Top Excel Budget Templates (Free Downloads Included!)

Table of Contents

Why Use an Excel Budget Template?

Step 1: choose the right template, step 2: set up the template, step 3: input your data, step 4: track and update regularly, step 5: analyze your finances, step 6: adjust as needed, 1. clarity and control, 2. smarter spending, 3. financial goal achievement, 4. improved savings habits, 5. reduced stress, step 1: set up your spreadsheet, step 2: format your template, step 3: use formulas for calculations, step 4: customize to your needs.

120+ PROFESSIONAL

Project Management Templates

- ✅ 50+ Excel Templates

- ✅ 50+ PowerPoint Templates

- ✅ 25+ Word Templates

Effortlessly Manage Your Projects Seamlessly manage your projects with our powerful & multi-purpose templates for project management.

Managing your finances effectively is crucial for achieving financial stability and reaching your financial goals. Excel budget templates are powerful tools that can help you track your income, expenses, and savings with ease. Explore our wide range of Free Excel Budget Templates is here to help! Whether you need to manage your personal finances, business budget, or plan for an event, we’ve got you covered. Choose from our variety of templates, including Annual, Business, Event, Family, Monthly, Personal, Project, Simple, Student, and Weekly Budget templates. Simplify your budgeting process and stay on top of your financial goals with our easy-to-use, customizable templates. Download your Free Excel template today and unlock a path to financial freedom!

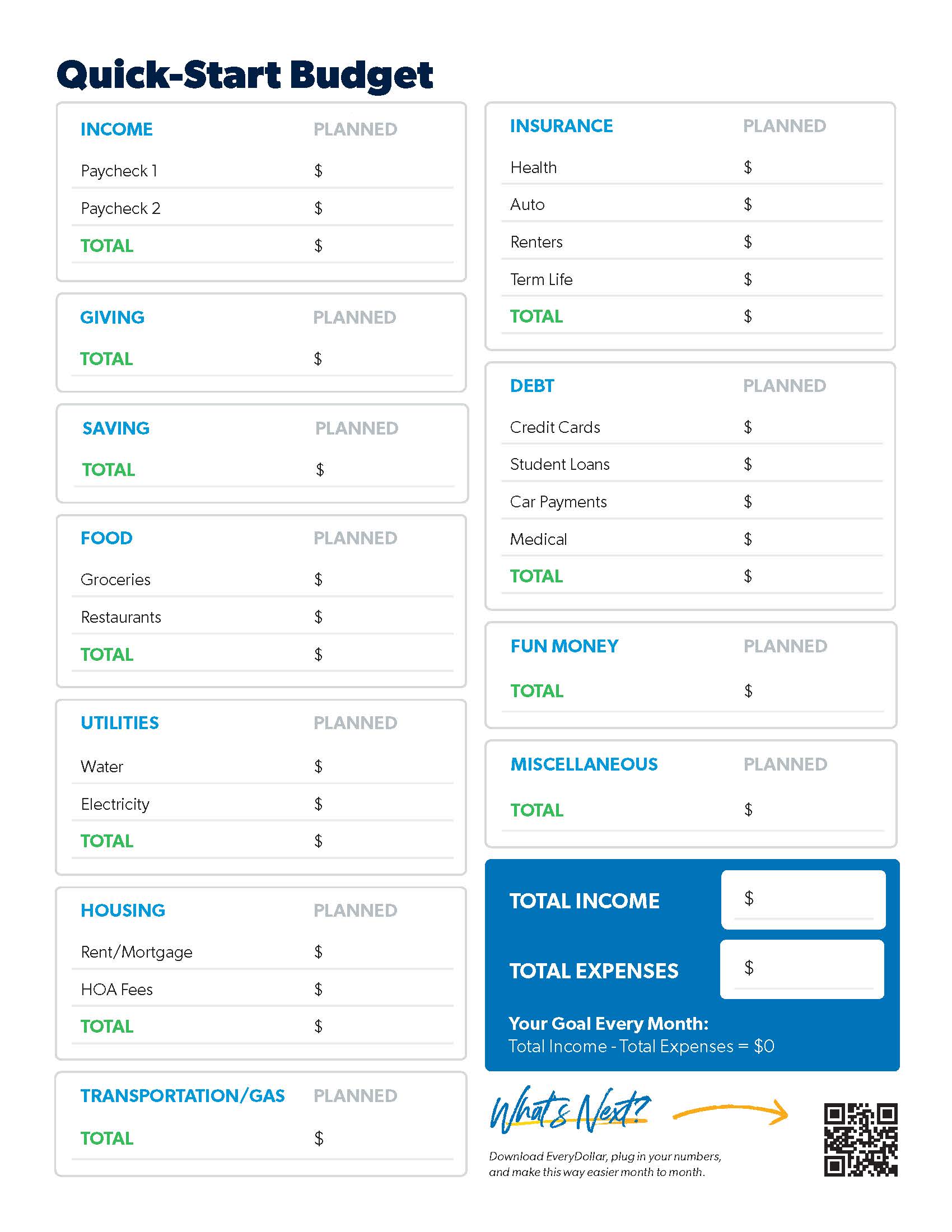

Simple Budget Template

The simple budget template is designed for simplicity and ease of use, making it perfect for beginners. This easy budget template features a basic layout with separate sections for income and expenses, helping you manage your finances without any advanced Excel skills. By providing automatic calculations for total income, total expenses, and remaining balance, this beginner budget template allows you to gain a clear snapshot of your financial status at a glance. Ideal for individuals or small families, this basic budget Excel tool helps identify areas where you can cut back on spending.

Download Simple Budget Template

Download Simple Excel Budget Template

- Basic layout with separate income and expense sections.

- Automatic calculation of total income, total expenses, and remaining balance.

- Customizable categories for different types of expenses (e.g., utilities, groceries, entertainment).

- Easy to set up and use without any advanced Excel skills.

- Provides a clear snapshot of your financial status at a glance.

- Helps identify areas where you can cut back on spending.

Usage: Ideal for individuals or small families who want a straightforward way to track their monthly finances.

Weekly Budget Template

For detailed short-term financial tracking, the weekly budget template is the perfect tool. This short-term budget planner helps you monitor your income and expenses on a weekly basis, providing a clear picture of your financial status. With customizable categories for detailed tracking and weekly summaries, this weekly expense tracker allows you to maintain consistent financial monitoring. Ideal for individuals or families, this weekly financial planning template helps you set and achieve weekly financial goals. Whether you prefer weekly budgeting or need to manage short-term finances, this detailed weekly budget template is essential.

Download Weekly Budget Tracker

Download Weekly Budget Template

- Sections for weekly income and expenses.

- Customizable categories for detailed tracking.

- Weekly summaries to monitor spending patterns.

- Helps maintain detailed short-term financial tracking.

- Provides a clear overview of weekly financial status.

- Useful for setting and achieving weekly financial goals.

Usage: Suitable for individuals or families who prefer to keep track of their finances on a weekly basis.

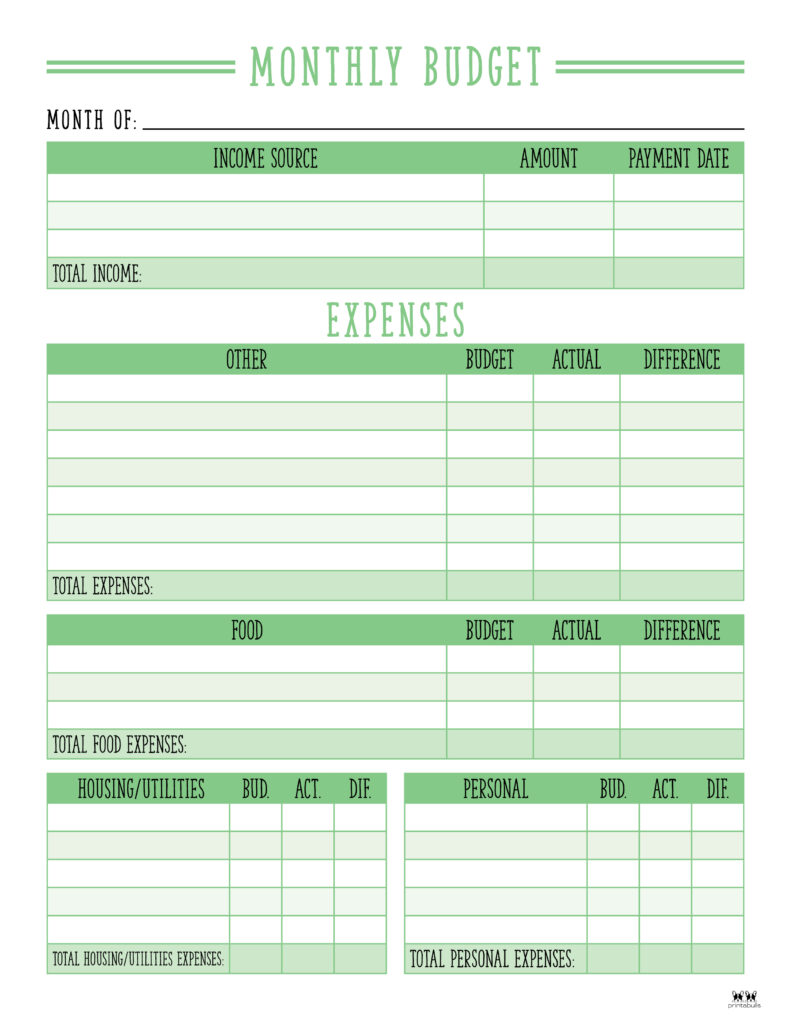

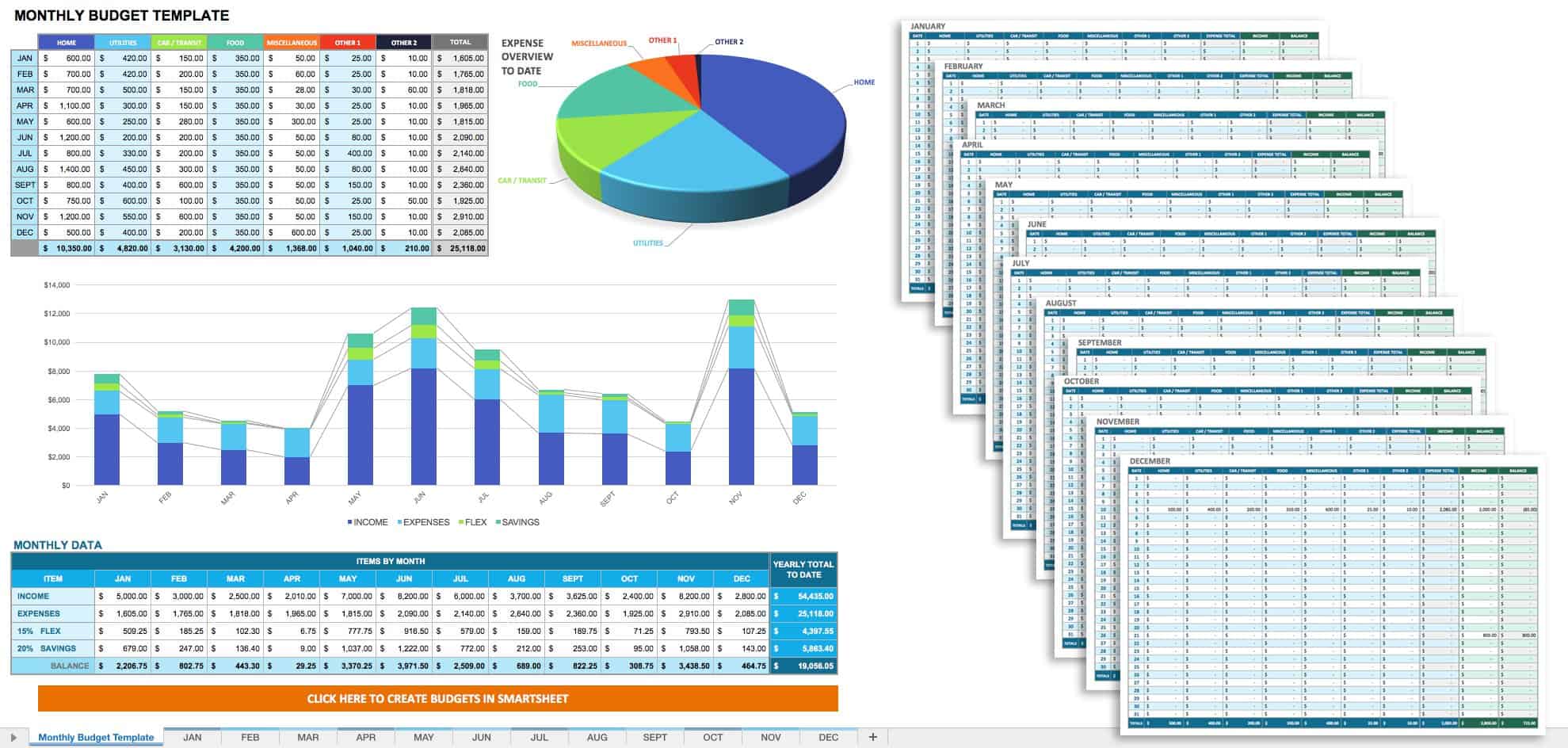

Monthly Budget Planner

The monthly budget planner is an excellent tool for detailed financial tracking on a monthly basis. This monthly expense tracker features separate sections for income, expenses, and savings, along with graphical representations of spending categories to help you visualize where your money goes. With a monthly summary that compares total income and expenses to previous months, this Excel monthly budget template helps you maintain consistent financial tracking. Suitable for anyone looking to monitor their spending and savings month by month, this budget spreadsheet is a must-have for monthly financial planning.

Download Monthly Budget Free Template

Download Monthly Budget Plan Template

- Separate sections for income, expenses, and savings.

- Graphical representations of spending categories to visualize where your money goes.

- Monthly summary of total income and expenses with comparison to previous months.

- Helps maintain consistent financial tracking month over month.

- Easy to spot trends in spending and savings.

- Useful for setting and monitoring monthly financial goals.

Usage: Suitable for anyone who needs to monitor their spending and savings month by month.

Annual Budget Template

For those seeking long-term financial planning, the annual budget template is the perfect tool. This yearly budget planner offers a comprehensive view of your income and expenses over an entire year. With monthly breakdowns for detailed tracking and forecasting features for future planning, this long-term budget Excel template helps you set and achieve annual financial goals. Ideal for identifying yearly financial trends and patterns, this yearly expense tracker provides a clear overview of your financial status. This annual financial planning template is essential for anyone looking to manage their finances over a longer period.

Download Yearly Budget Planner

Download Yearly Budget Plan Template

- Comprehensive annual view of income and expenses.

- Monthly breakdowns for detailed tracking.

- Forecasting features for future planning.

- Allows for long-term financial planning and tracking.

- Helps identify yearly financial trends and patterns.

- Useful for setting annual financial goals and budgets.

Usage: Best for those who want to keep an eye on their finances over the course of a year, including recurring expenses and long-term savings goals.

Personal Budget Template

The personal budget template is a customizable tool designed to fit your unique financial situation. This individual budget planner provides detailed sections for various types of income and expenses, allowing for personalized financial management. With monthly and yearly summary sheets, this personal expense tracker helps maintain a detailed record of your finances. By offering customization based on individual financial goals and needs, this detailed budget template provides a clear overview of your financial status. Perfect for anyone looking to manage their personal income, expenses, and savings goals efficiently.

Download Personal Budget Excel Template

Download Personal Budget Template

- Detailed sections for different types of income and expenses.

- Customizable categories to fit personal needs.

- Monthly and yearly summary sheets.

- Helps maintain a detailed record of your personal finances.

- Allows for customization based on individual financial goals and needs.

- Provides a clear overview of monthly and yearly financial status.

Usage: Perfect for individuals who want to keep track of their own income, expenses, and savings goals.

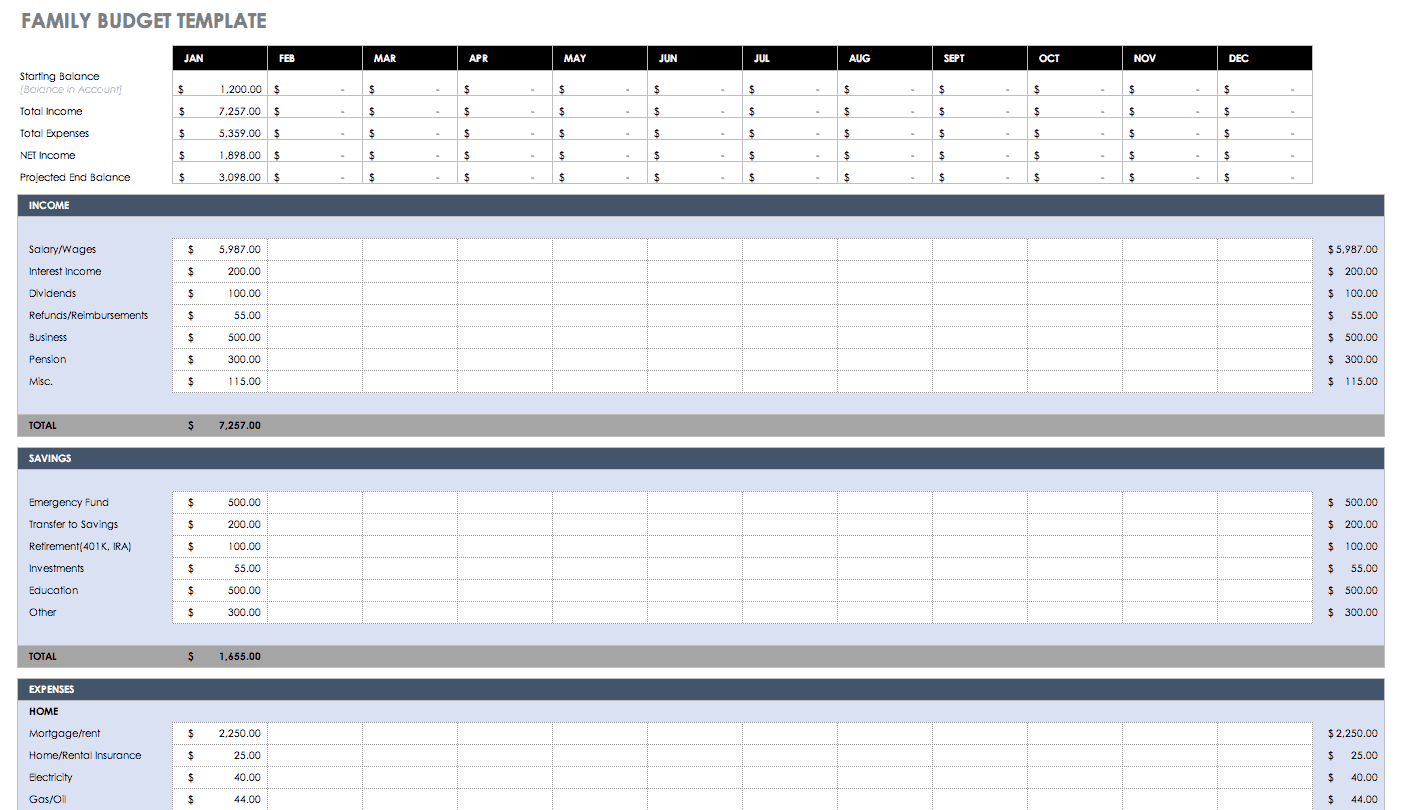

Family Budget Template

The family budget template is tailored to help households manage their shared finances effectively. This household budget planner includes special categories for family-related expenses such as childcare and groceries, making it an ideal tool for family financial planning. With sections for household income and expenses, this family expense tracker provides a clear overview of the family’s financial status. Graphical summaries help visualize spending patterns, making it easier to set and achieve family financial goals. This shared budget Excel template is perfect for families looking to manage their finances collectively.

Download Free Family Budget Tracker

Download Family Budget Template

- Sections for household income and expenses.

- Special categories for family-related expenses (e.g., childcare, groceries).

- Graphical summaries to visualize spending patterns.

- Helps families manage and track shared expenses.

- Provides a clear overview of household financial status.

- Useful for setting and achieving family financial goals.

Usage: Ideal for families looking to manage their finances collectively and ensure all household expenses are covered.

Student Budget Template

The student budget template is specifically designed to help students manage their limited finances effectively. This budget template for students includes sections for student income, such as part-time jobs and allowances, and expenses like tuition and books. With customizable categories, this student expense tracker fits the unique needs of students. Monthly summaries help track spending and savings, making this student financial planning template an excellent tool for maintaining a clear overview of financial status. Perfect for students, this customizable student budget template helps manage finances and stay within budget.

Download Student Budget Manager

Download Student Budget Template

- Sections for student income (e.g., part-time jobs, allowances) and expenses (e.g., tuition, books).

- Customizable categories to fit student needs.

- Monthly summaries to track spending and savings.

- Helps students manage and track their limited finances.

- Provides a clear overview of student financial status.

- Useful for setting and achieving student financial goals.

Usage: Perfect for students who need to manage their finances and stay within their budget.

Event Budget Template

Planning and managing the finances of events is made easy with the event budget template. This customizable event budget template is suitable for various types of events, ensuring you stay within your budget for any occasion. Detailed sections for event-related income and expenses, along with customizable categories, make this event expense tracker an essential tool for event financial planning. By providing summary sections to monitor your budget, this budget template for events helps you efficiently manage event-specific expenses. Ideal for weddings, corporate gatherings, and other events.

Download Event Budget Planner

Download Event Budget Template

- Detailed sections for event-related income and expenses.

- Customizable categories for different types of events.

- Summary sections to ensure you stay within your budget.

- Helps manage event-specific expenses efficiently.

- Provides a clear overview of event finances.

- Useful for staying within budget for various types of events.

Usage: Great for anyone planning an event, from weddings to corporate gatherings, to keep track of all related expenses.

Project Budget Template

The project budget template is designed to help manage the financial aspects of projects, big or small. This customizable project budget template includes sections for project income and expenses, ensuring your project stays on budget. With tracking and summary features, this project expense tracker provides a clear overview of project costs. Ideal for project managers or freelancers, this project financial planning template helps keep a close eye on project-specific finances. Whether you are handling a small project or a large initiative, this budget template for projects is an invaluable tool.

Download Project Budget Manager

Download Project Budget Template Excel

- Sections for project income and expenses.

- Customizable to fit different types of projects.

- Tracking and summary features to monitor project budget.

- Helps manage project-specific finances efficiently.

- Provides a clear overview of project costs.

- Useful for ensuring projects stay within budget.

Usage: Ideal for project managers or freelancers who need to keep a close eye on project costs.

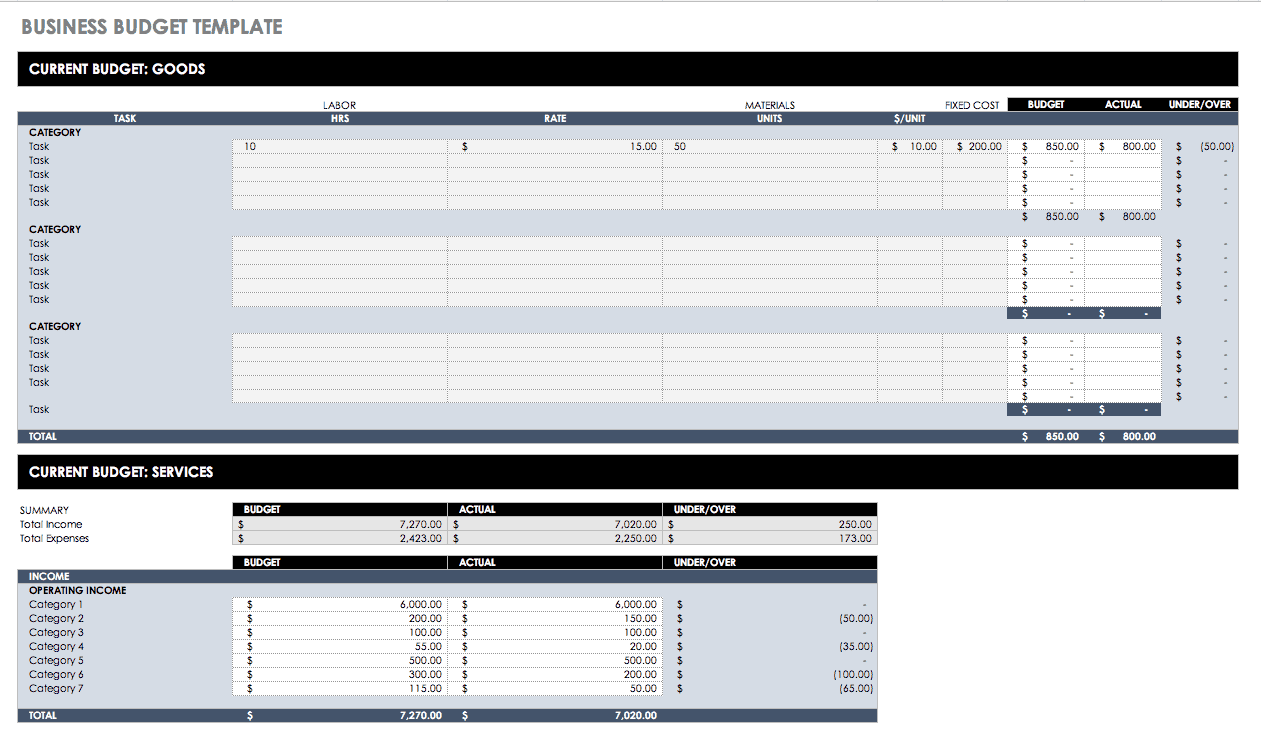

Business Budget Template

Designed specifically for small businesses, the business budget template helps manage business finances effectively. This small business budget planner includes sections for business income, expenses, and profits, making it an excellent tool for business financial planning. Customizable to fit various business needs, this business expense tracker provides detailed financial summaries and forecasts. Ideal for small business owners, this budget template for businesses offers a comprehensive view of the business’s financial status. With this tool, managing and tracking business finances becomes efficient and straightforward.

Download Business Budget Template

- Sections for business income, expenses, and profits.

- Customizable to fit various business needs.

- Detailed financial summaries and forecasts.

- Helps manage and track business finances efficiently.

- Provides a clear overview of business financial status.

- Useful for setting and achieving business financial goals.

Usage: Best for small business owners who need a comprehensive tool to manage their business finances.

Using an Excel budget template can make managing your finances much simpler and more efficient. Whether you’re an individual, a family, a student, or a business owner, there’s a template out there that can meet your needs. Download one of these top templates and start taking control of your finances today!

Imagine navigating a road trip without a map. Budgeting is similar. Without a clear plan, your finances become a confusing, potentially expensive journey. A budget template acts as your GPS, providing structure and direction. Excel budget templates offer numerous advantages for managing your finances:

- Ease of Use: Excel’s user-friendly interface makes it easy to input and organize financial data.

- Customization: Templates can be tailored to fit your unique financial situation.

- Automation: Excel’s formulas and functions automate calculations, saving time and reducing errors.

- Visualization: Charts and graphs help visualize your financial data, making it easier to identify trends and make informed decisions.

- Accessibility: Excel is widely available and compatible with various devices, allowing you to access your budget anytime, anywhere.

- Formulas Save Time: Automate calculations for a faster and more accurate budgeting experience.

- Data Visualization: Charts and graphs make your spending trends clear and easy to understand.

- Organization Powerhouse: Excel keeps your finances neatly organized in one place.

How to Use Excel Budget Templates

Using Excel budget templates can significantly simplify the process of managing your finances. Whether you’re tracking personal expenses, planning an event, or managing a business, these templates provide a structured way to monitor income and expenses. Here’s a step-by-step guide on how to use Excel budget templates effectively:

Identify Your Needs: Determine what type of budgeting you need (e.g., personal, family, event, business). Download the Template: Visit a trusted source like Microsoft Office Templates or a reputable financial website to download the template that suits your needs.

Open the Template: Open the downloaded Excel budget template on your computer. Customize Categories: Adjust the income and expense categories to match your specific financial situation. Most templates allow you to add, remove, or rename categories.

Enter Income: Start by entering all your income sources. This could include salary, freelance work, investments, or any other sources of income. List Expenses: Input your expenses in the corresponding categories. Be as detailed as possible, including both fixed expenses (rent, utilities) and variable expenses (groceries, entertainment).

Monitor Regularly: Make it a habit to update the template regularly with new income and expenses. This could be done daily, weekly, or monthly, depending on your preference. Review Summaries: Use the summary sections to review your financial status. Look at the total income, total expenses, and the remaining balance to understand your financial health.

Identify Trends: Use the graphical representations and summary sections to identify spending patterns and trends. This can help you make informed decisions about where to cut costs or how to allocate more funds to savings. Set Goals: Based on your analysis, set realistic financial goals. This could be saving a certain amount each month, reducing discretionary spending, or planning for a major purchase.

Modify Categories: If you find that your categories are too broad or too narrow, adjust them to better reflect your financial activities. Revisit Goals: Regularly revisit your financial goals and adjust them based on your current financial situation. If you achieve a goal, set a new one to keep yourself motivated.

Importance of Budgeting

Budgeting is a crucial aspect of financial management that can significantly impact your financial well-being. It involves planning and tracking your income and expenses to ensure you are living within your means and working towards your financial goals. Here are some key reasons why budgeting is essential:

Gain Insight: Budgeting gives you a clear picture of where your money is going. It clarifies your income and expenses, giving you control over your money. By tracking your expenses and income, you can see exactly how much you are spending and on what, allowing you to make informed financial decisions.

Avoid Overspending: A budget helps you avoid overspending by keeping your expenses in check. By setting limits for different categories, you can prevent unnecessary expenditures and ensure you have enough funds for essential needs.

Prioritize Needs Over Wants: With a budget, you can prioritize your needs over wants. This helps curb impulse purchases and avoid unnecessary debt. By allocating funds to essential expenses first, you can ensure that your basic needs are met before spending on discretionary items.

Avoid Debt: Budgeting helps you live within your means, reducing the likelihood of relying on credit cards or loans for day-to-day expenses. This proactive approach prevents the accumulation of new debt and promotes long-term financial stability.

Set and Reach Goals: Whether you’re saving for a vacation, a new car, a home, or retirement, a budget helps you set realistic financial goals and create a plan to achieve them. It helps you track progress towards these goals, ensuring you make steady progress.

Emergency Fund: Budgeting helps you build an emergency fund, providing a financial cushion for unexpected expenses like medical bills, car repairs, or job loss. Having this safety net can reduce stress and prevent you from falling into debt.

Consistent Savings: Budgeting enables you to set aside money regularly for savings. A budget ensures consistent allocation towards your savings goals. By treating savings as a fixed expense, you can ensure consistent contributions to your savings account, helping you build wealth over time.

Long-term Planning: A budget helps you plan for long-term financial goals such as retirement, education, or major purchases. It allows you to allocate funds strategically and work towards these goals systematically.

Peace of Mind: Knowing that you have a plan for your finances can significantly reduce financial stress. A budget provides clarity and structure, helping you feel more in control of your financial situation. Knowing every penny’s purpose brings peace of mind.

Preparedness: Being prepared for both regular and unexpected expenses can alleviate anxiety. Budgeting ensures you are financially prepared for various scenarios, providing peace of mind and stability.

How to Create an Excel Budget Template

Creating an Excel budget template is straightforward. Follow these steps to build a customized template that suits your financial needs:

Open a new spreadsheet in Excel. Title your sheet “Excel Budget Template” and create the following columns:

- Date: The date of the transaction.

- Category: The type of income or expense (e.g., Salary, Groceries, Rent).

- Description: A brief description of the transaction.

- Budgeted Amount: The planned amount for each category.

- Actual Amount: The actual amount spent or received.

- Difference: The difference between the budgeted and actual amounts.

- Notes: Any additional notes or comments.

| Date | Category | Description | Budgeted Amount | Actual Amount | Difference | Notes |

|---|---|---|---|---|---|---|

| 2024-06-11 | Income | Salary | $1500 | $1500 | $0 | Monthly paycheck |

| 2024-06-12 | Expenses | Rent | $800 | $800 | $0 | |

| 2024-06-14 | Expenses | Groceries | $200 | $220 | +$20 | Extra items |

| 2024-06-15 | Expenses | Utilities | $150 | $140 | -$10 | |

| Total | $1000 | $1160 | +$160 |

- Difference: =D2-E2

- Total Income: = SUM (D2:Dn) for all income rows

- Total Expenses: =SUM(E2:En) for all expense rows

- Net Total: =Total Income – Total Expenses

Adjust the categories and descriptions based on your financial situation. Add any specific items or recurring expenses that are unique to your budget.

Tips for Effective Budgeting with Excel

- Be Consistent: Update your budget regularly to ensure accuracy.

- Review Regularly: Analyze your budget at the end of each month to identify trends.

- Adjust as Needed: Modify your budget based on actual expenses and income.

- Use Conditional Formatting: Highlight important data and trends with Excel’s conditional formatting features.

- Backup Your Data: Regularly save and backup your Excel files to prevent data loss.

Using an Excel budget template is a powerful way to take control of your finances. With the ability to customize, automate, and visualize your financial data, Excel makes budgeting easier and more effective. Download our free templates above and start managing your finances today.

Recommended articles:

- ProjectManager.com: How to Make a Project Budget?

- Income and Expenses Tracking Templates : Check our templates for tracking Income and Expenses

- Smartsheet.com: Free Budget Templates

Share This Story, Choose Your Platform!

Whats the password for it

You can get the unlocked versions of our templates here: Analysistabs .org

WOW! Fantastic budget template! It’s very user-friendly. Made managing my finances much simpler. Highly recommend to anyone looking for an efficient budgeting solution.

Thank you for your feedback!

This Excel Budget Template is a game-changer! Super intuitive and helpful for financial management

Thank you so much for your kind words! I’m thrilled to hear that the Excel Budget Template has been so helpful for your financial management. If there are any specific features you particularly enjoy or if there’s anything else you’d like to see in future templates, please let me know. Your feedback is invaluable!

Just what I needed! This budget template simplifies complex financial tasks. Great job!

Thanks for the kind words! I’m glad the template is helpful. Let me know if there’s anything else you need!

Leave A Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

© Copyright 2012 – 2024 | Excelx.com | All Rights Reserved

Get expert insights delivered straight to your inbox.

Free and Easy Budget Template

5 Min Read | Apr 26, 2024

No matter what you want to do with your money, it starts with a budget. Because a budget is a plan for your money —you tell it where to go, so you stop wondering where the heck it went.

But if you’ve never budgeted before, or it’s been a while, jumping in can be challenging. You know what can help? A budget template!

There’s nothing like having clear directions to follow and step-by-step blanks to fill in to give you the confidence you need to get going on this budgeting journey. You ready? (Yes, you are.)

Steps for Using Your Budget Template

A budget template (or budget worksheet) is a great way to get everything on paper, right there in front of your eyes. We’ve got three steps to set up that budget and two more to keep it going—each and every month.

Before you dive in, print out your Quick-Start Budget template and open up your online bank account!

Also, heads up: We’re about to mention the Baby Steps a couple of times. This is the proven plan to get ahead with your money—from saving more to paying off debt to building real wealth.

1. List your income.

Do you see the Planned column at the top of your Quick-Start Budget template? That’s where you list out all the money that’s coming in this month. Here are some quick callouts when it comes to this first step:

- Make sure you write in regular paychecks and anything extra, like that side hustle money . (Go you!)

- If you’re married, list out all the income for both of you. (It’s pretty romantic, really.)

- If you’ve got an irregular income , take a look at what you’ve made the last few months and list the lowest amount as this month’s planned income budget line. You can adjust later in the month if you make more. (We’ve got a special irregular income budget template if you need it.)

2. List your expenses.

Now that you’ve planned for what’s coming in, you need to plan for what’s going out: your giving, saving (depending on what Baby Step you’re on), and spending.

When it comes to all the monthly spending you need to plan for, you’ll see the budget worksheet goes in this order:

- Four Walls —food, utilities, housing and transportation

- Other essentials—like insurance and debt

- Extras—like fun money and that helpful miscellaneous line

(You’ve probably noticed your online bank account is coming in real handy right now.)

As you work through your monthly budget template:

- Skip any lines you don’t need.

- Write in anything you don’t see a spot for.

- Add the planned amounts inside each box.

All right. What’s next?

3. Subtract expenses from your income.

When you do the math on your budget planner sheet, your income minus your expenses should equal zero. We call this the zero-based budget.

No, this does not mean you let your bank account reach zero. Leave a little buffer in there of about $100–300.

What it does mean is that you’re giving all your money a job—paying the bills and moving you forward on your money goals. Because you work hard for your money, people. And it should work hard for you. Every. Single. Dollar.

What if you don’t hit zero?

- Got money left over? Um, celebrate. This is great! Then put those dollars toward your current Baby Step.

- Got a negative number? Pause. Don’t freak out. It’ll be okay. You just need to cut spending (or increase your income !) until you get to zero.

So, guess what. That’s it for creating the budget. These next two tips will help you stick to it and make it actually work for you.

4. Track your transactions (all month long).

How do you stay on top of your spending? Track. Your. Transactions. That means you’re tracking everything that happens to your money all month long! This is how you keep an eye on your progress and keep from overspending.

5. Make a new budget (before the month begins).

Your budget won’t change too much from month to month—but no two months are exactly the same. So, create a new budget every single month. Don’t forget month-specific expenses (like holidays or seasonal purchases). And do this before the month starts so you can get ahead of what’s coming your way.

To the Budget Template . . . and Beyond!

Okay, you probably noticed those last two steps aren’t on your monthly budget template. Because the template is a great start. It really is! It helps you level up from budget dreamer to budget planner.

Start budgeting with EveryDollar today!

But once you get those first three steps on paper, it’s honestly way easier to keep up with it all when you’ve got an easy-to-use budgeting app like our personal BBFF (budgeting best friend forever), EveryDollar . Download the app (for free!), plug in all those numbers you organized on your budget template, and take your budget with you. Everywhere. It’s so much better than penciling in every transaction and doing the math yourself or rewriting a budget every month. Trust us.

Here are three more helpful resources before you go:

- If this budgeting flyover zoomed by too quickly, check out our Complete Guide to Budgeting !

- If you’re curious how your spending lines up with recommended budgeting percentages and common averages, you can find that info here.

- And if you if you haven’t yet, download your personal Quick-Start Budget template .

Hey, we’re proud of you for budgeting. It’s seriously the first step to go from where you are with your money to where you want to be. And you’re going great places, one EveryDollar budget at a time!

Did you find this article helpful? Share it!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books (including 12 national bestsellers) published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

How to Make a Budget: Your Step-by-Step Guide

Learning how to budget might seem overwhelming, but hear this: You can do it. Here's how to make a budget in just five steps.

How to Win With Money in 7 Baby Steps

These easy-to-follow Baby Steps will help you pay off debt, save for the future, and be a generous giver. You need a plan to win with money, and this is it!

To give you the best online experience, Ramsey Solutions uses cookies and other tracking technologies to collect information about you and your website experience, and shares it with our analytics and advertising partners as described in our Privacy Policy. By continuing to browse or by closing out of this message, you indicate your agreement.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

Monthly Budget Planners

June 8, 2021 by Printabulls Team 16 Comments

Vacations. Back to school supplies. Birthday presents. Christmas. It seems like there’s always something expensive lurking, waiting to drain your bank account. Even without these costly events, there’s always groceries, mortgages, utilities and car payments to think about. You need a budget to stay on top of it all. And we’re here to help you with that.

We’ve created 20 free printable monthly budget planners to help you get ahold of your finances. There are different styles, colors and categories on each one. Some feature columns while others are subdivided into boxes. Browse through them and find one you think will fit your needs, then simply click on it. A new tab will open, and you can print straight from there. It couldn’t be easier.

After trying your budget for a month or two, assess whether the printable you chose is working well. If not, come back and print a different one. Once you find what works for you, you can print 12 to prepare for the year, or you can laminate and reuse a single sheet.

Once you see how good it feels to really know where your money is going, you may want to organize your time in a likewise fashion. That’s why we’ve created 15 free printable hourly planners . If you can budget your money, you can budget your time! Enjoy the new feeling of self-control these habits will create in your life.

And if you like these monthly budget planners make sure you also check out our 18 free monthly bill organizers to keep track of all of those pesky bill details and 20 expense trackers just for expenses!

Reader Interactions

December 21, 2021 at 9:22 am

Thank you so much for this wide variety of trackers, planners and calendars. I’ve seen a lot of kinds all over Pinterest but you have so many different styles to use that fits anyone’s style of doing this. I will be following you to see what else you come up with that I can use to make living easier. Thanks again😊😊😊

December 22, 2021 at 9:07 am

You’re welcome, Debbie. Glad you found one you liked!

March 10, 2022 at 8:04 am

Thank you !! Super thankful

March 11, 2022 at 7:44 am

Our pleasure!! 🙂

June 2, 2022 at 11:00 am

I come to Printabulls monthly for calendars! I’ve printed games to play with my kiddos. We have laminated chore charts and my toddlers love checking off something when they complete it! I am looking for a grocery list printable though. Maybe that’s something ya’ll could consider when it’s time to add more ideas!

June 2, 2022 at 3:04 pm

We’re glad you’re finding plenty of helpful printables for your home! We love hearing that!

As for the grocery lists, it might be a little bit but it’s already on the list! 🙂 If you sign up for our email list in the website’s sidebar you’ll be notified whenever new printables (including the grocery lists) go live.

July 13, 2022 at 10:31 am

July 13, 2022 at 10:34 am

You’re welcome! 🙂

September 11, 2022 at 2:54 am

You must be an Angel 🥰 I felt like in heaven scrolling through your page and saving all kind of lists on my phone 🥰😍

THANK YOU SOOOOO MUCH FOR YOUR WORK 🙏😍 I LOVE LOVE LOVE LOVE YOUR PAGE!!!!

September 12, 2022 at 6:36 am

You’re welcome, Andrea!! 🙂

October 10, 2022 at 5:34 am

Hi I’d just really love to have some of your printables please.

October 10, 2022 at 6:32 am

For any printable, just click on the image and then print from your home computer. Hope that helps!

November 9, 2022 at 7:46 pm

This is just what I needed! Thanks!

November 10, 2022 at 7:25 am

April 11, 2023 at 1:17 pm

I love your finance related printable. I use them to help me to stay in budget. I appreciate that your free printable are truly FREE! Freebies also help me stay in budget. Thank you, so very much! T

April 12, 2023 at 7:33 am

We’re glad you find them useful and that they are helping you stay within your budget! It’s our pleasure to help! 🙂

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

The Complete Collection of Monthly Budget Templates

By Andy Marker | February 22, 2017

- Share on Facebook

- Share on LinkedIn

Link copied

Monthly budgeting is a common challenge. Whether you’re managing your family’s finances, running a business, tracking your personal spending, or planning for college, the costs can seem endless. Creating a monthly budget spreadsheet is a useful way to keep track of all these expenses and compare them with your income, so you can gain control over your finances.

Of course, there are many different ways you can budget money, depending on your income source, family size, and the level of visibility you want into your finances. You may also want to create separate budgets for special purposes, such as retirement, college savings, or home improvements, in addition to your personal monthly budget. Perhaps you’re interested in creating a budget for monthly business expenses or corporate projects. That’s why we created this comprehensive list of monthly budget templates. No matter what you’re budgeting for, this collection has a template to meet your needs.

Monthly Business Budget

Maintaining a budget is especially important when running a business. Whether you offer goods or services, this monthly budget template can help put you on the road to success. Record business expenditures, such as advertising, taxes, and legal fees, and plot them against business income, such as product sales and service fees. This template shows you where you need to reduce or eliminate spending, and helps you identify your most profitable sources of income.

Download Monthly Business Budget

Excel | Smartsheet

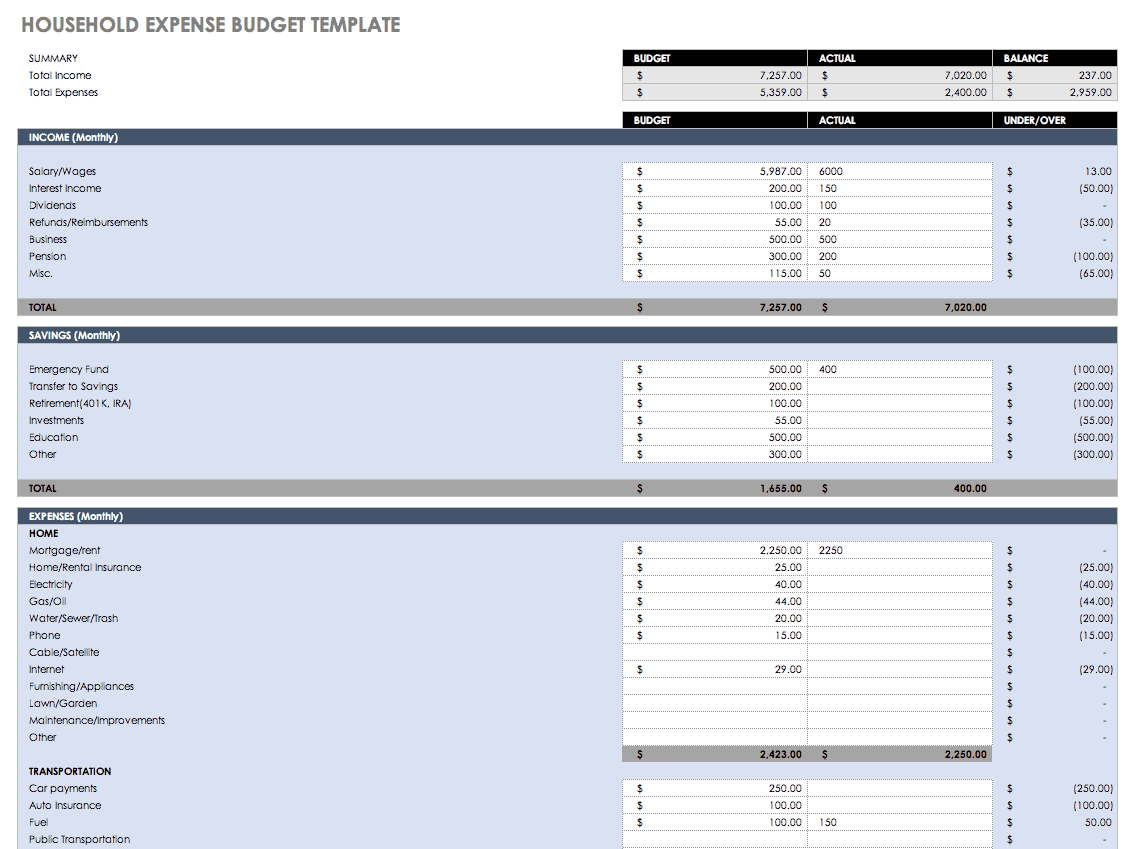

Household Monthly Expense Budget

When you have a house full of people, tracking expenses can get complicated. Monthly budget spreadsheets are helpful when managing spending for your family or roommates. This template gives you a close look at your household’s planned versus actual income and details expenses for individual categories on a monthly basis. Carefully tracking this information will help you better meet financial goals, prepare for emergencies, and plan for the future.

Download Household Monthly Expense Budget

Personal Budget

Setting a budget for yourself is hard — and following it can be even harder. Using monthly budget sheets helps make it easier. This detailed template offers a summary of your income, expenses, and savings goals (both in aggregate and by month) on one sheet with a detailed monthly breakdown by category on another. By taking a closer look at your budget, you can gain better control over your finances.

Download Personal Budget

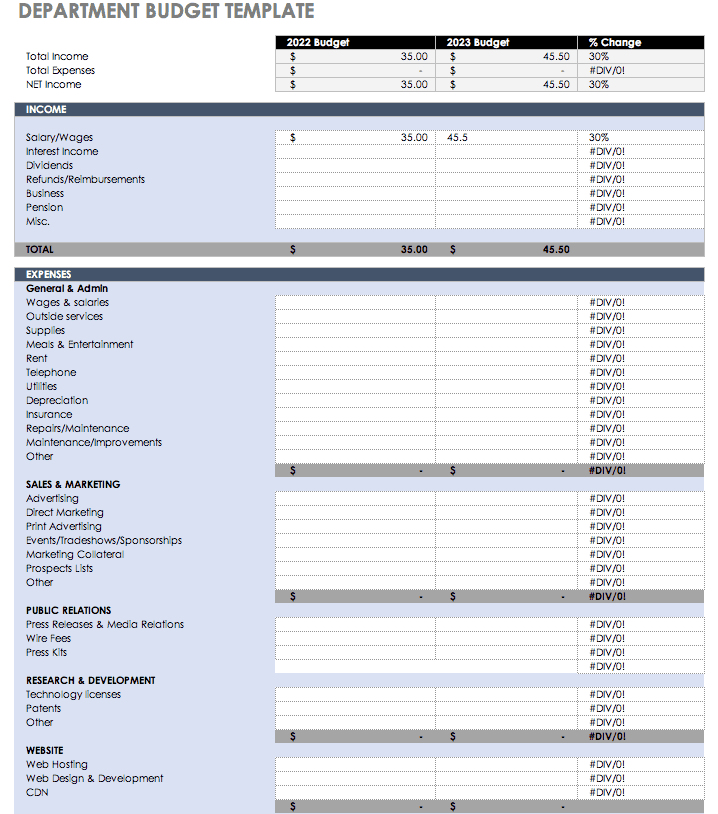

Department Budget

This monthly budget sheet can help you forecast expenses for your business or academic department for the entire fiscal year, as well as by month. You can also compare percentage changes in the budget from year over year. Expenses are grouped by category (for example, website, research, and travel costs) to give you a snapshot of how you’re allocating department funds.

Download Department Budget

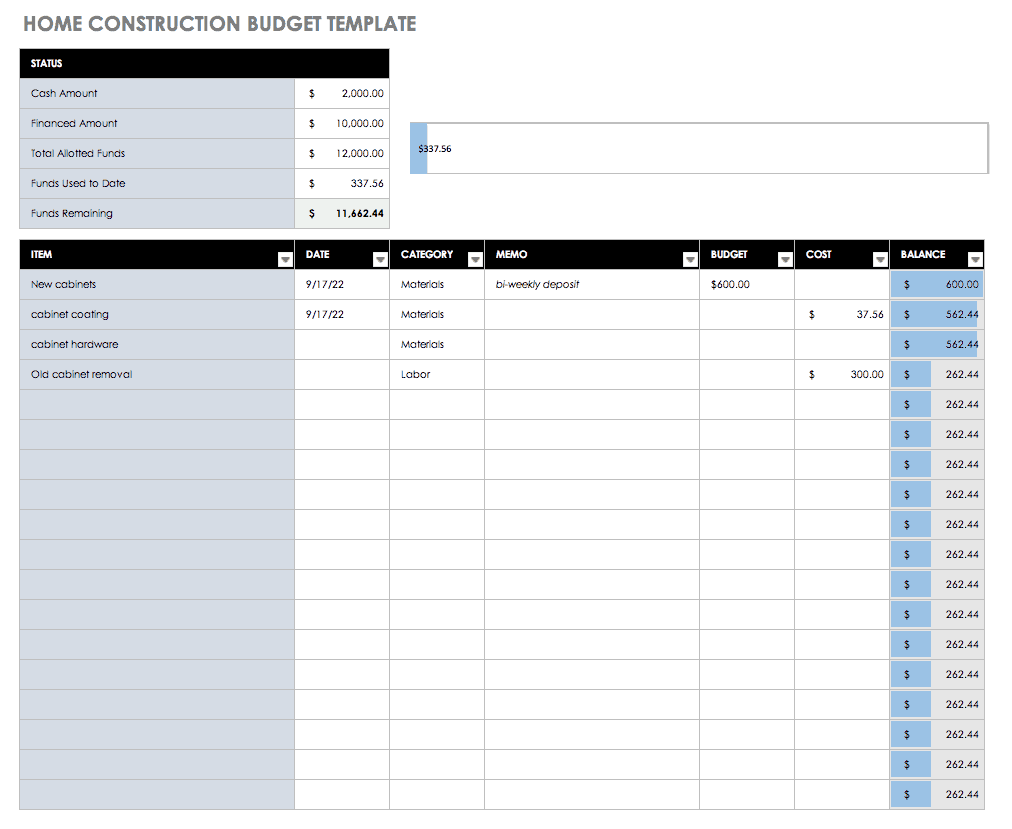

Home Construction Budget

Whether remodeling your home or building a new one, it’s easy for costs to get out of hand. Use this monthly budgeting worksheet to account for all labor and materials expenses, track spending by category, and ensure you’re within your overall budget. This template can also help you set aside extra funds for emergency repairs and unforeseen costs, which are common with construction projects. Check out these Excel construction management templates to help you manage a budget for larger jobs.

Download Home Construction Budget

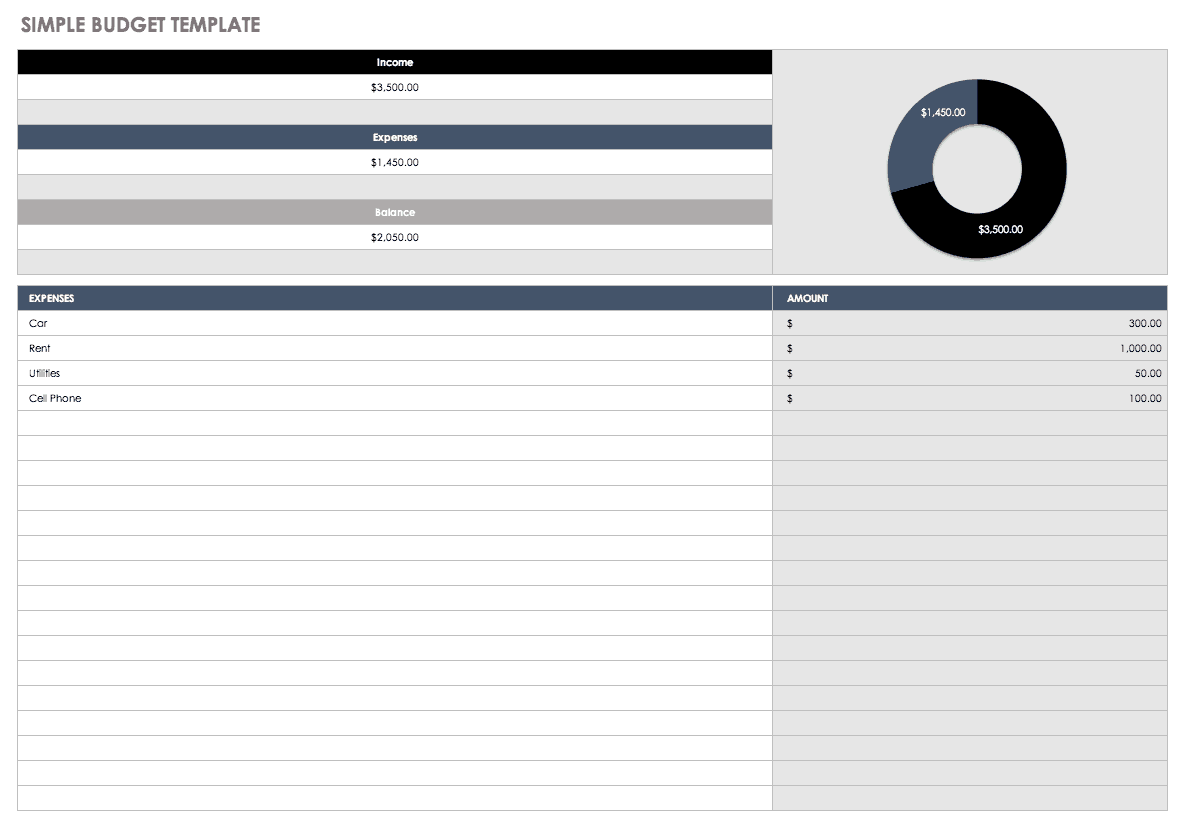

Simple Monthly Budget

If you just need a basic budget tracker, or if you’re making a budget for the first time, this simple budget template can help you get organized. It offers a basic snapshot of your income, expenses, and insight into extra money that you can save. You can also use this template to plot your finances on a chart for an at-a-glance look at your spending.

Download Simple Monthly Budget

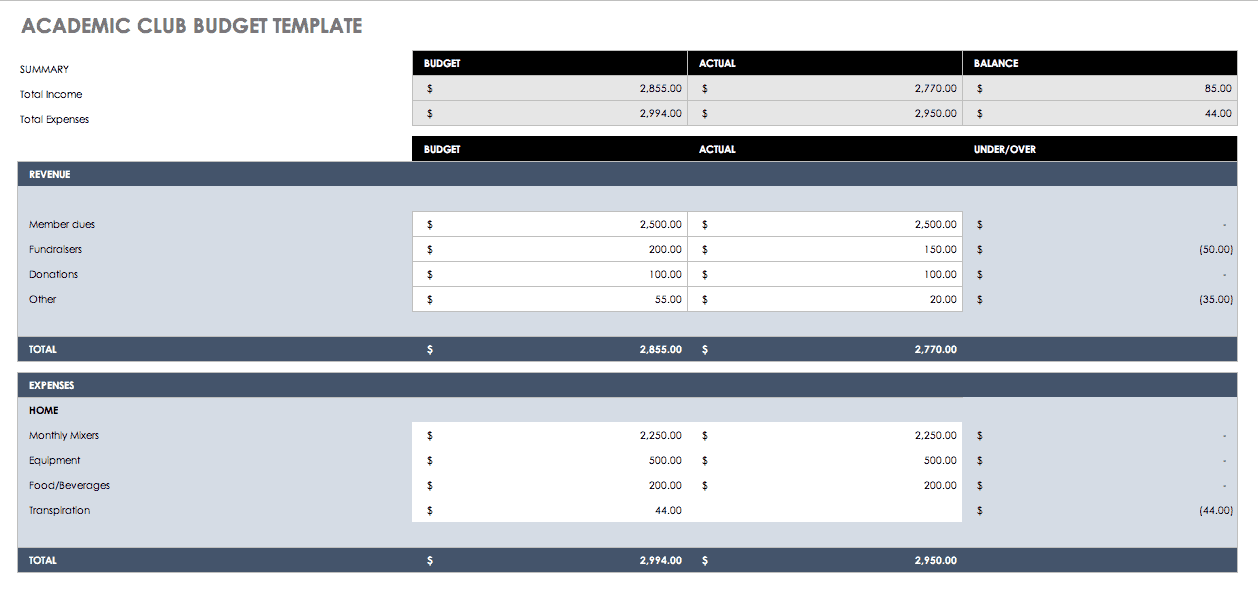

Academic Club Budget

This monthly budgeting sheet helps you track income and expenses for an academic club. Clubs often have annual goals for fundraising, dues, or sponsorship, as well as limits on monthly and annual spending. Tracking all this on a monthly budget planner can help you gauge progress toward financial goals, and verify that your club isn’t spending more than it’s making.

Download Academic Club Budget

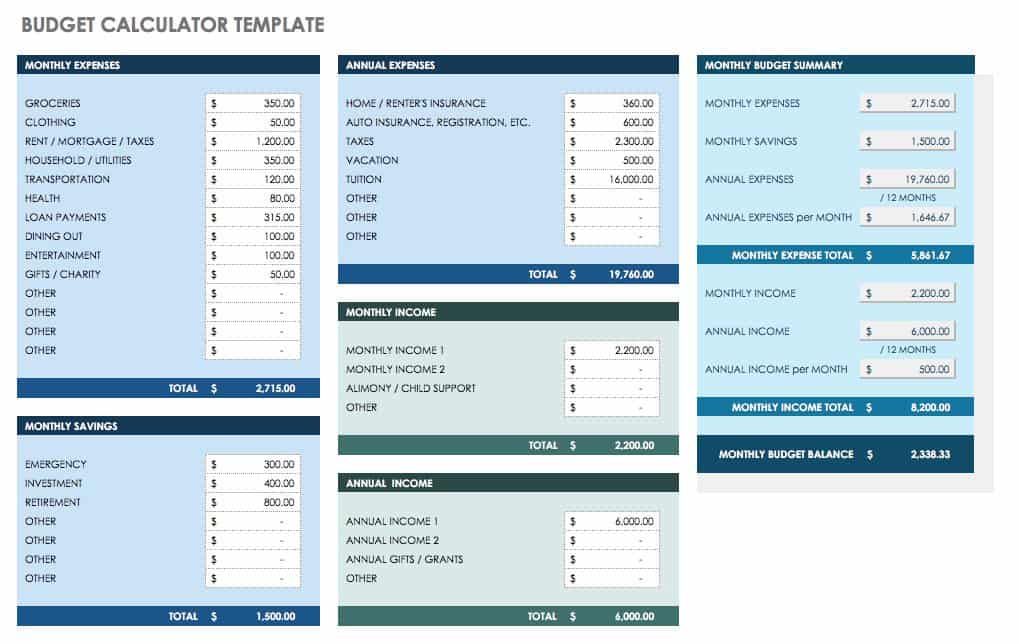

Monthly Budget Calculator

Using this basic budget calculator, you can quickly and easily plot regular expenses for major categories (housing, transportation, debt, etc.) against your income for the month. Simply plug in the payment and receipt amounts, and the calculator will reflect totals in aggregate as well as by category for the month. This gives you an at-a-glance view of how closely you’re sticking to your budget.

Download Monthly Budget Calculator

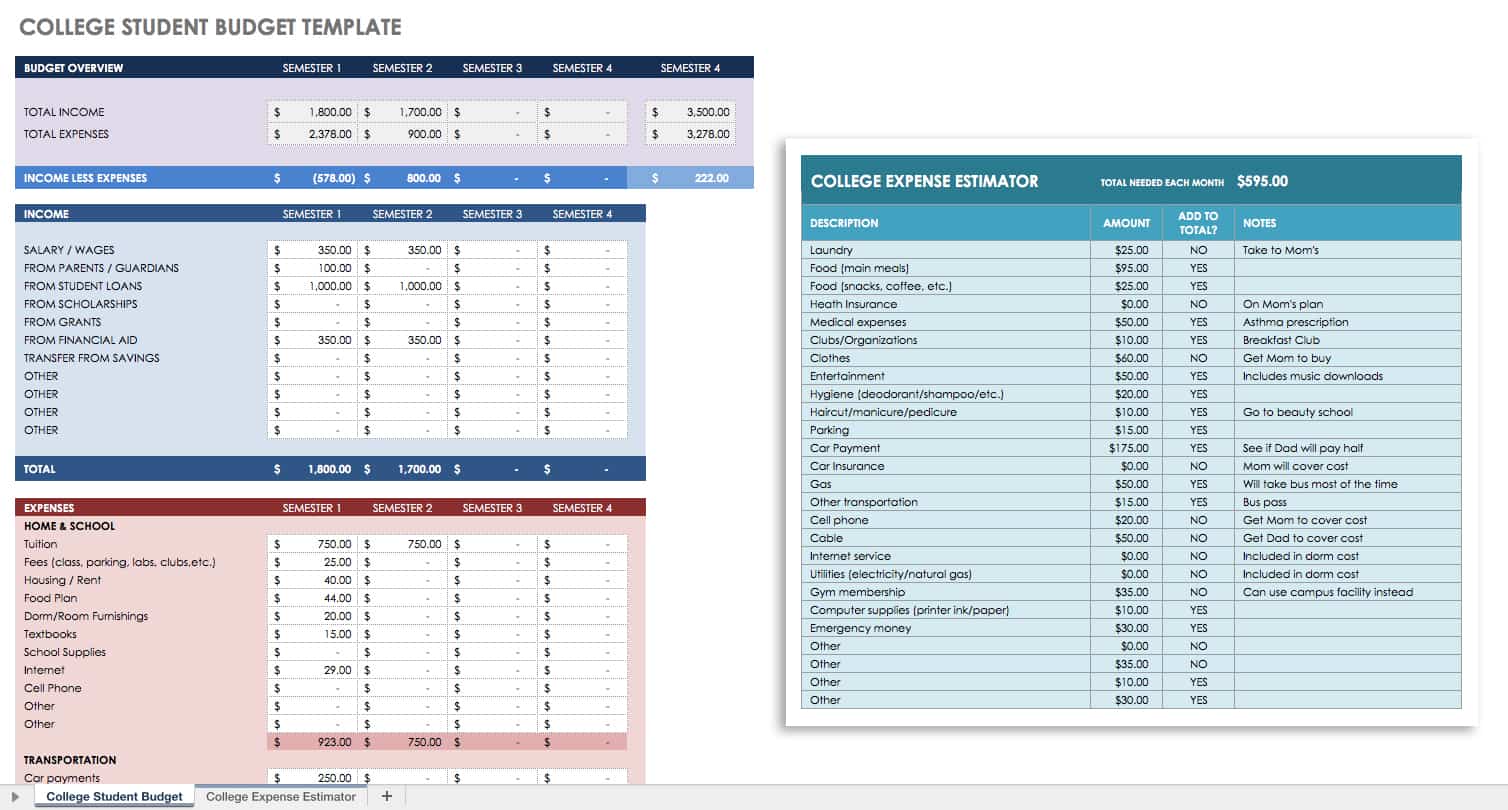

College Student Monthly Budget

College is one of the biggest investments many people will make in their lifetime. Use this monthly budget Excel spreadsheet to help plan for it accurately. In addition to tuition fees, this sheet will help you track spending on textbooks and educational supplies, housing, and transportation, as well as income from jobs, internships, and student loans or scholarships. You can also track your college budget by month or by quarter.

Download College Student Monthly Budget

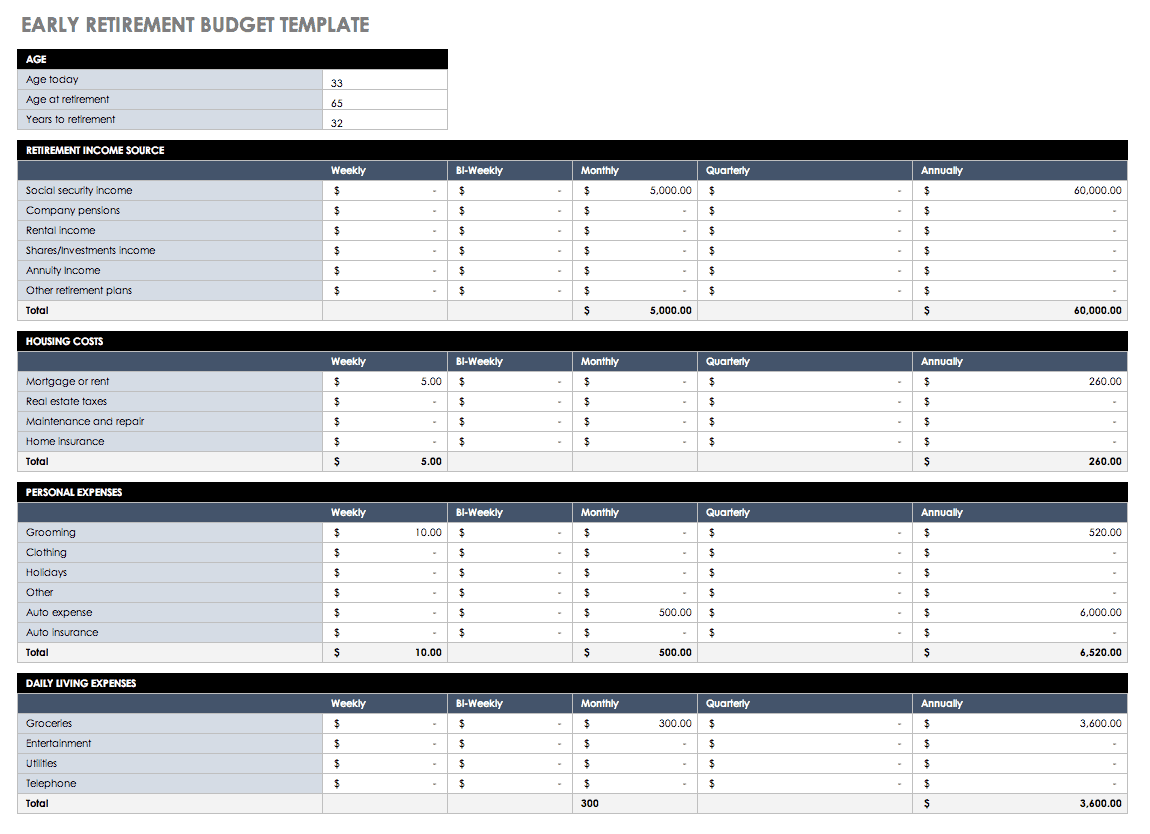

Early Retirement Budget Sheet

Planning ahead is especially important when it comes to your retirement. If income and expenses aren’t tracked and distributed properly, it could seriously impact your future. Using this monthly budgeting worksheet, you can ensure you’re financially secure when you retire. Track income sources as well as living, personal, and medical expenses on a weekly, bi-weekly, quarterly, or annual basis. You can also compare your actual income with what you need to retire comfortably.

Download Early Retirement Budget Sheet

Monthly Family Budget Planner

Families have a lot of expenses. From doctor’s visits to vacations to saving for college, you need a comprehensive budget to track your family’s spending. This monthly budget worksheet allows you to compare expenses with your family’s income and savings, and reflects annual totals by category. Using this template, you can make sure your family is financially prepared for future expenditures, such as education and retirement, as well as for any emergencies that may arise.

Download Monthly Family Budget Planner

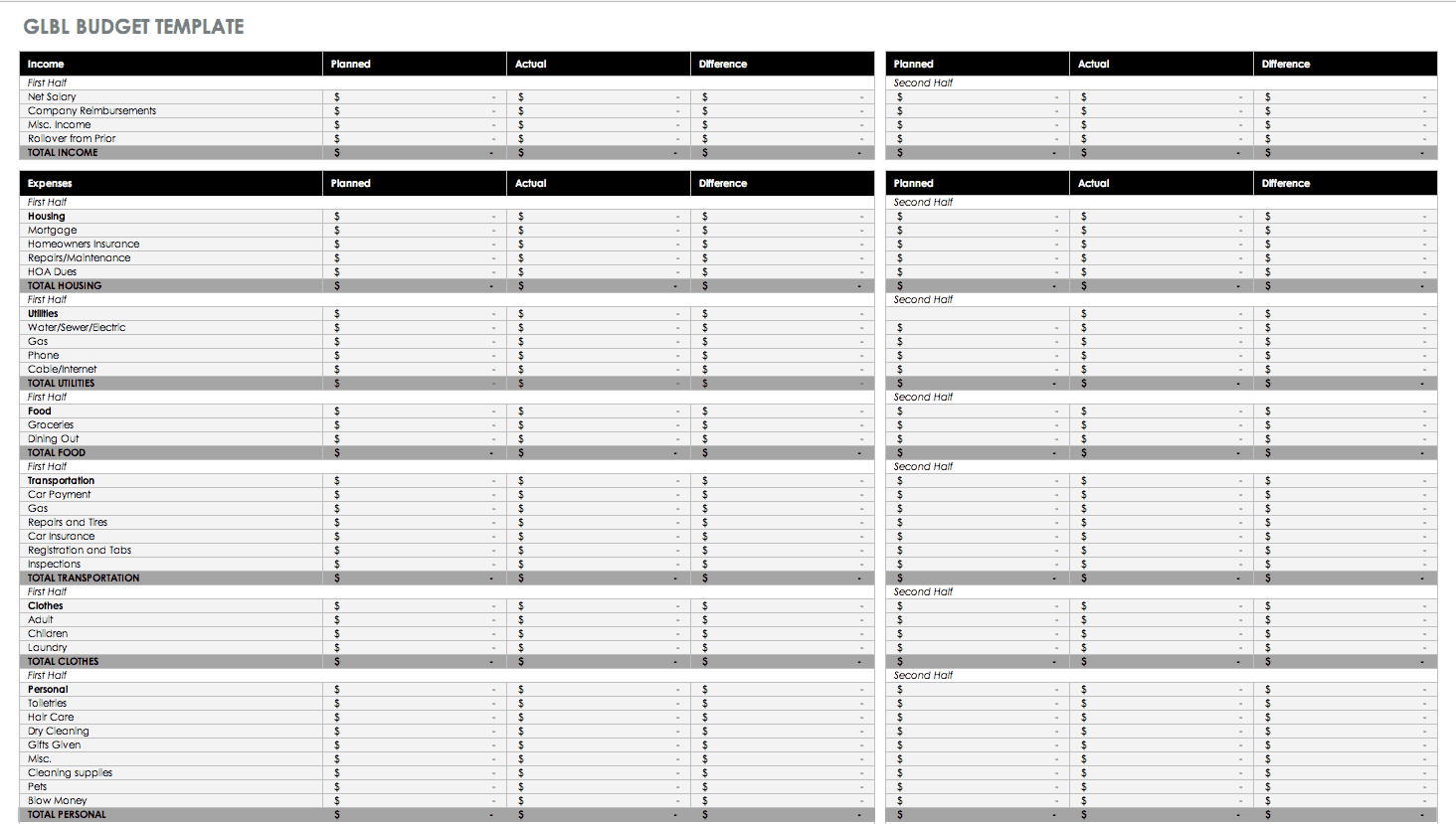

GLBL Monthly Budget Spreadsheet

If you want granular control over your finances, this “Gather Little by Little (GLBL)” budget template is for you. It allows you to designate every dollar of income you receive from your paycheck for a specific purpose, so you can avoid spending more than you’re making. This comprehensive monthly budgeting worksheet offers an at-a-glance view of all expenses and income on one sheet, and breaks down each spending category in detail on the following sheets in the template.

Download GLBL Monthly Budget Spreadsheet

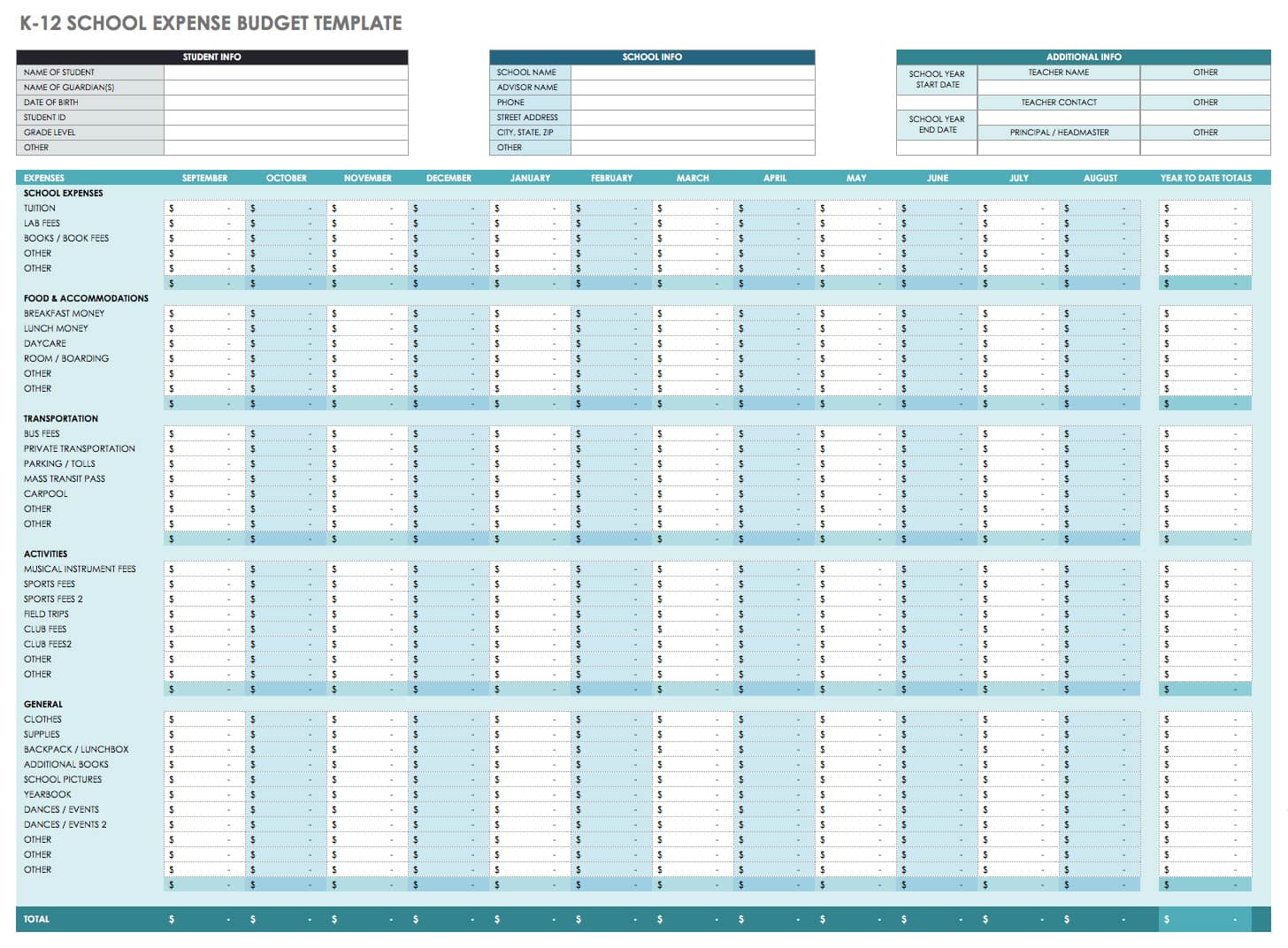

K-12 School Expense Budget Template

Even before your kids reach college, school expenses can add up. Keep track of them with this monthly budget template. It allows you to track all spending related to school and extracurricular activities: tuition, lab fees, books and school supplies, uniforms, club and team dues, and more. By managing your school budget, your kids will have the financial support they need to achieve their goals.

Download K-12 School Expense Budget Template

Monthly Budget Template

This all-purpose monthly budgeting spreadsheet can help you keep track of most personal and family expenditures. Use this template to enter housing expenses such as rent, utilities, and telephone; recurring payments such as car loan, insurance, and credit card charges; food and drink expenses; and other costs of living, such as child care, gym memberships, and entertainment. These can be tracked against your individual and/or family income, so you can make sure you’re prepared for the future.

Download Monthly Budget Template

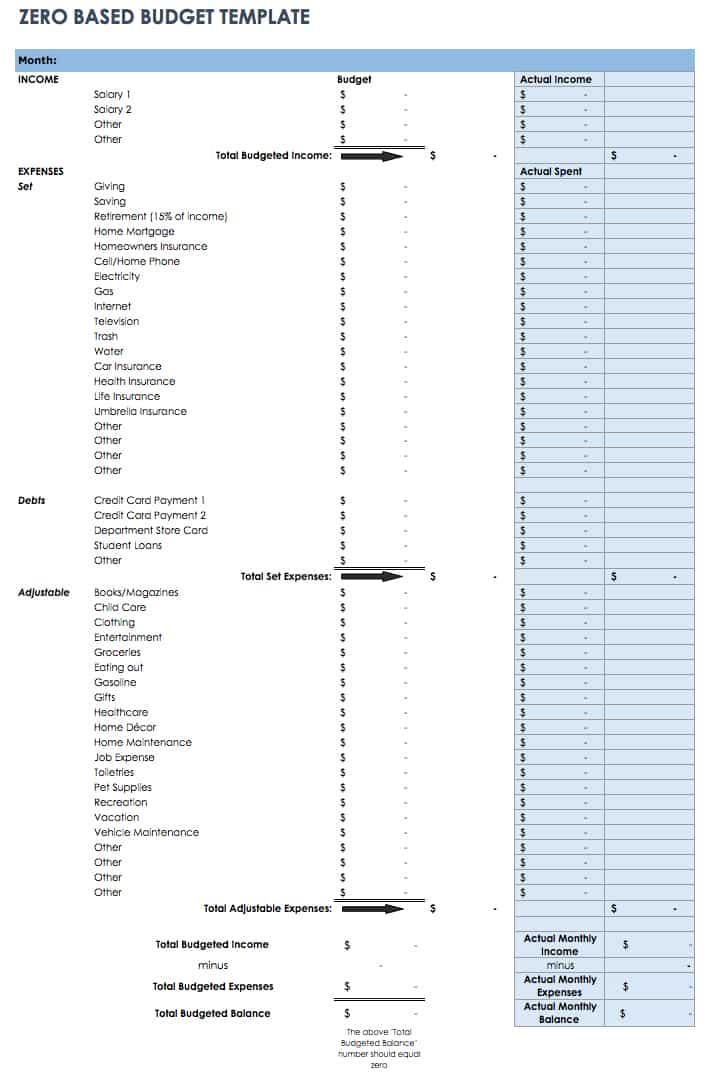

Zero-Based Budget Spreadsheet

Similar to the GLBL budget spreadsheet, the zero-based budget involves distributing your income to certain expense categories, so the balance equals zero at the end of each month. Whether you’re allocating money to living expenses (housing, car, groceries, etc.), to fun and entertainment, or to save for the future, a zero-based budget sheet will tell you where each dollar is going. Use this spreadsheet to plot your current income against your expenses, and adjust your budget until it zeroes out.

Download Zero-Based Budget Spreadsheet

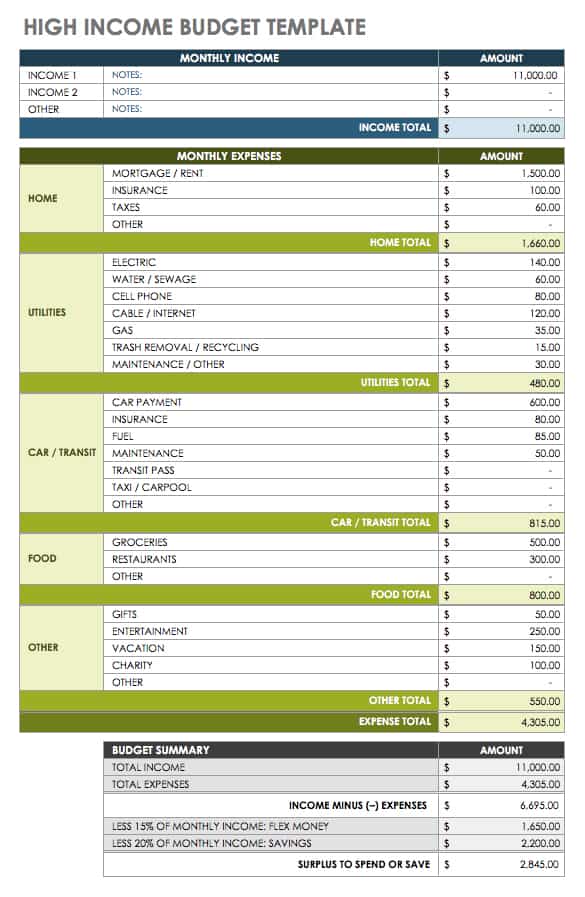

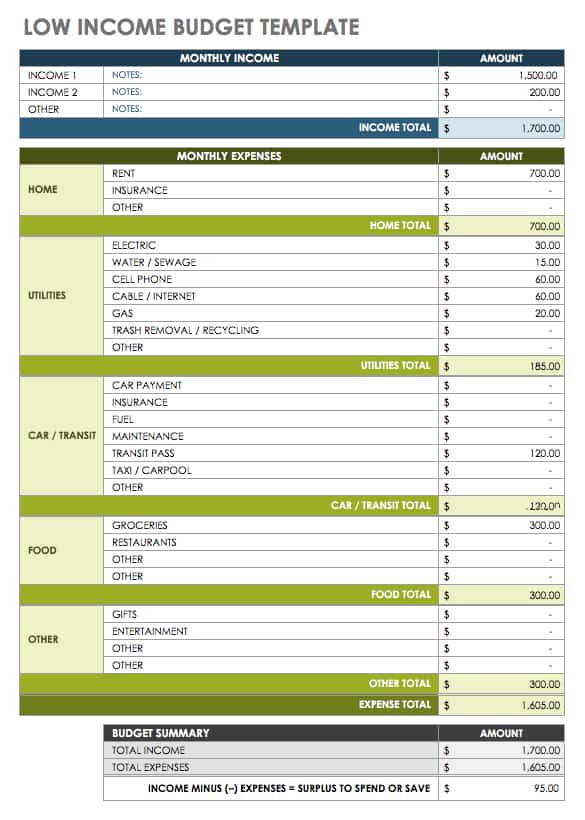

Completed Sample Budgets

Need some more help getting started? These templates offer an example of what your budget might look like once it’s complete. No matter how great your income, planning ahead is important so you don’t overspend, or spend too much in the wrong place. Easily compare your own spending against these sample low-income and high-income budgets to see if you’re on track or need to make adjustments.

Download High Income Budget - PDF

Download Low Income Budget - PDF

How to Use a Budget Template

To create your budget, first determine your regular income: for example, paychecks, government assistance, alimony payments, and child support. Businesses should consider how much money is allotted for specific projects. Don’t count irregular income, such as bonuses or gifts, since these fluctuate from month to month.

Next, calculate your regular expenses. Include everything from housing costs to insurance premiums to recreational spending. For variable expenses, such as utility bills, calculate your monthly average. Don’t forget to include things like groceries, gym memberships, and regular ATM withdrawals.

Finally, choose and download the right budget template and use it to plot all of this information - make sure your spending doesn’t exceed your income. You can also track your finances on an even deeper level by downloading and using one of our weekly budget templates .

Create a Monthly Budget in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- Search Search Please fill out this field.

How to Create a Monthly Budget

:max_bytes(150000):strip_icc():format(webp)/P2-ThomasCatalano-1d1189bf85d0470eb415291cb149a744.jpg)

- The 50/30/20 Rule

Calculate Your Income

List all your expenses, create and track your budget.

Ziga Plahutar / Getty Images

Regardless of your income and financial situation, a budget is one of the most important tools at your disposal. You can be alerted to trends you might not have noticed when you track your money habits, like spending nearly $70 a month on lunch-break coffees. Noticing those trends is an essential step in identifying your behaviors, and accepting a change is needed.

“A budget simply tells us how much money is coming in, how much is going out, and where it’s going—and this is essential information for everyone,” Jonathan P. Bednar II, CFP at Paradigm Wealth Partners in Knoxville, Tennessee, told The Balance in an email.

As many as 80% of Americans say they are following a budget, according to a 2021 budgeting survey conducted by Debt.com. The two most common reasons for budgeting, according to the survey, include wanting to increase wealth or savings, or being prompted by debt, according to the survey. Learn what steps you should take to create an efficient and useful budget, ultimately leading to a financially stable future.

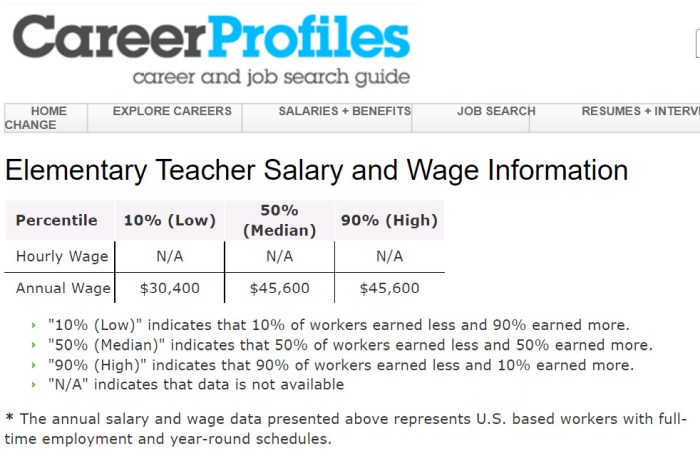

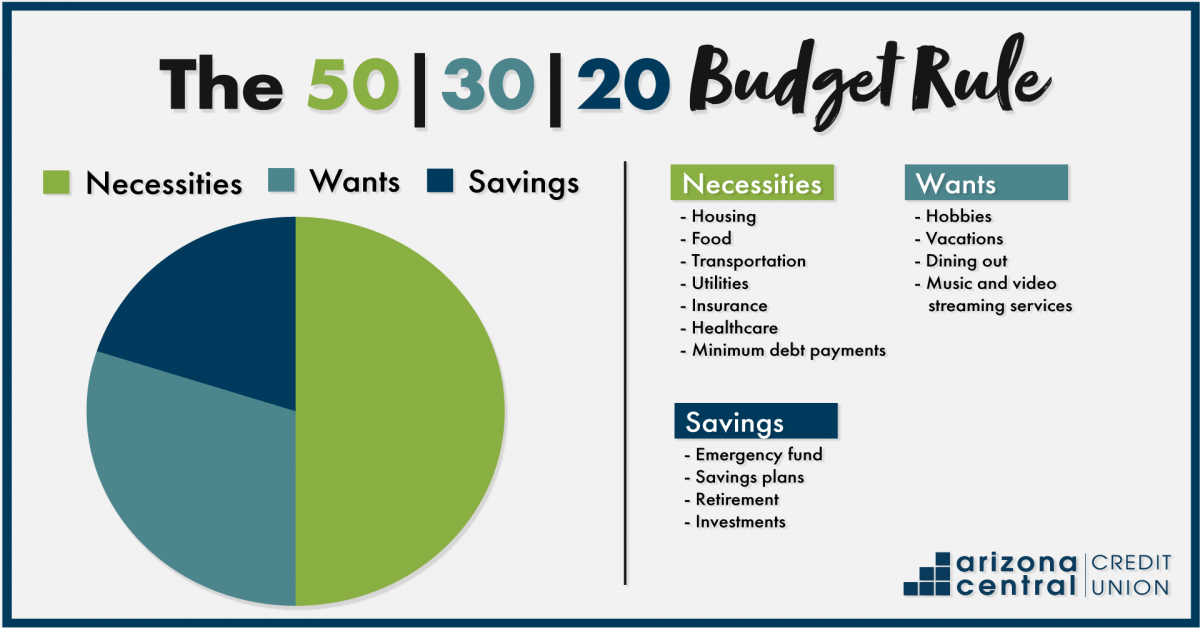

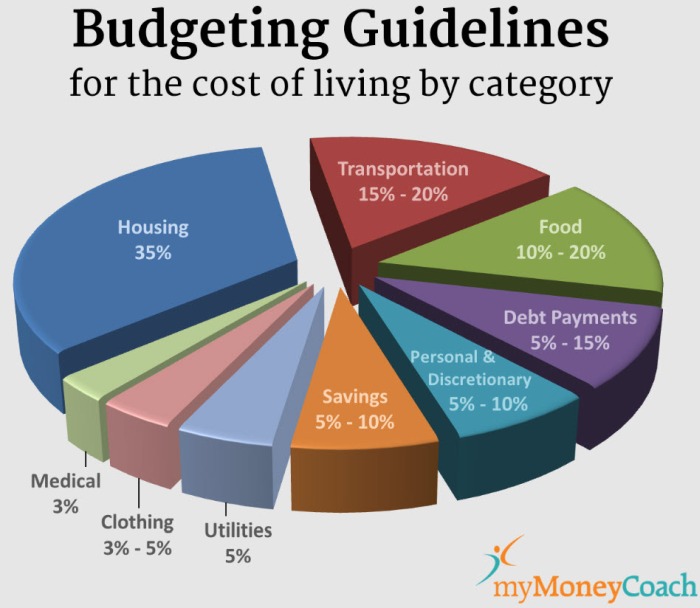

The 50/30/20 Rule

When it comes to budgeting, the simpler the better is usually the motto, as you’re less likely to be consistent with a complex budgeting process. One popular budgeting strategy is the 50/30/20 rule , which separates your spending by category: must-haves, wants, and savings or debt payoff, respectively, using net income.

A full 50% of your income should be budgeted for essential expenses, according to the rule. “This includes housing, utilities, auto payments, groceries, gas, minimum monthly debt payments, insurance premiums, etc.,” Bednar said. And ideally, according to Bednar, no more than 30% of this amount should go toward your housing payment.

The next portion of your net income, 30%, should be allocated for personal expenses, or things you really want but do not need. “These are items that you could cut if you had to, like dining out, hobbies, entertainment, gym memberships, and fun, monthly subscription boxes,” Bednar said.

The final 20% is the most essential part of your budget, according to Bednar, because what you do with it will largely determine whether you’re financially successful or not. “This portion of your budget goes toward your financial goals—things like paying off debt, saving for an emergency fund , saving for a home, and investing.”

While it’s tempting to make minimum payments on debt and put whatever’s left at the end of the month in savings, Bednar warns against this approach. “What usually happens is that there is nothing leftover, so if you don’t deliberately budget for those things, they’re unlikely to happen,” Bednar said.

If you have high-interest debt, you may want to consider flipping the wants and savings portions of your budget. “When those high-interest debts are dragging you down, it’s impossible to make any progress on your other financial goals,” Bednar said. Devoting that extra 10% of your income to paying off debt could save you thousands of dollars in interest.

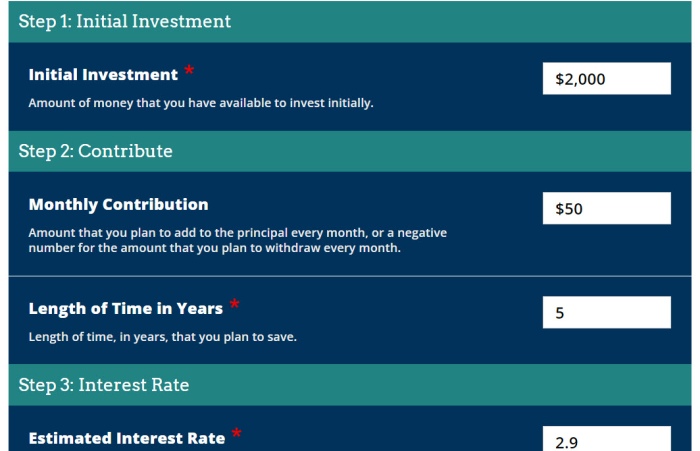

After deciding on a budgeting strategy , the next step is to determine your monthly income. “If you work for an employer as a W-2 employee, they will take care of all of the tax withholding, so you can use your after-tax income amount to create your budget,” Dave Henderson, CFP, ChFC, CLU, a self-employed advisor at Colorado-based Jenkins Wealth, said in an email to The Balance. If you’re self-employed, you’ll need to subtract your self-employment tax before calculating your net monthly income.

When calculating your income, be sure to include all sources. If you have multiple jobs, take part in a side hustle, or receive child support or government benefits, those values should be included in your monthly income.

After you determine what’s coming into your bank account, determine what’s going out. “You can do this by reviewing your credit card statements, as well as your bank statements for the last two-to-three months to determine where your money has been going,” Henderson said.

Some expenses are fixed, staying the same from month to month, and others are variable and change often, such as groceries and entertainment. With variable expenses, it’s helpful to look back at your receipts from the previous few weeks or months and calculate an average.

Consider starting a daily log of your expenses to see what you’re really spending your money on. Often, those small expenses, like running out for coffee or grabbing a snack on your way home from work, can be overlooked, so it’s best to keep track of them in the moment.

Now that you know the information you need for a budget, it’s time to actually create a budget.

While you can easily track your monthly spending habits by hand using pen and paper, there are several budgeting apps and software programs that make this process easier.

One popular budgeting app is Mint, which is Bednar’s favorite, because it is accessible and free. With Mint, as well as most others, you will need to gather details on your financial accounts, like credit cards and investments. These will be connected to the app and visible all in one place, ensuring all of the tracked information is accurate and up to date. According to Bednar, Mint recommends a budget based on the information you provide, but you also have the option of customizing it.

Here’s a sample of how the 50/30/20 rule might look, based on a net monthly income of $5,000, according to Bednar.

| Mortgage: $750 | Dining out: $350 | 401(k) contribution: $500 |

| Utilities: $400 | Hobbies: $250 | Emergency fund: $200 |

| Car Payment: $300 | Self-care: $150 | ROTH IRA contribution: $300 |

| Groceries: $400 | Entertainment: $300 | |

| Gas: $50 | Clothing: $200 | |

| Insurance: $400 | Household items: $150 | |

| Student loan: $200 | Charitable donations: $100 |

Once your budget is made, whether through an online platform or on paper, track your progress. “You will quickly see that there are some categories in the budget where adjustments need to be made,” Henderson said. “You may find out that you are spending way too much money on entertainment, for example, and not putting enough money into savings.”

If you’d rather use a simpler solution, the Federal Trade Commission also offers a budget worksheet .

By reviewing these gaps in spending, you can make adjustments accordingly. It’s also key to remember that even though you have a budget, it will only be useful if you periodically track and update it to reflect any changes to your income and expenses.

Debt.com. " Americans Are Budgeting More Than Ever ."

:max_bytes(150000):strip_icc():format(webp)/1-11-23controloffinances-2d5ac066ba3c4e959d29f92a54b4713a.jpeg)

7 Free Excel Spreadsheet Templates for Budgeting

Bookkeeping is crucial. Whether you are a housemaker or a business owner, keeping a budget is essential to meet your financial goals.

Some people create budgets in their minds, while others get them down on paper. Why not try another way?

Excel budget templates offer a quick way of budgeting. They provide the outline and you only need to fill in the cells.

You can choose any Excel template and use it to track expenses.

To help you make the right choice, we have listed the seven best free Excel budget templates for you. Let’s review them in detail below 😃

Table of Contents

Project Budget

Personal monthly budget, balance sheet, family budget planner, portfolio tracker, customizable 401k calculator, cash flow tracker.

A project manager is responsible for utilizing the funds of a project efficiently. In any business, funds make the backbone of the project.

If the manager is unable to manage the expenses properly, he may put the hard work of the entire team at stake 😕

To this effect, we suggest getting the Excel Project Budget template . It has helped hundreds of people execute their dream projects successfully and can help you too.

This free budget template will get you through all small and mid-level projects. You can use it for contract work, home renovation, office remodeling, etc.

It shows the actual costs and planned budget. You can use it to see if your expenses are within the budget and, if not, how you can improve them.

All in all, this is great for small tasks that are not as detail-oriented. But if you have bigger projects, it is better you get the paid version of this spreadsheet template.

Having a personal budget that keeps you on track with your savings goals is essential. You need to know where all your money is going and if these expenses are necessary.

You can use the Excel Personal budget template for this purpose. It will help you manage your monthly expenses. And you can add multiple sources of income apart from monthly income if any.

It also allows you to set monthly goals and helps you save money accordingly. You can separate fixed costs and see your actual spending. It includes budget categories like housing costs, travel expenses, entertainment, taxes, and others.

All you need to do is add your income and expenses, and this free budget template will do all the calculations for you 😉

Its primary purpose is to compare your budget with your actual costs on a monthly basis. For that, it records your projected and actual expenses.

It will instantly show you the difference and if you were able to meet your set goal. You can always start again and do better.

Being a business owner, you need to be well aware of all your assets and liabilities. An active reminder of how much money you have and how much you need to pay off is important.

It helps keep your mind straight and know the financial health of your company in a better manner. Only then can you make informed decisions and investments.

It will also tell you where to cut down money so you can perform adequate money management and add more to your equity.

You can use the Excel Balance Sheet template for this purpose. It is very easy to use and contains simple terms that even a layman can understand. Moreover, the template is easily customizable, and you can change it in whichever way you want 🎨

You can use this template to summarize your finances. And identify areas that are causing a deficit in your budget.

This balance sheet can also help you determine your net worth at a point in time. It is automatically calculated for you under the owner’s equity portion.

At the bottom of the sheet, you can find the common financial ratios. These include debt ratio, working capital, and 0ther information.

Having a household budget template is very important when you have a family. Household expenses keep on increasing, especially with kids.

To maintain them, you need to have a Family Budget Planner. It will tell you exactly where all the money is going and what you can do to save it.

You can use the Vertex42 Family Budget template . It will help you keep track of your money based on income and expenses for each month 🗓️

It can also work as a yearly planner and allow you to see the bigger picture. The family budget template can be really helpful in planning major life events beforehand.

For example, if you want to buy a house after two years, you need to start saving for it today. You will have to set a goal, for instance, $10,000. Per your income and monthly expenses, you will know where to cut down and add more money to meet your goal.

The best part of this template is its easy-to-use interface. The design is clear, and you can easily understand where to make changes. The template will automatically calculate and update the remaining expenses.

It contains different expense categories like Home Expenses, Daily Living, Children, and others.

If you are a shareholder, you need to have this budget template. It will help you actively keep track of your investments and shares. You can use it to see your transaction history, and your dividends or simply evaluate your equity 💲

The Portfolio Tracker can be of great help in this instance. Whether you are an active trader or prefer being a passive investor, bookkeeping is important to know your financial status.

You can use the Simple Investment Tracker for this purpose. It will readily give you an estimate of your total cost of accounts. It also shows the gain or loss per the market value and you can compare it with previous performance.

You can also check your Average Entry Price compared to the Current Costs and see if you are making enough profit. Moreover, it offers an easy way to compare investment value with market value and visualize the difference.

This budget template will offer comprehensive insights into your investment accounts. It is designed for people who want to quickly view their investments and their profit.

It only shows your investment, its details, and its current value. A disadvantage is that it doesn’t go into the details of everything. This can be difficult to understand as some sections require a description.

Other than that, it’s great for keeping track of your investments.

Having a strong financial status at the time of retirement is a dream of many. But only so many people are able to achieve it.

The key difference is planning and proper budgeting. You need to set a goal or a fixed amount of money that you need to save up before your retirement approaches.

Most people mindlessly put money in their 401k. To get your retirement plan on track, you need to invest money actively. It helps you make wise and informed decisions, and you can use your investments in a better way.

To help with that, you can use the free Customizable 401k Calculator Template . It is all you need to get your retirement plan on track. The interface of this template is simple, and it gives instant results on your entered values 🤓

Add your current annual income, your employer’s contribution, and your expected salary increment. Also, add your withheld salary, current age and the age you plan to retire at, interest rate, and other similar things.

The template budget excel will automatically calculate all other factors. It also displays all your data on a chart for better understanding.

As the name tells, a Cash Flow Tracker helps you track your cash flows. Cashflow simply means the money that comes in (inflow) and the money that goes out (outflow).

Having a cash flow tracker is crucial regardless of whether you are an individual or a business. It can help recognize expenses, operating cash, receivables of the business, and more.

It can also hugely impact your business decisions and planning. If your outflow is greater than your inflow, you need to cut down your expenses and improvise.

This will help you decide if your pace is well-suited for upcoming projects. And make timely decisions to improve it 🤗

The spreadsheet is easy to understand, and you can customize it however you like. All this contributes to making your money-tracking experience smoother. The goal is to help perform all operations smoothly and bring maximum inflows.

Frequently asked questions

Does excel have a budget template.

Yes, Excel has a variety of budget templates. From Personal Budgets to Project Budgets to Family Budget Planners, Excel has it all.

Written by Kasper Langmann

Hi, I'm Kasper Langmann 👋

I'm the co-founder of Spreadsheeto, a certified Microsoft Office Specialist, and a Microsoft MVP.

With over 10 years of experience, I’ve taught Excel to millions of people worldwide.

I spent over 15 hours researching and writing this tutorial.

Last updated on August 28th, 2024.

Before you go, sign up for my free Excel course (+100,000 students) ->

Microsoft 365 Life Hacks > Budgeting > Making Your Monthly Budget: Tips and Techniques to Take to Control of Your Finances and Your Future

Making Your Monthly Budget: Tips and Techniques to Take to Control of Your Finances and Your Future

When you sit down to create a monthly budget, you’re not only organizing your money habits. A monthly budget is about much more than that. By breaking down your spending habits and behaviors, and creating a plan of action, you’re giving yourself a chance to control your finances and your future. Take these steps and use these tips to build a monthly budget that works for you—and meanwhile, you’ll see a strategy for enabling your ideal future begin to take shape.

How to Make a Monthly Budget

To craft your monthly budget, start with the budgeting basics . Follow these simple steps to get the ball rolling:

Turn data into insights with Excel

Make better decisions backed by data and insights

- Calculate Your Monthly Income: Start with your monthly after-tax income or “take-home” pay as your spending limit for each month. If your income varies from month to month, use an average based on the last year or start with your low-earning month of that year as a baseline. Also be sure to include other sources of income like Social Security payments.

- Tally and Understand Your Monthly Expenses: Write down all of your expected monthly expenses, including your mortgage or rent, groceries, utilities, transportation, debts, and entertainment. As you’re tallying these expenses, make note of which ones might fluctuate from month to month, as well as which ones are fixed. For categories of spending that change over time, examine recent statements from your bank or credit card provider to estimate how much you tend to spend in these areas each month.

- Make Adjustments: Subtract your expenses from your income and see whether you are in the positive or negative. If your budgeted expenses are greater than your income, then you’ll need to identify areas where you can cut spending.

Monthly Budgeting Techniques and Goal-Setting

Even if your expenses are lower than your income, you’ll likely want to make some adjustments, too. Once you have more finalized income and expense numbers to work with, it’s time to work toward a sustainable plan that not only accounts for your spending but makes sure you’re doing that spending in the right places and on the right things for you. To help you do just that, use these techniques to help allocate your budget toward the right mixture of expenses.

Use Proportions

If you’re unsure of how to initially structure your budget in a way that leads to savings, some common budgeting systems might come in handy. The 50/30/20 rule is one of the most common—and straightforward—systems for monthly budgeting. Using this rule, you can aim to spend your money in the following fashion:

- 50% on Needs: Allocate half of your monthly after-tax income to your needs—things like rent or mortgage payments, groceries, and utilities.

- 30% on Wants: The next 30% of your spending goes toward your desires, the things that keep you happy. This should account for everything from nights on the town and takeout, to hobbies, leisure travel, and subscriptions.

- 20% on Savings and Debt Repayment: The remaining fifth of your monthly budget can then be allotted to repaying any outstanding debts (car payments, student loans, etc.) and to building up your savings—whether that’s a college savings or retirement plan, savings for a new home, or an emergency fund.

However, one drawback of the 50/30/20 rule is that some may struggle to clearly distinguish between some expenditures that are “wants” and “needs.” To simplify this, some budgeters instead use an 80/20 rule, where 80% is allocated toward both of these categories while the remainder is used for debt and savings. In yet another example of a proportional budgeting system, users of the 70/20/10 system cut their spending on wants and needs to 70% of their monthly budget, use 20% toward debt and personal savings, and a remaining 10% for long-term investments in things like retirement, college, and a new home.

Use an Envelope System

Even after you have your monthly budget categories outlined, it can be difficult to stick to them and always avoid overspending. A so-called envelope system can help you stick to your budget. Using your choice of cash and physical envelopes, a dedicated app like Goodbudget , or specific “sub-savings” accounts, this method calls for determining and maintaining strict spending limits on your various expense categories.

Whether your categories are as general as those in the 50/30/20 breakdown or include many more specific categories like “eating out” and “coffee breaks,” the envelope system requires you to draw money from the matching envelope or savings account. This way, you know that once you’ve run out of money in a given envelope, you must wait until the next month to spend any more on that item, activity, or category.

Account for Your Goals

A monthly budget that considers and reflects your own personal priorities isn’t just the right kind of budget—it’s the most sustainable one. No matter if you’re using a pre-set 50/30/20 system or your own personalized plan, be sure that it doesn’t just consider the present day-to-day but also your future. If you have your sights set on a future dream home, a new car, or a special trip next summer, factor incremental savings toward these aspirations into your monthly plan. Using a target amount and date, you can calculate just how much you need to spend and save each month to meet your goals over time.

Budgeting Tips to Make Yours a Success

Mastering your monthly budget will take some time and plenty of effort. Use these budgeting tips to help make your journey toward a working budget a much smoother one.

Get Some Help from Technology

While you might opt for an old-fashioned paper envelope system, in our digital age, there are countless budgeting apps that you can use to keep track of your spending. Apps like Mint offer a free, one-stop-shop for custom budgeting and tracking spending, while zero-based budgeting apps like EveryDollar help you put each cent of yours toward something specific.

Meanwhile, spreadsheets in Microsoft Excel and Google Sheets offer endlessly customizable ways to track your spending, your way. And you don’t need to be an accountant or Excel whiz to do so—pre-made budgeting templates are available to make it an easier process.

Make Space for Surprises

At the end of the day, no budget is ever going to be all-encompassing. After all, life is full of surprises; so ensure that your budget includes a category for surprise expenses or for savings toward an emergency fund that can help cover them. Here, the worst case—that you don’t have any surprises in a given month—is the best case. Any unused funds in this category can be put toward your savings or put to use elsewhere.

Stick with It

Just as no budget is perfect, no budget is ever final. Income, expenses, and aspirations all change as time goes by. Set time aside each month to adapt your budget and see that it’s still the best it can be. In the meantime, you can lean on more of our useful budgeting resources that help you make sure your budget, your finances, and your future are in your control.

Get started on your budget with the Personal Monthly Budget spreadsheet .

Get started with Microsoft 365

It’s the Office you know, plus the tools to help you work better together, so you can get more done—anytime, anywhere.

Topics in this article

More articles like this one.

Six ideas for finding summer travel savings

Discount and minimize summer travel expenses to plot your dream vacation. Learn six ideas for finding summer travel savings.

Maximize your household budget with summer savings

Score deals and discounts on household items this summer. Learn how to maximize your household budget with summer savings.

Five tips to pay off your student loans fast

Reach a debt-free state sooner with these five tips that can help you pay off your student loans.

Five tips to pay off your car loan fast

Learn about the pros and cons of paying off your car note early, as well as some tips to pay off your loan ahead of schedule.

Everything you need to achieve more in less time

Get powerful productivity and security apps with Microsoft 365

Explore Other Categories

Budget Planning and Budgeting Lessons

Budgeting teaching budget lesson plans learning worksheet household family planning exercises classroom unit teacher resources activity free tutorial curriculum basics.

Lessons appropriate for: 1st 2nd 3rd 4th 5th 6th 7th 8th 9th 10th 11th 12th Graders.

First Grade - Second Grade - Third Grade - Fourth Grade - Fifth Grade - Sixth Grade - Seventh Grade - Eighth Grade - Ninth Grade - Tenth Grade - Eleventh Grade - Twelfth Grade - K12 - Middle School - High School Students - Adults - Special Education - Secondary Education - Teens - Teenagers - Kids - Children - Homeschool - Young People

Teaching Special Needs - Adult Education - Budgeting for Kids - Children - Young Adults

Our Budgeting section delivers an array of educational tools. Dive into our collection that comprises lesson plans, printable worksheets, instructive videos, detailed articles, and more. Our lesson plans and printable worksheets are crafted to guide educators in imparting knowledge about the principles of budgeting and the importance of financial planning. Tailored to fit various learning environments, these resources are adaptable for both group lessons and self-paced studies. Our instructive videos provide a vibrant approach to understanding budgeting, bringing to life the nuances of financial planning with compelling animations and lucid breakdowns of intricate topics. Meanwhile, our detailed articles delve into the finer points of budgeting, offering expert commentary and profound insights into managing personal finances effectively. Whether you're a visual learner, a reading enthusiast, or someone in search of structured lessons, the Budgeting section of Money Instructor is equipped with resources to ensure you grasp the essentials of financial planning and lead a financially sound life.

Lessons and worksheets.

|

Use these budgeting worksheets with our lesson plan or for teaching your own budget lesson plans. Monthly and daily student budget sheets. Personal budget form. | |||||

| ||||||

|

Printable budget lesson starter worksheets for a lesson introducing budgeting. Includes creating a personal budget for yourself, and earning money while prioritizing needs and wants. | |||||

| ||||||

|

A lesson about budgets, what they are, and why we use them.

| |||||

| ||||||

|

Students learn what a budget is, why they should budget, and how to set up a simple budget. | |||||

| ||||||

|

This is an introductory worksheet. Students learn and identify fixed and variable expenses to help understand how to create a budget. | |||||

: | ||||||

|

Use these worksheets to teach basic budget concepts. Even a child should understand basic personal finance concepts. | |||||

| ||||||

|

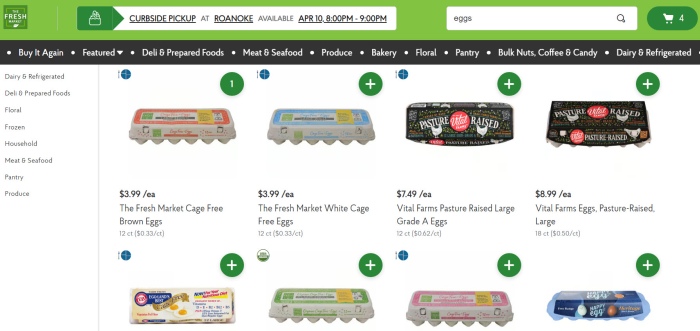

Students practice their skills at estimation while shopping for groceries. | |||||

| ||||||

|

An important budgeting money concept is understanding the difference between needs and wants. | |||||

| ||||||

|

Understanding the basic difference, between needs and wants, is crucial to good financial decision making. Students learn how to determine and prioritize their needs and wants and will also learn how to decide whether certain items are a necessity or a desire so they may demonstrate how different people interpret their own needs and wants.

| |||||

| ||||||

|

In this lesson, students learn to understand and identify what are their money habits. Every money decision you make either reinforces good or bad money habits. The first step toward creating good money habits is to first identify the money habits you currently have. | |||||

| ||||||

|

In this lesson, students keep a log of all their spending for products and services for a week to help identify their spending habits and patterns. | |||||

| ||||||

|

Learn about comparison shopping with this word problem worksheet. | |||||

| ||||||

|

This is a word problem worksheet for a lesson in basic budget concepts. | |||||

| ||||||

|

| |||||

| ||||||

| *

| |||||

| ||||||

| * Put together and categorize a budget. This is a good introductory worksheet showing what a simple one looks like. This worksheet is random, so every time you choose the link, a new worksheet is created. | |||||

| ||||||

| * This worksheet takes a predetermined budget and the student is asked to fill in the monthly items and determine if they are above or below their estimates. It also teaches and reinforces basic math skills. | |||||

| ||||||

|

A lesson for students on budgeting for school supplies, focusing on understanding financial priorities, tracking expenses, and implementing cost-saving strategies. They begin by identifying their financial starting point, recognizing income sources such as allowances, savings, and part-time jobs. From there, they delve into the significance of categorizing items into must-haves, luxuries, and intermediate essentials. The lesson concludes with the realization that budgeting transcends school preparation; it’s a lifelong skill that refines over time. | |||||

| ||||||

| * Test basic math skills while answering related questions. | |||||

| ||||||

|

Students will use given information to create a monthly spending plan, also known as a budget. In this lesson, they will develop the abilities needed to make an effective plan to budget monthly spending goals. | |||||

| ||||||

|

Use the coupons and answer the questions about grocery shopping with coupons. An introduction lesson on using coupons and discounts. Basic money math. | |||||

| ||||||

| Students learn about creating a realistic budget. | |||||

| ||||||

|

A lesson for students on how to build wealth and navigate your financial future by setting solid and achievable goals with our step-by-step guide. Covers everything from prioritizing objectives and creating SMART goals to budgeting and progress tracking. The tutorial covers various topics such as prioritizing individual financial objectives, whether that involves paying off student loans, purchasing a home, or embarking on investments. The lesson demystifies seemingly daunting financial goals, breaking them down into manageable tasks and highlighting the importance of creating realistic budgets. Students will understand how to allocate funds properly to avoid financial pitfalls, enabling them to take control of their financial destinies.

In this lesson, students learn to figure out their desired financial objectives by planning smart and effective financial goals that will help them achieve their goals. They will set financial goals that are specific, measurable, attainable, relevant, and time-bound.

A lesson on how to balance and prioritize between short-term and long-term financial goals, laying a foundation for a stable and independent financial future. Students learn about setting and prioritizing financial goals through a video lesson. Topics discussed include defining short-term and long-term goals, along with providing real-world examples of each. Students are guided through a step-by-step process of assessing their financial situations, listing, categorizing, and prioritizing goals, as well as developing actionable plans to achieve them. Strategies such as creating budgets, allocating income, and utilizing appropriate financial tools like high-yield savings accounts or tax-advantaged accounts like IRAs or 401(k)s are covered to facilitate understanding of the pathway to financial freedom. | |||||

| ||||||

|