profit.

Pixar, to preserve its culture, created a list of things that would not be changed as a result of the merger. For example, Pixar employees do not sign employment contracts. At Pixar, it is believed that We have never had to go back and look at it. Everything they’ve said they would do they have lived up to. Iger ensured that Pixar employees get mixed into the new environment.

Disney and Pixar, even after the merger, continued to work from their separate headquarters at Burbank and Emeryville respectively. Iger not only allowed the Pixar name to remain but also never changed employees’ email addresses. In other words, Disney allowed Pixar to maintain its own identity within the enlarged group. However, in turn, Iger involved Pixar employees in tasks that could increase efficiency of Disney.

Before the merger, Pixar used to release only one film a year. Not only this, but it also used to stay away from the idea of sequels as it believed that sequels destroy the creative process. However, after the merger, the work process at Pixar started changing and within a couple of years, Pixar’s executives started sanctioning the release of sequels and more than one film each year.

Business Ethics

( Click on Topic to Read )

- What is Ethics?

- What is Business Ethics?

- Values, Norms, Beliefs and Standards in Business Ethics

- Indian Ethos in Management

- Ethical Issues in Marketing

- Ethical Issues in HRM

- Ethical Issues in IT

- Ethical Issues in Production and Operations Management

- Ethical Issues in Finance and Accounting

- What is Corporate Governance?

- What is Ownership Concentration?

- What is Ownership Composition?

- Types of Companies in India

- Internal Corporate Governance

- External Corporate Governance

- Corporate Governance in India

- What is Enterprise Risk Management (ERM)?

- What is Assessment of Risk?

- What is Risk Register?

- Risk Management Committee

Corporate social responsibility (CSR)

- Theories of CSR

- Arguments Against CSR

- Business Case for CSR

- Importance of CSR in India

- Drivers of Corporate Social Responsibility

- Developing a CSR Strategy

- Implement CSR Commitments

- CSR Marketplace

- CSR at Workplace

- Environmental CSR

- CSR with Communities and in Supply Chain

- Community Interventions

- CSR Monitoring

- CSR Reporting

- Voluntary Codes in CSR

- What is Corporate Ethics?

Lean Six Sigma

- What is Six Sigma?

- What is Lean Six Sigma?

- Value and Waste in Lean Six Sigma

- Six Sigma Team

- MAIC Six Sigma

- Six Sigma in Supply Chains

- What is Binomial, Poisson, Normal Distribution?

- What is Sigma Level?

- What is DMAIC in Six Sigma?

- What is DMADV in Six Sigma?

- Six Sigma Project Charter

- Project Decomposition in Six Sigma

- Critical to Quality (CTQ) Six Sigma

- Process Mapping Six Sigma

- Flowchart and SIPOC

- Gage Repeatability and Reproducibility

- Statistical Diagram

- Lean Techniques for Optimisation Flow

- Failure Modes and Effects Analysis (FMEA)

- What is Process Audits?

- Six Sigma Implementation at Ford

- IBM Uses Six Sigma to Drive Behaviour Change

- Research Methodology

- What is Research?

- What is Hypothesis?

- Sampling Method

- Research Methods

- Data Collection in Research

- Methods of Collecting Data

- Application of Business Research

- Levels of Measurement

- What is Sampling?

- Hypothesis Testing

- Research Report

- What is Management?

- Planning in Management

- Decision Making in Management

- What is Controlling?

- What is Coordination?

- What is Staffing?

- Organization Structure

- What is Departmentation?

- Span of Control

- What is Authority?

- Centralization vs Decentralization

- Organizing in Management

- Schools of Management Thought

- Classical Management Approach

- Is Management an Art or Science?

- Who is a Manager?

Operations Research

- What is Operations Research?

- Operation Research Models

- Linear Programming

- Linear Programming Graphic Solution

- Linear Programming Simplex Method

- Linear Programming Artificial Variable Technique

- Duality in Linear Programming

- Transportation Problem Initial Basic Feasible Solution

- Transportation Problem Finding Optimal Solution

- Project Network Analysis with Critical Path Method

- Project Network Analysis Methods

- Project Evaluation and Review Technique (PERT)

- Simulation in Operation Research

- Replacement Models in Operation Research

Operation Management

- What is Strategy?

- What is Operations Strategy?

- Operations Competitive Dimensions

Operations Strategy Formulation Process

- What is Strategic Fit?

- Strategic Design Process

- Focused Operations Strategy

- Corporate Level Strategy

- Expansion Strategies

- Stability Strategies

- Retrenchment Strategies

- Competitive Advantage

- Strategic Choice and Strategic Alternatives

- What is Production Process?

- What is Process Technology?

- What is Process Improvement?

- Strategic Capacity Management

- Production and Logistics Strategy

- Taxonomy of Supply Chain Strategies

- Factors Considered in Supply Chain Planning

- Operational and Strategic Issues in Global Logistics

- Logistics Outsourcing Strategy

- What is Supply Chain Mapping?

- Supply Chain Process Restructuring

- Points of Differentiation

- Re-engineering Improvement in SCM

- What is Supply Chain Drivers?

- Supply Chain Operations Reference (SCOR) Model

- Customer Service and Cost Trade Off

- Internal and External Performance Measures

- Linking Supply Chain and Business Performance

- Netflix’s Niche Focused Strategy

- Process Planning at Mcdonald’s

Service Operations Management

- What is Service?

- What is Service Operations Management?

- What is Service Design?

- Service Design Process

- Service Delivery

- What is Service Quality?

- Gap Model of Service Quality

- Juran Trilogy

- Service Performance Measurement

- Service Decoupling

- IT Service Operation

- Service Operations Management in Different Sector

Procurement Management

- What is Procurement Management?

- Procurement Negotiation

- Types of Requisition

- RFX in Procurement

- What is Purchasing Cycle?

- Vendor Managed Inventory

- Internal Conflict During Purchasing Operation

- Spend Analysis in Procurement

- Sourcing in Procurement

- Supplier Evaluation and Selection in Procurement

- Blacklisting of Suppliers in Procurement

- Total Cost of Ownership in Procurement

- Incoterms in Procurement

- Documents Used in International Procurement

- Transportation and Logistics Strategy

- What is Capital Equipment?

- Procurement Process of Capital Equipment

- Acquisition of Technology in Procurement

- What is E-Procurement?

- E-marketplace and Online Catalogues

- Fixed Price and Cost Reimbursement Contracts

- Contract Cancellation in Procurement

- Ethics in Procurement

- Legal Aspects of Procurement

- Global Sourcing in Procurement

- Intermediaries and Countertrade in Procurement

Strategic Management

- What is Strategic Management?

- What is Value Chain Analysis?

- Mission Statement

- Business Level Strategy

- What is SWOT Analysis?

- What is Competitive Advantage?

- What is Vision?

- What is Ansoff Matrix?

- Prahalad and Gary Hammel

- Strategic Management In Global Environment

- Competitor Analysis Framework

- Competitive Rivalry Analysis

- Competitive Dynamics

- What is Competitive Rivalry?

- Five Competitive Forces That Shape Strategy

- What is PESTLE Analysis?

- Fragmentation and Consolidation Of Industries

- What is Technology Life Cycle?

- What is Diversification Strategy?

- What is Corporate Restructuring Strategy?

- Resources and Capabilities of Organization

- Role of Leaders In Functional-Level Strategic Management

- Functional Structure In Functional Level Strategy Formulation

- Information And Control System

- What is Strategy Gap Analysis?

- Issues In Strategy Implementation

- Matrix Organizational Structure

- What is Strategic Management Process?

Supply Chain

- What is Supply Chain Management?

- Supply Chain Planning and Measuring Strategy Performance

- What is Warehousing?

- What is Packaging?

- What is Inventory Management?

- What is Material Handling?

- What is Order Picking?

- Receiving and Dispatch, Processes

- What is Warehouse Design?

- What is Warehousing Costs?

You Might Also Like

What is process technology types, automation in manufacturing, what is resource planning, what is retrenchment strategy types: turnaround, divestment, liquidation strategies, what is supply chain restructuring approaches, scheduling in supply chain, what is operation management functions, challenges, what is postponing the point of differentiation advantages and disadvantages, strategy and operations in supply chain, what is expansion strategies types, growth strategy, what is customer service and cost trade-off factors for balancing, lean systems in supply chain, leave a reply cancel reply.

You must be logged in to post a comment.

World's Best Online Courses at One Place

We’ve spent the time in finding, so you can spend your time in learning

Digital Marketing

Personal Growth

Development

)

Disney's Most Notable Acquisitions Since Inception

)

Even though The Walt Disney Company was established already in 1923, many of the franchises and brands have been acquired during the last couple of decades. The acquisition strategy has been instrumental in cementing Disney's status as a world-leading entertainment powerhouse. In this article, we list and visualize Disney's most notable acquisitions year by year since its inception, and delve into the ongoing stream war against Netflix.

Decades of Acquisitions

From its beginnings as an animation studio in 1923, Disney has evolved into one of the world's leading companies within media and entertainment. The company's M&A strategy has been instrumental in this transformation, with key acquisitions including ABC Television in 1996, Pixar Animation Studios in 2006, Marvel Entertainment in 2009, and Lucasfilm in 2012. Of particular note is the landmark acquisition of 21st Century Fox in 2019, which remains the second largest media acquisition in history, second only to AT&T's $85 billion acquisition of Time Warner in 2018.

The 21st Century Fox Acquisition

Disney's acquisition of 21st Century Fox, announced on December 14, 2017, and completed on March 20, 2019, was the largest in the company's history. Initially valued at $52.4 billion, the deal's value was later revised to $71.3 billion following a bidding war with Comcast . It included key assets such as the 20th Century Fox film and television studios, U.S. cable channels like FX and Fox Networks Group, a 73% stake in National Geographic Partners, Indian television broadcaster Star India, and a 30% stake in Hulu. Prior to the acquisition, 21st Century Fox spun off several assets into the newly formed Fox Corporation, including the Fox Broadcasting Company and Fox News Channel. Other assets like the Fox Sports Networks and Sky were sold to third parties.

Disney's CEO Bob Iger highlighted that the acquisition was driven by Disney's anticipation to develop its own streaming service, Disney+, which launched in November 2019. The deal was less about Fox's production capacities and more focused on acquiring Fox's film and television libraries to expand Disney+'s offerings. This acquisition included film rights to third-party franchises such as Avatar, X-Men, Deadpool, and Fantastic Four, along with distribution rights to Star Wars. It also consolidated ownership of other franchises like Home Alone and gave Disney access to adult animation with shows like The Simpsons and Family Guy.

Quartr Pro is revolutionizing professional public market research

Request a personal demo to learn why Quartr Pro is quickly being adopted by leading asset managers, hedge funds, investor relations departments, and sell-side analysts worldwide.

- Request personal demo

)

The United States Department of Justice approved the acquisition under the condition that Disney sold Fox's 22 regional sports channels within 90 days of closing. Despite a lawsuit filed by a Fox shareholder to stop the acquisition, citing the absence of financial projections for Hulu, and Comcast's continued interest in acquiring Fox's Regional Sports Networks, Disney and Fox shareholders approved the merger on July 27, 2018. The approval from Mexico's telecom regulator, the Federal Telecommunications Institute, on March 11, 2019, cleared the last major holdout on the deal. As part of the acquisition's completion, Disney announced the integration of top 21st Century Fox television executives into the company, including Peter Rice as Chairman of Walt Disney Television.

Even though the acquisition of 21st Century Fox is one of the largest ever in the media and entertainment industry, it represents just one among many for Disney, underscoring the company's dominant market position. In the visual below, we have included every notable acquisition since 1990.

Visualizing 33 Years of Acquisitions

)

Disney's Most Notable Acquisitions Listed Chronologically:

1990's.

Miramax (1993)

Capital Cities/ABC Inc. (1995)

ESPN Inc. (1995)

Infoseek (1998)

Starwave (1998)

2000's

Fox Family Worldwide (2001)

The Muppets and Bear (2004)

Avalanche Software (2005)

Pixar (2006)

Climax Racing (September 2006)

Club Penguin (2007)

Junction Point Studios (2007)

Ideal Bite (2008)

Kerpoof (2009)

Hulu (2009)

Wideload Games (2009)

Marvel Entertainment (2009)

2010's

Tapulous (2010)

Playdom (2010)

Rocket Pack (2011)

UTV Software Communications (2012)

Maker Studios (2014)

Lucasfilm (2015)

BAMTech (2017)

Euro Disney SCA (2017)

21st Century Fox (2019)

2020's

Hulu (remaining 33%, 2023)

Streaming Wars

As of the third quarter of 2022, Disney had officially overtaken Netflix in total paying subscribers, marking a significant milestone given Netflix's long-standing dominance in the video streaming sector. However, Netflix has since reclaimed its leading position. Below, we present a visualization of the ongoing streaming war.

)

Another important aspect to consider is profitability. Disney has aggressively marketed Disney+ at a much lower price point compared to competitors such as Netflix. Consequently, analyzing the profitability comparison between Netflix and Disney's Direct-to-Consumer (DTC) segment becomes an intriguing study.

Netflix has been a dominant player in the SVOD (Subscription Video on Demand) domain and pioneered the concept of video streaming back in 2007, which is an important factor to consider. However, it remains to be seen whether Disney can transform its SVOD segment into a profit-generating business. The vast IP portfolio that Disney has acquired over several decades could prove to be a significant advantage in this endeavor.

)

Since its establishment in 1923, The Walt Disney Company has significantly expanded and strengthened its position as a leading entertainment powerhouse through a series of strategic acquisitions. The journey, as vividly captured in this article, highlights key milestones in Disney's evolution from an animation studio to a dominant force in the media and entertainment industry. Notable acquisitions include ABC Television, Pixar, Marvel, Lucasfilm, and notably the landmark purchase of 21st Century Fox. This latter acquisition, one of the largest in the industry, was instrumental for the development of Disney+ and significantly expanded Disney’s content library.

The list of acquisitions, extending from Miramax in the 1990s to acquiring the remaining stake in Hulu in 2023, illustrates Disney's aggressive strategy in expansion and diversification. Each acquisition has not only augmented Disney's portfolio but also bolstered its market dominance, marking its evolution into a global entertainment conglomerate. Although Disney's streaming services still face challenges, the company serves as a prime example of how mergers and acquisitions can be leveraged as core pillars of value creation.

Why are finance professionals around the world choosing Quartr Pro ?

With a broad global customer base spanning from equity analysts, portfolio managers, to IR departments, the reasons naturally vary, but here are four that we often hear:

Eliminate hours of searching for specific data points buried deep inside company material.

Everything you need for qualitative public market research in one single platform.

Understand the qualitative aspects of entire industries or specific companies.

Incorporate AI functionality into your daily workflow.

- Discover Quartr Pro

)

- Law of torts – Complete Reading Material

- Weekly Competition – Week 4 – September 2019

- Weekly Competition – Week 1 October 2019

- Weekly Competition – Week 2 – October 2019

- Weekly Competition – Week 3 – October 2019

- Weekly Competition – Week 4 – October 2019

- Weekly Competition – Week 5 October 2019

- Weekly Competition – Week 1 – November 2019

- Weekly Competition – Week 2 – November 2019

- Weekly Competition – Week 3 – November 2019

- Weekly Competition – Week 4 – November 2019

- Weekly Competition – Week 1 – December 2019

- Sign in / Join

- Featured Student Assignments (LawSikho)

The successful corporate marriage (merger) of Walt Disney and Pixar

This article is written by Riya Dubey, a student pursuing a Diploma in M&A, Institutional Finance and Investment Laws (PE and VC transactions) from LawSikho .

Table of Contents

Introduction

Walt Disney is a media and entertainment company founded in 1923 by Walt Disney and Roy Disney. Pixar was found in 1986 by Steve Jobs and is the pioneer in animation. In 2006, Pixar was acquired by Walt Disney. So, here we going to discuss the reasons why the merger was the best option and what are the reasons behind the successful merger of Walt Disney and Pixar even after so many years.

- The relations between Disney and Pixar were built in 1991 when they signed an agreement to produce and distribute the first computer-generated animated movie together that movie was “Toy Story”.

- After the success of the movie Toy Story in 1995, Disney and Pixar in 1997 signed another contract to produce five movies together in the next ten years.

The list of movies they produced under this contract includes:

- The Bug’s Life

- Toy story 2

- Monsters, Inc.

- Finding Nemo

- The Incredibles

- When the collaboration deal was at its end in January 2009, Disney announced that they will acquire Pixar Animation Studios for $7.4 billion.

The vertical merger between Walt Disney and Pixar

In a vertical merger, the merger takes place between two or more companies that operate for the specified finished product at different stages in the production process. This usually takes place so that there can be an increase in synergies created by the merging of companies. Vertical merging can be cost-efficient, increase profits, helps in diversification, and expands the market.

And when it comes to the merger of Walt Disney and Pixar it was a vertical merger because Pixar has specialization in animations and whereas Disney’s main focus is on creating animated movies. Both companies were in the same field and were operating at different stages of production. Their synergy has resulted in the production of smashing hits worldwide.

The merger of Disney and Pixar was made on two alliances:

- Sales Alliance: Here both Disney and Pixar will have to works on maximizing the profits by the marketing of their product together.

- Investment Alliance: Here both companies have to invest in the animation pictures and both will get a share of 50% profit made from the movies.

What other alternatives were available?

Internal Development:

The following benefits were available to Disney:

- Acquiring human and technology assets;

- 3D technology; and

- Development cost and fierce competition.

Strategic Alliance:

- Computer Animated Production System;

- Feature film related agreement; and

- Co-production agreement.

Merger & Acquisition:

- Modernized animation department;

- Elimination of competition; and

- Access to technology as well as human capital.

Reasons for the merger

- Disney by acquiring Pixar was getting the pool of talent in both creative and technical terms. This was going to be a great asset for Disney. The combined efforts and resources of Disney-Pixar can produce more movies in a year resulting in value addition for Disney.

- Disney was not getting the response that is expected and hence acquiring Pixar could have helped Disney in content generation with the advice of experts in Disney for distribution resulting in the maximizing revenue amount for both of the domains.

- For Pixar, this deal will be beneficial in terms of gaining monetary support from Disney.

- Getting acquired by Disney would provide Pixar a better position in the market against competitors like Lucasfilm, DreamWorks, Universal, etc. Disney was having experience in the animation industry and has assets like theme parks. And it would help Pixar to get the ratio of private equity increase. The acquisition was also helpful for Apple iTunes.

Comparison chart of Pixar and Walt Disney

| Pixar | Walt Disney | |

| Area | Short movies, ad commercials | Animated movies |

| Animation technology | 3D animation | 2D |

| Software | None | |

| Skill | It had employees have technical knowledge (PhDs). | Lack of computer graphic artist. |

| Assets | Experience in the know-how of the movie industry. | |

| Distribution channel | None | |

| Corporate culture | ||

| Operation cost | While creating the Toy Story there was a staff of only 110. | The larger staff of 125,000 employees and a large budget. |

Negotiating powers of seller

Pixar had have been great in creating the latest technology for animating short movies and Disney was not having that technology. So, by acquiring Pixar, Disney would have got the latest technology to stand in the market. Disney and Pixar both have talented teams of scriptwriters and animators. While acquiring Pixar, Disney knew that in the US, scriptwriters are unionized and in past, they have gone to strikes and it has resulted in the loss of hundreds millions of dollars to the studios. Disney was clear that employees of Pixar cannot be taken for granted.

Negotiating powers of buyer

Both Disney and Pixar had a great place in the market. All the movies produced by Pixar then were spinners for whoever was associated with it. Disney had considerable clout in bargaining for contracts.

In this deal, Bobs knew that acquisition of Pixar can turn Disney around therefore to reduce the fear of oppression he assured that the corporate culture of Pixar will be kept untouched. We can therefore say that here Disney was having low bargaining power.

Reasons for the successful corporate marriage of Walt Disney and Pixar

Merging of corporate culture:.

Certain things in the change management process have to be right for getting benefits from the merger of the corporate culture of two companies. And Disney and Pixar were able to manage this without any glitch: